Entering the European market for swimwear

Demand for swimwear is increasing in Europe. This is due to not only increasing temperatures but also changing demand for technical and UV-protective swimwear.

Contents of this page

1. What requirements and certifications must swimwear comply with to be allowed on the European market?

You need to comply with several requirements to export swimwear to Europe. Some are mandatory (both legal and non-legal). Others are voluntary and can give you a competitive advantage. Some requirements apply only to certain niches within the swimwear market.

What are mandatory requirements?

There are many legal requirements for exporting swimwear to Europe, covering aspects such as product safety, the use of chemicals (REACH), quality and labelling. Check the EU Access2Markets online helpdesk for an overview. Follow the steps below to be sure your product complies with the basic legal requirements:

- Make sure your product complies with the European Union's (EU) General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure you meet the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain Azo-dyes, flame retardants, waterproofing and stain-repelling chemicals and nickel. Test the input materials before production to prevent risk of non-compliance.

- Specify the material composition of every item of swimwear you export to the EU, in line with Regulation (EU) 1007/2011. Check the EU Access2Markets online helpdesk on how to do this.

- Do not violate Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides a design, they are liable if the item is found to violate a property right.

Tips:

- Read the CBI study on buyer requirements for more information about the requirements you have to meet to export apparel to the EU.

- Check the Q&A section on the website of the European Chemicals Agency for answers to the most common questions about REACH and the use of chemicals in apparel, accessories and trims. If you want to guarantee compliance for your recycled fashion, test every batch separately.

- Always discuss any compliance challenges and possible solutions with your buyer.

Figure 1: Women’s swimwear is the largest swimwear subcategory

Source: Photo by KAL VISUALS on Unsplash

Non-legal mandatory requirements

In addition to the legal requirements mentioned above, your buyer may have company-specific terms and conditions. Such requirements are non-legal, but still mandatory.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you agree to meet all the stated requirements. This means you will be held accountable if there are problems with a delivered order. Complying with REACH can be especially challenging. Most European buyers will not ask for expensive testing for smaller orders, but if illegal chemicals are discovered after delivery, you will bear all of the costs involved.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL). This refers to the worst quality level that is still tolerable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order quantity is defective.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order. If you agree to deliver Free on Board (FOB), which is the industry standard, your buyer will clear customs in the country of import. It is their responsibility to make sure the instructions comply with EU import procedures. Always try to lower the environmental impact (and financial cost) of the packaging materials you use.

Reducing packing materials or replacing them with sustainable alternatives not only minimises environmental impact but also lowers costs and increases your competitive advantage. Some alternatives include:

- Recycled cardboard

- Biodegradable plastics

Payment terms

For a first-time order, European buyers may agree to make a down payment (for instance 30%) and pay the rest (70%) after the order is completed. The safest payment method for you as a manufacturer is a letter of credit (LC). An LC obligates the buyer’s bank to pay the supplier when both parties meet the conditions they agreed upon. However, many buyers no longer favour LC payments, as it blocks their cash flow. Be aware that LCs do not offer financial protection against bankruptcies!

For any further orders, most European buyers ask for a telegraphic transfer (TT) after 30, 60, 90 or sometimes 120 days. This means the manufacturer has to finish production and hand over the shipment to the buyer, with all original documents, before payment is due. Payment is made after the number of days you agreed on with the buyer. This is a risky form of agreement as you bear the full financial risk.

Transparency

Supply chain transparency is key for the European apparel industry due to ever stricter laws at EU and national levels. For instance, the EU’s new Corporate Sustainability Due Diligence Directive (CSDDD) and Corporate Sustainability Reporting Directive (CSRD) require all larger European companies to report on how they manage social and environmental risks. Always help buyers to gain as much insight as possible into their whole supply chain.

Restricted substances

Ask your buyer if they have a restricted substances list (RSL). Such lists are often based on the safe chemicals use guideline issued by the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

Carbon footprint

Many European brands have committed to climate neutrality. Calculating the CO2 footprint of an apparel item is a complicated process, but several organisations have set benchmarks for specific materials and/or products. See the CBI study on tips to go green for more information.

Sustainable materials

Swimwear buyers prefer the use of sustainable yarns and fabrics in swimwear. Popular materials include:

- Fabrics made with recycled content, such as recycled Polyamide, or ECONYL® (made from recovered fishing nets, old carpets and landfill plastics), REPREVE™ or MIPAN®.

