Which trends offer opportunities or pose threats in the European cocoa market?

Sustainability concerns are rising and EU requirement for cocoa and cocoa products are getting stricter. This trend is driven by customer demand as well as European legislation. As a result, sustainability programmes have become commonplace among cocoa trading companies. European consumers want to know more about the context of cocoa production and the impact of their purchases. Demand for high-quality fine flavour cocoa and single-origin is also getting stronger. Multinationals are increasingly finding ways to expand their influence in this specialty market.

Contents of this page

- Cocoa sustainability is a high priority and EU regulations are getting stricter

- Sustainability programmes are commonplace in the private sector

- EU regulation on cadmium continues to impact the industry

- Demand for craft chocolate on the rise

- Storytelling increasingly important on the cocoa and chocolate market

- Health and wellness increasingly influence chocolate consumers

- Rising cocoa prices affect chocolate companies and consumers

1. Cocoa sustainability is a high priority and EU regulations are getting stricter

Sustainability in the cocoa sector remains critical worldwide. Poverty reduction and earning a living income remain very important and urgent topics. Child labour is also a returning agenda item. Improvements are hardly visible, and the levels remain very high in the cocoa sector. An estimated 1.5 million children are subjected to child labour in cocoa fields in Côte d-Ivoire and Ghana alone.

Generally, farmer income remains a top-line item. Initiatives like the Living Income Differential (LID) have been implemented in the largest producer countries, Côte d'Ivoire and Ghana. This governmental initiative seeks to improve the issue at an institutional level. It enhances collaborations between cocoa-producing countries, cocoa traders and chocolate manufacturers to consider the price of cocoa as the determining factor of sustainability, then ultimately implement a pricing mechanism that benefits cocoa farmers. Other initiatives on this topic include the Living Income Summit in 2022, hosted by the Sustainable Trade Initiative (IDH) in partnership with the Living Income Community of Practice, the Living Income Roadmap Steering Committee and the Business Commission of Tackling Inequality. Nestlé also rolled out an income accelerator programme to improve the livelihoods of cocoa-farming families and support transitioning to more sustainable cocoa farming in Côte d'Ivoire. The programme will be extended to Ghana in 2024.

There is likewise great concern about climate change and unsustainable farming practices. Research shows that the area suitable for cocoa production will decrease significantly in the near future due to climate change. Cocoa farming is also a main driver of deforestation in some producing countries like Côte d'Ivoire, contributing to climate change. Direct effects of climate change, like less rain, longer dry seasons and increased pests and diseases can negatively affect cocoa quality and yields. To tackle these challenges, it is increasingly important for farmers to adapt to more sustainable farming practices, such as using fewer synthetic fertilisers and other chemicals.

To address climate change and sustainability of the cocoa industry, the EU has also taken several actions. One is the European Green Deal (EGD), which was commissioned in 2019. The EGD aims to reduce greenhouse gas emissions and minimise the use of resources while achieving economic growth.

Another is the EU Regulation on deforestation-free products (EUDR), which came into full force on 23 June 2023. This regulation bans the sale of goods, including chocolate, produced on deforested and degraded land (See Table 1). Nation cocoa industries have already started finding ways to comply with this regulation. For instance, the Peruvian cocoa industry has already begun adapting to new regulations. To support Peru's efforts, Solidaridad coordinates innovative pilot programmes while working with its partners to conserve forests and support small-scale cocoa producers. Also, Ghana and Côte D'Ivoire, the two major exporters of cocoa beans, are putting up nationwide strategies to monitor deforestation and support farmers in complying with the rules.

Table 1: Relevant cocoa products that must meet EU Deforestation Free Regulation (EUDR)

| HS Code | Product Description |

| 1801 | Cocoa beans, whole or broken, raw or roasted |

| 1802 | Cocoa shells, husks, skins and other cocoa waste |

| 1803 | Cocoa paste, defatted or not defatted |

| 1804 | Cocoa butter, fat and oil |

| 1805 | Cocoa powder, not containing added sugar or sweeteners |

| 1806 | Chocolate and other food preparations containing cocoa |

The EU also approved a plan for a Corporate Sustainability Due Diligence Directive (CSDDD) on February 2022. The CSDDD is compulsory for all companies in the EU and for companies outside Europe that sell products or services in EU countries. Companies must take steps to find and prevent any harmful impacts their business and supply chains may have on people and the environment. The CSDDD sets common goals for all EU member states to achieve, but each member state can choose how to meet these goals in their own way.

