Entering the European market for pants and trousers

Some of the world’s most interesting apparel markets are in Europe. However, setting up a business relationship with a European buyer can be challenging. You will need to investigate the different European markets and sales channels and set realistic goals, so that you can measure your performance and success.

Contents of this page

1. What requirements must pants comply with to be allowed on the European market?

If you want to sell pants on the European market, there are several requirements that you need to comply with. Some are mandatory (both legal and non-legal). Others are voluntary. Meeting them can give you a competitive advantage. Some requirements only apply to certain niches in the pants market.

What are the mandatory requirements?

There are several legal requirements for exporting pants to Europe, including those concerning product safety, the use of chemicals (REACH), quality and labelling. Check the EU Access2Markets online help desk for an overview.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Product safety. Make sure that your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Use of chemicals. Make sure that you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain azo dyes, flame retardants, waterproofing and stain-repelling chemicals, and nickel.

- Use of restricted substances. Ask your buyer if they use a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemicals use of the Zero Discharge of Hazardous Chemicals (ZDHC) Foundation. Download the ZDHC Conformance Guidance here.

- Labelling. Specify the material content of every item that you export to the EU, in accordance with EU Regulation 1007/2011. Check the EU Access2Markets online help desk for more information on how to do this.

- Intellectual property. Do not violate any intellectual property (IP) rights and do not copy designs from or share designs with other buyers. If your buyer supplied the design, they will be liable in case the item is found to violate a property right.

Non-legal mandatory requirements

Besides the legal requirements mentioned above, you may be confronted with non-negotiable terms and conditions that buyers have created for dealing with suppliers. Such requirements are non-legal, but still mandatory.

Sustainable production and social compliance

Regarding harmful substances and organic production, European buyers may request standards such as the Standard 100 by Oekotex®, EU Ecolabel, BCI (Better Cotton Initiative), GOTS (Global Organic Textile Standard) or Bluesign®.

Regarding social compliance BSCI (Business Social Compliance Initiative) is the most popular (and often only) certification that European buyers will require. Other popular social standards are WRAP, SEDEX, ETI, SA8000, ISO 26000, FWF and Fair Trade.

A particular new focus for European brands and retailers is the shift to a “circular economy”. With its new Green Deal, the EU is targeting the reuse, repair, remanufacturing, and recycling of consumer products in Europe, including apparel. This means that manufacturers should train their design teams to develop new styles that are durable and easy to reuse, repair, refurbish, repurpose, or recycle. Ideally, manufacturers should play a significant role in remanufacturing, refurbishing, and repairing pants that are at the end of their life cycle. If you want to increase the amount of recycled content in your styles, check for the following certifications:

- The Recycled Claim Standard (RCS) tracks recycled raw materials through the supply chain using the chain of custody requirements of the Content Claim Standard.

- The Global Recycled Standard (GRS) is a product standard that incorporates recycled material verification, including social and environmental responsibility criteria, as well as chemical management.

Supply chain transparency is another increasingly popular topic in the European apparel industry. Many companies have already published their suppliers in the Open Apparel Registry. Fashion Revolution rates European brands in a transparency index.

Reducing your carbon footprint also has a high priority within the European Union. It is therefore important that you start to measure the carbon footprint within the entire supply chain and not only at your own factory. This will make you a more attractive supplier to European brands and retailers. It will also qualify you for a custom duty exemption in the near future, since the EU is planning a carbon levy for imported goods.

Tips:

- Check the CBI studies on the sustainable transition in apparel, recycled fashion and sustainable cotton for more information on sustainable production and trends in buyer requirements. Read the CBI study The EU Green Deal – How will it impact my business? to learn more about new EU regulations on sustainability and what they mean for manufacturers.

- Read how to comply with transparency requirements on the website of the Clean Clothes Campaign and Human Rights Watch.

- Online tools such as Sourcemap or Ecochain can help you map your supply chain, mitigate risks and track and report progress.

