What requirements must cocoa meet to be allowed on the European market?

To sell cocoa in Europe, you have to follow certain rules about food safety. Also, European buyers want products that are safe and good for the environment. If you want to sell to a special group of customers, you need to meet their specific rules too. Doing all this can help you sell more cocoa in Europe, especially if your cocoa fits the needs of these customers.

Contents of this page

1. What are the mandatory requirements for the cocoa sector?

Sustainability has become an important issue in the global cocoa sector. European chocolate consumers have increasing concerns about sustainable practices within the cocoa industry. This heightened awareness has led to an increased demand for sustainable cocoa products, which has urged people working in the industry to take action. Sustainability efforts include environmental, social and economic aspects, which each include significant challenges that need to be addressed as a whole.

Climate change and poor farming practices are major environmental concerns that affect cocoa production. Changes to rainfall patterns and increased pest infestations due to climate change threaten the quality and volume of cocoa harvests. Deforestation makes these challenges worse, as it shrinks the suitable cocoa production areas, particularly in the Côte d’Ivoire and Ghana.

Social sustainability concerns include topics like gender inequality and child labour in cocoa farms. Economic sustainability includes challenges like fair prices for cocoa to increase farmers’ living incomes and fair wages for farm workers. Consumers insist on ensuring a good living income for farmers and preventing the exploitation of children on cocoa farms.

To tackle these sustainability challenges, the European Union (EU) has introduced the EU Green Deal (EGD), to ensure that exporters from cocoa-producing countries comply with sustainability regulations. Key components of the EGD cover all 3 dimensions of sustainability. For instance, the Farm to Fork strategy for food safety and the biodiversity Strategy for 2030 include measures such as the EU Regulation on Deforestation Free Products (EUDR), which deals with environmental sustainability issues, specifically deforestation. Additionally, the European Council has approved the Corporate Sustainability Due Diligence Directive (CS3D) to promote social and economic sustainability.

For cocoa exporters that aim to enter the European market, it is crucial to understand and comply with regulations like the EUDR, CS3D and food safety requirements. You can find detailed information on food safety regulations through the European Commission's Access2Markets website, using the HS code for cocoa beans (1801).

EU Regulation on deforestation-free products (EUDR)

The EU Regulation on Deforestation-Free Products (EUDR) came into full force on 29 June 2023. It has replaced the old EU Timber Regulation. It has 3 main goals:

- To make sure that the products that Europeans buy and use don't harm forests in the EU and around the world.

- To reduce the pollution caused by making and using these products in the EU by at least 32 million metric tonnes every year.

To stop deforestation caused by making these products and to fix any damage done to forests.

This regulation limits the sale of goods, including cocoa beans and products like chocolate, that are produced on or associated with deforested and degraded land (see Table 1). Anyone who sells these cocoa products in the EU or sends them out of the EU must show that they didn't come from forests that were recently cut down or harmed. The regulation will be in effect as from 30 December 2024. This means that there is only a short time to adjust and get ready.

National cocoa industries have already started taking action to comply with this regulation. For instance, the Peruvian cocoa sector has already started adapting to the new regulations on deforestation. The organisation Solidaridad, in collaboration with partner organisations and the Peruvian government, helps cocoa farmers to geo-reference their farms. They also encourage farmers to start agroforestry practices. In this collaborative effort, government officials, producers, companies and civil societies are trained on how to use geo-referencing tools, such as the Global Forest Watch Pro. Also, Ghana and Côte d’Ivoire, which are the 2 major exporters of cocoa beans, are establishing national strategies to track deforestation and support farmers to comply with the rules. Ghana is doing this through its cocoa management system implemented by the Ghana cocoa board (COCOBOD). The system is currently being trialled/piloted with a tracking option for buyers to be able to check whether their cocoa is from a deforested place.

Table 1: Relevant cocoa products that must meet the EU Deforestation Free Regulation (EUDR)

| HS Code | Product Description |

| 1801 | Cocoa beans, whole or broken, raw or roasted |

| 1802 | Cocoa shells, husks, skins and other cocoa waste |

| 1803 | Cocoa paste, whether or not defatted |

| 1804 | Cocoa butter, fat and oil |

| 1805 | Cocoa powder, not containing added sugar or sweeteners |

| 1806 | Chocolate and other food products that contain cocoa |

Tips:

- Complying with the EUDR can feel like an extra burden for many cocoa suppliers, but it is actually very straightforward. The first step is to have a traceability plan that records the source of your cocoa. You should give unique identifiers to each batch of cocoa: 1) for farmers and farms including GPS locations, and 2) for the community or village where the cocoa is produced. You should record the cocoa’s movement or transportation information on paper or in a digital system. Once you have recorded this information, you can share it with your buyer. The buyer will be willing to pay you to verify that no deforestation has occurred, as they are responsible for legal liability.

- Read the CBI’s Tips to go green in the cocoa sector to learn more about climate change and deforestation.

The Corporate Sustainability Due Diligence Directive (CS3D)

On 24 April 2024, the European Parliament adopted the CS3D. The CS3D establishes common goals for all EU member states to achieve. The directive is binding for EU companies and non-EU companies who do business in the EU. EU member states have a period of 2 years to include the directive in their national laws. The CS3D will be phased in over a longer period. Companies with 5,000 employees and €1,500 million turnover will be impacted in 3 years. Companies with 3,000 employees and €900 million turnover will be impacted in 4 years. Companies with 1,000 employees and €450 million turnover will be impacted in 5 years.

The CS3D is compulsory for all companies in the EU as well as for companies outside Europe that sell products or services to EU countries. The directive is mainly focused on the social and economic aspects of sustainability. Companies must take steps to find and prevent any harmful impacts that their business and supply chains may have on people and on the environment.

National cocoa sectors, like the Ghana Cocoa Board, have started preparing to comply with the CS3D regulation. The Ghana Cocoa Board has teamed up with the International Trade Centre’s Alliances for Action sustainable agribusiness initiative to enforce compulsory human rights and environmental checks in Ghana’s cocoa industry. This partnership involves arranging training sessions, carrying out readiness evaluations and crafting a detailed action strategy.

Individual exporters to the EU must also create codes of conduct that focus on:

- Business ethics;

- Social responsibility, such as the welfare of farmers and processing facility workers and their living incomes;

- Environmental responsibility, such as carbon neutrality, the impact on local biodiversity and deforestation.