- Low-impact regenerated fibres, including TENCEL™, TENCEL Modal and Cupro/Rayon.

- Fabrics dyed with natural ingredients such as Rubia, Fibre Bio or Greendyes, water-based print dyes such as Adalberto or dyestuffs made from recycled materials such as Recycrom.

Recycling

The EU is introducing new legal measures to increase circularity in textiles, including new directives for the durability of textile products and a ‘right to repair’. The EU is also considering the introduction of an EU-wide apparel EPR (extended producer responsibility). This would make companies responsible for the way their products are disposed of, recycled or repaired. Some countries have already implemented national EPR schemes. Using recycled and repurposed materials will help your buyers to reduce waste and conserve resources.

Certification and standards

Many swimwear companies require suppliers to get certified for sustainable and/or fair production or the use of sustainable or UV-protective materials. Below is an overview of the most popular standards and certifications in Europe. Note that BSCI is almost a standard requirement for many European apparel companies. For a more detailed overview of popular standards, see the CBI study on buyer requirements.

Table 1: Europe’s most popular standards

|

Standard |

Logo |

Type of compliance |

Certification information |

|

Amfori BSCI |

|

Social |

By buyer invitation. Amfori provides a list of organisations that can do an audit |

|

SA8000® |

|

Social |

|

|

WRAP |

|

Social |

|

|

Sedex |

|

Social, environmental |

|

|

B Corp |

|

Social, environmental |

|

|

OEKO-TEX® STeP |

|

Social, environmental |

|

|

ZDHC |

|

Environmental (chemicals use) |

ZDHC provides a guide outlining requirements for showing ZDHC MRSL conformance |

|

Bluesign |

|

Environmental (sustainable production) |

See Bluesign services for manufacturers |

|

Global Recycled Standard |

|

Environmental (materials recycling) |

|

|

Recycled Claim Standard |

|

Environmental (materials recycling) |

|

|

UV Standard EN 13758-2 |

|

Clothing marking to offer solar UV protection |

See NEN-EN 13758-2:2003 en for more information |

|

UV Standard 801 |

|

Tests UPF in real-life situations |

See UV STANDARD 801 for more information |

Tips:

- Check the EU Access2Markets online helpdesk for an overview of all legal requirements for your product. Look up your product code to see a list of applicable requirements.

- Check the CSR Risk Check database (free to access) to learn about social and environmental risks associated with apparel production in your country and ways to manage them.

- Do not take financial risks with new buyers. Check their credibility, insure your orders with an insurance company or insist on a letter of credit.

- If you agree to an extended payment, don’t forget to calculate and add interest.

- Read the buyer’s manual carefully and don’t be afraid to negotiate terms and conditions before signing any agreement.

What additional requirements and certifications do buyers often want?

Besides legal and non-legal mandatory requirements, there are many services that buyers implicitly expect or at least highly appreciate if you do business with them.

Product design and development

European buyers are always looking for special designs, sustainable or innovative materials and production methods that will help them stand out in the market. Consider, for example:

- Fabrics with UV-protective properties;

- Chlorine-resistant fabrics designed for pool use;

- Fabrics that change colour when in contact with water. See, for example, Kameleon Swim;

- Fabrics and padding that enhance the wearer’s shape;

- Fabrics that provide long-lasting fit, such as Lycra® T400®;

- Performance-enhancing materials (such as special knits that reduce drag, improve blood circulation or support specific body areas); and

- Integrated wearable technologies (activity trackers, heart rate and blood pressure sensors, sensors that let parents keep track of a child or prevent them from entering deep water).

Printing

Printed fabrics are widely used in swimwear production. There are different printing techniques, including lithography (using printing plates and rollers on fabric), digital printing (inkjet and laser, allows for small production runs) and screen printing (transferring images onto fabric or garments using a fine material or mesh/film). Printing can be outsourced, but having your own printing and embroidery machines increases your flexibility.

To ensure quality (and/or environmentally-friendly production methods), buyers may require you to source your base materials from a preferred supplier or a controlled source. For example:

Communication

Smooth communication is an implicit requirement that all buyers have. Always reply to emails within 24 hours, even if it is just to confirm that you have received the email and will reply in full later. If you find a problem with a production order, immediately notify your buyer and try to offer a solution. Another good tip is to create a ‘time and arrival’ (T&A) file for every order and share it with your buyer. This file will help you manage expectations and monitor progress, and is the best guarantee for on-time delivery.

