Entering the European market for recycled fashion

The European market for recycled fashion is growing thanks to increasing awareness amongst brands and end consumers and ever stricter environmental regulations. Recycled fashion can be produced from cutting waste and post-consumer waste. Demand will grow not only for products made from recycled yarns and fabrics but also for ‘circular’ supply chain solutions that enable buyers to collect, repair and recycle post-consumer waste.

Contents of this page

The recycled fashion industry in Europe is being driven in part by upcoming EU legislation on:

- Extended producer responsibility (EPR; note that some EU member states have national EPR schemes);

- Right to repair;

- Corporate Sustainability Reporting Directive (CSRD);

- Corporate Sustainable Due Diligence Directive (CSDDD);

- Anti-greenwashing law;

- Product environmental footprint; and

- Digital Product Passport.

Read more about Europe’s vision on the circular economy here.

1. What requirements and certification must recycled fashion comply with to be allowed on the European market?

You need to comply with several requirements to sell recycled fashion on the European market. Some are mandatory (both legal and non-legal). Others are voluntary and meeting them can give you a competitive advantage. Some requirements apply only to certain niches within the recycled fashion market.

What are mandatory requirements?

There are many legal requirements for exporting recycled fashion to Europe, covering aspects such as product safety, the use of chemicals (REACH), quality and labelling. Check the EU Access2Markets online helpdesk for an overview. Follow the steps below to be sure your product complies with the basic legal requirements:

- Make sure your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure you meet the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain Azo-dyes, flame retardants, waterproofing and stain-repelling chemicals and nickel. The challenge with recycled yarns and fabrics is to make sure the input materials are REACH-compliant, so that the final product is, too.

- Specify the material content of every recycled fashion item you export to the EU, in line with EU Regulation 1007/2011. Check the EU Access2Markets online helpdesk on how to do this.

- Do not violate Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides the design, they are liable if the item is found to violate a property right.

Tips:

- Read the CBI study on buyer requirements for more information about the requirements you have to meet to export apparel to the EU.

- If you need help, always discuss compliance challenges and possible solutions with your buyer.

- Check the Q&A section on the website of the European Chemicals Agency for answers to the most common questions about REACH and the use of chemicals in apparel, accessories and trims. If you want to guarantee compliance for your recycled fashion, test every batch separately.

- Any fibre that makes up no more than 5% of the total weight of your product, or fibres that together make up no more than 15% of the total weight, may be designated as ‘other fibres’, immediately preceded or followed by their total percentage by weight. This lets you account for fibre contamination. Include an ‘other’ category of 15% on your composition label when working with mixed fibres, and 5% when working with single-fibre recycled fabrics.

- EU law does not (yet) require naming the country of origin (‘made in’) or provision of care instructions on labels. However, adding care labels is highly recommended.

Non-legal mandatory requirements

In addition to the legal requirements mentioned above, your buyer may have company-specific terms and conditions. Such requirements are non-legal, but still mandatory.

Transparency

Supply chain transparency and circular concepts go hand in hand. Transparency on the materials you source and conditions under which they are produced is being promoted by stricter supply chain transparency laws at EU and national levels. The EU’s new Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD) require all larger European companies to disclose and report on how they manage social and environmental risks.

Restricted substances

Your buyer may have a restricted substances list (RSL; this will be stated in the buyer manual, see below). Such lists exclude more chemicals from production use than legally required by REACH. RSLs are based on the safe chemicals use guideline issued by the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

Carbon footprint

Many Western brands have committed to climate neutrality. To calculate a product’s carbon footprint, the emissions are usually measured in units of carbon dioxide equivalent (CO2e) and then the total emissions are divided by the number of products. The calculation is a complicated process, but several organisations have set benchmarks for specific materials and/or products. See the CBI study on tips to go green for more information.

Content verification and social compliance standards

Buyers may require you to provide verification of material content and social compliance. Below is an overview of the most popular standards for recycled fashion in Europe.

