Entering the French coffee market

France is an important European importer of green coffee. About three-quarters of French imports are sourced directly from origin. The largest suppliers of green coffee to France are also the world’s largest producers: Brazil and Vietnam. Several large multinational roasters dominate the French coffee market, but France also has many small and medium-sized coffee roasters that import directly from origin. Many of these smaller roasters are focused on high-quality, ethically produced and traded coffees, providing interesting opportunities for exporters of certified as well as specialty coffees.

Contents of this page

1. What requirements and certifications must coffee comply with to be allowed on the French market?

Exporting to France comes with many requirements. Most requirements are set by the European Union (EU). Some requirements, however, are set by the French government or by companies themselves. These requirements can be divided into the following categories:

- Mandatory requirements: legal and non-legal requirements you must meet to enter the market

- Additional requirements: those you need to comply with to stay relevant in the market

- Niche requirements: linked to specific niche markets

The sections below describe the mandatory requirements, additional requirements and the requirements for niche markets. Most requirements are the same for all European markets. In addition to providing a short overview of all requirements, we address the requirements specific to the French market in more detail. For a more extensive and generic description, read our report on requirements for the European coffee market.

What are mandatory requirements?

Legal requirements on food safety and hygiene

You must follow the European Union legal requirements applicable to coffee. These rules mainly deal with food safety, where traceability and hygiene are the most important themes. Special attention should be given to specific sources of contamination, namely:

- Pesticides — consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide;

- Mycotoxins/mould, particularly Ochratoxin-A (OTA);

- Salmonella (although coffee is considered low-risk).

Payment and delivery terms

French payment and delivery terms do not differ from those of buyers in other countries. Payment is generally required within 30 or 45 days. It is crucial to examine these terms carefully. French buyers pay the same prices as buyers from other European companies for the same product. They will therefore pay neither more nor less than buyers from other countries. Your payment and delivery terms will depend on your incoterms. You can read more about this in our Tips on how to organise your coffee exports.

Trade tariffs

When exporting green coffee, no trade tariffs apply. This is also to the case for decaffeinated green coffee. The standard duty that applies to imports of roasted coffee is 7.5%. The duty for decaffeinated roasted coffee is 9%. These duties vary by country. This depend on whether your country has a contract with the European Union. Note that the importer is responsible for paying the trade tariff. As an exporter, you do not pay this tariff.

Labelling requirements

Labels of green coffee exported to France should be written in English, unless your buyer has indicated otherwise. The label should include the following information to ensure traceability of individual batches:

Tips:

- Learn whether any trade duties for roasted coffee apply to your country. Check the Access2Markets website.

- Read our study on exporting roasted coffee to Europe to learn more about this market.

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 1: Examples of green coffee labelling

Source: Escoffee

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are robust. Other materials (such as GrainPro and Videplast liners) are often used to pack specialty coffees inside jute bags.

Most green coffee beans of standard quality imported into France are packed in container-sized bulk flexi-bags that hold roughly 20 tonnes of green coffee beans each. The remaining green coffee is transported in traditional 60 or 70 kg jute sacks, held in containers of 17 or 19 tonnes.

Other packaging used in transporting coffee includes polypropylene super sacks for 1 tonne of coffee, polyethylene liners for 21.6 tonnes and vacuum-packed coffee. These techniques provide two advantages in the coffee trade, namely increasing efficiency and maintaining or preserving quality.

Figure 2: Examples of coffee packing: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Sustainability requirements

The main (mandatory) sustainability requirements come from the European Green Deal, including the European Deforestation Regulation (EUDR) and the European Corporate Sustainability Due Diligence Directive (CSDDD). The European Green Deal (EGD) is the European Union’s (EU) response to the global climate emergency. It is a package of policies that define Europe’s strategy for reaching net-zero emissions and becoming a resource-efficient economy by 2050. In addition to the EGD, the Forced Labour Regulation also affects Coffee Suppliers exporting to the EU.

The European Deforestation Regulation prohibits coffee that led to deforestation

One of the laws resulting from the EGD is the EU Deforestation Regulation (EUDR). This legislative measure clearly exerts the most influence on the European coffee industry. This regulation became effective in June 2023. It gave roasters and traders 18 months to implement the new rules. In December 2024, the European Union delayed implementation by one year, to 30 December 2025. Micro and small enterprises will have an additional six months. This law makes traceability and technology crucial for exports to the EU market. This will have implications for the coffee-producing industry. The EU provides an information sheet addressing frequently asked questions about this topic.

Certification is one of several tools that you could use to prove that your company complies with the EUDR. This could include certification schemes with strict environmental criteria promoting sustainable farming practices. Examples include Organic and Rainforest Alliance certification. Although it does provide relevant infrastructure, however, certification alone will never be sufficient.

