10 tips on how to do business with European coffee buyers

The European coffee sector holds countless opportunities for SMEs looking to export to the continent. But with so much competition in the market, it is important to cultivate great business relationships in order to thrive. To do this successfully, you need to understand the ways and wants of European buyers. Use the tips below as guidelines on how to do business with European buyers. If you are already doing business in Europe, these tips can help improve your relationship with your buyers. If you are new to the market in Europe, these tips will prepare you for your first ventures.

Contents of this page

- Understand the business culture in the European coffee sector

- Be professional in communicating with buyers

- Attend coffee trade shows and conferences and be well-prepared

- Provide good quality samples with the right information

- Follow-up, follow-up, follow-up

- Be well informed about pricing strategies and providing quotations

- Identify and emphasise your unique selling points

- Respect your contractual agreements

- Comply with mandatory sustainability and traceability requirements

- Leverage industry support

1. Understand the business culture in the European coffee sector

The overall business culture in the European coffee sector tends to be formal. Proper etiquette, punctuality, and professionalism are expected. Take time to build personal connections but keep initial interactions respectful and follow established norms. Be aware of notable cultural differences between countries (see Table 1). Strong relationships and trust are crucial, even within a formalised framework. While formal, the industry is not rigid. Personal relationships and trust play significant roles. Table 1 presents differences in the business culture of some European countries. Passport to Trade 2.0 also provides a good overview of differences in business cultures in Europe. An example is that North European buyers are often straightforward and will tell you what they think, whereas Southern European buyers tend to be less direct.

Table 1: Some differences in the business culture of a few European countries to note

| Aspect | Germany | Netherlands | France | UK | Belgium |

| Punctuality | Extremely punctual and efficient in business dealings. | Punctuality in business is regarded as a virtue, although apologies for a late arrival will be accepted good-naturedly. If you are unexpectedly delayed, call ahead. | Relatively punctual. While you should strive to be punctual, you won’t be considered late if you arrive ten minutes after the scheduled time. | Punctuality is expected and appreciated in the UK, but no one really minds if you arrive a few minutes late for a one-to-one meeting, provided there is a good reason e.g. traffic. | Punctuality in business is generally regarded as a virtue. |

| Communication Style | Directness and honesty are valued, avoid excessive flattery. | Comfortable with disagreement. | Impeccable personal presentation and etiquette expected. | Generally open and straightforward. Humour and understatement are commonly used. | |

| Decision Making | Relies on detailed facts/data. | Focuses on functionality. Value formal procedures but also emphasis on long-term relationships and sustainable sourcing. | Relatively bureaucratic. Patience is required, avoid appearing overly pushy. Relationships are important but built slowly over time. | Values input and openness. | |

| Corporate Hierarchy | Respects hierarchical structure. | Values personal connections. | There exists a strong, vertical hierarchy in French business culture. | Corporate hierarchy respected but input welcomed. | |

| Gift Giving | Gift giving is minimal to avoid perceptions of bribery. | They do not expect to give or receive anything other than the due reward for services rendered, but reasonably neutral modest gifts can be accepted. | Modest corporate gift giving only once relationship established. | Conservative attitude toward gift giving. | Gift giving is not normally an aspect of business relations in Belgium. If you decide that some sort of gesture is appropriate, make the gift a reasonably modest one and make sure it is logo neutral. |

Source: Passport to trade 2.0

Be familiar with common coffee industry terms

Familiarise yourself with industry-specific terms and jargon used across the European coffee sector regarding quality, sourcing, processing methods, certifications, and logistics. A shared vocabulary facilitates clear communication. The coffee sector uses specific terms and language that are essential for anyone doing business within the industry to understand. This language includes terms like "cupping" (a method for evaluating coffee quality), "direct trade" (a sourcing practice emphasising direct relationships between buyers and farmers), and "single origin" (coffee sourced from one specific location). Familiarity with this terminology is crucial for effective communication and establishing credibility. Exporters should recognise the importance of this industry-specific language and can learn more through resources such as industry publications, training programmes, and participation in professional coffee associations and trade shows. Understanding and using the correct terminology will facilitate smoother interactions and help build stronger business relationships.

Table 2: Common terminologies in the coffee sector

| Category | Common Terms | Definitions |

| Growing Regions | Central/East Africa, Central America, South America, Southeast Asia | Geographical areas where coffee is cultivated. |

| Variety Names | Typica, Bourbon, Caturra, Gesha, SL28 | Differentiates between various species or cultivars of coffee plants. |

| Main processing Methods | Washed, Natural/Dry, Honey, Semi-Washed | Techniques used to remove the coffee cherry's outer layers and extract the coffee bean. |

| Grading Standards | SCAA/SCA: Specialty Coffee Association of America / Specialty Coffee Association COE: Cup of Excellence | Standards used to assess the quality and characteristics of coffee beans. |

| Cupping Flavours | Nutty/cocoa, Sweet, Floral, Fruity, Sour/Fermented, Green/Vegetative, Roasted, Spices, Chemical, Papery/Musty | Sensory characteristics of brewed coffee, often assessed through cupping sessions. |

| Terroir | Soil Composition, Climate, Altitude, Microclimate | Environmental factors influencing the characteristics of coffee grown in a particular region. |

| Microlot | Small-Batch, Limited Availability, Single-Origin | A small, distinct batch of coffee beans from a specific plot within a farm or region. |