Table 1: Europe’s most popular recycling standards

|

Standard |

Logo |

Type of compliance |

Certification information |

|

Global Recycled Standard |

|

Environmental (material recycling) |

|

|

Recycled Claim Standard |

|

Environmental (material recycling) |

|

|

Cradle to Cradle Certified™ |

|

Environmental, social (material recycling, social responsibility, chemical management) |

Table 2: Europe’s most popular social standards

|

Standard |

Logo |

Type of compliance |

Certification information |

|

Amfori BSCI |

|

Social |

By buyer invitation. Amfori provides a list of organisations that can do an audit |

|

SA8000® |

|

Social |

|

|

WRAP |

|

Social |

|

|

Sedex |

|

Social, environmental |

|

|

Fair Wear |

|

Social |

|

|

B Corp |

|

Social, environmental |

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you agree to meet all the stated requirements. This means you will be held accountable if there are problems with a delivered order. Complying with REACH can be especially challenging. Most European buyers will not ask for expensive testing for smaller orders, but if illegal chemicals are discovered after delivery, you will bear all of the costs involved.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL). This refers to the worst quality level that is still tolerable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order quantity is defective.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order. If you agree to deliver Free on Board (FOB), which is the industry standard, your buyer will clear customs in the country of import. It is their responsibility to make sure the instructions comply with EU import procedures. Always try to lower the environmental impact (and financial cost) of the packaging materials you use.

Payment terms

For a first-time order, European buyers may agree to make a down payment (for instance 30%) and pay the rest (70%) after the order is completed. The safest payment method for you as a manufacturer is a letter of credit (LC). An LC obligates the buyer’s bank to pay the supplier when both parties meet the conditions they agreed upon. However, many buyers no longer favour LC payments, as it blocks their cash flow. Be aware that LCs do not offer financial protection against bankruptcies!

For any further orders, most European buyers will ask for a telegraphic transfer (TT) after 30, 60, 90 or sometimes 120 days. This means the manufacturer has to finish production and hand over the shipment to the buyer, with all original documents, before payment is due. Payment is made after the number of days you agreed on with the buyer. This is a risky form of agreement as you bear the full financial risk.

Transparency

Supply chain transparency is key for the European apparel industry due to ever stricter laws at EU and national levels. For instance, the EU’s new Corporate Sustainability Due Diligence Directive (CSDDD) and Corporate Sustainability Reporting Directive (CSRD) require all large European companies to disclose and report on how they manage social and environmental risks.

Transparency means not only disclosing information about your own operations to buyers, but also helping them to gain as much insight as possible into their whole supply chain.

Restricted substances

Ask your buyer if they have a restricted substances list (RSL). Such lists are often based on the safe chemicals use guideline issued by the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

Figure 1: A popular material for the production of recycled yarns is old fishing nets, which make up roughly 10% of ocean plastic pollution

Source: Photo by Joshua J. Cotten on Unsplash

What additional requirements do buyers often have?

Besides legal and non-legal mandatory requirements, there are many services that buyers implicitly expect or at least highly appreciate if you do business with them. These requirements can differ from buyer to buyer.

Product design and development

Buyers are increasingly focused on how products are designed and how easy they are to repair or recycle after use.

Buyers are therefore looking for different product development methods and the production of easily recyclable products.

Requirements that buyers have for recycled fashion:

- Technical advice on and innovation in easily recyclable yarns and fabrics;

- Circular supply chains: a factory should not only manufacture but also take back and recycle products;

- A factory should enable customers to meet extended producer responsibility requirements;

- Design support for easily recyclable products.

The major challenge for the recycled fashion industry is meeting market demand and expectations for quality and design. In general, there are 3 different ways to recycle textile waste. Each has its own challenges and benefits.

Table 3: Recycling methods and their characteristics

|

|

Description |

Benefits |

Challenges |

|

Mechanical recycling |

Mechanical apparel recycling is a process that involves breaking down old clothes into smaller fibres or pieces. These fibres are cleaned and used to create new clothing or other textile products without additional dyeing. It is a way to reuse old clothes and turn them into new items instead of throwing them away. This is the ‘cleanest’ form of recycling. |

No chemicals Flexible on MOQ No skilled labour needed No high level of investment needed

|

Quality of recycled yarns is lower Chemicals cannot be removed but must be treated using water Need to add virgin materials to create acceptable quality level Limits to fineness that can be achieved. Often results in a relatively nappy (fuzzy) fabric |

|

Thermal recycling (melting)

|

Thermal recycling of apparel is a method where old clothes are heated to high temperatures to break them down into basic materials like fibres and chemicals. These materials can be used to produce energy or new products. This process helps reduce clothing waste and can be more environmentally-friendly than traditional disposal methods. |

