7 tips on how to become EUDR compliant in coffee

The European Union’s Regulation on Deforestation-free Products (EUDR) has been developed to ensure that specific products sold in the EU are not grown on deforested land. The regulation is part of a broader regulatory strategy by the EU to address human rights and environmental degradation in agricultural supply chains. The requirements apply to traders and operators in the EU. However, for exporters it is important to learn about the requirements and understand what information EU importers will need. This can help meet the demands, build trust with existing buyers and create opportunities to attract new buyers.

Contents of this page

- Familiarise yourself with the EUDR

- Learn about collecting the documentation required for EUDR compliance

- Find out what support is provided by the EU

- Learn about enforcement by local authorities in the country that you export to

- Learn about how others are preparing for the EUDR

- Use the EUDR to gain a competitive advantage

- Learn about the costs of compliance

1. Familiarise yourself with the EUDR

The EUDR requires companies to ensure that the products they place on the EU market are legal and do not come from areas that were deforested after December 31st, 2020. It applies to importers and exporters based in the EU, as well as companies in the EU that are further down the supply chain. This includes major roasters and retailers. The EU defines these as “traders” and “operators”.

These companies need to prove that the coffee is traceable to farm level and did not come from deforested areas. They also need to prove that the coffee is bought and produced in full compliance with the regulations of the producing country. This chapter describes the key requirements for EUDR compliance.

What is the EUDR and why was it developed?

Climate change is one of the biggest challenges of our time. Climate change refers to long-term shifts in temperatures and weather patterns. Humans are responsible for almost all global warming over the last 200 years. Climate change causes extreme droughts, water scarcity, severe fires, rising sea levels, flooding, melting polar ice, large storms and declining biodiversity.

Deforestation is one of the main drivers for climate change and loss of biodiversity. It is responsible for more than 10% of global greenhouse gas emissions. The EU contributes to deforestation by using products that are produced on deforested land. Coffee is responsible for 7% of deforestation driven by the EU.

The EU is taking action to address these issues and fight climate change through changes in regulations. These changes are part of a broader global context. This includes legally binding treaties such as the Paris Agreement and soft law instruments such as the UN Sustainable Development Goals (SDGs).

In 2019, the European Commission (EC) published a communication on stepping up EU action to protect and restore the world’s forests. This communication resulted in the European Green Deal, the EU Biodiversity Strategy and the Farm to Fork Strategy. Through the European Green Deal, the EU aims to become a climate-neutral continent. This is a binding commitment under the EU Climate Law, which includes a target to reduce emissions by at least 55% by 2030.

The EU has a lot of influence as a consumer and trader of agricultural commodities. As part of the European Green Deal, the EU has developed the Regulation on Deforestation-free Products (EUDR). The EUDR requires companies to prove that the products they import do not come from deforested land and have not contributed to forest degradation. Only deforestation-free products can be placed on the EU market.

The EUDR aims to limit the EU market’s impact on global deforestation, forest degradation and biodiversity loss, promote deforestation-free supply chains, reduce the EU’s contribution to greenhouse gas (GHG) emissions, and protect human rights and the rights of indigenous people.

Figure 1: Deforestation is one of the main drivers of climate change and biodiversity loss

Source: Photo by Renaldo Matamoro on Unsplash

What is the scope of the EUDR?

The EUDR defines the scope for projects and company types, and determines which countries and trades need to be compliant. These requirements are explained in the following section.

Coffee is within the scope of the EUDR

The EUDR covers seven commodities: cattle, cocoa, coffee, palm oil, rubber, soya, and wood. For coffee, the EUDR covers coffee products with the following HS-code:

- 0901 Coffee, whether or not roasted or decaffeinated; coffee husks and skins; coffee substitutes containing coffee in any proportion.

According to 2024 reports, soluble coffee is not included. You can find the full list in Annex 1 of the EUDR.

Operators and traders are within the scope of the EUDR

The EUDR applies to operators and traders.

An operator is any “natural or legal person who, in the course of a commercial activity, places relevant products on the market or exports them”. Placing on the market means the first time that the product is made available in the EU. Operators also include companies further down the supply chain that convert the product.

A trader is “any person in the supply chain other than the operator who, in the course of a commercial activity, makes relevant products available on the market”. Making available on the market means any company that sells the coffee product for distribution, consumption or use in the EU.

An SME is a micro, small or medium-sized enterprise. The balance sheet total, net turnover and number of employees, determine whether a company is an SME. This is defined in Article 3 of Directive 2013/34/EU. Some requirements and timelines are different for SME companies.

This study will focus on information that is relevant for coffee producers and SME exporters that are based outside the EU.

Only EU countries are within scope

The EUDR applies to products imported into and exported from the 27 EU countries. In 2024, these countries are Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

The EUDR does not apply to imports into countries outside the EU, such as the United Kingdom, Switzerland, Norway and some other European countries.

