The sustainable transition in apparel and home textiles

Contents of this page

1. Introduction

Change can be an opportunity. One of the most important ambitions of Western apparel and textile markets is to transition to a fully sustainable value chain. This means that there is no negative impact on people, animals and the environment during the life cycle of textiles. Such a huge change requires a great deal of adaptation from buyers and manufacturers, but also promises enormous social, environmental and economic benefits. This report will help companies and business support organisations to understand what the sustainable transition is, and how they can meet and exceed tomorrow’s requirements.

The sustainable transition, like all socioeconomic transitions, is not a fixed concept introduced by a small group of actors. It is a moving target, influenced and determined by many different actors. Most experts on transition theory agree that transitions happen when technical or social innovations are slowly being adopted into existing systems in industry, culture, policy, science, consumer preference and technology. When significant events in the underlying political, economic and demographic landscape put sudden pressure on existing systems, then niche innovations can change the existing ‘regime’ or mainstream way of doing things.

The last fifty years have seen many different niche innovations in sustainable textiles being introduced in the sociotechnical system, from new techniques for cleaner production and better waste management to new strategies to improve working conditions. Significant events have also occurred, from factory accidents to environmental crises. When niche innovations are adopted into mainstream systems and irreversibly change business ethics and practices, it is appropriate to speak of a sustainable transition. Then the regime has changed.

2. A series of transitions

When an industry experiences a transition, buyer requirements (both legal and non-legal) change with it. This is a continuous process. Transitions force suppliers of apparel and home textiles to reflect on their capabilities and adapt to new developments in their target markets. In the last 50 years, the apparel and home textiles industry has gone through multiple transitions.

In the 1970s and 1980s, Europe moved production to Asia where labour was relatively cheap. Many trading companies set up offices in Hong Kong from where they handled business for European buyers. The main business driver was creativity in sourcing to reduce the purchase price. When shifting production to Asia did indeed prove to be sound business practice, brands and retailers started setting up their own buying offices in Asia. They wanted to reduce costs by cutting out the middleman and trading directly with manufacturers.

With the outsourcing of production to Asia, Western buyers and their governments lost insight and control over the circumstances in which apparel and textiles are made. In this period the OECD (Organisation for Economic Co-operation and Development) introduced its Guidelines for multinational enterprises, a set of recommendations on how companies should behave ethically when doing business in an international context.

In the 1980s, the focus of the apparel and textiles industry shifted to speed. To bring down lead times, fast fashion manufacturing established itself in countries like Italy, Turkey and Morocco, as well as in other markets close to Europe. From the late 1990s onward, retailers like Inditex and H&M became market leaders by supplying the European market with affordable and ever-faster changing collections.

After the year 2000, consumer safety came into focus in Europe, along with the protection of workers and the environment during production. New mandatory legal requirements concerning product safety and the use of chemicals (REACH) where introduced. Social compliance initiatives were started, including ETI, WRAP, SEDEX and BSCI, which quickly gained popularity among European buyers, who added these certifications to their terms and conditions for doing business. Greenpeace started the ‘Detox my fashion’ campaign, leading to the ZDHC.

Protest commemorating the first anniversary of the Rana Plaza disaster. Photo by Solidarity Center (CC BY-ND 2.0)

All this could not prevent unethical practices persisting in international supply chains for apparel and home textiles. The Rana Plaza disaster in 2013 underscored this fact in a dramatic way. A garment factory building collapsed in Dhaka, Bangladesh, killing 1,134 people and leaving many more injured. In response, new initiatives such as the ACCORD (mostly European signatories) and the Alliance for Bangladesh Worker Safety (mostly US signatories) were set up to address workers’ rights and building safety.

At the same time, several European governments drafted sustainability agreements with the European apparel and textiles industry. In Germany this led to the ‘Partnership for Sustainability Textiles’ and in the Netherlands to the ‘Agreement on Sustainable Garments and Textile’. These included far-reaching ambitions, for instance in terms of due diligence and transparency.

Meanwhile, pressure groups such as Clean Clothes Campaign, Fashion Revolution and Extinction Rebellion kept pushing governments, the industry and consumers to enforce and adopt fair and sustainable practices. This led to greater consumer awareness about human rights abuses and environmental degradation. Slowly but steadily demand for sustainable apparel and textiles in Western markets kept rising.

Markets and governments reacted with several pledges to source more sustainable materials and to reduce CO2 emissions. More than 50 companies signed the Textile Exchange’s 2025 Sustainable Cotton Challenge to source 100% of their cotton from the most sustainable sources by 2025. Members of the German Textile Partnership agreed to use 70% sustainable cotton by 2025, with 20% of this organic cotton. In addition, more than 40 large fashion brands pledged to achieve net zero emissions by 2050.

The sustainable transition

European governments and the EU decided to help speed up the transition by introducing new legal measures to promote fair and sustainably business practices. Several European countries including the UK, France and the Netherlands, introduced laws forcing large companies to investigate, prevent and remediate human rights violations and environmental pollution in their supply chains. The European Union is planning to introduce similar legal measures for all European corporations.

Furthermore, in 2019 the European Union presented the ‘Green Deal’: a growth strategy “to move to a clean, circular economy and stop climate change, revert biodiversity loss and cut pollution”. The ambition is to remake Europe into the “first climate neutral continent” by 2050. Europe is trying to achieve this goal not only through legislation, but also by making huge investments in clean technologies and developing new business models.

Concrete legal measures to help formalise the sustainable transition should be expected from 2021 onward. This includes legislation on: due diligence regarding human rights and environmental protection; a new ‘carbon border adjustment mechanism’ that imposes a tax on exports to the EU from countries that do not impose a carbon constraint on their industries; extended producer responsibility (EPR), meaning making companies financially responsible for environmental costs of textiles during their life cycle; and the ‘right to repair’ for consumers.

The introduction of such legal measures would formalise the sustainable transition and irreversibly shift sustainable production from a nicety to a legal requirement for doing business with the EU. Once again, change can be an opportunity. Companies that are able to meet and exceed tomorrow’s sustainability requirements will have a huge competitive advantage and reap the benefits of the sustainable transition.

Tips:

- Check the CBI report on buyer requirements to learn more about developments in mandatory requirements and additional requirements that buyers may have.

- Check the EU’s website about the European Green Deal (which includes a timeline) to keep yourself updated on coming policy changes.

- Read the Q&A section on the EU’s new Circular Economy Action Plan.

- Check industry association Euratex’s position paper on EPR.

3. Root Causes

The apparel and home textiles industry is still almost entirely based on the linear ‘take-make-waste’ model. Non-renewable resources and cheap labour are used to produce fashionable apparel and textile items that are burned or landfilled after use. Especially in the fast fashion industry products have a notoriously short lifespan. It is estimated that more than half of all fast fashion items produced are disposed of within a year. This is not because of inferior quality, but because consumers consider them ‘old’ or ‘out of fashion’.

In the words of the Ellen MacArthur Foundation this linear system “leaves economic opportunities untapped, puts pressure on resources, pollutes and degrades the natural environment and its ecosystems, and creates significant negative societal impacts at local, regional, and global scales”. A selection of such impacts is shown below.

Table 1: Overview of the impact of the global apparel and textiles industry

Sources: World Economic Forum, the Ellen MacArthur Foundation, IUCN, Global Fashion Agenda, Nature, ILO, Care, Global Slavery Index, Clean Clothes Campaign, Four Paws.

An economic opportunity

A transition to a sustainable apparel and textiles industry would have enormous social and environmental benefits for the global community. There is also an economic incentive. According to the Ellen MacArthur Foundation and McKinsey, the shift to a sustainable, circular economy would help recapture more than €400 billion in industry losses every year and still mitigate negative environmental impacts. The EU believes the transition to a sustainable, circular economy will stimulate competitiveness, innovation, economic growth and job creation.

