10 tips on how to organise your coffee exports to Europe

Understanding practical export processes and requirements is crucial to becoming and remaining a successful exporter. As trade margins are small, trade errors can make a difference between profit and loss. This document provides tips on effectively exporting your coffee to buyers on the European market.

Contents of this page

- Agree on the terms of payment with your buyer

- Be honest about your sample

- Optimise your coffee shipping strategy

- Understand the EU Customs

- Prepare the appropriate export documents

- Match your insurance with your contract

- Inform yourself about your buyer’s sustainability requirements

- Look into trade financing options

- Draft a clear contract

- Contact organisations that offer export assistance services

1. Agree on the terms of payment with your buyer

Cash Against Documents is the main method of payment when exporting coffee to Europe. You provide documents proving shipment, such as a bill of lading or invoice, and get paid in return. This ensures you receive payment for your goods.

Sometimes, a Letter of Credit is used as a payment term instead of Cash Against Documents. This method is safer but requires more work and is more expensive. It is therefore mainly used for very large shipments. For most starting exporters, Cash Against Documents is the best option.

Payment terms depend on who you are trading with. With trading companies, you often get paid quickly. Selling directly to roasters may mean higher profits but may also result in longer payment terms. Sometimes, payment can take up to 100 or even 360 days.

In Europe, the bank you use to receive a payment is not very important. Importers make use of a large variety of banks. Some large banks include HSBC, Barclays, and BNP Paribas.

Tips:

- Learn how the Cash Against Documents method works. It ensures you get paid once you ship your coffee. This is important to ensure smooth and secure transactions. You can learn more about this method on the Credit Tools website, or via your bank.

- Calculate the pre-financing costs, especially with longer payment terms.

- Do not be afraid to discuss and negotiate terms. Clear terms prevent future misunderstandings and ensure both parties are on the same page. Negotiating terms can sometimes shorten payment wait times or secure better deals.

2. Be honest about your sample

Buyers can require sample approval before shipment. They do so to avoid the risk of buying coffee without seeing it first from unknown shippers. The 2 most common ways to approve a sample are ‘Stock-Lot Sample’ and ‘Type Sample’.

Selling on a Stock-Lot Sample

This method avoids approval issues by using a sample from already stocked coffee. It should match exactly what will be shipped. It is not practical to use this for every deal. Using stock-lot samples is often best for new exporters or those entering specific markets or dealing with speciality coffees.

Once a good delivery is made, an exporter might offer 'quality equal to stock lot X' for a similar future sale without new samples. If there needs to be a small difference—for example, in bean size or colour—the phrase 'quality about equal to' might be used, mostly in long-term business relationships.

Type Sample

After successful deals, a buyer and seller might agree on a standard quality, known as a 'type', for future transactions without needing samples, though some roasters may still want them. The shipper and the buyer often keep the exact 'type’ secret.

Speciality and premium coffees are sold based on samples, while standard ones can be traded based on description. To reduce quality complaints, it is very important that the pre-shipment samples match the coffee that is shipped exactly. Any differences will likely lead to a claim.

Figure 1: Checking the quality is an important part of coffee trade

Source: Ethos Agriculture

Tips:

- Be aware of the quality of your product. This is the first step in selling your products for the right price. Undervaluing might lead to underpayment. Overvaluing your product might lead to a claim.

- Be honest about your sample and your description. Buyers will check the quality of your product.

- Read more about the approval of coffee sampling. You can do so on p229 of the ITC Coffee Guide.

3. Optimise your coffee shipping strategy

Shipping coffee to the European Union (EU) needs a well-thought-out plan, considering different ways to move the goods. Usually, sending large amounts of coffee involves both sea and land transportation.

Package your coffee with care

Green beans are usually packed in sturdy bags made of jute or sisal. The bags must be of the appropriate size. Consider both handling and stacking requirements in containers or freight vehicles. A moisture barrier lining or liner can be added to the bags to protect the beans from moisture.

Use sturdy pallets

Coffee bags are typically palletised for easy handling and storage. This ensures transportation stability and efficient use of shipping space. To minimise damage risk, select sturdy pallets and add a protective layer. A protective layer could consist of a slip sheet or cardboard.

