Entering the European market for workwear

This report explains what the most important opportunities and requirements are in the European market for workwear. You will learn about the rules and regulations for exporting workwear to Europe, about the best channels to get your product on the market, about the countries where your competitors are and the best ways to provide a quotation for a potential buyer.

Contents of this page

1. What requirements and certifications must workwear comply with to be allowed on the European market?

You will only be successful in exporting workwear to the EU if you understand all the legal and non-legal requirements of European buyers. Global competition has increased, and the requirements of buyers in the EU have become more demanding. In addition to focusing on quality, price and speed, buyers now also require good service, flexibility and sustainability.

Mandatory requirements

There are several legal requirements you need to comply with if you want to export workwear to Europe, including requirements concerning product safety, the use of chemicals (REACH), quality and labelling. Additionally, many buyers have created non-negotiable terms and conditions which all their suppliers need to respect. These requirements are non-legal, but still mandatory.

Product safety

Any item on sale in the EU, including workwear, must comply with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). National governments will check if your product meets the applicable safety requirements. If your product is considered unsafe, it will be rejected or withdrawn from the European market.

On top of the GPSD, the EU has laid down specific health and safety standards (EU Directive 2016/425) for the design, manufacturing, material use, testing and user instructions concerning protective wear, or ‘Personal Protective Equipment’ (PPE). If you want to manufacture and export PPE to Europe, you must comply with these standards.

The EU has determined three categories of risk against which PPE is intended to protect. The categories are specified below. If you produce Category I PPE, you yourself can perform the necessary tests to comply with Directive 2016/425. If you produce Category II PPE, an independent test institute must assess your compliancy. Category III PPE is subject to regular ongoing testing.

Category I includes exclusively the following minimal risks:

- superficial mechanical injury;

- contact with cleaning materials of weak action or prolonged contact with water;

- contact with hot surfaces not exceeding 50 °C;

- damage to the eyes due to exposure to sunlight (other than during observation of the sun);

- atmospheric conditions that are not of an extreme nature.

Category II includes risks other than those listed in Categories I and III;

Category III includes exclusively the risks that may cause very serious consequences such as death or irreversible damage to health relating to:

- substances and mixtures which are hazardous to health;

- atmospheres with oxygen deficiency;

- harmful biological agents;

- ionising radiation;

- high-temperature environments the effects of which are comparable to those of an air temperature of at least 100 °C;

- low-temperature environments the effects of which are comparable to those of an air temperature of – 50 °C or less;

- falling from a height;

- electric shock and live working;

- drowning;

- cuts by hand-held chainsaws;

- high-pressure jets;

- bullet wounds or knife stabs;

- harmful noise.

User instructions

You must supply user instructions with any item of PPE that you export to Europe. These instructions must include (among other things) your company name and address and information on: the proper way to store, clean, maintain and disinfect the product; the protection level; the risk against which the PPE is designed to protect and the name, address and identification number of the organisation that has tested your product.

Check article 1.4 of Annex II of EU Directive 2016/425 for a full overview of the information that you must include in the user instructions.

Technical documentation

In addition to user instructions, you must supply technical documentation with any item of PPE that you export to Europe. The technical documentation must include (among other things): a complete description of the PPE and its intended use; an assessment of the risks against which the PPE is intended to protect; a list of the essential health and safety requirements that apply to the product; design drawings of the PPE and test reports.

Check Annex III of EU Directive 2016/425 for a full overview of the information that you must include in the technical documentation.

REACH

Make sure you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain Azo-dyes; flame retardants; waterproofing and stain-repelling chemicals and nickel. Check the following link to familiarise yourself with the complete list of chemicals restricted by REACH.

Also ask your buyer if they use a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

Labelling

You must affix CE-marking to PPE as a visible indication that your product conforms with the PPE health and safety requirements. You must affix the CE marking to the PPE ‘visibly, legibly and indelibly’ (users must be able to see the label, text and symbols must be sharp and clear and they must not fade). If it is not possible to affix the CE marking to the PPE itself, you must affix it to the packaging and accompanying documents.

Read more on the EU’s rules and regulation for affixing CE-marking to PPE.