Europe after the sustainable transition

For these reasons, a fully transparent circular economy is the foundation of Europe’s strategy to minimise the negative impacts of the apparel and textiles industry. The goal is a closed-loop system in which apparel, textiles, home textiles, fibres and other materials retain their value for as long as possible and waste is minimised. This requires strategies such as recycling, refurbishing, reusing and rethinking the lifecycle of apparel and textiles. The system ideally has no impact on the environment, is fully transparent, avoids the use of non-renewable energy sources and guarantees respect for workers’ rights.

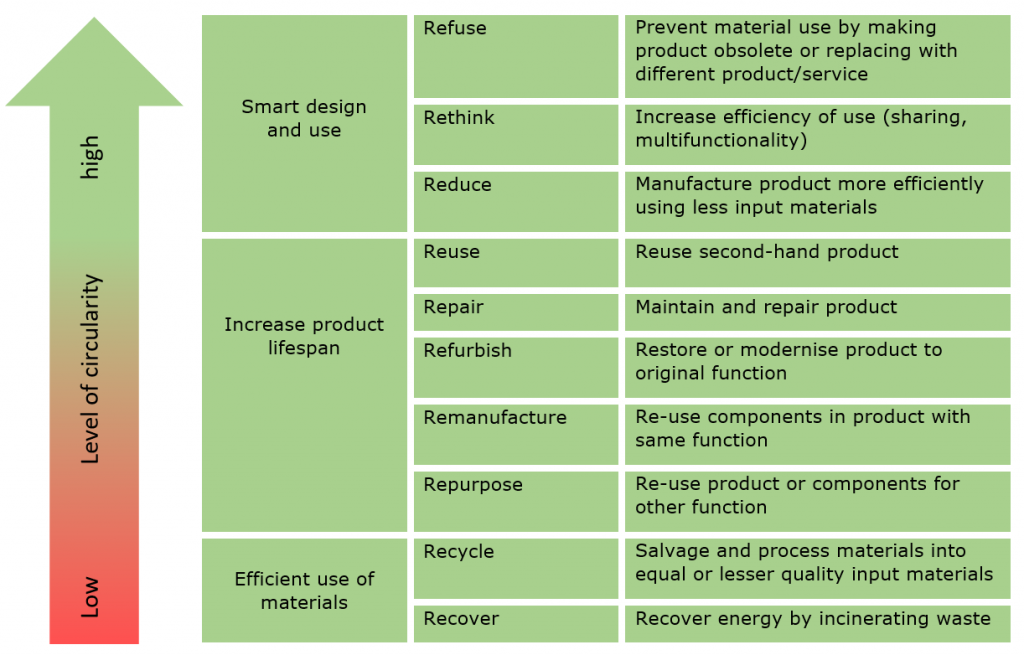

The figure below is the commonly used R ladder of circularity. It shows the different strategies for minimising the input of non-renewable resources and keeping products and materials in the apparel and textiles loop for as long as possible. Note that textiles that are non-reusable may be used as input material for other industries.

Figure 1: The R ladder of circularity

There are several characteristics that this figure does not show. A fair and sustainable, circular apparel and home textiles industry should also do the following.

- Guarantee workers’ rights, including a living wage, safe working conditions, gender equality and no child labour.

- Show respect for animal welfare.

- Eliminate CO2 emissions, by using renewable energy sources such as wind and solar power.

- Use renewable (virgin) input materials until they are no longer needed to create fully recycled fibres and fabrics of sufficient quality.

- Regenerate ecosystems and prevent deforestation, soil degradation, water depletion and biodiversity loss.

- Eliminate the use of toxic chemicals and prevent pollution of the environment.

- Prevent microfibres from entering the environment during the use of apparel, textiles and home textiles.

- Be fully transparent, with traceable material flows.

- Stimulate the calculation of the ‘true price’ of products, including the costs of negative impacts on society and the environment.

Tip:

- Watch Ellen MacArthur from the Ellen MacArthur Foundation explain the basics of the Circular Economy on YouTube.

4. Impact on producers

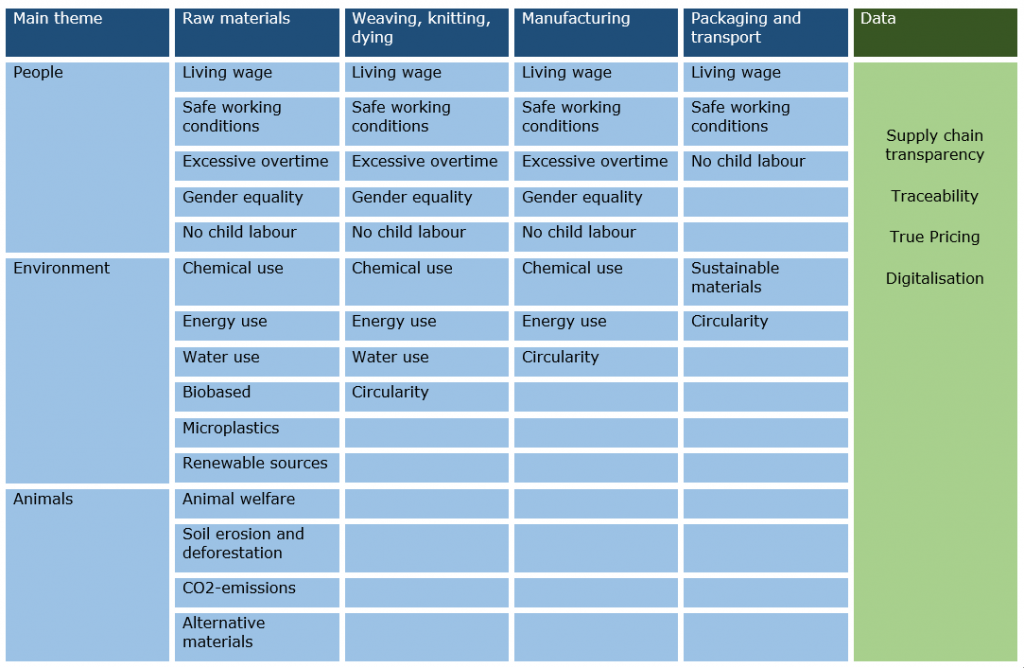

The sustainable transition in apparel, textiles and home textiles in Western markets will influence every step in the value chain and touches upon many different themes, from transparency and workers’ rights to clean production, recycling and design for recycling. For suppliers, it is important to recognise the relevant themes and set priorities based on their position in the value chain. This section covers the main themes in the sustainable transition of the apparel and home textiles industry.

Workers’ rights are covered in a separate section entitled ‘People’. Environmental issues and animal rights are subsequently covered per step in the value chain.

Figure 2: Main sustainability themes per step in the value chain

People

The apparel and home textiles industry employs 80-90 million people worldwide, most of them women. A large percentage of textile workers earn far less than a living wage, work many hours in unsafe conditions, often working too long as well, and lack other basic rights such as freedom of association. Many female textile workers face regular harassment, including sexual harassment. Throughout the value chain, children are put to work. In many countries they work primarily in cotton fields and in factories for ready-made items, but in other countries they also work in textile mills.

Several standards and certifications in the textile industry aim to encourage fair treatment of workers in garment manufacturing. Here are some of the standards currently most requested by European buyers.

- Amfori BSCI (Business Social Compliance Initiative). Currently for many European buyers BSCI is the most popular certification. It is a supply chain management system that helps manufacturers drive social compliance.

- Other popular standards that guarantee apparel and textiles are made with respect for workers’ rights are WRAP (Worldwide Responsible Accredited Production), SEDEX, ETI (Ethical Trade Initiative), SA8000, ISO 26000, FWF (Fair Wear Foundation) and Fair Trade.

Since 2015 several European governments have introduced laws requiring importing companies to do their due diligence on human rights violations in their supply chains. This includes the UK (Modern Slavery Act), France (Duty of Vigilance law) and the Netherlands (Child Labour Due Diligence Act). A similar initiative in Switzerland was narrowly rejected in 2020. The European Union is now planning to introduce legal measures for European corporations on human rights, the environmental duty of care and due diligence across economic value chains.

Tips:

- Check the eight fundamental ILO conventions on labour standards. They are a set of legally binding and non-binding principles on topics such as wages, forced labour, child labour and the freedom of association.