The European Cocoa Association (ECA) and the European Chocolate, Biscuit and Confectionery Industry Association (CAOBISCO) members supported both the EUDR and the EU-wide CSDDD.

There are several other international initiatives targeting the cocoa sector, such as the International Cocoa Initiative. This is a platform for chocolate and cocoa companies, civil society and governments to align projects and goals for addressing child labour and forced labour. Another example is the Cocoa and Forests Initiative. This is a platform between industry, donors and the governments of Ghana and Côte d'Ivoire against deforestation.

Sustainability issues are pressing for both producers and buyers. These issues will remain high on the international agenda. As said, the private sector also engages more closely with sustainability activities. This is elaborated on in the next section.

Tips:

- Check the website of the World Cocoa Foundation to stay up to date on the main sustainability issues affecting the sector, as well as the main initiatives targeting those issues.

- Consider developing and implementing your own corporate social responsibility (CSR) policy or code of conduct. This may help you stand out when your potential buyer has to choose between several suppliers. Some good practices are Nahua (Costa Rica), CABRUCA (Brazil) andIngemann (Nicaragua).

- Access the tools and guides of the Accountability Framework, for instance the one on how to use existing reporting systems to report on your own commitments.

- Check out these reports to learn more about the European Due Diligence Act, how the EU Green deal will impact your cocoa business,Tips to go Green, Tips to become more socially responsible in the cocoa sector, buyer requirements for cocoa and 10 things you should know about the EUDR.

- Support the training of cocoa producers you source from, to implement sustainable practices. This is because many social and environmental issues take place at the farm level, which may not be a part of direct handling and processing activities. You can use the World Cocoa Foundation's Climate-Smart Agriculture Training Manual as a guide.

2. Sustainability programmes are commonplace in the private sector

Consumer awareness about sustainable cocoa production has grown in the last decade: 87% of EU chocolate consumers perceive that sustainability claims are important when choosing what chocolate products to buy. This has resulted in an increased demand for sustainably produced cocoa and chocolate, especially in Northern and Western Europe.

Most importers, cocoa processors, chocolate makers and retailers have designed their own sustainability commitments over the years. Each company follows its own strategy in defining sustainability. Some use the certification schemes of the leading standard bodies (Rainforest Alliance, Fairtrade, organic) and some work through their own projects, while others combine both approaches. Depending on the buyer and their enforcement actions, producers will need to comply or commit to comply with the required standards.

Some corporate sustainability programmes:

- Nestlé: The Nestlé Cocoa Plan

- Mars: Cocoa for Generations

- Mondelez: Cocoa Life

- Lindt & Sprüngli: Farming Program

- Barry Callebaut: Forever Chocolate

- Cargill: Cocoa Promise

- Olam food ingredients (ofi): Cocoa Compass

Retailers express their sustainability concerns and requirements in their codes of conduct: see the sustainability webpages of REWE (Germany), Ahold Delhaize (Netherlands) and Carrefour (France) for examples. Since 2018, retailers have created the Retailer Cocoa Collaboration, aiming to support existing industry efforts to drive environmental and social improvements in the sector.

Many European retailers also actively promote certified cocoa and increasingly source certified cocoa for their own private-label brands. Belgium's partnership for sustainable cocoa Beyond Chocolate targets that by 2025, 100% of chocolate produced and/or sold in Belgium will be certified. These chocolate products may also be covered by a corporate sustainability scheme. Read more about the developments in certification in our statistics and outlook study.

Some European countries have also set sustainability goals targeting their chocolate and confectionery industry. Companies increasingly adopt their practices to contribute to these targets, for example by endorsing specific certification schemes or codes of conduct. Some countries work on their own national platforms to achieve their sustainability targets:

- Swiss Platform for Sustainable Cocoa

- German Initiative on Sustainable Cocoa

- Dutch Initiative for Sustainable Cocoa (DISCO)

- Belgian partnership for sustainable cocoa Beyond Chocolate

- French Sustainable Cocoa Initiative

In 2021, these national sustainability platforms signed a Memorandum of Understanding (MoU) to collaborate more closely and to enhance transparency.