Prevent moisture during transport

Coffee needs to be handled with care to keep its quality. For transport, it is packed in clean, odour-free containers that are specially prepared to keep out moisture. This helps prevent the coffee from getting mouldy. Coffee needs to stay dry. Sometimes, the inside of the containers is covered with materials that soak up any extra dampness.

Select your warehouses with care

Storage is best done in special warehouses before it is sent to stores or customers. These warehouses need to meet certain quality control standards. Climate control is sometimes needed, depending on the type of coffee and its packaging. The cost to keep goods in a warehouse changes based on the location, the services they offer, and how long the goods need to be stored. As such, it is important to understand how swiftly your coffees can be shipped when they arrive at the port before departure. It is smart to check prices from different warehouses to ensure you get a good deal.

Figure 2: Green coffee is typically stored in jute bags in warehouses

Source: Ethos Agriculture

Sea transport may come with unexpected costs

Sea transportation is the most common approach for sending coffee to the EU. The costs can vary depending on how far it is travelling, which shipping company is used, and the fuel price at the time. It is important to consider that shipping usually comes with additional costs. These might come unexpectedly if you are a starting exporter. Examples are insurance and taxes. Websites such as SeaRates or Hapag-Lloyd allow you to look up and compare what it costs to ship your coffee.

Many starting exporters cannot fill a full 20-tonne container. To avoid quality degradation, it is important not to share a container with other commodities. For small suppliers, it is best to share a container with other coffee suppliers to reduce costs.

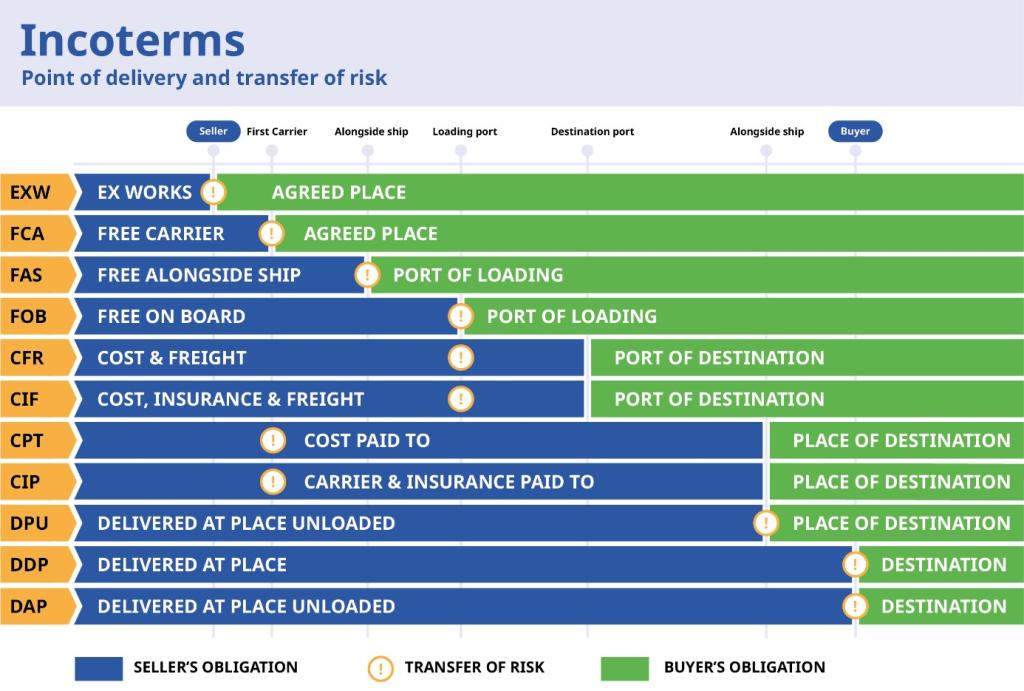

Mind the Incoterms

Your responsibility for the transport highly depends on the International Commercial Terms (Incoterms) in your contract. Sellers and buyers agree upon these terms to state clearly who is responsible for what. Examples include:

- FOB (Free On Board);

- CFR (Cost and Freight);

- CIF (Cost, Insurance and Freight);

- FCA (Free Carrier).

It includes risks and costs during the transport and delivery of the coffee. Each term has different rules about who handles the export clearances, shipping, and insurance, making it clear who pays for what and who needs to take care of different parts of the shipping process.