You must also specify the material content of every workwear item that you export to the EU, in accordance with EU Regulation 1007/2001.

If you use the care symbols recommended in the internationally recognised standard for care labelling ISO 3758: 2012, be aware that the care symbols are property of the company GINETEX. You need to pay a fixed compensation to GINETEX for the use of these symbols.

Intellectual Property Rights

Do not violate any Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides the design, they will be liable in case the item is found to violate a property right.

Non-legal mandatory requirements

Next to the legal requirements mentioned above, you may be confronted with non-negotiable terms and conditions that buyers have created for dealing with suppliers. Such requirements are non-legal, but still mandatory.

Sustainable production and social compliance

European workwear companies, primarily those operating in the B2B-market, have been among the first buyers to require (and invest in) sustainable production and social compliancy. This is because CSR-requirements (often laid down in tenders) tend to be stricter than in the B2B-market than in the B2C-market.

Another reason is that the relatively low pressure on delivery time and price and the high level of vertical integration in the workwear market (in comparison to the fashion market) enables buyers to invest in ethical production practices.

At the very least, buyers will ask you to open your factory doors for them, so they can conduct a personal inspection of your factory. Additionally, you may be requested to comply to the following independent standards:

- Regarding harmful substances and/ or sustainable production, Standard 100 by Oekotex® is the most widely required standard. European buyers may also require standards such as the EU Ecolabel, BCI (Better Cotton Initiative), GOTS (Global Organic Textile Standard) or Bluesign®.

- Regarding the use of recycled or ‘circular’ materials, buyers may require standards such as the GRS (Global Recycled Standard) or C2C™ (Cradle to Cradle).

- Regarding social compliance, BSCI (Business Social Compliance Initiative) is the most popular certification that European buyers will require. Other popular social standards are FWF, WRAP, SEDEX, ETI, SA8000, ISO 26000, and Fair Trade.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order, in a manual. If you agree with your buyer that they will clear customs in the country of import (which is the norm), it is their responsibility to ensure the instructions comply with EU import procedures. Your buyer will also appreciate any efforts you make to reduce the environmental impact (and financial cost) of the use of packaging materials.

Payment terms

For a first-time order, European buyers may agree to a down payment (for instance, 30%). They will pay the rest (70%) after the order has been completed. The safest payment method for you as a manufacturer is the LC (Letter of Credit). An LC obligates a buyer’s bank to pay the supplier when both parties meet the conditions they have agreed upon. However, many buyers no longer favour LCs, as these tie up their cash flow. Be aware that LCs do not offer financial protection against bankruptcies!

For any further orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means you as a manufacturer finish the production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days that you have agreed with the buyer. This is a risky payment agreement because you are taking the full financial risk.

Tip:

- COVID-19 has shown the negative impact of extended payment terms for manufacturers. It is advisable to negotiate a down payment on every order and a balance payment before handover. This reduces the risk of a cancellation due to a lockdown.

Acceptable Quality Limit

To guarantee product quality, your buyer may set an AQL (acceptable quality limit). This refers to the worst tolerable quality level. For instance, an AQL of 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order quantity (over several production runs) is defective.

Tips:

- For country-specific information on the health and safety standards for PPE, contact the official contact points in each member state of the EU.

- Read the CBI study on Buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter of leather fashion accessories to Europe.

- Read the CBI study on Organising Your Exports to Europe, for more (elaborate) tips on how to deal with payment terms, storing, packaging and shipping.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you confirm that you will comply with all the listed requirements. This means that you will be held liable in case of a problem after the delivery of an order. Complying with REACH can be especially challenging. With small orders, most European buyers will not ask for expensive testing, but if illegal chemicals are discovered after delivery, you will bear all expenses involved.

What additional requirements do buyers often have?

Next to non-legal, but mandatory requirements like standards and certifications, there are many services that buyers implicitly expect or at least highly appreciate if you want to do business with them.

Product design and development

Workwear is not as sensitive to seasonal trends as (fast) fashion, but product design is still important. After all, workwear is often worn by employees who need to make a professional impression and represent their employer’s company values. Many European importers of workwear will sell to their buyers further up the value chain styles from stock, with the option to customise fabrics, striping, (type and number of) pockets, zippers, prints and logos.