Codes of conduct on these 3 topics will guide you on how you do your business and make sure that you comply with the CS3D. For cooperatives, it is also important to keep track of your carbon footprint. Companies like Carbon Roots can help you estimate your carbon footprint. Buyers may request this information to have an idea of your environmental friendliness.

Tips:

- Read more about the European Due Diligence Act on the CBI website.

- Make sure that your suppliers also have responsible business practices. Many social and environmental issues occur at the farm level, which may not be a part of direct handling and processing activities.

- Cooperatives must reduce their carbon footprint by replacing chemical fertilisers with organic waste and by practicing organic farming, using green energy if possible or using vehicles and machines (for example, for hulling, washing and drying) that are fuel-efficient.

- Comply with open data transparency protocols and share your data with buyers.

- Make sure that your suppliers also have responsible business practices. Many social and environmental issues occur at the farm level, which may not be a part of direct handling and processing activities.

Food safety

Food safety and hygiene are key issues on the European market. Cocoa beans and cocoa products must follow EU food safety rules if you want to export to Europe. These rules make sure the food is safe to consume.

If producers and exporters process cocoa beans into cocoa products like cocoa powder, butter or liquor, they must follow hygiene standards. These standards are based on the HACCP principles (Hazard Analysis and Critical Control Points). They are essential for products beyond the primary production stage because products that are considered unsafe won't be allowed into Europe.

Although HACCP isn't typically required for cocoa beans, it may be necessary for other cocoa products like cocoa butter or cocoa powder. If certain products from specific countries repeatedly do not meet health certificate or analytical test requirements, stricter import conditions will be enforced on them.

Products from countries that repeatedly do not comply with these standards are put on a list that is included in the Annex of European Commission Implementing Regulation (EU) 2019/1793. This Annex currently does not list any countries for cocoa products.

Tips:

- Make sure your products comply with the General Food Law (Regulation (EC) 178/2002) and the general rules on Food Hygiene (Regulation (EU) 2017/625).

- Check the European Commission’s guidance platform for food for information on certain questions related to import requirements and the European rules on food hygiene and official food controls.

- Refer to the EU’s Rapid Alert System for Food and Feed (RASFF) Window database to see examples of withdrawals of cocoa products from the market and the reasons behind these withdrawals. Under “Product”, choose the category “cocoa and cocoa preparations, coffee and tea”. In addition, you can choose your country under “Country” to see examples of non-compliance. This can provide a basis for your own risk management system and help you avoid future notifications or even border rejections.

Food contaminants

Food can get contaminated during production because of the environment, farming methods or how it is processed or transported. However, since many contaminants are natural, it is not possible to ban them completely. European laws make sure that contaminant levels are kept very low to avoid health risks and to keep food quality high. These levels are decided on based on advice from the European Food Safety Authority (EFSA).

As of 25 April 2023, the European Union has updated food safety regulations to guarantee high standards of food safety and consumer protection. The regulation on maximum levels for certain contaminants in food, (EU) 2023/915, has replaced the regulation (EC) 1881/2006.

In the next sub-sections, we will talk about the main contaminants likely to be found in cocoa products. These include:

- Heavy metals;

- Pesticide residue;

- Mycotoxins;

- Polycyclic aromatic hydrocarbons (PAHs);

- Microbes; and

- Foreign matter.

Tips:

- If you want to sell your cocoa beans or products in Europe, you have to follow the rules on contaminants (Regulation EC 1881/2006). If you don't, your products won't be allowed in.

- Check the European Commission's fact-sheet titled 'Ensuring food is safe' for more details on controlling food contamination in the EU.

- Support your cooperatives and farmers to use good agricultural practices to decrease contaminants. You can find guidance on good agricultural practices for cocoa production on the Federation of Cocoa Commerce website.

- Read the Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements to learn about strategies to reduce or avoid heavy metals, pesticide residue, mycotoxins, polycyclic aromatic hydrocarbons (PAHs), microbes and foreign matter in your cocoa beans.

- See the website of the Transport Information Service for information on safe storage and transport of cocoa.

Heavy metals, specifically cadmium

Cadmium is a naturally occurring element found in soils. However, it can also come from contamination sources like pesticides and chemical fertilisers that contain cadmium. Cadmium contamination is a particular problem for cocoa production in certain Latin American countries. These regions often have high levels of cadmium in the soil because of volcanic activity, forest fires and other environmental factors. Consuming high cadmium levels is primarily toxic for your kidneys, which is a serious concern for consumer health. As a result, cadmium contamination in cocoa products is a significant issue that needs to be carefully monitored and requires reduction and avoidance strategies to ensure food safety and protect consumer well-being. The European Union has strengthened its regulation on cadmium in chocolate and derived products. In April 2023, the EU replaced the regulation (EC) no. 1881/2006 on maximum levels for certain contaminants with Regulation (EU) 2023/915 on the maximum levels of cadmium in certain food products.

A maximum level of 0.6 or 0.8 mg per kilogram of peeled cocoa beans may be safe. However, some buyers reject beans that exceed 0.3 mg per kilogram. Especially if beans are intended for cocoa powder production. This is because cadmium stays mostly in the solid parts of the bean rather than the fatty components. Cocoa beans with 0.3 mg of cadmium per kilogram will result in cake or powder with a concentration of 0.6 mg per kilogram. To comply with EU regulations, see the acceptable limits in Table 2.

Table 2: EU Regulations on maximum acceptable limits of cadmium in cocoa products

| Product Description | Maximum level (mg per kg in wet weight) |

| Milk chocolate with less than 30% of total dry cocoa solids | 0.10 |

| Chocolate with less than 50% of total dry cocoa solids; milk chocolate with 30% or more of total dry cocoa solids | 0.30 |

| Chocolate with 50% or more of total dry cocoa solids | 0.80 |

| Cocoa powder sold to the final consumer or as an ingredient in sweetened cocoa powder sold to the final consumer (drinking chocolate) | 0.60 |

To reduce cadmium levels, cooperatives and farmers can take several steps:

- Understand cadmium levels and blend beans to lower the overall cadmium content.

- Test peeled beans, as cadmium levels are higher in the shell than in the nibs.

- Improve soil conditions by reducing acidity through liming and adding organic materials like compost or biochar to limit cadmium absorption by plants.