The CSDDD will increase the requirements for traceability and human rights

Under the new CSDDD regulations, corporations must improve their sustainability performance across their global supply chains and prevent damaging effects on human rights and the environment. The regulations require businesses to take the following actions:

1. Integrate due diligence into their policies.

2. Identify actual or potential adverse impacts.

3. Prevent and mitigate potential adverse impacts; end actual adverse impacts and minimise their effects.

4. Establish and maintain a complaints procedure.

5. Monitor the effectiveness of their due diligence policy and measures.

6. Publicly communicate on due diligence.

The directive forces European companies to take responsibility for their full supply chains. It therefore requires your buyers to request proof that you are acting in a way that is socially and environmentally sustainable. The anticipated date for the CSDDD to come into force is around 2025-2026.

The Forced Labour Regulation bans coffee produced with forced labour from the European market

The objective of the Forced Labour Regulation, is to ban the production or exporting any product made using forced labour.

Based on risk-assessments, companies based in the EU will be required to ensure that no forced labour occurs within their supply chains. In April 2024, the EU Parliament granted final approval on the legislation. Companies should be prepared to begin complying with the Regulation’s requirements from mid-2027. Non-compliant European companies will be fined.

The full effect of the Forced Labour Regulation on exporting companies is still unclear. However, it will mean that European buyers will require more information from their suppliers.

Tips:

- For the full buyer requirements, read the CBI study on buyer requirements for coffee in Europe, or consult the specific requirements for coffee on the European Commission’s Access2Markets website.

- Consult EUR-Lex for more information on limits for different contaminants.

- For information on the safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Read more about quality requirements for coffee on the website of the Coffee Quality Institute.

- Read more about legal requirements for exporting coffee into the European market in our report on tips on how to organise your exports.

- Learn whether any preferential agreements apply to you. Select your country of origin and the trade code of your export product on the Access2Markets Trade Assistant. The trade code for coffee is HS0901.

- Read our tips on how to become EUDR compliant to get a better idea of how to prepare for the EUDR. In addition, watch our webinar with tips from importers and exporters.

What additional requirements and certifications do buyers often have?

Some French buyers may demand extra food-safety requirements for processing, or additional quality requirements.

Additional food safety requirements

You can expect buyers in France to request extra food safety guarantees from you. Regarding production and handling processes, you should think of:

- Implementation of good agricultural practices (GAP): The main standard for good agricultural practices is GLOBALG.A.P., a voluntary standard for certification of agricultural production processes that provide safe and traceable products. Certification organisations, such as Rainforest Alliance, often incorporate GAP in their standards.

- Implementation of a quality management system (QMS): A system based on Hazard Analysis and Critical Control Points (HACCP) is increasingly required by buyers as a minimum standard for green coffee production, storage and handling. The implementation of regular checking of residue levels in your green (and roasted) coffee is an example of what could be part of this system. Especially monitor Ochratoxin-A (OTA), polyaromatic hydrocarbons (PAHs) and glyphosate contamination.

It is good to keep in mind that your French importer might re-export quantities of green coffee to other destinations in Europe. Those other buyers push their requirements forward to other players in the supply chain. This may increase the need for you to adopt other specific certifications or standards. This will depend on the final market and market channel used.

Additional quality requirements

Green coffee is graded and classified for quality before export. There is no universal grading and classification system for coffee. The Specialty Coffee Association’s standards for green-coffee grading are normally used as a point of reference.

According to the International Trade Centre (ITC), grading is usually based on the following criteria:

- Altitude and region

- Botanical variety

- Preparation — wet processed (washed), dry processed (natural), semi-washed (wet-hulled), pulped natural or honey processed

- Bean size or screen size and, in some cases, bean shape and colour (note: screen size is important to ensure that coffee batches are uniform in size, which allows for uniform roasting and improves the quality of the final product)

- Number of defects or imperfections

- Roast appearance and cup quality in relation to flavour, characteristics and cleanliness

- Bean density

Specialty coffee is also graded according to its cupping profile. Fragrance, flavour, aftertaste, balance, acidity, sweetness, uniformity and cleanliness are important factors in the grading process. If you sell specialty coffee, buyers will need to know the cupping scores of your coffees. Although it is not mandatory, including this information with the documentation of the coffee you are exporting can add value. It is very important for you to be aware of the quality of your coffees, either through local cupping experts or by becoming a cupping expert yourself.

The Coffee Quality Institute and the cupping protocols of the Specialty Coffee Association consider that coffees graded and cupped with scores below 80 are considered standard quality, and not specialty. The exact minimum scores defining specialty coffee nevertheless differ by country and buyer. Some buyers consider a score of 80 too low and demand cupping scores of 85 or higher.

Additional sustainability requirements

Corporate responsibility and sustainability are very important in the entire European coffee market. Many European importers, including the French, have their own Corporate Sustainability Standards or Codes of Conduct. One example of a French Corporate Sustainability Standard is Touton’s PACT (Positive AgriCulture by Touton). Examples of Codes of Conduct include those of French roaster Méo and Nestlé’s brand Nespresso.

As an exporter, adopting Codes of Conduct or sustainability policies related to your company’s environmental and social impact may give you a competitive advantage. In general, buyers are likely to require you to comply with their code of conduct, and/or fill out supplier questionnaires regarding your sustainability practices.