Can be made from plastic bottles (clean input material) High-quality end product Easy process to implement Cost-effective Efficient process |

Can only be used on thermoplastic polymers that can be melted New legislation no longer allows bottles to be used as input material for new textiles Input material impurities can cause output and quality problems |

|

Chemical recycling |

Chemical recycling of apparel is a process that involves using specific, special chemicals to break down old clothes into their basic components. These components can be used to make new fabrics, plastics or other materials. This method recycles textiles more effectively and reduces the amount of clothing waste in landfills. |

Pulp can be mixed with wood and spun into viscose Quality is higher than mechanical and thermal recycling

|

Process uses chemicals Solvents used are expensive High-quality sorting is needed High-quality input material is needed Process consumes a lot of energy |

Limitations for different apparel items

Quality limitations for recycled yarns and fabrics have the following consequences for individual apparel subcategories:

- For knitwear, achieving fine gauges such as 14GG and 16GG is still not possible using mechanically recycled undyed yarns, nor is optical white for colour;

- T-shirts are still difficult to manufacture from 100% mechanically recycled yarns as T-shirt fabric requires a very fine yarn;

- Denims made from 30-40% mechanically recycled post-consumer waste are available, but 100% is not yet feasible;

- Jackets can be made from 100% recycled polyester from used PET bottles.

Designing for recycling

Design plays a key part in the second life stage of recycled apparel. Some materials, such as wool and cashmere, are relatively easy to recycle. Others, such as mixed materials and low-grade cotton, are difficult to recycle as the final material standards do not meet EU buyer expectations. It is the designer’s responsibility to integrate second life options into the design process by selecting easily recyclable materials.

Tips:

- Avoid fabric compositions that are a mix of different qualities. They are less easy to recycle than items made 100% from 1 material.

- Use high-quality materials as much as possible (such as wool, mercerised cotton, cashmere). They can be mechanically recycled into new fabrics and products with no need to add stabilising qualities.

- Offer your buyer second life options (new products made from recycled apparel) such as curtains, carpets, building materials. This will help them to think ‘circular’ when designing collections.

- Check the Circular Design Guide for tips on how to make apparel designs that are easy to recycle and repair.

Table 4: Overview of recycling companies

| Company name | Output |

Input Post-consumer waste |

Input Cuttings | Location |

|

Pure Waste |

Yarns, fabrics, t-shirts, sweatshirts |

|

x |

India |

|

Rester |

Non-woven, technical, automotive, geo-textiles, insulation, yarns, apparel fabrics |

x |

x |

Finland |

|

Textile Pioneers |

Yarns, fabrics, finished garments |

x |

x |

Denmark |

|

I:CO (SOEX Group) |

Fibres, full-service business concept |

x |

x |

Germany |

|

Altex |

Fibres and yarns for carpets and non-wovens (automotive) |

x |

x |

Germany |

|

Vanotex |

Fibres |

x |

x |

Belgium |

|

CLS-Tex |

Raw material |

|

x workwear |

Netherlands |

|

Lenzing/Refibra |

Cellulose fibre |

x |

x |

Austria |

|

Rifo Lab |

Garments, fabrics, yarns and home textiles |

x |

x |

Italy |

|

Reverso |

Yarns, fabrics |

x |

x |

Italy |

|

Recover |

Fibres (full-service business concept) design, technical assistance, etc. |

x |

x |

Spain, Sweden, Bangladesh, Pakistan |

|

Circular Systems Texloop |

Yarns and fabrics for fashion and home furnishing |

x |

x |

USA |

|

Re:NewCell |

Raw material |

x |

x |

Sweden |

|

Circulose |

Raw material |

|

x |

Sweden |

|

Södra |

Pulp |

x |

|

Sweden |

|

Textile Change |

Pulp |

x |

|

Denmark |

|

SaXcell |

Lyocell fibres |

x |

x |

Netherlands, Turkey |

|

Weturn |

Yarns, fabrics |

x |

x |

France |

|

Worn Again |

Raw material |

|

x |

UK, Switzerland |

|

Evrnu |

Raw material |

x |

x |

USA |

Communication

Smooth communication is an implicit requirement that all buyers have. Always reply to emails within 24 hours, even if it is just to confirm that you have received the email and will reply in full later. If you find a problem with a production order, notify the customer immediately and try to offer a solution. Another good tip is to create a ‘time and arrival’ (T&A) file for every order and share it with your buyer. This file will help you manage expectations and monitor progress, and is the best guarantee for timely delivery.