In addition, governments' procurement policies in Western Europe consistently focus on sustainability criteria for the purchase of products such as cocoa and chocolate. The Dutch government, for instance, has elaborated specific sustainable procurement guidelines, also for cocoa. All Dutch public agencies have started implementing them. This includes imposing conditions on their public tenders.

As these commitments and programmes show, companies and governments acknowledge the need to reach a more sustainable cocoa sector. The focus on and importance of sustainability for companies active in the cocoa sector will only increase and intensify. It broadens the focus on issues such as biodiversity and living incomes.

Tips:

- Before engaging in any certification scheme, verify with potential buyers whether a certification is required. You could discuss with them if there are any possibilities of receiving assistance in obtaining your certifications.

- Assess whether you will benefit from moving to sustainable production by using the Cocoa Farm Development Plan from the international standards for sustainable and traceable cocoa production.

- Research existing sustainability standards in the European market by approaching cocoa importers, supermarket chocolate category managers and sector specialists. Adhering to the guidelines set by these standards can be a good starting point if you want to supply cocoa beans to these companies.

- Check ICCO's website for a complete overview of all past and present cocoa sustainability initiatives.

3. EU regulation on cadmium continues to impact the industry

Cadmium is found naturally in the soil. However, pesticides and chemical fertilisers containing cadmium are also sources of contamination. Cadmium is a problem for cocoa in some Latin American countries. These countries suffer from high soil contamination from volcanic activity, forest fires and other factors. Intake of high levels of cadmium is primarily toxic to the kidneys, so it is a serious concern for consumers' health.

The European Union has strengthened its regulation on cadmium in chocolate and derived products. In August 2021, the EU amended regulation (EC) No 1881/2006, setting stricter maximum levels of cadmium in certain foodstuffs.

Studies recommend a maximum safe level of 0.6 or 0.8 mg/kg per kilogram of peeled beans. However, some buyers reject beans that exceed 0.3 mg/kg, especially for cocoa powder production because cadmium stays mostly in the solid parts of the bean rather than the fatty components. To comply with European regulations, beans with 0.3 mg/kg cadmium result in cake or powder with a concentration of 0.6 mg/kg, which is the permissible limit (See Table 2).

Table 2: EU Regulations on maximum acceptable limits of cadmium in cocoa products

| Product Description | Maximum level (mg/kg wet weight) |

| Milk chocolate with <30% total dry cocoa solids | 0.10 |

| Chocolate with <50% total dry cocoa solids; milk chocolate with ≥30% total dry cocoa solids | 0.30 |

| Chocolate with ≥50% total dry cocoa solids | 0.80 |

| Cocoa powder sold to the final consumer or as an ingredient in sweetened cocoa powder sold to the final consumer (drinking chocolate) | 0.60 |

Small-scale farmers, cooperatives and specialised bean- and powder-exporting companies in South America are the most affected by this issue. Cocoa from this region is known for its fine flavour attributes. However, farmers in these areas face the challenge of low producer prices and rising laboratory test costs, plus the implementation of mitigation measures can be costly.

Here are a few things cooperatives and farmers can do to reduce cadmium levels:

- Understand cadmium levels. Farmers should know how much cadmium is in their beans and try to mix or blend them, especially at the cooperative level, to lower the overall cadmium content and make it safe.

- Check peeled beans. It is important to test the cadmium levels in the peeled beans, which are used to make the final product that needs to meet regulations. Cadmium is usually higher in the shell than in the nibs.

- Improve soil conditions. Farmers can change the soil by reducing its acidity, by liming and adding organic materials like compost, manure, or special charcoal made from plants (called biochar). These practices help make the soil healthier and potentially reduce cadmium absorption by plants.

- Adjust to local conditions. The best ways to reduce cadmium will depend on the specific soil conditions, availability of materials, and their cost in each location. The goal is to bind cadmium in the soil or limit how much the plants absorb. It is also important to improve soil health and cocoa tree productivity.