- Adapt practices to local conditions, focusing on binding cadmium in the soil or limiting plant absorption while improving soil health and cocoa tree productivity.

- Use low-cadmium cocoa varieties through breeding programmes or grafting.

It is essential to customise these practices to the local environment and conditions, as there is no one-size-fits-all solution.

Tips:

- Be ready to provide your buyer with a laboratory analysis of the cadmium levels in your cocoa beans, when requested. This analysis should be done by an accredited laboratory. It will probably be repeated by your direct buyer. All stakeholders in the industry, including importers and chocolate makers, implement strict actions to comply with the new maximum levels of cadmium in food products.

- Learn about the requirements for methods of sampling and analysis for the official control of cadmium and other heavy metals. This will help you to ensure compliance.

- Access the online Choco SAFE tool, created by the Alliance of Bioversity International and International Center for Tropical Agriculture (CIAT), to calculate the safe EU limit for cadmium in different cocoa and chocolate products. Activate the language translate add-in on your browser to translate the information to your preferred language.

Pesticide residue

As part of the European Green Deal, the EU aims to reduce use of pesticides by 50% by 2030. Therefore, the EU has proposed legally-binding targets for maximum residue limits and has set strict rules to enforce environmentally-friendly pest control.

The maximum residue levels (MRLs) are the amounts of pesticides allowed in food products, including cocoa. For organic cocoa, the MRLs of pesticides must be zero. Buyers will randomly choose batches of organic cocoa to test and may send them to accredited third-party labs for residue testing. Pesticides are commonly used in conventional cocoa farming to manage insect infestations. This is especially relevant for cocoa farmers who use pesticides to fight insect infestations, such as mirid bugs and the cocoa pod borer, as well as diseases like black pod.

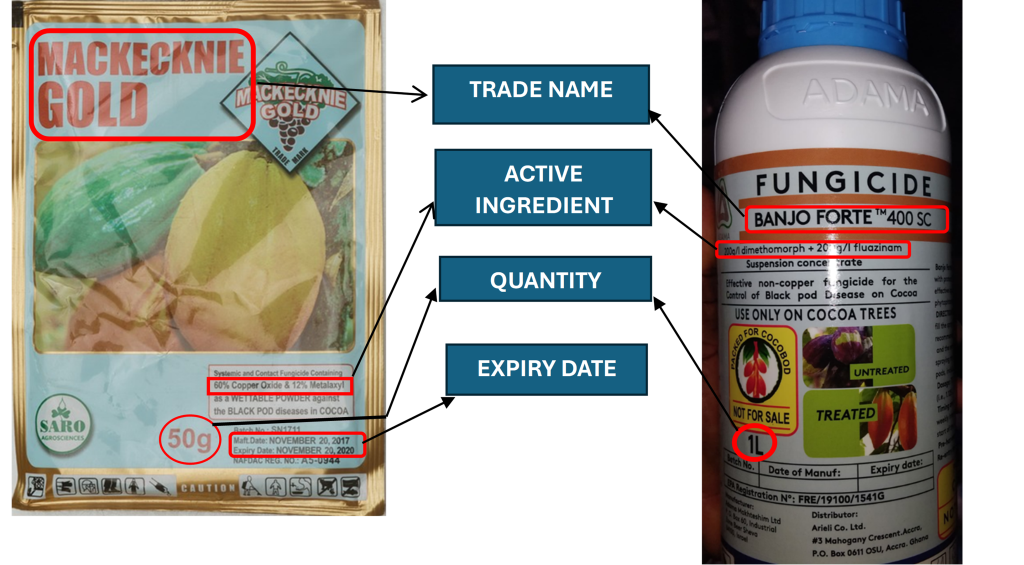

Cocoa farmers usually use fungicides with copper-based compounds to control black pod disease and other diseases like pink disease and anthracnose. These fungicides contain copper compounds like Fluazinam, Metalaxyl, Metalaxyl-M, Benalaxyl, Dimethomorph and Pyraclostrobin. Insecticides used to control mirid bugs and other major insects also contain compounds like Imidacloprid, Thiamethoxam, Bifenthrin, Acetaprimid, Deltamethrin, Pyrethrum, Alpha-cypermethrin, Teflubenzuron and Lambda cyhalothrin. You can find these ingredients on the label of the pesticide container. Check the EU pesticide database for cocoa for an overview of the current maximum residue levels (MRLs) for these compounds and others not listed here.

Figure 1: How to read a pesticide label

Source: Amonarmah Consults

It is crucial to know the producers you are working with and to understand their farming and pesticide control methods. Organic certified parcels go through strict controls, which makes it essential to test the goods that you import into the EU.

Chemicals may also be used during fumigation before or after transportation. Cocoa beans can be contaminated with chemicals during storage and transport. EU warehouses are closely monitored, and they have shifted away from fumigation on cocoa parcels. Instead, they use more environmentally friendly methods, like freezing or CO2 treatments.

One pesticide that has been under debate in the past years is glyphosate. But on 28 November 2023, the disagreements about this pesticide were resolved. The EU passed Regulation 2023/2660, which extends the use of glyphosate until 15 December 2033. Glyphosate, which is found in many herbicides, has faced criticism for health and environmental risks. Recent scientific assessments by the European Chemicals Agency (ECHA) and the European Food Safety Authority (EFSA) found that glyphosate is not carcinogenic and poses no significant risk to humans, animals or the environment.

Tips:

- Do not keep chemicals or used chemical containers in the same room where cocoa is being stored or transported.

- Read the instructions on the pesticide containers and follow the instructions for application, including the recommended dosage, very well. Farmers or cooperatives should contact extension agents or cocoa research institutions near them if they are not sure about the correct dosage, frequency or timing of application of these chemicals.

- Check the legislation regarding the controls on pesticide residue (Regulation EC 396/2005) for further information on pesticides.

- Focus on reducing pesticide residue in your products. A good way to do this is by applying Integrated Pest Management (IPM), an agricultural pest control approach that uses complementary crop management strategies and practices to help reduce the use of pesticides. Useful sources are COLEACP’s training modules on crop protection and the European Cocoa Association’s (ECA) pesticide use in cocoa practical manual.

- Check page 98 and 99 of the Manual for Cocoa Extension in Ghana for the recommended application dosage and frequency of fungicides and insecticides on cocoa farms to limit pesticide MRLs in cocoa beans.