| Fair Trade | Fair Prices, Fair Wages, Sustainable Farming Practices | Ensuring fair wages and working conditions for coffee producers, promoting sustainable farming practices. |

| Direct Trade | Direct Relationships, Transparency, Fair Prices | Sourcing model based on direct relationships between coffee roasters and producers. |

| Elevation/ Altitude | High Altitude, Low Altitude, High-Grown, Low-Grown | Height above sea level at which coffee is grown, influencing its flavour development and quality. |

| Blend | Blend Composition | Mixture of different coffee beans or roast levels, crafted to achieve a desired flavour profile and consistency. |

| Roast Profiles | Light Roast, Medium Roast, Dark Roast, Roast Duration, Roast Temperature | Characteristics of a coffee roast, including roast level, duration, and temperature, impacting flavour and aroma. |

| Acidity | Lively, tangy, sharp, bright, juicy, sparkly and so on | Desirable characteristic contributing to coffee's brightness and flavour complexity. |

| Body | Medium body, Full-Bodied, Light Body | Tactile sensation and mouthfeel of brewed coffee, ranging from light and delicate to full-bodied and creamy. |

Other terms used in logistics and shipping include:

- FOB (Free on Board): This term means that the seller is responsible for the products until they are placed aboard the vessel for shipment. After that, the buyer takes responsibility.

- CIF (Cost, Insurance, and Freight): CIF is a pricing model that includes the cost of the goods, insurance, and freight charges up to the final port. These charges are the seller's responsibility until the items arrive at the destination port.

- Certificates of provenance: These certificates certify the provenance of the goods, namely green coffee. They may be required for tariff rates and guarantee adherence to trade agreements by customs authorities.

- Phytosanitary Certificate: This document certifies that the exported green coffee meets the phytosanitary standards of the nation of import by being free of pests and diseases.

- The International Chamber of Commerce (ICC) publishes Incoterms, which are standardised words used in international trade. EXW (Ex Works), FCA (Free Carrier), and DDP (Delivered Duty Paid) are also examples of frequently used Incoterms that outline the obligations of the buyer and seller in a transaction.

The language and terminology can vary based on the specific European country, company, or an individual's background. But in general, coffee traders and processors use this specialised vocabulary to efficiently communicate about bean quality, sourcing, and logistics. Also, certain acronyms like ICO (International Coffee Organization), and HACCP (Food Safety Certification) may be used.

Be cautious about giving gifts

Gift-giving practices in business relationships can vary significantly across cultures, and it's essential to approach this aspect with caution when engaging with European buyers, particularly during the initial stages of establishing a professional relationship.

Once a solid business relationship has been developed and a foundation of trust has been built, small regional gifts or items representative of your company's origin or culture can be appropriate gestures to strengthen ties and show appreciation. These gifts should be modest in value and presented in a professional manner, without any expectation of reciprocation or favouritism.

When presenting any gift, it's essential to provide context and explain the cultural significance or regional connection behind the item. This adds value and meaning to the gesture, showcasing your appreciation for the business relationship and your desire to share a piece of your origin with your European partners.

Tips:

- Read more about the business etiquette of other EU countries here.

- Refer to CBI’s Tips for Organising Your Coffee Export to Europe to learn more terminology about logistics and contracting in coffee. Also, identify key topics you want to learn about regarding coffee export and marketing and check out the latest edition of the ITC Coffee Guide for more. Check out examples of coffee product specifications on Trabocca’s website to learn more terminology from the coffee sector.

- Be mindful of the gift policies and cultural sensitivities of the European company or individual involved. If there is any uncertainty or potential for misinterpretation, it's best to err on the side of caution and refrain from gift-giving until a deeper understanding of the appropriate protocols has been established.

- Learn about unethical gifting with the cooperate sector in some European countries.

2. Be professional in communicating with buyers

Coffee is fundamentally a people and relationships business, where knowing your clients and buyers is the key to success. Building strong, trust-based relationships is essential, as it fosters loyalty and repeat business. To maintain these relationships, effective communication is crucial. Initial contacts are best made through clear, concise emails, followed by teleconferences or video calls for more detailed discussions. Face-to-face meetings are invaluable for deepening connections and understanding your client’s needs. Regular check-ins, sharing industry insights, and personalised touches like sending coffee samples can also help strengthen these bonds and ensure long-term partnerships.

When approaching a potential European coffee buyer or partner for the first time, it's essential to adopt a formal and professional communication style. Initial interactions should be respectful and follow established business norms. There can be several layers of contact.

Ideally, the first contact with a buyer is in person. Such as meeting in the place of origin, or at a trade show like the World of Coffee (WoC), Specialty Coffee Expo (SCE), or the African Fine Coffees Association (AFCA) conference. These settings provide a great opportunity to establish a strong initial connection, discuss products in detail, and demonstrate commitment to quality and partnership.

Otherwise, you can also start with an introductory email: start your outreach with proper due diligence; know what a buyer is looking for. Are they looking for specialty coffees and single origin, or working more in the conventional markets? Knowing your customer is the starting point of any conversation. In the email, introduce yourself, your company, and your coffee range, such as varieties, certifications (e.g., Fairtrade, Organic, Rainforest Alliance), and production and processing capabilities. Describe how your products create value for the buyer considering what they are looking for. Highlight your unique selling points such as exceptional quality, distinct flavour profiles, or sustainable production practices.