- Provide buyers with as much information on your product as possible. The more information you can give about the origin of your materials, the better.

Other sustainability requirements may be:

- Use of organic cotton. This is cotton grown without the use of GMO’s (‘genetically modified organisms’) and synthetic chemicals. Read more about organic cotton in the CBI study on Sustainable cotton.

- Use of wool with a Responsible Wool Standard certificate or a confirmation of non-mulesing.

- Use of fabrics blended with eco-friendly fibres, such as hemp; regenerated fibres such as Tencel®, Modal® and Refibra™ (by yarn manufacturer Lenzing); or other sustainable fibres such as Recover, REPREVE or Infinited Fiber or even with innovative bio-based polymer fibres such as PLA, milk, seaweed and soy.

- Saving water during production by dyeing fabrics with new techniques (using CO2 instead of water) such as Dyecoo.

- Fabrics dyed with all-natural ingredients such as Rubia, Fibre Bio or Greendyes or dyestuffs made from recycled materials such as Recycrom.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order in a manual. If you agree that he or she will clear customs in the country of import, it is his or her responsibility to make sure the instructions comply with EU import procedures.

Payment terms

For a first-time order, European buyers may agree to a down payment when he or she places the order (e.g. 30%). They will pay the rest (70%) after the order is completed. The most requested payment method in the apparel industry is the L/C (Letter of Credit). An L/C obligates a buyer’s bank to pay the supplier when the conditions that both parties have agreed upon are met. Many buyers however no longer favour L/C payments, as it blocks their cash flow.

For follow-up orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means that you as a manufacturer finish the production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days that you have agreed on with the buyer.

The buyer manual

When you do business with a European buyer for the first time, they will give you a contract and/or a manual to sign. By signing the contract, you are confirming that you will comply with all the listed requirements. This means that you will be held accountable in case of a problem after the delivery of an order. Especially complying with REACH can be challenging. With small orders, most European buyers will not ask for expensive testing, but if illegal chemicals are discovered after delivery, you will bear all expenses involved.

Tips:

- Read the CBI study on Buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter of pants to Europe.

- Familiarise yourself with the complete list of chemicals restricted by REACH. Make sure you only work with suppliers of fabrics and trims that are REACH compliant. Ask for proof that they are.

- Check the EU Access2Markets online help desk for an overview of all legal requirements for your product. Here you can identify your product code and download a list of applicable requirements.

- Do not take financial risks with new buyers. Insure your orders via an insurance company or insist on L/C

What additional requirements do buyers often have?

Besides legal and non-legal mandatory requirements, there are many services that buyers implicitly expect or at least highly appreciate if you want to do business with them. These requirements can differ from buyer to buyer.

Product design and development

European buyers are always looking for special designs, materials or production methods that will help them stand out in the market. Consider for instance:

- Blended fabrics, including stretch fabrics with elastane/Lycra for extra comfort.

- Different weaving and/or knitting techniques such as mesh and houndstooth.

- Innovative finishes that improve hand-feel or improve functionality such as quick-dry and easy ironing.

- Prints, preferably using sustainable techniques (see above).

- Garment dyeing during production to increase flexibility.

Popular pant types are casual pants (focus on comfort, made out of materials like cotton and polyester/cotton mixed with elastane); dress pants (originated with the suit but nowadays sold separately, made out of woven materials like wool, viscose, linen and blends); dresual pants (a mix of casual and dress pants, often made out of basic materials like cotton with elastane, or wool); fashionable pants (richly decorated haute couture styles); and sports pants (designed with a focus on maximum comfort and made out of materials like polyester, Lycra, Taslan and nylon).

Fitting

Fitting and size specs are always a big challenge when manufacturing pants. Sizing issues are still the main reason for the high return rates for pants in online shopping. Try to investigate innovative solutions such as 3D sampling. This can help you optimise the fitting of your pants. Read the CBI study 8 tips to go digital in the apparel sector for background information on 3D sampling and other forms of digitalisation.