Flexibility

Many factories are wholly focused on getting ‘convenient’ orders, with simple styles, large quantities and long delivery times. But if you want to start a business relationship with a European buyer, be prepared to accept complicated orders first. Buyers will want to test your factory before giving you big, easy orders. However, make sure at the start that buyers will not place only difficult orders with you and easy orders elsewhere.

In their first order, you can expect European buyers to require:

- High material quality and impeccable workmanship.

- Order quantities below your normal minimum order quantity (MOQ).

- A price-level below what you would normally accept for small-quantity orders.

Tip:

- Stay updated on European circular economy policies. In 2019, the European Union (EU) presented the Green Deal with the aim to make Europe the first climate-neutral continent by 2050. Among other things, this covers eco-design requirements so textile products are fit for circularity, the uptake of secondary raw materials, tackling the use of hazardous chemicals, easy re-use and ‘the right to repair’ for end consumers.

Figure 2: A popular recycled yarn is rPET, made from recycled PET

Source: Photo by tanvi sharma on Unsplash

What are the requirements for niche markets?

Recycled fashion is still a niche market but becoming more mainstream. However, there is a distinction between mainstream recycled fashion and some up-and-coming recycling methods and business models. Because they are still uncommon, these niches are often buyer-specific.

100% traceable recycled apparel

To increase the level of quality, sustainability and REACH-compliance, some buyers only work with recycled fabrics made from a 100% traceable source. For some, this source may be Europe to guarantee that input materials are REACH-compliant. Other brands, such as MUD Jeans, go so far as to collect their apparel after the end of use and recycle it at a designated plant. The fact that MUD Jeans rents out jeans and controls the collection process makes this easier.

Biodegradable apparel

In a truly circular economy, products and materials do not lose their value during recycling and can be re-used endlessly. Some European buyers have developed a totally different approach to recycled fashion, in the form of biodegradability. They use fabrics that break down into natural elements. For instance, the circular fashion brand A.BCH produces 99% compostable clothing. Outdoor sportswear brands Houdini (which also rents out clothes) and VAUDE are experimenting with PrimaLoft Bio, a 100% recycled biodegradable performance fabric.

Product passport

The market is demanding product and production transparency showing not only how and where apparel is produced but also measuring supply chain impacts. This helps buyers and manufacturers assess different ways to reduce social and environmental impacts.

Tips:

- To calculate a product’s carbon footprint, the emissions are usually measured in units of carbon dioxide equivalent (CO2e) and then the total emissions are divided by the number of products. The calculation is a complicated process, but there are benchmarks for different materials and products. See the CBI study on tips to go green for more information.

- Mention your sustainable approach on your website and your product. This will add value to your product and increase your uniqueness and profitability.

2. Through what channels can you get recycled fashion on the European market?

Before you start to approach European recycled fashion buyers, you need to determine what market segment fits your company best and through what channel(s) you want to sell your product.

How is the end market segmented?

European buyers of recycled fashion can best be grouped by price/quality level as this determines the quality and price level of the materials they use in fashion designs.

Table 5: Recycled fashion market segmentation

|

Consumer type |

Price level |

Fashionability |

Material use |

Functionality |

Order quantities |

|

Luxury consumer

|

High to very high retail prices |

Highly fashionable, unique designs |

Use of luxury materials such as recycled wool and cashmere. High-quality recycled polyester |

Very high requirements for product quality, design and innovation |

Low order quantities |

|

Practical consumer

|

Medium retail prices |

Practical designs in line with latest fashion trends |

Recycled cotton, wool, recycled polyester |

Medium requirements for design, good product quality is required |

Medium to high order quantities |

|

Price-conscious consumer

|

Medium - low retail prices |

Basic, functional styles |

Medium quality materials made from cutting waste. Recycled polyester |

Medium to low requirements for design and quality |

High order quantities |

Luxury consumer

European luxury consumers shop at European apparel brands in the luxury and upper-middle market such as Filippa-K and Viktor & Rolf. These brands want top-quality recycled materials and workmanship. Recycled cashmere and wool are popular fabrics in this segment, as is recycled cotton combined with a relatively expensive virgin yarn (such as Tencel™). Another common material is recycled polyester, because of its yarn stability, competitive price level and good sustainability story.

