What is the impact of the war in Ukraine on exports of coffee?

Russia is a medium-sized coffee importer, and Ukraine’s coffee imports are relatively small. We expect that their imports from developing countries will go down in 2022. This will affect exports to Ukraine and Russia from developing countries, for example Indonesia, Uganda and Ethiopia. However, failed harvests and supply chain disruptions have had a much bigger impact on the global coffee market. Russian buyers are also finding new ways to pay for their coffee imports. This means that the effect of the war on coffee exports is very small.

Product focus

This study focuses on green coffee beans, which are classified as HS code 090111 (‘coffee, not roasted, not decaffeinated’). The available data do not distinguish between bulk, high-quality and speciality coffees.

Contents of this page

1. How does the war in Ukraine affect sourcing inputs for coffee?

So far, the war in Ukraine has not caused scarcity of sourcing inputs for coffee. However, it has raised the prices of sourcing inputs. This has not had a serious impact on producers and exporters of coffee, because prices of coffee have also gone up a lot in 2022.

Input prices have gone up

Fertiliser is an important input for growing coffee plants. The average rate of nitrogen fertilisers used on coffee farms is similar to hybrid corn, so coffee is one of the crops with the highest nitrogen demand. Other inputs for coffee production are electricity, fossil fuels (diesel) and pesticides.

Russia is one of the world’s biggest exporters of fertilisers. The country’s temporary ban on fertiliser exports had a big impact on the global fertiliser market. Some coffee-producing countries have also had less fertiliser available for their crops. However, the developing countries that export coffee do not rely too much on Russia for their fertiliser imports. Most countries also bought fertiliser in advance, so there was enough local stock.

The war in Ukraine has had a much bigger impact on prices for energy commodities and for inputs that use a lot of energy commodities in their production. Fertilisers are a clear example of this. Nitrogen-based fertilisers are the largest group. Their production process starts by mixing nitrogen from the air with hydrogen from natural gas (an energy commodity) at high temperature and pressure to create ammonia. About 60% of the natural gas is used as a raw material. The other 40% is used to power the synthesis process.

The higher prices for energy commodities are unlikely to change in the next few years. This means that fertiliser prices will stay high. It also means that all the countries that depend on fertiliser imports, including countries that bought fertiliser in advance, will have to pay higher fertiliser prices for their 2023/2024 crop.

Farmers explore alternatives to synthetic fertiliser

Some governments are actively trying to support their farmers. In Kenya, for example, the government has received a loan from the African Development Bank. This loan is meant to “support food security efforts amid rising cost of inputs and prevailing drought” and it gives farmers subsidised access to fertiliser.

To become less dependent on synthetic fertilisers, some farmers are exploring the use of organic fertilisers. In Peru, for example, the Coffee Alliance for Excellence (CAFE) initiative is supporting farmers to do this. Their analysis showed that farmers can achieve similar results by spending $4.50 per hectare on organic compost, instead of $17 per hectare on synthetic fertilisers.

Figure 1: Producing biofertilisers in Peru – CAFE Project

Source: TechnoServe @ YouTube

Tips:

- Stay up to date on developments for farm inputs, for example by following RaboResearch Farm Inputs.

- Explore opportunities to develop a local production/supply of organic fertiliser. See the CAFE initiative (Figure 1) for more information.

- Keep track of national initiatives that offer subsidies or other financial support to farmers to compensate for the higher input prices.

2. How does the war in Ukraine affect competition for coffee?

Ukraine and Russia do not produce or export coffee. This means that the direct impact of the war in Ukraine on competition for coffee is quite small. However, both countries do import coffee. If these imports drop, more coffee will become available on the world market. This seems to have caused the rising coffee prices to stabilise. However, the demand for coffee is high.

Figure 2 clearly shows that the 2 biggest suppliers of green coffee beans are Brazil and Vietnam. Colombia is in third position, but quite far behind. Indonesia, Honduras and Uganda come next.

