What requirements must grains, pulses and oilseeds comply with to be allowed on the European market?

To access the European market, you need to meet various legal requirements. Additionally, potential buyers may request certification. For grains, pulses and oilseeds, European regulations prioritise consumer health and safety. You also need to be prepared for the growing importance of sustainability standards. It is important to stay informed about changing laws and requirements by monitoring the market constantly.

Contents of this page

1. What are the mandatory requirements for grains, pulses and oilseeds?

Most requirements involving the import of grains, pulses and oilseeds (and food in general) relate to food safety. The European Commission for Health and Food Safety is responsible for the European Union’s policy and for monitoring implementation of the relevant laws.

Official food controls

Food imported into the European Union (EU) is inspected regularly. Such inspections can be conducted on imports (at the border) or at a later stage in the value chain (for example on the premises of the importer). The controls ensure that the products meet the legal requirements (for grains, pulses and oilseeds); these are described in more detail below.

An important element of this legislation is that ‘all food businesses outside Europe, after primary production, must put in place, implement and maintain a procedure based on HACCP principles’. HACCP-compliant production does not need to be verified by certification or official controls. However, a HACCP plan is a key element in a quality management system for companies aiming to supply the European market.

Non-compliance with European food legislation is reported via the Rapid Alert System for Food and Feed (RASFF). In 2023, 468 issues with grains, pulses and oilseeds were reported through RASFF. This was 10% more than in 2022. The most common issues were the presence of pesticide traces that exceeded the maximum residue limits (MRLs), mycotoxins and inappropriate documentation.

Source: Globally Cool, based on the RASFF database, May 2024

Non-compliance leads to stricter requirements

If imports of a certain product from a specific country are repeatedly not meeting the requirements set by European food legislation, the frequency of official controls at the border is increased. Such products are listed in Annex 1 of the regulation on the temporary increase of official controls and emergency measures. Table 1 lists the types of grain, pulses and oilseeds that temporarily need an increased number of official controls upon entry into the EU. This list changed for several hazards/products/origins between May 2023 and May 2024 (indicated by an asterisk).

Table 1: Grains, pulses and oilseeds subject to a temporary increase in identity and physical checks in the EU (frequency of official controls in %)

| Country of Origin | Brazil | China | India | Madagascar | Pakistan | Sudan | Turkey | USA |

|---|---|---|---|---|---|---|---|---|

| CN Code and product name / hazard | ||||||||

| 0713 35 00 – Black-eyed beans | ||||||||

| Pesticide residues | 30* | |||||||

| 1006 - Rice | ||||||||

| Aflatoxins and Ochratoxin A | 5 | 10 | ||||||

| Pesticide residues | 10* | 0* | ||||||

| 1202 41 00 - Groundnuts (peanuts), in shell | ||||||||

| Aflatoxins | 10 | 50* | 20 | |||||

| Pesticide residues | 30 | |||||||

| 1202 42 00 - Groundnuts (peanuts), shelled | ||||||||

| Aflatoxins | 10 | 50* | 20 | |||||

| Pesticide residues | 30 | |||||||

| 1207 40 90 - Sesame seeds | ||||||||

| Salmonella | 20 |

Source: EUR-Lex, May 2024

*Changed values compared to the Commission Implementing Regulation (EU) 2019/1793 edition of 16/02/2023.

Increased official controls for Indian and Pakistani basmati rice have challenged Indian and Pakistani exporters

The increased testing of products under regulation (EU) 2019/1793 has had quite some impact on basmati rice imports to the EU from India and Pakistan. Since 2022, the regulation has changed several times and affected the testing frequencies for pesticides and aflatoxins for Indian and Pakistani basmati rice. Both countries underwent changes in the testing frequencies in different ways, therewith also impacting their competitive positions.

For example:

- Between June 2023 and July 2024, India did not have an increased frequency for pesticide testing, while Pakistan’s rate was 5%. This explains India’s growth in rice exports to Europe in 2023.

- From July 2024 on, India’s rice export testing frequency for pesticides went up to 10%, while Pakistan’s rate stayed at 5%. This is likely to have a positive impact on Pakistan’s rice exports to Europe in the short term, as importers will prefer origins with the lowest sourcing risks. This will go at the cost of rice imported from higher-risk countries, i.e. at the cost of rice imports from India.

