The Moroccan market potential for green coffee from Guinea

Morocco is an emerging market, with a growing demand for coffee. Moroccan green coffee imports have been increasing over the last decade. Guinea has been an important supplier of green coffee to Morocco, mainly to serve the country’s steady mainstream market. While the Moroccan market is slowly moving towards more distinguished, premium flavour profiles, demand for lower-grade Robusta is still high. The Moroccan coffee market is mainly a market for standard coffee and is driven by price. This provides opportunities for Guinean exporters. To successfully enter the Moroccan market, it is important to supply constant volumes of consistent quality, transported in quality packaging.

Contents of this page

- Product description

- What makes Morocco an interesting market for green coffee from Guinea?

- Which trends offer opportunities or pose threats to the Moroccan coffee market?

- What requirements must Guinean coffee comply with to be allowed on the Moroccan market?

- Through what channels can you get Guinean coffee on the Moroccan market?

- What competition do you face on the Moroccan coffee market?

- How to do business with buyers in Morocco?

1. Product description

The focus of this study is green coffee beans, classified under HS code 090111 (coffee, not roasted, not decaffeinated). The available data do not distinguish between different coffee qualities (bulk, high-quality or specialty coffees) or between conventional or certified coffee beans.

According to the International Coffee Organization (ICO), Guinea produced an estimated 150 thousand 60-kg bags (9 thousand tonnes) of green coffee in 2020, accounting for only 0.1% of global coffee production. Production volumes have been up and down and have shown a declining trend since 2015. About 98-99% of coffee produced in Guinea is considered to be Robusta coffee, while only very small volumes of Arabica coffee (about 100 tonnes) are produced in the country.

- Robusta coffee (Coffea Canephora) is considered a lowland coffee, as it grows best at heights of less than 600 metres. Its beans have a caffeine content of approximately 2.7%. Robusta beans are smaller and rounder than Arabica beans. When roasted, Robusta beans generally have a stronger and harsher taste than Arabica, which is often described as bitter. Robusta beans are often used in coffee blends and are commonly used for instant coffee production.

Since 2013, the Guinean Ziama-Macenta Robusta coffee has a protected geographical indication. This Robusta coffee has characteristics that bring it closer to an Arabica: acidic, low in bitterness, high aromatic intensity and a strong persistent aroma. The shape is a half-circle, slightly tapered.

- Arabica coffee (Coffea Arabica) grows best at heights of between 600 and 2,000 metres. It is the most dominant species in the global coffee market (representing about 75% of global coffee production) but is rare in Guinea. Arabica beans are fairly flat and elongated. Arabica coffee beans have a smoother, more aromatic and more flavourful taste compared to Robusta. Arabica beans have a caffeine content of approximately 1.5%. Due to its characteristics, Arabica beans make up a large share of specialty coffees.

In general, Guinean coffee is perceived as low-grade quality. According to a Guinean coffee study conducted for CBI in 2020, coffee chain actors in Guinea prefer to harvest unripe green coffee cherries to receive quick cash instead of waiting longer to harvest the ripe product. This is often followed by improper drying. Still, according to interviews with Moroccan roasters, Guinean Robusta is appreciated for several of its characteristics. It is similar to popular African (Ugandan and Tanzanian) coffee. Compared to coffees from Asia, it has a strong flavour profile with chocolate notes. Guinean coffee is used by Moroccan roasters in blends with other Robustas and Arabicas.

As can be seen in the figure below, a very large share of Guinean coffee production has been exported in the last decades. According to the ITC Trade Map, Guinean coffee is largely exported to other African countries, mainly Morocco, Senegal and Algeria. National consumption of local coffee is very low.

2. What makes Morocco an interesting market for green coffee from Guinea?

Morocco is an emerging market that is experiencing rapid economic growth. This is reflected in the country’s green coffee imports, which have increased consistently in the last decade. Its geographical position provides interesting opportunities for foreign trade, but its role in the coffee trade is still limited. The close distance between Guinea and Morocco also makes Morocco an interesting market for Guinean coffee exporters.

Moroccan green coffee imports on the rise

According to data of the Moroccan ’Office des Changes’, Morocco’s total green coffee imports amounted to nearly 48,917 tonnes in 2021, showing an increase at an average annual rate of 5.7% since 2017. According to the ITC Trade Map, Morocco is the world’s 24th largest green coffee importer in terms of volume, and Africa’s largest. It is estimated that 75% of green coffee imports are Robusta against 25% Arabica.

Before the 1960s, Morocco sourced its green coffee mainly from Brazil. After that, Morocco imported its coffee almost exclusively from Ivory Coast. When the Ivorian supply declined around 1975, Indonesia was able to enter the Moroccan market, followed by Vietnam. While diversifying its imports from Asia, Morocco also turned to other African countries, in the knowledge that only they would be able to replace Ivorian coffee. Robusta coffee from Togo and Guinea is grown on the same meridian and the same latitude as Ivorian coffee, thus benefiting from very similar characteristics. This remains true today: despite the addition of Robusta from Indonesia and Vietnam, African coffees are more popular in Morocco than Asian coffees and can generally substitute each other in terms of quality. In addition, coffees from Africa – in contrast to other origins – benefit from a zero customs duty when imported into Morocco.

Currently, Morocco’s main suppliers of green coffee are Uganda, Indonesia, Vietnam, Togo, Guinea and Tanzania. The COVID-19 pandemic has clearly reshuffled the cards between supplier countries. Togo lost some market share because of the crisis, while Tanzania gained some.

In 2021, 34% of Morocco’s total imports were supplied by Uganda, and 20% by Indonesia. The import value of Ugandan green coffee amounted to €27 million in 2021, while the import value of Indonesian coffee reached €16 million. Imports from Uganda increased at an average annual rate of 15% since 2017, while Indonesia registered a year-to-year decline of -2.7%.

Moroccan green coffee import volumes from Guinea have been unstable over the last decade, overall showing a slight downward trend. Still, Guinea has typically been among the top-5 largest green coffee supplying countries to Morocco in this period. An exception was 2021, when Moroccan import volumes from Guinea dropped sharply to only 93 tonnes, at €133 thousand. The main reason for the declining export volumes in 2020 and 2021, however, was because of a temporary export halt by the main Guinean exporters (for internal business management reasons). It was most definitely not because of a decrease in interest from Moroccan coffee importers. According to Moroccan statistics, in the first six-months of 2022, Guinea exported nearly 8,500 tonnes to Morocco. The 2022 data show that Guinea ranked as the largest supplier compared to competitors.

Guinea and its coffees are expected to continue to benefit from its reputation and the country’s geographical proximity to Morocco. As an industry source indicated, during the most severe supply chain disruptions caused by the COVID-19 pandemic and the steep increases in freight costs, the interest in coffees from Guinea grew compared to coffees from Vietnam or Indonesia.

*For 2022 specifically: only first six months

*For 2022 specifically: only first six months

Roasted coffee imports by Morocco increasing

Besides increasing green coffee imports, Morocco’s roasted coffee imports are also steadily increasing. In 2021, Morocco imported an estimated 3,349 tonnes of roasted coffee, mainly from Spain (51% of supplies) and Italy (30%).

The import of roasted coffee shows a clear upward trend. Where green coffee import volumes grew at a year-to-year rate of 5.7% between 2017 and 2021, roasted coffee imports grew at much higher rates of nearly 30%. Over the same period, the import value of roasted coffee increased by 16%.