The EUDR applies to both import and export

The EUDR applies both to exports and imports. If a coffee product that is within scope is exported from an EU country to a country outside the EU, then the EUDR requirements also apply.

The EUDR starts on December 30, 2024

The EUDR was adopted on May 31, 2023 and entered into force on June 29, 2023. The main prohibitions and obligations under the EUDR will not apply until December 30, 2024, giving operators and traders an 18-month transition period to implement the new rules.

From December 30, 2024 onwards, coffee can only be placed on the EU market or exported if it complies with the EUDR requirements.

Companies need to prepare their shipments well before the start date. Coffee contracts are often arranged far in advance: some coffee for 2025 was already purchased in the first half of 2024.

SME traders and smaller operators will receive an extra six months to ensure compliance. The EUDR will apply to SMEs on June 30, 2025.

What are the mandatory requirements for coffee?

The coffee can only be placed on the EU market if the coffee is:

- Deforestation-free.

- Produced in accordance with producing country legislation.

- Covered by a due diligence statement.

Coffee must be deforestation-free and legal

The coffee must be produced deforestation-free and according to producing country legislation.

Imported coffee must be deforestation-free. This means that the land used for coffee production has not undergone deforestation since the cut-off date of 31 December 2020. Deforestation is defined as the conversion of forests into agricultural land.

Deforestation-free includes land that is free from forest degradation. Imported coffee cannot come from land that was subject to forest degradation. Forest degradation means structural changes to the forest structure, for example from primary forest to plantation forest or planted forest.

Coffee agroforestry systems are also classified as agricultural land use. While managing shade trees within agroforestry systems does not constitute deforestation, the conversion of natural forests into agroforestry systems does fall under the EU definition of deforestation.

Imported coffee must comply with the laws on legal production that apply in the country of production. This includes land use rights, the protection of the environment, rules about the forest, human rights and the rights of indigenous peoples, and tax, trade and customs regulations. This is defined in Article 2.40 of the EUDR.

Companies must set up a due diligence system

EU traders and operators need to set up a due diligence system. The traders and operators must take three steps:

- they must collect evidence that the product is traceable, deforestation-free and legal.

- they must determine the risks of non-compliance.

- if any risks are identified, they must take action to mitigate them.

Companies must set up a due diligence systemThe EUDR will create a benchmarking system for assessing the risk of deforestation in different countries or regions. This system will categorise producing countries into three different risk levels based on the level of deforestation risk: Low risk areas, Standard risk areas, and High risk areas.

Companies only need to take the first step for coffee that comes from a Standard risk country or region. However, the coffee will still be subject to the same traceability requirements. All three steps need to be taken for coffee from Standard risk or High risk sources. Coffee from Standard risk and High risk sources will also be checked more frequently by the local authorities (1% for Low risk, 3% for Standard risk and 9% for High risk).

The EU plans to publish the EUDR risk levels for each country by December 30, 2024. However, the risk categorisation has been postponed until 2025. Until the risk classification of countries is officially determined, all sources will be treated as Standard risk. This means that all three steps need to be taken for all coffee regardless of its origin. Local authorities will need to check 3% of all coffee.

Traceability and geolocations are needed

Companies need to provide in their due diligence statements the geolocation points of the plots of land where the coffee comes from. Polygon mapping is mandatory for plots larger than 4 hectares. GPS points can be collected for plots that are smaller than 4 hectares. The coffee must be traceable to the specific plots where it was cultivated.

Coffee cannot be mixed with coffee of an unknown origin. Geolocation coordinates must be available for all coffee that needs to be EUDR compliant.

If the operator declares ‘in excess’ in the due diligence statement, they take full responsibility for compliance of ALL plots of land for which a geolocation is provided. This includes plots of land that are not used to produce the coffee that is shipped.

Due diligence statements need to be uploaded to the information system

The due diligence statement needs to be uploaded to the information system. Producers and exporters from producing countries do not need to do this if they are not within scope of the EUDR. Traceability and geolocations are needed

The requirements are slightly different for SME operators. They do not need to do due diligence on products if this has already been done by their supplier. They also do not need to submit a due diligence statement to the information system. However, they still need to provide due diligence reference numbers. Read the requirements on the EU website for more details.

The obligations of non-SME traders are the same as the obligations of non-SME operators further down the chain (those that convert the product).

Learn more about the information system in the tip about support provided by the EU, or read more about the Deforestation Regulation implementation.

Poverty is recognised as a root cause of deforestation

The EU expects that a fair price is paid to producers, especially smallholders. Although this cannot be enforced legally, the EUDR stipulates that “reasonable efforts” should be made to ensure that a fair price is paid to producers. This is to ensure a living income and address poverty as a root cause of deforestation.

Who is responsible for ensuring EUDR compliance within an organisation?

The EUDR applies to operators and traders in the EU. They are responsible for compliance with the EUDR. They are also responsible for the accuracy of the geolocation coordinates.

