The EU Green Deal – How will it affect my business?

Climate change and loss of biodiversity are serious risks to life on Earth. This is why the European Commission introduced the European Green Deal (EGD) in 2019. The EGD includes plans that are designed to reduce greenhouse gas emissions and the use of resource while still promoting economic growth. This means that products sold in the European Union (EU) must satisfy stricter sustainability standards. If you export goods to the EU, you need to understand how the EGD might affect your business, and you need to get ready for these changes.

Contents of this page

- What is the European Green Deal?

- What is the Farm to Fork Strategy?

- What is the Circular Economy Action Plan?

- How does the European Green Deal affect imports to Europe?

- What extra requirements must suppliers to the EU satisfy, and when?

- What are the main obstacles to export caused by the EU Green Deal?

- What opportunities to export does the EU Green Deal offer?

- What else should I know about the EU Green Deal?

1. What is the European Green Deal?

The European Green Deal (EGD) is the EU’s response to the global climate emergency. It is a group of policies that set out Europe’s strategy to reduce its emissions to net zero and create a resource-efficient economy by 2050. The EGD will affect all parts of the economy, including agriculture, industry, services, energy, finance, transport, and construction. It also includes important policies, such as the Farm to Fork Strategy and the New Circular Economy Action Plan.

The policies of the EGD will probably change how goods are made and used. This means that products that are sold in the EU, including imports from other countries, will need to satisfy stricter environmental and social sustainability standards. Many policies have already been introduced since the EGD began, but some decisions are still expected in the coming year. It is not clear yet how and when many of these policies will be introduced, but you need to understand the goals of the EGD so you can be ready to satisfy these higher standards

A plan for a carbon-neutral Europe

The EGD is an ambitious plan to make Europe climate neutral by 2050. The first big goal is to reduce greenhouse gas (GHG) emissions by at least 57% by 2030 (compared to 1990 levels) to improve the well-being and health of present and future generations. The EGD explains what investments are needed and what financing tools are available to help with this climate transition. In some cases, the EGD also suggests new and improved policies to make sure this transition is a success.

Ambitious goals

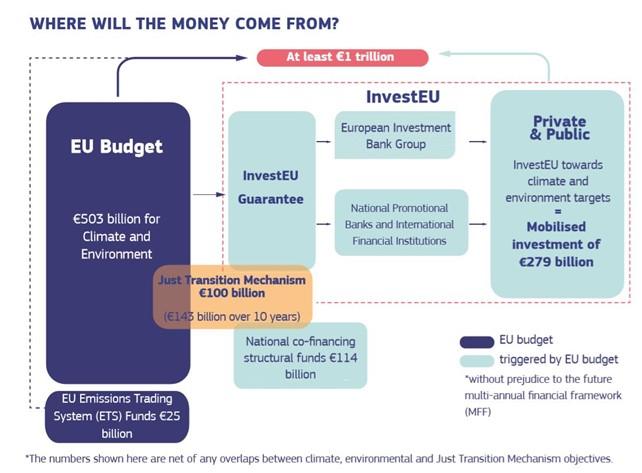

One of the goals of the EGD is to protect people in Europe from the effects of climate change. To do this, the EGD has set ambitious targets to protect, care for, and improve Europe’s natural resources, land, and ecosystems. To reach those targets, the European Commission created the European Green Deal Investment Plan (EGDIP), which is also called the Sustainable Europe Investment Plan (SEIP). This plan aims to collect at least €1 trillion for sustainable investments by 2030. However, despite the EU’s progress as part of the EGD, the Climate Action Tracker (CAT) concludes that many of its policies, actions and climate finance efforts are not effective enough.

Figure 1: Financing of the European Green Deal

Source: European Commission (n.d.)

Another goal of the EGD is to make Europe a leader in global climate action. To do this, the EU is working with its allies and trade partners around the world. The EU also understands that some regions, industries, and workers might find it more difficult to make this transition. The European Commission has provided policy guidance to help these people achieve the EGD’s goals.

Key elements of the EGD

The European Commission introduced the EGD on 11 December 2019, and the first legislative proposals were launched on 14 July 2021. These proposals include both mandatory and voluntary actions, such as the European Climate Law. They aim to promote the transition in key economic areas, such as aviation, energy, industry, transport, land use, forestry, and agriculture.

Key elements of the EGD

The EGD focuses on the following policy areas:

- More climate ambition in the EU for 2030 and 2050.

- No pollution in an environment without toxic substances.

- Clean, affordable, safe energy.

- Preservation and restoration of ecosystems and biodiversity.

- Encourage industry to make a clean and sustainable economy (Circular Economy Action Plan).

- A fair, healthy, and environmentally friendly food system (Farm to Fork strategy).

- Efficient use of energy and resources in construction and renovation.

- Acceleration of the transition to sustainable and smart mobility.

2. What is the Farm to Fork Strategy?

The Farm to Fork Strategy (F2F) is a mix of regulatory and voluntary measures that aim to make Europe climate neutral by 2050. It focuses on creating a fair, healthy, and eco-friendly food system for all Europeans to help to address the climate crisis.

F2F was launched on 20 May 2020, and it aims to reduce the environmental and climate effects of Europe’s food system and to stop biodiversity loss. To do this, F2F will try to reduce food waste, make sure citizens have enough affordable food, make sure that the EU can compete with other parts of the world, and guarantee fair prices for food producers.

Figure 2: The Farm to Fork (F2F) strategy in short

Source: European Commission (n.d.)

Main goals of the F2F Strategy

F2F has set 5 main targets to be reached by 2030:

- Reduce the use and risk of chemical pesticides by 50%.

- Reduce the loss of nutrients by at least 50%.

- Reduce the use of fertiliser by at least 20%.

- Reduce sales of antibiotics for farm animals by 50%.

- Make sure that the organic farming area is at least 25% of the total arable landMain goals of the F2F Strategy

The actions needed to achieve the goals of F2F include: updating many existing regulations for the food and agriculture sectors, creating new rules, and improving coordination within the EU (0). The European Commission has also suggested programmes to promote a sustainable food labelling system (Table 2 and Table 3), to encourage authorities to buy more organic products, and to introduce the Organic Action Plan 2020–2026.

Table 1: Sustainable food production actions to deliver the Farm to Fork Strategy

| Relevant implementation actions | Timeline | Affected sectors |

| EU Guidelines on Aquaculture | Published: Q2 2021 | Fish and seafood |

| Regulatory and administrative framework for aquaculture | Published: Q2 2024 | Fish and seafood |

| Planning of space and access to water for marine aquaculture | Published: Q2 2024 | Fish and seafood |

| The new Common Agricultural Policy | Implementation: Q1 2023 | Agricultural and Forestry sectors |

| Biopesticides – approval criteria for microbial active substances | Adoption: Q3 2022 | Agricultural sector |

| Revision of the existing animal welfare legislation, including on transport and slaughter | Adoption: Delayed (initially planned for Q3 2023) | Apparel, home decoration and home textiles |

| Revision of Sustainable Use of Pesticides Directive | Withdrawn indefinitely, Directive (2009/128/EC remains in force) | Agricultural sector |

| EU Strategy on Algae (Blue bioeconomy) | Adoption: Q4 2022 | Natural food additives and Fish and seafood sector |

| Action plan for integrated nutrient management to reduce pollution from fertilisers | Commission Adoption delayed: Initially planned Q2 2023 | Agricultural and Forestry sectors |

Note: “Relevant policies and legislation” means relevant to the CBI sectors covered in this research and relevant to production/trade in non-EU countries