- Check the data on a living wage in your country and try to set up a living wage programme. Dutch workwear manufacturer Schijvens is a good example.

- Familiarise yourself with the buyer requirements regarding social issues by reading the codes of conduct for suppliers that European buyers such as C&A and H&M require.

- Check this practical tool created by the UN for assuring children’s rights with regard to sourcing frameworks.

- Study your country’s score for corporate social responsibility (CSR) risks, and try to adjust your company policy to address possible issues.

Raw materials

The first step in the supply chain concerns raw materials. The apparel and home textiles industry is a major contributor to many of the environmental crises we experience today. Among other things it causes deforestation, biodiversity loss, soil erosion, water depletion, liquid waste pollution, solid waste pollution, air pollution and CO2 emissions in producing countries, as well as enormous waste streams in target markets. A large portion of these impacts is caused by the production of raw materials.

Chemical use

The production of both natural and synthetic fibres requires large amounts of chemicals that are harmful to the environment. There are several ways to produce raw materials using fewer chemicals as well as less harmful ones. To limit the use of chemicals in the production of raw materials, there are several sustainable options available for producers.

- Organic cotton. This is cotton grown without the use of GMOs ‘genetically modified organisms) and synthetic chemicals. To meet the rising demand for organic cotton in Europe, the EU will simplify its organic directive in 2021 and strengthen its control mechanism. Read more about organic cotton in the CBI study on sustainable cotton.

- Man-made cellulosic fibres made from chemically recycled cotton waste. Some of the best-known are Bemberg (or Cupro) by Asahi Kasei, Circulose by Re:newcell, Refibra™ by Lenzing and Nucycl by Evrnu. Although not all of these initiatives are commercially viable yet, the technique of chemically recycling cotton in theory makes it possible to produce fabrics with 100% recycled material content.

- Regenerated fibres, such as Tencel® and Modal® (produced by yarn manufacturer Lenzing), or other sustainable fibres, such as Recover, REPREVE and Infinited Fiber, or even with innovative bio-based polymer fibres, such as PLA, milk, seaweed and soy.

- Fabrics blended with eco-friendly fibres, such as hemp or linen.

- Biodegradable regenerated fibres, such as Pond or PrimaLoft Bio.

- Use of recycled plastic fibres, such as PET (recycled polyester) or recycled nylon.

Biobased materials

Some European and US brands and retailers avoid the use of synthetic fibres and chemicals made from non-renewable sources in favour of ‘biobased’ materials. These can be made from plants or other forms of biomass from climate-smart agriculture. Biomass-based fibres and dyes reduce dependency on non-renewable fossil fuels, decrease CO2 emissions and prevent shedding of microplastics. In a 2017 Duke University survey among international apparel and textile professionals, 55% of respondents indicated they were looking to increase their use of biobased materials in the coming years.

Microplastics

Washing apparel and textiles made with synthetic fibres is estimated to be responsible for up to 35% of all microplastics particles found in the world’s oceans today. The exact impact of microplastics on marine life and human health is still under debate, but there is little doubt that microplastics are harmful when digested, as are the chemicals and organic pollutants associated with microplastics.

Currently industry standards such as Ecolabel or OEKO-TEX® do not yet include an evaluation of fibre shedding, but the EU is working to include microplastics in the REACH regulatory framework for restricted chemicals in apparel and textile products (see below).

Tip:

- Watch this short video published by The Economist about microfibres from textiles.

CO2 emissions

The latest decade was the warmest on record according to the UN. The global apparel and home textiles industry is a major contributor to global warming, causing approximately 10% of all CO2 emissions each year. Switching to organically farmed natural fibres and recycled and regenerated fibres from non-renewable sources can significantly reduce CO2 emissions. Various studies agree that organic cotton causes up to 40% less CO2 emissions than conventional cotton, while for rPET this is up to 35% less.

Water use

Cotton and polyester are the two most used fibres in the production of apparel and home textiles. Especially cotton requires large amounts of water to produce. It can take up to 10 thousand litres of water to produce one pair of denim jeans. Switching to organic cotton may save over 90% in water use and avoid pollution caused by synthetic fertilisers and other fertilisers and pesticides. The production of polyester requires less water, although all fibres require large amounts of water in the next step of the value chain, which includes dyeing.

Animals

The use of animal-derived materials such as wool and leather in apparel and home textile products comes with very distinct concerns: animal welfare, soil erosion, deforestation and greenhouse gas emissions. A small but growing number of European brands and retailers are switching to alternative ‘vegan’ materials.

The use of endangered species of animals and plants or parts thereof in apparel and home textile items is restricted by the EU wildlife regulatory measures EC 338/97. This regulation is based on the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). Check which animals and plants are restricted on the website of the EU Trade Helpdesk.

A commonly used framework in Europe for assessing animal welfare is informed by the ‘Five Freedoms’ that animals should have, which include freedom from hunger or thirst, freedom from discomfort, freedom from pain, freedom to express natural behaviour and freedom from fear. Animal rights advocacy group Four Paws has translated these into a set of recommendations on animal welfare. The challenge for apparel and home textile producers is to trace their animal-derived materials, which is very difficult in many countries.

Cattle rearing causes massive soil erosion and deforestation in many parts of the world. This is why some apparel and home textile companies have pledged to avoid buying leather from countries that are known for deforestation due to cattle rearing. An example is the VF Company (parent to Timberland, The North Face and Kipling), which announced in 2019 that it will no longer source leather from Brazil. Cattle are also responsible for the emission of large amounts of greenhouse gases, including methane.

Because it is very difficult to trace animal-derived materials and determine how animals have been treated during their lifetime and during the slaughtering process, a growing number of European brands and retailers market themselves as ‘animal cruelty free’ or ‘vegan’. They avoid the use of animal-derived materials or have completely abandoned it. Instead they use textiles (natural and synthetic) or plant-based non-wovens such as paper (e.g. Uashmama), pineapple (H&M using Pinatex) cork (Pelcor) and microorganisms (Le Qara).

Tips:

- Check TextileExchange’s Sustainable Cotton Matrix for a complete overview of sustainable cotton options or search the ITC Standards Map for sustainable cotton standards and their requirements.

- Read TextileExchange’s quick guide to organic cotton for an overview of environmental benefits of organic cotton farming.

- Check Material District or Springwise for an extensive overview of innovations in sustainable fibres, yarns, fabrics and non-wovens.

Weaving, knitting, dyeing, washing, printing

The next steps in the apparel and textiles value chain – weaving, knitting, dyeing, washing, printing and finishing – cause several negative impacts on the environment. Especially the dyeing and washing processes require large amounts of water and chemicals, and may cause harm to people working in the dyeing houses and damage to the environment if wastewater is not treated properly.

A recent article in Biomedical magazine stated that textile mills around the world discharge millions of litres of wastewater that may contain harmful chemicals, such as “sulfur, naphthol, vats, nitrates, acetic acid, soaps, chromium compounds, and bulky materials such as copper, arsenic, lead, cadmium, mercury, nickel, and cobalt, […] formaldehyde-based dye fixing agents, hydrocarbon-based softeners, and non-biodegradable dye chemicals”.

Chemicals

To improve human health and the protection of the environment, apparel and textiles imported into the EU must comply with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). This regulation restricts the use of a large selection of harmful chemicals, including certain azo dyes, flame retardants, waterproofing and stain-repelling chemicals and chromium VI in leather. The complete list of chemicals restricted by REACH is available online. Every year, new restrictions are added.

On top of REACH, many fashion brands and retailers have formulated their own restricted substances lists (RSLs), which are stricter than REACH. Manufacturers that want to do business with these buyers need to comply with these buyer-specific RSLs. Such RSLs are often inspired by the Zero Discharge of Hazardous Chemicals (ZDHC) guideline on safe chemicals use. Download the ZDHC Conformance Guide to learn how to comply with the ZDHC guideline.

To limit the use of toxic chemicals in textiles, buyers may require fabrics to have been bleached with sustainable techniques using hydrogen peroxide or ozone instead of chlorine. Alternative eco-friendly dyeing methods are dyes with only natural ingredients, such as Rubia, Fibre Bio or Greendyes.