After providing the initial introduction, politely request an introductory call or video meeting to discuss potential partnerships in more detail. An initial call or meeting should focus on understanding your client. In this meeting, explore how you can be of service to your potential client. Also, propose attending major coffee events, such as World of Coffee or HOST Milan, where you can arrange in-person meetings with European buyers. Be prepared to discuss your company's capabilities, quality control measures, certifications, and commitment to sustainability and compliance.

You can phrase your request as follows:

"I would be delighted to arrange an introductory call or video meeting to discuss a potential partnership and answer any questions you may have about our coffee range. Additionally, we plan to attend [Event Name, e.g., World of Coffee or HOST Milan] in [Location] on [Date] where I would welcome the opportunity to meet with you in person, share our coffee samples and explore how we can collaborate to meet your specific needs."

One important thing to also note is that direct coffee trade is becoming a growing trend in Europe, particularly in the specialty segment. This means building a personal relationship with buyers can enhance direct trade of your coffee. You can invite potential buyers for a visit to your producing region, offering them samples of micro lots. In building this relationship, demonstrate knowledge and control of your value chain, and answer emails and phone calls promptly.

At all meetings, maintain a professional yet warm tone in all communications. Promptly respond to inquiries and requests from potential buyers. Consistently emphasise your commitment to quality, sustainability, and compliance with relevant European standards and regulations. This approach demonstrates reliability and builds trust, which is crucial for establishing long-term partnerships in the European coffee market.

Avoid common misconceptions that hinder exporters within the coffee sector

European coffee buyers pay attention to your values and adherence to quality, sustainability and business regulations in your own country. See our tips on Going Green, Social Responsibility and Buyer Requirements in the coffee sector to learn more about how to meet the demand for these values. It is important to know this and comply with mandatory requirements including the regulation on deforestation-free products (EUDR), the Corporate Sustainability Due Diligence Directive (CS3D) and food safety requirements for your coffee export business. We provide more information about these in the tip on complying with mandatory sustainability and traceability requirements. However, many exporters have some misconceptions that can hinder their coffee export business.

Here are some common misconceptions you should avoid to give you a competitive edge:

Assuming price is the primary factor. Price is not the primary factor driving purchasing decisions, especially in the premium and specialty coffee segments. European buyers are willing to pay a premium for coffees that meet their stringent quality standards, showcase unique flavour profiles, and align with their sustainability and ethical sourcing principles. While price is still a consideration, it is often secondary to quality with regards to supplying specialty coffee. Sustainability and the overall value proposition offered by the supplier is also very important.

- Underestimating documentation requirements. Suppliers expect proper documentation of your business certificates and on sourcing, quality control measures, certifications, and compliance with labour and environmental standards in your own country. Verbal claims or assurances do not suffice. European buyers require detailed product specifications, certifications (e.g., Fairtrade, Rainforest Alliance, Organic), traceability records, and documentation demonstrating compliance with relevant regulations and standards. Transparent and well-documented supply chains are highly valued.

Expecting quick results. Building trust and demonstrating reliability through consistent performance over an extended period is crucial for establishing successful long-term partnerships in the European coffee market. Quick wins or one-off transactions are less valued than developing relationships based on consistently delivering high-quality products and services. European buyers often prioritise suppliers who have proven themselves reliable over time, as they value the stability and predictability of such partnerships.

- Overlooking cultural differences. Failure to adapt to the formal business cultures and communication styles prevalent in European markets can hinder the development of successful partnerships. Understanding and respecting these cultural differences is crucial for building strong relationships and fostering trust with European partners.

- Ignoring sustainability trends. Sustainability trends, such as transparency, environmental responsibility, and fair labour practices, are becoming increasingly important for European buyers and consumers alike. European buyers are actively seeking suppliers who can demonstrate their commitment to sustainable and ethical practices throughout their supply chains. Certifications, third-party audits, and comprehensive reporting on sustainability initiatives are often expected or preferred.

Tips:

- Visit the Harvard Business Review webpage to learn more about writing professional emails.

- Have all your coffee business and export registration documents scanned and ready in a folder on your computer. Also, bring a printed version with you to show to a potential buyer during in-person meetings. Seeing these documents may give buyers confidence in doing business with you. Always be transparent and honest. Be clear and open about your own track record, your supply capacities and the quality of your coffees.

- There is a growing number of digital tools available that can help you order, gather and communicate information about your products. Refer to CBI’s Tips for Going Digital in the Coffee Sector to learn more about what is available and how these tools can help you to build strong relationships with buyers.

3. Attend coffee trade shows and conferences and be well-prepared

Conferences serve as ideal platforms for learning, networking, and professional development, offering opportunities to forge new business relationship along the way. These events can significantly boost personal and organisational growth. They provide opportunities to expand your knowledge, stay up to date on the latest trends, and find solutions to challenges. Moreover, conferences offer excellent venues to showcase your organisation, ideas, and work to others.

As the saying goes, "success is where preparation and opportunity meet." This is particularly true when aiming to connect with potential buyers interested in your coffee. Effective preparation involves thorough research and planning: define your objectives, outline what you want to achieve during the conference, identify attendees, and select sessions that align with your goals.

Just as athletes practice for competitions, you should treat the conference as your game time. Structure your attendance by creating a strategic plan. Review the conference website, examine (or request) the list of attendees, and highlight individuals you wish to meet. Research the speakers and sessions to identify presentations most relevant to your business objectives. Schedule and prepare for meetings with key stakeholders in advance. In the hustle and bustle of a conference, everyone is busy, making it challenging to catch people’s attention. However, being prepared helps you deliver your message efficiently, even with limited time or opportunities to speak with your targets. Overall, being well-prepared allows you to fully engage with the conference's content.