Table 2: Ethical food production actions to deliver the Farm to Fork Strategy

| Relevant implementation actions | Timeline | Affected sectors |

| Initiative to improve the corporate governance framework (integrate sustainability into corporate strategies) | In force since July 2024 | Agricultural, Fishery and Forestry sectors |

| EU Code of Conduct on Responsible Food Business and Marketing Practices | Implementation: Q2 2021 | Tourism, Agricultural, Fishery and Forestry sectors |

| Revision of EU geographical indications scheme (to tackle food fraud) | In force since May 2024. | Agricultural and Fishery sectors |

Note: “Relevant policies and legislation” means relevant to the CBI sectors covered in this research and relevant to production/trade in non-EU countries

Table 3: Nutrient content, food safety and labelling actions to deliver the Farm to Fork Strategy

| Relevant implementation actions | Timeline | Affected sectors |

| Revision of rules on information provided to consumers | Adoption delayed: Q4 2022 | Agricultural, Fishery and Forestry sectors |

| Proposal for a Directive on Green Claims | Adopted in March 2024 | All |

| Proposal for harmonised mandatory front-of-pack nutrition labelling to enable consumers’ health-conscious food choices | Publication delayed: Q4 2024 or later | Agricultural, Fishery and Forestry sectors |

| Agricultural products – revision of EU marketing standards | Adopted by the Parliament and Council and entered into force: Q2 2024 | Agricultural sector |

| Revision of EU legislation on Food Contact Materials (food safety and environmental footprint) | Commission adoption delayed: Q1 2025 or later | Agricultural, Fishery and Forestry sectors |

| Revision of Directive 94/62/EC on Packaging and Packaging Waste (REFIT) | Adopted by the Parliament: Q2 2024 | Agricultural, Fishery and Forestry sectors |

| Set nutrient profiles to restrict promotion of high salt, sugar or fat content | Commission adoption delayed: Initially planned for Q4 2022 | Agricultural, Fishery and Forestry sectors |

| Revision of legislation for plants produced by certain new genomic techniques | Q2 2023 | Agricultural and Forestry sectors |

Note: “Relevant policies and legislation” means relevant to the CBI sectors covered in this research and relevant to production/trade in non-EU countries

The EU food system relies on global supply chains for tropical fruits and spices, grains, oils and animal feed. To achieve the goals of F2F, the EU’s trade policy will increase cooperation with non-EU countries to improve nutrition and to reduce food insecurity. The EU will do this by making food systems more resilient to climate change and cutting down food waste.

Areas of international cooperation will include:

- Food research and innovation; with particular reference to climate change adaptation and mitigation;

- Agroecology;

- Sustainable landscape management and land governance;

- Conservation and sustainable use of biodiversity;

- Inclusive and fair value chains;

- Prevention of and response to food crises, especially in fragile contexts;

- Resilience and risk preparedness;

- Integrated pest management;

- Plant and animal health and welfare;

- Food safety standards;

- Antimicrobial resistance; and

- Sustainability in humanitarian and development interventions.

The EU’s cooperation strategy under the F2F will also focus on getting strong commitments from non-EU countries in important areas, such as animal welfare, pesticide use, and the fight against antimicrobial resistance.

Since F2F was published, some laws and initiatives have been proposed that are relevant to CBI sectors. So far, these are:

New Common Agricultural Policy (CAP)

The New Common Agricultural Policy (CAP) entered into force on 1 January 2023. It builds on the previous CAP, and it aims to promote sustainable and competitive agriculture that supports farmers’ livelihoods and makes sure that the society has healthy and sustainable food. Compared with the old CAP, the New CAP sets stricter targets to help achieve the goals of the EGD:

- An obligation to set higher ambitions on environment and climate action;

- Alignment of national CAP strategic plans with the targets of the EGD;

- EU farmers who are entitled to subsidies must satisfy stronger mandatory requirements (such as a higher percentage of arable land dedicated to biodiversity);

- At least 25% of the budget for subsidies will go to environmental schemes. This will strengthen incentives for climate and eco-friendly farming practices and approaches, and it will help to improve animal welfare;

- At least 35% of funds will go to measures that aim to combat climate change and support biodiversity, the environment and animal welfare;

- In the fruit and vegetables sector, operational programmes will spend at least 15% of their expenditure on the environment (compared to 10% in the old CAP);

- 40% of the CAP budget must be relevant to the climate and it must strongly support the general commitment to spend 10% of the EU budget on biodiversity goals.

Agriculture and rural areas are crucial to the European Green Deal, and the CAP 2023–27 will be an important tool to help to achieve the goals of the F2F strategy.

Each EU country has created a national CAP Strategic Plan, which combines funding for income support, rural development, and market measures. When countries designed these plans, they had 10 specific objectives and the Commission gave them some broad policy measures that could be adapted to fit their national needs and capacities. Starting in 2024, each EU country will submit an annual performance report and have a yearly review meeting with the Commission.

Like the old CAP, the New CAP focuses on the EU’s agricultural sector, but EU agriculture also affects global agriculture. This means that the effects of this policy on SMEs in developing countries will be linked to the regulations and actions of F2F and other relevant policy areas of the EGD. SMEs that export to the EU will need to reduce their use of pesticides and chemical fertilisers, improve the welfare of farmed animals, and follow stricter labelling regulations.

Tips:

- Read the UN’s view on the potential positive impacts of EU policies on African farmers.

- Read the Arc2020 view on the Impact of CAP Beyond the EU – A Closer Look on Soya Imports and Milk Product Exports

New organics legislation

The new Regulation on Organic Production and Labelling of Organic Products (which is also called the new organics legislation) entered into force on January 1, 2022. As well as the general labelling requirements that exist for all food products, there are extra rules for the labelling of organic products and raw materials.

The new organics legislation aims to strengthen the control system, which will help to build even more consumer confidence in the EU organics system. It is supported by the action plan for organic production in the EU, which was launched by the European Commission in March 2021. The requirements of the New EU Organic Regulation will apply to imports from non-EU countries with a delay of 1–1.5 years, compared to the EU. The transition period for non-EU countries is expected to end on 31 December 2024.

The EU regulations on organic farming are designed to provide a clear structure for the production of organic goods across the whole of the EU. This aims to satisfy consumer demand for trustworthy organic products while providing a fair marketplace for producers, distributors and marketers.

Imported organic food must also be checked to guarantee that it has been produced and shipped in accordance with organic principles.

These are some of the changes to the new organics legislation:

- The scope of production rules now also includes secondary agricultural products such as beeswax, sea salt, wool and others.

- There are specific rules for wine (including restrictions on sulphites), aquaculture (for example, on maximum stocking densities and water quality requirements), and hydroponics & aquaponics (under EU rules, plants grown hydroponically must not be marketed as organic unless they grow naturally in water).

- Livestock farmers must also satisfy specific conditions if they want to market their products as organic.

- Engineered nanomaterials are not allowed in organic products.

- Both EU and non-EU operators must follow mandatory models to get an organic certificate.

- There are new rules for group certification. These new rules are very detailed and involve some significant changes for operators in developing countries.

- The rules on ‘Labelling’ in the new organics regulation will not only cover the label on the product. They also apply to all statements, indications, trademarks, trade names, pictures or signs about a product on packaging, documents, signs, labels, rings or bands that accompany or refer to that product.

- Producers can only use words like ‘organic’ and ‘ecological’ (or shorter terms like ‘bio’ and ’eco’) if the product is certified organic. Producers must make sure that the design of product packaging is different enough from the colours (green and white) and shapes (leaf) of the EU Bio logo, because this could make consumers think that a non-organic product is organic.