Certification standards are sometimes part of the sustainability strategy of traders, coffee roasters and retailers. As such, a standard like Rainforest Alliance has become important in the mainstream coffee market. About 20 coffee supply chain actors operating in France hold certification from the Rainforest Alliance.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about food safety management systems, hygiene standards and certification schemes.

- Find out which standards or certifications potential buyers prefer within your target segment. Buyers may prefer a certain food safety management system or sustainability label. This will depend on their end clients and/or distribution channels.

- Carry out a self-assessment to measure how sustainable your production practices are. You can fill out this online self-assessment form by Amfori BSCI to assess your social performance. This Excel form by the Sustainable Agriculture Initiative (SAI) Platform can be used to assess the sustainability performance of your farm.

- See our study on certified coffee for more information about the demand on the European market, trends and specific trade channels.

What are the requirements for niche markets?

Requirements for organic coffee

To market your coffee as organic on the European market, it must comply with the regulations of the European Union for organic production and labelling. Obtaining the EU organic label is the minimum legislative requirement for marketing organic coffee in the European Union. A mandatory national organic label does not exist in France. However, there is a widely spread national organic logo: the AB mark, owned by the French Ministry for Agriculture and Food.

Before marketing your green coffee as organic, an accredited certifier must audit your growing and/or processing facilities. Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you always work with an accredited certifier. To obtain organic certification, you can expect a yearly audit. The aim of the audit is to ensure that you comply with the rules on organic production. Organic certification is very demanding. Before starting the process, you should therefore be sure that you will be able to attract a market that is willing to cover these additional expenses and requirements.

All organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). Control authorities must issue these COIs before the departure of a shipment. This requires you to get the necessary information, such as the importer address and TRACES number, first consignee, and seal and vessel number of your container. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES), where you must register as an organic exporter.

Requirements for other certifications

One of the most common French certifications is Fairtrade. To use the Fairtrade logo, you must have Fairtrade certification, for which the accredited certifier is FLOCERT.

In addition to Fairtrade certification, you can also get Fair Trade certification. Fairtrade differs from Fair Trade. You can read more about the differences on the Fairtrade website. To obtain Fair Trade certification, you must undergo a certification process and become a member of the World Fair Trade Organization (WFTO). The WFTO has its own logo, which you can display on all your products if you are a member.

Another popular fair trade standard on the French market is Fair for Life, for which the accredited certifier is IMO/Ecocert. BIOPARTENAIRE (Équitable & Bio) is a combined organic and fair trade label from France. This label is based on the Fair for Life criteria with additional mandatory criteria, such as organic certification and long-term contracts for all partners in the supply chain.

Other, though less recognised fair trade options on the French market are Fair Choice (the accredited certifier is Control Union) and Small Producers’ Symbol (SPP). Always check demand and interest for a specific certification with your (potential) buyer.

Requirements for direct trade

The high-end specialty coffee segment is characterised by direct trade relations and a high level of transparency and traceability from source to consumer. This means that buyers of these types of coffees ask for requirements that go beyond certification. Besides high quality, these buyers could be interested in your stories about the origin of your coffee. This implies that you should know the specifics of your coffee and be willing to share this information honestly. In addition, direct trade could require more frequent coffee-farm visits, product assessments by your buyers, and long-term business relationships.

Tips:

- Learn more about organic farming and European organic guidelines on the European Commission website and the Organic Export Info website.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search at the organic movement in your own country and ask if they have their own support programs or know about existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Read our report on Exporting organic coffee to Europe for more information on how to enter the European market for organic coffee. You can find importers that specialise in organic products on the Organic-bio website.

- Try to visit trade fairs for organic products, like BIOFACH in Germany. Check out their website for a list of exhibitors, seminars and other events at this trade fair. Here you will also find booths of the organic certification bodies.

- If you produce coffee according to a fair trade scheme, find a specialised French buyer that is familiar with sustainable or fair trade products, for instance via the FLOCERT customer database.

- Try to combine audits in case you have more than one certification, to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Use this cost calculator to estimate what costs will be involved for your organisation to get Fairtrade-certified.

2. Through which channels can you get coffee onto the French market?

The French end market for coffee can be segmented by quality and by type of consumption: in-home and out-of-home consumption. The high-end segment represents a growing niche market in both the in-home and out-of-home segments, as consumers increasingly demand specialty coffees. Suppliers in producing countries mainly enter the French market through importers or medium-sized and large roasters.

How is the end market segmented?