Vietnam and Brazil are also by far the biggest suppliers of green coffee beans to Russia and Ukraine. Their export volumes (88,000 tonnes to Russia and 66,000 tonnes to Ukraine in 2020) show that Russia and Ukraine are not their main destinations, but these are still important markets for both countries. These countries may have to find different export destinations for some of their coffee if imports from Ukraine and Russia go down.

Coffee prices have increased sharply

Prices increased for all types of coffee in 2022, and they are expected to continue to grow or at least to stay high in the next few years. If these high prices make up for the higher production costs, this will lead to more profit for the coffee growers.

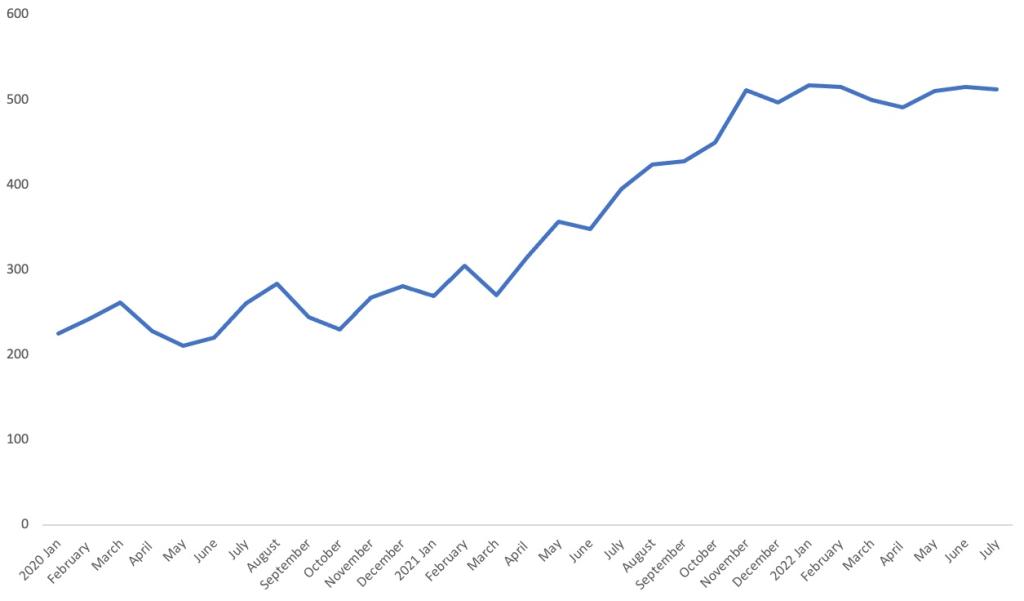

Figure 3: Monthly green Arabica coffee bean prices in 2020-2022 (in USD per kg)

Source: ICE (July 2022)

From January 2021 until July 2022, coffee prices more than doubled because of dry weather in Brazil, supply chain disruptions, and higher freight costs. They have stabilised since the start of the war in Ukraine in February 2022.

Coffee prices mainly depend on:

- supply;

- demand;

- logistics.

Supply-side issues have a big impact on coffee prices. Coffee beans grow in very specific climate zones, but global warming is making many areas less suitable for growing coffee. Weather conditions and/or pests and diseases threaten production. For example, dry weather and frost caused harvests to fail in Brazil, which led to 14% fewer green coffee bean shipments in January 2022. Supply is also threatened by political instability and unrest, which make it difficult to grow or trade beans.

Of course, demand also affects prices. More and more people consume coffee as part of their daily life. This leads to higher consumption worldwide, which leads to higher prices for coffee. When hedge funds and other speculative investors show an interest, this also increases the demand for coffee.

Disruptions in logistics also influence coffee prices. Freight rates reached their highest level in 2021, after they reached record highs during the COVID-19 pandemic. At the start of the war in Ukraine in February 2022, experts thought that the resulting rise in fuel costs could also lead to a new rise in freight rates. A few months later, freight rates have decreased, although they are still much higher than they were in 2019.