Green coffee is slowly losing ground to roasted coffee if comparing their relative shares in total coffee imports. In 2017, 97% of Morocco’s total coffee imports were green coffee versus 2.9% roasted coffee. In 2021, the share decreased to 94% for green coffee imports versus 6.4% for roasted coffee imports. The import value of green coffee in 2021 comprised 79% of total Moroccan coffee imports, down from 87% in 2017.

This trend indicates a growing interest in premium coffee products in Morocco, which is mainly sourced from Europe as a finished product. For instance, Città d’Italia is a roasted coffee product imported by and marketed in Morocco. It is marketed as ‘directly imported from Italy’ and ‘roasted according to the experience of the [Italian]masters’. This product is imported and distributed by the Moroccan company Alea Food, and competes next to Alea Food’s own locally roasted coffee brand: Café La Varenne. Read more about the premiumisation of the Moroccan coffee market in the trend section below, and what this means for Guinean coffee exporters.

The Moroccan coffee roasting industry

The national coffee roasting industry in Morocco is limited in size. It has around 80 roasters, of which less than ten have larger-scale operations. The main national roasters are:

- Asta Groupe: A group active in coffee roasting since 1973. They also engage in roasted coffee imports, and in the commercialisation and packaging of tea products and fruit juices. The coffee branch is called Société des Cafés Sahara. Some of the main coffee brands of this roaster are: Asta, Taiba, Diamant Noire and Mondial Espresso. Most of these brands are available in retail shops across the country, in whole beans, ground coffee or coffee pods. The Asta range also includes instant coffee products.

- Cafés Carrion: This company, active since 1924, imports and roasts green coffee from Colombia, Brazil, Honduras and Nicaragua (Arabicas), and mainly sources its Robustas from Indonesia, Vietnam, Ivory Coast, Cameroon and Uganda. Their coffee products include instant, capsules, pods, ground and whole beans.

- Les Cafés du Brésil: This company is active in the import, roasting, packaging and distribution of coffee since 1953. Other than the name suggests, this company sources beans from a wide variety of countries. It offers products for both the foodservice industry (hotels and catering sector) and a range of 100% Robusta retail products, commercialised under brands like Taj, Safwa and Fadl.

- Les Cafés Dubois: This coffee roaster was founded in 1926. It offers coffee capsules (the Java Timor range) including single origin (Brazil, Ethiopia and Colombia) and blends. Their product range also includes vacuum-packed ground coffees and whole beans. The company is known for its quality coffees.

- Alea Foods: Coffee roaster,importer and distributor of finished coffee products. Café La Verenne is their own brand, which includes a Robusta blend including beans from Guinea, Congo, Ivory Coast, Cameroon and Togo.

- Cafés Bourneix: Active on the Moroccan market since 1960, this roaster is specialised in serving the foodservice industry (bars, restaurants, etc.). It also offers ground coffee and whole bean products for consumers.

The multinational companies Jacobs Douwe Egberts (JDE) and Nestlé Morocco are also active on the Moroccan market. JDE has its Middle East and North Africa (MENA) headquarters in Casablanca, as well as a roasting plant. JDE is present on the Moroccan market with the brands L’Or, Carte Noire, Grand’Mère, Maxwell House, Samar and Gaouar. Nestlé has been present in the Moroccan market since 1992, manufacturing Nescafé instant coffee products. As of 2021, Nestlé Maroc will also directly manage the premium coffee brand’s operations of Nespresso in the country.

The Moroccan roasters face competition to their high-end coffees from the imports of roasted coffee products into the country. Competitors are the Italian brands Illy and Lavazza. Top Class Espresso is the main importer and distributor of the latter in Morocco.

Morocco: a large regional market with potential to grow

In the MENA-region, Morocco is the second-largest retail market for coffee. In 2022, an estimated €1.3 billion is expected to be spent on coffee products in all retail outlets, including hypermarkets, supermarkets and convenience stores. Only Iran is expected to spend more, with €2.7 billion in 2022.

When looking at per capita spending, however, the figures are more modest. The average consumer spending on coffee in Morocco is a little over €35 per year. In the MENA region, countries like Israel and Qatar spend significantly more at €105 and €78 respectively.

Per capita coffee consumption is relatively low in Morocco with an estimated 0.8 kg of coffee per year. This corresponds to about 1 cup of coffee every 4 days. Some sources, however, indicate that the average consumer in Morocco consumes about 1 cup of coffee a day. Still, other countries in the region tend to consume more: Algeria’s per capita consumption amounts to an estimated 3.5 kg/year, and for Tunisia this is 1.5 kg. To compare, Northern and Western European countries register among the highest per capita consumption rates a year, with volumes of over 8 kg per person per year.

Coffee consumption is relatively low, as it competes with tea. Moroccan mint tea, locally called atay, is a traditional drink and consumed daily in high volumes. Tea is popular nation-wide, but especially in rural areas. In this respect, Morocco’s rapid urbanisation shows the growth potential for coffee, since the product is more significantly consumed in cities. In 2021, 64% of Morocco’s total population lived in urban areas, compared to 59% a decade earlier. Also, disposable incomes have risen and are expected to keep growing in Morocco, giving scope for increased spending. Consumer spending on coffee products in Morocco is expected to grow annually by 3.3% between 2022 and 2026.

Morocco: no trade hub for coffee

Morocco is considered a hub for trade with Europe and the Middle East, as well as internal trade from and within Africa. This is mainly due to Morocco’s geographical location close to Europe, located along the trade route connecting the Indian Ocean to the Atlantic Ocean and the Mediterranean Sea. As the border between Morocco and Algeria has been closed since 1994, all terrestrial trade passes through Mauritania.

Despite being a trade hub for several goods, Morocco is currently not considered as such for coffee and is not expected to become one either. Green coffee imports are rarely re-exported, as the national coffee industry almost entirely consumes green coffee. In 2021, green coffee exports amounted to less than 0.1% of coffee imports, with a mere 15 tonnes. Morocco is not considered a trader of roasted coffee either. In 2021, Morocco ranked 64th on the list of roasted coffee exporters, with just 397 tonnes, mainly destined for Tunisia and Algeria. The main Moroccan port of entry for green coffee is the Port of Casablanca.

Tips:

- Stay up-to-date about on coffee market developments. For instance, check out the monthly coffee market reports by the International Coffee Organization (ICO).

- Access the ITC Trade Map to analyse Moroccan trade dynamics yourself and to determine your export strategy. By selecting a specific country as your reporting country, you will be able to follow developments such as trade flows with established suppliers, the emergence of new suppliers and changing patterns in direct and indirect imports.

- Refer to the ITC Coffee Guide – 4th Edition. This guide contains lots of information, also about the practical aspects of the coffee trade. Check the content table to find out what you want to learn more about.

3. Which trends offer opportunities or pose threats to the Moroccan coffee market?

Coffee consumption trends in Morocco are slowly changing, as the market is opening up towards more premium coffee products. This is illustrated by the growing popularity of coffee capsules and the take-off of premium coffee shop chains in the country. Still, the market is heavily dominated by mainstream products, including low-grade Robusta. This is where opportunities lie for most exporters from Guinea.

Coffee consumption habits in Morocco

Coffee consumption patterns in Morocco depend greatly on the standard of living and purchasing power of consumers. In general, coffee is not consumed throughout the day in Morocco, unlike in other Arab countries. Moroccan consumers favour tea, which is consumed at various moments of the day.