During sessions, do not hesitate to share your experiences or ask questions when prompted. Remember, it's always crucial to maintain a tone that is both professional and warm in all your interactions. Whether it is a virtual or in-person meeting, have the following materials prepared:

- Representative samples of your coffee varieties, both green and properly roasted and packaged for evaluation. Include key coffee data and your contact information on the label attached.

- Comprehensive documentation, including:

- detailed product specifications (variety, origin, processing methods, cupping scores, etc.)

- certifications (e.g., Fairtrade, Organic, Rainforest Alliance)

- traceability records and supply chain information

- compliance documentation (e.g., food safety, labour standards)

- Promotional materials or visual aids highlighting your organisation’s capabilities, quality control measures, sustainability initiatives, and unique value propositions. Before attending the conference, ensure your promotional materials are updated and fit the objectives of your attendance. Prepare leaflets or a (digital) presentation of your organisation, including key data on your business, services and contact information.

- Dare to stand out: use colours, pictures, and celebrate what you stand for.

Tips:

- Ensure you have no other work commitments. Make sure you have the time to devote to this. Do not get distracted; it is expensive to attend conferences and important to completely immerse yourself in the event.

- Let people know you will be attending via your social media platforms and network; they might want to link up with you in advance.

- Prepare and plan at least three meetings before the conference; be specific on what you want to achieve.

- Prepare and bring a conference survival kit, including pens, notebook, charger(s), business cards and snacks – let nothing get in the way of effective conference attendance.

- Learn more about how to navigate a coffee conference here.

4. Provide good quality samples with the right information

In the coffee sector, the product itself is the most powerful tool of communication with any buyer. A well-prepared coffee sample serves as the business card of a cooperative or exporter, showcasing their quality, capacity, and potential. It provides tangible proof of what they can offer, helping to establish credibility and trust. By sharing samples, exporters can demonstrate their commitment to excellence and foster stronger connections with buyers, making it a crucial step in building lasting business relationships.

When providing samples, aim to provide 200-350 grams of green coffee beans as a standard sample size. However, be prepared to adjust this based on the buyer's specific needs. It is therefore important to know your potential buyer’s specific needs. Pack your samples in vacuum-sealed bags for optimal preservation. If vacuum-sealing isn't available, high-quality ziplock bags are a suitable alternative. Each sample should feature an eye-catching sticker that clearly and professionally displays crucial information:

- Company Name

- Region & Country

- Altitude (meters above sea level - The height at which the coffee was grown)

- Coffee Variety

- Processing Method (How the coffee was processed (e.g., washed, natural))

- Growing Conditions (Soil type, climate, and any other relevant factors)

- Certification (if applicable)

- Contact Details

- Availability

Ensure your sample accurately represents the overall characteristics and quality of your coffee beans. Don't just take beans from the top of storage; mix them properly to give a true representation. When potential buyers visit your farm or cooperative during harvest, you can provide a direct “Day-Lot Sample”. Day-lot samples are taken from a specific day's harvest. This method provides a detailed representation of the beans harvested on that particular day, including factors like soil type, altitude, and climate. You can improve on the outcomes of your sampling process if you maintain open communication and when you are receptive to feedback. This can help you understand buyer preferences and improve your sampling process. Also, engage in cupping sessions and other sampling activities to better understand how your coffee is evaluated.

Figure 1: Coffee cupping

Source: Ethos Agriculture

It is important to have complete information on your product range. This will help you understand the genuine worth of your coffee, considering both its intrinsic and extrinsic qualities, to boost your negotiation skills.

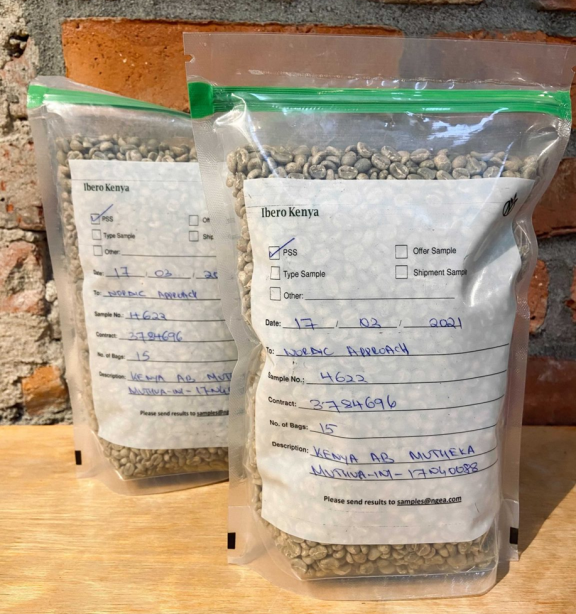

Figure 2: Coffee samples

Source: Ethos Agriculture

Buyers will assess both the physical and sensory quality of the samples you send. If you cannot match any particular aspect of the sample quality, tell your buyer as soon as possible. Always be honest and transparent about your samples and the quality of your coffee supplies. If you are not, you risk losing the trust of your potential buyer.

When suppliers and buyers enter into direct trade relations, this is usually upon approval of a pre-shipment sample. Buyers tend to include the right of refusal on delivery (with the ‘replace clause’), meaning that a replacement pre-shipment sample has to be offered.