Mycotoxins

Mycotoxins like Ochratoxin A (OTA) are harmful substances, which can occur in cocoa as a result of the fungal infection of crops. This toxin is produced when crops are dried in the sun or stored. However, its formation can be stopped by using proper drying and storage methods. This toxin can also create a bad taste. Because the health risks of mycotoxins have been recognised, regulatory limits have been set around the world, particularly in the European Union. In 2022, the European Union set new limits for Ochratoxin A (Regulation (EU) 2022/1370). There is no specific limit for cocoa beans, although cocoa powder is mentioned, with a maximum OTA level of 3 μg per kilogram.

Tips:

- Focus on good agricultural, drying, processing and storage practices, for example by adopting Good Agricultural Practices (GAP) and/or Good Manufacturing Practices. These steps have a significant influence on the development of mycotoxins.

- Read and follow the Codex Alimentarius’ Code of Practice for the Prevention and Reduction of Ochratoxin A Contamination in Cocoa (Reference code CXC 72-2013).

Polycyclic aromatic hydrocarbons (PAHs)

Polycyclic aromatic hydrocarbons (PAHs) may also contaminate cocoa during the post-harvest or primary processing stages. These substances are classified as carcinogenic to humans. PAHs like Benzoapyrene are harmful compounds often found in cocoa. In cocoa, PAHs can result from cross-contamination during artificial drying, where wood-fuelled units emit smoke that may contaminate the beans.

If your cocoa has a smoky flavour, it may have been dried artificially or exposed to external smoke sources. It is important to have your cocoa beans analysed for PAHs to ensure safety.

Table 3: EU Regulations on maximum acceptable limits of polycyclic aromatic hydrocarbons (PAHs) in cocoa

| Product | Maximum level (μg per kg) | Remarks | |

Benzo(a)pyrene | Sum of PAHs: benzo(a)pyrene, benz(a)anthracene, benzo(b) fluoranthene and chrysene. | For the sum of PAHs, maximum levels refer to lower bound concentrations, which are calculated on the assumption that all the values of the 4 substances below the limit of quantification are zero. | |

| Cocoa beans and derived products except products listed in the next row below. | 5.0 μg/kg fat | 30.0 μg/kg fat | Including cocoa butter. |

| Cocoa fibre and products derived from cocoa fibre intended for use as an ingredient in food. | 3.0 | 15.0 | Cocoa fibre is a specific cocoa product produced from the shell of the cocoa bean and contains higher levels of PAHs than the cocoa products produced from the cocoa nibs. The cocoa fibre and derived products are intermediate products in the production chain and are used as an ingredient in the preparation of low calorie, high fibre food. |

Tips:

- Avoid drying cocoa beans with fire or beside roads, using inefficient artificial dryers and storing cocoa in the presence of smoke.

- Read and follow the Codex Alimentarius’ Code of Practice for the Reduction of Contamination of Food with Polycyclic Aromatic Hydrocarbons (PAH) from Smoking and Direct Drying Processes (search for CXC 68-2009).

Microbes

Although cocoa is considered relatively low risk for microbiological contamination such as Salmonella, this can occur as a result of incorrect harvesting and drying techniques. No microbiological criteria for cocoa have been set in current European legislation. However, food safety authorities can withdraw imported food products from the market or prevent them from entering the European Union if microorganisms are found. Salmonella can also occur later in the chocolate-making process, although it is rare. For example, there were 2 Salmonella outbreaks in factories of Ferrero and Barry Callebaut in Europe in 2022. This is why it is important for farmers to follow proper harvesting, fermentation and drying techniques.

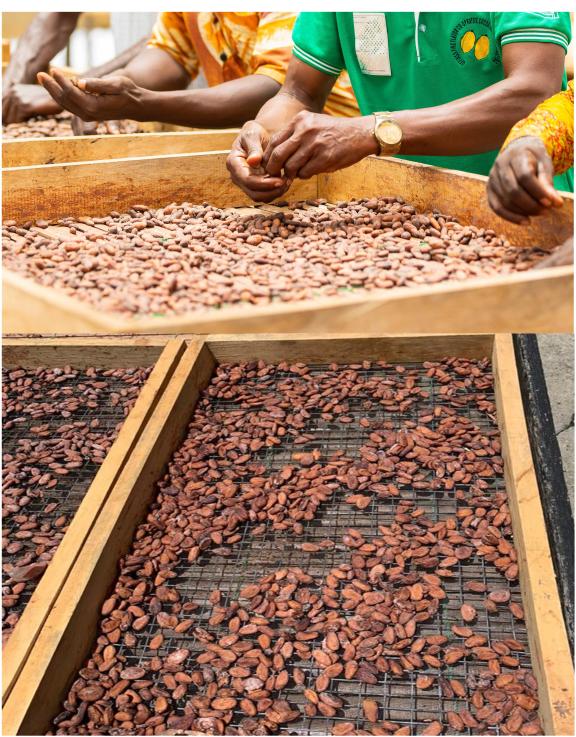

Figure 2: Heaped fresh cocoa beans ready to go through the fermentation process

Source: Amonarmah Consults

Tips:

- Check the legislation on the microbiological criteria for food products (Regulation EC 2073/2005) for further information on microorganisms.

- Check page 50 of the cocoa manual of Cocoa Research Institute of Ghana on good drying and storage practices to reduce microbes.

Figure 3: Fermented cocoa beans drying in the sun

Source: Amonarmah Consults

Foreign matter

Contamination by foreign matter like plastic and insects is a risk if you do not carefully follow food safety procedures. This foreign matter can come from materials like recycled paper and treated jute bags. Although it is cheaper to dry beans in the sun, this leaves the beans exposed to insects and pollutants. This foreign matter can impact the flavour and quality of the beans.

The European Union currently has no specific legislation on foreign matter. However, this does not mean that products cannot be rejected by a buyer due to the presence of foreign matter. It is important to remove foreign matter when you turn or rake the beans during drying.

Figure 4: Turning cocoa beans during drying to enhance even drying and remove foreign matter

Source: Amonarmah Consults

Figure 5: Removing foreign matter from cocoa beans

Source: Amonarmah Consults

Extraction solvents

In the cocoa industry, solvents are sometimes used to extract cocoa butter from cocoa beans or other cocoa products. 2-methyloxolane is an extraction solvent used in the production or fractionation of fats, oils or cocoa butter. The European Parliament's Directive 2009/32/EC, which regulates the use of solvents in the production of food and food ingredients, establishes a maximum residue limit (MRL) of 1 milligram of extraction solvent per kilogram of product (1 mg/kg) for the solvent 2-methyloxolane when used in the manufacturing of fats, oils or cocoa butter.