When consumed in Morocco, coffee is mainly prepared in two ways: nous-nous (half milk, half coffee) or café noir (cup of espresso). In general, about 60% of Moroccan consumers drink their coffee mixed with milk s sugar, and 40% prefer it black. Spiced coffee may also be prepared: this is coffee brewed with spices like ginger, cinnamon or cardamom. The main roasters in the country also offer ready-made spiced coffee, for sale in supermarkets. These products are made with cheap Robusta beans. An example of such products is Asta Epicé.

At home, coffee is most commonly prepared in an Italian or Turkish coffee maker, mainly with Robusta blends. Filter coffee is mainly consumed at breakfast with milk, though some Moroccan households use this style of coffee making.

Imported European brands, such as Lavazza, and coffee capsules are most often consumed in business environments, by the middle and upper classes and in the high-end hotel and restaurant sector. This premium market segment mainly offers coffee origins that already have an established reputation, such as Ethiopia, Brazil and Colombia (Arabicas) and Indonesia (Robusta). According to industry sources, Guinean Robusta and its flavour profile are not well-known in Morocco by consumers, as the beans are usually used in blends.

A changing consumer interest in quality

The coffee taste profile in Morocco has been slowly changing in recent years. Trade data show that supply volumes from Uganda, Tanzania and Brazil are growing rapidly. On the other hand, supplies from Indonesia and Vietnam decreased between 2017 and 2021. It shows a growing interest in more complex coffee flavours, such as “the full-bodied flavours from coffee from Uganda”.

This may be a potential threat for exporters of Guinean coffee, as the bean quality is seen as low standard. However, Guinean coffee is much used in blends and this is not expected to change. At the same time, opportunities could arise for higher-quality coffee profiles, specifically Guinea’s Ziama-Macenta Robusta. Coffee from this specific region is said to have characteristics similar to those of Arabica: “a slightly acidic taste with little bitterness, high aromatic intensity and a persistent strong, fine aroma”.

Growing number of premium coffee shops in Morocco

Most coffee is consumed at-home; about 33% of the coffee sold in Morocco is estimated to be consumed outside the home in public cafés. Take-away or to-go coffees, immensely popular in Europe and the US, are almost non-existent in Morocco. This is mainly so as coffee consumption in a café in Morocco is considered ‘an experience’.

There are several national coffee shop chains in Morocco, of which Cafés Carrion is a good example. This well-known national coffee shop and roaster has over 50 locations throughout the country. They offer 100% Arabica coffees, as well as Arabica/Robusta blends.

In addition, there is a clear take-off of international premium coffee shops in the country. These chains are mainly located in the larger cities like Casablanca, Marrakech and Rabat. Examples of international premium chains in the Moroccan market include:

- Turkish Espressolab, which has been operating in Morocco with two locations since 2020. The company offers sustainably grown premium (Arabica) coffee beans from origins such as Tanzania, Ethiopia, Indonesia, Guatemala, Colombia, Brazil and Kenya.

- French Columbus Café & Co, which opened their first shop in Rabat in 2017, and is planning to open its second café in 2022.

- British Costa Coffee has three shops in Morocco. It opened its first shop in 2014, had to close down in 2020 due to legal operational disputes, but re-entered the market in 2022.

- American Caribou Coffee will open its first store in Morocco in October 2022.

- Italian Segafredo opened its fourth coffee shop in Morocco in 2017.

- American Starbucks has been present in Morocco since December 2011. It is the country’s international premium coffee shop market leader with 18 locations.

The above list shows the confidence of international chains and franchisers in the growth potential of the Moroccan coffee market. Tourism is seen as one of the drivers of the growth in premium coffee chains in the country in recent years. Other explanations are increased urbanisation in Morocco and a young population.

The growing number of premium coffee shops in the country also drives change in the Moroccan coffee market. For one, they introduce higher-quality coffees to a broader part of the population. Also, these chains help spread concepts such as ‘single origin coffees’ and ‘Fairtrade-certified coffee’ to a larger audience in Morocco. It is likely that this will also drive up demand for a more diverse coffee range in supermarkets and other shops.

If you are interested in sourcing coffee to these chains, it is important to understand their coffee profiles and the types of coffee they work with. For instance, coffee chains like Caribou Coffee and Costa Coffee serve, for example, good-quality coffee blends containing both Robusta and Arabica beans. Starbucks, on the other hand, only works with Arabica beans, making it less interesting for Guinean Robusta exporters.

Growing demand for coffee capsules

In Morocco, the consumption of ground coffee is growing, particularly the interest in coffee capsules. Coffee capsules are mainly sold through retail channels. Sales of coffee capsules have benefitted from the fact that the Moroccan retail market is growing. This growth is explained by young people’s increasing preference for modernising their purchasing outlets, switching from traditional street markets to 21st century outlets. Traditional channels still account for about 80% of grocery retailing. Yet it is estimated that ‘modern’ retail shops will support 30% of national spending by 2025.

The most popular brands dominating the Moroccan coffee capsule market are Lavazza and Nespresso. Nespresso currently has six boutiques in the country. Other popular capsule brands on the Moroccan market include the JDE owned brands L’Or and Carte Noire and the Moroccan brand Dubois. Asta also has its capsule range under the Asta Black brand.

A large share of the coffee capsules for sale in retailers are from brands that are roasted and manufactured abroad. For instance, the L‘Or capsules for sale in shops like Marjane Market are roasted and manufactured in France. This means that the coffee capsule market in Morocco is dominated by independent traders and distributors, who import those products as finished consumer goods. The increased imports of coffee capsules by Morocco comes at the expense of green coffee imports.

However, as the main local roasters are more and more involved in capsule manufacturing, the development of this market segment should not represent a threat for Guinean green coffee exports. Green coffee imports still make up the bulk of imports, and this is not expected to change in the future. What is expected, is that the demand for Arabica imports will increase, as Arabica is often used for the manufacturing of the coffee capsules.

Figure 4: Coffee capsules from Les Cafés Dubois

Source: Les Cafés Dubois

Morocco has a small and emerging specialty market

The specialty coffee market in Morocco is very small. Still, it is worth mentioning, as this niche segment is slowly growing in the country, driven by interest from younger generations in higher-quality products. Examples of specialty coffee shops in Morocco are few. One example is the Japanese %Arabica, which works with high-quality Arabica beans only. Their first store opened in 2018 in Casablanca, followed by another shop in Marrakesh. Another example is Bloom Coffee, a Moroccan specialty coffee roaster who advertises using the following statement: “We specialise in ethically sourcing, selecting and roasting seasonally fresh coffees that are sweet, complex and full of flavour”.

Morocco’s emerging specialty coffee market is also illustrated by the organisation of the country’s First National Moroccan Aeropress Championship in October 2022. Other initiatives like Barista Consult Morocco also illustrate the interest in boosting the specialty coffee scene in the country: Barista Consult aims to educate, encourage and promote specialty coffee brewing and consumption in Morocco.

The examples given above are some of the very few companies and initiatives active on the specialty coffee market in Morocco. Specialty roasters will be looking for high-quality (Arabica) beans with unique flavour profiles, which can evidence sustainable production and traceability across the chain. As a result, exports to these parties is only interesting for Guinean exporters that are able to supply traceable, sustainable and high-quality coffees.

Tips:

- Improve your coffee quality by investing in soil and plant health. There are Do-It-Yourself methods of producing compost, both solid (for mixing with soil) and liquid (for spraying) that improve quality and production volumes. It also makes plants more resilient to climate change. See CBI videos on this topic here (made for Liberian and Sierra Leonean cacao farmers, but equally effective for coffee).