- Labels for organic products entering the EU market must include the code number of the relevant control body and the place where the agricultural raw materials in the product were grown (e.g., EU/non-EU agriculture, and whether the product and its raw materials were partially or entirely produced in other countries).

The new organic legislation creates some problems for smallholders and cooperatives from non-EU countries. The new rules include an updated definition of Groups of Operators, and they set new limits on farm size/organic turnover for their members—up to 5 hectares of total land area OR up to €25,000 of organic turnover. They also limit the membership to a maximum of 2,000 farmers. Experts think that most Group Operators will need to create new legal entities to keep their organic certification. This adds both costs and legal burdens in many countries. Many organic producers who cannot satisfy the new requirements by the end of 2024 may not be able to export their coffee, cocoa, bananas, and other key food commodities to the EU. Fairtrade thinks that this might affect up to 800,000 families in the Global South.

Tips:

- Read this report from AGRINFO to learn about the biggest changes in the new organics regulation.

- Read CBI’s article on the implications of the EU Organic Regulation for exporters of grains, pulses, and oilseeds.

- Read the EU Commission’s Frequently asked questions on the New organic rules.

- Tradin Organic offers technical support to farmers who want to switch from conventional to organic agriculture.

Biopesticides – approval criteria for microbial active substances

One of the goals of the EU’s Farm to Fork Strategy is to reduce dependence on chemical pesticides. This includes making it easier to market biological active substances, such as microorganisms.

This initiative describes the approval criteria for microbial active substances in Annex II of Regulation (EC) No 1107/2009, because their unique characteristics are different from chemical substances. After the initiative was approved in June 2022, permission was given to use more than 60 microorganisms in the EU. The Annex to the Regulation entered into force in November 2022.

For SMEs in the agricultural sector that export to Europe, this means that they will need to adopt new agricultural practices that do not use microbial active substances. For example, they might use pest-fighting companion crops or different products that satisfy the allowed chemical limits. They will need to get new investments, involve technical experts, and do some experimentation. For processors of agricultural products, this might involve working more closely with their suppliers to help them to adopt different agricultural practices that comply with the biopesticide initiative.

Tip:

- Visit the website of the Integrated Pest Management (IPM) Coalition, which has resources to help farmers reduce their use of hazardous pesticides. These resources include a pesticides database and the ’Pesticides & Alternatives’ app. This free app for your telephone has information about the toxicity levels of more than 700 pesticides, and it suggests ways to prevent and control almost 3,000 agricultural pests without chemicals. You can download the app from Google Play or the iTunes App Store, and it is available in English, Portuguese or Spanish. After you have downloaded it, you can use it offline.

EU Code of Conduct on Responsible Food Business and Marketing Practices

The EU Code of Conduct on Responsible Food Business and Marketing Practices is one of the first results of the Farm to Fork Strategy, and it is an essential part of the F2F action plan. It describes voluntary actions that people in different parts of the food supply chain (such as food processors, food service operators, and retailers) can take to improve and communicate about what they are doing to be more sustainable. These actions can be taken within individual companies, or people can work together with other companies in the industry and with other stakeholders in the food system, such as farmers and consumers. The Code came into force on 5 July 2021, and at the moment it is a voluntary industry initiative. However, it may be updated and possibly turned into a law if the European Commission thinks that voluntary commitments are not enough. As of Q3 2024, the Code is still voluntary.

The Code includes 7 goals. Each goal has its own targets and actions that aim to make it easier for European consumers to make healthy and sustainable food choices. Actions in major areas can be expected together with an agreement to move towards higher levels of ambition within a specific period of time. For the more advanced companies that want to increase their commitments, the Code also includes a framework for more ambitious, measurable actions.

For companies exporting to Europe, this might mean stricter traceability requirements and corporate social responsibility (CSR) policies.

The Code is quite flexible for SMEs. For example, it offers less strict requirements for monitoring and reporting. SMEs that cannot report every year can provide simplified reports once every 2 or 3 years, describing their commitments and giving specific information about their activities. In addition, there are initiatives that can help the SMEs (worldwide, not only EU) that sign the Code:

- Enterprise Europe Network, and especially its sustainability advisors to see what SMEs need and what their priorities are;

- European Cluster Collaboration Platform, which helps SMEs to share information and create business opportunities across Europe. This aims to improve collaboration in the entire food supply chain, to achieve a green transition in the agri-food ecosystem;

Tip:

- Read CBI’s market information on requirements for food exports to the EU (choose the sector that applies to your product), including policies about a code of conduct and CSR. When you are choosing a sector, read the information that CBI has published about trends and opportunities for healthy and sustainable food choices for EU consumers.

Figure 3: F2F will change the type and amount of inputs used in agriculture

Source: Pixabay

Other relevant regulations

Some other regulations that might affect exporters from countries outside the EU will enter into force in the short term and mid-term. For example, there is the Action plan for integrated nutrient management to reduce pollution from fertilisers. The EU Commission was expected to adopt this action plan in Q2 2023, but it seems to be delayed. The plan describes the effects of fertilisers on human health and on the environment. New limit values for contaminants in fertilisers will probably be introduced, as well as restrictions on the type and amount of chemical fertilisers used in agriculture. This will affect the business model of companies that work in conventional agriculture, both within and outside Europe.

EU Deforestation Regulation (EUDR) is new legislation which aims to make sure that some commodities (palm oil, cattle, soy, coffee, cocoa, timber and rubber, as well as derived products, such as beef, furniture, or chocolate) that are sold on the EU market do not involve deforestation. This legislation supports the EU Green Deal. EUDR has several key features:

- Producers must prove that production complies with relevant legislation in the producers’ countries;

- Products must not come from land that has been deforested (whether naturally or by humans), and producers are not allowed to deforest after 2020;

- Producers must collect and store geographic coordinates and the date or time range of production on all the plots of land where the relevant commodities are grown or harvested. This information must be stored for at least 5 years;

- Producers must show that there is a very low risk to human rights, including free prior and informed consent (FPIC) and the rights of indigenous peoples, local communities and customary tenure rights holders.

There must be a Due Diligence Statement to show that producers have complied with these requirements.

Large businesses and entire countries and jurisdictions are also criticising EUDR and trying to push the EU to delay it. Indonesia and Malaysia, the world’s largest exporters of palm oil, have even complained to the World Trade Organization (WTO). Other major timber and agricultural producers, including Brazil, have also raised concerns about the regulation’s complexity and how it might affect small farmers and supply chains. Even EU countries are worried. In September 2024, Germany asked the European Commission President to suspend EUDR implementation. In early October 2024, the EU Commission proposed that EUDR implementation should be delayed by one year. On 16 October, the Council agreed to the Commission’s proposal. If the European Parliament also approves the proposal, the obligations resulting from EUDR will become mandatory on:

- 30 December 2025, for large operators and traders

- 30 June 2026, for micro-businesses and small enterprises

Tip:

- Read WWF’s EUDR Step-by-step Guide for Business.

In the next 2–3 years, the new or revised regulations will probably change these things:

- The types of materials used to package raw materials and specially processed products;

- The type of practices allowed in animal farming;

- The type and amount of pesticides allowed in agriculture;

- The type of genetic technologies allowed in plant breeding and cultivation;

- The nutrient content of food products;

- The type of information provided to consumers, including front-of-pack labelling and other marketing standards.

Tips:

- Read about informative sessions on Pesticides, New Genomic Techniques and Veterinary medicine that have been held since 2020 for Embassies and Missions of non-EU countries as part of the F2F strategy. Visit the European Commission’s event page regularly to find out about information sessions on topics that you are interested in.

- Learn about Maximum Residue Levels on this webpage.