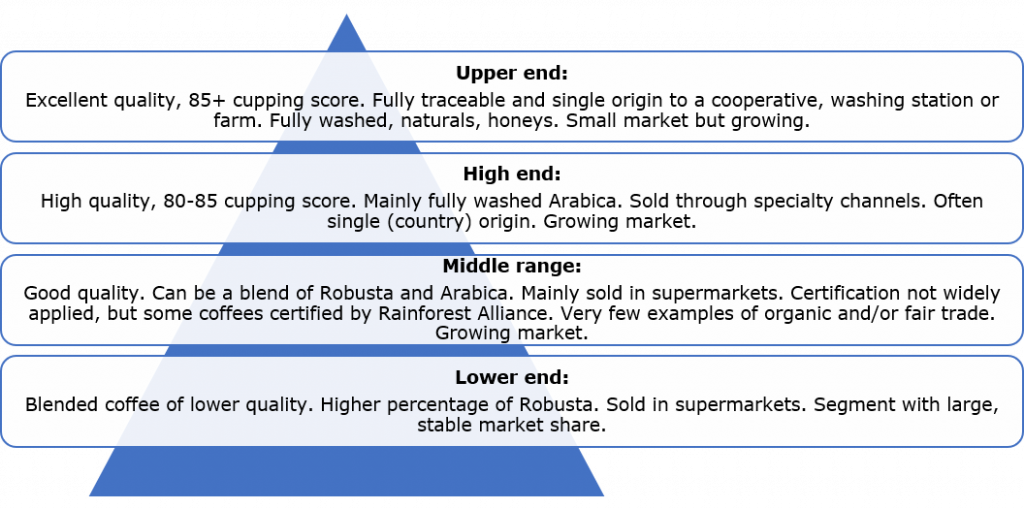

The French end market for coffee can be segmented by quality, as shown in the figure below:

Figure 3: Coffee end market segmentation by quality

Source: ProFound

In France, supermarkets are the main sales channel for coffee. Supermarkets have a wide variety of coffee products, ranging from low-end to high-end products. The following are the largest supermarkets in France:

- E. Leclerc (24% grocery market share)

- Carrefour (21% grocery market share)

- Les Mousquetaires (17% grocery market share)

- Système U (12% grocery market share)

- Auchan Retail (9% grocery market share)

- Lidl (8% grocery market share)

Low end: Coffees in the low-end segment are mainstream, low-quality and mainly blended coffees. One characteristic of these blends is a high share of Robusta beans. Besides some mainstream brands, also the lower-quality private label products from supermarkets belong to the low-end segment. In addition, most coffee pads and instant coffee belong to this low-end segment. Coffees in the low end of the market are mainly sold in supermarkets and through service channels, such as offices and universities.

Product and price examples in the low-end segment (based on Carrefour’s retail prices in 2024) include:

| Product | Retail price (€/kg) | ||

| Low end | Carrefour Classic (Whole beans, 1000-gram package) |

| 8.35 |

| Grand’ Mère Familial (Whole beans, 1000-gram package) |

| 9.62 |

Middle range: Middle-range coffees are commercial coffees with a good and consistent quality profile, such as quality espresso. This segment typically consists of blends with a higher proportion of Arabica compared to the low-end segment. The middle-range segment represents a stable coffee market, in which sustainability certifications are important.

Middle-range coffees are often sold in supermarkets and by the food service industry. Premium private label ranges of retailers typically belong to the middle-range segment. Examples of middle-range products and prices, based on Carrefour’s retail prices in 2024, include:

| Product | Retail price (€/kg) | ||

| Middle range | Malongo (Whole bean, 100% Arabica, Fairtrade-certified, 500-gram package) |

| 15.98 |

| Ethiquable, Origin Peru (Whole bean, 100% Arabica, Organic and fair trade-certified, 1 kilogram package) |

| 17.85 | |

| Carrefour Selection, Origin Malawi (Whole bean, 100% Arabica, 200-gram package) |

| 22.75 |

High and upper ends: High-quality coffee mainly consists of washed Arabicas. These coffees are often single origin and coffees with a special story. The upper end of this segment consists of specialty coffees of excellent quality, often from micro or nano lots that go through processing methods such as naturals and honeys. These are mainly fully traceable and single origin Arabica beans with a cupping score of 85 and above. The high and upper-end segments are a small but growing market.

Sustainability certifications are not very common in this segment. Some buyers have their own sustainability requirements, and others focus purely on quality instead of sustainability. Long-term contracts between suppliers and buyers are characteristic of the high-end and upper-end segment, as are higher prices. Some buyers and suppliers agree on projects for communities and distribution of money to farmers, a common characteristic of certifications aimed at social impact. The high and upper-end segments do see a growth in organic-certified coffees, however.

Coffees from this segment are mainly sold directly by specialty roasters, at their physical and web shops and at coffee events. An example of a coffee event in France is the Paris Coffee Festival. An example of a specialised French coffee web shop where you can find high and upper-end coffees is Cofféa. To find examples of French specialty roasters and cafés, refer to the European Coffee Trip website.

Examples of coffees in the high and upper-end market segments include:

Examples of coffees in the high and upper-end market segments include:

| Product | Retail price (€/kg) | ||

| High and upper ends | Variety: JARC Process: Natural Roaster: Brûlerie MÖKA |

| 42.00 |

Variety: Red Catuai Process: Black honey Roaster: Piha Roastery |

| 45.40 | |

Variety: Tall Mokka Process: Natural |

| 103.90 |

Segmentation by type of consumption

In addition to the market segmentation by quality, the French coffee market can also be segmented into at-home and out-of-home consumption.

