Exporting natural fibres to Europe

Natural fibres are widely used in the clothing industry. Cotton is the most popular natural fibre. While man-made fibres are growing in volume, the demand for natural fibres is still high in European apparel. The main driver is an increasing consumer awareness of environmental issues. Organic fibres have the largest potential as a niche market, but new natural fibres offer good opportunities as well.

Contents of this page

- Product description

- Which European markets offer opportunities for exporters of natural fibres?

- Which trends offer opportunities for natural fibres on the European apparel market?

- Which requirements must natural fibres comply with on the European apparel market?

- What competition do natural fibres face on the European market?

- Which channels and segments are best for natural fibres on the European apparel market?

- What are the end-market prices for natural fibres on the European apparel market?

1. Product description

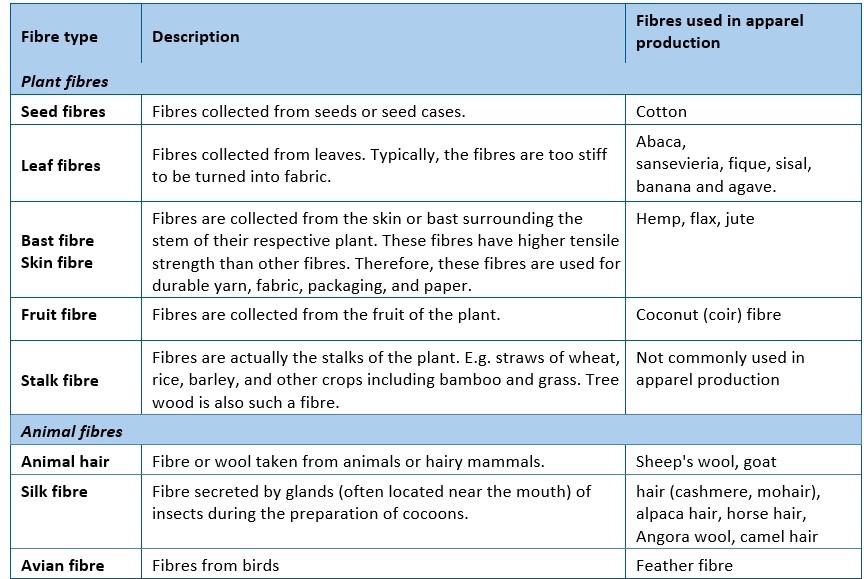

Natural fibres are found in nature and made from plant, animal and mineral sources. They can be categorised into two main groups: cellulose or plant fibre; and protein or animal fibre.

Fibres are used as a raw material to create yarn, which is then woven, knitted, matted or bonded into fabric used in apparel production.

Figure 1: Natural fibres according to fibre type used in apparel production

Product specifications

Quality

Textiles made of natural fibres are considered to be more comfortable than synthetic fibres and have a different quality profile. However, their quality cannot be rigorously controlled, as fibre lengths may vary considerably in natural materials. Another disadvantage compared to synthetic fibres is that natural fibres tend to be less durable.

Materials

Each natural fibre has its own unique set of inherent characteristics. In the process of making fabric out of yarn, natural fibres can be mixed with synthetic or man-made fibres to create the desired properties. For example, think of elasticity, weight, wash-resistance or strength. Cost reduction can also be a reason for mixing materials.

The most popular fibres on the European market include:

Cotton

Cotton is the world's most widely used natural fibre and remains the undisputed “king” of the global textiles industry. An estimated 60% of cotton fibre is used as yarn and threads in a wide range of clothing, most notably in shirts, T-shirts and jeans but also in coats, jackets, underwear and foundation garments.

Organic cotton

Organic cotton is grown without the use of GMO seeds, insecticides or pesticides.

Wool

Wool is the second-most popular natural fibre in many countries. Wool is multifunctional and suitable for clothing, household fabrics and technical textiles. Most of the world’s wool is used for making garments, including sweaters, dresses, coats, suits and active sportswear. Its ability to absorb and release moisture makes it ideal for producing garments that are both comfortable and warm. Blended with other natural or synthetic fibres, wool also adds drape- and crease-resistance.

Merino wool

Merino wool has gained ground as an alternative to synthetic fabrics, especially those used in athletic and outdoor wear.

Silk

Silk’s natural beauty has made it sought after for use in high-fashion clothes, lingerie and underwear. Other properties, such as comfort in warm weather and warmth during colder months, add to its popularity.