Practical consumer

The middle market caters to practical consumers. Recycled cotton (both cutting waste and post-consumer textile waste) and wool are popular materials in this market segment. See, for instance, Mango and Bestseller. This market segment also has demand for recycled polyester (a popular fabric in all market segments, from luxury to budget).

Price-conscious consumer

The lower-middle and budget markets, with companies such as Inditex (parent company of retail chains such as Zara and Massimo Dutti) and JBC, cater to price-conscious consumers. They are characterised by demand for recycled polyester and cheap yarns and fabrics made from cutting waste.

Tips:

- See the Cradle to Cradle Certified product registry for an overview of 50 innovative recycled fabrics.

- Research and contact global recycled fashion manufacturers to build your network and find out about workable recycling options.

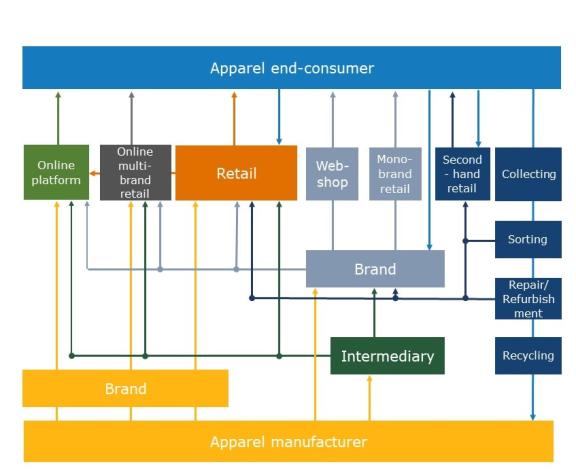

Through what channels does a product end up on the end market?

A buyer’s position in the value chain determines how they do business with you. Every buyer has their own approach. Always try to find out in what part of the value chain your buyer is operating, what challenges they face in the market and how you can support their sales strategy.

- If you want to target European end consumers, try selling via platforms such as Alibaba, Wish, Amazon or Wolf & Badger (for small independent brands). Most online consumers live in countries in Europe’s northwest. You will need to invest in a webshop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness.

- The growing second-hand market in Europe is serviced by online platforms such as vestiairecollective.com, vinted.com and depop.com, and national websites such as marktplaats.nl (the Netherlands).

- Online multi-brand retailers such as Zalando, ASOS and YOOX sell existing apparel and other brands and often develop their own private collections, mostly value brands. They can detect market interest very fast and immediately respond to sales data. Such companies usually place a small test order first. Then, if the item is selling well, they place an actual production order. Fast delivery is a must.

- If you want to sell to retailers, the biggest names in recycled fashion are retailers such as Inditex and H&M. Besides big chains, most recycled fashion is sold in boutique shops that can be found in almost every European city. These shops sell existing (sustainable) brands, but some also order products that are specially developed and manufactured for them. This market level is less competitive and relatively easy to enter.

- Apparel brands typically develop their collections 6 to 9 months in advance. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every salesman sample needs to be current, meaning it must look exactly like the product will in the shop, with branded hangtags and accessories. It may take many months before orders are placed.

- Intermediaries such as agents, traders, importers and private label companies will sell your product on to buyers up the value chain. They are extremely price-focused and require flexibility in quantities and qualities. Some are located near or in the production countries and primarily do sourcing and logistics, such as Fashion Linq. Others, such as Fully Fashion, work from Europe and also do market research, design and stock-keeping. Their service level determines what commission rate they charge.

Figure 3: The fashion market value chain

Tips:

- Look for potential buyers on the exhibitor lists of trade fairs, such as Neonyt (Germany), even if you don’t plan to attend. If you do plan to meet a buyer at a fair, check what collections they have, buy 1 or 2 items and prepare matching or even improved samples.