The requirements do not apply to producers and (SME) exporters from producing countries. They are not responsible for compliance. However, if they sell to EU traders or operators, it is important that they provide all the relevant information the right way. For exporters it is important to know what information EU traders and operators will need.

Producers can prepare for EUDR compliance by collecting the relevant information about their plots of land, and share this with their buyers.

Producer groups and farmer associations can prepare for EUDR compliance by supporting farmers with geolocation mapping and traceability. They can then provide all the relevant information to their buyers.

Middlemen can prepare for the EUDR by ensuring that the coffee they buy and sell is fully traceable. It must also include the geocoordinates of the plots of land where the coffee was produced.

What are the consequences of non-compliance?

If part of the shipment is non-compliant, then that part must be separated from the EUDR compliant part. If this is not possible, then the entire batch or shipment is considered non-compliant. It can therefore not be sold on the EU market.

If an EU operator or trader is non-compliant, they can be fined by the EU. The fines can be up to 4% of annual turnover. It can also include confiscation or exclusion from public funding or contracts.

Some companies are taking a risk-based approach to batch management. They plan to source larger batches from low-risk production areas, and smaller batches from high-risk production areas. With the high-risk areas more likely to be flagged for deforestation, the risks of losing a batch are smaller if the batches themselves are smaller.

Many stakeholders are calling for the sector to support high-risk producers rather than leave them out of their supply chain. These high-risk producers may be compliant with the EUDR if they are properly mapped and documented. This may take more effort, but the result is that marginalised smallholder farmers are not excluded from the supply chain. Having a broad range of coffee-producing countries also contributes to a rich variety of flavours and qualities. Exporters can help coffee farmers by supporting the higher-risk farmers as well.

There are calls from the industry for a delay of the EUDR. In December 2023, the European Coffee Federation (ECF) sent a letter to the European Commission urging the delay of the implementation of the EUDR. While there are still some uncertainties, the EUDR is widely supported by the coffee sector. The industry has been involved in the development of the Regulation since 2019. The European Coffee Federation supports the political objective and high level of ambition of the regulation. Individual companies such as Neumann Kaffee Gruppe have also come out in support.

Tips:

- Stay informed on the developments of the EUDR. Keep an eye on news related to the EUDR, especially the risk levels. If the country from which you buy is classified as High risk, then that might change the requirements for your buyers. Visit the Deforestation Regulation implementation webpage of the EC for more information.

- Talk to government agencies. Read our study on Tips for doing business with European coffee buyers for more information about government agencies.

- Talk to sector associations such as the European Coffee Federation and Koffie en Thee Nederland. Read our study on Tips to find buyers for more information about sector associations.

- Speak to your buyers about paying a fair price to producers, especially smallholders. The EUDR can be used to support farmers receive a higher income.

2. Learn about collecting the documentation required for EUDR compliance

To provide your buyers with the right information, it is important to know what documentation is required. The key documentation is described in this chapter.

Collecting information for the due diligence statement

EU traders and operators must collect the following information:

- Product description

- Quantity

- Country or region of production

- Date of harvesting

- Geolocations

- Name, email and address of suppliers

- Name, email and address of buyers

- Deforestation-free evidence

- Evidence of legal compliance

The documentation must be kept for at least 5 years. See Article 9 of the EUDR for more details.

Performing a risk assessment

The risk assessment needs to consider at least:

- The risk level of the country or region.

- The presence of forests, and deforestation and land degradation in the country.

- Cooperation and collaboration with indigenous people present in the country.

- Documentation supporting this evidence.

- Concerns related to the producing country or companies in the supply chain.

- The structure and risks of the supply chain.

- Evidence from service providers or third-party certification that supports the risk assessment.

For full details, see Article 10 of the EUDR.

Collecting the geolocations of the plots

EU traders and operators must provide the geolocation of the plots of land where the coffee was produced. This must be done with either a polygon or a GPS location.

A polygon is a drawing around the perimeter of the plot of land. It must have enough latitude and longitude points to describe the perimeter. Each point must have at least six decimal digits. Polygons are required for plots larger than 4 hectares.

A GPS point is a single point on the plot of land. The GPS point must have at least six decimal digits. GPS points are required for plots of land smaller than 4 hectares.

There are many tools available that can help you map plots of land. See the tip on tools and resources for more information.

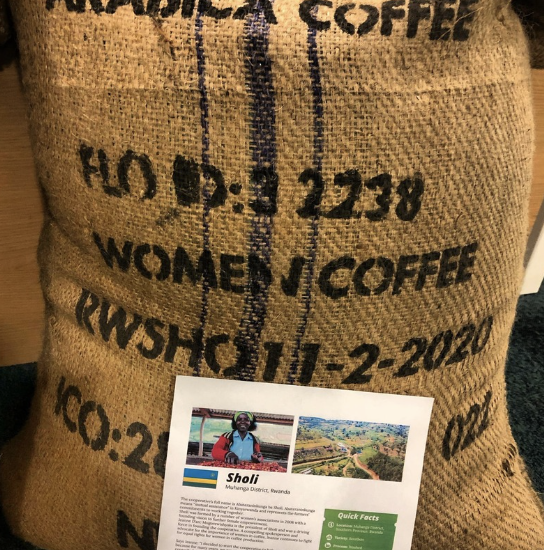

Figure 2: A bag of green coffee in Rwanda

Providing deforestation-free evidence

The geolocations must be checked against maps to determine if the plots are deforestation-free. This can be done in three stages:

- Geolocations

- Forest cover data at the 2020 cut-off point

- Protected area boundaries

Other sources can be used to support the analysis. This includes national data on deforestation and protected areas.

