The German market potential for coffee

Germany is Europe’s largest importer of green coffee beans. The German coffee roasting industry is enormous, serving both its domestic coffee market — the largest in Europe — and export markets. Sustainability has become a minimum entry requirement for the German coffee market. The demand for specialty coffee is growing; this segment is taking on larger market shares.

Contents of this page

1. Product description

Harmonised System (HS) codes are used to classify products and to calculate international trade statistics, such as imports and exports. The focus in this study is on green coffee beans, which are classified in HS codes 090111 (coffee, not roasted, not decaffeinated) and 090112 (coffee, not roasted, decaffeinated). The available data do not distinguish between bulk, high-quality and specialty coffees.

Approximately 124 coffee species exist in the wild, of which only a few are commercially relevant. The two most important species on the market are:

- Coffea Arabica (Arabica): Referred to as a highland coffee, because it grows best at altitudes between 600 and 2,000 metres, Arabica is the most dominant species in the coffee market, representing about 75% of global coffee production. Each coffee tree yields an average of two to four kilos of cherries. Arabica beans are fairly flat and elongated. Arabica coffee beans have a smoother, more aromatic and more flavourful taste compared to Robusta. Arabica beans have a caffeine content of approximately 1.5%.

The main sub-varieties of Arabica are the Yemen accession, which branches out into Typica and Bourbon coffee lineages and the Ethiopia/Sudan accession.

Examples of Typica cultivars are the Hawaiian Kona, Jamaican Blue Mountain, SL14 and Maragogipe. Examples of the Bourbon cultivars that are found mostly in Latin America are Caturra, Villa Sarchi and Pacas. Examples of Bourbon cultivars found in East Africa are Jackson, K7, SL28 and SL34.

Examples of the Ethiopian and Sudanese cultivars are Geisha, Java, Sudan Rume and Tafari Kela.

- Coffea Canephora (Robusta): Robusta coffee can be considered a lowland coffee, as it grows best at altitudes below 600 metres. Robusta accounts for around 25% of global coffee production. Its beans have a caffeine content of approximately 2.7%. Robusta is less susceptible to pests and diseases than Arabica. Its beans are smaller and rounder than Arabica beans. When roasted, Robusta beans generally have a stronger and harsher taste than Arabica, and it is often described as bitter. Robusta beans are often used in coffee blends and instant coffee.

Examples of crossbreeds of the Arabica and Robusta species are Catimor, Castillo (the most commonly coffee plant grown in Colombia), IHCAFE90, Ruiru 11 and Sarchimor.

2. What makes Germany an interesting market for coffee?

Germany is Europe’s largest green coffee importer. The country serves as a coffee trade hub, re-exporting relatively high volumes of green coffee to other European countries. Large volumes of green coffee also stay in the country, destined for Germany’s large, well-established coffee roasting industry.

Germany is the largest importer of green coffee beans in Europe

Germany is Europe’s largest importer of green coffee beans. In 2021, Germany accounted for 34% of total European imports sourced directly from producing countries, an approximate 1.1 million tonnes valued at €2.6 billion. Total import volumes remained stable between 2017 and 2021 on average, growing at an average rate of 0.3% annually.

Most green coffee beans enter Germany via the Port of Hamburg. The ports of Bremen and Bremerhaven are also important entry points for coffee into Germany. Most German green coffee traders are located near these ports. Examples of large coffee trading companies in Germany include ECOM, Kaffee Import Compagnie, Neumann Kaffee Gruppe and Rehm & Co. An example of a small importing company focusing on specialty coffee is Touton Specialties.

Germany is an important coffee trade hub in Europe

Germany is a consolidated hub for coffee re-exports in Europe. Germany was the second-largest re-exporter of green coffee beans in Europe in 2021, with a share of 36%. Total German re-exports of green coffee beans in 2021 reached 208,000 tonnes, increasing by 1.9% on average between 2017 and 2021. The main destinations for Germany’s green coffee re-exports were Poland (42%) and the Netherlands (11%). Other export destinations include the Czech Republic (6.8%), France (5.4%) and Austria (4.1%).

Besides the trade in green coffee beans, Germany also holds a key position in the trade of roasted coffee beans. Germany is Europe’s second-largest roasted coffee exporter after Italy, with a market share of 23% in 2021. Exports of roasted coffee beans from Germany amounted to 256,000 tonnes in 2021, at a value of €1.5 billion. Between 2017 and 2021, Germany’s exports of roasted coffee beans registered an annual average growth rate of 3.7% in volume. The main destinations for German roasted coffee in 2021 were Poland (40,000 tonnes), the Netherlands (27,000 tonnes) and France (24,000 tonnes).