- Make sure coffee plantations have enough shade, to shield coffee plants from an ever-hotter climate. Guinea is on the frontier of sub-Saharan Africa, where desertification will hit hard without sufficiently large trees.

- Consider spending time in Morocco to better understand the culture, market and its trends. For instance, by looking around in supermarkets and shops where coffee is sold and served.

4. What requirements must Guinean coffee comply with to be allowed on the Moroccan market?

To enter the Moroccan coffee market, exporters must comply with both mandatory and additional buyer requirements. In this document you can find the most important requirements.

Food safety

Food safety laws ensure the hygiene, safety and quality of food products throughout the whole supply chain. Morocco has several, but the main food safety law is No 28-07 published in March 2010.

The National Office for Food Safety (Office National de Securité Sanitaire des produits Alimentaires, ONSSA) is the Moroccan entity charged with the regulation, implementation and control of agri-food products for import.

An important aspect of controlling food safety hazards is defining your critical control points. This means that you define the risks in your supply chain, indicating how you prevent, mitigate and monitor these risks, as well as what to do if something goes wrong. Elaborating on such a Hazard Analysis Critical Control Points (HACCP) scheme can be done in collaboration with experts specialised in implementing food management principles.

Food contaminants

To be able to enter the Moroccan market, you must comply with maximum levels of food contamination, such as pesticides and mycotoxins/mould.

Plant products are subject to a phytosanitary inspection carried out by the agents of the Plant Protection Services of the ONSSA. Processed and roasted coffee beans are exempted from the phytosanitary inspection and phytosanitary certificate. However, green coffee can be subject to quality control tests and rigid regulations.

Pesticides

The presence of pesticides is one of the most common reasons for border authorities to reject coffee coming from producing countries. The use of pesticides is permitted but should be strictly controlled to remain within the allowed limits.

Morocco has been intending to harmonise its maximum residue limits (MRLs) for pesticides and contaminants with the EU. Order no. 156-14 of January 2015 sets MRLs on the level of pesticides allowed in food products, including coffee. The maximum pesticide residue level applicable to coffee has now been established by the codex alimentarius. The MRLs apply only to green coffee. Check the Pesticide Index of the Codex Alimentarius here.

Imported food products are not systematically controlled for pesticide residues but ONSSA agents are authorised by law to demand/request laboratory analysis for certain products.

Mycotoxins/moulds

Moulds are another important reason for coffee border rejections. Joint decree no. 1643-16 published in November 2016 establishes Morocco’s maximum permitted levels for contaminants in primary products and food. In Morocco, the only contaminant which is limited for coffee is Ochratoxin A.

Ochratoxin A (OTA) levels are found in green coffee beans. OTA contamination can occur during production (picking of overripe cherries), post-harvest practices (bad fermentation) and during transportation in humid/leaky containers or storage in badly ventilated warehouses.

Although there is no specific limit for green coffee beans, the maximum level of Ochratoxin A in roasted coffee is 5 μg/kg and 10 μg/kg for soluble (instant) coffee. Check the Code of Practice for the prevention and reduction of OTA contamination in coffee on FAO’s webpage.

Foreign matter

Contamination from foreign matter, such as plastic, insects and dust, is a risk and should be avoided. Moroccan importers have shared that, too often, Guinean coffee arrives covered in dust. It is necessary to offer clean batches of coffee, free of foreign matter. The removal of foreign matter is sometimes done using magnets to remove anyiron. Winnowing (using airflow) can help to remove dust, leaves and stems.

Labelling

Food labelling legislation does not apply to bulk products such as green coffee. However, there are guidelines you must follow. Products used as raw materials for processing or repackaging such as green coffee are exempted from the use of the Arabic language in terms of their labelling. Generally, the label should be written in English and should include the following information:

- Product name

- International Coffee Organisation (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 5: Example of green coffee labelling

Source: Escoffee

Packaging

It is important to ensure proper packaging of your products. Some Moroccan importers have voiced concerns about the quality of bags used in Guinea. In low-quality bags, seams may come undone and the bags could open during transport and/or storing.

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. The traditional size of these jute sacks is 60 kg. The kind of packaging used and is the party responsible for the costs of said packaging should be agreed upon in the contract signed by you and your buyer.

Other materials, such as GrainPro, are often used to pack specialty coffees inside jute bags. These materials tend to better preserve grain quality.

Figure 6: Examples of coffee packing: jute bags (left) and GrainPro (right)

Source: GrainPro

Quality requirements

In general, coffee in Morocco is subject to quality control tests. When the coffee arrives in Morocco, officials analyse the samples taken from various bags to check whether all the conditions are met. Legally, the 300g sample must have no more than 240 defects and the weight of the defective beans must not exceed 10% of the total weight, otherwise the goods are denied entry onto the market.

Before export, green coffee is usually graded and classified for quality. There is no universal grading and classification system for coffee. While most producing countries have and use their own grading systems, Guinea does not. Grading coffee is important to identify the quality. Grading and classification is usually based on the following criteria:

- Altitude and region;

- Botanical variety;

- Processing method — wet/washed, dry/natural, honey, pulped naturals;

- Screen size (This is important to roasters as it allows for uniform roasting which improves the quality of the final product);

- Number of defects or imperfections;

- Bean density;

- Cup quality.

The coffee that enters Morocco will most likely also undergo a green coffee assessment. This means that your buyers will do a screen-size evaluation, defect count and assessment of bean colour, appearance and smell. This is followed by a moisture check and water activity analysis. Moroccan roasters generally ask for grade 2 Guinean green beans or even grade 1. Grade 3 from Guinea is considered too small, especially compared to other African countries like Ivory Coast.

If you sell specialty coffee, it is important for buyers to know the cupping score of your coffee. Although not mandatory, adding this information to the documentation of the coffee you are exporting might add value. It is very important to be aware of the quality of your coffees, either by inquiring with local cupping experts or by becoming a cupping expert yourself.

Note that there is no exact definition of specialty coffee within the coffee industry. The Coffee Quality Institute and the Specialty Coffee Association agree that coffees graded and cupped with scores below 80 are considered standard quality and not specialty. Nevertheless, the exact minimum scores defining specialty coffee differ per country and per buyer. Some buyers consider 80 too low and demand a cupping score of 85 or higher.

Customs

Imported goods are subject to customs duty, parafiscal tax on imports, value added tax and other duties and taxes. Usually, imports of green coffee to Morocco face a 10% duty.

Table 1: Import customs duty

| Product | Import duty | V.A.T | Parafiscal tax | Accumulated rate |

| Green coffee | 10% | 14% | 0.25% | 25.65% |

| Roasted coffee | 50% | 14% | 0.25% | 71.25% |

Source: Café Asta

However, Morocco has signed bilateral agreements with sub-Saharan African countries, including Guinea. This means Guinea is exempt from tariffs as well as other African countries. Guinea is also a beneficiary of the total import duty exemption as part of the royal initiative in favour of the least developed African countries. Green coffee is one of the products benefiting from the total import duty exemption.

In addition, both Morocco and Guinea signed the African Continental Free Trade Area (AfCFTA). The AfCFTA officially entered into force in May 2019 and aims to create a continent-wide customs union and remove tariffs on 90% of traded goods. On 1 January 2021, African countries opened their markets under the AfCFTA agreement for duty-free goods and service trade.

Nevertheless, there are plans to lower tariffs for green coffee from Latin America and Asia as of January 2023. Tariffs will be lowered to 2.5%. If this is accomplished, it could be a potential threat to coffees from Africa as coffees from other regions will become more affordable.