Tips:

- Check the Q&A section on the website of the European Chemicals Agency for answers to the most common questions about REACH and the use of chemicals in textiles and leather.

- Keep yourself up to date on REACH by checking the candidate list of the substances of very high concern, which are under consideration of being restricted by REACH.

- Check H&M’s restricted substances list 2020 to get an idea of the specific requirements buyers can have.

- Read more about the ZDHC programme and check which brands are working with ZDHC.

- Get the latest notifications on national and EU regulations and bans on products on EPingalert.

- Make sure you only work with suppliers of yarns and dyes accessories that are REACH compliant. Ask for proof that they are.

Water use

Processes such as bleaching, dyeing, resin treatment, waterproofing and adding flame retardants all require large amounts of water. New techniques are available to save water during such processes, including integrated dyeing, washing and finishing systems, such as Big Box Dyeing by Chinese denim manufacturer Advance Denim, dyeing fabrics with CO2 instead of water, (e.g. Dyecoo), and laser finishing of fabrics.

CO2 emissions

The emissions of greenhouse gases caused by weaving and knitting, such as carbon dioxide (CO2), are largely due to the machinery in textile mills running on fossil fuels. Wet processes such as bleaching, dyeing, washing and drying also consume lots of fossil fuel energy. Switching to renewable energy sources such as solar, wind, hydroelectric or geothermal energy can significantly reduce the carbon emissions of textile mills and dyeing houses.

Circularity

There are many opportunities for recycling in the dyeing and washing process. Besides reducing water input, it is important for textile mills to increase the recycling of wastewater. Another option is switching to dyestuffs made from recycled materials, such as Recycrom.

The use of recycled cotton in new fabrics makes it possible for spinners to create fabrics that do not have to be dyed. Sapphire Mills from Pakistan, for instance, has created a denim fabric made with 77% organic cotton and 22% post-consumer recycled cotton, involving no dyeing at all. Brazilian mill Vicunha has introduced Twig: a fabric made with only recycled cotton, also using no dyes.

Manufacturing

The sustainable transition of the apparel and home textiles industry will require a lot of adaptation from producers of ready-made products. This is not because factories always have the biggest environmental impact. The reason is many European buyers will place responsibility for the entire product supply chain in the hands of the manufacturers. This requires an organisational setup that can deliver two things: supply chain management and guaranteed compliance with the buyer’s requirements.

Chemicals

The use of chemicals in the manufacturing process is usually limited to glue during production and detergents during washing. In both cases, manufacturers should consider switching to products without harmful chemicals to protect the people working with them and the environment.

CO2 emissions

Switching to renewable energy sources such as wind and solar power has multiple benefits. It brings down the carbon footprint of the factory and prevents air pollution around factories that still use diesel-powered generators as a backup in case of power shortages and outages.

Such measures should appeal to buyers who are working on offsetting CO2 emissions within their own supply chain (sometimes called ‘carbon insetting’). In 2019, a big group of buyers pledged to pay special attention to cutting CO2 emissions. Kering Group and Gap want to use 100% renewable energy by 2030. H&M even wants to become carbon positive by 2040. Such developments mean that investing in renewable energy and sourcing materials with a small CO2 footprint can give manufacturers a serious competitive advantage.

Circularity

An important aspect of the circular economy is waste prevention during production. Manufacturers can minimise cutting waste by investing in automated systems for cutting patterns and improving the efficiency of material use (fabrics, leather). Non-avoidable cutting waste should be repurposed by choosing strategies high up the R ladder (see above). Cuttings are ideally used as recycled content in new yarns and fabrics, or as non-woven materials. Using landfill to dispose of cutting waste or burning it to provide energy for the ironing department are not sustainable solutions.

With its new Green Deal, the EU is targeting reuse, repair, remanufacturing and recycling apparel and textile products in Europe. This means manufacturers should train their design teams to develop new styles that are durable and easy to reuse, repair, refurbish, repurpose or recycle. Ideally, manufacturers play a role in remanufacturing, refurbishing and repairing end-of-life apparel and home textile items (see also the section on new business models below).

Recycling post-consumer apparel and home textiles requires a supply chain that can collect and sort post-consumer items. Sometimes the collecting and sorting is done in a particular market and the post-consumer items are exported to other countries that have shredding capacity available and spinning mills that have the technology to process lint from recycled sources.

Tips:

- Check CBI’s study on Recycled Fashion for information on the market potential and ways to enter the European market.

- For more background information and practical guidance, check the Ellen MacArthur Foundation – Make Fashion Circular.

- Watch this short video by the Ellen MacArthur Foundation on the circular economy in textiles.

Packaging and transport

The EU and the European fashion industry are strong committed to reducing the environmental impact of packaging and packaging waste. Amendment 2018/852 to the EU regulation on packaging and packaging waste (Directive 94/62/EC) requires EU Member States to recycle 50% of plastic and 75% of paper and cardboard packaging waste by 31 December 2025. Meanwhile brands, retailers and packaging suppliers are working to introduce sustainable alternatives to conventional materials like cardboard and polyester.

Suppliers can tap into this trend by using less packaging material. This will not only save costs, but also will reduce the impact of packaging on the environment. Another option is to use environmentally friendly versions, such as recycled and biodegradable materials.

Another sensible method of minimising CO2 emissions is avoiding air freight when shipping orders to Europe in favour of more environmentally friendly modes of transport. Forwarder can provide a measurement of their sustainability performance, for example their score on the Clean Shipping Index. Transport by train can in some cases be an environmentally friendly transport option. The Yiwu-London train, for example, takes 18 days from the UK to China, and there are also routes from China to Italy and Spain.

Tips:

- When using cardboard, get the FSC-certified version.

- Buyers do not always require the use of individual hangers or polybags.

- Forwarders may measure the carbon footprint of transport and offer ways to reduce or compensate it. See for example DHL.

After having outsourced almost the entire apparel and textile supply chain in the last 50 years, Western markets are trying to regain insight in the circumstances in which textiles are made, all the way down to the factories and fields where raw materials are produced. Photo by Trisha Downing on Unsplash.

Transparency

No supply chain can be truly called sustainable if it is not transparent. Therefore, suppliers should invest in creating a fully transparent supply chain. This means they will need to investigate where their suppliers are sourcing their materials and how they have processed them. Suppliers will also need to invest in tools that can track and trace the origins of your products and prove their sustainability.

Turkish denim manufacturer Orta provides a nice example of a manufacturer servicing buyers with traceability information. It has a supplier map detailing the regions from which it sources materials, dyes and chemicals; a Life Cycle Assessment (LCA) tool and an app that shows buyers the environmental impact of their decisions in the design and production process.

To increase the level of quality, sustainability and REACH compliance, some European buyers will only work with recycled fabrics made from 100% traceable sources. Others, such as Dutch jeans brand MUD Jeans, will even go as far as to collect their apparel after use and have it recycled at a designated recycling plant.

Tips:

- EU Regulation 1007/2011 states that manufacturers must specify the material content of every textile item that is exported to the EU. Stating the country of origin in labelling is not mandatory, although it is preferable. Check the EU Trade Helpdesk for details.

- The Fashion Transparency Index 2020 provides background information on the growing demand for transparency and the transparency scores of big apparel retailers.

- Read how to comply with transparency requirements on the websites of the Clean Clothes Campaign and Human Rights Watch.

- Check the Open Apparel Registry. Many European companies have published their suppliers here.

- When mapping a supply chain upstream, manufacturers should start by asking their suppliers where they source materials. Check Sourcemap or Ecochain for examples of supply chain mapping methods.

- If manufacturers want to verify that one or more input materials are in a final product, they can use the Textile Exchange’s Content Claim Standard (CCS). This is a third-party verified chain of custody standard.

- Stay up to date on new traceability tools. The industry is experimenting with DNA tags, crypto tags and blockchain technology to increase transparency and traceability.