Labelling requirements

European Union food labelling rules make sure that consumers get the essential information to make an informed choice when buying their food. These rules aim to standardise the labelling of cocoa and chocolate products and provide clear definitions for these items.

The labels should be clear, easy to read and permanent to make them understandable to consumers, typically in the language(s) used in the European market. This concerns pre-packaged products such as chocolate.

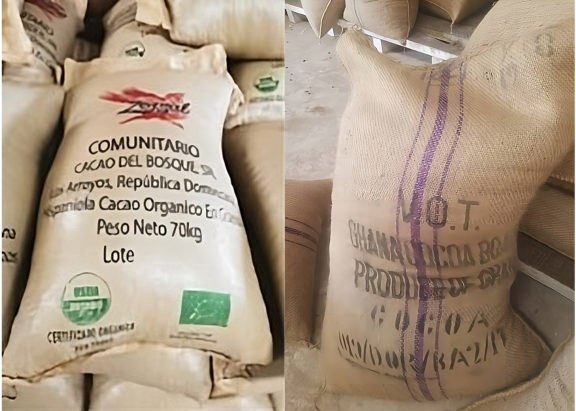

For cocoa beans, which are sold in bulk, no specific legislation applies to the labelling. However, the labels should follow the labelling standards of cocoa products where possible and at least include the:

- Product name;

- Grade or specification;

- Lot or batch code;

- Country of origin;

- Net weight in kg;

- Supplier’s name and business address;

And, in case of organic, fair trade or other certification: the name/code of the inspection body and the certification number

Also, as part of the EU Regulation on deforestation-free products (EUDR), labelling requirements aim to support efforts to monitor and reduce deforestation in the cocoa supply chain. This may involve including traceability information or deforestation monitoring methods on product packaging, or providing buyers with detailed information about the geographic origin of the cocoa beans. These labelling and transparency measures make it possible for buyers and consumers to check that the cocoa products they purchase are not contributing to deforestation in the regions where the cocoa comes from.

Figure 6: An example of labelling for cocoa beans

Source: Amonarmah Consults

For pre-packaged cocoa products, in addition to the labelling requirements listed above, the label should also include:

- An ingredient list (including any additives);

- Allergen information;

- The quantity of certain ingredients;

- Date marking (best before/use by dates);

- Any special storage conditions and/or conditions of use;

- Instructions for use, if needed;

- The alcohol level of drinks (if higher than 1.2%); and

- A nutrition declaration.

Packaging requirements

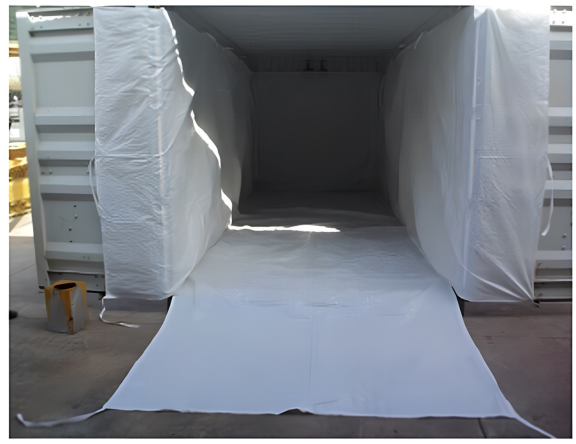

Cocoa beans are traditionally packed in large jute bags that typically weigh between 60 and 65 kilograms. However, there is a growing trend towards bulk shipping, where cocoa beans are transported directly in the ship's cargo hold or in containers using a flexi-bag. This method, known as "mega-bulk" shipping, is commonly used by large cocoa processors for standard-quality beans.

In the specialty cocoa market, jute bags are also a popular choice. However, for very high-quality micro lots, vacuum-sealed GrainPro packaging can be used. This packaging ensures that no condensation occurs on the inside, and it helps to eradicate insects in all life stages. The vacuum-sealed packaging maintains optimal conditions for cocoa storage, including low oxygen or high CO2 concentration. This provides the perfect conditions for the long-term storage of cocoa beans.

Figure 7: Container lined with flexi-bag

Source: Manual for cocoa extension in Ghana

Figure 8: Conveyor system for filling the container for bulk shipment

Source: Manual for cocoa extension in Ghana

Good packaging should contribute to keeping the environment safe and ensuring that the cocoa is healthy to eat. Packaging should protect the cocoa from getting contaminated or leaking. The European Union (EU) doesn't have specific regulations solely dedicated to cocoa packaging. However, cocoa packaging, like all food packaging, must follow general EU legislation about food contact materials and items. The primary regulation for food contact materials in the EU is Regulation (EC) no. 1935/2004. It ensures that materials and items meant for food contact don't transfer their parts to food in amounts that could harm human health or alter the food's composition in unacceptable ways.

Figure 9: Cocoa packaged in jute sacks

Source: Amonarmah Consults

Figure 10: Cocoa in a GrainPro bag

Source: Victor Dela Casa

Payment and delivery terms

Payment and delivery terms mean the conditions that are agreed on for the transfer of funds in exchange for the cocoa beans. These terms set out when and how payment will be made, which influences the cash flow, risk management and relationships with suppliers. Common payment terms include Letter of Credit (LC), Cash in Advance, Open Account and Documentary Collection (DC). Each method offers different levels of security and flexibility, which allows buyers to set their payment arrangements according to their preferences and circumstances.

You need to negotiate to establish payment terms that are beneficial for both you and your buyer. Effective negotiation involves clear communication, understanding each party's needs and constraints and seeking solutions that fit with both parties' preferences and circumstances. The way you receive payment and deliver your goods might change depending on where you're sending them from and where they're going. Bank accounts are the main platforms through which you receive your payment from a buyer. The main bank account-based payment methods include credit transfers, cheques, direct debits and card payments. These methods all involve moving funds from the buyer's account to the seller's account.