- Work out the costing before you present your company and samples to a potential buyer. See the CBI study on cost calculation for tips and advice.

- Monitor fashion news sites such as FashionUnited and Fibre2Fashion for industry news on recycling. MaterialDistrict organises trade fairs and offers a good online overview of innovations in circular materials, including yarns and fabrics.

- Try to visit or participate in events and discussions on recycling in fashion. This will build your network and keep you up to date, as the industry changes fast.

What is the most interesting channel for you?

As you move higher up the value chain, your margins will increase, but so will the service level that buyers expect from you. If you still have little experience exporting to Europe, intermediaries and brands are likely the best starting point.

Intermediaries

Agents or traders/importers/private label companies are the most adventurous type of buyer and are usually the first to try out new sourcing destinations and factories. Working for this type of buyer gives you access to many different buyers up the value chain, letting you learn how to service them.

Brands

Few European fashion brands specialise in recycled fashion, but the use of recycled yarns and fabrics is becoming increasingly common for many. There is room for price negotiation with brands (especially in the higher market segments), but your service level has to be higher than what intermediaries ask from you.

Retailers

Most large European fashion retailers sell recycled fashion collections and are used to doing business with manufacturers in developing countries. It can be very difficult to start a business relationship if you do not meet all such a buyer’s requirements. Besides delivering a good-quality product at a competitive price, your service level has to be very high. Retailers may lack professional expertise on recycled fashion, so product quality and development advice is highly appreciated.

Smaller, local fashion retail chains such as JBC, WE and VARNER can also be an interesting channel, as they often struggle to find suppliers that can meet their requirements for low order quantities.

Tips:

- Work with recycling companies. Many buyers partner or are connected with recycling companies. You can work as a team to offer buyers ready-made products.

- Create a story for your product/production, supported and proven by data. This story will boost your sales, attract buyers and add value to your product.

3. What competition do you face on the European recycled fashion market?

The European market for recycled fashion is small but growing and far from settled. Many buyers are still looking for the best way to set up an efficient supply chain that meets their requirements. At the other end of the value chain, many manufacturers worldwide are entering the post-consumer recycled apparel market. If you want do this too, you need to secure a supply of second-hand clothes or fabrics before shortages push up prices.

Which countries are you competing with?

Many apparel-producing countries make items from recycled fabrics, but not all have locally produced recycled materials. China is big in recycled polyester (rPET), Spain and Morocco in recycled denim, India in recycled cotton and Italy in recycled wool.

Table 6: Competing countries

|

Country |

Strengths |

Weaknesses |

Image in Europe |

Future developments |

|

China |

Market leader in recycled polyester made from PET bottles and wool fabrics from cutting waste |

High MOQs, rising labour costs, no GSP, long distance to and from EU for recycling post-consumer waste |

High quality, high service |

Technical innovation focused on producing semi-finished products made from cutting waste and local post-consumer waste meant as input material for various industries |

|

India |

Experienced in recycling post-consumer apparel waste for use in carpets and curtains. Newly developed recycled yarns used for flat knits, denims, T-shirts and socks |

Lower service level than China, struggling to comply with social standards |

High quality, focus more on cotton and viscose, less on polyester products |

Growing export of materials and ready-made garments made from post-consumer waste sourced on international markets |

|

Morocco |

Close to Europe, making it suitable for recycling European post-consumer waste. Free trade agreement with the EU |

Relatively high wages and production costs |

High quality, relatively expensive |

Focus on circular solutions beyond recycling, for instance refurbishment and repair |

|

Italy |

Long history of manufacturing flat knits, focus on recycling high-quality post-consumer waste into new yarns |

High production costs |

High quality, high cost |

Recycling industry focused on medium to high quality and price level |

|

Spain |

Developed a process of recycling post-consumer denim jeans waste into new yarns and fabrics |

High production costs |

High quality, high cost |

Focus on development and export of expertise in sustainable and recycled apparel, less on local production of ready-made garments |

Tips:

- Focus on product development and sourcing. Offer buyers different qualities that are sourced from different countries. Be aware that transport and stock-keeping adds extra costs to your proposal.