Digitisation

Until the early twentieth century, most consumers in the EU and the US would buy apparel and textiles at a local tailor or textiles store. These provided tailored items that suited taste, budget and build. Their craftsmanship vanished with the rise of mass-produced ready-to-wear clothing and home textiles. Wastage, overstock and unused apparel and textile items in households are the unintended side effects.

The current rise in new digital techniques, such as body scans, online fitting rooms, 3D printing and automation, and the increasing availability of real-time sales data mean that manufacturers can now once again offer more flexibility and tailor to buyer needs. Digitisation also offers opportunities for new business models. Online platforms and networks can put manufacturers in direct contact with buyers higher up the value chain, including end-consumers.

Although all this does not directly improve the sustainability of the apparel and textiles value chain, it can reduce wastage and mismatches. Digitisation also makes it easier for intermediaries, brands and retailers to base their production on market demand, increase their supply chain transparency and communicate about impacts.

True pricing

To determine social and environmental impacts, an increasing number of brands and retailers are looking at ‘true cost accounting’ or ‘true pricing’ as a method to quantify impacts. European sportswear brand Puma was one of the first companies to calculate and monetise environmental impacts. Dutch social enterprise True Price has published a nice example of a true price calculation of a basic white T-shirt made with cotton from India. Calculating the costs of social and environmental impacts of a textile product offers companies a method to monitor and report on their sustainability performance and to prioritise actions for improvement.

Innovation

According to most transition theory experts, the introduction of new techniques is rarely sufficient to force a transition of a socioeconomic system. A proper transition requires outside pressure as well: new knowledge, new legal measures, or an influential event that uproots the underlying political, economic and demographic landscape, and puts pressure on the existing systems to change. However, innovation is a key driver for change. The table below provides an overview of interesting sustainable innovations for each step in the value chain.

Table 2: Examples of sustainable innovations in apparel and textiles production

| Raw materials | Weaving, knitting, dyeing | Manufacturing | Transparency |

| Sustainable agriculture | Renewable sources | Optimisation | Mapping and impact |

| hydroCotton | huue | Unspun | Oritain |

| Farfarm | Indigo Mill Designs | Smartex | VeChainThor |

| Pili | &Wider | ||

| Biomass waste | Colorifix | Packing | MonoChain |

| Green Whisper | Nature Coatings | Sustainable materials | Sourcemap |

| Mango Materials | IndiDye | Paptic | Ecochain |

| Orange Fiber | SpinDye | Tipa | True Price |

| Agraloop | Imogo | Returnity | |

| Fullcycle bioplastics | Drywired | RePack | |

| Recycrom | |||

| Textile waste | Vienna Textile Lab | Recycling | |

| Bemberg | Materials and tools | ||

| Circulose | Resource efficient dye-systems | Econic | |

| Refibra | Avitera | Resortecs | |

| Nucycl | Dystar Cadira | Wolkat | |

| Recover | Dyecoo | Fastfeedgrinded | |

| REPREVE | Tonello | Pure Waste | |

| Infinited Fiber | circular.fashion | ||

| Renewable non-wovens | Reverse Resources | ||

| Renewable sources | Amadou | Circular Systems | |

| Flocus | Provenance | Recover | |

| Cocoon | Uashmama | ||

| Spintex | Pinatex | ||

| Sorona | Pelcor | ||

| Galy | Le Qara | ||

| Algalife | MycoTEX |

New business models

Many manufacturers feel that their responsibility for the product ends once they hand over the goods to their buyer. However, the shift away from the take-make-waste model and the move to a circular economy will require the adoption of new creative business models. This will give producers, brands and retailers more control over the fate of apparel and home textile items during and after use. This creates an opportunity for manufacturers to develop interesting ‘full concepts’ for the European market.

Examples of full concepts:

- Taking responsibility of post-consumer textiles by offering buyers the option of returning their product for circular purposes such as recycling into new lint and fibres. An option higher up the R ladder is servicing buyers with the possibility to remanufacture, refurbish or repair used items.

- Another way to secure control over products after use is implementing a leasing model. Instead of selling products, end-consumers are offered the possibility of leasing apparel and home textile items for a periodic fee. This means ownership of the product remains in the hands of the manufacturer, brand or retailer, who can collect the items for recycling, remanufacturing, refurbishment, repairing or reuse. This model has been pioneered by workwear and home textile manufacturers.

- Mass market made-to-measure. Offering buyers stock service in fabrics and trims reduces mismatches and unsold collections and increases speed-to-market. This principle is based on manufacturing according to market demand.

- Recycling or destroying medical wear is often organised by local organisations in the proximity of the buyer. This service is costly but necessary due to legal regulations. By servicing buyers with the full concept of production and recycling or destroying, manufacturers can create a future-proof supply chain.

Tips:

- For inspiration on circular business models, check out consumer brands MUD Jeans (leasing and reusing, recycling jeans), Circos (leasing and reusing, recycling baby apparel), Teemill (collecting and remanufacturing), Interface (remanufacturing carpeting) and Ahrend (leasing and reusing, refurbishing furniture).

- Read this article on The Guardian website about the rise in Europe of apparel rental platforms.

5. Who are the main actors?

The sustainable transition in apparel and home textiles is driven by many different players, including governments, industry associations, pressure groups, development organisations and consumers. Understanding their motives and actions is crucial for suppliers to adapt to future requirements.

EU and national governments

The EU as well as several national European governments are rapidly creating a new playing field for European apparel and textile brands and retailers. They are responsible for:

- Driving innovation (subsidies, tax deductions). For an overview of EU funding instruments for the circular economy, check the EU’s Open Data Platform.

- Economic incentives, such as sustainable procurement. See for instance this example of circular procurement of towels, wash cloths, scarves and overalls by the Dutch government.

- Legislation (due diligence regulation, taxes, tax deductions and bans).

- Trade policies (international movement of waste streams).

- Voluntary actions (industry agreements, pledges and standards).

Industry associations

Sector associations in the apparel and home textiles industry represent and support member companies, for instance in talks with the EU and national governments about new standards and regulations. Sector associations also provide their members with information and advice about the impact of the sustainable transition on their businesses.

Associations typically try to balance the commercial interests of their members with the ambitious sustainable goals that pressure groups and politicians might be pursuing. Some have recently changed their views and now favour many of the proposed sustainability policies. Check the position of Euratex (the European confederation of textile and apparel associations) on social and environmental due diligence and extended producer responsibility (EPR).

The following sector associations are the most important ones in Europe. They represent various international and national markets and market segments.

- The International Apparel Federation represents sector associations, brands and manufacturers in trade and sourcing issues.

- The European Branded Clothing Alliance represents more than 60 member companies.

- Eurocommerce represents the interests of 34 big retailers and wholesalers in Europe.

- For an overview of national sector associations, check the member page of Euratex, the European confederation of textile and apparel associations.

The following are sector associations for specific apparel markets or niches.

- PCIAW is the international sector association for workwear.

- COTANCE is the representative body of the European leather industry.

- Children’s Fashion Europe promotes the interests of children’s fashion companies in Europe. It comprises several national children’s fashion associations.

- United Fashion is an independent platform connecting manufacturers to independent European designers and startup fashion labels.

Pressure groups

Pressure groups are an important driving force behind the sustainable transition. A famous example is the ZDHC, resulting from Greenpeace’s ‘Detox my fashion’ campaign. Pressure groups often play a double role in their dealings with apparel and textile companies. They may be exposing human rights abuse, animal cruelty and environmental scandals in international supply chains in the media, yet many also work together with companies and governments to remediate and prevent such issues.

Fashion Revolution has drafted a list of key organisations in the sustainable transition of apparel and textiles.

Development organisations

Several international development organisations offer subsidised development programmes or coaching services, or access to these, including UNDP, FCDO, DANIDA, ITC, GIZ, ICCO and Solidaridad. CBI offers export coaching to SMEs in 35 countries, including advice on sustainable business practices and matchmaking. The CBI website offers an overview of current apparel programmes.