Figure 3: Pre-shipment coffee samples

Source: Nordic Approach

Tips:

- First politely verify whether a buyer is interested in receiving a sample. If the buyer is interested, send samples with a reliable courier by registered mail to ensure that your samples arrive in time and in good condition. This is relatively expensive, so budget for these necessary costs. In some cases, buyers will have budgets available to cover these costs.

- Do not send roasted coffee beans. Read the Nordic Approach’s guide to green coffee samples to understand a buyer’s perspective on sample procedures.

- Invest in your own cupping facilities to understand the value of your coffee. If you do not have cuppers in your organisation, have your coffee cupped by local cupping experts (preferably ones with a Q-grader diploma). This allows you to understand your coffee’s cupping score and actual value before sending it to buyers. Check the website of the Coffee Quality Institute to learn how to become an expert yourself. Check out this article to find out why cupping is so important and to understand what cupping can tell coffee producers about their product.

- Ask buyers for their feedback on your sample presentation and quality by following up with them by email or telephone.

- Ensure your packaging aligns with European standards and regulations, as outlined in our Buyer Requirements for Coffee in Europe study.

5. Follow-up, follow-up, follow-up

Following up is a crucial element for any business. It helps you strengthen your relationship with a (potential) buyer and may provide you with successful sales opportunities. Also, good communication and follow-up provides you with a competitive advantage, as it shows you are a reliable professional to work with.

Tips:

- After a visit to a buyer’s office or a meeting at the trade fair, email the client to thank them for their time, adding some points of your conversation with the importer.

- After a shipment has been received, provide after-sales service by asking if the product was received well and if there have been any responses from the importer’s clients regarding your product.

- Inform your (potential) clients of any newsworthy fact regarding your operations, whether it is new machinery, new staff, a General Assembly, or certification changes. For more tips, read this article on building and maintaining coffee supplier-buyer relationships.

- Ask about the cupping results of your sample. If you do not get an answer, continue to ask for it until the buyer gives you a response. It is okay to insist in a polite way on feedback about your coffee.

6. Be well informed about pricing strategies and providing quotations

As a coffee exporter, it's crucial to monitor global coffee futures markets to understand price trends and market dynamics. You can find real-time and historical pricing data, charting tools, contract specifications, and other market information related to the Arabica and Robusta coffee futures markets. In addition, coffee authorities in your country typically provide information on coffee prices linked to different types and screens. See the Uganda Development Authority’s website for an example.

Monitoring these global futures markets is crucial for coffee exporters because they serve as benchmarks for international coffee prices. They also provide insights into global supply and demand dynamics, which can influence pricing strategies and risk management decisions. This information can guide your pricing strategies and help you protect yourself against price risks through hedging. Hedging is a trading operation that allows a trader to turn a less acceptable risk into a more acceptable one.

Equally important in price setting is understanding your production costs. This includes farm inputs, labour, processing, storage, and transportation. By calculating these costs and factoring in your desired profit margins, you can set informed prices that ensure both profitability and competitiveness in the market.

When providing quotations to European buyers, clarity and transparency are essential. Your quotations should include detailed product descriptions, specifying the coffee variety, origin, processing method, quality grade, and any certifications. Additionally, clearly outline the pricing structure. This includes any taxes, duties, or additional costs, to avoid misunderstandings.

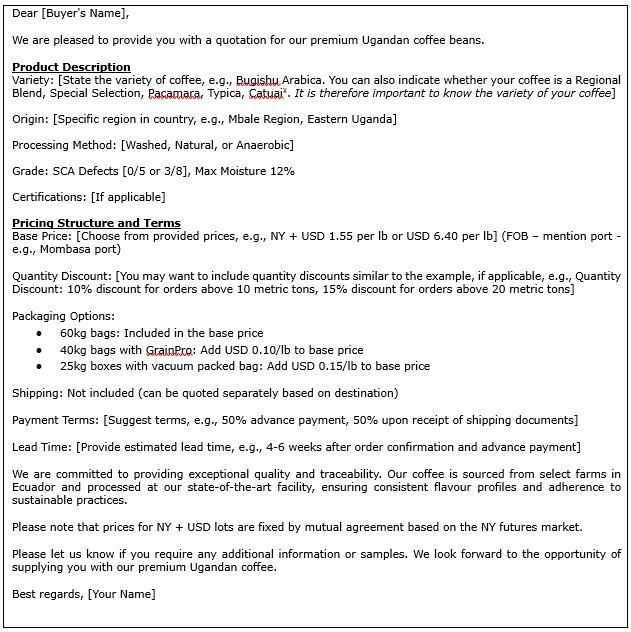

Figure 4: Example of information to include in your quotation

Note: ¥- for variety, Regional Blend: This term usually refers to a coffee blend that is sourced from a specific geographical region, such as a country or a specific area within a country. The blend is created to showcase the unique flavours and characteristics of that particular region.

Special Selection: This is a term used by coffee roasters or retailers to indicate a coffee that has been carefully selected for its high quality, unique flavour profile, or limited availability.

Pacamara: This is a specific variety of coffee plant that is a cross between the Pacas and Maragogype varieties. It is known for producing large coffee beans with a unique flavour profile that often includes notes of citrus, nuts, and chocolate.

Typica: This is one of the oldest and most well-known varieties of coffee plants. It is known for its excellent cup quality, with a clean, sweet, and complex flavour profile. Many modern coffee varieties are descendants of Typica.