Silhouettes

The skinny has been the most popular silhouette for pants (both men and women) in recent years, but this trend is giving way to loosely styled, wide-legged and flared pants. Other popular cuts are chinos (long classic cut with slit pockets) and primarily for women: peg-leg pants (relaxed fit with a cropped tapered leg); baggy pants (fitted at the waist, flared towards the leg); jumpsuits (attached to a top); harem pants (gather at the waist and ankles, held by elastic band); bell bottoms (fitted, flared from the knees); leggings (fitted, made from knitted stretch material), cargo pants (pants with bulky outside pockets) and shorts.

Figure 1: Pants made with comfortable, stretchy fabrics have become popular in Europe in recent years

Photo by Frank Flores on Unsplash

Figure 2: The skinny used to be the preferred silhouette, but more relaxed styles with straight and wide legs are back in fashion in Europe

Photo by Pesce Huang on Unsplash

Printing

Printed pants are often included in the collections of European fashion brands. They are mostly designed for women but sometimes also for men. There are different printing techniques you can use: lithography (using printing plates and rollers on fabric); digital printing (inkjet and laser, allows for small production runs) and screen printing (transferring images onto fabric or garments using a fine material or mesh/film. Printing can be outsourced but investing in printing and embroidering machines increases your flexibility.

Flexibility

If you want to start a business relationship with a European buyer, be prepared to accept complicated orders first. Buyers will want to test your factory before they give you big, easy orders. Make sure at the start that a buyer will not continue to only place difficult orders with you and convenient orders elsewhere.

What are the requirements for niche markets?

There are many interesting niches within the pants category. Be aware that niche buyers usually offer smaller orders and require a relatively high service level. This means you need to adjust your manufacturing and sourcing setup if you want to be profitable.

Workwear

Pants are a basic item in many workwear sub-categories, such as hospital clothing and corporate wear. These categories offer relatively big orders and stable business, but beware of strict buyer requirements, including safety standards. Check the CBI study on workwear.

Made-to-measure

Manufacturing what has already been ordered by the end consumer is a small but growing niche with big market potential. As a manufacturer, you need to be able to handle individual orders. Added together the volumes can be substantial.

Special sizes

Following the ‘body acceptance’ trend, ever more European fashion brands have started to include silhouettes in their size range for specific body types, such as plus size, petit, tall and maternity fashion. If you are a manufacturer of tubular knits, you may be required to invest in bigger machinery to make large-sized styles. Check this article by fashion consultancy Edited about the growing market for special sizes.

Adaptive wear

The adaptive apparel market is a niche that caters to the individual requirements of consumer groups with very diverse needs, such as disabled people and the elderly. This target group is underserved but growing. Be aware that adaptive wear has very specific requirements regarding safety and functionality. Read the CBI study on Adaptive apparel.

Modest wear

Many people with an Islamic background prefer ‘modest’ styles. This target group is underserved in Europe, but growing. Source for materials that obscure the female silhouette, so no fabrics that are too stretchy or thin. For specific requirements read the CBI study on Islamic wear.

Denim jeans

During the COVID-19 pandemic, fashion sportswear items such as sweatpants were a fast-growing product category. Now that restrictions have been mostly lifted in Europe, purchases of sweatpants are declining and denim jeans are making a comeback. Jeans have specific requirements regarding fit, designs (washes) and sustainability. Read Edited’s trend report on the denim market (2021).

Tips:

- If you decide to focus on a niche, investigate the specific requirements and make sure you can comply. Be aware that order quantities in niche markets are usually smaller than in mainstream markets. Try to become a specialist in the niche of your choosing.

- Try to think ahead in your product development if you service niche markets. New innovations are introduced almost daily. Try to find workable innovations that will not only give you the tools to diversify but also to cut expenses.

- Develop a specialised collection that represents the niche requirements to show your potential customer that you understand and supply according to their requirements.

