Entering the Belgian coffee market

In 2020 Belgium sourced 96% of its coffee imports directly from producing countries. The three main green coffee suppliers were Brazil, Vietnam and Honduras, accounting for about 58% of total supplies. The increasing interest in high-quality and certified coffees in Belgium underlines the growing importance of origin, traceability and social impact of coffee. This makes storytelling an increasingly important aspect for every actor along the value chain in the coffee sector.

Contents of this page

1. What requirements and certification must coffee comply with to be allowed on the Belgian market?

1. Legal and non-legal requirements you must comply with

Legal requirements

You must follow the European Union legal requirements applicable to coffee. These rules mainly deal with food safety, where traceability and hygiene are the most important themes. Special attention should be given to specific sources of contamination, namely:

- Pesticides — consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide;

- Mycotoxins/mould, particularly Ochratoxin-A (OTA);

- Salmonella (although coffee is considered low-risk).

Quality requirements

Green coffee is graded and classified for quality before export. There is no universal grading and classification system for coffee. The Specialty Coffee Association’s standards for green coffee grading are often used as a point of reference. However, most producing countries have and use their own grading systems.

Grading is usually based on the following criteria:

- Altitude and region;

- Botanical variety;

- Preparation — wet processed (washed), dry processed (natural), semi-washed (wet-hulled), pulped natural or honey processed;

- Bean size or screen size and sometimes also bean shape and colour (Note: screen size is important to ensure uniform roasting which improves the quality of the final product);

- Number of defects or imperfections;

- Roast appearance;

- Cup quality in relation to flavour characteristics, fragrance/aroma, taste, acidity, body, uniformity, balance, cleanliness and off-notes.

Specialty coffee is also graded according to its cupping profile. If you sell specialty coffee, it is important for buyers to know the cupping score of your coffee. Although not mandatory, adding this information to the documentation of the coffee you are exporting might add value. It is very important to be aware of the quality of your coffees, either by inquiring with local cupping experts or becoming a cupping expert yourself.

Note that there is no exact definition of specialty coffee within the coffee industry. The Coffee Quality Institute and the cupping protocols of the Specialty Coffee Association consider that coffees graded and cupped with scores below 80 are considered standard quality and not specialty. Nevertheless, the exact minimum scores defining specialty coffee differ per country and per buyer. Some buyers consider 80 too low and demand a cupping score of 85 or higher.

Labelling requirements

Labels of green coffee exported to Belgium should comply with the general food labelling requirements of the European Union. The label should be written in English and should include the following information to ensure traceability of individual batches:

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 1: Example of green coffee labelling

Source: Escoffee

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. Other materials, such as Grainpro or other innovative material like Videplast liners, are often used to pack specialty coffees inside jute bags.

Most green coffee beans of standard quality imported into Belgium are packed in container-sized bulk flexi-bags that hold roughly 20 tonnes of green coffee beans each. The rest of the green coffee is transported in traditional 60 kg or 70 kg jute sacks, each with a net volume of 17 tonnes to 19 tonnes of coffee.

Other packaging used in transporting coffee includes polypropylene super sacks for 1 tonne of coffee, polyethylene liners for 21.6 tonnes and vacuum-packed coffee. These techniques provide two advantages in the coffee trade, namely increasing efficiency and maintaining or preserving quality.

Figure 2: Examples of coffee packing: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: raadtradingco.com, bls-bulk.com and GrainPro

Tips:

- Activate the “Translation” function of your browser to make the studies available in your native language.

- For the full buyer requirements, read the CBI study on buyer requirements for coffee in Europe or consult the specific requirements for coffee on the European Commission’s website Access2Markets.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Read more about quality requirements for coffee on the website of the Coffee Quality Institute.

- Find out more about delivery and payment terms for your green coffee exports by reading our study Organising your coffee bean exports to Europe.

2. Additional requirements

Additional food safety requirements

Expect buyers in Belgium to request extra food safety guarantees from you. Regarding production and handling processes, you should think of:

- Implementation of good agricultural practices (GAP): The main standard for good agricultural practices is GLOBALG.A.P., a voluntary standard for certification of agricultural production processes that provide safe and traceable products. Certification organisations, such as Rainforest Alliance/UTZ, often incorporate GAP in their standards.