A quick scan of the RASFF database for the first half of 2024 shows that the pesticides most found in basmati rice from both countries are tricyclazole (10 times for Indian origin) and the neonicotinoids thiamethoxam (found in Indian and Pakistani rice 6 and 5 times, respectively), acetamiprid (19 alerts for Pakistani rice) and imidacloprid (9 times for Pakistani rice, once for Indian rice).

Interestingly, tricyclazole, which is frequently found in Indian rice, has an MRL of 0.01 mg//kg. Following European Food Safety Agency (EFSA) studies in the past few years, in January 2023 EFSA made a recommendation to lift the MRL from 0.01 to 0.09 mg/kg.

However, the MRL for tricyclazole will remain at 0.01 mg/kg, following concerns about a loss of competitiveness of European rice production, since locally produced rice would have kept the 0.01 mg/kg limit. There was no majority in the EU parliament supporting the proposal, thus the low 0.01 mg/kg tricyclazole limit will keep on having a large impact on Indian basmati rice exporters in the European market.

Most striking about Pakistan’s rice exports to Europe is the fact that excessive pesticide residues are rarely detected in Pakistan’s major basmati rice varieties – the ‘Super Basmati Family’ – as these varieties are very close to the original traditional cultivars. In the European market, this gives Pakistan’s rice exporters a Unique Value Proposition.

There are two other tables in the same EU Regulation 2019/1793 that list products for which special import conditions apply due to contamination risks. Annex 2 describes special import conditions for food shipments which:

- consist of a product that comes from multiple countries of origin.

- consist of two or more ingredients from Table 2 below and that make up over 20% of the total amount of ingredients.

For such shipments, the frequency of identity and physical checks as a percentage is increased to ensure that contamination hazards remain controlled. Export shipments from high-risk countries (Table 2) must have a health certificate (Annex IV of EU Regulation 2019/1793) and a certified analytical test report, showing test results for the specific hazard. In 2022 and 2023, this often went wrong with sesame seeds shipments coming from Sudan and Nigeria, and less frequently with shipments from Ethiopia and Uganda.

In other words, for the products listed in Annex 2 (Table 2 below), the import conditions are stricter than for the products listed in Annex 1.

Table 2: Grains, pulses and oilseeds subject to special conditions for import to the EU (frequency of identity and physical checks in %)

| Country of Origin | Bolivia | Ethiopia | Ghana | India | Nigeria | Sudan | Uganda |

| CN Code and product name / hazard | |||||||

| 1202 41 00 - Groundnuts (peanuts), in shell | |||||||

| Aflatoxins | 50 | 50 | 50 | ||||

| 1202 42 00 - Groundnuts (peanuts), shelled | |||||||

| Aflatoxins | 50 | 50 | 50 | ||||

| 1207 40 90 - Sesame seeds | |||||||

| Salmonella | 50 | 30* | 50 | 50 | 20 | ||

| Pesticide residues | 30* |

Source: EUR-Lex, May 2024

*Changed values compared to the Commission Implementing Regulation (EU) 2019/1793 edition of 16/02/2023.

Last, Annex 2a of EU Regulation 2019/1793 reveals that imports of foodstuffs consisting of dried beans (under HS codes 07133500, 07133900 and 07139000) from Nigeria have been put on hold due to high levels of pesticide residues.

Tips:

- Stay informed with updates about official controls on the European Commission website. The list is updated regularly. Even if your country is not on the list, you still need to be aware of the most common forms of contamination for your product and implement all possible preventive measures.

- Search the RASFF database for examples of withdrawals from the European market.

- Subscribe to the European Food Safety Authority (EFSA) newsletter (free of charge) for news about European food safety developments.

- Comply with the general hygiene provisions in Regulation (EC) No 852/2004 for primary production (Annex I) and for food business operators (Annex II).

- Implement a HACCP system into your daily practice. Even if HACCP is not required in your country, exporting to the EU means that you need to comply with European food safety regulations.

Control of pesticide residues

The EU Regulation on maximum residue levels of pesticides specifies the MRLs for pesticides in or on food products. A general default MRL of 0.01 mg/kg applies whenever no specific level is mentioned in relation to that product. Products containing more pesticide residues than permitted are withdrawn from the European market.