In addition to styling, product design and innovation are very important in the workwear market. Innovative designs, materials and production methods that make your workwear perform better during use and maintenance can give you a serious competitive advantage.

Innovations that have recently found their way into the workwear market are for instance:

- Fabric made with cork waste

- Heat and flame protection on breathable, stretch fabrics

- Thread‐based triboelectric nanogenerator (TENG)

To ensure quality (and in some cases also environmentally respectful production methods), buyers may require you to source your base materials at a preferred supplier. For instance:

Figure 1: Many companies require workwear with company-specific logos, texts or other forms of customisation

Photo by Frank Albrecht on Unsplash

Communication

Smooth communication is an implicit requirement that all buyers have. Always reply every e-mail within 24 hours. Even if it is just to confirm that you have received the e-mail and will reply more elaborately later. If you encounter a problem with a production order, immediately notify the customer and try to offer a solution. Another good tip is to create a T&A (time and arrival) of every order and share it with your buyer. This file will help you to manage expectations, monitor progress and is the best guarantee for on-time delivery.

Flexibility

Many factories focus only on getting ‘convenient’ orders: simple designs, large quantities and long delivery times. However, if you want to start a business relationship with a European buyer, be prepared to accept complicated orders first. Buyers will want to test your factory before giving you big, easy orders. Make sure at the start that a buyer will not continue to place only difficult orders with you and convenient orders elsewhere.

Many customers also look for manufacturers that can offer them stock service in products or fabrics. This will increase their flexibility. Be aware that within the workwear product category orders can vary from big to single pieces of which the majority part is personalised.

Expect a European buyer to require for his or her first order:

- high material quality and impeccable workmanship;

- order quantities below your normal Minimum Order Quantity (MOQ);

- a price-level that is lower than you normally would accept for small quantity orders.

Tips:

- Not only ‘sell’ your company to a new buyer, but also ‘sell’ the buyer to your company. Make sure your whole team sees the opportunity and makes a big effort to service the new buyer in the best way possible.

- Factor in extra lead-time for the first order from your new buyer to get it 100% right the first time.

- Be transparent about this to your buyer.

Niche requirements

The workwear market has many sub-categories, each associated with workwear items that have very distinct characteristics, including workwear designed:

- for use in different dangerous environments;

- to protect different parts of the body, such as eyes, face, respiratory system, hands, and feet;

- to protect against different risks, such as mechanical impact, cold, heat, rain and foul weather, liquid chemicals, fire and flames, electric shock, radiation, drowning, harmful noise and viral or bacterial contamination.

Be aware that each type of PPE can have very distinct requirements concerning design, material use, production, packaging, use and maintenance. For a full overview of PPE sub-categories check the EU’s harmonised norms and standards list for PPE.

Anti-viral workwear

The COVID-19 pandemic has led to an enormous rise in demand for specific PPE, such as face masks and gloves, and has triggered several anti-viral textile innovations. British workwear brand Wearwell, for instance, launched a new anti-viral fabric finish in 2020. Italian manufacturer MIC introduced anti-viral sewing thread for use in PPE. The use of anti-viral materials can be an interesting niche, but you should make sure that the materials you use comply with REACH (the EU directive that also covers the safety of PPE) and any buyer-specific sustainability requirements.

Wearable technologies

As the need to measure personal and working circumstances becomes more important it is to be expected that workwear companies will implement technologies into their collections to measure personal worker and environmental circumstances. This way companies can better react to unsafe situations, avoid injuries and improve performance.

Recycled materials

A popular trend among European workwear companies is to use recycled content in their designs. Havep for instance sells aprons made with 20% pre and post-consumer recycled cotton waste and 55% recycled PET. Schijvens even sells workwear T-shirts and polo shirts made with 50% pre and post-consumer recycled cotton and 50% recycled PET. The company positions itself in the market as a ‘circular’ workwear company.

Circular supply chains

Ideally, the recycled content used in workwear collections originates from companies’ own supply chains. European buyers are increasingly looking for manufacturers that can support them in recycling their own collected waste. This means that you as a manufacturer should think about how the waste could be recycled or reused.