- Study the basic and never-out-of-stock-items of these niche markets, such as Asos’ plus-size selection and The Able Label’s classic styles. These represent the largest order potential in terms of volume.

2. Through what channels can you get pants on the European market?

Before you start to approach European buyers, you need to determine which market segment fits your company best and through what channel(s) you want to sell your product.

How is the end market segmented?

In addition to the obvious segmentation based on gender, age and product type, segments in the pants market can best be distinguished by price/quality level and fashionability. The largest segments are the luxury market, the upper-middle and middle market and the budget segment. Within these segments, brands and retailers may offer the following sub-segments: basic, mainstream or high fashion (‘haute couture’).

Table 1: Pants market segmentation

| Consumer type | Price level | Fashionability | Material use | Functionality |

Luxury consumer (luxury market)

| Very high | From basic to high fashion | Extremely high-quality materials from nominated suppliers such as a-grade fine leather, merino wool, mercerised cotton, cashmere, regenerated fibres | Very high requirements regarding comfort, durability and fit. Often dry clean/handwash only. |

Fashion conscious consumer (upper middle market)

| High | From basic to fashionable | High-quality materials, sometimes from nominated suppliers such as branded viscose, (organic) cotton, merino wool, polyester/Lycra | High requirements regarding comfort, durability and fit |

Practical consumer (middle market) | Medium | From basic to fashionable | Wool/viscose blends, combed/carded cotton, polyester/Viscose | Preference for easy-care and machine washable materials |

Price conscious consumer (budget market) | (extremely) Low | From basic to fashionable | Carded cotton, polyester, micro fibres | Only easy-care and machine washable materials |

The luxury consumer

In the luxury market, European brands like Versace, Gucci and Dolce & Gabbana sell extremely fashionable, luxurious pants at a very high retail price. The trends that are born here are translated to the lower segments of the fashion industry. Because buyers have extremely high standards regarding design, workmanship, material quality and brand image, production mostly takes place in Europe. Order quantities are low.

The fashion-conscious consumer

The upper-middle market caters to fashion-conscious consumers. It is home to A-brands such as Ted Baker, Closed and French Connection selling creative designs, but in a less conspicuous way than in the luxury segment. Consumers appreciate brands for their brand image, original designs and high-quality materials. Smaller brands with a distinct sustainable profile such as Armed Angels, People Tree and KnowledgeCotton Apparel operate in this segment. Retail prices are high, order quantities are low to medium.

Practical consumers

Practical consumers shop in the middle market. Here you will find brands and retailers such as Zara, Only and Benetton selling both fashionable and more functional styles. Focus is on washability, fit and medium-quality materials. Buyers will sometimes require organic fabrics. Order quantities are high, retail prices low to medium.

Price-conscious consumers

Price-conscious consumers looking for both fashionable and more basic designs shop for pants at large retail chains such as H&M (basic to fashionable), Primark (basic to fashionable), Piazza Italia (basic), HEMA (basic) and Carrefour (basic). Sustainable materials are in small demand, with notable exceptions such as C&A and Zeeman (organic cotton). Order quantities are high and retail prices are (very) low, so your margins are too.

Tips:

- Check online shopping platforms for pants such as Yoox (luxury and upper-middle market segments) Zalando (all market segments) or Asos (middle and budget market) for inspiration on styles and colours.

- Find your inspiration in the luxury segment but never copy the styles.

- Focus on finding sustainable fabrics that add value to your product and differentiate you from the existing styles offered in the market. Search the Material District database for hundreds of innovative and sustainable fibres and fabrics.