Peace silk

Peace silk is a natural silk popular with animal welfare advocates, as it does not require the boiling of live silkworms.

Flax

Flax is processed by spinning to make linen textiles. More than 70% of linen goes into clothing manufacture, where it is valued for its exceptional coolness in hot weather – the legendary linen suit is a symbol of breezy summer elegance.

Jute

Jute is a rainfed crop that does not need pesticides or fertilisers. The final fabric is durable, biodegradable and strong.

Eucalyptus

Eucalyptus fibres are used to produce Tencel, or lyocell. Eucalyptus trees can be grown on land that is unusable for growing food and the trees require a minimum of water. Because the Tencel production process is a “closed loop”, some think of it as the fibre of the future.

Soy

Soy fabric is made from food production waste. This fibre biodegrades much more quickly than oil-based, man-made fabrics.

Packaging

Packaging needs to meet all European requirements. These requirements aim to prevent packaging waste, to promote the reuse of packaging and to reduce the final disposal of such waste. Retailers are primarily responsible for the way that products are packed for sale in shops and can ask you as a supplier to do this for them.

2. Which European markets offer opportunities for exporters of natural fibres?

The year 2016 was a historic year for global fibre production, because the market’s total volume surpassed the threshold of 100 million tonnes for the first time in history. This figure includes both natural and man-made fibres (source: The Fiber Year Consulting).

The three largest growers and manufacturers, China, India and the United States, accounted for a world share of more than 60%.

Complexity is at the heart of the apparel industry, with many players involved in the process of converting fibres into fashion products. The more natural and sustainable your fibres, the higher you will rise in the value chain.

Natural fibres stable, man-made fibres growing

The growth of natural fibres has remained stable over the past few years. Their total share on the global fibres market is estimated by different sources at 30% to 40%. Man-made fibres take the larger part of 60% to 70%. Man-made fibres are still growing (2% in 2016).

Several major trends are affecting the world fibre market. Population and prosperity growth are boosting the demand, while sustainability and climate change challenges are causing a shift in the demand for different kinds of fibre.

Cotton, while still the leading fibre in the apparel industry, is under pressure because it requires a lot of arable land and water. Wood-based cellulosic fibres are expected to grow. These fibres are made with cellulose extracted mainly from wood, bark or leaves of plants and from other natural plant-based products.

Interest in natural fibres is growing

While man-made fibres are partly replacing natural fibres, interest in natural fibres is increasing. The market is actively looking for alternatives to cotton and wool; for example, organic cotton or wood-based cellulose fibres.

An estimated 60 million households, or 200 million people – between 2% and 3% of the world’s population – have a job in natural fibre production or in the natural fibre value chain.

Europe is the third-largest market in the world

While the above developments are global, they apply equally to Europe. Europe is the third-largest market in the world for textiles fibre (both natural and man-made). The Asia-Pacific market is the largest in terms of both production and consumption. The reason is that the demand from major end-use industries here is growing. North America is the second-largest market.

3. Which trends offer opportunities for natural fibres on the European apparel market?

Regulatory incentives are promoting sustainable initiatives

Natural fibres are markedly more environment-friendly than synthetic fibres in terms of both production and disposal. Natural fibres are completely biodegradable. Natural fibre can thus play a key role in the emerging green economy. Several initiatives for improvements in the clothing industry have been taken at the national, European and global level; for example, the Discover Natural Fibres Initiative (DNFI).

Tips:

- Tap into the sustainability trend by emphasising your use of natural fibres.

- Strengthen your sustainability profile by reducing waste, providing fair labour conditions and contributing to a transparent supply chain.

- Communicate your company’s performance on responsible water use, energy consumption and chemicals to gain a competitive advantage.

Consumer awareness is boosting demand

Many consumers in Europe have a preference for natural, simple and “earthy” materials. This preference is causing the organic segment to grow. Many designers and fashion brands are tapping into it. This 2017 article on organic clothing brands offers many examples.

Natural fibres also have a positive image with connotations of health; for example, non-allergenic properties, comfort and moisture absorption.

Tips:

- Promote the natural origins of your materials as an important selling point.

- Promote any health benefits related to your materials. For example, your materials may be suitable for sensitive skin, strong in moisture absorption or breathable.

Demand for niche fibres due to shortages

Market shortages in raw materials such as cotton will create demand for niche natural fibres such as jute, abaca and Seacell. Designers have also begun experimenting with bamboo fibre. Bamboo absorbs greenhouse gases during its life cycle, and it grows quickly and plentifully without pesticides. However, bamboo’s eco-friendliness is still up to debate; for instance, because processing it can involve chemicals.