- Use low-cadmium cacao varieties. Some types of cocoa beans have naturally lower levels of cadmium. Farmers can choose these varieties for breeding programmes or as rootstock when grafting. Although it may take time to see results, starting these practices now is important.

Remember, there is no one-size-fit-all situation. It is necessary to adapt these practices to the local environment and conditions.

Tips:

- Be ready to provide your buyer with a laboratory analysis of cadmium levels in your cocoa beans when requested. This analysis should be done by an accredited laboratory. It will probably be repeated by your direct buyer. All stakeholders in the industry, including importers and chocolate makers, are implementing strict actions to comply with the new maximum levels of cadmium in food products.

- Familiarise yourself with the requirements for methods of sampling and analysis for the official control of cadmium and other heavy metals. This will help you ensure compliance.

4. Demand for craft chocolate on the rise

Global demand for craft chocolate is expected to keep rising, as Europe plays an important role in the global craft chocolate market with an expected major growth for 2023-2028. Craft chocolate comes in various types, each offering unique flavours and characteristics. Consumers in Europe are shifting towards craft chocolate products like single-origin and bean-to-bar chocolates.

Single-origin chocolate

The desire for premium single-origin cocoa and its flavours is growing in Europe. The chocolate flavours may be unique to the origin based on variety (e.g. fine flavour cocoa types), agro-climatic factors and post-harvest handling techniques. Consumers have become increasingly interested in the agro-climatic, environmental and social features of production areas. With increasing sustainability concerns, they want to know the story of producers and their communities.

For example, people want to hear stories of how production is done in a way that enhances social and environmental sustainability. This makes them want to buy these types of chocolate to show their support of socially and environmentally responsible actions. They also want to be able to trace their chocolate to the origin, and this ties in with traceability concerns of sustainability. Consumers therefore perceive single-origin chocolate as being more premium and sustainable. Thus, single-origin chocolate is increasingly becoming commonplace in mainstream segments.

For instance, retailers have started to offer a wide variety of single-origin private-label chocolates, like the Dutch Albert Heijn's private-label brand Delicata. Delicata offers chocolates from Uganda, Peru, Costa Rica and Tanzania. There is also the L'origine du goût chocolate collection from retailer E-Leclerc (France), made from Nicaraguan single-origin cocoa. In the UK, Waitrose offers a line of single-origin chocolates from Ecuador, Dominican Republic and Peru under its No. 1 collection.

Valrhona Inc., a renowned French chocolate producer, has been sourcing cocoa beans exclusively from the Maria Trinidad Sanchez estate (Dominican Republic). This approach ensures consistent flavour and quality for their chocolate products. Chocolate brands offering single-origin bars include Blanxart (Spain), Willie's Cacao (United Kingdom), Original Beans (the Netherlands) and Domori (Italy).

Figure 1: Single-origin bars from private label brand Delicata (Netherlands)

Source: Dieline

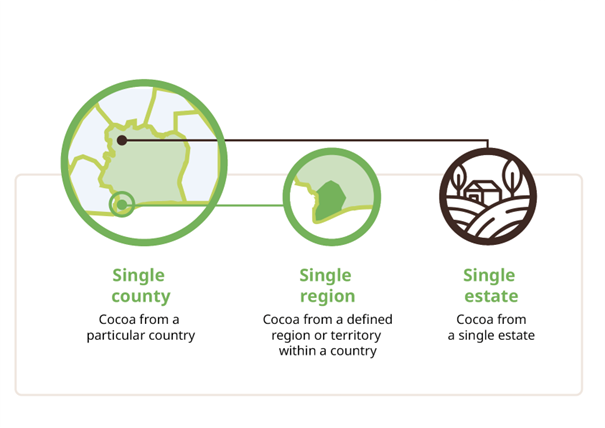

The widespread offer of single-origin chocolate is making high-end brands increasingly look for other ways to differentiate their products. These brands focus on more specific origin products. Single-origin products consist of three types: single-country, single-region and single-estate (Figure 2).

Single-country chocolate is made using cocoa grown within a specific country. Various factors influence the sensory profile of single-country chocolate, including genetics, land conditions, and post-harvest processes like fermentation and drying. To the consumer, the type of chocolate then comes to represent the flavour and essence of the country where it is produced.