In the international coffee trade, most contracts are Free On Board (FOB) contracts. FOB means that the exporter is responsible for the freight to the departure harbour, where the importer takes over. Buyers prefer this because they can negotiate rates that individual exporters cannot obtain.

An exporter in a country without a seaport might use a Free Carrier agreement (FCA). This means that the buyer arranges for the goods to be moved to the nearest port and then sent by sea to the final destination. International transport companies, often connected to shipping lines, can handle everything. The risk of loss is transferred when the coffee is delivered to the freight carrier at the place of embarkation.

For starting exporters, FOB (for coastal countries) and FCA (for landlocked countries) are usually favourable because these terms limit your responsibilities. More experienced traders might want to experience other forms of contracts.

Figure 3: Overview of the incoterms

Source: design by Bart Wortel

Tips:

- Familiarise yourself with Incoterms to ascertain your responsibilities and risks during shipping. This is essential in planning shipment budgets and logistics.

- Establish strong partnerships with reliable freight forwarders and shipping companies. Trusted partners can lead to better rates, improved handling, and expedited port procedures. These relationships can mean the difference between timely deliveries and costly hold-ups, impacting your reputation and profitability.

- Exploring alternative trade and export routes is crucial. Nearby ports can become overcrowded, leading to high warehouse costs and delays. Exporting through a different port may require longer land transportation but can ultimately be more efficient.

- Ensure you use the optimal container size for your shipment to maximise space. Under-utilising container space can significantly affect shipping expenses. Properly assessing the volume of your coffee exports will allow you to choose the most cost-efficient container.

- Check the moisture levels regularly before exporting. This ensures that your coffee maintains its quality throughout transit. This secures the value of your shipment and the satisfaction of your customers. Consistent moisture monitoring can also help you make informed decisions about packaging needs, desiccants, or moisture barriers.

4. Understand the EU Customs

Navigating customs regulations is pivotal when exporting coffee to the European Union (EU). The EU has specific customs policies that ensure the smooth transit of goods across its borders. This secures food safety standards and protects its market.

Required documentation for customs authorities

All goods imported into the European Union (EU) must be declared to the respective customs authorities by filling out the single administrative document (SAD). Together with the SAD, you must provide authorities with documentation. This includes freight documents, commercial invoices, inspection certificates, proofs of origin and customs declarations.

Note that all these documents are the responsibility of the importer you will be working with. Your responsibility as an exporter is to help the buyer comply with the customs procedures. Therefore, make sure to send the export documents by email and on paper to your buyer along with the shipment.

Trade tariffs

The European Union does not apply any tariff on green coffee beans, regardless of country of origin. Tariffs may apply to roasted coffee, as shown in table 1. To see if your country belongs to the Generalised Scheme of Preferences (GSP) or Everything But Arms (EBA), refer to the website of the European Commission. Refer to the Access2Markets webpage to see if your country has an Economic Partnership Agreement (EPA) or Free Trade Agreement (FTA) with the EU.

Most coffee-producing countries are part of a preferential group and are therefore eligible for reduced trade tariffs. Note that these groups may change over time. Therefore, it is essential to check the current state of your country via Access2Markets Trade Assistant.

Table 1: EU tariffs for green coffee beans and roasted coffee

| Origin | Green coffee | Roasted coffee | Examples |

| Any country | 0% | 7.5% | |

| GSP | 0% | 2.6% | |

| GSP+ | 0% | 0% | Philippines, Sri Lanka |

| EBA | 0% | 0% | Nigeria |

| EPA / FTA | 0% | 0% | Costa Rica, Peru |

Source: Access2Markets Trade Assistant

Tips:

- Check out the Access2Markets website for a full list of documents for customs clearance and procedures in the EU.

- Access GOV.UK to find more specific information about the customs procedure in the United Kingdom.

- Access the TARIC database to find more information on all measures relating to EU customs tariffs, and commercial and agricultural legislation.

- Check whether any preferential agreements apply to you. Select your country of origin and the trade code of your export product on the website of the Access2Markets Trade Assistant. The trade code for coffee is HS0901.

- Consider hiring a freight forwarder or customs broker to help you arrange the proper documentation. Refer to the International Forwarding Association (IFA) or this list on Ezilon Europe to find a list of forwarding agents and companies. Refer to the member list of the International Federation of Customs Brokers Associations to find customs brokers in your target country.