Flexibility

If you want to start a business relationship with a European buyer, be prepared to accept complicated orders first. Buyers will test your factory before giving you large, easy orders. However, make sure at the start that buyers will not place only difficult orders with you and easy orders elsewhere.

In their first order, you can expect European buyers to require:

- High material quality and impeccable workmanship;

- Order quantities below your normal minimum order quantity (MOQ); and

- A price level below what you would normally accept for small-quantity orders.

Even then, be aware that ‘big, easy orders’ may never come, especially if you are working with smaller brands and retailers. Such buyers are increasingly spreading out their orders over the year as swimwear is no longer only a summer item. This is due to climate change (longer summer season) and online retail (consumers now expect swimwear to be available anytime, anywhere). This means you’ll need to adjust your production lines, maintain stocks and deliver small collections fast, all year long.

What are the requirements for niche markets?

There are many interesting niches in swimwear. Be aware that niche buyers usually want smaller orders and require a relatively high service level. This means you need to adjust your manufacturing and sourcing setup if you want to be profitable.

Ethical swimwear

An increasing number of consumers are looking for swimwear brands that prioritise ethical and sustainable production practices, such as using eco-friendly materials, reducing waste and ensuring fair labour conditions.

UV-protective swimwear

UV-protective swimwear may sound contradictory, because most swimwear is designed to not cover the whole body. However, UV-protective swimming shirts and shorts are becoming a staple in swimwear collections, especially for children.

Special sizes

Following the ‘body acceptance’ trend, ever more European fashion brands are expanding their size ranges for specific body types such as plus, petite, tall and maternity sizes.

Adaptive wear

Adaptive apparel is a niche market that caters for consumer groups with very diverse individual needs, such as disabled people and the elderly. Be aware that adaptive swimwear has specific requirements for product safety and functionality. See the CBI study on adaptive apparel.

Modest wear

Many Europeans with an Islamic background prefer ‘modest’ styles, designed to cover the body from head to toe and show little figure. This target group is underserved but growing. For specific requirements, read the CBI study on Islamic wear.

Performance-enhancing swimwear

Sportswear is a growing product category, including swimwear designed for athletes, both professionals and amateurs. They appreciate performance-enhancing properties such as fabrics that reduce drag or have integrated wearable technologies (performance trackers such as heart rate and blood pressure sensors).

Tips:

- If you decide to focus on a niche market, research the specific requirements and make sure you can meet them. Be aware that order quantities are usually smaller in niche markets than mainstream markets. Try to become a specialist in your chosen niche.

- Develop a specialised collection that matches the niche requirements to show potential customers that you understand and can supply to their requirements.

- Study your niche market’s basic and never-out-of-stock items. They represent the largest order volume potential.

- Save water in production by dyeing fabrics using new technologies such as DyeCoo (CO2 instead of water) or all-natural ingredients such as Rubia, Fibre Bio or Greendyes, using water-based print dyes such as Adalberto or dyestuffs made from recycled materials such as Recycrom. Waterproof swimwear with sustainable coatings includes NEOSEED.

2. Through what channels can you get swimwear on the European market?

How is the end market segmented?

Besides divisions based on gender, age and product type, the swimwear market can also be broken down based on price, quality and functionality. The biggest segments within this market can be categorised as luxury, performance, upper-middle and middle, and budget.

Table 2: Swimwear market segmentation

|

Consumer type |

Price level |

Fashionability |

Material use |

Functionality |

|

Luxury consumer (luxury market) |

Very high prices |

Unique, creative designs |

High-quality fabrics and trims, nominated suppliers |

Highly fashionable and functional |

|

Athletic consumer (upper middle market) |

Medium-high prices |

Designs focused on performance improvement |

High quality, nominated suppliers |

Highly functional |

|

Fashion conscious consumer (upper middle market) |

Medium-high prices |

Fashionable designs inspired by luxury market but manufactured with more affordable materials |

High-quality fabrics, sometimes nominated suppliers, sustainable materials |

Fashionable and functional |

|

Practical consumer (middle market) |

Medium prices |

Wide range of products from basic to fashionable manufactured from affordable materials |

Medium quality, sometimes sustainable materials |

Fashionable and functional |

|

Price-conscious consumer (budget market) |

Low/extremely low prices |

Focus on basic styles with fashionable details |

Medium quality |

Functional and sometimes fashionable |

Luxury consumer

In the European luxury swimwear market, brands such as Agent Provocateur, Moschino and Versace sell extremely fashionable, luxurious swimwear at very high retail prices. Creativity and uniqueness rule in this segment, along with perfect fit and high-quality fabrics and trims (from nominated suppliers). Because buyers in this segment have extremely high standards for design, workmanship, material quality and brand image, production mostly takes place in Europe. Order quantities are low.