At-home consumption: In most European countries, including France, retail sales for in-home consumption account for most of the overall market. Nestlé, Jacobs Douwe Egberts and Lavazza are the largest players on the French mainstream market for in-home coffee consumption. The at-home market accounts for around 86% of all French coffee consumption.

Out-of-home consumption: In France, there is a strong culture of eating and drinking out-of-home. The out-of-home consumption segment for coffees consists mainly of hotels, coffee bars and restaurants. Major players in this segment include:

- McDonald’s, under the brand name McCafé. It sources its coffee from Segafredo.

- Polar Café

- Colombus Café & Co

- Mon Café Italien

- Café Richard

The out-of-home market accounts for about 14% of all French coffee consumption.

Figure 4: French coffee market segmentation by in-home and out-of-home consumption

Source: ProFound

Tips:

- Compare the product assortment and price levels of French supermarkets, such as Carrefour, with specialised coffee roasters which you can find on the European Coffee Trip website.

- Refer to our study on trends in the coffee market to learn more about developments within different market segments.

- Check the website of the Specialty Coffee Association (SCA) to learn more about the high-end coffee segment, market trends and main players.

Through which channels does coffee end up on the end market?

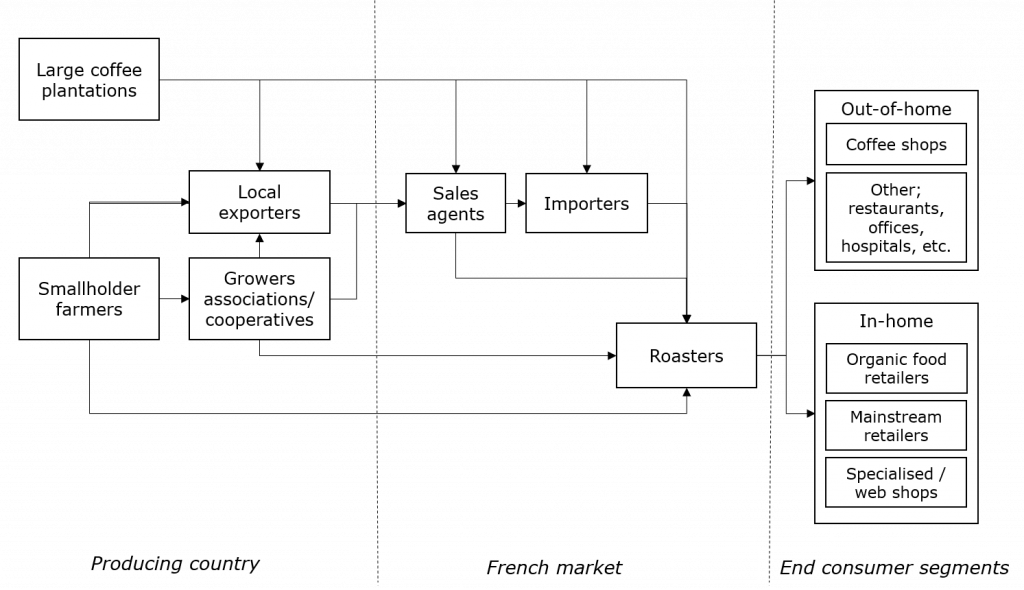

As an exporter, you can use different channels to bring your coffee onto the French market. The way of entering the market will vary according to the quality of your coffee and your supplying capacity. Bear in mind that shortened supply chains are a general trend in Europe. This means that retailers and coffee roasting companies are increasingly sourcing their green coffee directly. Figure 5 below shows France's most important market entry channels for green coffee beans.

Figure 5: Market channels for green coffee in France

Source: ProFound

Importers play a vital role in connecting exporters with roasters

Importers play a vital role in the coffee market, functioning as supply chain managers. They maintain wide portfolios from various origins, pre-finance operations, perform quality control, manage price fluctuations and establish contact between producers and roasters. In most cases, importers have long-standing relationships with their suppliers and customers. In general, importers either sell the green beans to roasting companies in France or re-export them to other European roasters and/or traders.

Large-scale importers usually have minimum volume requirements starting at around 10 containers, covering a wide range of qualities, varieties and certifications. At the same time, they provide strong support regarding logistics, marketing and financial operations.

Imports of green coffee beans mainly enter France via the port of Le Havre, where most importers are located. Bordeaux is another important port for coffee imports. Examples of large-scale importers in France are Maison P Jobin & Cie (part of the Neumann Kaffee Gruppe), Olivier Langlois (part of Group Sopex), Volcafe France (part of ED&F Man) and Touton S.A. These supply coffee to large roasters and mainstream retailers in Europe.

Specialised importers are able to buy small and mid-sized volumes of high-quality and single-origin coffees, from micro-lots to Full Container Loads (FCL). An example of a specialised coffee importer in France is BELCO. France also has importers who specialise in ethical products, including coffee. Normally these focus on specific organic and fair-trade markets. Examples of specialised French importers include Alter Eco and Ethiquable.