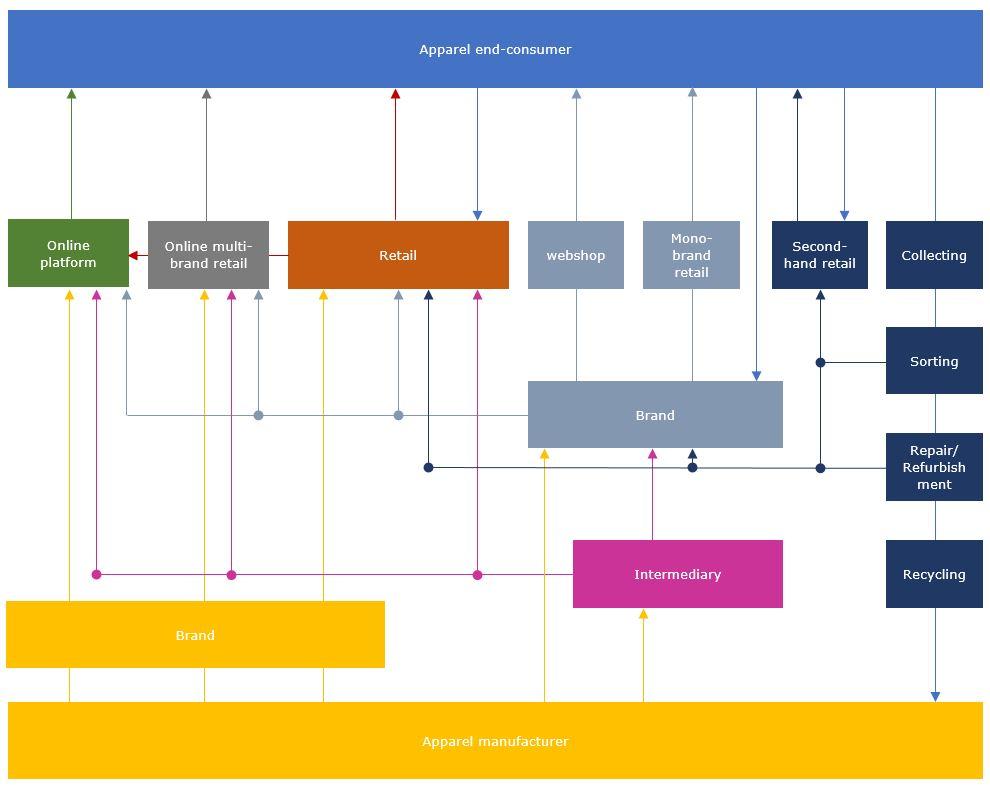

Through what channels does the product end up on the end-market?

The most important distinction you should make between potential buyers is their place on the value chain, because this will determine how they do business with you. Within each part of the value chain, you will find buyers of different market size, with different requirements regarding MOQ and price.

Each type of buyer needs a specific approach. Always try to find out in what part of the value chain your buyer is operating, what challenges he or she faces in the market and how you can contribute to his or her sales strategy.

- If you want to target European end consumers, try selling via platforms such as Alibaba, Wish, Amazon or Wolf & Badger for independent brands. Most online consumers are in north-western Europe. You will need to invest in a web shop, stock, order management and customer service. Your biggest challenge will be return policies and a lack of brand awareness, making it difficult to find buyers outside the budget market.

- The growing second-hand market in Europe is serviced by online platforms such as vestiairecollective.com, vinted.com, depop.com or national websites such as marktplaats.nl (the Netherlands).

- Online multi-brand retailers such as Zalando, Asos and Yoox sell existing fashion brands and develop their own private collections, mostly value brands. They can detect market interest very quickly and will immediately react to sales data. Usually, such companies will place a small test order first. If the item is selling well, they will place the actual production order. Fast delivery is a must.

- Europe is home to some big retail chains such as H&M, Zara, C&A and Marks and Spencer, but also many smaller chains and boutiques. Retailers can place an order relatively easily, as they only need one development sample for order confirmation. For the major retailers, order quantities are usually high, and so is price pressure.

- Brands typically develop a collection 12 months in advance. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every sample needs to be ‘actual’: looking exactly like the product will in the shop, with branded hangtags and accessories. It may take many months before orders are placed.