- Implementation of a quality management system (QMS): Buyers are increasingly requiring a system based on Hazard Analysis and Critical Control Points (HACCP) as a minimum standard for green coffee production, storage and handling. Regularly checking the residue levels in your green (and roasted) coffee is an example of a measure that could be included in this system. It is particularly important to check for (and aim to prevent) Ochratoxin-A (OTA), polyaromatic hydrocarbon (PAH) and pesticide contamination, such as glyphosate contamination. Proactively obtaining certificates of analysis on a regular basis for the coffee you produce and export is recommended, preferably from an EU-accredited laboratory such as Eurofins or Tüv.

- For roasted coffee, HACCP might be required, and this must sometimes be accompanied by certification from the Global Food Safety Initiative (GFSI) such as: BRC Global Standard Food Safety, FSSC 22000, IFS Food or SQF.

It is good to keep in mind that your Belgian importer might re-export green coffee to other destinations in Europe. Those other buyers push their requirements forward to other players in the supply chain, which might increase the need for you to adopt other specific certifications or standards. This will depend on the final market and market channel used.

Additional sustainability requirements

Corporate responsibility and sustainability are very important throughout the European coffee sector. Coffee industry players in Belgium also have sustainability policies reflecting their relationship with farmers and transparency in their operations, as well as their social and environmental impact in the place of origin. Examples of these company policies or codes of conduct can be found on the website of importer EFICO.

As an exporter, adopting codes of conduct or sustainability policies related to your company’s environmental and social impact may give you a competitive advantage. In general, buyers will likely require you to comply with their code of conduct, and/or fill out supplier questionnaires regarding your sustainability practices.

Certification standards are very often part of the sustainability strategy of traders, coffee roasters and retailers. As such, a standard like Rainforest Alliance/UTZ has become increasingly important in the mainstream coffee market.

Apart from these sustainability requirements, it is important to be aware that the EU is implementing its so-called European Green Deal. This Green Deal is aimed at making Europe sustainable and climate neutral by 2050. To achieve this goal, the EU is working on legislation that requires companies to address human rights and environmental standards in their value chains, including those that trade in coffee. As with the corporate codes of conduct, companies will require you to comply with these additional requirements. The EU is also working on a European due diligence solution to stop EU-driven deforestation, which also pertains to coffee cultivation.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Find out which standards or certifications are preferred by potential buyers in your target segment. Buyers may have preferences for a certain food safety management system or sustainability label depending on their end clients and distribution channels.

- Carry out a self-assessment to measure how sustainable your production practices are. You can fill out this online self-assessment form by Amfori BSCI to determine your social performance. This Excel form by the Sustainable Agriculture Initiative (SAI) Platform can be used to assess your farm’s sustainability performance.

- See the list of Rainforest Alliance/UTZ registered coffee actors in Belgium to identify interesting players. Learn which ones are certified to buy your Rainforest Alliance/UTZ certified coffee.

- See our study on certified coffee for more information about the demand on the European market, trends and specific trade channels.

3. Niche requirements

EU Organic

In order to market your coffee as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Obtaining the EU organic label is the minimum legislative requirement for marketing organic coffee in the European Union.

Note that a new EU organic regulation came into force on 1 January 2021. Producers in third countries (outside of the European Union) will now have to comply with the same set of rules as producers in the EU. Also, inspections of organic production and organic products have become stricter to prevent fraud.

Before you can market your green coffee as organic, an accredited certifier must audit your growing and/or processing facilities. Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you always work with an accredited certifier. To become organic certified, you can expect to undergo a yearly inspection and audit, which is aimed at ensuring that you comply with the rules on organic production.

Note that all organic products imported into the EU must be accompanied by the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control authorities prior to the departure of a shipment. This means you will have to obtain the necessary information, such as the importer’s address and TRACES number, first consignee and the seal and vessel number of your container. If this is not done, the item cannot be sold as an organic product in the European Union and will be sold as a conventional product. COIs can be completed using the European Commission’s electronic Trade Control and Expert System (TRACES), where you will also have to register as organic exporter.

Fair trade

Before you can market your coffee as fair trade, an accredited certifier must audit your growing and processing facilities. The most common fair trade standard in Belgium is Fairtrade, for which the accredited certifier is FLOCERT.

Fair for Life (certified by IMO/Ecocert) and Fair Choice (by Control Union) are other fair trade certifications that producers may choose. However, keep in mind that these standards are not as well known on the Belgian market. Both certification have the advantage of being cheaper, as the control bodies may combine the fair trade audit with the organic or Rainforest Alliance audit. However, you should be sure to always check the demand and interest for a specific certification with your (potential) buyer. Also, in the case of Fair Choice and Fair for Life, it is a good idea to check if and if so, what kind of a premium would be involved, as this is not regulated, unlike Fairtrade’s minimum price.