Lesser-known natural fibres such as eucalyptus and soy fibre tap into the interest in innovative, natural fabric solutions.

- Consider using niche products within the natural fibre segment; for instance, organic natural fibres.

- Find out more about important trends in our study of trends in European apparel.

4. Which requirements must natural fibres comply with on the European apparel market?

The requirements for apparel based on natural fibres can be divided into (1) musts, or legal requirements; (2) common requirements, the ones that you need to comply with in order to keep up with your competitors; and (3) niche market requirements for this segment.

Legal requirements

There are many requirements that your products have to comply with by law in order to be sold in Europe. The main areas they cover are:

- product safety (all products);

- use of chemicals (in textiles, leather and accessories);

- labelling (there are specific rules for textiles);

- use of materials derived from wild plants and animals.

Tips:

- For more general information on this topic, see our study of buyer requirements on the European apparel market and the section about the General Product safety direction on the EU Export Helpdesk, http://trade.ec.europa.eu/tradehelp/.

- Familiarise yourself with the full list of restricted substances in products marketed within Europe by checking out restricted chemicals in textile and leather products on the EU Export Helpdesk, http://trade.ec.europa.eu/tradehelp/.

- Make sure that you know Europe’s labelling requirements as well. For more information, see the Textile labelling rules on the EU Export Helpdesk, http://trade.ec.europa.eu/tradehelp/.

- For an overview of all legal requirements that apply to your product, see the EU Trade Helpdesk, where you can use your product code to obtain a list of relevant requirements.

- Take into account that legal requirements, which may refer to matters such as flammability or the use of azo dyes, may result in a longer time to market or higher costs for you.

Naming of fibres

Directive 2008/121/EC of the European Parliament on textile names offers instructions in this topic.

Liability for defective products

In theory, your European buyer is responsible for damage caused by defects in your products. However, the buyer can pass on a claim to you, which means that European legislation on product liability is relevant to you.

Flame retardants in textiles

Make sure that you do not use flame retardants which are forbidden under European legislation. Textiles failing to comply with this legislation will be withdrawn from the market.

Labelling

European Parliament and Council Directive 96/74/EC deals with product labelling. Among other things, it stipulates that textile products must be labelled or marked whenever they are put on the market for production or commercial purposes. The names, descriptions and details of textile fibre content have to be indicated on products offered for sale to consumers.

A product composed of two or more fibres, neither of which accounts for 85% of the total weight or more, must be designated by the name and the percentage by weight of one of the two main fibres, followed by the names of the other fibres. Fibres which account for less than 10% of the product’s composition may be described as “other fibres”, or by their name, provided that the full percentage composition of the product is given.

The following information is generally included on European apparel labels:

- care symbols;

- composition (fibre content by percentage);

- size;

- country of origin (“Made in”);

- further information, such as ecolabels or labels for sustainable cotton.

The basis of these regulations is that the label must include information on the main fibre types used and their percentages. Washing instructions, size of garment and country of origin are recommended. The product information on the label must be in English.

Non-legal requirements and standards

In addition to the legal requirements that you will face as a supplier from a developing country exporting sportswear to Europe, you will also face requirements that are not mandatory yet unavoidable; for example, care labelling.

Tip:

- Get familiar with the care labelling system of the International Association for Textile Care Labelling, GINETEX, an important system in Europe.

Certification

Certification can be required by buyers, but is not legislated. Particularly if your natural fibre products comply with specific sustainability standards, it is a good idea to get them certified as a means of gaining a better standing with buyers.

Tips:

- Study the many different aspects of sustainability that are popular on the European and German market, and find out with which one(s) your fibres comply. You do not have to cover every aspect of sustainability in order to make sustainability a strong selling point.

- Learn more about standards from the International Trade Centre’s Standards Map.

- Consider certification not only as a means of making clear to customers what you stand for, but also as a means of providing direction to your own sustainability development.

- Discuss with buyers which sustainability aspects matter the most to them and try to match.

- Remember that sustainability itself is not a selling point but an added feature on the mainstream market; always keep the functionality of your fibres, as well as design, price and saleability, in view as top selling points.

Sizing requirements

The European apparel industry is pushing for standard sizing legislation, as sizing systems currently vary across Europe. Usually, the designer decides which system to use. For consumers, sizing variations between different countries can be a hindrance to buying clothes online. For this reason, the industry is working towards standardisation.