There are several public sources available for mapping and analysing the geolocations. A few examples are:

- The EU Forest Observatory map, produced by the JRC. It shows annual global forest cover changes between 2016 and 2022. This map is likely to be the primary map used by competent authorities to assess compliance.

- Global Forest Watch, which was established in 1997 and can be used to monitor forests worldwide.

- Global Forest Change data from the Global Land Analysis and Discovery (GLAD) laboratory of the University of Maryland.

- Tropical moist forest data from the Joint Research Centre (JRC) of the European Commission. It has information on changes in forest cover from 1990 to 2021 in the humid tropics.

- The Natural Lands map by the Science Based Targets Network and the World Resources Institute (WRI). It was developed to help companies with their commitments on "no conversion of natural ecosystems”.

- Worldwide land cover mapping. Provides global land cover for 2020 and 2021 at 10-meter resolution.

- The Copernicus Land Monitoring Service (CLMS). This is a free tool provided with support from the EU.

There is not one single source available that operators can use to determine the deforestation status of the plots. Some maps do not accurately identify whether an area is covered by forest or agriculture. This is especially the case with agroforestry, which is not considered a forest by the EUDR but can look like a forest on satellite images. A high number of shade trees can also make identification difficult. Cloud cover can also make it more difficult to monitor forests.

There are some regions where the maps are more accurate. This is the case when there is a clear difference between forests and agriculture. This is easier to see with plantation-style production. Some countries have also recently published detailed maps, for example Côte d’Ivoire. Service providers can help you identify forests and plots available for agriculture.

There are some differences between the definitions of the EUDR and local definitions. For example, the definition of forests in Peru is not aligned with the EUDR definition. Brazil has already digitised a large part of coffee production maps, but other counties still have a way to go. Producing countries need support from the EU and the industry to help with the transition to EUDR compliant production.

The use of these systems and maps does not guarantee compliance with the EUDR. Some maps may not be accurate enough. They can be used for the risk assessment, but they are not definitive proof that the plot of land is deforestation-free. On-the-ground checks might be necessary.

It is also important to verify legal compliance with local legislation. Farmers may have permission from the government to produce coffee in protected areas. Collecting evidence is essential.

There are many tools and organisations that can provide support. See the tip on service providers for more details.

Tips:

- While companies have a responsibility to ensure EUDR compliance, a large share of the work falls on the shoulders of farmers and producer organisations. Companies will have new demands for producers to collect and maintain detailed information about their operations. It is important to assist them in this work by providing support and resources. By working together, you can help them to organise the flow of required information. This makes it easier for producers to provide the documentation to any buyer.

- Support the collection of the geolocations for the plots where your coffee is produced. Make sure that the producers that you buy from have the geolocations available. If possible, verify that they are correct, and provide this evidence to your buyer.

- If you are collecting geolocation data from the producers, it is important to share this data with the producers. They need to have data ownership to get better access to EU markets. This gives farmers more opportunities, and therefore more power to get a better price for their products. Poverty is a driver of deforestation, so paying farmers more also helps fight deforestation.

- Research the best maps available for your production country or region. On-the-ground checks can help confirm whether an area has been deforested or not. These checks may be easier for an exporter to do, since they are closer to the production area. By checking the geolocations against the deforestation maps, exporters can increase the quality of the documentation that they give to their buyers.

- Collect all the necessary documentation for EUDR compliance. Producers and (SME) exporters do not need to give this evidence to the EU, but your buyers may ask for this information. You can help your buyers by having this information readily available. This will also help build trust with your buyers, and potentially lead to new buyers.

3. Find out what support is provided by the EU

The EU provides many services and systems to support compliance with the EUDR. In this chapter you can learn more about the options.

Learn about the Team Europe Initiative on Deforestation-free Value Chains

The Team Europe Initiative on Deforestation-free Value Chains (TEI) focuses on supporting partner countries, including public and private-sector stakeholders. The TEI will be an entry point for producing countries needing support or access to TEI services. As part of the TEI:

- the Zero Deforestation Hub will provide information about partnerships for deforestation-free value chains and help coordinate actions related to this.

- the Sustainable Agriculture for Forest Ecosystems (SAFE) Project focuses on supporting smallholders and assisting producing countries to ensure access to the EU market. SAFE is operational in Brazil, Ecuador, Indonesia and Zambia. More activities will start in the Democratic Republic of the Congo and Vietnam in 2024.