Tips:

- Focus on applying good agricultural practices to reduce the presence of food contaminants. The risk of contamination of any kind can be prevented by improving growing, drying, processing and storage practices. Information on good agricultural practices in coffee production can be found on the website of World Coffee Research and elsewhere.

- Understand the causes of contamination in green coffee. Read this article to better understand green coffee contamination.

- Consider buying (or renting) a winnower to be able to provide cleaner batches of coffee.

- Test your green coffee for moisture content. The International Coffee Organization states that dried green coffee beans should have a moisture content of 8 to 12.5%. Moisture levels of >12.5% increase the chances of OTA contamination. Buyers will reject green coffee with such high moisture levels.

- Invest in good-quality packaging to protect your coffee beans during storage and transportation. Poor-quality packaging will negatively impact the quality of your coffee, and therefore damage the trust your buyer has in your company.

5. Through what channels can you get Guinean coffee on the Moroccan market?

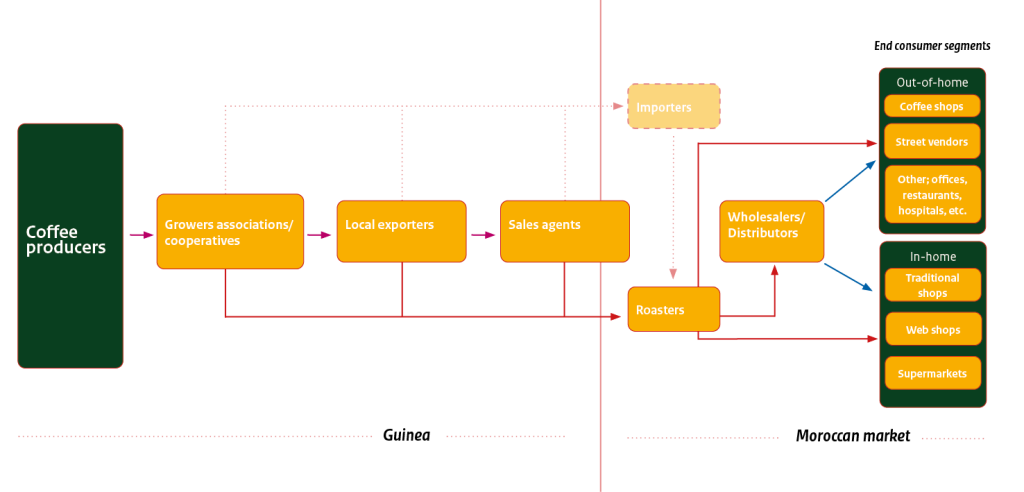

The Moroccan end market for coffee can be segmented by quality and by type of consumption: in-home and out-of-home consumption. The largest share of Robusta exported from Guinea will enter the lower end segment. Coffee consumed in out-of-home locations, such as Moroccan coffee shops, is increasingly of the midrange quality. Suppliers from Guinea mainly enter the Moroccan market through roasters.

How is the end market segmented?

The Moroccan end market for coffee can be segmented by quality and by type of consumption: in-home and out-of-home consumption. The following figure shows the segmentation by quality in Morocco:

Figure 7: Coffee market segmentation by quality in Morocco

Source: ProFound, 2022 (based on ITC Coffee Guide)

Lower end: The coffees in the lower-end segment are mainstream and low quality. This refers to beans with clear defect counts and few quality attributes. Coffees that end up in this segment are sold at high volumes for the lowest price possible. Robusta beans make up a large share of this segment. These beans are most often used in coffee blends. Apart from low-grade ground coffee, this segment also comprises most coffee pads and instant coffees. Final buyers are typically large roasters and manufacturers of solubles. Low-end coffees are mainly sold in traditional shops, by street vendors and in supermarkets. To a certain extent it is also used in bars in Morocco.

Industry players in the food and cosmetics sector may also buy low-quality beans for use in cosmetic and food applications. These actors typically transform the beans into coffee extracts, which may later be used as a flavour ingredient.

Midrange: Midrange coffees are coffees with a good, consistent quality profile. This segment typically consists of premium products, such as coffee capsules, whole beans and good quality ground coffee. This segment comprises 100% Arabica products, but also blends that typically use a higher proportion of Arabica compared to coffees in the lower-end segment. End buyers are usually large and midsize roasters and national or international premium coffee shop chains. Midrange coffees are most often sold in supermarkets and by coffee shops. Storytelling is important in this segment, especially for branding and marketing purposes. A share of the coffee is ‘single origin’, tracing back to country level. The midrange segment represents a growing coffee market in Morocco.

High end: These are high-quality (specialty) coffees, mainly Arabicas with cupping scores of 82 and above. These coffees are fully traceable and single origin. Usually, high-end coffees have packages where the origins of the product are explicitly stated, as well as other features that represent an added value for the product, such as social/environmental impact. Coffees in the high-end segment are mainly sold directly by specialty roasters, at their coffee shops.

Coffees of exceptional quality (cupping score >84) typically trace back to cooperatives, washing stations or estates. These are often from micro- or nano-lots and undergo special processing methods using naturals and honeys. Sustainability certifications are not common in this segment, except for organic. This is because sustainability practices are often commonplace among buyers. Long-term contracts between suppliers and buyers characterise this upper-end segment, as well as higher prices. The high-end market is very small and very niche in Morocco.

Table 2: Examples of lower-end, midrange and high-end coffee products on the Moroccan market

| Segment | Product | Image | Price* (€/kg) |

| Lower-end | Name: Café Taiba Roasted locally by Asta Groupe |

| 6.87 |

Name: Annachoua Type: Ground coffee, blend Package size: 200 grams Roasted locally by Cafés Carrion |

| 8.04 | |

| Mid-range | Name: Ambassadeur Type: Whole beans, 100% Arabica Package size: 1 kilogram Roasted locally by Les Cafés Dubois |

| 13.78 |

Name: Arabica Supérieur Type: Whole beans, 100% Arabica Package size: 250 grams Roasted locally by Cafés Carrion |

| 14.52 | |

| High-end | Variety: SL28, SL34, Batian, Ruiru 11 Origin: Kiambu, Massaï Region, Kenya Flavour: Citrus notes, honey & caramel Cupping score: 85 Package size: 250 grams Roasted locally by Bloom Coffee |

| 44.12 |

Sources: Marjane, 2022 and Bloom Coffee, 2022

* Prices in 2022

The examples above are end-market prices for coffee and vary depending on the targeted market (quality) segment. Green coffee export prices typically amount to only 5% to 25% of the end-market prices, depending on the coffee quality, volumes, the number of actors involved in the chain, and the supplier’s relationship with the buyer.

The figure below shows the value distribution of wholesale mainstream coffee of standard quality. Roasters often end up taking more than 80% of the wholesale coffee price. This large percentage includes a variety of costs, often including import costs, roasting costs, packaging and marketing costs, and costs needed to run shops. Although 81% may seem a lot, many importing companies like roasters have modest margins while taking high risks. A coffee farmer usually takes about 10%.

Out-of-home and in-home segment, and its sales channels

In addition to the market segmentation by quality, the Moroccan coffee sector can also be segmented into in-home and out-of-home consumption:

- In-home consumption: By far, most coffee is consumed at home in Morocco. Supermarkets and traditional shops in Morocco are the main sales channels for coffees consumed at home. Both retail outlets sell lower-end and mid-range coffee products for attractive prices. The largest supermarkets in Morocco are Marjane, Asswak Assalam, BIM, Carrefour and Atacadão (both from the LabelVie Group). High-end products are rarely for sale in Moroccan supermarkets; those products are typically sold at specialty coffee shops.