- Check the European Commission’s F2F page regularly for informative events.

3. What is the Circular Economy Action Plan?

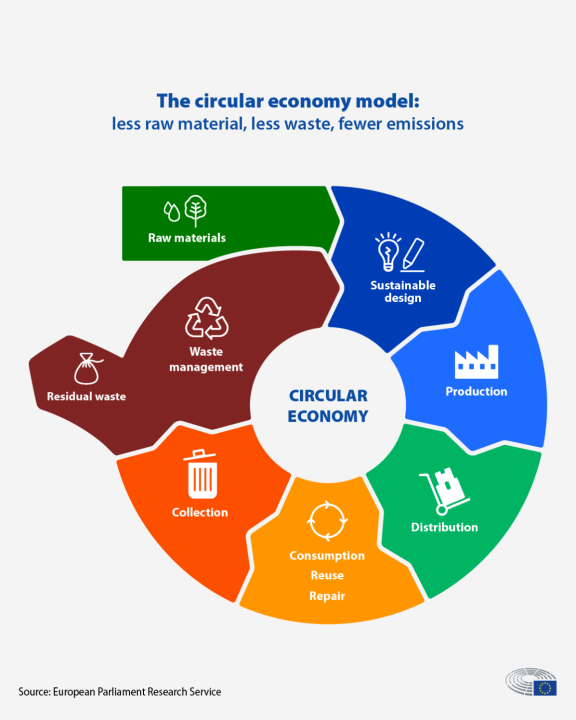

The EU’s Circular Economy Action Plan (CEAP) was adopted in March 2020 as a key part of the EGD. The CEAP includes laws and actions that aim to change how products are designed, made, and used so that no waste is created. This means that materials are used and reused in a way that reduces the need for natural resources. The CEAP focuses on different sectors, including packaging, technology, vehicles, and textiles.

What is a circular economy?

The circular economy is a way of producing and using goods that aims to keep using materials and products for as long as possible. This means sharing, leasing, reusing, repairing, refurbishing, and recycling to reduce waste as much as possible. When products are no longer useful, their materials can be reused many times. This creates more value.

This is different from the linear economic model we have now. In the linear model, materials are made into products, used for a short time, and then thrown away. This system depends on large amounts of cheap, easily available materials and energy, but it is not sustainable in the long term.

Sometimes, people call the CEAP the ‘new CEAP’ because it is based on the first CEAP adopted in 2015. The “new” CEAP is more organised and covers more products and materials than the previous CEAP.

The measures that have been introduced under the new CEAP aim to:

- make sure that sustainable products are the standard in the EU;

- empower consumers and public buyers in the EU;

- focus on sectors that use the most resources and have a high potential for circularity, such as electronics, textiles, and furniture;

- reduce waste;

- make sure that circularity is good for people, regions, and cities;

- lead global actions to create a circular economy.

The first CEAP led to important progress in building a resource-efficient economy, including a Directive on single-use plastics and mandatory Ecodesign rules for energy-related products such as household appliances, motors, and power supplies. However, many of the measures proposed in the first CEAP were voluntary, and only a few became official laws before the end of 2018.

Figure 4: A circular economy

Source: Parliament News (2023) “Circular economy: definition, importance and benefits.”

The new CEAP includes many legal and non-legal initiatives to use the circular economy concept in the EU's economy, manufacturing, and trade activities. For example, this means updating rules on waste pollution and changing the types of materials that are allowed in the construction sector. Many of the CEAP measures are important for SMEs in developing countries in sectors such as agriculture, food, apparel, and home textiles (Table 4). These measures made some progress in 2022 and 2023, but also had significant delays.

Table 4: Summary of relevant actions by the European Commission to implement the CEAP

| Relevant implementation actions | Timeline | Affected sectors |

| EU Strategy for Textiles | Adopted March 2022 | Apparel, Home Textiles |

| EU rules to empower consumers for the green transition | In force since March 2024 | Apparel, Home Textiles |

| Ecodesign for Sustainable Products Regulation | In force since July 2024 | Apparel, Home Textiles |

| Proposal for a Directive on Green Claims | Adopted in March 2024 | All |

| Packaging and Packaging Waste Regulation | Adopted in April 2024, final text expected in Q4 2024 | All |

Source: Profundo summary based on the European Commission announcements

Note: “Relevant policies and legislation” means relevant to the CBI sectors covered in this research and relevant to production/trade in non-EU countries.

Laws and initiatives of relevance to CBI sectors have been proposed since the CEAP was published. To date, these are:

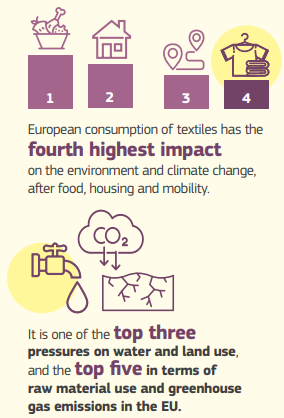

EU Strategy for Sustainable Textiles

There are many initiatives under this strategy. They aim to improve the life cycle of textiles by making them last longer, making them easier to recycle, and giving information about their materials and their effect on the environment. The strategy also looks at how we use and throw away textiles, and it tackles problems such as fast fashion, textile waste, and the destruction of unsold items. The EU wants to make sure that by 2030, textiles are more durable, repairable, reusable, and recyclable, while also respecting social rights.

Figure 5: Environmental effects of EU consumption of textiles

Source: Factsheet EPR for textiles

This strategy will influence many different laws by adding principles of textile circularity into other EGD laws and initiatives in the future. For example, the strategy promises to set new environmental performance reporting requirements for textiles that are sold on the EU market under the Digital Product Passport. The Digital Product Passport is part of the Ecodesign for Sustainable Products Regulation, and it will implement EU rules about extended producer responsibility (see the box below) for textiles as part of the 2023 Amendment to the Waste Framework Directive.

These are some of the other effects of a European circular textiles economy on SMEs in third countries:

- Demand for recycled content in textiles (in the short term, this will probably focus on recycled polyester, as it is the most available textile), including designing less complex material combinations to make textiles more recyclable;

- Stricter controls on the environmental effects of products placed on the EU market mean that producers will need more traceability;

- Companies are starting to bring their supply chains back to their own countries (nearshoring), after they moved the supply chain to other countries in the past to save money (offshoring). EU retailers will want to reduce supply chain costs that are determined by the distance between research and development (R&D), product development and manufacturing, time to market and increased wages in offshoring destinations (such as China, the Philippines and India);

- A growing secondary material market in Europe that focuses on reuse, repair, and return. This aims to make good-quality second-hand textile products and materials more available, and reduce the consumption of new products. This might decrease demand for newly produced textiles from outside Europe; and

- Extended producer responsibility (see box below) in promoting sustainable textiles and in the treatment of textile waste. This will become stricter.

Tips:

- Read the CBI study on sustainable transition in apparel and home textiles for more information.

- Watch this webinar by the Flanders District of Creativity and learn about the possible effects of the EU strategy for sustainable and circular textiles on global textile supply chains.

- Visit the Global Textile Regulations Hub by Carbonfact, which provides information about international textile regulations and laws for fashion, apparel, and footwear.

Extended Producer Responsibility (EPR)

The 2023 Amendment to the Waste Framework Directive includes extended producer responsibility (EPR). This policy makes a producer responsible for what happens to a product after it has been used and becomes waste. It aims to encourage producers to think about the environment when they design and make their products, and to help to create an economy that reuses and recycles materials as much as possible.

Figure 6: Order of preference for managing and disposing of waste

Source: European Commission, Waste Framework Directive

Some industries already use this approach. For example, in the EU, producers of batteries and accumulators, vehicles, and electric and electronic equipment must pay for the collection, recycling, and disposal of their products at the end of their life.