5. Prepare the appropriate export documents

Exporting your coffee is only possible if you meet your country’s local export requirements. You should understand the legal procedures required by your country. You can access the requirements on the website of your Ministry of Trade or your country’s local trade portal (examples: Rwanda, India and Brazil).

It is important for European buyers that you can offer all documents in time. European buyers are easily annoyed if they have to ask for a document twice or when not all documents are available immediately. An exporter’s promise that a document will be available at short notice does not suffice for European importers. In many cases, your ability to show all documents on time is even more important than the price of your coffee.

Regardless of the country you are based in, several documents must be prepared and presented. The required documents are described in this section. Note that the documents deviate a little from country to country.

Commercial Invoice

As an exporter, you must prepare and submit an official commercial invoice. This is part of the customs declaration. This invoice should include the following information:

- Date;

- Reference to order;

- Contact details of buyer and supplier;

- Invoice number;

- Payment conditions;

- Delivery conditions; and

- Country of origin.

Bill of Lading

The Bill of Lading represents the contract between the coffee owner, referred to as the shipper, and the carrier of the goods. It is a receipt for the freight services and usually contains the following information:

- Shipping bill number and date;

- Name and address of both the shipper and the receiver (buyer);

- Type and quantity of the goods being carried.

The shipper issues the Bill of Lading.

Certificate of Origin

There are 2 different certificates for the Certificate of Origin (CO). One is issued by the International Coffee Organisation (ICO). The EU issues the other. The ICO certificate is a document which shows a unique identification code for coffee exports from producers in origin countries to importers. Refer to this link for an example of an ICO Certificate of Origin. The certificate issued by the EU identifies the origin of the coffee being exported and is commonly issued by a chamber of commerce. Refer to this example of specialised importer Nordic Approach to see a Certificate of Origin issued by the EU.

Phytosanitary Certificate

Coffee is a food product, and the EU has strict regulations concerning food safety and agricultural products. These include pesticide controls, labelling requirements, and packaging standards. The European Food Safety Authority (EFSA) provides detailed information on these regulations. Your buyer's responsibility is that the imported products meet these requirements. Therefore, it is important to ask your buyer what proof they require. These could include tests to check for pesticides, insecticides or herbicides residuals. An example is a glyphosate test, often required for organic coffees. Your buyer should pay for these tests unless stated differently in your contract.

Phytosanitary certificates are typically issued by the exporting country's national plant protection organisation (NPPO). This organisation enforces plant health regulations and conducts inspections and certifications.

Export License

Exporting coffee usually requires an export licence issued by your government. The organisation responsible for issuing these licenses differs per country. In Uganda, you need to register with the Uganda Registration Services Bureau (URSB) and obtain a Tax Identification Number (TIN). If your coffee meets the Uganda Coffee Development Authority (UCDA) quality standards, you can request an export licence via the URSB. You can find many important documents at the Uganda Trade Portal.