Direct trade

Direct trade relations, and high transparency and traceability from source to consumer, characterise the high-end specialty coffee segment. This means that buyers of these types of coffees impose requirements in addition to certification. Besides a high-quality product, these buyers are interested in the stories from your place of origin. This implies that you should know the specifics of your coffee and be willing to share this information honestly. Moreover, direct trade may result in more frequent visits to the coffee farm and product assessments by your buyers, as well as promoting a long-term business relationship.

Tips:

- Learn more about opportunities for organic coffee in the Belgian market on the website of the Belgian organic certification organisation Bioforum.

- Learn more about organic farming and European organic guidelines on the European Commission website and the Organic Export Info website.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search by learning about the organic movement in your own country and inquire about support programmes or existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Find importers that specialise in organic products on the website Organic-bio.

- Try to visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of exhibitors, seminars and other events at this trade fair. There you will also find organic certification bodies on the exhibitors’ list.

- If you produce coffee according to a fair trade scheme, find a specialised Belgian buyer that is familiar with sustainable or fair trade products, for instance via the FLOCERT customer database.

- Use this cost calculator to estimate what costs will be involved for your organisation to become Fairtrade-certified.

- Try to combine audits in case you have more than one certification, to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

2. Through what channels can you get coffee on the Belgian market?

The Belgian end market for coffee can be segmented by quality and by type of consumption: in-home and out-of-home consumption. The high-end segment represents a growing niche market in both the in-home and out-of-home segments. Suppliers in producing countries mainly enter the Belgian market through importers or medium-sized and large roasters.

1. How is the end market segmented?

The Belgian coffee end market can be segmented as follows:

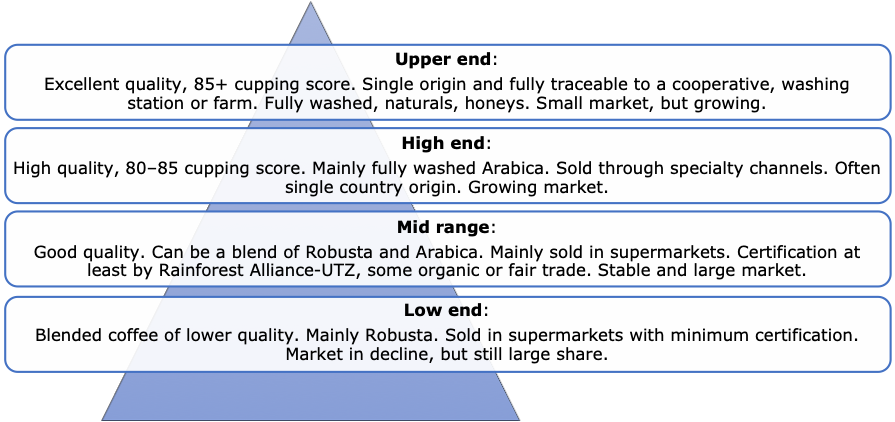

Figure 3: Coffee end market segmentation by quality

Source: Pro Found

In Belgium, supermarkets are the main sales channel for coffee. Supermarkets sell a wide variety of coffee products, ranging from low-end to high-end products. This variety includes a wide range of private label coffee products. These products are popular as they offer the same characteristics as branded products, but usually do so at more affordable prices. The total share of private label products in Belgian retail reached over 43% in 2020.

The largest supermarkets in Belgium are:

- Colryut Group, which includes supermarkets Colruyt, Okay, Cru, Spar and Bio Planet

- Ahold Delhaize with supermarkets Delhaize and Albert Heijn

- Carrefour

- Aldi

- Lidl

Low end: The coffees in the low-end segment are mainstream, low-quality and mainly blended coffees. These blends are characterised by high shares of Robusta beans. Besides some mainstream brands, the lower-quality private label products from supermarkets also belong to the low-end segment. In addition, most coffee pads and instant coffee belong to this low-end segment. Coffees at the low end of the market are mainly sold in supermarkets and through service channels, such as for offices and hotels.