An upcoming trend in sizing is the consumer demand for more personalised sizing.

Tips:

- As long as there is no European legislation on sizing, use a recognised standard for your products, such as the EN 13402 standard. This standard describes a flexible sizing system on the basis of body dimensions and the related information on size labelling for consumers.

- Become familiar with Europe’s extensive requirements for sustainability and other general matters in our study of buyer requirements on the European apparel market.

5. What competition do natural fibres face on the European market?

Degree of rivalry is moderate

The European market for natural fibres is highly desirable to new entrants, of which there are many. Because the apparel retail industry is fragmented, there is room for large numbers of smaller players in this industry.

Also, the apparel market is growing, which means that companies are eager to improve revenues. This provides opportunities for suppliers from developing countries looking to enter the market.

The great many different kinds of products and applications on this market mean that competition is less fierce.

Supplier power is moderate

High levels of competition among suppliers place pressure on prices. This can have a negative effect on exporters from developing countries.

Many suppliers from developing countries such as China possess a large share of the export market.

Multiple distribution channels result in less bargaining power for individual distributors.

Many independent retailers would argue that some of the brands supplying them are also their competitors.

Buyer power is moderate

Several buyers with no significant concentrations and low switching costs means that buyers do not have a lot of power on this market. This fact means that you have a good negotiating position as a supplier.

New entrants are welcomed

Low market entry barriers mean that there is ample room for new competitors to enter the market. Low switching costs for consumers leave the door open for changing products or stores.

Strong brand names are important and new competitors need to establish brand recognition on the market. The fragmented market offers non-brand opportunities for market players on the low-end market.

Substitution is moderate

The threat of substitutes for natural fibres is medium, as there is a low threshold for consumers to shop around. The main threat comes from man-made fibres offering strong functionalities.

Brand loyalty is higher in sustainability niche segments, where man-made fibres are not an option.

Tips:

- Focus on small and medium-sized enterprises (SMEs) in Europe rather than on large players.

- Actively contact European buyers; for instance, while participating in trade shows.

- Establish relationships with innovation centres so you can be involved in the development process of new yarns and techniques.

- Certify your product with a sustainability label or ecolabel in order to lend credibility to your products’ sustainability claim and thus increase the competitive advantage of your product.

- Consider joining a European clothing retail cooperative or initiative in order to improve your market visibility and access to new channels.

- Join a buying hub service so you can become connected.

6. Which channels and segments are best for natural fibres on the European apparel market?

Generally speaking, the European market channels and segments for natural fibres are comparable to those of the wider apparel sector in Europe. If the focus is on sustainable materials, the middle and higher market segments are usually the best targets, as added value and specialisation matter more there than at the lower end.

The most obvious channels for getting apparel based on natural fibres apparel into European countries are importers and wholesalers. The most commonly used channel in Europe for apparel in general is that of specialist apparel retailers. In most European countries, this channel accounts for 40% to 60% of the distribution.

Tips:

- Develop a clear market positioning before setting up distribution channels for the market.

- Try to create a bulk business based on a sustainable differentiator; for example, offer a saleable mid-market product that stands out from others because of a sustainability aspect.

- Use storytelling to inspire buyers and attract customers through your sustainability performance.

- Contact importers and wholesalers directly via their representatives, and be prepared to negotiate terms.

- Learn more about man-made fibres in our study of the market for man-made fibres in Germany.

- Learn more about sustainability trends and expectations by reading our study of sustainable apparel in Europe.

7. What are the end-market prices for natural fibres on the European apparel market?

Preferences for natural fibres over man-made fibres usually have to do with comfort, sustainability and exclusivity. The higher your fibres score on any of these three factors, the higher the price will be.

Typically, the retail price for apparel is 4.5 to 6 times the Free on Board (FOB) price. FOB means that the cost of delivering the goods to the nearest port is included, but that the buyer is responsible for the shipping from there and for all additional shipping fees. Clothing products based on natural fibres will be sold to consumers at a much higher price than your export price, although there is great variation between low- and high-end prices. Natural fibre prices also vary considerably according to the item of clothing to which they are applied.

The surge in cotton prices has contributed towards an overall rise in fibre prices, although the price differential with polyester has increased. Viscose staple fibre prices are on a par with cotton prices.

Please review our market information disclaimer.

Search

Enter search terms to find market research