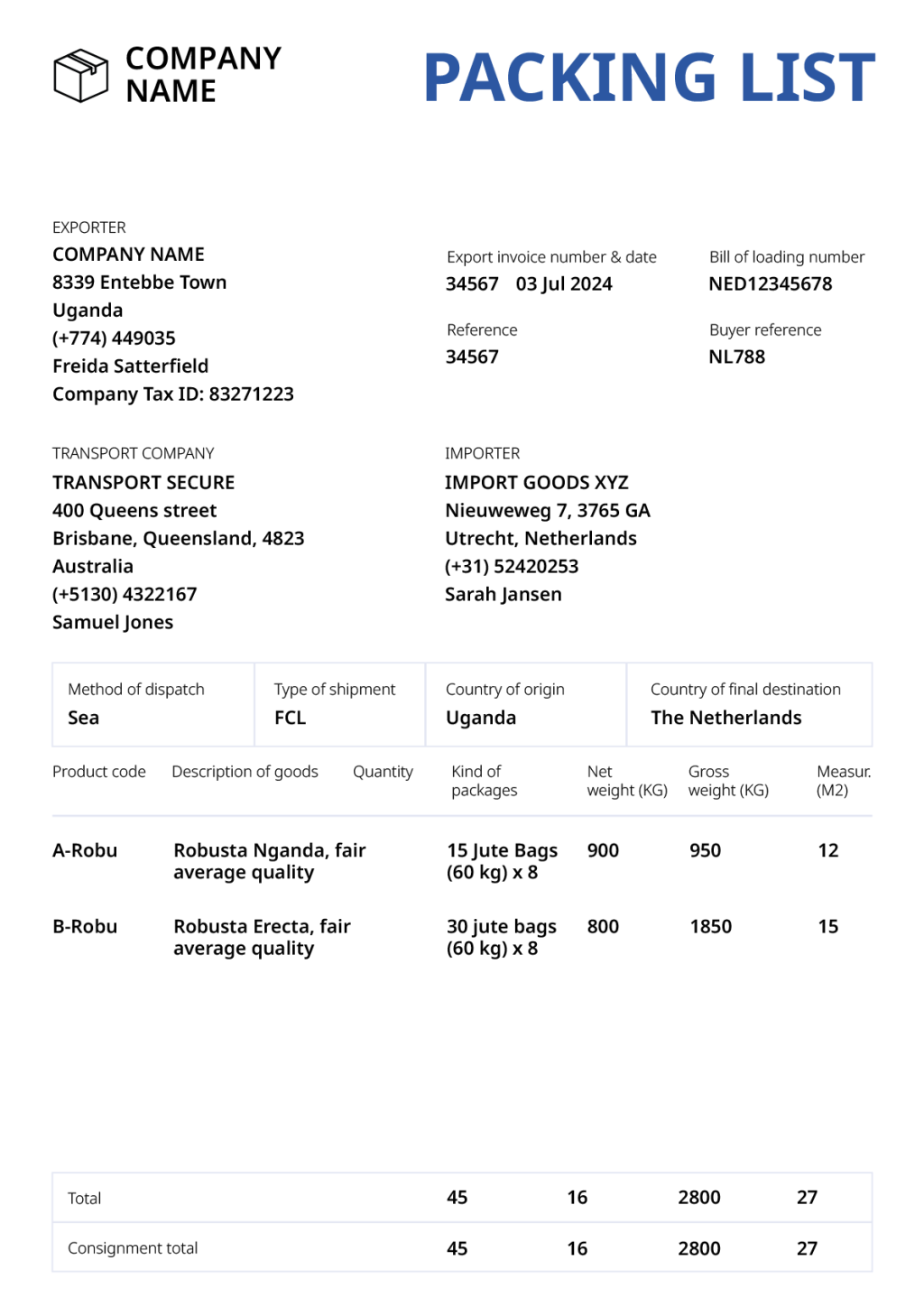

Packing List

The packing list provides details on how the goods are packed and identifies the marks and numbers on the packages being shipped. It should include the following information:

- Date;

- Contact information of exporter, importer and transport company;

- The origin address of cargo;

- The destination address of cargo;

- Total number of packages within this shipment;

- A detailed description of the content of each package, including the type of packaging;

- The volume and weight of each package.

Figure 4: Example of a packing list

Source: design by Bart Wortel

Insurance Certificate

If the goods are insured, an insurance certificate provides coverage details. The certificate is issued by your insurance company or broker. It includes at least which risks are insured, the exporter’s name, mailing address, and the operations that you perform.

Export Declaration

An export declaration is an official document or electronic submission that contains information about exported coffee. It includes details such as the exporter's information, consignee details, description of the goods being exported, quantity and value. The Customs Authorities normally require the export declaration.

Other documents

Depending on your country, you may need other documents. It is best to consult the Custom Authorities about these required documents. An example is the Movement Certificate EUR.1. This may be required to benefit from reduced tariffs under trade agreements between European Union countries and your country.

Tips:

- Discuss with your buyer how and when they would like to receive your export documentation.

- Consult your buyer and freight forwarder if any other additional documents are required to facilitate the shipment. Ask for example documents if and where required.

- Hire an export agent or contact your local chamber of commerce to help you meet the required regulations.

- Make sure to have copies of all the requested documents and financial transactions.

- Check out this article on what to include in a commercial invoice and learn how to prepare one. You can also download an export invoice form via the Shipping Solutions website.

- Refer to CBI’s study on Buyer requirements for more detailed information about legislative requirements, such as maximum contaminant levels.