Product and price examples in the low-end segment, based on Delhaize's retail prices in 2021, include:

| Product | Image* | Retail price (€/kg) | |

| Low-end | 365, private label (ground coffee, UTZ-certified, 500-gram package) |

|

5.90 |

| Delhaize, private label (whole bean, UTZ-certified, 250-gram package) |

|

9.56 | |

| Douwe Egberts (whole bean, UTZ-certified, 500-gram package) |

|

14.38 |

*Source of pictures: https://www.delhaize.be/

Mid-range: Mid-range coffees are commercial coffees with a good and consistent quality profile, such as quality espresso. This segment typically consists of blends with a higher proportion of Arabica compared to coffees in the low-end segment. The mid-range segment represents a stable coffee market, in which sustainability certifications are increasingly important.

Mid-range coffees are often sold in supermarkets and by the food service industry. Premium private label ranges of retailers typically belong to the mid-range segment. Examples of mid-range products and prices, based on Delhaize's retail prices in 2021, include:

| Product | Image* | Retail price (€/kg) | |

| Mid-range | Latitude 28, private label (whole beans, 100% Arabica from Guatemala, Fairtrade-certified, 250-gram package) |

|

15.96 |

| Lavazza (whole beans, 500-gram package) |

|

16.58 | |

| Illy (whole beans, 100% Arabica from Brazil, 250-gram package) |

|

28.76 |

*Source of images: https://www.delhaize.be/

High and upper ends: High-quality coffee mainly consists of washed Arabicas. These coffees are often single origin and have a special story. The upper end of this segment consists of specialty coffees of excellent quality, often from micro- or nano- lots that undergo processing methods such as naturals and honeys. These are mainly fully traceable and single origin Arabica beans with a cupping score of 85 and above. The high- and upper-end segments in Belgium are growing niche markets.

Sustainability certifications are not as common in this segment. This is because sustainability practices are often commonplace among buyers. Long-term contracts between suppliers and buyers characterise the high and upper-end segment, as well as higher prices. Additionally, the buyer and supplier usually agree on projects for communities and the distribution of money to farmers, a common characteristic of certifications aimed at social impact. The high- and upper-end segments are, however, seeing growth in organic-certified coffees.

Coffees in this segment are mainly sold directly by specialty roasters, at their physical and web shops as well as at coffee events. An example of a coffee event is the Brussels Coffee Week. An example of a specialised Belgian coffee web shop is Bob Plaza. For examples of Belgian specialty roasters and cafés, see the website European Coffee Trip.

Examples of coffees in the high and upper end market segments include:

| Product | Image* | Retail price (€/kg) | |

| High- and upper-ends |

Variety: Bourbon Process: Washed |

|

30.00 |

|

Variety: Bourbon, Caturra, Pache Process: Washed |

|

52.00 | |

|

Variety: Catuai Process: Natural - Anaerobic |

|

70.00 |

*Source of images: https://www.parlor.coffee/, https://orcoffee.be/ and https://mokcoffee.be/

Value distribution: As shown by the above examples, end market prices for coffee vary depending on the targeted market segment. Green coffee export prices typically amount to only 5% to 25% of the end-market prices, depending on the coffee quality, the size of the lot and the supplier’s relationship with the buyer. Figure 4 below shows the value distribution of wholesale mainstream coffee. Roasters often end up taking more than 80% of the wholesale coffee price. A coffee farmer takes about 10%.

Prices for speciality coffee may have reference to the international London and New York market prices but much of the coffee trade takes place on a price differential basis. In the speciality segment, the shares of added value for farmers tend to be much higher than in the mainstream coffee market, as well.

The Speciality Coffee Association provides an illustrative example of how exporters should look into their value chain, in terms of different costs and margins. You should also refer to the Specialty Coffee Transaction Guide to get an idea of the current market prices for speciality coffee. This guide quantifies anonymous contract and pricing data of importers and roasters, based on quality, quantity, and origin of the coffee purchased.

Segmentation by type of consumption: In addition to the market segmentation by quality, the Belgian coffee sector can also be segmented into in-home and out-of-home consumption:

- In-home consumption: Most coffee consumption in Belgium takes place at home. During the COVID-19 pandemic, consumption at home increased greatly, due to the closure of out-of-home establishments. Retail sales in Belgium accounted for roughly 80% of the country’s total coffee volume sales before the pandemic. Home consumption is becoming increasingly diverse because of the different qualities available and the use of coffee pods and capsules.

A relatively large share of the coffee consumed in Belgium is made with pods and capsules (40% of the market in 2019). Ground coffee and whole beans had the largest market share (46%) in 2019. Coffee capsules (+8.5%) and whole beans (+8.2%) are both growing steadily, while the share of instant coffee (total market share of 12% in 2019, representing a decrease of 2.3%) and ground coffee (-6.4% in 2019) is declining. - Out-of-home consumption: Pre-COVID-19, Belgium’s out-of-home consumption accounted for approximately 20% of all Belgian coffee volume sales.