Consumers

Consumers display a somewhat ambivalent attitude towards sustainable apparel and home textiles. When questioned in a survey, a large percentage of respondents will usually stress their commitment to sustainability and fair practices, but this is not always reflected in sales data. For example, according to a 2019 research by Carbon Trust, 67% of respondents support the idea of a recognisable carbon label to demonstrate that products have been made with a commitment to measuring and reducing their carbon footprint. However, the research also indicated that 52% of respondents said that they do not generally think about the carbon footprint of a product before buying it. In a 2017 survey by Euromonitor, only 6% of respondents cited ‘sustainably produced’ when asked for which product features they would be willing to pay more. ‘Comfortable’ (42%) and ‘high quality’ (33%) ended significantly higher.

This has not stopped an increase in both supply and demand of ‘ethically’ marketed apparel and textiles. According to a report by fashion consultancy Edited, the number of new fashion items available online in the US and the UK which were described as ‘sustainable’ increased by 33% in 2017-2019. Edited also observed a 49% growth in ‘eco’ products, 173% growth in ‘recycled’ products and 70% growth in ‘vegan’ products. According to a 2020 McKinsey report, internet searches for ‘sustainable fashion’ tripled between 2016 and 2019.

Table 3: Overview of important stakeholders

6. Strategies for producers and business support organisations

The transition to a sustainable apparel and home textiles industry requires adaptability from suppliers worldwide. Buyer requirements will constantly become stricter and more difficult to meet. The transition also offers opportunities, as there are solutions available for suppliers to make their business more sustainable and to gain an advantage over competitors.

Producers

The five priorities for future sourcing by apparel and textiles companies are, according to a 2017 research by Accenture:

- Speed to market

- Social and environmental compliance

- Excellence in product quality

- Innovation

- End-to-end value chain collaboration

Speed to market

Having the right product in store at the right time has proven to be more successful than being the cheapest. This requires speed to market from suppliers, but more importantly: flexibility. Online sales and increasing availability of real-time sales data have diversified the market. This means that Asia, with its long lead times, is no longer the ideal manufacturing location for some buyers. This creates opportunities for suppliers who are located close to their end market and are able to offer low quantities, fast production and a high service level.

Compliance

Buyers often pass on the responsibility for sourcing sustainable materials made under fair and sustainable conditions to manufacturers. This means manufacturers must adapt their own sourcing strategy, build a transparent supply chain and comply with all the legal and non-legal requirements concerning workers’ rights and sustainability that buyers may now require. This is an investment, but will provide suppliers with competitive advantages, given that few suppliers are currently able to service buyers 100% with regard to their sustainability requirements.

Quality

Investing in quality involves more than just dealing with product quality, which is a non-negotiable requirement. Investing in the quality of service levels is just as important. This will increase business and will guarantee a smoother manufacturing process that gives buyers the confidence that manufacturers can comply with their standards.

Innovation

Focus on implementing technical innovations such as automation, efficient machines for cleaner production, new sustainable materials and new waste treatment techniques. This can provide many benefits for suppliers: faster and more efficient production, reduction of waste, and a wider range of sustainable materials, designs and functionalities on offer for buyers.

Value chain collaboration

Buyers are increasingly looking not just for a supplier, but for a supply chain partner who can process and react immediately to end-market sales data. Suppliers need to be working on the same level as the buyer on communication, design and order follow-up. Suppliers should therefore focus on becoming an extension of their buyers’ business setup and take care of the full product life cycle, from raw material to manufacturing, and ideally also processing the post-consumer waste. As a producer, you should focus on the following.

- Setting up a flexible production system that can produce high-quality products and handle small minimum order quantities (MOQs) and fast delivery.

- Ensuring adherence to all legal mandatory sustainability requirements for doing business with the EU. Get certification (BSCI and WRAP first) to meet non-legal buyer requirements.

- Paying a living wage, eliminating workers’ rights abuses and improving health and safety in factories.

- Creating a reporting system for social and environmental impacts.

- Increasing supply chain transparency and material traceability by mapping your supply chain upstream. Start by asking your suppliers where they source materials.

- Studying new sustainable materials and product and production innovations. Try to offer buyers sustainable alternatives to conventional materials.

- Switching to renewable energy sources such as solar or wind.

- Minimising cutting waste. Invest in automated systems for cutting patterns and improving the efficiency of material use.

- Minimising CO2 emissions by avoiding air freight and reducing packaging materials.

- Reducing mismatches and wastage by collaborating with buyers on digitisation and sharing sales data.

- Training the design team to develop new styles that are durable and easy to reuse, repair, refurbish, repurpose or recycle.

- Developing new business models together with buyers (e.g. repairing, remanufacturing or recycling of post-consumer waste, leasing instead of selling, mass customisation).

Business support organisations

The best way that sector organisations in producing countries can service local and international companies is by creating a bridge between the local industry and the export market. Any supporting organisation should have:

- A clear online visibility describing the role of the support organisation and its services

- A database of local manufacturers

- A database of current buyers

- A database of potential buyers in different export markets

The database of manufacturers should include:

- Product group specifications

- Buyer references

- Available third-party certifications

- Company profiles and website references

- Contact details

The different services a support organisation could focus on to support the manufacturers are:

- Creating a website including content and photography

- Providing merchandise training

- Preparing manufacturers for third-party social and environmental certifications (self-assessments)

- Developing of sales and marketing skills

- Increasing production efficiency

- Providing design, market trends and product development services

- Promoting CSR and sustainability

To support manufacturers in preparing them for the sustainable transition support organisations need sufficient know-how and experience. The best strategy is to develop these internally, by seeking collaboration with counterparts actively involved in the sustainable transition, such as ZDHC, Fashion for Good and CBI (see table 3 for an overview of stakeholders per sustainability theme).

One of the most valuable assets a support organisation can develop is a database containing background information on the sustainable transition and on buyer requirements. Such a database should also contain information on suppliers of sustainable materials, accessories, machines and chemicals.

The contact database should include:

- International suppliers of sustainable fabrics, accessories and trims including price comparisons

- Suppliers of innovative machines that enable production requiring less energy and input materials and generating less waste

- Suppliers of sustainable chemicals from renewable sources

In several countries support organisations (often government supported) also offer production related services. These can include:

- Sample making and costing

- Chemical product testing

- Physical product testing

- Training programmes on workers’ rights

- Training programmes on sustainable sourcing

- Training programmes on efficiency and productivity

- Collective bargaining

7. How to adapt to the sustainable transition: the case of Egypt

Every country and company that regards Europe as a target market for the future needs to adapt to changing buyer requirements during and after the sustainable transition. In this section we consider how the Egyptian apparel and home textiles industry can best position itself, as an example and inspiration for other producing countries.

Considering the sustainable transition and Egypt’s unique features, it makes sense for the Egyptian apparel and home textiles industry to focus on:

- using local (organic) cotton fabrics

- eliminating workers’ rights abuses and improving health and safety in factories

- creating a reporting system for social and environmental impacts

- getting certification (BSCI and WRAP first)

- switching to renewable energy sources such as solar or wind

- enhancing production efficiency and digitalisation to increase speed and reduce wastage

- encouraging design and product development

- improving communication and merchandising

Alongside investing in such an industry upgrade, Egypt should also invest in education that can improve and support industry service levels and help the industry to become more competitive.

Key features of the Egyptian apparel and textiles industry

Egypt has a large apparel and home textiles industry. It consists of around 6,700 companies active in the production of cotton, yarn, woven and knitted fabrics, apparel and home textiles. Just over 1,300 companies export 2.8 billion euros in textiles, home textile products and apparel to international markets, primarily the EU and the US. The EU imports 64% of Egypt’s home textiles and 35% of its apparel products (CBI 2019).

One of Egypt’s unique selling points is its domestic production of ELS cotton (‘Extra Long Staple’), also known in the industry and by international consumers as ‘Egyptian cotton’. This superior type of cotton is processed by Egyptian manufacturers into ultrasoft fabrics and high-quality home textiles, such as bed sheets, towels and high-end shirts and socks. A small amount of cotton is produced according to organic standards.