Catuai: This is a hybrid coffee variety that is a cross between the Mundo Novo and Caturra varieties. It is known for its high yield, good cup quality, and resistance to certain diseases. Catuai is widely grown in Central and South America.

Read the guide to coffee species to learn more about coffee cultivars and varieties

Source: Amonarmah consults

In this example, the quotation provides a clear product description, pricing structure with quantity discounts, payment terms, and lead times. It also highlights the coffee's unique selling points, such as its origin, processing method, quality grade, and certifications.

The specialty coffee segment in Europe commands higher pricing and margins compared to mainstream commercial coffee ranges. This reflects the exceptional quality, unique flavour profiles, and added value that specialty coffees bring to the market. The Specialty Coffee Association (SCA) provides an example of the economics of the coffee supply chain to demonstrate the costs and margins of specialty coffee supply. Perfect daily grind also provides a guide in their article on how to determine your production cost. This will help you to identify your additional costs and think about the margin you want to make. This information gives you a better idea of the minimum price for which you want to sell your green coffee. Also, be ready to negotiate pricing if the interest in a trade deal is mutual.

It is important to strike a balance between commanding a premium price and remaining competitive within the specialty coffee landscape. Conducting thorough market research and analysing competitor pricing strategies is essential to ensure your pricing is aligned with the perceived value of your range while also remaining attractive to potential European buyers. Refer to the Specialty Coffee Transaction Guide to get an idea of average market prices for specialty coffee over several years. This guide shows the mean contract and pricing information based on the coffee's quality, volume and origin.

Additionally, once you are aware of market prices and margins, you can consider offering promotional discounts or introductory offers to attract new customers and establish long-term partnerships with European buyers who value quality, sustainability, and traceability. Specifically, promotional strategies could include:

- Volume discounts: offering discounted rates for larger order quantities can incentivise buyers to place more substantial initial orders and helps you establish a stronger foothold in their markets.

- Introductory pricing: Offering a temporary discounted rate for a limited time can trigger the interest of buyers and encourage them to try your coffees.

When presenting promotional offers or discounted pricing, it's crucial to clearly communicate the value proposition and the temporary nature of the offer. This transparency builds trust and reinforces the premium positioning of your specialty coffees in the long run.

Tips:

- Watch the New York futures markets closely at Nasdaq: Coffee, or check the daily market information published by the International Coffee Organization (ICO). Try to find clients that do not set their prices based on the New York market price. For this you will have to demonstrate quality, traceability and excellent marketing skills. Also, remember that exchange rates fluctuate, which may have an effect on the price you get. You can cover this risk by including a clause on currency risk in your contracts.

- Read the Specialty Coffee Transaction Guide. This provides an alternative for the current reliance on the volatile C-market price for price discovery.

- Check to see if your national coffee association publishes daily or weekly market updates. This can be helpful information to help you sell your coffee at the best price and at the right time. Examples of associations that do so include Anacafé (Guatemala), the Uganda Coffee Development Authority (UCDA) and the Colombian Coffee Growers Federation (FNC). Also, check out the video series on coffee economics by Karl Wienhold to learn more about topics such as FOB prices, farmgate prices and the impact of exchange rates in coffee trade.

- Learn about the futures markets from the ITC Coffee Guide or read this article from Perfect Daily Grind on how green coffee is bought and sold. The Intercontinental Exchange website also offers information on the Robusta coffee futures market and the Coffee C futures for Arabica coffee.

- Read about hedging and other operations in the ITC Coffee Guide to learn more about risk management strategies.Read more about what hedging is and how it may impact you as a coffee producer.

7. Identify and emphasise your unique selling points

Emphasising unique selling points (USPs) that resonate with European coffee buyer preferences is crucial for standing out in a highly competitive market. You should highlight your USPs with regard to sustainability and Ethical Sourcing, Traceability and Provenance, Quality and Flavour Profile and your Innovative and Unique Range.

Below are some strategiesto help you identify and highlight these USPs:

Sustainability and Ethical Sourcing

European buyers and consumers are increasingly aware of environmental and social sustainability practices. Green coffee buyers need origin stories to demonstrate how these matters are addressed. Emphasise your initiatives in areas such as:

- Environmental conservation: share your story about the efforts you have made in preserving biodiversity, implementing shade-grown practices, and minimising the use of agrochemicals.

- Ethical labour practices: demonstrate your commitment to fair wages, safe working conditions, and the empowerment of smallholder farmers.

- Certifications: obtain and prominently display certifications such as Fairtrade, Organic, Rainforest Alliance, which signify adherence to stringent sustainability standards. Be aware this is not relevant to all buyers, so carefully align and explore with your buyers if these investments pay off.

Traceability and Provenance

European buyers value transparency and the ability to trace the origin of their coffee. Leverage the unique story behind your coffee by highlighting:

- Specific origin: provide details about the region, farm, or cooperative where your coffee is grown. Emphasise the unique soil and microclimates that contribute to its distinctive flavour profile.

- Cultural heritage: if your coffee production has roots in indigenous traditions or ancestral farming practices, share these stories to create an authentic connection with buyers.

- Varietal specificity: highlight any unique or rare coffee varieties you cultivate, such as heirloom or landrace varieties, which can differentiate your range.

Quality and Flavour Profile

European buyers, especially in the specialty coffee segment, prioritise quality and unique flavour profiles. Emphasise:

- Processing methods: describe your meticulous processing techniques, such as washed, natural, or honey processing, and how they contribute to the coffee's unique flavour characteristics.