- Check out the ITC Coffee Guide, which unpacks all export requirements, examples, documentation and terminology.

6. Match your insurance with your contract

The insurance you require depends on the contract(s) you have. It is key to examine your contracts closely to prevent over- or underinsurance.

Your buyer is responsible for the shipment if you work with an FOB contract. This includes insurance from the moment it is shipped. However, as an exporter, you are still responsible for transporting to the harbour of departure. This means that if you work under an FOB contract, you might still want to insure your transport till the harbour.

This may be different for other incoterms. An example is a Cost, Insurance, and Freight (CIF) contract. Under the CIF contract, the sea transport insurance is the exporter's responsibility. The exporter must provide an insurance certificate. You can arrange the insurance yourself or work through a broker.

Insurance companies will not reimburse costs related to transport problems resulting from external factors that cannot be controlled. Examples are natural disasters, wars, riots, fire, and so on. In the insurance documentation, these may be referred to as force majeure.

Next to transport insurance, a common insurance is export credit insurance. This secures exporters against non-payment risks and ensures that they do not face financial losses if a buyer fails to pay. If you work with a letter of contract, which is most common, a large share of your financial risks is already covered. An export credit insurance is especially relevant if you work with extended payment terms. An export credit insurance is also more important if you rely very much on one or a few buyers.

Figure 5: Insuring your transport over land may be a good idea when working with an FOB contract.

Source: Ethos Agriculture

Tips:

- Select export credit and transport insurance that match your shipment's value and risk exposure.

- Partner with well-known insurers experienced in the coffee sector. Examples are Atradius and Allianz (former Euler Hermes). This enhances your credibility with European buyers.

- Thoroughly understand your insurance policy’s terms, coverage limits, and exclusions. Being well-informed helps avoid surprises during claims and ensures you are adequately protected.

- Periodically review your insurance coverage as your business grows and market dynamics change. Adapting your insurance to current needs ensures continuous protection against evolving risks.

- Keep detailed records of all transactions, conversations, and agreements concerning your insurance policy. Documentation is crucial for making informed decisions and streamlining the claims process. This ensures you get the support you need when it matters most.

7. Inform yourself about your buyer’s sustainability requirements

European buyers are forced to abide by ever-stricter European regulations on sustainability. Many of these regulations force buyers to prove that they source responsibly. This means they require evidence that the coffee they buy from you is produced according to specific standards.

Important recent European legislation includes:

- Corporate Sustainability Reporting Directive (CSRD)

- The European Deforestation Regulation (EUDR)

- The corporate sustainability due diligence directive (CSDDD)

The Corporate Sustainability Reporting Directive (CSRD)

This directive forces European buyers to report on social and environmental risks. This makes it easier for investors and consumers to compare and evaluate the sustainability efforts of companies. It also creates a level playing field for buyers. European buyers must first report in 2025, about 2024.

The implications of the CSRD are uncertain. It is possible that it will lead to more emphasis on ethical sourcing. This may lead to both higher demands and better payment. Demands may be higher because buyers may demand farming methods that are better for the planet. It may also lead to more proof that you do not put children to work. It is also likely that the CSRD leads to more demand for certification as proof of ethical sourcing.

Another implication is that buyers might need more data from their suppliers to publish this in their reports. Since all buyers now need to report under a common framework, the data requests from different buyers should become more similar.

The European Deforestation Regulation (EUDR)

The EUDR is effective from 30 December 2024 onwards. Small businesses will have 6 more months to comply. Buyers will demand proof that coffee is produced on land that has not been deforested after 31 December 2020. This includes legal and illegal deforestation. The proof, for instance, consists of geolocation data per producing farm. These need to be single GPS points or polygons depending on the size of the plot. The polygon data is acquired by polygon mapping. It uses the coordinates of the farm. Based on these coordinates, your buyer will check if there was deforestation. This can be done by comparing it to the Global Forest Watch data.

While this is the responsibility of the coffee importer and buyer in the EU, many buyers will rely on your polygon data. Letting your buyer do the polygon mapping could make you more dependent on these buyers. Controlling your own data points can provide a competitive advantage over other exporters. In addition, many buyers will be unable to do the polygon mapping. Controlling your own geolocation data makes you less dependent on a few buyers.