- Intermediaries (agents or traders/importers/private label companies) sell your product on to buyers up the value chain. They are price focused and require flexibility in quantities and qualities. Some are located near or in the production countries and primarily do sourcing and logistics, such as Li & Fung. Others such as Brand District work from Europe and do market research, design and stock keeping. Their service level determines the commission rate that intermediaries charge.

Figure 3: Pants market value chain

What is the most interesting channel for you?

If you are a small to medium-sized manufacturer in a developing country, intermediaries are likely the most interesting type of buyer for you, followed by smaller (niche) brands and retailers. The bigger brands and retailers are only potential buyers if you have the right certifications and can handle large volume orders. End consumers are a difficult target group, because of complicated customer service demands.

Intermediaries

Agents or traders/importers/private label companies are usually the first to explore new sourcing destinations (from their perspective). Be aware that they are very price focused. Intermediaries act as a ‘middleman’ between you and companies further up the value chain, which means they need to keep their prices close to your factory price. This leaves less negotiation room for you as a manufacturer. Furthermore, traders require flexibility from manufacturers regarding quantities and qualities.

Small (niche) brands and retailers

Supplying major European brands and retailers as an SME may not be realistic due to the high requirements and high volumes. Unless you have the right certification and can produce volume orders, small (niche) brands and retailers are more likely business partners.

Most brands and retailers offer a n.o.o.s. (never out of stock) programme for pants. These are basic styles that vendors have in stock all year long. Smaller retailers mostly rely on brands that keep continuous stock for them. If you want to supply smaller retailer and/or brands, they will most likely ask you how you will service them with stock. There are two ways:

- Keep stock material and trims that will create great flexibility and fast delivery.

- Keep ready-made stock in a warehouse in Europe. This enables you to supply the buyer almost immediately from your stock.

Europe also has many start-up brands and retailers (especially online) that search for small factories to support them with business development. The main risk with smaller companies and/or start-ups is that their business is risky and can be terminated in case of a bad season or performance.

Growing second-hand market

In addition to using sustainable materials to manufacture pants, a second sustainable solution is to expand the product lifespan. Brands are more and more focused on taking back second-hand clothing to repair, refurbish and resell them. In addition to brands, platforms such as Asos are also increasingly focusing on selling second-hand clothing.

Online multi-brand retailers

Also promising are multi-brand online stores that produce private collections, because this market is growing. This is a budget market with low profit margins, but potentially big volumes, mostly spread over many small orders. Check for instance ‘8’ by Yoox, Zalando’s private label brand ‘YOURTURN’, or ‘ASOS DESIGN’ by Asos.

Tips:

- Intermediaries can be found both in Europe and in production countries. You can find intermediaries specialised in pants by using an online search engine. Use keywords such as ‘full service’, ‘pants’ or ‘trousers’, plus ‘solution’. Trader’s websites usually show the brands they are working with.

- Read the CBI study ’10 Tips for finding buyers on the European apparel market’ for information on finding buyers via trade fairs, matchmaking websites, online databases and sector associations.

- Investigate what basic styles your prospect has in their collection. Try to offer your (potential) buyer stock service in these styles.

3. What competition do you face on the European pants market?

Manufacturing pants requires a high level of expertise. The right shape and especially fit of a 5-pocket pant is key to its success or failure in sales. Pants with a bad fit will never sell. If you are considering manufacturing pants for the EU market, study the styles and fits. If you have any doubt about your capabilities, start with manufacturing ‘easy’ styles before you focus on the 5-pocket styles.

Which countries are you competing with?

Major pants manufacturing countries such as Bangladesh, Pakistan, Cambodia and Vietnam are GSP (General Scheme of Preferences: reducing or removing import duties) countries with a clear focus on volume business. China used to be solely focused on volume orders, but has developed into a design- and innovation-driven sourcing destination.