- the Technical Facility on Deforestation-free Value Chains will provide expertise and technical support based on the needs in producing countries. The facility will be launched in 2024. They expect to work on needs assessments, geolocation, land-use mapping and traceability systems.

Become familiar with the deforestation information system

In 2024, the EU is developing and piloting an information system. EU traders and operators upload their due diligence statements to the information system. The competent authorities use the information system to check due diligence Statements.

The first pilot of the system was completed in January 2024. A demonstration was given to members of the European Coffee Federation (ECF) in February 2024. The second pilot phase is scheduled to take place in the middle of 2024. It should take place with the same companies that took part in the first pilot. For coffee, these are CAFEA Group, Hacofco, Illy, Louis Dreyfus Company, Nestlé, Ofi, Sucafina and Ibericafé.

The tool is expected to be open to user registration in November 2024. The launch is planned for mid-December 2024. Operators and traders can then start submitting due diligence statements to the system.

The API interconnection function is also expected to be ready by then. With an API, companies can connect their own system directly to the EU’s deforestation information system. The technical specifications for the API are publicly available so operators can develop the connection to the system.

Figure 3: The EU rules guarantee that the products EU citizens consume do not contribute to deforestation or forest degradation worldwide

Source: Photo by Guillaume Périgois on Unsplash

Tips:

- Check if the Team Europe Initiative on Deforestation-free Value Chains can give any support to you or your producers.

- Follow the progress on the development of the information system. Check the EU website on the deforestation information system.

Learn about the relevant tools and resources that are available

There are many tools and resources available to help you supply coffee that is compliant with the EUDR. Several service providers are also available to support you. Many other tools are still being developed in 2024, while the coffee sector is preparing for the EUDR.

First, determine whether a tool or service provider is needed. It is not always necessary to work with a service provider or certification programme. Operators can also be compliant without using one. Focus on the requirements of the EUDR, and then determine if you need support.

If you are looking for a tool or a service provider, it is important to first compare the different options. Important factors to consider are the purchasing costs, the operational costs, which goods are covered, monitoring and reporting options, and flexibility. It can also be useful to look at current customers and check if they are already active in the country where you are located.

Use free tools for geolocations and risk analyses

Collecting the geolocation coordinates of a plot of land can be done using Geographic Information Systems (GIS) or other devices. Some of these tools are available for free. Examples include:

- Most smartphones. One example is using OpenStreetMap apps. Be aware that the GPS data on smartphones may not always be accurate enough.

- Handheld Global Navigation Satellite System (GNSS) devices. These do not require mobile network coverage, only a solid GNSS signal.

- The geolocation tool developed by EUSPA and TechnoServe. Their free tool will allow producers to capture and share geotagged farm-level sourcing data.

- INATrace is a free digital open-source solution that focuses on the traceability of global supply chains.

- TradeAware Lite is the free version of the LiveEO EUDR compliance tool.

Consider working with service providers

There are many service providers that are offering tools and services for EUDR compliance. These may have different levels of expertise or experience. It is therefore very important to first consider whether you need to work with a service provider.

It is important to remember that a lot of work will still need to be done by your own organisation. Exporters need to invest in the capacity of their own staff as well. Make sure that you understand the EUDR and what kind of information is needed. Consider if you can have the right expertise within your organisation. Look at whether your current systems or a free solution could be enough to achieve this. Companies should not rely only on a third-party service provider. If you still need to work with a service provider, then it’s important to choose your service provider carefully.

Exporters should carefully consider the price and length of the contract. The EUDR is a new regulation, and the tools and services are therefore also relatively new. It will take time to develop and improve these tools. Consider that the service provider landscape could look very different a few years after the EUDR is fully implemented.

There are many service providers that can help you with your EUDR compliance. Some examples (listed in alphabetic order) are:

- Beyco is a platform that can be used to verify deforestation risk.

- Farmforce Integrated Enterprise Deforestation Monitoring can help with field mapping, compliance and data quality assurance.

- Frontierra provides geospatial services, risk analysis, risk assessment and the development of a due diligence system.

- Global Traceability has developed a tool called RADIX Tree that is an end-to-end product for the entire compliance process.

- Koltiva can help with supply chain mapping, deforestation checks, traceability, due diligence statements and compliance.

- Meridia Verify can be used to verify data quality, deforestation, legality and traceability.

- Nadar uses satellite-powered technology to enable businesses to ensure traceability and track deforestation in their global supply chain.

- Satelligence can help with traceability, risk assessment, risk mitigation and submitting due diligence statements.

- Single Earth EUDR Tool for Geolocation.

- Sourcetrace focuses on sustainable agriculture and empowerment of farmers.

- Taroworks is a social enterprise that sells a mobile data platform to help organisations with data collection, monitoring, sales and inventory management in the field.

- Terra-i+ can help prepare for EUDR compliance and check farms for compliance.