Figure 11: Cocoa ready to be loaded onto the ship

Source: Amonarmah Consults

Sometimes, you might receive late payments. Previously, the EU Late Payment Directive required member states to set laws to regulate payment schedules. The payment terms could not be more than 60 days, unless both parties agreed otherwise. If no terms were set, the default was 30 days. However, some countries had laws that were more favourable to suppliers. For this reason, the EU passed a directive in 2019 to combat unfair practices in food supply chains. As a results, payment terms have now all been limited to 30 days for perishable goods and 60 days for other food items.

On 12 September 2023, the EU proposed a new, stricter rule, suggesting a maximum payment term of 30 days for all food products. Member states still have to agree to this before it is passed. While the proposed regulation has not been finalised or enacted yet, it demonstrates the EU's commitment to addressing late payment issues and protecting suppliers. It is crucial to stay informed about the developments and potential changes to payment term regulations. This knowledge can help you to negotiate terms that are beneficial to you when you are signing supply or trade contracts within the EU market.

The EU's Access2Markets website has the information you need about taxes, rules and other things that might affect your trade. You can look up the taxes and rules for exporting cocoa beans (HS code 18 0100) from your country to any European destination on this site.

Intellectual property (IP) rights

If your cocoa business has developed unique innovations, processing methods such as distinctive fermentation techniques or equipment designs, or brands specifically associated with your cocoa products, these may be considered intellectual property that requires protection. Intellectual property (IP) rights provide you with a legal basis to protect your inventions, innovations and branding elements from unauthorised use or replication by others. Securing IP rights, such as patents, trademarks or trade secrets, can help your business keep a competitive advantage and prevent others from unfairly benefitting from your proprietary developments in the cocoa industry. An example of cocoa companies that have used IP rights to protect their brand is the Trinidad and Tobago Fine Cocoa Company (TTFCC).

The primary concern for TTFCC was establishing proof of origin and keeping compliance with quality standards. In the chocolate sector, false claims and deceptive marketing campaigns about origin are widespread because of the minimal enforcement, which makes consumers confused. To address this, TTFCC has used various intellectual property tools to verify and safeguard the company's claims of origin and quality from potential imitators.

Another example is "Belgian chocolate", which refers to chocolate made following the guidelines of the Belgian Chocolate Code. This means that the entire process of mixing, refining and conching must take place in Belgium. Although not legally mandated by Belgian law, this code is upheld by members of the Choprabisco association to protect the reputation of Belgian chocolate manufacturers and to provide transparency to consumers about the authentic Belgian origins and production methods of the chocolate.

The EU is a signatory of IP rights agreements, such as the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

The IP rights in the TRIPS agreement include:

- Copyright and related rights;

- Trademarks, including service marks;

- Geographical indications, including origin references;

- Industrial designs;

- Patents, including the protection of new varieties of cocoa with desirable traits, such as flavour profiles;

- Layout designs of integrated circuits;

- Undisclosed information, including trade secrets and test data.

Tips:

- Read about the European Union Directive 2009/32/EC for more information about limits on extraction solvents. Also refer to the Annex 1 Directive for the amended sections.

- Read about labelling and packaging guidelines for more information on labelling rules for pre-packaged products, such as chocolate and chocolate products. Also, check Access2Markets for European Union food labelling requirements for cocoa and cocoa-derived products.

- Visit the UN Economic Commission for Europe’s website to learn more about payment methods.

- Learn about Incoterms, which provide rules and guidance for global trade. Incoterms divide the responsibilities between exporters and importers regarding shipment coordination, insurance, duties, customs clearance and documentation. For instance, it is essential to agree on who pays for insurance during transport in case of any problems.

- Learn more about EU policies regarding intellectual property rights and agreements with other nations and details on how to uphold your rights.

2. What additional requirements and certifications do buyers ask for in the cocoa sector?

Buyers often want more than what the law requires, especially when it comes to food safety, taking care of the environment and treating workers fairly. In Western and Northern Europe, they have even stricter rules compared to Southern and Eastern Europe. These buyers want products to be safe, made sustainably and produced ethically.

Although it is important to follow the law, it is also necessary to meet these extra demands from buyers. This will keep your customers happy. You need to understand and meet these different expectations in different places to keep up with changing market needs. This also helps you to build trust with customers who care about these issues.

Quality criteria

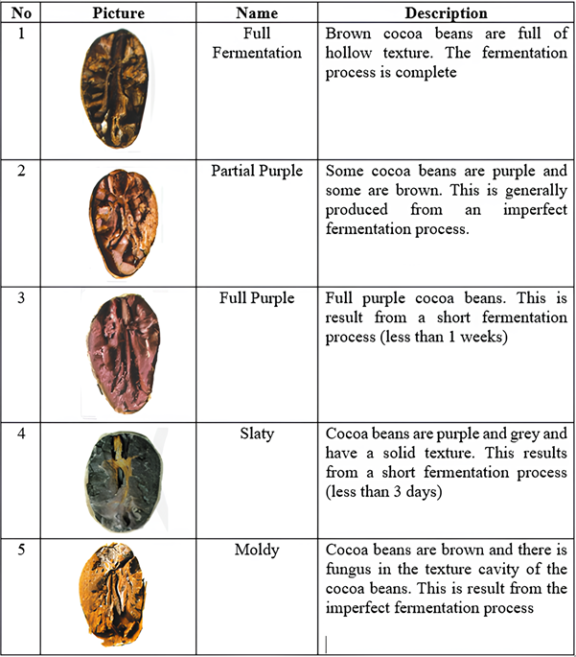

To export cocoa beans to Europe, you should meet your buyer's quality standards, especially for fine flavour beans. European buyers check cocoa quality using various methods, like sensory tests, chemical analysis and physical checks. The guide Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements provides recommendations on cocoa growing, post-harvest practices and quality evaluation methods that contribute to cocoa quality. Cooperatives and exporters can assess the quality of cocoa beans themselves after the drying process by conducting a cut test. This procedure involves exposing the cotyledons of cocoa beans to identify defects, like slaty or violet discoloration and contamination. See Figures 12 and 13 for a visual example. Understanding the quality of cocoa beans using this test enables you to make improvements in the fermentation and drying processes, thereby enhancing the overall cocoa bean quality.

Figure 12: Sample of cocoa beans to be physically examined using a cut test

Source: Amonarmah Consults

Chocolate makers and cocoa traders often use different methods to assess cocoa quality. These methods are based on international cocoa standards, such as:

- The ISO’s Standards on classification and sampling for cocoa beans.