Single-estate chocolate focuses on expressing the flavour of a specific farm instead of the whole country. This classification not only represents the land where the cocoa is grown but also encompasses that particular farm's effort and characteristics. Single-estate chocolate reflects the farmer's own unique essence and personality and the farm's work culture, lifestyle and initiatives, representing the entire family behind it.

Single-estate chocolate makers like Cluizel aim to showcase the special flavours and qualities of a cocoa farm by carefully preserving and enhancing the cocoa's aromas and characteristics. They achieve this by maintaining a close and regular partnership with the farmers to obtain the finest cocoa beans to craft their chocolate. This close collaboration also provides them with valuable insights into the farmers' culture and traditions. Another example is the single-estate chocolate line of lukerchocolate. One single-estate cocoa exporter is Hacienda Victoria (Ecuador).

The term 'single origin' or 'single estate' chocolate doesn't always mean the chocolate is made in the country where the cacao beans come from. Often, chocolate companies buy beans from farmers in different countries and make the chocolate in places like Europe. But there are some special cases of high-quality local production, like Pacari (raw chocolate made in Ecuador) and Marou (bars made in Vietnam).

Figure 2: Types of single-origin sources

Source: Amonarmah Consults

The importance of single-origin and single-estate on the European market increasingly requires cocoa exporters to know the characteristics of their cocoa. It also requires sharing stories about the production context and providing assurance of their cocoa's origin.

Tips:

- Explore the possibility of adding value to your product. Do so by specifying the characteristics of the cocoa beans grown in your area or in your farm (single-estate cocoa). These characteristics can be related to the product's organoleptic profile, the farmers' profile, production and post-harvest methods, or interesting aspects of the surrounding nature and community. It will make your product more attractive to cocoa buyers. This applies especially to those interested in high-quality and unique cocoa.

- Explore the possibility of obtaining legally protected geographical indications (GIs) for specific cocoa varieties. This can be an important element in your storytelling. Read the frequently asked questions on GIs on the World Intellectual Property Organization (WIPO) website, where you can find answers on applying for GI protection,

- Know and maintain the genetics of your cocoa trees. This distinguishes your unique flavour profile if you want to partner or sell your cocoa beans to single-origin chocolate makers. Learn more about harvesting and post-harvest management to improve and distinguish your cocoa bean quality. Harvesting at the right time – not too late and not too soon – enhances cocoa bean quality.

- Link up with research institutions near you if you are a cocoa farmer or cooperative. They can help you identify the varieties of cocoa trees on your farm. Some cocoa research institutes are CRIG (Ghana), CRIN (Nigeria), ICCRI (Indonesia) and UWICRC (Trinidad and Tobago). Cocoa varieties, production practices and conditions affect the quality and flavour of your cocoa beans.

- Investigate whether you qualify for industry awards, such as the International Cocoa Awards (ICA) or the Cocoa of Excellence. This can be an interesting way to profile yourself in the European market for fine flavour cocoa. ICA rewards flavour, quality and diversity of different origins.

Bean-to-bar chocolate

The demand for bean-to-bar chocolates is also increasing in Europe. Bean-to-bar chocolate means that the maker controls every step of the production process. It includes all steps from buying the cocoa beans to creating the chocolate bar. There are many European companies making bean-to-bar and single-origin chocolate products, often using fine flavour cocoa beans. Here you can find a list of bean-to-bar producers worldwide.

Although some bean-to-bar makers also work with commercial-quality cocoa, most focus on high quality. For cocoa producers, the bean-to-bar concept involves different methods of production, packaging and direct shipping or sales to high-end outlets. Bean-to-bar enables a small number of producers to add significant amounts of value to their cocoa production. This value addition for cocoa producers is mainly done through quality branding and packaging, and by offering superior cocoa qualities.

These high-quality products are mainly sold through specialised channels, such as the web shops Chocoladeverkopers (Netherlands), True Chox (Germany) and Cocoa Runners (UK) or the web shops of bean-to-bar makers themselves. Specialised chocolate shops like The Chocolate Shop and Chocolátl (Netherlands) and organic supermarkets also have some bean-to-bar products in their assortment, like Planet Organic (UK).