For whom is this an interesting entry channel? Specialised traders could be interesting if you have organic and/or fair trade-certified coffees, as well as evidence of high cupping scores of at least 80. Note that some buyers may require scores higher than 85, plus high transparency and traceability. Remember that many specialised importers prefer to work directly with producers or cooperatives.

Large roasters

Most large roasters buy their own coffee beans from the country of origin, although they might also source through importers. Large roasters usually blend different qualities of green coffees to safeguard quality consistency. The final product is distributed to retailers and the food service industry. Large coffee roasters in France include Nestlé France, Jacobs Douwe Egberts, Lavazza, Segafredo Zanetti, Méo, Darboven and UCC Coffee France.

Roasters can operate under their own brands and/or private labels. As in other food markets, private labels are growing fast. In August 2023, private labels comprised a market-volume share of 20%, according to L'Observatoire de la grande consommateurs (LSA). In 2023, this was 18%.

For whom is this an interesting channel? If you are an exporter of green coffee beans and can offer high volumes (10 containers or more), you should consider entering the French market through large importing companies. These companies usually have agents or representative offices in producing countries. They can buy your coffee and do the exporting.

Medium-sized and small roasters

Although there is a growing number of small roasters which import green coffee directly from origin, the largest share of smaller roasters continues to buy their coffee via importers. This is the case as not all roasters can take on the additional responsibilities necessary to import directly from source. Importers help roasters with financial services, quality control and logistics. Nevertheless, small roasters often maintain a direct connection with their producers, as they need detailed information for quality control, as well as for storytelling to market the coffee to their clients (brands or consumers).

Small roasters are often specialised in single origins and the finest specialty coffees. Examples of small roasters in France include: Kawa Coffee, Verlet Paris, Oven Heaven, Placid Roasters and Substance Café. Refer to the website of European Coffee Trip to find more specialty coffee roasters in France.

Several medium-sized roasters in France specialise in ethical products, including coffee. These roasters usually focus on specific organic and fair-trade markets. Examples of specialised French roasters include Lobodis, Maison Merling, Malongo and Cafés Sati.

Some French roasters import directly from farmers (or farmer groups). One example is Malongo, which sources directly from producer cooperatives.

For whom is this an interesting channel?

Supplying to small roasters is interesting for producers and exporters who offer high-quality coffees and micro-lots, can guarantee traceability and are willing to engage in long-term partnerships. If you have very high-quality coffees and are currently working through an importer, it might be interesting to explore direct trade possibilities and see whether you could connect directly with roasters. This requires the financial means and technical expertise to organise export activities and an export licence.

Supplying medium-sized roasters may also be an interesting alternative if you have a consistent and reliable quality and volume. Many medium-sized roasters will also require one or more certifications for sustainable production. Be aware that many smaller roasters may not be importers. It is nevertheless important to interest them in your coffee. You could then find a logistics partner (importer) to ship your coffee to the destination.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Attend trade fairs and other events to meet potential French buyers. Interesting events include SCA’s World of Coffee (every year in a different European city), BIOFACH (organic, Germany), and the Paris Coffee Festival. Attending such physical or virtual events can provide you with additional insight into the preferences of French buyers and/or consumers, with regard to origin, flavour and sustainability certification.

- Check out the list of roasters on the website of the French Coffee Union. It will help you find potential partners and learn more about the French market.

- Invest in long-term relationships. Whether you are working through importers or roasters, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance.

- See our study on buyer requirements for coffee to learn which European market standards and requirements you need to comply with when supplying to Europe.

- See our study on how to do business with European buyers for more information about complying with buyer requirements, how to send samples and how to draw up contracts.

3. What competition do you face on the French coffee market?

Which countries are you competing with?

As a coffee supplier, you operate within a global and competitive landscape. For producers and exporters, it is important to understand the market segments in which they operate in and the scale at which they work. By identifying these factors, you can determine which other countries with which you are competing. Understanding the quality level, volume, and positioning of your products improves your ability to assess your competition and develop strategies to differentiate yourself in the global market. This knowledge is essential for positioning yourself effectively and competing successfully.

Most coffee that comes from producing countries directly is sourced from Brazil, followed by Vietnam, Ethiopia, Honduras, Peru and Colombia. To see how much coffee was imported from your country in 2023, hover your mouse over your country in Figure 7.

Source: Eurostat and ITC Trademap

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Attend trade fairs and other events to meet potential French buyers. Interesting events include SCA’s World of Coffee (every year in a different European city), Biofach (organic, Germany), COTECA (Germany) and the Paris Coffee Festival. Attending such physical or virtual events can provide you with additional insight into the preferences of French buyers and/or consumers, with regard to origin, flavour and sustainability certification.

- Check out the list of roasters on the website of the French Coffee Union. It will help you find potential partners and learn more about the French market.

- Invest in long-term relationships. Whether you are working through importers or roasters, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance.