- The Fine Cacao and Chocolate Institute (FCCI): visit the FCCI official website and contact them to receive their sampling protocol and grading form.

- Heirloom Cacao Preservation’s (HCP) genetic evaluation of cocoa to identify and value cocoa and its flavours.

Equal Exchange/TCHO’s guide to cocoa sensory analysis tasting form to assess the quality of cocoa along the value chain.

In addition, a work group of the Cocoa of Excellence Programme, which is coordinated by The Alliance of Bioversity International and CIAT, has launched the International Standards for the Assessment of Cocoa Quality and Flavour. You can download the Guide (for the Assessment of Cacao Quality and Flavour) here.

The protocols outline how to: 1) sample cocoa beans; 2) check their physical quality; 3) process them into powder, liquor and chocolate; and 4) evaluate their flavour. These standards were created to address the challenges faced by suppliers in understanding buyer assessments of quality and flavour diversity. This understanding helps suppliers improve quality in their supply chain.

Figure 13: Cocoa cut test chart

Source: Lestari et al. 2019

Food safety certification

Buyers may ask for extra assurances, like specific quality standards and quality management systems (QMS) to ensure food safety. For cocoa beans, it is crucial to follow good agricultural practices for food safety. Certification organisations often include GLOBALG.A.P. in their standards. A QMS, like HACCP, might be required for cocoa bean storage and handling. If you export semi-finished cocoa products, buyers may expect certificates like IFS, FSSC 22000 or BRCGS for your facilities.

Supplier Code of Conduct

European buyers are increasingly addressing social and environmental issues in the cocoa supply chain. It is becoming common for them to develop corporate social responsibility (CSR) policies and codes of conduct that suppliers must follow. The CSRD (Corporate Sustainability Reporting Directive) entered into force in the EU in early 2023. Companies in the EU must disclose information on what they see as risks and opportunities regarding social and environmental issues.

Apart from your own code of conduct, European buyers will expect you to comply with their code of conduct regarding corporate social responsibility. This might be their own code of conduct or one based on external initiatives, such as the Business Social Compliance Initiative (BSCI) or Sedex Members Ethical Trade Audit (SMETA). These standards are most common among large-scale importers and retailers. Examples are the Barry Callebaut Supplier Code of Conduct, the Ofi Supplier Code of Conduct and the Cargill Supplier Code of Conduct.

Some examples of these codes of conducts from retailers are:

- Coop (Switzerland): Action, not words – sustainability at Coop

- Ahold Delhaize (Netherlands/Belgium): ‘Grounded in Goodness’ strategy'

- Carrefour (France): Social and Environmental Responsibility, which is their commitment to their Corporate Social Responsibility.

Examples of corporate social responsibility strategies from importers, cocoa processors and chocolate manufacturers include:

- Nestlé: Nestlé Cocoa Plan

- Mars: Sustainable in a Generation Plan

- Ferrero: Corporate Social Responsibility

- Mondelez: Cocoa Life

- Cargill: Cocoa Promise

- Barry Callebaut: Forever Chocolate

- Lindt & Sprüngli: The Farming Program

- Olam: Cocoa Compass

Tips:

- Ask your buyer about their cocoa quality assessment practices and their recommendations. Some buyers will request factors that may be considered undesirable by other buyers, such as low fermentation levels.

- Learn more about maintaining the quality of your cocoa during transportation on the website of the Transportation Information Service (TIS).

- Ask your buyers or potential buyers exactly what type of certification they require from you.

- Think about creating and putting into action your own CSR policy or code of conduct. While it might not be mandatory for buyers, it can demonstrate your commitment to social responsibility. Plus, it could make you more noticeable when buyers are deciding between different suppliers.

- Access the tools and guides of Accountability Framework.

Sustainability certification

In the EU, buyers sometimes ask for certifications from programmes like Fairtrade or Rainforest Alliance. These certifications show that your cocoa is made responsibly, with fair work and care for the environment.

Many European companies have rules for their suppliers to be sustainable, covering issues like child labour, safe working conditions, deforestation and pesticide use. Different certification schemes focus on different parts of sustainability. Rainforest Alliance is the most common for cocoa.

You can read the guide for farmers on how to get Rainforest Alliance certified. If you are an exporting company, read this guide for companies on how to get supply chain certification. In June 2020, the Rainforest Alliance published its new certification programme for farmers and companies. Note that Rainforest Alliance is continuously strengthening its cocoa certification programme. For instance, in November 2022 it updated its Origin Matching Mass Balance requirements.

Fair trade standards also focus on how your business treats people in the supply chain. Once you have been certified by an independent third party, you can use a fair trade logo on your product. Fair trade products usually have a set minimum price and an extra premium added to them.

The most common fair trade standard in Europe is Fairtrade International. The accredited certifier for fair trade is FLOCERT. Read this full guide to learn more about how to become a fair trade producer. Access the fair trade standard for cocoa for small-scale producer organisations here.

Note that Fairtrade also revised its standard for cocoa for small-scale producer organisations and traders in 2022. The updated fair trade standard has 2 clear requirements for certification: one for producer groups and one for traders. Cocoa cooperatives and traders need commitments for new fair trade sales volumes, confirmed by the end buyer and validated by the national fair trade organisation. Products with the fair trade label mean producers receive a Fairtrade Minimum Price. The current minimum prices and premiums for cocoa, whether organic-certified or conventional, can be found in the Fairtrade Minimum Price and Fairtrade Premium Table.