Leasing workwear

Buying workwear can be a big investment for European companies. Especially now as the economy is recovering from the Corona pandemic many companies are hesitant to invest in a new company wardrobe. In order to service customers, ever more companies offer lease constructions. Some companies also offer cleaning and repair services to guarantee the quality of the collection. Offering your buyer a lease construction will create mutual dependence as this often involves multiple year contracts.

Tips:

- Always ask your buyer about the specific performance characteristics and the legislation and standards your product needs to comply with. Confirm this information (in written form) and do an honest self-assessment of your capabilities before you confirm any order.

- Check the Cradle-to-cradle Certified Products Registry for an overview of 50 innovative recycled fabrics.

- Follow Innovation in Textiles for the latest updates on technical textiles for the workwear market.

- Watch these Youtube-video’s about the production of circular, sustainable workwear by workwear brands Schijvens and Tricorp.

2. Through what channels can you get workwear on the European market?

Before you start to approach European workwear buyers, you need to determine what market segment fits your company best and through what channel(s) you want to sell your product.

How is the end-market segmented?

Besides price-level and the specific risks against which the workwear is intended to protect, the most significant segmentation concerns the employment position of end users. End consumers of workwear are either non-professional hobbyists, self-employed professionals or employees. This largely determines what requirements your buyer will have and through what channels you can best sell your product.

Table 1: workwear market segmentation

| Buyer type | B2C/ B2B | Functionality | Price | Material use | Compliancy level |

DIY consumer

| B2C (business to consumer) | Basic, functional styles | Price- conscious | Low – medium quality materials | Little focus on compliancy |

Self-employed professional

| B2C and B2B (business to business) | Focus on functionality, price, durability and safety | Price- conscious | Good quality materials | Little focus on compliancy |

Employee

| B2B | Highly functional, durable and safe styles | Less focus on price | High-quality, fit-for-purpose materials | Strict compliancy requirements regarding safety, corporate identity and sustainability |

The DIY consumer

End-consumers buy workwear to work in and around the house in leisure time. This so-called DIY-market (Do It Yourself) is one of Europe’s biggest retail markets, dominated by companies such as Hornbach and OBI. DIY is not only a popular pastime (gardening for instance) but also an economic inevitability for many Europeans, due to generally high labour costs. Hiring a professional to do jobs such as painting, carpentry or cobbling can be too expensive for many Europeans. The focus is mainly on functionality and price, not on compliancy.

The self-employed professional

Self-employed professionals such as plumbers, electricians, carpenters and installation workers buy their workwear for their occupation and are free to choose the vendor. This market is catered by DIY shops and specialised workwear suppliers such as Cofra, Mascot or Carhartt. This is the so-called SEWE-market (Self-Employed Without Employees). They will work by themselves with perhaps one or two colleagues or an on-the-job student. SEWE’s are focussed on functionality, price, durability and safety, not much on compliancy. SEWE’s are usually very brand-loyal.

The employee

If an employee is required to wear (protective) workwear or a uniform, it will be either issued by his or her employer or they must acquire it themselves according to certain specifications. The focus is on high-quality materials, durability, consistency in all aspects concerning the product, its use and maintenance (design, logistics, information), customer service and compliancy with health and safety regulations, sustainability and social standards. This market is catered by highly specialised workwear suppliers such as Havep, Tricorp or Roots.