Figure 5: Belgian coffee sector segmentation by in-home and out-of-home consumption

Source: ProFound

Tips:

- Learn more about mainstream Belgian supermarkets’, such as Colruyt, promoting of standard quality and high-quality coffees. Compare their product assortment and price levels with specialised stores, such as the Belgian web shop Bob Plaza.

- Refer to our study on trends in the coffee sector to learn more about developments within different market segments.

- Check the website of the Specialty Coffee Association (SCA) to learn more about the high-end coffee segment, market trends and main players.

2. Through what channels does coffee wind up on the end market?

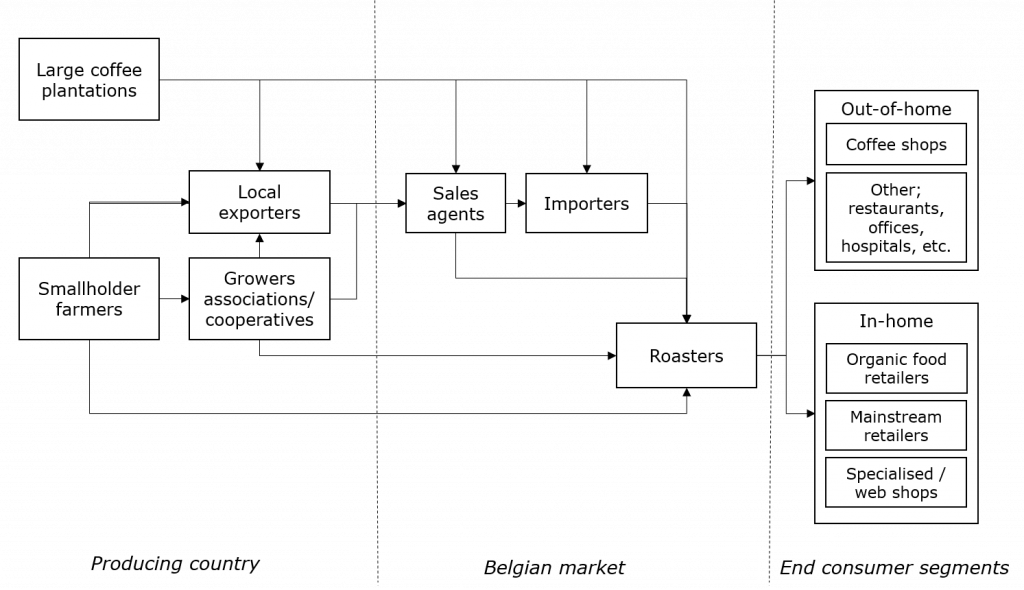

As an exporter, you can use different channels to bring your coffee to the Belgian market. Entering the market will vary according to the quality of your coffee and your supplying capacity. Bear in mind that shortening supply chains are a general trend in Europe. This means that retailers and coffee roasting companies are increasingly sourcing their green coffee directly. The below figure shows the most important market channels for green coffee beans entering Belgium.

Figure 6: Market channels for green coffee in Belgium

Source: ProFound

Importers

Importers play a vital role in the coffee market, functioning as supply chain managers. They maintain wide portfolios from various origins, pre-finance operations, perform quality control, manage price fluctuations and establish contact between producers and roasters. In most cases, importers have long-standing relationships with their suppliers and customers.

Green coffee beans mainly enter Belgium via the Port of Antwerp and the Port of Zeebrugge. Most green coffee traders in Belgium are located near these ports. In general, importers either sell the green beans to roasting companies in Belgium or re-export them to other European buyers.

Large-scale importers usually have minimum volume requirements starting at around 10 containers, covering a wide range of qualities, varieties and certifications. At the same time, they provide strong support on logistics, marketing and financial operations. Examples of large-scale importers in Belgium include EFICO, Supremo and Coffeeteam.

Specialised importers are able to buy small and medium-sized volumes of high-quality and single origin coffees, from micro-lots to full container loads (FCL). Examples of specialised importers in Belgium are: Sucafina Specialty and Rucquoy Frères, both focusing on specialty and high-quality coffees. They sell their coffees to specialty coffee shops, such as Caffènation.