This also happens to single-use plastic and packaging waste. By the end of 2024, all EU countries must have an EPR scheme in place for packaging waste. This means that producers and importers must pay fees for the collection, sorting, and recycling of packaging waste according to the rules in each country.

Some countries have their own EPR rules that are stricter than EU laws. In France, EPR covers sectors such as textiles, paper, household chemicals, and furniture, and it also covers many product categories such as toys, sports equipment, and gardening tools. In Spain, a new law requires producers of textiles, furniture, and plastics for farming to take responsibility for managing their waste.

Tips:

- Check out Lovat’s guidance that presents specific EPR regulations for every EU country and the UK.

- Read the EU Factsheet on the Textiles Strategy and the Questions and Answers

- Help to create the Textiles Ecosystem Transition Pathway

- Look at the UK Government’s advice for producers on how to prepare for EPR for packaging.

New EU rules for empowering the consumer for the green transition

The new EU rules for empowering the consumer for the green transition change existing laws, and they will help consumers in the EU to make informed and environmentally friendly choices when buying products. The new rules will require traders to give much more information about the durability, reparability and sustainability of the product being sold, while also putting more strict controls on what a ‘sustainable’ product is. This means that businesses will not be allowed to use unclear terms like 'conscious,' 'sustainable,' or 'responsible' just because they have good environmental records; these claims must also include social responsibility. The new rules will also protect consumers from early obsolescence in the products that they buy (see box below), and they will only allow verified sustainability labels.

Early Obsolescence

Early obsolescence is also known as planned obsolescence, and it is when manufacturers make products that only last for a short time. Sometimes this is because of bad design. In the case of electronics, the company might publish updates that do not work with older models. Early obsolescence aims to make consumers buy new products again and again, instead of being able to repair them or use them for a long time.

Ecodesign for Sustainable Products Regulation

This initiative aims to make products placed on the EU market more sustainable. This builds on a law which already exists called the Ecodesign Directive, which focused on energy-related products and allowed each EU country to implement their own rules. The new regulation covers all products that are manufactured, except for food, feed, medicines, plants, and animals. These are some of the main changes:

- Ecodesign requirements: minimum criteria will be set for different product groups, to make sure that products are sustainable, reliable, reusable, repairable, and energy efficient, and that they contain recycled materials. These requirements will also aim to support producers to remanufacture, recycle, and/or recover materials, and to limit the environmental effect.

- Product Passport: all products must have a digital ‘product passport’ which contains relevant information that will be determined by the sector and product group.

- The proposal for a New Ecodesign for Sustainable Products Regulation (ESPR) was adopted in March 2022. In December 2023, the Council and the Parliament reached a provisional agreement. The law entered into force in July 2024. Under the new law, performance and information requirements will be set progressively for new products on the EU market. By July 2024, there were 29 product groups for Ecodesign criteria. Each group has its own part of the law that makes the Ecodesign criteria mandatory. The provisional agreement of December 2023 also included textiles (especially garments and footwear) and other products in its list of priority products for the 2024–2027 working plan. The EU is developing the implementation of laws for new products and revising old ones.

Tips:

- Watch this webinar on the Sustainable Product Policy. It describes specific ways to make sure that products in the EU are more sustainable and use resources more efficiently.

- If you can, consider bringing in a specialist to help you to understand the specific risks and opportunities for your business. The specialist could also do a Life Cycle Assessment to understand how your supply chain affects circularity.

How the CEAP will affect you

The EU Strategy for Textiles was adopted in 2022, and more CEAP laws have been adopted in the past year. However, each EU country still needs to implement them in the next 2 years. This means that European companies that import goods and services from third countries will begin to adapt to these changes in the short term (1–2 years).

The EU Strategy for Textiles has started to change the market, because companies need to respond to changes in the practices and expectations from consumers in the EU. But even before that, many buyers demanded more recycled packaging, more recycled textiles, and more information from suppliers about sustainability in the supply chain.

Companies in the EU are also being accused of ‘greenwashing’. In 2022, the Netherlands Authority for Consumers and Markets (ACM) asked 2 big chains, Decathlon and H&M, to remove sustainability claims from their products that they could not prove. Under the new law, companies in the EU must be more careful about the claims they make about their products, and they will probably look more carefully into the sustainability claims made by their suppliers.

Figure 7: There are indications that EU buyers want more recycled textiles

Source: CBI

In the long term (3–10 years), SMEs that export to Europe will need to:

- Introduce production processes that minimise waste throughout the life cycle;

- Limit the amount and type of packaging they use for their products;

- Introduce information systems to show clearly how the product is made and whether it satisfies the new Ecodesign requirements. They will also need to give more information so that buyers can make ‘green claims’ and European consumers can understand their choices.

See the section below on extra requirements that suppliers may need to satisfy. It provides more information on other laws that are part of the CEAP and tips for how to deal with them.

4. How does the European Green Deal affect imports to Europe?

The EGD affects imports into Europe in different ways. The EGD requires higher sustainability standards in primary production and industrial processes, and SMEs from third countries will need to give more information about the products they export to Europe. In the short term, this could mean that production and export costs will increase. In the long term, it could increase competitiveness in a sustainable global market. Other markets are also becoming more sensitive to environmental and social issues. For example, countries in Asia that have a growing middle class are interested in healthier diets, and in North America, consumer interest in sustainable food and beverages went up by 18.4% between 2022 and 2024.

The EGD is already changing existing norms to make businesses and supply chains more sustainable. The following effects can be expected on imports to Europe:

A) Stricter social and environmental sustainability requirements in the production and processing of goods and services

Even if laws and regulations do not change, or do not come into practice for several years, European consumers want more products that do not harm the environment and respect human rights and animal welfare. This means that buyers, especially larger companies, want goods that are produced, processed and packaged using high social and environmental standards. The Make Fashion Circular initiative brings together major garment industry players (including H&M, Lacoste, Primark and Ralph Lauren) to use more circular solutions.

Most of the large food and beverage brands have committed to sourcing agricultural products responsibly. The fisheries sector is starting to follow this trend. Some of the major European retailers are also publicly committing to creating a sector that avoids food waste and improves standards for animal welfare, as well as other sustainability commitments. For example, Dutch supermarket Albert Heijn has committed to ensure that at least 60% of the protein it sells by 2030 is plant-based. Other major EU retailers, Aldi and Lidl, recently made the same commitment. Albert Heijn offers plant-based meat alternatives at the same price as or cheaper than traditional products.

All of this means that there is more demand for sustainably produced goods and services. The EGD policies and initiatives will increase this demand further. This could be a great opportunity for SMEs that already produce food and textiles that satisfy high sustainability standards, such as EU organic, as long as they keep up with the changing organic rules.

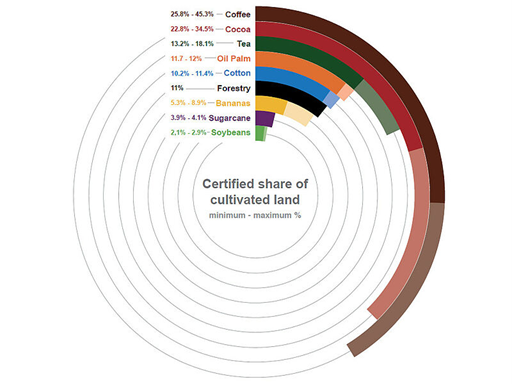

B) Increased demand for information about practices used in the production of commodities

The EGD aims to increase the responsibility of European manufacturers and retailers to be transparent about where and how goods are produced and how they affect people and the environment. To do this, new laws are being discussed, including a law on human rights and environmental due diligence, as well as regulations on non-financial reporting.