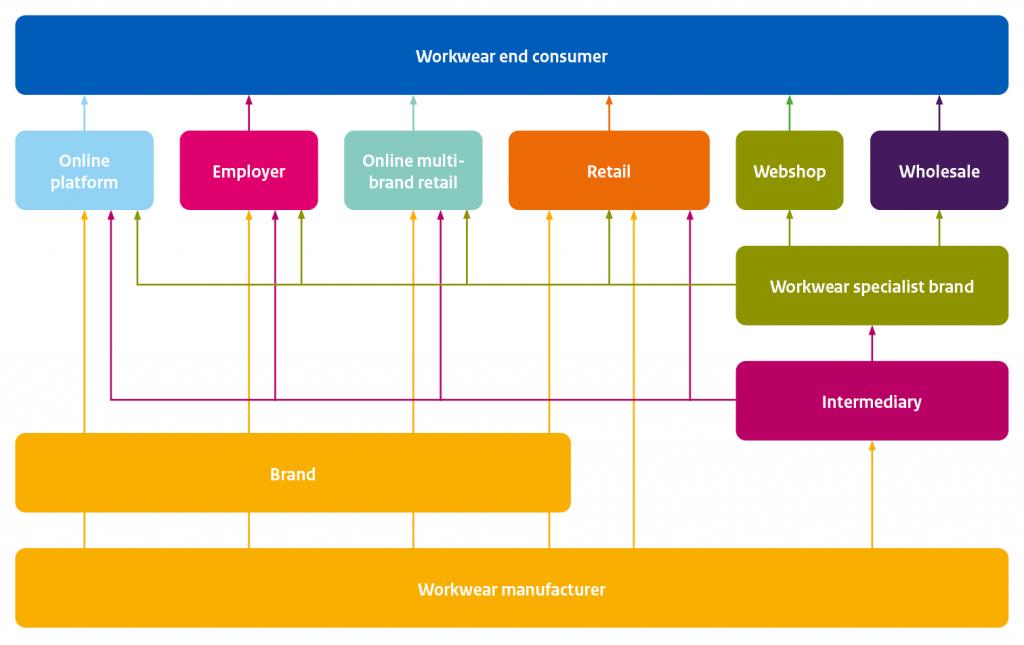

Through what channels does the product end up on the end-market?

Their place up the value chain determines how buyers will do business with you. Each buyer requires a specific approach. Always try to find out in what part of the value chain your buyer is operating, what challenges they face in the market and how you can contribute to their sales strategy.

- If you want to sell directly to European end-consumers in the DIY-market, try platforms such as Alibaba, Wish, Amazon. They will let you advertise your product and handle your sales for a commission. Most online consumers can be found in the countries of North-West Europe. You will need to invest in a webshop, stock, order management and customer service. Your biggest challenge will be return policies.

- The shortest and perhaps most profitable route to employees is via their employer. Your biggest obstacles however will be: lack of awareness and authority in the market; sales capacity and customer service. Compliancy with health and safety rules and regulations is crucial. You will also need the capacity to design, sample and test products and you will need to keep stock (for quick re-delivery). If you want to target companies directly, try to contact the manager of ‘indirect purchasing’.

- If you want to sell directly to retailers, the biggest European names in (protective) workwear are Groupe Adeo, Kingfisher, OBI and Bauhaus. Retailers sell to end-consumers and SEWE’s. They can place an order relatively easy as they only need one development sample for order confirmation. Order quantities are usually high, just as price pressure. Retailers focus heavily on compliancy with health and safety regulations, sustainability and social standards.

- B2B workwear specialists such as Mascot, Arco, HAVEP or COFRA target SEWE’s and employees. They will supply the design but highly appreciate product development and innovation. This group of buyers requires high-quality materials and workmanship. You will often need to keep stock of materials and trims (possibly from preferred suppliers). Compliancy with health and safety rules and regulations is crucial, with sustainability and social standards often required. Expect several sampling rounds.

- Intermediaries (agents or traders/ importers/ private label companies) sell your product on to (specialised) retailers. They require high-quality materials, workmanship, compliancy and flexibility and they are very price focused. Some are located near or in the production countries and primarily do sourcing and logistics. Others work from Europe and also do market research, design and stock keeping. Their service level determines the commission rate that intermediaries charge.

Figure 2: Workwear market value chain

Tips:

- Read the CBI study on Finding buyers for an extensive overview of European apparel market segments, channels and requirements.

- Do a thorough research of the market your ideal buyer is operating in and adjust your proposition to his or her requirements and ambitions.

- You can find traders specialised in workwear by using an online search engine. Use keywords such as ‘full service’, ‘workwear’ plus ‘solution’. Trader’s websites usually show the buyers they are working with.

What is the most interesting channel for you?