Opportunities and risks

In theory, Egypt has the potential to fulfil many of Europe’s sustainability requirements. The country has an integrated supply chain that can produce high-quality natural fibres, fabrics and ready-made products in an environmentally friendly way. This integration makes it possible to reach a high level of supply chain transparency. Moreover, thanks to Egypt’s proximity to Europe – one of its biggest markets – and its good infrastructure and logistics, it is well positioned to service buyers that require flexibility and speed, and who want to partner with their suppliers on circular business models in which apparel is not only manufactured but also returned and recycled.

There are challenges too. They concern economic capacity as well as social and environmental risks. For a concise overview of the strengths, weaknesses, opportunities and threats of the Egyptian apparel and home textiles industry, see table 4.

Raw materials

Although Egypt produces its own raw materials, the industry has many weaknesses. The production of conventional cotton is limited, resulting in imports of natural fibres and fabrics. Production capacity in man-made fibres is lacking. Egypt’s cotton production causes soil degradation, water depletion and chemical pollution. Child labour is a notorious problem on Egyptian cotton farms. According to Textile Exchange, Egypt’s share in the global production of organic cotton dropped 34% percent in 2018-19 and is now only 0.12%. In the same period, global production of certified cotton fibres increased by 31%. India was by far the biggest contributor to global growth. It increased its volume of organic cotton fibre by 37 metric tonnes, followed by number two, Turkey, which added 10 metric tonnes during the same period.

The dramatic drop in Egypt’s production during this period was in part due to temporary overstock. Nonetheless, the Egyptian organic cotton industry struggles with competition from other countries and cheap imports. It needs investment to reach its full potential.

Weaving, knitting, dyeing

The second step in the value chain – weaving, knitting, bleaching, dyeing, washing, finishing and printing – shows a lack of production capacity and causes social and environmental risks. There is limited production capacity for fine woven fabrics, denim fabrics from conventional cotton and light-weight cotton fabrics. There is no production capacity for fabrics made from man-made fibres. The capacity for bleaching, dyeing, washing, finishing and printing is of insufficient quality. Most accessories and trims also need to be imported.

Workers in textile mills and dyeing houses face health and safety risks. Outdated machinery and limited wastewater treatment result in water depletion and chemical pollution. According to industry sources, some 80% of dyeing houses do not recycle their wastewater.

Manufacturing

Egypt has a diverse apparel and home textiles industry, with small and larger firms producing anything from high-quality ELS home textile products to low-margin mass market items made with imported materials. The US is the largest market for Egypt’s apparel exports (46%), while the EU imports 64% of Egypt’s home textiles and 35% of its apparel products. Many factories are struggling with a lack of knowledge of international requirements regarding service, communication and design, as well as with a lack of modern machinery and/or insufficient investment in modern machinery.

Social risks include living wage issues, health and safety risks, sexual harassment, child labour and limited freedom of association. Recycling strategies are mainly limited to processing cutting waste into low-value non-wovens.

Transport

One of the key strengths of Egypt is its proximity to Europe and its well-developed infrastructure. This makes Egypt an interesting sourcing destination for European companies looking to near-shore their Asian production, or part of it. Together with Egypt’s capacity for manufacturing low MOQs, this will service European buyers that require speed and flexibility. It may also offer opportunities for European buyers looking to partner with manufacturers in developing circular business models focused on returning and recycling post-consumer apparel and textiles.

Table 4: Strengths, weaknesses, opportunities and threats of the Egyptian apparel and home textiles industry

| Strengths | Weaknesses | Opportunities | Threats |

| Unique ELS cotton | Declining production. ELS cotton mainly used in home textiles, underused in apparel | Invest in ELS cotton production. Increase use for high-quality, mid-luxury market apparel. Strengthen the Egyptian Cotton Association | Declining cotton prices, increasing competition. Foreign competitors misappropriating ‘Egyptian cotton’ brand image |

| Organic cotton | Low, declining production of organic cotton | Invest in production of organic cotton. Rising demand for organic, sustainable apparel and textiles | |

| Water scarcity, low organic production (water-extensive) | Invest in production of organic cotton, water-extensive farming | Water depletion | |

| Low wastewater treatment capacity | Invest in sustainable wastewater technologies | Chemical pollution | |

| Potential for fully integrated supply chain | Lack of processing capacity in certain fine fabrics, lack of quality dyeing, finishing, printing capabilities leads to export of unprocessed high-quality cotton. CMT factories | Build up processing capacity for local fibres. Invest in equipment, knowledge and skills to shift focus from CMT factories to FOB | |

| Lack of locally produced man-made fibres and fabrics | |||

| Comparatively low wages | Limited availability of skilled workers, high turnover rate | Bring wages in line with living wage, improve secondary benefits. Invest in automation to reduce dependency on labour. Invest in skills training | Living wage concerns from international buyers. Rising wages. Competition from low-wage and lower-wage countries in mass market products (Asia) |

| Child labour on farms and in factories | Prevent child labour in factories and on farms, work with international stakeholders | Buyers avoiding Egyptian market | |

| Preferential access to EU and US markets. Large, growing local market | Relatively low volume apparel exports to Europe | Increase export to EU, increase focus on production for local market | |

| Proximity to EU market: 8-day delivery | Advertise speed, flexibility. Asian production moving closer to EU (near-shoring) | Competition from EU and MENA region: Morocco, Tunisia | |

| Good infrastructure and logistics | Build up circular value chain using post-consumer apparel and textiles | Competition from EU and MENA region: Morocco, Tunisia | |

| Factories offering low to high MOQs | Advertise flexibility, extend target group: target mid-luxury market segments | Competition from EU and MENA region: Morocco, Tunisia | |

| Few third-party certified companies | Invest in minimum certification requirements: BSCI, WRAP first | Large portion of Egyptian industry never able to export | |

| Low innovation rate, outdated equipment | Invest in new sustainable technologies (see section 7.3 below) | Lack of funds. Regional competitors invest more in innovation, such as sustainable chemicals, bio-degradable polyesters, water recycling, automation, renewable energy sources (see section 7.3 below). | |

| Negative reputation due to low service level, communication, knowledge gap in design, pricing, costing, IT, sustainability | Invest in English speaking staff, higher service level | Buyers avoiding Egypt and shifting to regional competitors | |

| Government support for building up sector | Limited funds and lack of knowledge | Egyptian government and business support organisation partner with international counterparts | |

| Political instability | Buyers moving to other (regional) markets |

Strategies for Egypt to adapt to the sustainable transition

The best way for Egypt to increase its competitiveness is to focus on its strengths and try to make investments to address its biggest weaknesses. Egypt has the potential to build a fully integrated sustainable supply chain for medium to high-quality apparel and home textile products made with locally grown natural fibres and recycled post-consumer waste.

The government, business support organisations, companies and foreign donors should invest in production capacity for sustainable natural fibres, environmentally friendly equipment in dyeing houses and factories, and industry support regarding anything from workers’ rights and certification to design and branding.

Awareness

However, all such investments will have a limited impact if the industry itself is not convinced that adapting to the sustainable transition is the best way forward. Creating a lasting sustainable change in the Egyptian industry requires the awareness and commitment of everyone involved. It is important that stakeholders invest in creating awareness within the industry, including within business support organisations and especially at universities. Creating a sustainable product that is fit for recycling starts with design. According to industry insiders, there is currently too little attention being paid in curricula to identification and use of sustainable materials and production methods that increase the opportunity for recycling apparel and textile items.

Raw materials

It would be wise for Egypt to focus its export strategy on the use of high-quality natural fibres and sustainable production within their FOB (Free on Board) manufacturing of ready-made products. This requires investments in knowledge, production capacity and promotion of local long and extra-long staple cotton and organic cotton production, in line with current government policy.

Besides cotton, Egypt could consider building up production capacity of sustainable alternative fibres such as hemp, flax, flocus (kapok) and biodegradable polyesters. This would require investments in R&D and spinning. Combining such materials with long-stapled cotton could result in a unique product proposal.