- Out-of-home consumption: About 33% of the coffee sold in Morocco is estimated to be consumed out-of-home in public cafés, be it traditional coffee houses or in one of the growing number of premium international coffee outlets. Other popular places to consume coffee out-of-home are in universities, offices and other public places. No estimates are available on the size of those segments. In these out-of-home segments, roasted coffee blends are most popular and show an upward trend. The Robusta beans in this case need to be big (grade 1) as they are blended with Arabica beans.

What can be observed in the out-of-home segment is that the COVID-19 pandemic has caused the number of street coffee vendors to grow fast. These street vendors are people who suffered from job loss as a result of the crisis. Many started selling coffee on the streets from a vehicle as a means of generating some income. Coffees are typically prepared using a percolator, with an integrated grinder, using whole grain beans. This informal activity is a threat to established coffee shops, as they usually sell a high number of coffees-to-go at busy traffic points, such as university exits or along busy roads. These sales points are popular due to close proximity to their customers.

Tip:

- Learn more about the types of coffees sold in Moroccan supermarkets’, such as Marjane. Look at the products for sale, the quality and origins.

Through which channels can you get coffee on the Moroccan market?

How easily (or whether at all) you can enter the Moroccan market depends on quality of your coffee and your supply capacity. All roasters active on the Moroccan market have their own importing branch, allowing them to source coffee directly from the country of origin. This is important, as it means that there are no coffee traders/importers as such in Morocco. An exception to this is Octa Trading which represents Indonesian Robusta in the country. Also, in addition to its own coffee roasting and importing activities, Asta Group is engaged in some trading activities, as it imports and sells small volumes of green beans to smaller roasters.

As such, the most common market entry channel for exporters is directly sell to roasters in Morocco. Medium-sized and large roasters usually sell (either through distributors or directly) roasted coffee to retail outlets and to out-of-home outlets such as coffee shops or restaurants.

About 35% of coffee imports in Morocco is destined for coffee shops, restaurants and hotels. The remaining coffee is divided between different retail outlets. The main distribution channel is the traditional shop (also: traditional markets, so called ‘souks’), representing about 70%-75% of retail sales. These traditional shops tend to buy roasted coffee from wholesalers. Demand is price-driven and cheap Robusta (often from Asia) is usually sold in these shops. The other 25%-30% is sold through supermarkets, as roasted beans, ground coffee or coffee capsules.

The figure below shows the most important market channels for green coffee beans entering Morocco. Note that the Moroccan market absorbs almost 100% of its coffee imports for own consumption.

Figure 9: Market channels for green coffee

Source: ProFound, 2022

Mid-sized and large roasters

Most large roasters active on the Moroccan market buy their green coffee directly from producing countries. Sometimes there may be some spot purchases from Europe, but only to compensate a possible supply deficit from producing countries. Roasters usually perform analyses and cup testing to check the evenness of the roast and to identify any defects that can occur in post-harvest processes, such as fermentation, drying and storage. Most of these roasters blend different qualities and origins of green coffees to safeguard quality consistency. The final product is sold directly to retailers and the food service industry, or through wholesalers and distributors.

Although mid-size roasters also source directly from the origin, these players are not used to or willing to handle all logistics issues and risks. That means they often ask to buy green coffee on Cost and Freight (CFR) delivery terms and only sometimes Free On Board (FOB). Trading under Cost, Insurance and Freight (CIF) terms is prohibited by the Moroccan government, because they want Moroccan importers to pay insurance in Morocco.

CFR is a legal term used in foreign trade contracts. A contract that specifies that a sale is on CFR terms, means that you, as the seller (exporter), are required to arrange for the transport of goods by sea to a port of destination and to provide the buyer with the documents necessary to obtain them from the carrier. With a CFR sale, the seller is not responsible for procuring marine insurance against the risk of loss or damage to the cargo during transit. FOB means that your buyer pays for shipping and insurance and takes ownership of the cargo at the point of departure from the supplier’s port. If goods are damaged in transit, the buyer (or their insurance company) is responsible. For an exporter, FOB frees you from having to bear costs and responsibility over the shipping and customs processes.

Examples of roasters in Morocco that source green coffee directly from coffee producing countries include Cafés Carrion, Les Cafés du Brésil, Cafés Bourneix, Les Cafés Dubois and Milagro. Other examples of medium-sized Moroccan roasters are Dahab Industrie, Benssy Café, Habycaf, Ice Café, Mécafé y Sodecaf.

These roasters work with a variety of supplying countries, sometimes including Guinea. Some companies, like ASTA group and Alea Food, work with a wide variety of products (including coffee) – these companies have their own distribution team.

Small specialised roasters

Small roasters in Morocco buy their coffees via intermediaries who are not necessarily based in Morocco. This is the case as only few roasters can take on the additional responsibilities and risks involved in importing directly from the source. Importers help roasters with financial services, quality control and logistics. Nevertheless, specialised roasters often maintain a direct connection with their producers, as they need detailed information for storytelling in order to market the coffee to their clients (brands or consumers). Small roasters often specialise in single origins, specialty coffees or coffees with other special attributes, such as organic certification.

Examples of small roasters active in the Moroccan market include: Bloom Coffee (specialty roaster), Cafés Organic (organic roaster) and Ti Cafew (specialty, organic and mainstream, 100% Arabica). Another example is Les Cafés Mirka. This artisan coffee roaster is also engaged in the sales of Espresso machines in Morocco, and is an authorised distributor of the De’Longhi and Krups coffee products.

What is the most interesting channel for green coffee exporters from Guinea?

If you are a supplier of low-grade (Robusta) coffee, the most interesting market channel is that of large roasters. These will need coffees that comply with the requirements as mentioned above, but no spectacular taste profile is needed. This channel is mostly concerned with price and volume. These large roasters will compare your coffee to that from other regions, in terms of price, logistics (time) and quality.

Note that Moroccan buyers can demand to pay at delivery, especially when they are not familiar with you as an exporter. Disputes can emerge upon arrival in the case of non-compliance (for instance, because the coffee quality is not as agreed upon).

Selling to mid-sized roasters, who are only willing to buy on CFR delivery terms, can be interesting too. Note, however, that CFR can be more expensive for you as an exporter than FOB. Although CFR is usually not recommended, it also has its advantages. It is a service to your buyer, as you take care of coordinating the shipping and take up more risk. If you decide to ship under CFR terms, you can charge an extra margin over the original (FOB) price of the products, as you are also providing the buyer with this service.

If you are a supplier that can differentiate its coffee from the low-grade type (either a carefully harvested and processed Robusta or Arabica) and feel you can compete with higher quality coffees, then the midsize and smaller roasters in Morocco could provide an interesting channel. Here, apart from higher quality (to be assessed in a cupping test), your communication (client-focused service) should be good. This can translate into a trust-building relationship with a roaster that values you as a reliable supplier of better than average coffee in a consistent way, for which a premium can be paid.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality and volume.

- Attend trade fairs to meet potential Moroccan buyers. The main food trade fairs in Morocco are SIAB and Morocco Food Expo. Attending fairs can provide you with additional insight into the preferences of Moroccan buyers with regard to quality and volumes.

- Invest in long-term relationships. Regardless of your buyer, it is important to establish strategic and sustainable relationships with them. This will help you manage market risks and will help secure a fair price for your product.