If you are a small to medium-sized manufacturer in a developing country, then intermediaries, such as importers and private label companies, B2B workwear specialists and retailers, are the most interesting channels for you. Always define your own Unique Selling Points (USPs) and determine what type of buyer best fits your capabilities before you approach them.

Intermediaries

Intermediaries (agents , traders, importers and private label companies) are the most adventurous types of buyers and are usually the first to explore new sourcing destinations. By doing business with these types of buyers, you will have access to many different buyers further up the value chain and you can learn how to service them by following the trader’s instructions. At the same time, you avoid the risk and investment associated with directly supplying to a B2B workwear specialist or a retailer.

B2B workwear specialists

B2B workwear specialists sell high-quality, highly specialised workwear items at a relatively high price level. A good example is this waterproof workwear jacket by ROOTS, which complies with eight different (ISO) standards. Because of their demanding requirements with regard to product quality, innovation and flexibility, many B2B specialists are vertically integrated. To service this type of buyer, you need to have strong capabilities in sourcing (fabrics, finishes, trims), product development and thorough knowledge of rules and regulations and technical innovation.

Retail

Is your company’s strong point is producing large quantities of relatively low-tech workwear items with a low level of compliance to health and safety standards and standards for ethical production? In that case, large (DIY) retailers such as the ones mentioned above or Auchan and Hornbach are an interesting channel for you. Such companies sell low-tech workwear products such as basic overalls, workpants and protective gloves at relatively low retail prices. Expect large order quantities and relatively long lead times.

Tips:

- You can find potential buyers on the exhibitor list of the A&A fair for workwear in Germany, even if you don’t plan to attend (or if shows are cancelled because of COVID-19). If you do plan to meet a (potential) buyer at a fair, check what collections they have, buy one or two items and prepare matching or even improved samples. Also work out your costing before you introduce your company and samples to a potential buyer.

- Otherwise check European workwear sector associations PCIAW or Textile Services for contacts and industry news.

3. What competition do you face on the European workwear market?

The workwear market in the EU is dominated by European brands. This is because services such as continuous stock and made-to-measure are in high demand in Europe and often only provided by European brands that are close to the market.

Which countries are you competing with?

Table 2: Competing countries

| Country | Strengths | Challenges |

| China | The biggest exporter of workwear to Europe. Technical innovation, high efficiency, excellent customer service and the local availability of highly specialised fabrics and trims give Chinese manufacturers an advantage over competitors in developing countries. | High MOQs, relatively long lead times, rising labour and transport costs and China lacks General Scheme of Preferences (GSP) status that removes import duties to the EU.

|

| Tunisia | Located close to Europe, resulting in very short lead times. Experienced in producing trousers and denim, but nowadays also produces topwear in small quantities, including workwear. | The biggest challenge for Tunisia is competing on cost due to relatively high wages, inflation and a small working population. |

| Bangladesh | Specialised in making relatively cheap basic apparel of fair quality, including relatively low-tech workwear. Efficiency is high and the country benefits from low production and labour costs and enjoys GSP status. | The biggest challenge for Bangladesh will be to increase technical expertise, facilitate smaller orders and to get more factories to comply with international safety and sustainability standards. |

| Vietnam | Long history in making apparel, including basic, good-quality workwear at a competitive price. The country enjoys GSP status. | High MOQs, limited availability of local fabrics and trims and in general a lack of capacity (especially in the factories that operate in the north and south of the country). |

| Morocco | Same geographic advantage as Tunisia but with slightly lower wages and a population that is three times bigger. Morocco has a long manufacturing history and is very experienced in manufacturing high-quality products. | Due to its proximity to Europe and the widespread use of French, the main countries that currently source apparel from Morocco are Spain and France. Relatively high wages and production costs. |

| Pakistan | With a long apparel manufacturing history and thanks to the availability of high-quality leather, it has specialised in items such as gloves and protective wear. Motor bike collections with special protection are often manufactured in Pakistan. The country enjoys GSP+ status. | Due to safety concerns, European employees are sometimes not allowed to visit the country.

|

Tips:

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the competitive advantages of doing business with you. Besides GSP, consider factors such as distance to Europe, ease of doing business and transparency.