There are many other service providers available. It is important to research several options before making a choice based on your needs.

Learn about the role of voluntary certification programmes

Voluntary Sustainability Schemes (VSS) can assist with EUDR compliance. This includes certification programmes. However, they do not replace the due diligence obligations of the companies. This means that even if a product meets the requirements of a VSS, it will not automatically be considered compliant with the EUDR.

These schemes can be used to support companies with their risk assessment. They can also help with geolocation data, traceability and other documentation that is needed for compliance. This includes VSS such as Fairtrade, Rainforest Alliance, 4C and Enveritas. See the case study for more information about Enveritas.

Rainforest Alliance can provide support

Rainforest Alliance supports EUDR Compliance from Farm to Retailer. The system was adjusted in 2024 to make it possible to buy and sell coffee according to the EUDR requirements.

The first step is EUDR compliance at production level. Rainforest Alliance has adjusted their standard for alignment with the EUDR requirements. Farmers can select these specific criteria when they go through the certification process. If they are certified with these criteria then they can deliver EUDR-compliant coffee to the first buyer in the chain.

The next step is to set up the right level of traceability. Rainforest Alliance offers the necessary traceability levels of Identity Preserved (IP) and Mixed IP. All companies in the supply chain will need to be certified against this traceability level to buy and sell fully-traceable Rainforest Alliance certified coffee.

Fairtrade can provide support

The Fairtrade Standards complement the EU deforestation law. Fairtrade has updated its coffee standard to meet EUDR requirements. The updated standard will take effect in 2026. The necessary traceability levels are already possible in the Fairtrade system. Fairtrade aims to have all georeferencing data of Fairtrade coffee farms by the end of 2025.

Fairtrade has partnered with Satelligence to scale up satellite monitoring of forested areas and farms to all certified cocoa and coffee producer organisations globally.

Fairtrade also highlights that poverty is a root cause of deforestation, and that deforestation can only be stopped if root causes are addressed. The Fairtrade Minimum Price and Fairtrade Premium can contribute to a living income. This also lines up with the expectation of the EU that a fair price is paid to producers.

4C can provide support

4C partners with Global Risk Assessment Services (GRAS) to provide an EUDR solution to EU importing operators and their suppliers. Through GRAS, it provides the tools to collect geocoordinates of the production areas and farmer IDs. Related legal documents to provide evidence on tenure and land use rights can also be uploaded. The information is then checked for deforestation in the database. The system also allows companies to do the risk analysis and provides the basis for the risk mitigation.

Traceability is provided throughout the entire supply chain. The existing 4C Portal can be used for uploading and replicating the coffee flow to demonstrate traceability. Relevant ‘deforestation-free’ documentation can be attached.

Organic can provide support

Organic already requires full traceability along the entire supply chain. Non-organic coffee cannot be mixed with organic coffee, to ensure that it keeps its organic status. This has the benefit that traceability is already in place.

However, organic certifications are not necessarily aligned with the EUDR. Check with the organic certification that you use to learn more about the details.

Learn more with online training

Free training videos are available online. See for example the training videos and webinars published by Preferred by Nature, Geo for Good, the International Coffee Organization and Rainforest Alliance.

There are also many guides available. The OECD and FAO have published a comprehensive Business Handbook on Deforestation and Due Diligence in Agricultural Supply Chains. Service providers have also provided guides. See for example the guides of Swift Geospatial.

Tips:

- Research the options. For example, check the free Fine Cacao and Chocolate Institute tool that benchmarks service providers. The tool lists solutions for both coffee and cocoa. You can find the coffee solutions in the column called “Target customers”. The tool assesses the solutions on what they are able to provide, including mapping, verification, traceability and security. Forests of the World recommends seven things to consider when you are choosing a service provider.

- Talk to your current service providers. They may be able to help you with EUDR compliance as well.

- Do not rely only on service providers. Exporters will also need to do and understand a lot of this work, so this cannot all be outsourced to a service provider. Make sure that you understand the EUDR and what kind of information your buyers may need. Invest in the capacity of your own organisation. By building your own capacity, and taking on part of the work yourself, you can also save money. You do not need a service provider for everything. It also gives you more flexibility as an exporter. You are less dependent on external parties and the contracts you have signed with them.

- If you are selling certified coffee to your buyers, talk to your suppliers and buyers about their certification level. Make sure that they are all certified at the right level for EUDR compliance to avoid problems along the supply chain.

- Read the CBI study Tips for going digital in the coffee sector for more information about digital service providers.

4. Learn about enforcement by local authorities in the country that you export to

The EUDR will be enforced by competent authorities in the Member States. They will check the compliance of relevant products based on the due diligence statements submitted by the operators. The implementation can be slightly different from country to country. The European Commission is working closely with the competent authorities to ensure correct implementation. Together, they make sure that the same rules apply regardless of which port they use to enter the EU.

The countries that import the largest volumes of coffee are Germany, Italy and Belgium. For information on other countries, see the EU list of national competent authority (authorities) and contact points. See also our study on Tips for doing business for more information about custom requirements in EU countries.