Athletic consumer

In the high-performance sportswear segment, athletic swimmers buy their swimwear primarily for its functionality. Brands such as Arena, Speedo and TYR focus on performance and high-quality materials. Fabrics are typically highly technical, lightweight and drag-reducing. This category will not grow fast and demand is led by innovation.

Fashion-conscious consumer

The upper-middle market consists of top-tier brands such as Oxbow, Brunotti and Protest. This segment is more relevant for women’s than men’s swimwear as women are typically more motivated to follow the latest fashion trends, while men tend to be more practical. Consumers in this segment appreciate brand image, original designs and high-quality materials. Retail prices are medium-high and order quantities low to medium.

Practical consumer

Practical consumers shop for swimwear that is comfortable and easy-care, from brands and retailers such as Calzedonia, Next or Hunkemöller. This target group cares about fashion but is guided by their budget. Order quantities are medium-high and retail prices low to medium.

Price-conscious consumer

Price-conscious consumers shop for basic designs at large retail chains such as H&M, Marks and Spencer and Lidl. Though consumers in this segment expect low to very low retail prices, they also expect good quality. To be successful in the segment, you have to focus on high-efficiency, volume production and low prices (which means low margins).

Tips:

- Visit online shopping platforms for swimwear such as YOOX (luxury and upper-middle market segments), Zalando (all market segments) and ASOS (middle and budget market) to get inspiration on styles and colours.

- You can find inspiration in the luxury segment, but never copy the styles.

- Follow the economic situation in your target market and develop a suitable price strategy.

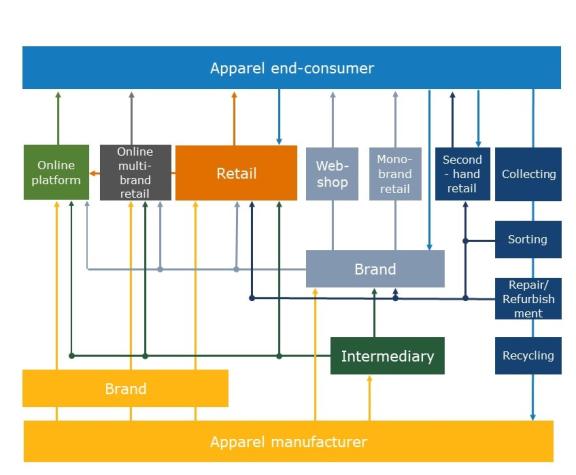

Through what channels does the product end up on the end market?

Always try to find out if you are dealing with a brand, retailer, intermediary or other type of buyer. Every buyer has a different sourcing and sales strategy and different challenges. Adapt your pitch accordingly.

- If you want to target European end consumers, try platforms such as Alibaba, Wish, Amazon or Wolf & Badger (for small independent and/or sustainable brands). Most online consumers live in countries in Europe’s northwest. You will need to invest in a webshop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness.

- Online multi-brand retailers such as Zalando, ASOS and YOOX sell existing swimwear and other brands and often develop their own private collections, mostly value brands. They can detect market interest very fast and immediately respond to sales data. Such companies usually place a small test order first. Then, if the item is selling well, they place an actual production order. Fast delivery is a must.

- If you want to sell to retailers, the biggest names in swimwear are retailers such as Inditex and H&M. Besides big chains, most swimwear is sold in boutique shops that can be found in almost every European city. These shops sell existing brands, but some also order products that are specially developed and manufactured for them. This market level is less competitive and relatively easy to enter.

- Apparel brands typically develop their collections 6 to 9 months in advance. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every salesman sample needs to be current, meaning it must look exactly like the product will in the shop, with branded hangtags and accessories. It may take many months before orders are placed.