There is little effort to promote bean-to-bar products (under private label) in mainstream retail channels. For instance, Willie's Cacao in the UK is one of the very few bean-to-bar products in the mainstream retail channels, available at Waitrose supermarkets. An expansion of the bean-to-bar offer at supermarkets would likely drive up sales of this product category in Europe. Leading bean-to-bar players in Europe include Georgia Ramon (Germany), Heinde & Verre (Netherlands), Domori (Italy), and Zotter (Austria). For an overview of bean-to-bar producers, refer to the bean-to-bar website.

Next to bean-to-bar chocolate, there are new trends on the rise: farm-to-bar chocolate and tree-to-bar chocolate. Farm-to-bar is a term that emphasises the direct connection between the cocoa farm and the chocolate bar. Cocoa beans are sourced directly from the farmers or specific farms, ensuring fair trade practices. Farm-to-bar chocolate makers aim to establish sustainable relationships with cocoa farmers, support local communities, and promote social and environmental responsibility throughout the supply chain. Paul and Mike chocolate produces farm-to-bar chocolate in India.

Tree-to-bar is different from bean-to-bar, as bean-to-bar makers are not necessarily located in cocoa-producing countries. All tree-to-bar chocolate makers have complete control over how their cocoa beans are grown and processed. This implies that tree-to-bar companies tend to safeguard transparency and traceability along the chain. Cacaoteca is a tree-to-bar chocolate maker from Dominican Republic.

Tips:

- Read this blog entry about the market and craft (bean-to-bar) chocolate makers to learn more about trends and dynamics within this segment.

- Read this article to learn more about the differences between bean-to-bar, farm-to-bar and tree-to-bar.

- Learn more about craft chocolate makers around the world.

5. Storytelling increasingly important on the cocoa and chocolate market

Consumers continue to seek storytelling about the cocoa origin of craft chocolate. They want to know the story behind a product: 59% of European consumers consider chocolates with a unique story to be more premium. They want to know where it comes from and how it is made. Also, most European consumers (66%) believe that high-quality chocolates should be accompanied by a narrative of their origin and their creation process.

Consumer preferences and motivations are changing when it comes to choosing chocolate products. Consumers continue to seek unique and novel chocolate experiences to break away from their usual routines. They are therefore not only interested in delightful flavours that will please their taste buds, but want to stimulate their curiosity and sense of adventure as they taste the chocolate. This trend is also closely associated with an increasing emphasis on the cocoa's source, as well as principles of transparency and traceability. The chocolate brand Ethiquable is taking advantage of these consumer motivations by using its packaging to tell the story of the cocoa producers and cooperatives and the cocoa's origin.

Figure 3: Ethiquable: storytelling for a chocolate bar in the European market

Source: Ethiquable

Generally, a good story helps you market your product to cocoa traders. Cocoa importers and chocolate makers will in turn use your stories in their communication with their consumers. By telling an appealing story, they can connect consumers to the cocoa's origin and the producers. This adds value to the final chocolate product.

Make sure to share your stories with a larger audience. For instance, share it through social media and/or your website. When talking about your mission and the history of the farm or cooperative, give the story a face. Do so by providing good-quality photos of the plantations, the farmers and their families.

Exporting companies sharing appealing stories about their company and history include Kokoa Kamilia (Tanzania), Lukerchocolate (Colombia), Esco Kivu (DR Congo) and Ingemann (Nicaragua).

Tips:

- Develop and express your unique selling points as a supplier of cocoa beans. Think about factors that set you apart from your competitors and create your marketing story around these factors. For example, they can be related to the origin of your cocoa beans, the agro-climatic characteristics of the producing region, the culture of the producing communities, the unique quality of your product, your post-harvest techniques, or a combination of these aspects.

- Never make claims that you cannot support, for instance on the quality or production volumes of your cocoa.

- Check out the website of the specialty cocoa importer Uncommon Cacao, and see how they tell the story about the cocoa producers they buy from.

- Refer to our study on Going digital in the cocoa sector to find tips on how to increase your market attractiveness and storytelling through digital experiences.

6. Health and wellness increasingly influence chocolate consumers

Demand for high-quality cocoa is stimulated by a growing consumer interest in healthy and mindful indulgence. European consumers are increasingly concerned about the impact of food on their health and wellness. The COVID-19 crisis has made consumers even more quality- and health-conscious. This drives up the demand for healthy and organic chocolate brands. This increasing demand is expected to continue.