The growth of voluntary sustainability initiatives, such as certification schemes and companies’ own initiatives, also means that more information is available about goods that are marketed as sustainable. Today, sustainable-certified goods are a significant share of the market in some sectors (Figure 6). Coffee has been certified as sustainable for the longest time, for more than 30 years. The market share of other certified commodities has grown in the last 10 years. In some cases, this growth started even earlier. More seafood production, from both wild catch and aquaculture, is also expected to comply with basic sustainability standards.

Figure 8: Certification rates for different commodities, 2023

Source: FiBL-ITC-IISD; The state of sustainable markets 2023, page 17

These trends could mean that SMEs that export to Europe will need to give more information about how goods are produced, and they could be audited based on this information. SMEs might need to have systems for collecting information from suppliers about production and labour practices, and they might need to explain where the goods come from (also called traceability). They might need to satisfy a voluntary sustainability standard, which could be a certification scheme or a company’s own initiative.

But voluntary sustainability standards and certification schemes are not a substitution for EU compliance, because many of them do not include some of the new rules, such as EUDR’s requirements for geolocation information.

Tips:

- Read CBI’s study on the current offer and future trends in social certifications.

- Read Profundo’s Benchmark of voluntary soy standards and their (expected) compliance with EUDR.

- Read EU Commission’s FAQ on the implementation of the EU corporate sustainability reporting rules.

What is traceability?

Traceability is the ability to follow all the processes in a product cycle: from procurement of raw materials to production, consumption, and disposal. The purpose of traceability is to show where and when the product was produced, and who produced it.

For animal products and by-products that are imported into the EU, there are already some traceability requirements for food and safety reasons. More and more, traceability is required by buyers with high social and environmental sustainability standards for all types of products, including agricultural products, fisheries and raw materials for textiles.

C) In the short term, changing to new models of sustainable production will probably increase costs

The change to using more sustainable processes and operations involves costs for recycled materials, energy-efficient and waste-minimising processes, traceability systems for products and the right auditing of these processes.

The implications of the EGD are becoming clearer, but it is still not clear how it will affect the investments that producers will need to make so that they can export goods to the EU, as well as the effect on the costs of those goods. Because the EU has promised a just transition, there might be support available to reduce the effects on small businesses and their employees, and there might be time to adjust to the costs of the change. The EU might also create support programmes through supply chains or in bilateral/cooperative funding agreements with countries. There are already several green cooperation programmes in Africa. These include the Partnership on Food and Nutrition Security and Sustainable Agriculture (FNSSA) and the Partnership on Climate Change and Sustainable Energy (CCSE).

D) In the long term, the EGD will make exporters more competitive in the sustainable global market

Europe is not the only important market that is making its economic activity more sustainable. For example, the UK passed a Modern Slavery Act that requires companies to report on the risk of forced labour in supply chains, and the US bans imports of goods that are produced using forced labour. Because more countries are setting net-zero goals and societies are demanding respect for human rights, the environment and animal welfare, supply chains will be affected everywhere. Soon, it will be normal in every market to have sustainable production of materials, goods and services. In the US, the FOREST Act is similar to EUDR, though so far it is more relaxed. This law is supported by politicians from both the government and the opposition. Other jurisdictions will probably also continue to strengthen sustainability requirements for their imports. Companies that adapt to these changes sooner will probably have better market access.

Achieving the objectives of the EGD will require more efforts outside the EU, which means that suppliers in developing countries must also have circular business practices. The EU needs and wants goods and services from outside its borders, and it knows that climate change, inequality and environmental degradation affect the whole world. The EU has committed to ensuring a just transition that has positive effects on small businesses and the production of sustainable goods outside Europe. In the short term, SMEs that export to Europe could get different forms of support. In the long term, they need to be prepared to compete in a sustainable global market.

Tips:

- Find out about the main sustainability certification schemes and standards relevant to your sector. The State of Sustainability Initiatives has good summaries for many products, including bananas, coffee, cocoa, cotton, palm oil, soybean, sugar, tea, timber, wild catch and aquaculture.

- Read this briefing from Proforest for more information on how to achieve traceability in your supply base and what types of information your buyers want to know.

5. What extra requirements must suppliers to the EU satisfy, and when?

The EGD aims for ambitious GHG emissions reductions by 2030 and climate neutrality by 2050. But to achieve those goals, it is necessary to act much sooner. Some policies that will probably affect your business were introduced between 2020 and 2023, and more policies will be announced in the coming year.

Timeline of upcoming EU Green Deal policies

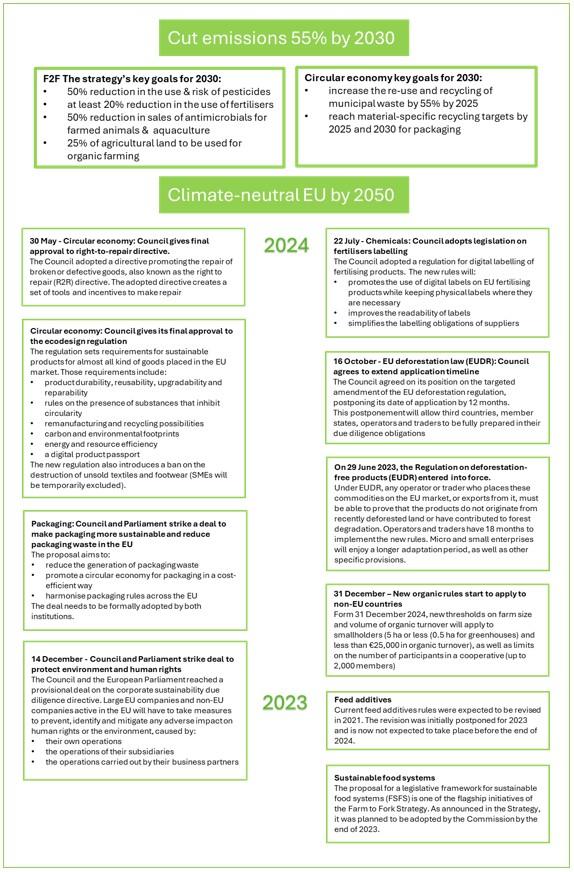

Figure 9: European Green Deal timeline, including the main goals

Source: EU Parliament (n.d.), “Legislative Train Schedule. A European Green Deal”

Regulations planned for 2024–2025

Substantiating (or proving) ‘green’ claims

This initiative will require companies that claim that their products are ‘green’ or environmentally sustainable to substantiate or prove those claims. Specific objectives include creating a standard for providing reliable environmental information, as well as reducing and simplifying the administrative burden of collecting this information, especially for SMEs. This will build on the previous Single Market for Green Products Initiative, which developed and tested Environmental Footprint methods in various sectors between 2013 and 2018.

After a long delay, the European Commission proposed the Green Claims Directive in March 2023. In June 2024, the European Council, which represents all EU Member States, agreed on a shared view of the directive. This agreement will help to guide discussions with the European Parliament to finalise the directive. Negotiations are expected to start at the end of 2024. The proposal adds more details to the Directive on empowering consumers in the green transition.

The EU believes that the further development of common and global standards for circular goods is necessary, whether this is through a regulated certification scheme or voluntary, ‘soft standards’. The Council has suggested a new way for companies to avoid having their environmental claims checked by outside experts. If a company provides certain documents before making a claim, they might not need that check for simpler claims.