Germany has a large coffee roasting industry

According to PRODCOM figures, Germany has the second-largest coffee roasting industry in Europe after Italy, with a sold production volume of 571,000 tonnes in 2020, at a value of €1.7 billion. Sold production volumes of roasted coffee increased slightly, registering an average annual growth rate of 1.3% between 2016 and 2020.

Large coffee roasters in Germany include Tchibo, Jacobs, Dallmayr, J.J. Darboven and Melitta. Nestlé also has large roasting facilities in Germany. Examples of small-scale roasters are Backyard Coffee and Bergbrand, which cater to niche markets. To find more roasters in Germany, have a look at the database of the German Coffee Association.

Germany is a large coffee consumption market in Europe

Germany’s per capita coffee consumption is not among Europe’s highest, but at approximately 5.4 kg per year, it still above the European average of approximately 5 kg. According to the German Coffee Association, domestic in-home consumption of roasted coffee increased by 7,900 tonnes, whereas out-of-home consumption of coffee decreased by 5,800 tonnes in 2021. This decrease in out-of-home consumption was mainly the result of the global COVID-19 pandemic.

Tips:

- Activate the “Translation” function of your browser to make the studies available in your native language.

- Look up the websites of the Port of Hamburg and the ports of Bremen and Bremerhaven to learn more about the ports themselves and potential trade partners based there.

- See the website of the German Coffee Association for more information about the coffee industry in Germany. This association supports the coffee interests of its members, including coffee traders, brokers, roasters, producers of instant coffee and coffee equipment manufacturers.

- Access EU Access2Markets to analyse European and German trade dynamics and to build your export strategy. By selecting the Germany as your reporting country, you will be able to follow developments such as trade flows with established suppliers, the emergence of new suppliers and changing patterns in direct and indirect imports.

- See our study of trade statistics for coffee for more detailed information about the European trade in green coffee beans.

3. Which trends offer opportunities in the German market?

Sustainability commitments in coffee are crucial on the German market, and sales of sustainably certified coffee are increasing. Germany is Europe’s largest organic food market, which makes organic certification an interesting proposition for coffee exporters. Demand for specialty coffee is also growing and taking on larger market shares in the German market.

The German organic market is shifting from niche to mainstream

Germany is the market leader of organic food sales and consumption in Europe. In 2021, organic food sales in Germany reached almost €16 billion, representing about 6.8% of total food sales in Germany. The organic market in Germany grew approximately 5.8% between 2020 and 2021.

In Europe, Germany is the leading importer and consumer of organic coffee, with the demand for organic coffee in Germany continuing to grow. According to a survey conducted by Tchibo, 19% of German consumers are willing to pay a higher price for coffee that is certified as organic.

The popularity of organic foods in Germany is driven largely by consumer interest in health and environmental impact. In addition, German consumers have relatively high disposable income compared to those in other countries in Europe, which allows them to spending more on everyday products, such as coffee.

Coffee exporters will find some of the best opportunities for organic coffee in Germany, but they will also encounter a competitive market that is the prime destination for producers of certified organic coffee

Sales of sustainably certified coffee on the rise in Germany

Sales of coffee with sustainability certifications show continuous growth in Germany. The main reason behind this growth is that German consumers increasingly demand coffees with positive social and environmental impact. When it comes to social impact, German consumers are most concerned about fair wages and good working conditions.

Germany is the largest market for Fairtrade-certified coffee, followed by the UK, the US, Canada, and France. In 2021, more than 24,000 tonnes of Fairtrade coffee were sold in Germany, good for 5% of the total German coffee market. Fairtrade coffee sales by volume increased at an average annual rate of 7.4% between 2017 and 2021, reaching a value of almost €541 million in 2021. In a survey conducted early 2022, 31% of consumers in Germany said they were willing to pay more for Fairtrade-certified coffee.

Approximately 74% of Fairtrade-certified coffee sold in 2021 in Germany was also certified organic. Important suppliers of Fairtrade-certified coffees to Germany are Brazil, Colombia, Honduras and Peru. Aldi Süd, REWE and EDEKA were among the German retailers with highest sales of Fairtrade coffee in 2021. Tchibo and J.J. Darboven are the leading German roasting companies for Fairtrade coffee. Retail sales of Fairtrade-certified coffees grew by 17% as a result of increased at-home consumption during the COVID-19 crisis.

Rainforest Alliance, now merged with UTZ, is also widely present in the German coffee market. Many Germany-based coffee supply chain actors are certified by Rainforest Alliance. Among them are importers (Neumann Kaffee Gruppe (NKG) and List + Beisler), roasters (Tchibo and RÖSTfein), retailers (Lidl and Kaufland) and coffee shops (McCafé and Caffe Bistrot). In 2020, seven German retailers announced their commitment to working towards a living income and living wage for coffee farmers and workers.

On 11 June 2021, the Supply Chain Due Diligence Act was adopted by the German government. This Act will enter into force in 2023. It sets human rights and environmental standards for large German companies and their supply chains. German buyers will implement stricter purchasing requirements and increase supply chain monitoring to comply with these standards.