Table 2: Competing countries

| Country | Strengths | Challenges |

| Bangladesh | Bangladesh dominates the fashion industry with high volume, low price manufacturing. The country benefits from low production and labour costs and the GSP. | The biggest challenge for Bangladesh will be to increase technical expertise, facilitate smaller orders and to get more factories to comply with international safety and sustainability standards. |

| China | China offers pants buyers high quality, technical innovation, high efficiency, excellent customer service and the local availability of fabrics and trims. | Relatively high MOQs (although Chinese manufacturers are increasingly becoming more flexible), rising labour and production costs and no GSP that removes import duties to the EU. |

| Turkey | Turkey produces high-quality apparel in small quantities. The country can deliver very quickly, thanks to its proximity to Europe (lead times of 8-10 weeks from fabric to delivery in-house or shorter). This gives Turkey a big advantage over Asian manufacturers, as the European market is discovering the importance of responding quickly to sales results and market trends. | Relatively high price level |

| Pakistan | Pakistan is a country well known for manufacturing good-quality, relatively cheap jersey, pants and leather products. As such, it is a popular alternative to Bangladesh. The country benefits from the GSP. | The biggest downsides are high MOQs and security issues. Many buyers do not want to travel to Pakistan (or are prohibited from doing so by their company), so they cannot procure in Pakistan (or only via an intermediary). |

| Cambodia | Cambodia is another upcoming production country for apparel, including pants. Many factories are set up by foreign investors (notably the Chinese), which also supply fabrics, trims and expertise. The country benefits from the GSP. | High MOQs make it difficult for smaller European buyers to source here. Production quality is sub-optimal due to an inexperienced and relatively small workforce. |

| Vietnam | The workmanship of Vietnamese fashion manufacturers makes their products stand out in quality. The country also benefits from the GSP. | High MOQs, limited availability of local fabrics and trims and a general lack of capacity. |

Tips:

- If you want to improve your speed and flexibility, investigate the garment dyeing process.

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the competitive advantages of doing business with you. Besides GSP, consider factors such as distance to Europe, ease of doing business and transparency.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with apparel production in different countries, including your own. Use this information to mitigate risks and to advertise the advantages of sourcing in your country.

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

Which companies are you competing with?

The Crystal Group is a manufacturing group with twenty factories in five countries (China, Bangladesh, Sri Lanka, Cambodia and Vietnam). Key to its success is what it refers to as its ‘co-creation’ business model, which focuses on building long-term relationships with leading global apparel brands and working as a proactive partner in both innovation and sustainability. The Crystal Group offers excellent service, including dedicated production teams to advise buyers on product specifications, raw materials, finishes, treatments and washings.

Son Keng is a manufacturer of fabrics and casual pants and pants with its headquarters in Hong Kong and factories in China and Cambodia. The company has its own fabric mills (two) for winding, warping, dyeing, weaving, mercerising and finishing fabrics. Son Keng focuses on volume orders and basic styles. It is WRAP and BSCI certified.

Konsey Textile in Turkey offers a wide range of knitted and woven apparel items for men, women and children. The company is known for its design input and flexibility, all combined with speedy delivery. Konsey specifically advertises its low minimum order quantities and its use of organic cotton and bamboo in many of its products.

Tips:

- Study what customer base successful pants producers have and what services they offer to their buyers. Advertise your strengths (vertical integration for instance, or product development) and work on your weaknesses.

- Be flexible in your minimum order quantity, even if the product has a high quality and finishing standard, especially for first-time orders. Innovate in product development and design and build your reputation on creativity. Finally: offer excellent customer service.

- Check the free online database Open Apparel Registry. This website lets you look up the suppliers of hundreds of European fashion brands, including buyers of pants.

- Read the CBI study 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your USPs and doing business with European buyers.

- If you want to target a European market that you don’t know very well, try opening new doors by using an agent based there.

Which products are you competing with?