This new proposal focuses on clear environmental claims and labels that companies use to show their eco-friendliness. It covers both current and future labels, from both public and private sources. The proposal makes a clear difference between environmental claims and labels, so companies know what rules apply to each. Companies must use clear standards and the latest scientific information to support their claims and labels. These claims and labels should also be easy to understand and should clearly mention the specific environmental features they focus on, such as how long a product lasts, whether it can be recycled, or its impact on biodiversity.

The Commission says that any proposed regulation will consider world trade rules on fair competition. For example, this means that any labelling/information tool should not disadvantage imported products compared with goods that are produced in the EU.

Tips:

- Read the EU Q&A on European Green Claims.

- Read the SBS Position Paper on the Green Claims directive.

- Read the Hungarian Consumer Authority’s general rules for green claims.

- Read the Dutch government’s rules for sustainability claims.

Directive on corporate sustainability due diligence

The Directive on corporate sustainability due diligence (CSDDD) aims to improve the EU regulatory framework on company law and corporate governance and help companies manage sustainability-related matters in their own operations and value chains, including social and human rights, climate change, the environment, etc.

Voluntary action has not led to clear improvement in all sectors. To improve this situation, the CSDDD will introduce incentives for businesses that operate in the EU to respect human rights and the environment in their own operations and throughout their value chains. European companies must identify, prevent, reduce and account for their negative effects on human rights and the environment, and they must have the right governance, management systems and measures.

In particular, under the CSDDD:

- Companies must identify, prevent, reduce, and report on negative impacts on human rights and the environment within their operations, subsidiaries, and value chains.

- Business directors must include due diligence in corporate strategies. They must consider the human rights, climate change, and environmental effects of their decisions.

- Companies must make their sustainability reports public. This makes their Environmental, Social, and Governance (ESG) performance clearer throughout their operations and value chains.

- Large companies must make sure that their business strategies help to achieve the Paris Agreement’s goal of limiting global warming to 1.5°C. This means that they must have a clear plan to achieve net zero emissions.

Companies that are based in the EU must comply with the CSDDD if they have more than 1,000 employees and a net worldwide turnover of more than €450 million. Non-EU companies must also comply with the CSDDD if they have more than €450 million in net turnover within the European Union. These are the deadlines for non-EU companies to comply: non-EU companies that generated a net worldwide turnover of more than €450 million in the EU in the last financial year before 26 July 2029 must comply by the end of July 2029. Non-EU companies that generated a net turnover of more than €1.5 billion in the EU during the last financial year before 26 July 2027 must comply by the end of July 2027. Finally, non-EU companies that generated a net turnover of more than €900 million in the EU in the last financial year before 26 July 2028 will need to comply by the end of July 2028.

At the moment, the new rules do not apply to SMEs. However, the CSDDD offers some support and protection for SMEs, which could be indirectly affected as business partners in value chains. For example, it says that companies ‘should also be responsible for using their influence to contribute to an adequate standard of living in chains of activities. This is understood to include a living wage for employees and a living income for self-employed workers and smallholders, which they earn in return for their work and production’.

Although the first reporting deadlines might seem to be far in the future, it can be difficult to make sure your company complies with the CSDDD, and you might have to pay serious penalties if you fail to comply. This means that EU importers must work together with their suppliers in third countries to comply with the CSDDD. SMEs that export to the EU through buyers who must comply with the CSDDD might need to satisfy stronger traceability requirements.

Reducing packaging and packaging waste

Although the EU has adopted the Packaging and packaging waste regulation, it has not yet entered into force (the final text is expected at the end of 2024). The measures in the Regulation will require producers to make sure that all packaging is reusable or recyclable and that they reduce the complexity of packaging materials, including the number of materials and types of plastics used.

If you sell products on the EU market that require a lot of packaging, or a special type of packaging, these rules will apply to you and to your buyers in Europe. You might need to find ways to reduce the amount of packaging and/or use different materials. For example, you might need to use materials that are lighter, have more recycled content, have no plastic content or can be reused.

Tips:

- Read DS Smith’s explainer on the Packaging and Packaging Waste Regulation.

- Visit Glopack’s page for links to ongoing EU projects that develop innovative packaging solutions, or join its stakeholder’s platform to connect with innovators who are developing sustainable packaging.

Figure 10: The EGD calls for a big reduction in packaging and packaging waste

Source: Pixabay

6. What are the main obstacles to export caused by the EU Green Deal?

In the short term, it might not be clear what the EGD regulations mean or when they will start

- There will probably not be much clear information about emerging EGD rules and policies in the next few years. This will be an important challenge for SMEs in their countries and for their EU-based buyers, who will be struggling with this. Some initiatives may be delayed or withdrawn, and other initiatives may have longer transition periods. The Commission has already proposed that the EU Deforestation Regulation (EUDR) should not be implemented until 1 year later. However, as of October 2024, it is unclear whether the proposal will be supported.

- Buyers have different systems for collecting sustainability information from their supply chains. This often means that SMEs that export to the EU must satisfy different demands for similar sustainability information, using different formats and platforms. Companies will need to introduce harmonised reporting under CSDDD and EUDR, and this might add costs and administrative burdens for producers in the short and medium terms.

- New organic regulations set a limit on land area that is managed by individual smallholders, a limit on annual income, and a limit on the number of members of [TC-VU1] a cooperative. This will probably create administrative burdens and costs in the producer countries.

- Costs will probably increase because companies will need to change to more sustainable processing/production operations, using technologies and materials that satisfy standards from the EGD. For example, this might include higher prices for fertilisers and materials with recycled content. It might also include costs associated with certification and auditing for ‘green’ claims, such as hiring an independent auditor. It is still not clear who will pay those types of costs.

- EU-based producers will have institutional support (subsidies, inclusion in R&D programmes) and will probably start using the new practices sooner than producers in non-EU countries. This will increase competition between EU-manufactured products and imports from third countries. Collaboration with and support for non-EU producers are also being considered as part of the EGD, but the budgets for programmes outside the EU are much lower than the planned budgets for EU-based enterprises.

What can businesses do to deal with the obstacles of the EGD?

- Many EGD policies were defined in 2022-2023. Other policies are still being developed or clarified through delegated acts, FAQs, platforms, and other tools. If you want your perspective to be considered, you can submit feedback during the consultation processes. There are various times you can do this throughout the process of making a law. During the consultation process, you can also submit feedback through your sector association, exporter association or government. On the Welcome to Have your say page of the EU, you will find a list of new policies and existing laws that offer the opportunity for feedback. The opportunities to provide feedback on EGD-related policies and regulations include:

- Organic imports – list of recognised control authorities and control bodies (Q4 2024)

- High-risk organic and in-conversion products from non-EU countries – detailed list (feedback period upcoming, probably Q4 2024)

- Reducing packaging and packaging waste (final text expected by the end of 2024)

- You can also share your ideas to make existing EU legislation simpler, less difficult to implement, and future-proof. To add your suggestion, you will need to register (or log in, if you already have an account).

- Make your company more traceable. Start gathering information, and consider sharing this information with your buyers so that you can work together to find and solve problems with your traceability. This briefing from Proforest has more information on how to make your supply base traceable and what types of information your buyers want to know.

7. What opportunities to export does the EU Green Deal offer?

In the short term, your business can benefit from increased partnership opportunities

- Businesses in Europe will be responsible for the compliance of the products they bring into the EU with Green Deal principles. Buyers with sustainability commitments are already looking for ways to form partnerships with suppliers in third countries. These partnerships aim to improve environmental and social practices in the supply chain. The law says that the buyer needs to satisfy higher sustainability standards, so buyers are willing to help you to make the change to meet their needs. For example, the Olam Group launched the AtSource platform in 2018 to help its customers in the food ingredients and agricultural sector to collect sustainability information from their supply chains.