- Intermediaries such as agents, traders, importers and private label companies will sell your product on to buyers up the value chain. They are extremely price-focused and require flexibility in quantities and qualities. Some are located near or in the production countries and primarily do sourcing and logistics, such as Fashion Linq. Others, such as Fully Fashion, work from Europe and also do market research, design and stock-keeping. Their service level determines what commission rate they charge.

Figure 2: Swimwear market value chain

What is the most interesting channel for you?

As you move higher up the value chain, your margins will increase, but so will the service level buyers expect from you. If you still have little experience exporting to Europe, intermediaries and brands are likely your best starting point. Only approach big brands and retailers if you have the right certifications, production efficiency and can handle large volume orders. End consumers are a more difficult target group due to complicated customer service demands.

Intermediaries

Agents or traders/importers/private label companies are usually the first to explore new (for them) sourcing destinations. Be aware that they are very price-focused. Intermediaries act as ‘middlemen’ between you and companies further up the value chain, and therefore have to keep their prices close to your factory price. This leaves less negotiation room for you as a manufacturer. Furthermore, traders need manufacturers to be flexible on quantity and quality.

Small/niche brands and retailers

Many European fashion brands and retailers want to cut out intermediaries entirely and source directly from manufacturers. That can make these companies an interesting category of buyers, but beware that size matters. Small and medium suppliers may not realistically be able to meet major European brands’ and retailers’ high volume and other requirements. Unless you have the right certifications (BSCI at a minimum) and can produce large volume orders, small and niche brands and retailers are more likely business partners.

Be aware that swimwear is traditionally a seasonal product, though sales are spreading out more over the year. This means that sales success depends partially on the weather. To spread your risk, it is wise to combine swimwear production with other product groups that are related to swimwear but less seasonal. A broader product portfolio will also make you more appealing to buyers.

Tips:

- Study online companies’ required service levels, as they differ from regular retailers. Speed and low MOQs are a must.

- Look for potential buyers at swimwear trade fairs. Even if you don’t actually attend, you can check the exhibitor list. For example, ISPO in Germany, Interfilière in Paris (there is also an Interfilière in China where many Asian exhibitors go), Maredamare in Italy and CPM in Russia.

3. What competition do you face on the European swimwear market?

Swimwear is manufactured worldwide, so you will likely face stiff competition in this market. The most important ways to get a competitive advantage over other countries and manufacturers are based on technical knowledge, service level, flexibility (willingness to accept lower MOQs), efficiency and beneficial trade agreements.

Which countries are you competing with?

China used to be the main sourcing destination for high-volume orders, but now is focused more on design and a medium-high price level. It is still the global market leader in fabric manufacturing, and so the best country from which to source fabrics for volume orders. Countries such as Vietnam and Bangladesh have taken over China’s volume orders, giving buyers some flexibility in MOQs. Closer sourcing destinations, such as Turkey, are focused on fast fashion and very capable of delivering the right product at the right time.

Table 3: Competing countries

|

Country |

Strengths |

Weaknesses |

Image in Europe |

Future developments |

|

China |

Local production of synthetic fibres, many different production techniques and innovations available locally |

Decreasing flexibility, increasing wages, no GSP |

High flexibility, increasing quality level |

Growing towards medium-high quality and special designs, moving away from volume orders |

|

India |

Flexibility in products and qualities |

Limited availability in synthetic materials, lagging in sustainable production techniques |

High flexibility, focus on cotton products |

Focus on swimwear-related products and beachwear in cotton |

|

Turkey |

Proximity to Europe, production speed |

Increasing prices, decreasing flexibility, GSP limited to the use of materials from EU and Turkey |

High quality, relatively expensive compared to Asia |

Growing competition from production countries in the region, such as Egypt |

|

Sri Lanka |

High-quality workmanship, technical products |

Price level, lack of local fabric production |

High quality, high export to Italian market, economic instability |

Growing production cost |

|

Bangladesh |

Price level, the number of green factories |

High MOQs, low flexibility, relatively long production times due to local lack of materials |

High volume, medium quality |

Growing industry, orders shifting from China to Bangladesh, investment in more technical styles |

|

Morocco |

Proximity to Europe, a favourable trade agreement |

Relatively low flexibility, lack of local fabric production, high dependence on export to Spain |

High quality, but service level needs improvement |

Focus on medium-high segment |

Which companies are you competing with?

Sunwear is a design-driven, flexible beachwear manufacturer in China. The company offers a wide range of products for different swimwear categories. Sunwear has built up considerable expertise in the use of sustainable materials and in product design and development to support their international buyers.