In 2022, one-fifth of all issues reported in RASFF related to excessive pesticide levels or traces of illegal pesticides. In 2023, pesticides made up almost 30% of the total number of reported issues. The largest number of issues were reported for rice and beans. For rice, more than 50% of the cases involved excessive residues of a mix of pesticides.

The most frequently found excessive levels of single pesticides in these products were:

- Rice: tricyclazole, the MRL is 0.01 mg/kg since 2017 (previously 1mg/kg), and chlorpyrifos (MRL of 0.01 mg/kg).

- Beans: chlorpyrifos, the MRL is 0.01 mg/kg.

The EU regularly updates its list of approved pesticides.

Tips:

- Select your product or the pesticide that you use in the EU pesticide database to see the list of relevant MRLs.

- Follow the ongoing reviews of MRLs in the EU to prepare for potential changes in MRLs. Among the latest comprehensive reviews is Croplife’s EU Pesticide Renewal Monitor (February 2024). Another interesting publication is the USDA’s EU Early Alert - Pesticide Review (with several editions per year but no update since March 2023), which discusses the pesticides that are up for review in the European Union.

- Apply Integrated Pest Management (IPM) to reduce your use of pesticides. This is an agricultural pest control strategy that uses natural control practices in addition to chemical spraying. For more information about IPM, see the FAO website.

- Work closely with farmers to keep full control of the use of pesticides in your raw materials. Engage plant protection experts who can guide and advise farmers on the sustainable use of pesticides.

- Check with your buyers if they have additional requirements for MRLs and pesticide use.

Control of contaminants

Food contaminants are substances that have not been added to food intentionally. These may infect grains, pulses and oilseeds during the various stages of production, packaging, transport or storage. Contaminants can pose a health risk to consumers. To minimise these risks, the EU has set maximum levels for certain contaminants in foodstuffs.

Mycotoxins

Almost 40% of all issues reported in the RASFF database in 2022 were due to mycotoxins, and in 2023 the share remained high although substantially lower, at 20%. Mycotoxins are toxic compounds that are produced naturally by types of mould. The most common mycotoxins in grains, pulses and oilseeds are aflatoxins and ochratoxin A. Aflatoxin contamination is particularly common in groundnuts, followed by rice. Ochratoxin A mainly appears in rice.

To protect consumers, the EU has set aflatoxins and ochratoxin A limits for specific grains, pulses and oilseeds.

Table 3: Mycotoxin limits for specific grains, pulses and oilseeds

| Mycotoxin | Product | Limit (μg/kg) |

|---|---|---|

| Aflatoxins | Groundnuts before sorting | 8 for B1 15 for sum of B2, G1 and G2 |

| Aflatoxins | Groundnuts, oilseeds and processed products containing groundnuts and oilseeds intended for direct human consumption All cereals and products derived from cereals (except infant food, dietary foods for medical purposes, and unsorted maize) | 2 for B1 4 for sum of B2, G1 and G2 |

| Aflatoxins | Maize and rice, untreated | 5 for B1 10 for sum of B2, G1 and G2 |

| Ochratoxin A | Sunflower seeds, pumpkin seeds, melon/watermelon seeds, hemp seeds, soybeans | 5 |

| Ochratoxin A | Unprocessed cereals | 5 |

| Ochratoxin A | All products derived from unprocessed cereals, including processed cereal products and cereals intended for direct human consumption (with a few exceptions: infant food and dietary foods for medical purposes) | 3 |

| Deoxynivalenol | Cereals and their derivates | From 200-1,750 depending on the product |

| Zearalenone | Cereals and their derivates | From 20-200 depending on the product |

| Fumonisins | Cereals and their derivates | From 200-2,000 depending on the product |

Source: EUR-Lex, May 2024

Ochratoxin A was the subject of scientific research in the EU in 2018-2022. Studies suggested that ochratoxin A may be genotoxic (which means that it may cause genetic mutations) and carcinogenic (causing cancer). So far, these studies have not resulted in any significant reductions in the EU’s limits.

Tips:

- Use the Manual on the Application of the HACCP System in Mycotoxin Prevention and Control on the website of the Food and Agriculture Organisation (FAO).

- See the Transport Information Service for information on the safe storage and transport of grains, pulses and oilseeds.