The decision to remove several Russian banks from the SWIFT international payments system has not led to a big drop in coffee transactions with Russian buyers. Russian buyers have often continued to buy coffee from the same suppliers for a similar price, but with different payment methods (for example via Switzerland or via intermediaries). This means that the SWIFT decision will not have a big effect on the coffee market size and prices.

Prices are likely to stay high for the next few years

Roasters have used their inventories to tackle the short supply in 2021/2022. We expect that roasters will want to restock their supplies. This means that, even when the supply of coffee matches consumption, demand will still be high because of restocking.

The higher fuel and fertiliser prices that are caused by the war in Ukraine have not yet influenced coffee prices, because they did not affect this year’s harvest. However, we expect them to affect next season’s harvest (2023 and beyond). This means that coffee prices are also likely to stay high throughout 2022 and 2023.

Tips:

- Follow coffee prices to stay aware of market developments.

- Consider exporting to Europe, and find relevant markets in our study about the demand for coffee on the European market.

- Read more about the impact of COVID-19 on the coffee sector in our article.

3. How does the war in Ukraine affect coffee exports from developing countries?

The main cause of instability in the coffee market is disruption to the supply. Changes to demand are only a small factor. The lower demand for coffee in Russia and Ukraine will mainly affect their biggest supplying countries: Vietnam, Brazil, Indonesia, Colombia, Uganda and Ethiopia. However, Russia and Ukraine were not these countries’ biggest coffee buyers, so the impact is quite small. Prices for coffee are also at the highest level for over 5 years, so coffee producers can easily sell their crop to other buyers.

Russian and Ukrainian coffee demand may drop

Russia’s main coffee suppliers are Vietnam (40% of imports), Brazil (31%) and Indonesia (10%). Ukraine imports most of its coffee from Vietnam (32%), Brazil (24%) and India (16%). Figure 6 and Figure 7 show the export volumes of these main supplying countries to Russia and Ukraine from 2016-2020.

*2021 is not included because Russia has not yet reported to UN Comtrade (in July 2022).

Russian imports will go down because:

- transport routes are unavailable;

- traders are afraid that they will not get their money;

- prices have risen;

- the value of the rouble is unstable.

The value of the rouble is changing a lot because of the war in Ukraine. In spring 2022, it hit a record low at €0.0061. After a record high of €0.018 in early July, it is now going down again. The value of the rouble influences Russian coffee imports. When the rouble’s value is low, coffee is too expensive for many Russian citizens. Although rich Russians will still be able to drink coffee, poorer people cannot afford to buy coffee at high prices. Russians are also more likely to buy Robusta coffee when the rouble is low, because Robusta is cheaper than Arabica.

Ukrainian imports will drop because:

- transport routes are unavailable;

- many people have left the country;

- many people who stayed have less money than before the war.

Effects on supplying countries may be small

However, imports will not drop as dramatically as market experts predicted at the beginning of the war. The volume of Russian imports will decline the most because Russia imports a lot more coffee than Ukraine. The biggest percentage drop can be found in Ukraine. Ukrainian coffee import volumes are lower than Russian imports, but the war has caused a big drop in demand.

The main coffee-supplying countries have not banned coffee exports to Russia. Coffee traders also expect Russian importers to find a way to get their coffee, despite the restrictions.

Even if Russians cannot import as much coffee as they would like, the global demand for coffee is so strong that coffee growers in developing countries will easily find other buyers. The effect on these suppliers may also be small because Russia and Ukraine are not their biggest markets. For example, Indonesia exported only about 2% of its total coffee export volume to Russia in 2020, and exports to Ukraine were even smaller.

This means that the drop in demand from Russia is not big enough to have a serious effect on the competition for coffee suppliers from developing countries on the world market.

Tips:

- Regularly check the website of the International Coffee Organisation and read its monthly review of the coffee market. Here you can read about the latest developments in the supply and demand for green coffee, and about the international coffee futures markets.

- Stay up to date on the latest information about world transport routes.

Globally Cool B.V. carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research