Table 4: Most important third-party certification standards requested by European cocoa buyers.

| Name | Certification body | Type | How to get certified? | Most used in European end- market(s) | Cost for companies |

| Rainforest Alliance | Access the list of authorised certification bodies of the Rainforest Alliance standard. | Environmental and social sustainability | Check the guide for farmers on how to get certified if you are a farmer. Companies can also consult the guide for companies to get certified. Operators usually undergo a full recertification audit process every 2-3 years. | Multiple | The cost of Rainforest Alliance certification depends on the implementation of the standard, such as training, human resources, input and equipment and the audit costs. Check this post by the Rainforest Alliance to read more about the costs of getting certified. |

| Fairtrade | FLOCERT | Social Sustainability | Check out this link to learn how to become a Fairtrade producer. Operators usually undergo a full recertification audit process every 1-2 years. | Ethical and fair trade stores | Access the cost calculator of FLOCERT to get an estimation about your costs for getting Fairtrade-certified. If you are a farmer, choose the “I grow, farm or produce Fairtrade products” option. If you process cocoa into semi-finished products, choose the “I buy, sell or manufacture Fairtrade products” option |

| EU Organic | Access the list of recognised control bodies and control authorities for EU Organic, issued by the EU. | Environmental sustainability | Read about Regulation (EU) 2018/848 to learn more about the legislative requirements. | Organic food stores | Costs vary and depend on set-up, scale, location and non-conformities. |

| Fair for Life | ECOCERT | Social sustainability | Access the Fair for Life certification process to learn about the steps that must be followed to become certified. Operators usually undergo a full certification audit process every year. | Ethical and fair trade stores | Certification costs vary depending on the size and complexity of operation, location of your operation and of producers. |

| Small Producers Symbol (SPP) | Refer to this list for an overview of authorised certification entities. | Social Sustainability | Consult this guide for an overview of the general certification procedure for small producers’ organisations. | Ethical and fair trade stores | Access this link for an overview of the costs for SPP certification. |

| International Featured Standard (IFS) | Approved IFS certification bodies (CBs) provide auditing services to companies seeking IFS certification. Their IFS auditors perform certification audits. Check the IFS website and search for their consultants/trainers in your country. | Quality and Safety | Consult the IFS website for the roadmap to be certified. | Supermarkets and specialty stores | Costs vary and depend on set-up, scale and location. |

| Food Safety System Certification (FSSC 22000) | Check this list for an overview of authorised certification bodies. You can also search based on your country. | Quality and safety | Check the FSSC website for an overview of steps to follow to be certified. | Supermarkets and specialty stores | Costs vary and depend on set-up, scale and location. |

| British Retail Consortium Global Standards (BRCGS) | The certification body depends on your country. Find out here. | Quality and safety | Visit this page for an overview of the 5 main steps you need to take to obtain certification. | Supermarkets and specialty stores | Costs vary and depend on set-up, scale and location. |

| Demeter | Check this list to see which organisations are authorised as certification bodies by Demeter in your country. | Organic biodynamic | Visit this page for an overview of the International Demeter Biodynamic Standard, and refer to the section on biodynamics to get insights into the principles that form the foundation of Demeter certification. | Specialty and organic food markets | Varies depending on country, farm size and certification scope. |

Source: Amonarmah Consults

Tips:

- For a full overview of certification schemes, consult the ITC Sustainability Map App.

- If you decide to get certified, consider multiple certification schemes. For example, investigate the accessibility of certification programmes in your country or region, the credibility and recognition of the available certification programmes, the costs of certification and the type of certification preferred by buyers in your main European target markets.

- Check the CBI Study on social certification standards, and specifically the certification matrix in this study, for more information about considerations on certification and the differences between certification schemes.

- Look into the list of Rainforest Alliance cocoa farms and supply chain actors. This is how potential buyers could also find you or check your certification status as a supplier.

- Before joining a fair trade certification programme, ensure it is in demand in your target market and that it is beneficial for your product in terms of costs by consulting your potential buyer.

3. What are the requirements and requested certifications in the niche markets for cocoa?

If you want to enter a specific niche market, you should follow specific niche requirements. These requirements differ per buyer. Meeting these additional requirements for value addition can increase your chances on the market considerably.

Organic certification

Organic-certified products are becoming more popular in Europe. Germany, France and Italy are the largest markets for organic foods. Organic cocoa is produced naturally, but getting certified can be costly for small farmers, though it may lead to better yields and quality. Demand for organic-certified fine flavour cocoa is rising in Europe, creating a niche market opportunity.

If you plan to sell organic cocoa products in Europe, they must meet the European Union's organic production and labelling standards. Obtaining the EU Organic label is a legal requirement for selling organic cocoa products. Simply having organic-certified cocoa beans is not sufficient; the processing facility must also be certified as organic.

Since 1 January 2021, new EU organic regulations have been enforced, applying to producers outside the EU as well. Stricter checks are now in place to prevent false claims. Before you sell your cocoa products as organic, a certified inspector must visit and assess your farms and processing facilities. You can find approved organisations listed by the EU to ensure you choose an authorised inspector.

To be certified as organic, you will need to have an annual inspection and review to ensure compliance with organic production rules. Additionally, if you wish to sell organic products in the EU, you must get a special electronic certificate known as a Certificate of Inspection (COI) from authorised inspectors before your products can be shipped. Without this certificate, your products cannot be labelled as organic in the EU and will be considered regular products. These certificates can be obtained through the TRACES system developed by the European Commission.

If you want to export to countries outside the European Union (EU), check the required legislation for those countries. For instance, Switzerland has its own Swiss Organic Law, and the Organic Products Regulations 2009 apply in the United Kingdom. Note that countries outside the EU require a specific COI, such as the GB COI.

If you export organic cocoa, make sure you label your cocoa batches with the name of the control body and the certification number. Labels for cocoa beans should be written in English.

Tips:

- Check the legislation about organic products (Regulation EC 834/2007) for further information on organic production methods.

- Visit FiBL’s OrganicExportInfo website to find more information on organic standards, certification schemes and import regulations in different European countries.

- Learn about the requirements of organic certification, such as the standard of the International Federation of Organic Agriculture Movements (IFOAM).

- Read about the main changes in the new EU organic regulation on the Ecocert website.

- Learn about organisations and programmes that can help you switch to organic farming. Begin by checking with local organic groups in your country to see if they offer support or know about other helpful initiatives. Check the database of affiliates of IFOAM Organics to search for organic organisations in your country.

Niche fair trade standards

Niche fair trade standards used on the European market include Naturland Fair, the Small Producers' Symbol (SPP) and Fair for Life (certified by Ecocert). Fair for Life recognises ingredients certified according to other certification schemes/standards, which Rainforest Alliance and Fairtrade do not. There is also a label by the World Fair Trade Organization (WFTO), which recognises entire organisations that fully follow fair trade practices.

Tips:

- Check the ITC Standards Map app for an overview of non-legal standards that are relevant to the European cocoa market regarding sustainability.

- Transparency in the cocoa supply chain is valuable. Buyers search for details like where the cocoa is produced, who is involved in production and how it is traded.

Amonarmah Consults carried out this study in partnership with Molgo Research and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research