6. What competition do you face on the Moroccan coffee market?

For Guinean coffee exporters, most competition will come from other Robusta producing countries, especially from Africa. The largest Robusta suppliers to Morocco are Uganda, Indonesia, Vietnam, Tanzania and Togo. African suppliers have the advantage of 0% effectively applied tariffs for imports into Morocco, while suppliers from other continents are faced with 10% tariffs.

Because of the closer proximity to Morocco, African origins for Robusta are preferred. Transit time for coffee coming from Asia is often compared to coffee originating from other African countries. Furthermore, storage costs for roasters are ideally kept as low as possible, while roasters must always ensure sufficient stock. Countries closer to Morocco offer Moroccan roasters greater flexibility.

It is not likely that Guinean Arabica coffee will find an easy market in Morocco, as the Arabicas imported into Morocco are from the most well-established Arabica origins: mostly Brazil, Colombia and Ethiopia. However, Arabicas from East Africa are highly priced, so a strategy to market more competitively priced Arabicas from Guinea might be worth developing.

In general, competition is very high for mainstream coffee with low added value. This segment is mainly dominated by large suppliers and cooperatives which are able to deliver large quantities, enabling them to compete on price. It is difficult for small and medium-sized companies, for example those which only export a few containers per year, to compete in this segment.

New entrants to the market will face competition from already successful coffee exporters, especially due to the fact that they have already established relationships with buyers. Entering the market as a newcomer requires you to have extensive knowledge of your product, stable quality and volumes, and good communication skills to enable you to start building your own relationships with buyers. If your identified potential buyer is not yet buying coffees from Guinea, it might be more difficult to establish initial contact. You may be required to supply more extensive information about the producing regions and the producing communities, for example.

Uganda: Morocco’s largest green coffee supplier

The number one green coffee supplier to Morocco is Uganda. In 2021, Morocco imported nearly 17 thousand tonnes from Uganda, mostly Robusta. Between 2017 and 2021, green coffee imports from Uganda registered an average annual growth rate of about 15%. There is an increasing demand for Ugandan coffee in the Moroccan market, thanks to its interesting flavour profile and the fact that the coffee is available all year round.

Total Ugandan coffee production reached 375 thousand tonnes in coffee year 2021/22, of which 85% (318 thousand tonnes) was Robusta. Uganda was the world’s fourth-largest Robusta producer in 2021/22. Coffee is mainly grown by smallholder farmers, who are organised under NUCAFE, the national umbrella for coffee farmers’ organisation. NUCAFE’s membership counts more than 213 farmer cooperatives and associations. Some Ugandan coffee cooperatives and exporters are very well-organised.

This ensures that Uganda is the most important competitor for Guinea. Especially taking into account that the prices between both countries are almost equal. According to interviews with Moroccan roasters, Uganda is more consistent in supplies (with good maritime routes) than Guinea, which has a bad reputation in terms of supply consistency.

The Uganda Coffee Development Authority (UCDA) helps to promote and guide the development of the Ugandan coffee industry through quality assurance, research and improved marketing techniques. UCDA has also encouraged the production and marketing of high-quality Arabica coffees. In addition, private companies have also invested in Uganda, focusing on sustainable production approaches.

The fact that Uganda is the only African country where green coffee is available throughout the year gives the country a strong competitive advantage. However, disruptions in weather and precipitation patterns, due to climate change, are leading to increased supply chain difficulties.

Examples of Ugandan exporters are Ankole Coffee Producers Union, Kawacom (part of the Ecom Group) and Great Lakes Coffee.

Indonesia: decreasing coffee supplies to Morocco

Indonesia is the world’s third-largest Robusta producer. Total Indonesian coffee production amounted to 635 thousand tonnes of green coffee in 2021/22. About 88% of total production is Robusta, making Indonesia the world’s third-largest Robusta producer. Coffee in Indonesia is almost entirely grown by smallholder farmers.

Indonesia is the second-largest supplier to Morocco with 9.9 thousand tonnes of green coffee in 2021. Indonesia has managed to position itself in the Moroccan market because of its larger Robusta beans. The taste of Indonesian Robusta is earthy and mild. Although it is not among the most preferred taste profiles by Moroccan consumers, the bigger size of the beans makes them a good option for blending with Arabica beans. As a result, Indonesian Robusta is mainly roasted to be sold in whole beans blends (as Arabica beans tend to be bigger than Robusta).

Between 2017 and 2021, direct coffee imports from Indonesia decreased at an annual average rate of –2.4%. This is partly caused by an increased interest in Uganda as a coffee origin. In addition, Indonesian coffee exports have been steadily declining since 2013, due to adverse weather conditions, farmers switching to other crops, increasing local consumption and rising costs.

Indonesia is a large and diverse country, with many islands and microclimates. This has brought opportunities, such as coffees with distinctive flavour profiles. The size and diversity, however, also pose challenges throughout the industry, mainly when it comes to logistics and communication (about 750 different languages are spoken in the country). The value chain in the country itself is very complex, and generally there are up to four different intermediaries between farmer and exporter.

Examples of Indonesian exporters are Indo Coffee, Coffee Arks, Ketiara Cooperative and Niagacoffee.

Vietnam: large producer of Robusta

Vietnam was Morocco’s third-largest green coffee supplier. In 2021, Morocco imported an estimated 6.8 thousand tonnes of green coffee from Vietnam. Between 2017 and 2021, Vietnamese supplies to Morocco decreased at an average year-to-year decline of -1.2%. This is mainly due to the fact that Morocco is increasingly sourcing coffee from Uganda. Through their trade office in Morocco, however, Vietnam aims to increase trade between both countries.

Vietnam is the world’s second-largest coffee producer, only after Brazil. Over 96% of Vietnamese coffee production consisted of Robusta coffees in 2021. Vietnam’s coffee production is strongly focused on creating large volumes of standard quality coffees, mostly directed to the instant coffee market.

Like Indonesian Robusta, the Vietnamese beans are cheap but not well-appreciated by Moroccan consumers. It is mainly blended with beans from African origins to enhance the taste.

Examples of large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group and Mascopex.

Tanzania: fast growing supplies to Moroccan market

In 2021, Tanzania exported 6,115 tonnes of green coffee to Morocco; a significant growth from five years earlier when exports amounted to 989 tonnes. Tanzania produces both Arabica (54%) and Robusta (46%) coffee, mainly by smallholder farmers. Robusta is typically harvested between April-November and processed using the natural method in Tanzania.

Tanzanian coffee is mainly traded through a centralised auction system, where cooperative societies offer coffee on behalf of farmers. Tanzania Coffee Board (TCB) regulates the coffee industry in Tanzania and advises the government about the growing, processing and marketing of coffee within and outside the country. The past years, efforts by the government have mostly focused on replacing existing trees to improve yields.

Examples of Tanzanian exporter companies are Kagera Cooperative Union and Kilimanjaro Native Cooperative Union.

Togo: Morocco key destination for Togolese coffees

In 2021, Togo was the seventh-largest green coffee supplier to Morocco with 1,161 tonnes. Supplies to Morocco by Togo have fluctuated over the years, with a peak of 5,539 tonnes of green coffee in 2018. Morocco is one of the main export destinations for coffee from Togo. Like Uganda, Togo is one of the main competitors for Guinean Robusta in Morocco.