Rainforest Trading from Peru is one example of a successful coffee exporter. They offer a wide range of certified coffees, including Rainforest Alliance, EU Organic and Biosuisse, Fairtrade, among several other. Other interesting examples are Ibrahim Hussien (Ethiopia), Mayorga Organics (Honduras), Kawa Kabuya (DR Congo) and Rwashoscco (Rwanda).

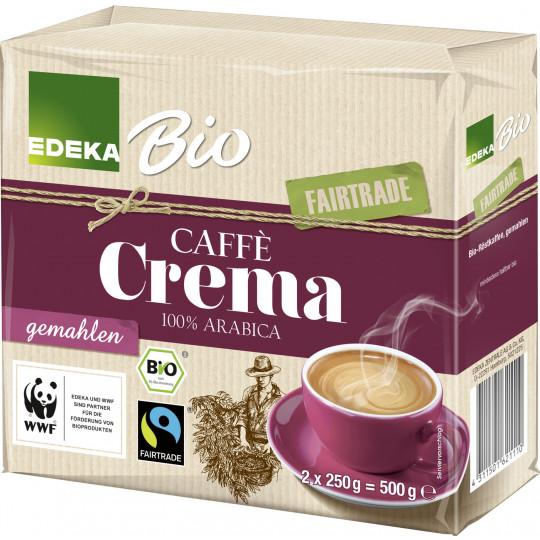

Figure 2: Certified sustainable coffee sold at German retailer Edeka

Source: Edeka

Germany’s specialty coffee market is growing

The market for specialty coffee is growing in Germany. This is partly reflected in the increase of out-of-home consumption in the country. In 2021, 20% of Germany’s total annual coffee consumption was consumed out-of-home, mainly at work. The sales volume of the out-of-home segment decreased by 5.7% in 2021 due to the lockdowns related to the COVID-19 pandemic. Out-of-home consumption is expected to recover, as pre-COVID levels of coffee sales had already been reached by the second half of 2021.

Germany is the second-largest branded coffee shop market in Europe, after the United Kingdom. In 2020, Germany had 5,490 branded coffee shop outlets. Market leaders include McCafé, Tchibo and Coffee Fellows. These coffee shops tend to serve higher-quality coffees. The trend of serving higher-quality coffees, especially to younger generations, brings opportunities for exporters of high-quality coffees.

The specialty coffee market in Germany is also marked by the expansion in specialty coffee shops and small-scale specialty roasters, such as The Barn, Five Elephant and Flying Roasters. In 2021, 294 specialty cafés and 64 specialty roasters in Germany were mentioned on the European Coffee Trip, up from the 155 specialty cafés and 53 specialty roasters that were listed in early 2019.

These specialty coffee cafés and roasters cater to niche markets and follow the principles of direct trade, transparency and high-quality products. Most of the small-scale roasters will continue to buy from dedicated importers, but some are becoming large enough to import directly themselves, which is the case of Elbgold Rösterei in Hamburg.

BeGet inspired by looking at examples of other coffee exporters such as cooperative COOPFAM from Brazil, which offers specialty and organic coffees to the European market.

Single-serve coffee machines becoming more popular in Germany

Germans mainly purchase ground coffee (47%), followed by whole beans (41%) and single-serve methods, such as coffee pods (6.8%) and capsules (5.3%). Demand for whole beans in particular is increasing at the expense of ground coffee and coffee pads. Sales of fully automatic machines grew by 20% between 2019 and 2021, reaching a 33% market share. In 2019, approximately 24% of German coffee drinkers owned a coffee pad machine and 22% owned a coffee capsule machine.

Retailers sell all kinds of coffee capsules to cater to consumer preferences. For instance, rezemo sells bio-based coffee capsules made from German wood. High-quality coffee cups and single-origin varieties are also widely available.

Tips:

- See our study on trends for coffee to learn more about current trends in the European market.

- See Germany’s national chapter of the Specialty Coffee Association (SCA) for more information about the German specialty coffee market.

- Promote the sustainable and ethical aspects of your production process and support these claims with certification. See our study on doing business with European coffee buyers for more tips on marketing and promoting your coffee.

- Before engaging in a certification programme, make sure to check that the label has sufficient demand in your target market and whether it will be cost-beneficial for your product, always in consultation with your potential buyer.

- Are you interested in exporting high-quality coffee? Learn more about cupping scores on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q-grader or R-grader certificate so that you can cup and score your Arabica and/or Robusta coffee according to international standards.

- Find potential business partners in Germany by checking the lists of Fairtrade-certified operators, German Rainforest Alliance-certified coffee brands, UTZ-certified coffee supply chain actors and German organic coffee importers.

Gustavo Ferro and Lisanne Groothuis of ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research