Germany

The competent authorities for Germany are Bundeskriminalamt (Federal Criminal Police Office) and Bundesnetzagentur (Federal Network Agency). The contact point is Bundeskriminalamt, TCO-VO (department ST).

Italy

The competent authorities for Italy are Uffici del Pubblico Ministero presso, the Ministry of Internal Affairs (Department of Public Safety), the Ministry of Justice, and other ministries. See the full list of national competent authorities for details. It also lists 25 contact points.

Belgium

The competent authorities for Belgium are:

- Federal prosecution service (Federaal parket/parquet federal)

- Section Directorate for Combating Serious and Organised Crime (DJSOC)

- Belgian Institute for Postal Services and Telecommunications (BIPT)

The point of contact is the Federal prosecution service.

Tips:

- Watch the CBI webinars about the EUDR for more details. The webinar on the EUDR in the cocoa sector took place in June 2024, and the webinar on coffee is scheduled to place in September 2024. Check the CBI events page for details.

- Remember that it is the responsibility of the importer to submit the due diligence statement and prove compliance. As an exporter from a producing country, you only need to provide the information to your buyers.

5. Learn about how others are preparing for the EUDR

The coffee industry is working hard to prepare for compliance. Some companies are more prepared than others. Companies that source certified coffee and specialty coffee often already have more traceability set up. Rainforest Alliance and Dimitra already shipped EUDR compliant coffee in the first half of 2024.

The coffee sector is also working on compliance through various platforms and initiatives. One of these platforms is the Global Coffee Platform (GCP). GCP uses an Equivalence Mechanism that determines if a company’s sustainability standard can be considered equivalent to the Coffee Sustainability Reference Code. According to the GCP, the Equivalence Mechanism can also play a role as a supporting tool for meeting EUDR requirements. Organisations such as the International Coffee Organization (ICO) help inform the coffee sector of their obligations and raise awareness.

With the EUDR starting in December 2024, and with some coffee that will be sold in 2025 already in supply chains, it is important to prepare as soon as possible. Exporters can learn from what other companies are doing to prepare. In this section we present three examples.

Learn about how producers can prepare

There are many things that coffee cooperatives can do to prepare. One example is how Abateraninkunga Ba Sholi is preparing for the EUDR.

Sholi is a Rwandese coffee cooperative that was founded by 30 women in 2008. The cooperative now also includes men, but nearly half of their members are still women. Sholi has partnered successfully with the Progreso Foundation since 2014.

However, success brought new challenges, including managing diverse internal and external data demands. This includes membership registries and certification requirements. The upcoming European Union Deforestation Regulation (EUDR) adds more complexity.

To address these challenges, Sholi adopted the Beyco platform. Beyco offers a central data management tool with insights for internal decision-making. Sholi hired a dedicated data manager to lead this implementation. They registered 552 smallholder farmers on Beyco, complete with geolocations. This database aids internal tracking and positions Sholi well for EUDR compliance.

Sholi's experience offers valuable lessons for other small and medium-sized exporters. Their success shows the importance of commitment to digitisation and innovation. By hiring a dedicated data manager, Sholi ensured that they could effectively use new technologies. This strategic decision has been key in their transition to using Beyco and preparing for EUDR compliance. With the right tools and a dedicated team, small exporters can navigate the complexities of data management and regulatory compliance.

Figure 4: Sholi cooperative in Rwanda

Source: Beyco

Learn about stakeholder partnerships

The approach taken by the ISEAL Alliance is a good example of how stakeholders can collaborate to achieve more together. The ISEAL Alliance is the global membership organisation for credible sustainability standards. Their members include coffee certification systems such as Rainforest Alliance and Fairtrade as code-compliant members and 4C and the Global Coffee Platform as community members. ISEAL works together with their members to ensure alignment with the EUDR in several ways.

In February 2024, ISEAL published credibility criteria for evaluating certification schemes. It includes the minimum criteria that a standard must meet to align with the EUDR requirements. It also explains what is needed for a strong assurance process and traceability and data management. This document can be useful in determining if a certification system can help you with EUDR compliance.

In April 2024, ISEAL published a technical guidance on behalf of their members. The paper identifies opportunities for further guidance for an effective implementation of EUDR. ISEAL convenes the certification programmes to create more alignment. Together, they can accomplish more than by working alone.

Learn about the territorial approach

In the mandatory requirements section, we explained the “in excess” approach. With this approach, the operator takes full responsibility for compliance of ALL plots of land for which a geolocation is provided. One version of this approach is the territorial approach, whereby an entire production area is mapped and monitored.

JDE Peet’s and Enveritas are developing a territorial approach. They have an agreement to verify that coffee that is exported from a specific region or country does not come from deforested land. JDE Peet’s is signing deals with countries to monitor their coffee-growing regions. In April 2024, they had signed deals with Ethiopia, Papua New Guinea, Tanzania, Uganda, Peru, Honduras and Rwanda.