Figure 6: The goal of the EUDR is to prevent deforestation in producing countries

Source: Photo by Matthis Volquardsen

The Corporate Sustainability Due Diligence Directive (CSDDD)

The CSDDD requires European buyers to report and take action to prevent and mitigate negative impacts on human rights and the environment. These negative impacts include the full supply chain. This means buyers will demand information on how producers and exporters deal with human rights and the environment. This regulation will affect your buyer starting from 2026 or 2027. The exact date depends on your buyers’ turnover. This new regulation will probably significantly affect the information exporters will need to provide in the near future.

Many of these regulations are new, and your buyers may also struggle to understand how to abide by them. Therefore, the information requested might differ from buyer to buyer.

Tips:

- Discuss the sustainability requirements with your buyers. Also, ask how they expect their demands to change in the future. Since European regulations will become much stricter in the near future, you need to prepare for this.

- For information on other mandatory requirements, read CBI’s study on Requirements for exporting coffee to Europe.

- Explore how to map the GPS points or polygons yourself. This reduces your dependency on buyers who own the polygon data. If this is too costly, consult your buyer on how to arrange this.

8. Look into trade financing options

There are 2 main options for financing your exports. These are loans offered by a bank and pre-finance by your buyer.

Financing your export via the importer

In the commercial coffee sector, most buyers will not finance your trade. This is because it is more difficult for them to decline your offer once they notice your delivery does not meet the agreed standards.

Some specialty coffee buyers may be willing to pre-finance your production so that you can cover costs related to production and export. If a buyer decides to pre-finance you, the amount can range from 20% to 100% of the costs. The remaining part is paid upon arrival in Europe if the coffee is in good condition. The agreements you manage to make will all depend on the nature of your relationship with the buyer. This includes the mutual level of trust and commitment. Note that a buyer will usually not pre-pay the full or partial amount of first shipments, as trust must be established first.

Getting a loan from a bank

Instead of pre-financing, many buyers prefer that you work with social lenders or a bank for trade finance. They may provide 60 to 70% of the value of a contract you and a (reputable) buyer signed. Note that such financial institutions will only lend money if you have a few years of successful export track record. This means you should have no claims or financial losses. This can be a challenge when starting up, as you might not have working capital or a track record yet. Refer to CBI’s study on Going digital in the coffee sector for specific tips on how digital tools can help you access finance.

Examples of financial institutions that offer trade finance to coffee producers include Rabo Rural Fund, Triodos Investment Management and Oikocredit (the Netherlands), Root Capital (United States of America), responsAbility and Impact Finance (both from Switzerland), Alterfin (Belgium), Shared Interest (United Kingdom) and Sidi (France).

Tips:

- Read this article on Perfect Daily Grind to assess whether taking out a business loan benefits you as a coffee producer.

- Check out case studies highlighting the role of financial institutions in supporting the coffee sector, and learn how these services can aid you. An example is Oikocredit’s support of the Chajul cooperative in Guatemala.

- The international lenders listed above often have offices in your country. Explore which lenders operate locally and build relationships with them to understand their terms and services. Some institutions also offer additional services such as financial management or price risk management training.

9. Draft a clear contract

Once you agree on all terms, you must draft a sales contract with your buyer. Almost all European buyers use the standard coffee contracts by the European Coffee Federation (ECF). In most cases, a contract is made up by the European buyer in ‘short form’.

A coffee contract usually states the following:

- Name of buyer and seller;

- Name of the coffee bought/sold (for example, Kenya Kirinyaga AA Washed);

- Quality (for instance, cupping score);

- Certifications;

- Volume in bags in kilogrammes;

- Price and total amount per pound/kilogramme/tonne;

- Terms of sales (shipment, terms of delivery and payment, and sample approval);

- Arbitration Settlement and

- Insurance agreements (who pays for it).

Strict contract fulfilment regarding contingencies during export procedures and transport is crucial. You must be familiar with the legal and practical aspects of export terms and responsibilities to prevent disputes. In case of disputes, coffee associations such as the British Coffee Association (and similar organisations in other European countries) can provide arbitration services. Note, however, that agreements about arbitration services should be included in your contract beforehand.