Pants are a staple of European wardrobes, with many European consumers owning several pairs.

Athleisure

Although the athleisure trend has waned a bit since COVID-19 restrictions on movement were lifted in most European countries, it still influences almost every product group, including pants. Especially formal styles have lost ground to more comfortable pants, not just in terms of design, but also in material use. Even pants that still look formal are often made with the use of stretch fabrics for maximum comfort.

Loungewear

An even more informal offshoot of the Athleisure trend is loungewear: extremely comfortable styles designed for wear in and around the house. This trend is helped by people in Europe preferring to stay at home, both for work and recreation (the ‘Netflix generation’).

Denim

The import of denim jeans to Europe has declined somewhat in recent years, but denim jeans are still a staple of the wardrobe of Europeans. Denim jeans are expected to make a comeback in the years following the COVID-19 pandemic.

Second-hand fashion

The market for second-hand apparel is growing steadily in Europe, helped by convenient reselling, renting and swapping apps such as Vinted, Vestiaire Collective and By Rotation. This could in time threaten the import of pants into Europe.

Sustainable alternatives

Two of the materials traditionally used to make pants, conventional cotton and wool, score relatively badly on sustainability. Considering the rising demand in Europe for sustainable apparel, try to use sustainable materials (see the above paragraph on sustainable production and social compliance).

Figure 4: Denim jeans are expected to become more popular in Europe with the relative decline of the loungewear trend

Photo by Ricardo Gomez Angel on Unsplash

Tips:

- To diversify, include comfortable styles in your product portfolio and concentrate on sustainability. Develop a product with a ‘sustainable story’ (see above).

- Stay informed about the trends in the European pants market and try to adapt your product portfolio to new developments, even if it means also using different materials.

- Develop a close cooperation with your fabric supplier. By combining your expertise on product development, you will increase your competitiveness.

- Try to collaborate with your buyer’s design department on your own product development.

4. What are the prices for pants on the European market?

The factory price of your product (in fashion industry jargon, your ‘FOB price’: Free On Board) is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin.

The average cost breakdown of your FOB price should look like this:

Note that these percentages may differ per factory and per order. Some factories accept lower profit margins during offseason periods, or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials. Efficiency goes up and material prices go down when producing large volume orders.

Stock service

If your buyer requests a stock service, make sure that your extra risk is compensated with an extra profit margin (of 10% in the example above). If you are considering keeping stock for specific customers make sure that you have a signed contract that will guarantee that your customer will take all stock within a fixed timeframe.

Retail pricing

The retail price of a pair of pants is on average 4-8 times the FOB price (this is called the ‘retail markup’). It follows that the FOB price is on average 12,5-25% of the retail price of the product. Exceptions do occur. In the budget market, some large European retail chains may only double the FOB price. Retailers mark up the FOB price by 4-8 times because they need to account for (among other things) import duties, transport, rent, marketing, overhead, stock keeping, markdowns, VAT (15-27% in EU-countries).

According to Eurostat’s 2020 comparison of retail prices for apparel, France has the highest price level of the top six European importers of apparel and footwear at 107.6 points compared to the European average of 100, followed by the Netherlands (106.1), Italy (101), Germany (98.2), and Spain (92.2). The UK, which is now out of the EU, had a score of 90.7 in 2019. Note that brands and retailers that sell in multiple European countries usually keep prices equal or deviate only slightly from the standard retail price.

Online commerce and a strong budget segment have made consumers in Europe accustomed to low prices. However, an increased focus on sustainability and rising costs for materials and production (due to the global COVID-19 pandemic and political instability) as well as shipping have put manufacturers, suppliers and buyers under enormous price pressure. In 2021, McKinsey predicted that retail prices would rise by 3% on average in 2022. In the first quarter of 2022, inflation figures in the EU exceeded that prediction.

This study was carried out on behalf of CBI by FT Journalistiek.

Please review our market information disclaimer.

Search

Enter search terms to find market research