People consume chocolate because of its properties that affect their physical health. For instance, flavonoids in cocoa are associated with health benefits such as lower blood pressure, improved blood vessel health and lower cholesterol levels. Some chocolate brands are also adding extra flavonoids to their bars to optimise the health benefit, as in the development of FlavaBars by Barry Callebaut and FlavaNaturals.

The higher the percentage of cocoa in chocolate, the higher the levels of flavonoids in the chocolate. Flavonoids are therefore high in dark chocolate. Their health benefit has made dark chocolate popular worldwide. One chocolate brand highlighting the health benefits of cocoa on its labels is The Good Chocolate Company from Belgium.

Apart from having desirable chocolate with high levels of flavonoids, people are becoming more interested in chocolate without sugar and dairy, which is healthier. The concept of reducing sugar in food products has also become well-established: 41% of global consumers are trying to limit their sugar intake, and 14% are avoiding sugar entirely.

There is a growing demand for sugar-free chocolate bars, or chocolates with alternative sweeteners like stevia and coconut sugar. Chocolate makers Stella Bernrain (Switzerland) and Klingele Chocolade (Belgium) offer chocolate products without added sugar. Some big companies also offer chocolate products with alternative sweeteners.

Moreover, in response to consumer health concerns about artificial sweeteners more products are emerging that contain additional ingredients from the cocoa fruit, to reduce the use of artificial sweeteners in cocoa. For instance, Nestlé has created a chocolate with cacao pulp-derived sugars. The pulp usually goes to waste on the cocoa farm during fermentation of the beans. Cooperatives and farmers can seek supply partnerships with chocolate processors in their location who are interested in cocoa pulp as a natural sweetener. This can serve as additional income for the farmer.

There is also a booming trend towards plant-based alternatives to limit the use of artificial sweeteners and flavourings. For instance, 6 out of 10 consumers expect chocolate brands to offer a plant-based alternative. The chocolate industry is increasingly adding natural ingredients to its chocolate products. Real fruit, vegetables or nuts are added to cocoa products as these are perceived as healthy by consumers. Chocolates with various textures and flavours are perceived by 59% of European consumers as being more premium in quality.

The product line Côte d'Or consists of chocolate bars containing banana, orange, cranberries, almonds and pecan nuts. The Paul and Mike chocolate company also uses only natural and real fruits, nuts, spices and pure floral distillates in their product line. Other brands are adding more exotic ingredients to their chocolate products: Lovechock (Netherlands) has a chocolate bar with baobab fruit.

Plant-based chocolate may not necessarily be free of animal products like dairy. Vegan chocolates are also growing in popularity because of dairy allergies, lactose intolerance, or consumers opting for a vegan lifestyle. Big chocolate manufacturers have increasingly been offering such products in recent years. For instance, in 2022 Lindt & Sprüngli expanded their dairy-free chocolate product portfolio. Nestlé introduced a vegan KitKat in the United Kingdom in 2021. There is also an increasing demand for protein-fortified chocolates.

Apart from dark chocolate and sugar- or lactose-free chocolates, there is also more interest in cocoa nibs. This is gaining popularity as more people discover its superfood benefits, like high nutritional value and rich flavour. For example, it contains micronutrients like magnesium, which plays an essential role in supporting hundreds of chemical reactions in the human body and helps fight against diseases like type-2 diabetes, high blood pressure, inflammation and migraines.

Cocoa nibs are increasingly being used in a variety of products, including frozen desserts, smoothies, oatmeal, and as a topping. Bakery manufacturers also incorporate cocoa nibs into bread and muffins. Food and beverage manufacturers use them in snacks, sauces, spreads, flavoured milk, lattes and cappuccinos.

Apart from physical health benefits, people also consume cocoa for their mental health. Nowadays, many care about how specific food components affect their brain function in terms of their cognitive or mental health. Chocolate is one of those foods that contain a combination of proteins and fats that are shown to boost serotonin and dopamine levels in our brains.