- SMEs could also benefit from the EU’s increasing efforts for international cooperation on research and innovation, because these are both central elements of the EGD, the F2F and CEAP. The European Commission has published a list of Green Alliances and Partnerships to achieve the goals of the EGD through international trade.

In the long term, better sustainability will give SMEs a global competitive advantage

- As more EGD regulations and initiatives are adopted, the EU will create more support programmes. The EU will work with institutional stakeholders in third countries to achieve a smoother transition, and some programmes will specifically help SMEs. For example, the EU-Africa: Global Gateway Investment Package ‘aims to support Africa for a strong, inclusive, green and digital recovery and transformation’. This package focuses on issues such as biodiversity, agri-food systems, and climate resilience and disaster risk reduction. There are similar initiatives in Latin America and the Caribbean, the Middle East, Asia, the Pacific, and other regions. The EU Commission plans to foster a stronger and more effective engagement of SMEs in the Global Gateway initiatives. Look for updates on this and other initiatives from the national export support agencies or the EU representative in your country.

- As knowledge grows about the implications of the EGD on trade, more tools and mechanisms will become available to give information about your product and to improve your processing/production practices in a harmonised way. One of those tools is the EU Digital Product Passport (DPP), which has been introduced as part of the Ecodesign for Sustainable Products Regulation. Starting in 2026, specific products that are sold in the EU must have a Digital Product Passport (DPP). These passports must include all the relevant information about each product’s origin, materials, environmental impact, and disposal recommendations. DPPs can help you to answer many different information requests from your buyers. Some products are considered to have a bigger effect on the environment (garments and footwear, furniture, chemicals, batteries, consumer electronics, electronic devices, and construction products). These products will probably need a DPP straight away in 2026, with other products being added gradually in 2028-2030.

- Many of the policies and legislative measures of the EGD are improvements to existing regulations that current exporters to Europe already satisfy. Of course, future exporters to Europe will have to comply with these regulations too. If you have sustainability standards in your operations, you will have the opportunity to do business with Europe. This could also give your business a competitive advantage in other international markets.

Tips:

- Read this article by Circularise to help you to understand DPPs and learn how you can introduce a DPP system.

- Watch this webinar organised by European Circular Economy Stakeholder Platform to learn from the experience of leaders who use DPPs in their operations.

How can my business use these opportunities?

- Contact the EU delegation in your country and ask about the support they offer to SMEs. EU Delegations and Offices outside the EU work with different regional cooperation programmes to give information about the EGD. They also work through the governments of countries in Central and South America and East and West Africa to give information about the new policies. The European Union External Action Service has published a list of its Delegations and Offices around the world that you can contact for further information.

- Ask your buyers in the EU about their plans to implement EGD regulations in their supply chains, and discuss the possibilities for support. Some large EU businesses are giving information to their suppliers in countries outside the European Union, to tell them about EGD developments and how this could affect them.

- If you are a member of sector association or a sectoral initiative on sustainability, discuss how you can deal with the challenges together and with other actors in the supply chain. Find out if your sector association is a member of Enterprise Europe Network (EEN). Some of EEN’s regular brokerage events cover policy developments in the EU that affect SMEs, including the EGD.

Find out about relevant sustainability certifications in your sector. This will help you to understand what is involved in high sustainability standards for the production and processing of your goods, and what you might need to do to satisfy future buyers’ expectations and/or EU regulations. Click on the relevant sector on CBI’s market information webpage to find information about certification schemes that apply to your sector. Read CBI’s sectorial studies and learn about the trends and growing demand for environmentally and socially sustainable products

8. What else should I know about the EU Green Deal?

Other important EU Green Deal policies that will impact SMEs from developing countries that export to Europe include the Directive on corporate sustainability due diligence (CSDDD) and the Biodiversity Strategy for 2030. It is not clear yet whether the Carbon Border Adjustment Mechanism (CBAM) will affect imports of products from the different CBI sectors, but it is good to look out for the planned adjustments to this initiative.

The Biodiversity Strategy for 2030 and the legal framework to stop and reverse EU-driven deforestation

- A crucial goal in the development of a sustainable and fair food system is the conservation of biodiversity. Because of the need to protect nature and reverse biodiversity loss, the European Commission has published the Biodiversity Strategy for 2030. Like F2F, the Biodiversity Strategy aims to make society more resilient to future threats such as zoonotic diseases (diseases that spread between animals and humans and are caused by deforestation and wildlife trade), food insecurity, the impacts of climate change, and forest fires. The Biodiversity Strategy establishes a larger network of protected areas in the EU, on land and at sea. To restore damaged land and sea ecosystems, the Biodiversity Strategy aims to increase organic farming and biodiverse landscape features on agricultural land. This will stop and reverse the decline of pollinators and reduce the use and risk of pesticides by 50% by 2030.

- As well as goals for the EU, the Strategy has ambitious goals for the whole world. The EU has committed to ensuring full implementation and enforcement of biodiversity provisions in all its bilateral and multilateral trade agreements by 2030. The EU has committed to continue to offer financial support through the Neighbourhood Development and International Cooperation – Global Europe Instrument (NDICI-Global Europe) and to double its external funding for biodiversity, especially for the most vulnerable countries.

The Carbon Border Adjustment Mechanism

- The EGD recognises that if Europe wants to become carbon-neutral by 2050, it will need the cooperation of its suppliers in Africa, Latin America, and Asia. Without this cooperation, European businesses could move their operations to countries with less strict regulations on GHG emissions. This is called carbon leakage. The Carbon Border Adjustment Mechanism (CBAM) aims to reduce carbon leakage by putting a carbon tax on imports of certain goods from outside the EU. The mechanism aims to put a fair price on the carbon that is emitted during the production of carbon-intensive products that are imported into the EU and to encourage climate-friendly production in non-EU countries.

- Under CBAM, EU importers will buy carbon certificates for the carbon price that they would have paid if the products had been produced under the EU’s carbon pricing rules. If a non-EU producer can prove that it has already paid for the carbon that was emitted during production in a country outside the EU, the EU importer does not have to pay the price. To give businesses and non-EU countries legal certainty and stability, CBAM will be introduced in gradual steps. At first, it will only apply to specific goods that have a high risk of carbon leakage. In the transition phase (until the end of 2025), importers will need to report on the imbedded emissions from their value chains, but they will not yet need to buy certificates. In the definitive phase, which will start from 2026, importers of products that are covered by CBAM will need to register with national authorities. They will also be able to buy CBAM certificates from those authorities.

- The first phase of CBAM (2023–2025) will only apply to fertilisers, iron, steel and energy (including hydrogen), but SMEs that export their products to the EU need to know that other goods might be included later. It is not clear if CBAM will apply to fertilisers that are used in the production of imported agricultural goods. The agricultural products themselves do not yet have to satisfy CBAM. There are also some opportunities for SMEs in third countries. For example, there are concerns that CBAM will increase costs for agricultural producers in Europe, which could give agricultural imports a competitive advantage.

Tip:

- Read a factsheet on how the EU is planning to support developing countries to adapt to CBAM.

How can I stay informed about the EU Green Deal?

- Visit the EU webpage ‘Delivering the European Green Deal’ to find out about the latest developments, and register to get notifications about proposals and laws that are relevant to your operations.

- Watch CBI’s 2025 webinar for more information about the effects of the EU Green Deal on your sector.

- Sign up for CBI newsletters to get the latest news that is relevant to your sector.

Profundo carried out this study by Diana Quiroz and Pavel Boev on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research