For which companies is this an interesting entry channel? The most interesting channel for you will depend on the quality of your coffee and your supply capacity in terms of volume. If you are an exporter of green coffee beans and can you offer high volumes (10 containers or more), you should look into entering the Belgian market through large importing companies. These companies usually have agents or representative offices in producing countries, which can be your first point of contact.

Specialised traders can be interesting if you have evidence of high cupping scores of at least 80, although some buyers may require scores higher than 85, plus a high degree of transparency and traceability. Keep in mind that many specialised importers prefer to work directly with producers or cooperatives.

Large roasters

Most large roasters buy their own coffee beans from the country of origin, although they might also source through importers. Roasters usually perform analysis and cup testing to check the evenness of the roast and to identify any defects that can occur in post-harvest processes, such as fermentation, drying and storage. Large roasters usually blend different qualities of green coffees to safeguard quality consistency. The final product is distributed to retailers and the food service industry.

Roasters can operate under their own brands and/or private label. Examples of large roasters operating under their own brands in Belgium include Rombouts, Sas Coffee and Miko Koffie. In addition to roasting under its own brand, Beyers also roasts for retailers’ private label brands.

For which companies is this an interesting entry channel? Supplying directly to large-scale roasters is only interesting if you are able to supply large volumes at consistent quality. If you work with bulk coffees, discuss minimum quality and other requirements, such as certification, with your potential buyer.

Small roasters

Although a growing number of small roasters import green coffee directly from the place of origin, the largest share of smaller roasters continues to buy their coffee via importers. This is the case as not all roasters can take on the additional responsibilities and risks involved in importing directly from the source. Importers help roasters with financial services, quality control and logistics. Nevertheless, small roasters often maintain a direct connection with their producers, as they need detailed information for storytelling in order to market the coffee to their clients (brands or consumers). Small roasters often specialise in single origins and the finest specialty coffees.

Examples of small roasters in Belgium directly importing coffee include: Aksum Coffee House, MOK coffee and OR coffee.

For which companies is this an interesting entry channel? Supplying to small roasters is interesting for producers and exporters that offer high-quality coffees, have micro lots, can guarantee traceability, and are willing to engage in long-term partnerships. Assess whether small or medium-sized roasters are interested in establishing direct trade relationships, and whether you have sufficient means to organise your exports.

Intermediaries and agents

Agents act as intermediaries between you, coffee importers and roasters. These are actors with vast market knowledge, who can help you assess and select interesting buyers. Some agents are independent, while others are hired to make purchases on behalf of a company. Note that agents are not as common in Belgium as they are in other European markets, such as Germany and the United Kingdom. Examples of agents in Europe are Eugen Atté and Euroca, both of which are based in Germany.

For which company is this an interesting entry channel? If you have limited experience exporting to European countries, agents can be a big help. Agents are also interesting if you have limited quantities of coffee or if you lack the financial and logistical resources to carry out trade activities. Working with an agent is also useful if you need a trusted and reputable partner in the coffee sector. Be prepared to pay them commission for their work.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Attend trade fairs to meet potential Belgian buyers. Interesting trade fairs in Europe include SCA’s World of Coffee (every year in a different European city), Biofach (organic) and COTECA (both in Germany), and the Brussels Coffee Week. Attending such events can provide you with additional insight into the preferences of Belgian buyers with regard to origin, flavour and sustainability certification.

- Check this list on the website of the Belgian Coffee Roaster Association highlighting several coffee roasters in Belgium. It will help you find potential partners and learn more about the Belgian market.

- Invest in long-term relationships. Whether you are working through importers or roasters, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance.

- See our study on buyer requirements for coffee to learn about which European market standards and requirements you need to comply with when supplying to Europe.

- See our study on how to do business with European buyers for more information about complying with buyer requirements, how to send samples and how to draw up contracts.

3. What competition do you face on the Belgian coffee market?

In general, competition is higher for mainstream coffee with low added value. This segment is mainly dominated by major suppliers and cooperatives which are able to deliver large quantities so they can compete on price. It is difficult for small and medium-sized companies, for example those which only export a few containers per year, to compete in this segment.

Volumes in the specialty coffee market are smaller, and the focus is more on quality, origin and sustainability. However, as the requested volumes are smaller, and more and more producers are focusing on this segment, competition can also be quite fierce. There are several competitions to identify the highest quality coffees produced worldwide, for instance the Cup of Excellence. These competitions might be an interesting entry point for this segment but it may be necessary to invest a large sum of money in order to enter this segment.