- See our study on buyer requirements for coffee to learn which European market standards and requirements you need to comply with when supplying to Europe.

- See our study on how to do business with European buyers for more information about complying with buyer requirements, how to send samples and how to draw up contracts.

Brazil: The world’s largest coffee producer

Brazil was the largest direct supplier of green coffee to France in 2023. With a volume of more than 57 thousand tonnes of green coffee, Brazil accounted for more than 25% of all coffee exports to France. Between 2019 and 2023, Brazil’s exports to France increased at an average yearly growth rate of 3.1%.

Brazil is the world’s largest producer and exporter of coffee. Although it produces both Arabica (around 70%) and Robusta (around 30%), almost 80% of its exports consist of Arabica.

Brazil’s coffee-producing areas are relatively flat. This has intensified the use of mechanical pickers, thereby reducing labour costs in Brazilian coffee production. It has also led to average decrease in quality, as machines cannot distinguish between ripe and unripe cherries.

Brazil produces mainly natural and pulped natural coffees. Low-grade Brazilian Arabica is used mostly in blends. Demand for these blends is high amongst Italian roasters, who focus mainly on price.

Despite the lower coffee prices, Brazilian coffee farmers are relatively successful. Factors contributing to their success include the following:

- the scale at which they operate;

- mechanised cherry picking;

- an efficient infrastructure;

- a favourable climate.

Brazil is the only large producing country in which the average farmer is able to generate a living income based on coffee farming.

Although Brazil is known mainly for exporting large volumes of standard-quality coffee, the country also has a strong reputation as a producer of speciality coffees. The sector receives considerable institutional support through the Brazil Specialty Coffee Association (BSCA). The association aims to raise quality standards and enhance value in the production and marketing of Brazilian coffees.

Examples of exporters of speciality coffees in Brazil include Burgeon and Bourbon Specialty Coffees.

Table 1: Competitive country profile of Brazil

| Strenghts | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Climate change will have a severe negative impact on Brazilian coffee production in the coming decades. The country’s domestic coffee consumption has a strong influence on its export levels. For this reason, export volumes of green coffee are expected to decrease in the coming decades.

Vietnam: The world’s largest Robusta producer

Vietnam is the world’s second-largest coffee producer. It was also the second-largest direct supplier of green coffee to France in 2023. With a volume of almost 31 thousand tonnes of green coffee, Vietnam accounted for 14% of all coffee exports to France. Between 2019 and 2023, these exports decreased, with an average yearly growth rate of 1.5%.

In 2021, more than 96% of all Vietnamese coffee production consisted of Robusta coffees. Vietnam’s coffee production focuses strongly on creating large volumes of standard-quality coffees.

Examples of large Vietnamese coffee-exporting groups include Simexco Daklak, the Intimex Group, Tin Nghia Corporation and Mascopex.

Table 2: Competitive country profile of Vietnam

| Strenghts | Weaknesses | Image on the coffee market |

|

|

|

Source: Standard Insights

Climate change is expected to have a heavy influence on Vietnam’s coffee production. The country is becoming hotter and dryer. It is already one of the 10 countries most affected by climate change.

Ethiopia: Producer of highly valued organic Arabica coffees

Ethiopia was the third-largest direct supplier of green coffee to France in 2023. With a volume of 10 thousand tonnes of green coffee, Ethiopia accounted for 4.5% of all coffee exports to France. Between 2019 and 2023, Ethiopian exports of green coffee to France increased by an average growth rate of 4.1% per year.

Ethiopia is the world’s largest producer of organic coffee. The Ethiopian government strongly encourages the sector to adopt more sustainable growing techniques and to focus on producing high-quality Arabicas. Ethiopian producers rely on the uniqueness of Ethiopia as an origin, as many consider it the birthplace of coffee. Ethiopia’s coffees have high potential in the specialty market.

Almost all coffee in Ethiopia is traded on the Ethiopian Commodities Exchange (ECX). Since 2017, however, exporters have been able to sell directly to international buyers. This is due to recurring issues related to the lack of traceability of farm-specific or organic-certified coffees sold through ECX.

Examples of Ethiopian coffee exporters include BunAroma and EthioGabana.

Although the future of other coffee-producing countries with regard to exports of roasted coffee is uncertain, exports from Ethiopia are even more uncertain. In addition to climate change, multiple factors are influencing coffee production in Ethiopia. The civil war is threatening the local economy and forcing farmers to abandon their farms. The quality of production declined in 2023, and the Ethiopian government is regulating the industry.

Table 3: Competitive country profile of Ethiopia

| Strenghts | Weaknesses | Image on the coffee market |

|

|

|

Honduras: Large supplier of organic coffee

Honduras was the fourth-largest direct supplier of green coffee to France in 2023. With a volume of nine thousand tonnes of green coffee, Honduras accounted for 4.1% of all coffee exports to France. Between 2019 and 2023, green-coffee exports from Honduras declined by an average of 13% per year. The drop in exports may be related to decreases in yield, price and production output in the country.