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the advantages of doing business with you. Focus on GSP, but also consider factors such as distance to Europe, ease of doing business and transparency.

Which companies are you competing with?

At Yousstex International, jeans fabric is cut, sewn, washed and branded. Thanks to innovative production techniques, Yousstex can produce jeans with a highly sustainable profile. The factory is located in Touza, a rural area of Tunisia. With 550 employees, Yousstex is quite small for a garment manufacturer and has a family feel.

SIP in Tunisia creates innovative designs using recycled yarns and fabrics. Pattern, cutting and sewing designs are developed at SIP headquarters, creating valuable intellectual property. The company has 1,500 employees and manufactures over 3 million units of apparel every year.

Shasha Denims in Bangladesh began as a family-owned company with a vision to set a global standard in green and sustainable denim manufacturing. It develops and refines environmentally-friendly techniques and procedures. Shasha has now positioned itself as one of the leading 100% export-based denim manufacturers in Bangladesh.

Which products are you competing with?

Recycled fashion competes with several other types of fashion products and practices in the broader fashion industry. Some of the primary competitors and alternatives to recycled fashion are:

Vintage

Second-hand and vintage stores offer pre-owned clothing and accessories at lower prices. While recycled fashion may incorporate second-hand items, it competes by emphasising upcycling, repurposing and reimagining used garments to create unique items.

Sustainable fashion

Sustainable fashion brands produce clothing using environmentally-friendly materials (such as organic cotton, Tencel™ or bamboo), with ethical labour practices and sustainable production processes. Recycled fashion competes by focusing on the specific use of recycled or upcycled materials as a primary selling point.

Rental

Clothing rental and subscription services let consumers access a changing wardrobe without the need for constant purchasing. Recycled fashion can compete by offering a similar service with an emphasis on sustainable and repurposed garments.

4. What are the prices for recycled fashion?

The factory price of your product (in fashion industry jargon, the Free On Board, or FOB, price) depends on many factors, including the cost of materials, workforce efficiency, overhead and profit margin. For a step-by-step guide on how to calculate the FOB price of apparel items, see this CBI study on cost-price calculation.

The average cost breakdown of your FOB price should look like this:

Retail pricing

The retail price of an apparel item is on average 4 to 8 times the FOB price (known as ‘retail markup’). Therefore, the FOB price is on average 12.5-25% of the retail price of the product. There are exceptions. In the budget market, some large European retail chains may only double the FOB price markup. Retailers mark up the FOB price by 4 to 8 times to account for import duties, transport, rent, marketing, overhead, stock-keeping, markdowns and VAT (15-27% in EU countries), amongst other things.

Material pricing

Collecting, selecting and processing post-consumer apparel waste is a labour-intensive process. Among other things, it involves selecting waste apparel items by quality (fibres, blends), colour, cleanness and removing all trims and tags before shredding. In countries where wages are low, this can result in fabrics that are price-competitive with fabrics made from virgin yarns. In countries with higher labour costs, these yarns and fabrics cannot yet compete with virgin fabrics.

Another major influence on fabric price is the percentage and price/quality level of the virgin yarn blended with the recycled yarn. Virgin yarns are mixed with recycled yarn to stabilise the final yarn. Any yarn can be used, but for reasons of sustainability, buyers may choose relatively expensive yarns such as Tencel™ or organic cotton. In any case, blending yarns cancels out the economy of scale of 100% cotton yarn production.

Retail price levels

According to Eurostat’s 2022 comparison of retail prices for apparel in Europe, of the top 3 European apparel and footwear importers, France has the highest price level, at 105.4 points compared to the European average of 100, followed by Germany (98.7) and Spain (84.8). Denmark is the EU country with the highest price point (134.4), while Switzerland is the most expensive European country for apparel (141.5).

Source: Eurostat

Developments in cost and pricing

Online commerce and a strong budget segment have made European consumers accustomed to low prices. However, a stronger focus on sustainability and rising costs for materials, production (due to global political instability) and shipping have put manufacturers, suppliers and buyers under huge price pressure. Inflation in Europe decreased somewhat in 2023, but is still higher than normal.

Frans Tilstra and Giovanni Beatrice for FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research