New entrants to the market will face competition from already successful coffee exporters, especially due to the fact that they have already established long-term relationships with buyers. Entering the market as a newcomer requires you to have extensive knowledge of your product assortment, stable quality and volumes, and good communication skills to enable you to start building your own new relationships with buyers. If the potential buyer is not yet operating in your country of origin, it might be more difficult to establish initial contact. You may be required to supply more extensive information about the producing regions, the producing communities and traceability, for example.

Latin American countries are Belgium’s main Arabica coffee suppliers

Brazil: Brazil is the world’s largest coffee producer and Belgium’s largest supplier. The coffee supplied by Brazil to Belgium reached 84 thousand tonnes in 2020, representing a slight annual average decrease of 1.4% since 2016. Brazil produces both Arabica (75%) and Robusta (25%) varieties, but about 80% of exports consist of Arabica.

Brazil’s coffee-producing areas are relatively flat, which has intensified the use of mechanical pickers in the industry. This has drastically reduced labour costs in Brazil’s coffee production, but also resulting in lower quality, as machines do not distinguish between ripe and unripe cherries. Coffee prices in Brazil went down, especially in relation to other coffee producing countries. Brazil mostly produces natural and pulped natural coffees. Low-grade Brazilian Arabica is mostly used in blends.

Although the country is mainly known for exporting large volumes of standard quality coffee, it also has a strong reputation as a producer of speciality coffees. The sector receives considerable institutional support from the Brazil Specialty Coffee Association, which aims to elevate the quality standards and enhance value in the production and marketing of Brazilian coffees. Examples of successful exporters of speciality coffees in Brazil are Burgeon and Bourbon Specialty Coffees. Large Brazilian exporter Costa Café has also started exporting speciality coffees in addition to its regular mainstream coffee exports.

Honduras: Supplying 38 thousand tonnes in 2020, Honduras is another major supplier of Arabica to Belgium. Honduras registered an average annual increase of almost 18% in coffee exports to Belgium between 2016 and 2020.

The Honduran Coffee Institute IHCAFE has been promoting the production of value-added coffees, either through certification or by actively improving coffee quality. The country has grouped coffee production and quality specifications into six different regions according to differences in microclimates and soil composition. Honduran exports of speciality organic coffees increased by 30% between 2016 and 2017 thanks to these efforts.

In addition to the growing reputation as a high-quality coffee supplier, a relatively large share of coffee from Honduras is organic. In 2019, about 24 thousand hectares were dedicated to organic coffee farming in Honduras, approximately 5.4% of the total land used for growing coffee. This relatively low share underlines the growth potential of Honduras as an organic producer. Nevertheless, accounting for 37 thousand tonnes or 26% of European organic coffee imports in 2019, Honduras was already the second-largest supplier of organic coffees to the EU, only after Peru.

Examples of successful exporters in Honduras are Asoprosan, Cafico, Capiro Coffee Export and Aruco.

Colombia: Colombian exports to Belgium decreased at an average annual rate of 2.2% between 2016 and 2020. Total exports to Belgium in 2020 amounted to 18 thousand tonnes of green coffee in 2020.

Colombia is the world’s largest producer of washed Arabica. The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee, solidifying the country’s established image and brand for high-quality coffees. The Café de Colombia trademark is a registered protected geographical indication (PGI) in Europe. Colombia is unique in this regard, as it is the only coffee-producing country to have obtained this designation .

Colombia is an important producer of certified coffees worldwide. Colombia is the second-largest producer of Rainforest Alliance-certified coffees and the largest producer of Fairtrade-certified coffees. The wide availability of certified coffees has allowed green coffee exporters to access various markets and segments in Europe. Examples of successful Colombian cooperatives or private organisations which export coffee to the international market include InConexus, Red Ecolsierra, La Maseta and Cadefihuila.

Peru: In 2020, Belgium imported about 13 thousand tonnes of green coffee from Peru. Between 2016 and 2020, green coffee imports to France decreased at an average annual growth rate of 11%.

Peru is a large supplier of organic coffee and was ranked the world’s second-largest organic coffee producer in 2019, only after Ethiopia. The land used for organic cultivation of coffee in Peru reached 103 thousand hectares, which is about 23% of all of the land used for growing coffee in the country. In 2019, Peru was the largest organic coffee supplier to the EU, with organic green coffee supplies reaching almost 46 thousand tonnes. The production of organic coffees is actively promoted by local government agencies and non-governmental organisations (NGOs), mainly as a strategy to increase farmers’ income.