- Tasting notes: Provide detailed tasting notes and flavour descriptors that showcase the complexities and nuances of your coffee. Tastify can be a great tool to visually display your coffee characteristics.

- Awards and achievements: Highlight any awards, recognitions, or positive reviews your coffee has received from reputable organisations or industry experts.

Innovative and Unique Range

Differentiate your range by showcasing any innovative or unique aspects, such as:

- Distinctive varieties: if you grow or offer rare or exotic coffee varieties, emphasise their uniqueness and limited availability.

- Special preparations: highlight any special processing methods, such as anaerobic fermentation, barrel-aging, or experimental drying techniques, that create unique flavour profiles.

- Exclusive micro-lots: Offer exclusive micro-lots or small batches of exceptional coffee that cater to buyers seeking rare and special products.

Leverage storytelling and marketing materials (websites, brochures, videos) to bring these unique selling points to life, creating a compelling narrative that resonates with European buyers' preferences for quality, sustainability, and authenticity.

An example of a coffee cooperative that effectively uses compelling storytelling to highlight sustainability, quality, and unique heritage is the Cooperativa de Caficultores de Manizales (Coffee Growers Cooperative of Manizales) in Colombia. Another is Cooperativa Regional de Caficultores de Guaxupé (Cooxupé) from Brazil. Both cooperatives share compelling narratives rooted in four core themes. First, they both celebrate the rich heritage and tradition of coffee cultivation in their respective regions, portraying generations of dedicated farmers who pass down expertise and foster authenticity. Second, they champion sustainable farming practices, showcasing commitments to organic methods and environmental conservation efforts, appealing to environmentally-conscious consumers. Third, they highlight the positive community impact of coffee production, showcasing economic opportunities and social programmes that uplift local families and communities, fostering a sense of support and connection among consumers. Finally, they accentuate the exceptional quality of their coffee beans, attributing it to the ideal growing conditions in their regions, positioning themselves as premium brands that deliver superior coffee experiences to consumers worldwide.

Tips:

- To bring these stories to life, consider incorporating multimedia elements such as:

1. High-quality photography and videography showcasing the beauty of the landscapes, the coffee production process, and the people involved.

2. Interactive maps or virtual tours that allow buyers to explore the origin and trace the journey of your coffee.

3. Testimonials or interviews with coffee experts, buyers, or satisfied customers who can attest to the quality and uniqueness of your range of products. - Read The Ultimate Guide to Marketing Your Rainforest Alliance Certified Product to learn how to communicate your sustainability story.

- Marketing skills include setting clear goals and objectives and writing good content. Strengthen your marketing skills by using relevant digital tools and get inspired by other successful companies, such as Clearpath Coffee (Colombia).

- Access CBI’s Going Digital in the Coffee Sector Study to learn more about digital marketing.

8. Respect your contractual agreements

The coffee market is volatile, with market conditions and prices that may vary a lot over the year. If you want to establish long-standing and reliable relationships with your buyers, it is very important to respect your contractual obligations, regardless of market changes.

Most European importers buy their coffee under the terms of a European Standard Contract for Coffee (ESCC). Note that the European Coffee Federation may revise this document. If you honour your agreements and deliver according to the terms of your contract, your buyers are more likely to turn into loyal customers.

Algrano reports that more producers have been opting for open contracts. Open contracts give both parties more flexibility. Suppliers can diversify their pool of buyers and roasters can worry less about changing consumer needs and wholesale demands.

Tips:

- Before signing a contract, make sure to research your buyer’s reputation and track record. One way of doing this is by simply googling them to see if any negative news comes up. Alternatively, approach the export promotion agency in your country.

- Do not default on a contract in order to deliver the goods to a different buyer offering a better price. This can have a negative impact on your reputation as an exporter and will jeopardise future business opportunities.

- Refer to CBI’s Tips on Organising Your Export to read more about how to draft a contract. Check out Trabocca’s article on understanding you coffee contracts to learn more about terms and conditions within a contract.

- If you do get a legitimate claim, honour the claim and give your client a credit note on his next purchase, so as to keep them in your portfolio of clients.

- Read more about your rights as a coffee supplier in The Unfair Trading Practices Directive: a transposition and implementation guide.

9. Comply with mandatory sustainability and traceability requirements

In recent years, European buyers have increased their sustainability requirements. They expect you to have food quality and safety management systems in place to demonstrate your ability to control potential food safety risks. This ensures that your coffee is both safe for roasting and for human consumption. If you are unable to comply with these sustainability requirements, it will be very difficult for you to access the European coffee market.

For example, the European Green Deal (EGD) aims to make Europe climate-neutral by 2050, impacting trade and imports by enforcing stricter sustainability standards, particularly for export companies from developing countries. One focus area is the Farm to Fork strategy.

Additionally, the EGD includes the Biodiversity Strategy for 2030, which includes measures like the EU Regulation on deforestation-free products (EUDR). EUDR also restricts import of coffee products from lands acquired forcibly from local and/or indigenous communities, or whose cultivation involves labour and human rights abuses. Importers that fail to comply with EUDR could face fines of up to 4% of their net profit in any EU member state.

There is also a social and economic sustainability strategy; the Corporate Sustainability Due Diligence Directive (CS3D), which has recently been approved by the European Council. The CS3D is compulsory for all companies in the EU, and companies outside Europe that sell products or services in EU countries. It tackles mainly the social and economic concerns of sustainability. Companies must take steps to detect and prevent any harmful impacts their business and supply chains may have on people and the environment.