The initiative uses satellite imagery, artificial intelligence, and on-the-ground verification to determine if deforestation has taken place. If deforestation is found, then JDE Peet’s will support local authorities, NGOs, and farmers to reforest the land. The goal is that the entire production area is compliant with the geolocation requirements of the EUDR. The geolocations for all coffee plots in this production area are then provided for any coffee sourced from this area.

Operators can use any approach to fulfil the requirements in the articles. This could include a territorial approach if this leads to compliance with the EUDR. It is therefore important for SME exporters to follow the progress if they trade in a country where this approach is being developed.

There is some concern among NGOs about the territorial approach since it is only based on the deforestation aspect of the EUDR. It does not consider the legality of production or due diligence requirements of other laws such as the Corporate Sustainability Due Diligence.

Tips:

- Consider working together with your current suppliers, buyers and service providers to work towards EUDR compliance. Learn from others that have worked together to prepare.

- Watch the webinar on the EUDR from the International Coffee Organization (ICO). It includes more information about the “territorial approach” at the 36-minute mark.

6. Use the EUDR to gain a competitive advantage

As an exporter, providing the necessary documentation required by the EUDR is not strictly your responsibility. However, being proactive and offering this service can bring significant benefits to your buyers in the EU. This can make you stand out from your competitors and strengthen your business relationships. Having the information available can open doors to new business opportunities and expand your customer base.

EU importers will expect that their suppliers have all the required due diligence and traceability data immediately accessible. This information needs to be properly compiled, digitised, and stored in a way that it can be shared quickly with buyers. You need to be able to share this with your buyer immediately on request. Having the information ready will help strengthen the relationship and create confidence that you can deliver. If the information is not ready, then there is a risk that the buyer will stop buying from you.

However, this should not only be the responsibility of exporters. Exporters should also expect some support from buyers. EU traders and operators should invest in capacity building programmes, especially for smallholder farmers. They should support by offering training on EUDR requirements, data collection methods and tools, and risk mitigation measures.

Being organised also means that you can have the information ready immediately for other buyers or new buyers. This can lead to finding new buyers.

Tips:

- Collect all the necessary documentation for EUDR compliance for your buyers based in Europe. If possible, collect this for other coffee as well. This makes the coffee more attractive to new buyers. Many non-European buyers (for example those based in the United States of America) are also looking to buy coffee that is deforestation-free, in anticipation of a Forest Act. This could also lead to new business outside the EU.

- Exporters should be able to provide proof or assurance that the data is accurate. The importer is liable and would have to pay the fine for non-compliant imports. Expect your buyers to scrutinise the data that you provide, because any mistakes could lead to fines and penalties.

7. Learn about the costs of compliance

It will cost money to ensure that the coffee that you sell is EUDR compliant. This includes costs of geolocation mapping, data collection, traceability, and possibly the management of these things in a system. In 2024, it is not clear yet how much full EUDR compliance will cost, because the EUDR has not yet come into effect. However, it is important to estimate the costs of compliance. Not only for your own budget, but also to support the producers with the extra efforts that they must take. As an exporter you can then factor this into the price.

Calculate the costs of EUDR compliance

For exporters, the main costs are investment costs and ongoing costs. Investment costs include collecting the right documentation about producers, getting the geolocations of the plots, and costs related to traceability. Ongoing costs are keeping this information up to date due to farmer turnover, checking the data accuracy, ongoing traceability costs, tool or service provider costs and more. It can also include audit costs if certification is used for EUDR compliance. An internal control system may need to be set up to manage everything. If you already have a large part of supply polygon mapped, then the impact on the costs is lower.

As part of the EUDR, the EU expects that a fair price is paid to producers, especially smallholders. A fair price might also mean a higher cost for buyers.

In May 2024, public information on the extra cost of EUDR compliance in coffee was not yet available.

Read our study on Tips for doing business for more information about pricing strategies.

Consider contractual agreements

Exporters can include in their contracts with producers which information they will need to provide. This way, the producers know exactly which information is expected, and the exporter knows that the information will be provided. Attention should also be paid to include good purchasing practices.

There is a risk that some producers will be excluded from the EU market if they cannot comply with the EUDR. There are also concerns that the market will focus on those producers that are closer to compliance. For example, there have been reports that coffee buyers are buying less coffee from Africa because of concerns about EUDR compliance.

Many NGOs are calling for more support for smallholder farmers to ensure they are not unintentionally excluded from the EU market. By working with the producers that you already buy from, exporters can help ensure that these producers are not excluded from the market.

Tips:

- Estimate the cost of compliance, and factor this into the price of your coffee. Ensure that producers are sufficiently supported and rewarded for the extra efforts that they need to make.

- Do not exclude producers from the supply chain, but work with them to ensure that they can comply with the EUDR. Work with your buyers on supporting these producers.

Long Run Sustainability carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Search

Enter search terms to find market research