The government of Peru has prioritised the international promotion of its coffees. The unique origin, the sustainability of production and the high quality of the coffees are key focus areas of these efforts. Peru is regarded as the fourth-largest producer of coffees with sustainability certification, including Rainforest Alliance/UTZ and Fairtrade. Promotion is done by the Peruvian export promotion agency PromPeru. As part of the international promotion strategy, Peru recently introduced its own national coffee brand to the international market: Cafés del Peru.

Examples of Peruvian exporters to the European market include EcoAndino, CenfroCafé and Coop Norandino.

Vietnam and Uganda are Belgium’s largest Robusta suppliers

Vietnam: Vietnam is the world’s second-largest coffee producer, with production volumes reaching 1,878 thousand tonnes between October 2019 and September 2020. Belgium imported a total of 61 thousand tonnes of green coffee from Vietnam during this period. Between 2016 and 2020, imports from Vietnam increased year on year by 6.0%.

Approximately 96% of Vietnamese coffee production consisted of Robusta coffees. Vietnam’s coffee production is strongly focused on creating large volumes of standard quality coffees, mostly directed to the instant coffee market. In recent years, Vietnam’s Robusta exports have been faced with fierce competition from the Brazilian Conilon and Robusta beans from other countries, leading to slightly lower export volumes. Examples of large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group, Tin Nghia Corporation and Mascopex.

It is likely that trade between the European Union and Vietnam will increase again in the near future, as the European Union-Vietnam Free Trade Agreement (EVFTA) entered into force in August 2020. This agreement lifted tariffs on all green, roasted and processed coffee from Vietnam. To help boost coffee trading through the EVFTA, the Vietnamese government asked the country’s coffee industry players to apply advanced cultivation, processing and storage technologies, to better meet the requirements of European importers.

Uganda: Another major Robusta producer is Uganda. Approximately 80% of total Ugandan exports consist of Robusta. In 2020, total imports to Belgium amounted to almost 11 thousand tonnes. Between 2016 and 2020, a year-to-year decrease of 8.4% was registered.

The fact that Uganda is the only African country where green coffee is available throughout the year gives it a strong competitive advantage. However, disruptions in weather and precipitation patterns, due to climate change, are increasingly leading to supply chain difficulties.

The Uganda Coffee Development Authority (UCDA) helps promote and guide the development of the Ugandan coffee industry through quality assurance, research and improved marketing techniques. UCDA has also encouraged the production and marketing of high-quality Arabica coffees, for instance through the establishment of an online auction to trade specialty coffee since 2018.

Coffee in Uganda is mainly grown by smallholder farmers, who are organised under NUCAFE, the national coffee farmers’ umbrella organisation. NUCAFE’s membership boasts 213 farmer cooperatives and associations. Examples of Ugandan exporters are: ACPU and Great Lakes Coffee.

Belgium’s trade with Central African countries

Before the third wave arrived (see our coffee trends study to read more about the different waves in the coffee market), Belgium used to import a large share of its coffee beans from Central African countries. In 2020, Burundi, Democratic Republic of Congo and Rwanda together accounted for only 1.1% of total Belgian imports, exporting total of 3.5 thousand tonnes of green coffee to Belgium.

The current relationship between Belgium and its former colonies, in the realm of coffee, now takes shape through Belgian organisations and their projects in Africa, like Belgian NGO Rikolto setting up a project to assist coffee cooperatives in DR Congo while linking them to Belgian buyers, such as retailer Colruyt.

Examples of exporting coffee cooperatives in DR Congo are, for instance, Muungano Cooperative and SOPACDI.

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them too. Look into their marketing strategies, the product characteristics they highlight and their value addition approaches. Successful companies that already export to the European market from which you can learn include, for example, Aicasa (Peru), Bourbon Specialty Coffees (Brazil) and La Meseta (Colombia). Another interesting exporting company to learn from is Caravela Coffee, which has a wide portfolio of specialty coffees from Latin America, facilitates contact between roasters and producers, and has set up representative offices in destination markets.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and trade fairs. Quality competitions also provide good opportunities to share your story. The auctions organised by the Cup of Excellence are one such example

- Are you interested in exporting high-quality coffee? Learn more about cupping scores on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q Arabica or Q Robusta Grader certificate to be able to cup and score your coffee through smell and taste according to international standards.

- Work with other coffee producers and exporters in your region if you company size or product volume are too small. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive in the European market.

- Develop long-term partnerships with your buyers, including always complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability in the Belgian market. See our tips on doing business with European coffee buyers for more information.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research