It is also important to enhance traceability of your products. A traceability system is a good way of providing information about the origins of your products to all the parties in the supply chain. It offers reassurance to buyers about what they are purchasing. Digitisation plays a major role in bringing more traceability to the supply chain. One of the tools that is increasingly being used is blockchain. For an example, see how trader Trabocca's use of blockchain, implemented by Fairfood Trace, has made their coffee purchasing from Ethiopia more transparent and traceable.

Apart from traceability, buyers in both mainstream and niche segments may expect you to have certifications that show your commitment to social and environmental responsibility. Certifications also help buyers control risks in their value chain. The main certification schemes in the coffee sector are 4C, Rainforest Alliance, Fairtrade and Organic. Be aware that organisations offer different types of certificates and focus on various sustainability criteria. They follow consumer trends in different market segments in specific countries.

However, the high-end specialty coffee segment is less characterised by certifications and more so by quality, direct trade relations, high transparency and traceability from source to consumers. Specialty coffee buyers aim to establish direct contact with coffee farmers. These buyers want to know all the details about coffee production and the value chain, often combined with information on the coffee-growing area. Many buyers know how costly certification can be for small producers and avoid making this demand.

Tips:

- To find out more about corporate social responsibility and certification, see CBI’s study on Buyer Requirements and our Country Studies for related market trends.

- See our study on social certifications to read about certification schemes addressing social responsibility in the coffee sector.

- Consult the International Trade Centre (ITC) Standards Map for an overview of different certification schemes.

- Read our study on legal requirements in the European coffee market, which offers an overview of the requirements for coffee exports to Europe. Also refer to CBI’s Tips to go Digital in the Coffee Sector to learn about how digitisation can help you to implement a traceability system for your business.

- Refer to this Coffee hazards and risks guide to better understand what a trader does to guarantee the sourcing of coffee that complies with food safety standards.

10. Leverage industry support

There are several government agencies and non-governmental organisations (NGOs) that offer valuable support and resources to facilitate the export growth of your coffee business. They aim to support coffee exporters, cooperatives, and farmers from developing countries in successfully navigating the European market and adhering to its requirements for sustainable and ethical trade practices. Being affiliated with such organisations and entities will help you to better understand the priorities of European buyers and get access to the funding, training and resources they have available.

For instance, CBI (Centre for the Promotion of Imports from developing countries (CBI), Netherlands) is well-known for our export coaching programmes, market intelligence, and capacity building for exporters from developing countries. We offer tailored training, coaching, and consultancy services to help businesses comply with European market requirements, improve product quality, and develop effective export strategies. Our "Export Coaching Programme for Coffee" is specifically designed to support coffee exporters in accessing the European market.

Other important agencies and NGOs are:

- Swiss Import Promotion Programme (SIPPO), Switzerland: SIPPO focuses on promoting sustainable trade and economic development in developing countries. They offer training, coaching, and consultancy services to help businesses comply with European standards, improve production processes, and access new markets.

- Import Promotion Desk (IPD), Germany: The IPD is a joint initiative of the German Federal Ministry for Economic Cooperation and Development (BMZ) and the Federation of German Wholesale, Foreign Trade and Services (BGA). They offer training and coaching programmes to help businesses from developing countries meet European market requirements and access distribution channels.

- International Trade Centre (ITC), Switzerland: The ITC is a joint agency of the World Trade Organization (WTO) and the United Nations, focusing on promoting sustainable economic development and trade in developing countries. They offer a range of services, including market analyses, trade facilitation, and capacity building. The ITC's Coffee Guide provides valuable insights into the European coffee market, including consumer trends, quality standards, and market access requirements.

- Open Trade Gate Sweden (OTGS), Swedenofficial organisation known as Kommerskollegium: OTGS is a Swedish government agency that supports sustainable trade and economic development in developing countries. They offer training programmes, market intelligence, and networking opportunities to help businesses access the European market.

- Africrops! Uganda: Africrops! is an NGO that works to improve the livelihoods of smallholder farmers in Africa, including coffee producers. They offer training, technical assistance, and access to certification programmes to help farmers improve their production practices, meet international standards, and access premium markets.

- Solidaridad: An international NGO that works towards sustainable supply chains, including for coffee, through certification, training, and capacity building programmes.

- Fairtrade International: A leading organisation that promotes fair trade practices and provides certification for coffee and other agricultural products.

- Rainforest Alliance: A non-profit organisation that certifies sustainable agricultural practices, including coffee production, and provides training and support to farmers.

Tips:

- Leverage the expertise of government agencies and NGOs to gain market insights, access training opportunities, and establish connections with potential buyers.

- Participate in trade fairs, exhibitions, and buyer-seller meetings organised by these agencies to showcase your products and network with European buyers.

- Seek assistance in obtaining relevant certifications, such as Fairtrade, Organic, or Rainforest Alliance, as these certifications are valued by European buyers.

- Utilise the market intelligence and export coaching services provided by these agencies to develop effective marketing strategies and improve your export readiness.

In conclusion, refer to CBI’s studies on Tips for Finding European Coffee Buyers and Tips for Organising Your Coffee Export to Europe. These studies provide detailed information to clearly define your product range, preferred target market, and they give you strategies to find buyers and properly export your coffee to buyers in the European market.

Amonarmah Consults carried out this study in partnership with Molgo Research, and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research