Bali Swim is a small sustainable manufacturer based in Bali (Indonesia). It calls itself “Bali’s most eco-conscious, solar-powered factory” and uses imported recycled fabrics such as Carvico, ECONYL® and REPREVE®. Bali Swim is experienced in using sustainable materials and offers low MOQs and high flexibility.

Angora is a swimwear, beachwear and sportswear manufacturer in Istanbul, Turkey. Founded in 2008, its core business is the development and manufacture of a wide range of swimwear and related beachwear and sportswear products, allowing buyers to create integrated summer/beach collections.

Tips:

- Outsource design to strengthen your service level.

- Study successful swimwear producers’ customer bases and what services they offer their buyers. Advertise your strengths (product development, vertical integration, flexibility, short lead times, sustainable production, and so on) and work on your weaknesses.

- Be flexible in your MOQs, especially for first-time orders, even if your product has a high quality and finishing standard. Innovate in your product development and design and build a reputation on creativity.

Figure 3: Swimwear can be combined in collections with cover-ups and other types of beachwear

Source: Photo by Jonathan Borba on Unsplash

Which products are you competing with?

Swimwear competes with various other types of swim-, beach- and activewear, depending on the context and consumer preferences. Below are some product categories that may compete with swimwear.

Beachwear

Beach cover-ups like sarongs, kaftans and beach dresses are often worn over swimwear. Brands such as Seafolly offer a range of beach cover-ups.

UV-protective swimwear and apparel

UV-protective swimming shirts and shorts are becoming a staple in swimwear collections, especially for children. UV-protective swimming shirts for women could become a threat to the bikini. Brands like Coolibar focus on sun-protective clothing.

Boardshorts

Boardshorts are popular for water sports and are worn by men and women. Brands like Quiksilver and Roxy are known for their boardshorts.

Rash guards

Rash guards offer sun protection and are commonly worn by surfers and water sporters. Brands like O'Neill specialise in rash guards.

Athletic swimwear

Specialised athletic swimwear is used in competitive swimming and water sports. Brands like Speedo and TYR are known for their performance swimwear.

Activewear

The boundary between swimwear and activewear has blurred, and many activewear brands now offer swimwear collections. For example, Nike and Adidas have swimwear lines.

Lingerie and underwear

In some cases, swimwear competes with lingerie and intimate apparel brands, which offer products such as bra-sized swimwear and bikini sets. For example, Victoria's Secret.

4. What are the prices for swimwear on the European market?

The factory price of your product (in fashion industry jargon, the Free On Board, or FOB, price) depends on many factors, including the cost of materials, workforce efficiency, overhead and profit margin. For a step-by-step guide on how to calculate the FOB price of apparel, see this CBI study on cost-price calculation.

The average cost breakdown of your FOB price should look like this:

Source: Eurostat

Note that the cost price of swimwear is often calculated based on the item weight, as the yarn is a substantial part of the cost. Percentages may differ by factory and order. Some factories accept lower profit margins during off-season periods or when order volumes are high. Percentages for labour versus fabrics may also differ, depending on workforce efficiency and the wage level and price of materials. Efficiency goes up and material prices go down when producing large volume orders.

Retail pricing

The retail price of a swimwear item is on average 4 to 8 times the FOB price (known as ‘retail markup’). Therefore, the FOB price is on average 12.5-25% of the retail price of the product. There are exceptions. In the budget market, some large European retail chains may only double the FOB price markup. Retailers mark up the FOB price by 4 to 8 times to account for import duties, transport, rent, marketing, overhead, stock-keeping, markdowns and VAT (15-27% in EU countries), amongst other things.

Source: Eurostat

According to Eurostat’s 2022 comparison of retail prices for apparel in Europe, of the top 3 European apparel and footwear importers, France has the highest price level, at 105.4 points compared to the European average of 100, followed by Germany (98.7) and Spain (84.8). Denmark is the EU country with the highest price point (134.4), while Switzerland is the most expensive European country for apparel (141.5).

Price development

Online commerce and a strong budget segment have made European consumers accustomed to low prices. However, a stronger focus on sustainability and rising costs for materials, production (due to global political instability) and shipping have put manufacturers, suppliers and buyers under huge price pressure. Inflation in Europe decreased somewhat in 2023, but is still higher than normal.

Frans Tilstra and Giovanni Beatrice for FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research