The levels of serotonin and dopamine in the brain contribute to a sense of happiness and well-being. In fact, eight out of ten European consumers report that eating chocolate makes them happy. Moreover, cocoa beans contain natural stimulants like caffeine and theobromine, which provide an energy boost. The awareness of the potential cognitive and emotional effects reflects a growing trend in mindful consumption.

Lastly, consumers are increasingly drawn to organic products as healthier options. This trend is expected to continue boosting the share of organic chocolate by 3% yearly. Organic options are now available not only among well-established, renowned brands, they also come from small, independent producers. This trend has steadily gained momentum over the years. Retailers are also acknowledging the value of this label and its potential appeal to customers. One leading organic chocolate brand is the UK's Green&Black, where 'green' means organic and 'black' represents dark chocolate.

Tips:

- To learn more about why chocolate is perceived as a healthy food, read this article in Vox.

- Offer different types of chocolate using special healthy ingredients with unique branding. This will give your chocolate company a chance to stand out. Instead of just competing on price, you can meet people's desires for options with additional health benefits.

- Introduce a 'simple' line of organic chocolates that exclusively feature organically-sourced ingredients, from cocoa and nuts to all other components. Emphasising the cocoa percentage in the recipe will further enhance the product's reputation for quality.

7. Rising cocoa prices affect chocolate companies and consumers

Rising cocoa bean prices is one major recent trend in the cocoa sector. This is due to reasons such as climate change, the Russia-Ukraine war and increasing demand for cocoa beans. The impact of rising cocoa bean prices extends its reach across chocolate companies and consumers. The price of chocolate is also expected to keep rising as cocoa beans prices stay high.

The increase in cocoa prices is impacting big companies and smaller ones alike. Experts think it will stay high until 2024. One reason for this is that cocoa production in West Africa is not doing well – the region provides about two-thirds of the world's cocoa beans.

The weather resulting from climate change plays a big role here: there is El Niño, which is when the ocean gets warmer than usual. Normally, El Niño brings more rain to some places, but in West Africa, where lots of cocoa is grown, it makes the climate dry. The long dry seasons and too much rain in wet seasons have caused cocoa production to drop.

Another reason for the high prices is the Russian invasion of Ukraine in February 2022. This caused great turmoil in the energy world. Prices for e.g. oil, coal and gas shot up because people thought there wouldn't be enough energy for Europe without Russia's help. High fertiliser prices are also increasing costs for producers. This is leading to lower yields as some farmers reduce their fertiliser use.

Chocolate makers got worried and did not order as much cocoa. They thought they couldn't run their factories because of the high energy prices. But Europe found other ways to get energy and the winter wasn't too cold. So when fuel prices finally dropped in August 2022, chocolate companies realised they didn't have enough cocoa beans. They are now competing for the same limited supply of the cocoa beans, but this is also causing the price of the cocoa beans to spike. For instance, in January 2021, before the Russia-Ukraine war, cocoa beans cost about € 2,179 per tonne. By August 2022, when fuel prices went down, they cost around € 2,242 per tonne. But the prices kept going up. In July 2023, prices were at the highest they have been in 12 years, reaching € 3,028 per tonne.

Because of this, it is harder for chocolate companies to make money. Worse, the cost of sugar, another important ingredient in sweet chocolates, is also rising. So making chocolate is becoming even more expensive for these companies. As a result, factories are cutting back on production. However, some chocolate makers can revise their recipes, possibly replacing sugar with healthier options discussed earlier. See the section on health above. These changes can improve and affect chocolate's taste and quality while reducing production costs.

In response to higher cocoa costs, chocolate companies have raised product prices. However, this move could influence consumer demand, lowering sales if chocolate is perceived as unaffordable.

Tips:

- Try new ingredients: Test different things that you can use instead of sugar in your chocolate. Make sure they taste good and do not affect the quality of your product negatively. For instance, you can make chocolate with cacao pulp-derived sugars. The pulp usually goes to waste on the cocoa farm during the fermentation of the beans. You can source this from cocoa farmers in your country.

- Improve your production: Keep looking at how you make your chocolate and see if you can do it in a smarter way. If you can reduce waste and use things more efficiently, it can cost less to make your chocolate.

ProFound – Advisers In Development carried out this study and was updated by Amonarmah Consults in partnership with Molgo Research, and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research