The Honduran Coffee Institute (IHCAFE) promotes the production of value-added coffees through certification and active quality improvement. The country has grouped coffee production and quality specifications into six regions in terms of microclimates and soil composition.

In addition to its growing reputation as a high-quality coffee supplier, Honduras produces a relatively large share of organic coffee. According to The World of Organic Agriculture 2022 (FiBL & IFOAM), about 24,000 hectares were dedicated to organic coffee farming in Honduras. This is approximately 5.7% of the country’s total planted coffee area. Honduras is one of Europe’s largest suppliers of organic coffee. In 2021, exports of specialty and certified coffee amounted to 54% of total exports.

Examples of successful exporters in Honduras include Asoprosan, Cafico, Capiro Coffee Export and Aruco.

Table 4: Competitive country profile of Honduras

| Strenghts | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Peru: Large supplier of sustainably produced coffees

Peru was the fifth-largest direct supplier of green coffee to France in 2023. With a volume of 6.7 thousand tonnes of green coffee, Peru accounted for 3.0% of all coffee exports to France. Between 2019 and 2023, Peru’s exports of green coffee declined by an average of 3% per year.

Coffee is one of Peru’s main agricultural products. It accounts for around 25% of the country’s agricultural income. As much as 40% of its farmland is destined for coffee production. In the highlands, this is even 70%. Peruvian exporters are especially important in the specialty market segment. Peru counts as the global leader in the production of specialty coffee. One example of a Peruvian specialty exporter is RainForest Trading.

In addition to specialty coffees, Peru has a dominant position as a supplier of organic coffee. It is the second-largest exporter of organic coffee. The country dedicates 90 thousand hectares to growing organic coffee.

The flavour profile of Peruvian coffees is usually nutty, chocolatey and mildly citrusy. The country’s varieties include Catimor, Pache, Bourbon, Typica and a small amount of Pacamara. The main processing method is wet processing.

Peruvian coffee has a reputation for consistent quality and sustainable production. The country is a leader in trading coffee with Fairtrade certification, and smallholders own 75% of the coffee industry. In 2018, Peru introduced a national coffee brand, Cafés del Peru, to the international market.

Table 5: Competitive country profile of Peru

| Strenghts | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Colombia: The largest supplier of washed Arabicas

Colombia was the sixth-largest direct supplier of green coffee to France in 2023. With a volume of 4.6 thousand tonnes of green coffee, Colombia accounted for 2.0% of all coffee exports to France. Between 2019 and 2023, imports of Colombian green coffee to France decreased at an average yearly rate of 13.4%. This was mainly the result of the decrease in Colombian coffee production. The outlook for 2024/2025 is positive, however, and Colombian exports are expected to grow in the short term. At the same time, however, the expected growth of 1.6% will not make up for several years of significant decline.

Colombia is the world’s largest producer of washed Arabica coffee. The country has a strong national coffee industry with a high level of technological development. The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee. The country has an established image and brand for high-quality coffees. Colombian coffee is known for its notes of chocolate, nuts, herbs, fruit, and citrus. The main processing technique is washed processing. The country’s best-known coffee varieties include Typica, Bourbon, Caturra and Castillo.

The Café de Colombia brand is a protected trademark. It is registered in eAmbrosia, the register for protected trademarks in Europe. Registration in eAmbrosia is unique amongst coffee-producing countries. The establishment protects the rights of more than 550,000 small-holder families in the country.

The Colombian coffee industry is developing fast. Coffee companies are increasingly investing in capacity-building and product quality. Colombian producers can follow coffee quality and tasting programmes via the Federación Nacional de Cafeteros de Colombia (FNC) to obtain certification. The Coffee Quality Institute (CQI) has a strong presence in Colombia. The institute provides courses in partnership with the National Institute of Professional Training SENA. The country’s coffee has had ongoing success in competitions, including the World Barista Championships.

Table 6: Competitive country profile of Colombia

| Strenghts | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them. Look into their marketing strategies, the product characteristics they highlight and their value addition approaches. Successful companies that already export to the European market – so companies from which you can learn – include ACPU (Uganda), O’Coffee (Brazil), Bourbon Specialty Coffees (Brazil) and La Meseta (Colombia). Another interesting exporting company to learn from is Caravela Coffee, which has a wide portfolio of specialty coffees from Latin America, facilitates contact between roasters and producers, and has set up representative offices in destination markets.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and trade fairs. Quality competitions also provide good opportunities to share your story. For instance, refer to the auctions organised by the Cup of Excellence.

- Are you interested in exporting high-quality coffee? Learn more about cupping scores on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q Arabica or Q Robusta Grader certificate to be able to cup and score your coffee through smell and taste according to international standards.

- Work with other coffee producers and exporters in your region if your company size or product volume are limited. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive on the European market.

- Explore opportunities supported and funded by national coffee institutes or coffee boards and aimed at promoting your country’s coffees across the globe.

- Develop long-term partnerships with your buyers. This implies complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability on the French market. See our tips on doing business with European coffee buyers for more information.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research