Togo produced a total of 23,106 tonnes of green coffee in 2021, almost exclusively Robusta. The country has had difficulties guaranteeing stable production, heavily affecting export volumes. Problems affecting the Togolese coffee sector include ageing trees, land tenure rights, and smallholder farmers with limited access to education and resources. The government is investing in the sector by supporting maintenance and fertilisation of coffee plantations and through the regeneration of old coffee plantations.

Brazil: world’s largest coffee producer

Brazil is the world’s largest coffee producer and exporter, producing both Arabica (63%) and Robusta (37%). Much of the coffee grown in Brazil is consumed domestically, especially its cheaper Robusta. In 2021, only 10% of total green coffee exports were Robusta.

Brazil was Morocco’s fifth-largest green coffee supplier in 2021. Brazilian supplies to Morocco amounted to 2,466 tonnes in 2021, registering an average annual increase of 5.0% since 2017. Brazilian exports of Arabica beans will not pose direct competition with the Robusta from Guinea. What does increase competition is that Brazilian Robusta coffee exports are growing, and this trend is expected to continue.

Brazil’s coffee producing areas are relatively flat, which has intensified the use of mechanical pickers. This has reduced labour costs in Brazil’s coffee production, but has also lowered quality, as machines do not distinguish between ripe and unripe cherries. That is why Brazil is mainly known for exporting large volumes of coffee of standard quality.

Examples of exporters in Brazil are Costa Café, Cafeeira Fundão, Guaxupé and Kaffee Exportadora e Importadora.

Tip:

- Understand what kind of suppliers sell coffee to your Moroccan buyer. Understanding their quality will allow you to reference your coffee in comparison. If your coffee cups better than Brazilian Robusta, for instance, you can mention that in your negotiations. If your Guinean coffee is very similar to other origins, it will allow you to present your coffee as a valuable substitute.

7. How to do business with buyers in Morocco?

If you want to do business in Morocco successfully, you will need to have a clear picture of the business etiquette and culture in the country, as well as the specific requirements of Moroccan clients. Use the following tips as guidelines on how to do business and initiate or improve your relationships with Moroccan buyers.

Be culturally aware and know Moroccan business etiquette

The mix of Arab, Muslim, Berber and French cultures in Morocco has led to a complex business etiquette. As a former French protectorate, there is still a strong French influence in the country, though Islamic values also have a great impact on business culture. Moroccan business practices emphasize courtesy and a degree of formality. Business culture is also strongly hierarchical.

Punctuality is not necessarily considered a virtue within Moroccan culture. Depending on your experiences with other buyers, this may be a challenge in terms of approaching, negotiating or obtaining answers from potential partners. Sometimes, a delay in response does not necessarily mean disinterest or unwillingness, it is just a cultural habit. A business agenda is rarely scheduled in advance and meetings may start and end later than originally scheduled.

In Morocco, French is the preferred language for business, diplomacy, higher education and government matters. However, since the Moroccan official languages are Arabic and Berber, coffee buyers may appreciate if you use some Arabic terms such as In sã’ Allãh (used to indicate the hope that an event will occur in the future, if such is God's will) and Masha’ Allah (which expresses "God has dictated his will" or "According to God's will", mostly used when a decision is made on the basis of religion).

The common French language knowledge in both Guinea and Morocco provides an opportunity to Guinean exporters.

Regarding non-verbal communication, handshakes are common when it comes to greeting someone of the same sex. However, when it comes to greeting someone identifying as a different sex, it is best to allow the counterpart to extend their hand first. Some devout Muslims refrain from shaking hands with someone of a different sex, so it is suggested to just nod and smile.

Business outfits are often formal and tend to be conservative for all sexes (dark suits covering most of the arms and legs, especially for those identifying as women).

Know your product and find your ideal buyer

To sell your product successfully to the right buyer, it is important for you to know the specific characteristics of your product first. These should minimally include the variety of coffees you can provide, your supply capacities, the quality and the characteristics of the post-harvest practices. Have your coffee cupped in a cupping lab so you can describe your coffee in terms of aroma, acidity, body and balance. Note that in the high-quality/specialty segment, the origin of coffee is also very important.

Knowing your product enables you to match it with the right buyer. Check the websites of potential buyers to gather some initial information on the type of coffee they source, its quality and its origin. One of the most important initial questions is whether your potential client imports directly from the country of origin or via an intermediary. Keep in mind that you want to find buyers that are willing to develop long-term business relationships, either directly or through an importer. Mention that to them and assess the seriousness of your potential buyer inbuilding such a relationship.

Once you have found a potential buyer, it is important to understand their business, their culture and their individual requirements and demands. Ask yourself questions about where their products are sold, or in which segment(s) they operate, to fully understand their business. Aim to engage with business partners that match your company’s philosophy and product range, and that you feel comfortable doing business with.

In order to find a good Moroccan buyer, it is recommended that considerable time be spent in Morocco to understand the culture and market. Schedule meetings with coffee importers and ask many questions to understand what kind of coffee, prices and volumes buyers need. Citizens of Guinea do not need a visa for Morocco, but they must have an Electronic Travel Authorisation.

It is highly recommended to have an agent (paid on commission basis) in Morocco to evaluate the reliability of roasters. This is especially so when they are medium-sized and not used to trading significant volumes. Also, as the Robusta market in Morocco is a highly price-driven market, a local agent will be better able to negotiate prices.

Send samples to interested buyers

If a buyer is interested in your coffee, offer them a sample of your product. Samples give potential buyers the opportunity to analyse the coffee beans and make sure they match their requirements before committing to a purchase. Buyers may only authorise a purchase after they have verified the sample. Hence, when you send a sample, make sure it is a true representation of the coffee you will be selling the client.

Make sure to agree with your potential buyer on when and what kind of samples to send (defining quantity, packaging, labelling). Samples usually consist of 300 grams of green coffee beans which can be vacuum-packed or packed in zipped plastic bags.

You may also agree on the accompanying documentation. Samples are often sent with a fact sheet providing information such as variety, altitude, location, annual production, harvest and marketing season, processing system, anti-pollution measures, warehousing and dry processing. Remember that the costs for sending the sample are often assumed by the supplier.

Figure 11: Example of a sample

Source: Nordic Approach

Be a consistent and reliable supplier

Roasters, distributors and retailers working with mainstream products look for suppliers who are consistent and reliable in terms of product quality and volumes. This is crucial as roasters plan their production, especially their blends. Inconsistent supplies are a risk for roasters. As roasters in Morocco import directly, they need to have constant supplies and cannot face stock shortages. Consistent and year-round quality is essential. Roasters often ask to work on a supply contract base with their suppliers.

If you manage to supply consistent volumes and have good and effective communications with your buyer, your relationship may turn into a long-term partnership. This requires you to understand your buyer’s requirements and needs and to involve them in your considerations. Always provide them with clear and prompt information, especially regarding price, contract, quality, transportation and changes in production.

Tips:

- Study the cultural and business etiquette in Morocco. Some recommended websites are Culture Crossing Guide and Commisceo Global.

- Make sure to have clear, up-to-date and reliable information on your product range. Buyers might expect you to have product specification sheets. Never make claims that you cannot support, for instance on the quality or volumes you are able to offer. To achieve this, you must be in control of your supply chain.

- Plan a trip to Morocco to meet coffee roasters and learn about the coffee culture. Bring well-labelled samples, business cards and proper attire.

- Work on an irrevocable documentary credit basis when making agreements with your buyers. This means that the agreement cannot be cancelled or amended without the consent of all parties concerned. Do not send credit documents directly to your buyer.

Lisanne Groothuis from ProFound – Advisers In Development with support from Bettina Balmer carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research