- Most online search engines will let you create a ‘news alert’ on a topic. This way you can automatically follow the latest developments in the apparel industry in a specific country.

Which companies are you competing with?

Kinglong Workwear is a Chinese manufacturer of workwear and safety garments for the US and European market. The company offers a large selection of SGS certified CE-compliant topwear items such as coveralls, high visibility workwear, jackets, pants and safety vests. Kinglong is Oeko-tex 100 and ISO9000 certified. The company tries to engage with potential buyers by regularly publishing workwear related blogs and news stories on their website and social media.

Many of the professional workwear manufacturers in Tunesia have foreign owners or are in Joint Ventures with a foreign company. Wearwell is a successful example of a foreign owned company with a production location in Tunesia. The setup within the UK has a sales and marketing focus to build turnover and service buyers. This adds value especially regarding the production and sale of complicated workwear styles.

Cutting Edge in Bangladesh is an example of a fashion apparel manufacturer that has expanded its product range to relatively low-tech workwear uniforms. Currently the company sells to buyers in the US (Cintas uniforms for instance) and Europe. Cutting Edge stresses its compliancy with local labour and safety laws and is BSCI and SEDEX certified.

Tips:

- Check the exhibitors list of the A+A workwear trade fair for an overview of workwear manufacturers worldwide. You can search the attendees by country and check how they present their company and products on their website for inspiration.

- Study your competitors and try to understand why European buyers are interested in placing orders there. Understanding your competitor will help you to diversify and improve your USP’s.

- Read the CBI study 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your USP’s and doing business with European buyers.

Which products are you competing with?

Cheap (fast) fashion poses a threat to low-tech, basic workwear because it makes durability less relevant. With basic T-shirts on sale anywhere in Europe for less than €5 (often conveniently packed in quantities of 5, 7 or 12) and trousers for less than €10, it is possible for both professionals and hobbyists to replace traditional basic workwear items with casualwear since it is not a great loss if it is damaged or destroyed during work. Competition in the cheap fashion market however is very strong so it is not a good market opportunity. This does not apply to uniforms because this product category is based on very specific designs.

An upcoming trend in the European workwear market is towards durable workwear items which can be repaired or recycled. Ever more workwear brands offer leasing package deals that include repair/replacement and regular cleaning of the workwear. This way of doing business creates secured revenue for the supplier and reliability of quality for the buyer. Check for instance the workwear rental service by CWS.

Tips:

- Look beyond manufacturing products. Keeping stock and increasing your service level by adding cleaning, repairs and lease constructions might enable you to increase your business.

- Consider opening a local office in your target market, perhaps in a joint effort with other (workwear) manufacturers in your country. The high service level required in the European market needs local support.

4. What are the prices for workwear?

The factory price of your product (in fashion industry jargon, your ‘FOB-price’: Free On Board) is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin.

The following chart shows the average cost breakdown of your FOB-price:

Note that these percentages may differ per factory, style (set of technical requirements) and order. Some factories accept lower profit margins when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials (especially in the workwear industry, safety compliant materials are relatively expensive). Efficiency goes up and material prices go down when producing large volume orders.

Wholesale and retail pricing

The B2B price for which specialised workwear brands sell on your product or retailers sell on to end-consumers, is on average 4-8 times the FOB-price (this is called the ‘retail markup’). Exceptions do occur. In the budget market some large European retail chains may markup the FOB-price only by 2 times. The FOB-price is marked up because buyers need to account for (among other things) import duties, transport, rent, marketing, overhead, stock keeping, returns, markdowns and/or VAT (15-27% in EU-countries).

According to Eurostat’s 2020 comparison of retail prices for apparel, compared to the European average of 100, France had the highest price level among the top six European importers of apparel and footwear in 2020, with a price level index of 107.6, followed by the Netherlands (106.1), Italy (101), Germany (98.2), Spain (92.2). The UK, which is now out of the EU, had a price level index of 90.7 in 2019.

This study was carried out on behalf of CBI by Frans Tilstra and Giovanni Beatrice for FT Journalistiek.

Please review our market information disclaimer.

Search

Enter search terms to find market research