It is important to know your rights as a coffee supplier. In April 2019, the EU published a new directive (EU 2019/633) to protect small and medium-sized suppliers in the food supply chain against unfair trading practices by economically more powerful buyers. This directive applies to suppliers outside the EU when selling to an EU-based buyer. By July 2021, 16 Member States had already notified complete transposition of the Directive.

The Directive includes a list of prohibited unfair trading practices, which include:

- The refusal of a written supply agreement if requested by a supplier;

- Late payments (after 30 days for perishable products, over 60 days for other agri-food products);

- Unilateral changes to contracts; and

- Last-minute order cancellations (less than 30 days).

Tips:

- Object if your buyer asks you something you cannot live up to. If your buyer requests a shipment in May, but you cannot deliver before June, say so. Giving ‘no’ for an answer is perfectly acceptable in European business culture. Not living up to your promises may have severe consequences.

- If you do not understand the details of your contract, contact your buyer. Most buyers are happy to explain these details to avoid mistakes.

- Know your contract, and object if your buyers request you to make additional costs that are not in the contract. These may include payment for pesticide tests, including moisture bags, and so on. It is acceptable for a buyer to make such a request, but your buyer should also pay for it.

- Always deliver on your promises. If changes are inevitable, communicate properly and discuss them with your buyer to find a solution.

- Read this article on Perfect Daily Grind to learn what happens when coffee farmers are sued for defaulting on contracts.

- Read more about your rights as a coffee supplier in The Unfair Trading Practices Directive: a transposition and implementation guide.

10. Contact organisations that offer export assistance services

As a coffee exporter, you must deal with many documents, logistics and requirements. Some organisations specialise in helping you with the technical and/or practical aspects of organising your export.

Figure 7: Overview of organisations that offer export assistance services

Source: Design by Bart Wortel

Trade Commissions or Consulates

Embassies, trade commissions, and consulates of your country in foreign markets can provide valuable assistance and guidance for exporters. They offer market insights, regulatory information, introductions to local distributors or buyers, and help resolve any market entry challenges.

Examples are:

- UK Department for Business and Trade

- Trade Commission of Spain (ICEX)

- Italian Trade Agency (ITA)

- German Chambers of Commerce Abroad (AHK)

International Trade Associations

Various industry-specific trade associations can offer valuable assistance to exporters. These associations focus on specific sectors and provide industry-related information, networking opportunities, trade shows, and educational resources to facilitate international trade.

Some examples include:

Local business partners

Often, it is most beneficial to talk to local business partners when looking for expertise. If you start exporting, dry milling operators, shippers or other exporters may be willing to provide information.

Chambers of Commerce

Most countries have chambers of commerce. They provide resources, guidance, and networking opportunities for businesses interested in exporting. They offer services such as market research, trade missions, and matchmaking events to connect exporters with potential buyers or partners. Many countries also have chambers of commerce that facilitate trade between 2 countries. Examples are:

- The German-Brazilian Chamber of Commerce and Industry

- The French-Indonesian Chamber of Commerce and Industry

Export Promotion Agencies

Governments often have export promotion agencies or trade development organisations that assist businesses in expanding their exports. These agencies provide market intelligence, trade counselling, trade missions, and financial support programmes to help companies enter new markets.

Also, ask around to find national export promotion authorities that are active in your country.

Some examples include:

Freight forwarders

Freight forwarders help you arrange the logistics, transportation, and delivery of goods to Europe. Note that many freight forwarders also offer custom brokerage services. Refer to the International Forwarding Association (IFA) or this list on Ezilon Europe to find a list of forwarding agents and companies.

Customs brokers

Customs brokers help you handle import and export customs formalities. They assist exporters and importers in meeting the European import requirements. They take care of all entry procedures, requirements and valuation. Refer to the member list of the International Federation of Customs Brokers Associations (IFCBA) to find customs brokers in your target country.

Tips:

- Have a look at ITC’s global Business Support Organisation directory. This can help you find institutions in your country that can guide your export.

- Work with someone offering the option of consolidating the shipment. This means that your order will be transported together with those of others. This may lower the shipping costs.

- Read CBI’s Tips for finding buyers and Tips for doing business in the cocoa market. These reports provide useful tips about topics related to exports.

- Read CBI’s Exporting to Europe Guide for more relevant information on organising your export.

Molgo Research carried out this study in partnership with Long Run Sustainability, Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research