The production of organic cotton requires investment in capacity and efficiency, otherwise Egypt will lose the competition with other countries that can produce more and cheaper organic cotton. Organic production can also minimise water depletion and pollution, two serious sustainability risks in Egypt. The government, sector associations and international NGOs should work together to prevent child labour and increase worker safety on cotton farms.

Simultaneously, imports of cotton fabrics into Egypt should be discouraged. Building up a fully integrated vertical supply chain will add economic value to exports. FOB manufacturing is more profitable than CMT (Cut-Make-Trim). This is because manufacturers that focus on CMT manufacturing can only calculate their profit in relation to the time spent on manufacturing a product. When a full product is manufactured, the profit is calculated with regard to all elements within the manufacturing setup, such as fabrics, trims, packing and CM (Cut and Make). It also offers the opportunity to increase transparency and traceability, two features of a sustainable supply chain that are in high demand in the EU and the US, and which few other production countries can currently offer.

The risk for factories that are fully focused on CMT is that buyers will immediately order elsewhere if labour costs in a competing country turn out to be cheaper. By developing FOB business in which buyers are fully serviced – from fabric making to design to manufacturing – the risk of a buyer moving business will depend on more elements than just the price of labour. The recommendation is for factories to start developing products based on locally available materials. The downside to FOB business is that factories need to control every aspect of production: on-time delivery, quality and compliancy of fabrics and accessories, manufacturing and on-time delivery of the end product. This means that quality management and good communication with suppliers and buyers are crucial.

Tips:

- Source local fabrics and start presenting them to your customer.

- Research your customer’s nominated fabrics and source alternatives that are better or add more value.

- Create a costing overview that will show you the profitability of FOB business compared to CMT.

The Egyptian Cotton Association should be strengthened to improve the branding and promotion of local ELS cotton. Egyptian cotton is still a unique quality that is highly appreciated in the industry and among consumers.

Weaving, knitting, dyeing

Investing in local fabric-making can reduce the dependency on imports, for instance from India and also from Turkey, which is a direct competitor. Until fabric imports are no longer required, Egyptian mills should investigate which fabrics are most used in the industry and build a never-out-of-stock in these greige goods (i.e. unfinished fabrics). This means they should consider continuously manufacturing basic qualities such as cotton pique and jersey throughout the year, to be made available to manufacturers. This should improve the manufacturing speed of ready-made apparel manufacturers and increase flexibility. By finishing in-house it would still be possible to export to the EU without paying duties.

To prevent health and safety risks and environmental pollution, dyeing facilities should invest in a setup that requires less water, a primary and secondary wastewater treatment facility and in the recycling of wastewater. This is a major investment that few factories are currently focusing on. A centralised water recycling system could reduce the investment needed to reduce the environmental impact and meet future buyer requirements.

Manufacturing

Factories should focus on the following.

- Using local (organic) cotton fabrics to meet sustainable demand and offer a unique product. For more information check section 4.2 or the CBI study on sustainable cotton.

- Eliminating the abuse of workers’ rights and improving health and safety in factories. For more information check section 4.1 or the CBI studies on buyer requirements and sustainable apparel.

- Creating a reporting system for social and environmental impacts. For more information check section 4.6 or the CBI studies on buyer requirements and sustainable apparel. Consultancy Deloitte has also published a simple overview of sustainability reporting strategies.

- Getting certification (BSCI and WRAP first) to meet minimum buyer requirements and meet social compliance. For more information check the CBI study on buyer requirements and sustainable apparel.

- Switching to renewable energy sources such as solar power or wind. For more information check the CBI study on sustainable apparel.

- Increasing production efficiency by implementing lean manufacturing and digitisation in production to improve speed and reduce wastage. Check for instance this article with very accessible information on the basics of implementing lean manufacturing concepts such as Kanban and Kaizen in cutting and sewing.

- Promoting design and product development to increase service level and tap into circular strategies. For more information check section 4.10 or the CBI studies on buyer requirements and sustainable apparel.

- Ensuring communication and merchandising meets minimum buyer requirements. For more information check the CBI study on finding buyers and doing business with European buyers.

- Engaging in sales and marketing to promote Egypt and open new markets. For more information check the CBI study on finding buyers.

Scarabeaus Sacer, established in 2018, is an Egyptian sustainable streetwear brand. The company produces apparel items made with 100% GOTS-certified organic Egyptian cotton and natural dyes, made in a Fair Trade certified factory. Hangtags are made from recycled materials and the use of polybags is avoided.

Circularity

Egypt’s proximity to one of its biggest target markets and its good infrastructure offers it an opportunity to play a role in circular business models for the EU market. This would prepare Egypt for a future carbon border adjustment mechanism (EU carbon border tax), extended producer responsibility (EPR) for EU buyers and the right-to-repair for EU end-consumers.

In order to enhance circularity, manufacturers should invest in sustainable material sourcing and design. Among other things, this means using high-quality, durable materials, as the EU is focusing on reuse as a strategy to reduce environmental impacts. Companies should also consider minimising the use of different materials (blends) and complex designs in a product, making it easier to remanufacture.

Manufacturers should investigate strategies to partner with buyers, for instance on processing post-consumer waste from the EU (as high up the R ladder of circularity as possible). Especially the denim and home textiles industries (curtains, carpets) can benefit from increased availability of locally produced recycled yarns and fabrics.

A good way for local business support organisations to help the industry is by setting up an R&D centre for circular strategies and by training young designers to design for circularity. International stakeholders such as the Ellen MacArthur Foundation, Fashion for good, The Circle Economy and CBI can help build the curriculum (see Figure 6 for an overview of stakeholders).

Factories should invest in production efficiency and digitalisation to improve manufacturing speed and flexibility and decrease the amount of wastage. Improving manufacturing speed will immediately improve competitiveness.

Tips:

- Visit a highly efficient factory in a country like China and study the production set-up.

- Monitor the production time of all operators and identify any delays. A barcode system may help you track items as they go through each process in the production line.

- Train workers on moving towards intuitive production (trusting on skills without looking).

- Motivate operators to increase efficiency, not only with financial incentives, but also with alternative motivations to increase happiness and status.

- Use automated pattern design programmes such as Gerber to minimise cutting waste.

Promising product categories

Based on existing capacity, investments, industry support and sustainable market demand trends, the following products can be considered to offer the biggest growth potential for the Egyptian apparel and home textiles industry.

- Mid-luxury market Egyptian cotton products, including home textiles, womenswear, underwear and woven men’s shirts can benefit from the superior quality and reputation of Egyptian ELS cotton. Currently Egyptian cotton is under-utilised in these categories. Using organic ELS cotton will create an extra competitive advantage. The fact that ELS cotton is grown locally offers opportunities for answering requirements about transparency and traceability.

- Sportswear and athleisure are growing market segments in both Europe and the US. The Egyptian industry was doing very well in sportswear before the Covid-19 pandemic hit the industry. This is still a promising category for the mid-long term, however. Although Egypt lacks a local supply of polyester, it could source man-made fibres regionally, for instance in Turkey. An interesting sustainable proposition would be to focus on sportswear made with natural fibres and mixes, such as 95% cotton with 5% elastane, or other interesting blends, such as cotton and Tencel, or bio-degradable polyesters.

- The medical wear industry in Egypt has been booming recently. This segment could try to build on its success by developing supply chain solutions, for instance in a joint R&D centre. The idea is a full concept, not just the product, such as:

- manufacture-deliver-take back after use-recycle;

- flexible quantity manufacturing by keeping the required fabrics in stock. - The denim sector offers opportunities for both export and the domestic market. There are currently significant foreign investments in fabric making, which could make Egypt less dependent on imports and offer opportunities for sustainable production of fabrics and washings.

- Recycling post-consumer waste does not always offer excellent opportunities for apparel manufacturing, but recycled yarns can already be used in coarser yarns for home textile products such as carpets, curtains and cushions. Investing in circular business models with European partners can benefit both markets.

Frans Tilstra and Giovanni Beatrice from FT Journalistiek carried out this study on behalf of CBI. The contents are based on desk research and various interviews with industry experts.

Please review our market information disclaimer.

Search

Enter search terms to find market research