- Only use ISO/IEC 17025-accredited laboratories to test for contaminants in grains, pulses and oilseeds. The presence of aflatoxins must be tested according to the EU regulation on methods of sampling and analysis for the official control of the levels of mycotoxins in foodstuffs.

- Visit the EU portal of Access2Markets for more information on import rules and taxes in the European Union. Specific product codes can be selected under chapters 0713 (Pulses), 10 (Cereal grains) and 12 (oilseeds).

Foreign matter

RASFF reported ten cases of foreign matter in 2022 (2.3% of the total number of reported cases). In 2023 this number grew substantially to 18 (3.8%). Grains, pulses and seeds/oilseeds should be cleaned in order to remove any larger contaminants. Foreign matter is substances or objects other than the relevant crop or product, such as plastic or metal parts or pest infestation.

Plant toxins

Since December 2020, following Commission Regulation (EU) 2020/2040, there are maximum limits in place for the level of pyrrolizidine alkaloids (PA) in certain foodstuffs. In 2022, six cases with PA were reported in the RASFF database but this number increased to 26 in 2023. These mainly involved oilseeds and added value cereal products, mainly flours.

Microbiological contaminants

EU regulation 2073/2005 on microbiological criteria for foodstuffs lays down the microbiological criteria for certain micro‑organisms and the implementing rules that food business operators must comply with. It does not set specific limits for grains, pulses and oilseeds.

Microbiological contamination is not common in grains and pulses, but is often found in oilseeds. RASFF has 100 and 56 cases of salmonella contamination reported in 2022 and 2023, respectively. This mostly involved sesame seeds from Nigeria and India. Salmonella must be completely absent from grains, pulses and oilseeds.

Tips:

- Invest in basic post-harvest processor equipment, like mechanical sieves and metal detectors. More advanced technology includes optical sorting equipment.

- Keep the product cool and dry during transport. Insect control treatment can be necessary if the product is stored for more than a few weeks. Read more about maintaining product quality during transport in CBI’s Tips to Organise your Exports of grains, pulses and oilseeds.

- For more information on the EU’s management of food contaminants, see the factsheet on how the EU ensures that food in Europe is safe (PDF).

- Keep your food safety testing practices up to date, for example by automating and computerising your process.

Metal contaminants

Metals such as lead occur naturally in the soil and in water. Pollution from human activity adds to the background level of metals in the environment. Because of this, metal residues can occur in food. Contamination can also result from food processing and storage.

Heavy metal contamination occurred in three cases in 2022. In two cases, beans were found to be contaminated with cadmium, and the other two cases involved lead in rye.

In 2023, the number of heavy metal contamination cases grew to 12, all related to cadmium. Most of these cases involved rice, six of them related to Italian rice. Other products found with heavy metal contamination were beans and rice flour from China, peas from Ukraine and oilseeds from Bolivia.

The EU has set the following limits for cadmium and lead residues in grains, pulses and oilseeds:

- 0.20 mg/kg of cadmium in soybeans and bran, germ, wheat and rice

- 0.10 mg/kg for cadmium in cereals other than bran, germ, wheat and rice

- 0.20 mg/kg for lead in cereals, legumes and pulses

Tip:

- Check the national legislation in your target countries through the ’My Trade Assistant’ tool at EUAccess2markets.

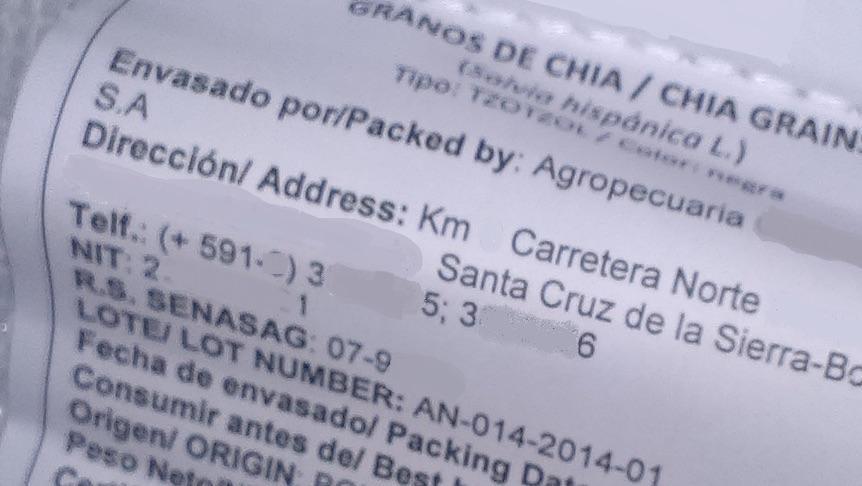

Use correct labelling and packaging

Food imported into the EU must comply with the legislation on food labelling. The label of bulk packaging must include:

- Name and variety of product, for example ‘Sunflower seeds’

- Batch code

- Net weight in metric system

- Shelf life of the product or best-before date, and recommended storage conditions

- Lot identification number

- Country of origin

- Name and address of the manufacturer, packer, distributor or importer

An identification mark can be used to replace the lot identification number and the name and address of the manufacturer, packer, distributor or importer. Labels can also include details such as brand, drying method and harvest date. The batch details can also be included in the technical data sheet. Novel food, organic food and genetically modified food require additional labelling.

Figure 2: Business-to-business labelling

Source: ICI Business, 2021

Labelling for consumer products is much more detailed. If the imported product goes directly to the retail channel, product labelling must comply with the EU regulation on the provision of food information to consumers. This regulation relates to nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information. Cereals containing gluten (such as wheat, barley and oats), lupin, peanuts, sesame and soybeans must be marked as allergens.

In 2022 and 2023, RASFF received 8 and 10 cases, respectively, that involved missing an allergen declaration on the label. This had to do with the presence of gluten in gluten-free products and the undeclared presence of allergens like milk, wheat, sulphites and nuts in products. Other labelling issues (unspecified) were only reported twice in each year.

Tips:

- Learn how to label your products from Food and Drink Industry Ireland’s practical guide to food labelling (PDF).

- Take all possible forms of allergen contamination into account for the allergen declaration on the label.

- Ask your buyer to approve your draft version before you print your labels.

- For product-specific packaging requirements, see our product studies.

- Contact Open Trade Gate Sweden if you have specific questions regarding rules and requirements in Sweden and the EU.

Phytosanitary inspection

Practically all grains, pulses and oilseeds for sowing require a phytosanitary certificate. Some grains and product origins have additional phytosanitary requirements for imports into Europe. This mainly applies to seeds for propagation/planting. For these products, you must have an official statement that your product is free from specific diseases or comes from an area where these diseases are not found.

For example:

- Wheat, rye, barley and other grains of the genus Triticum and Secale originating in Afghanistan, India, Iran, Iraq, Mexico, Nepal, Pakistan, South Africa and the USA must be free from Tilletia indica Mitra. Wheat, rye and triticale from these countries also require a phytosanitary certificate, including for food or feed purposes.

- Maize imported into the EU needs to be declared officially free from Pantoea stewartia. Maize requires a phytosanitary certificate, for both food and feed purposes.

Tip:

- Familiarise yourself with Regulation (EU) 2016//2031 on the protective measures against pests of plants and specifically the lists of products that require special requirements or phytosanitary certificates before being imported into the EU, which can be found in Annex VII and Annex XI of the Implementing Regulation (EU) 2019/2072.

Check whether your product is a novel food

Products that are new to the European food market, or products that were not widely consumed in the EU prior to 1997, are considered ‘novel foods’. These novel foods are subject to specific legislation. Before introducing a new ingredient as a foodstuff, you must provide data to prove that it is safe for consumption within its suggested use, and apply for authorisation. Food ingredients that have already been approved can be found on the union list of novel foods (Implementing Regulation (EU) 2017/2470).

Follow these steps when introducing a new food into the EU:

- Check for novel food status: Check the Novel Food Catalogue and the consultation process on novel food status to see if your product is a novel food. In earlier consultations, you can see for example that mung bean protein isolate is novel (PDF) when used in foods, but cold-pressed Nigella sativa (black cumin) seed oil is not novel (PDF) and has no restrictions.

- Check whether your product qualifies as a traditional food: Find out whether you have substantial evidence of traditional consumption, because traditional foods from third countries undergo a simplified assessment procedure. If the safety of the traditional food can be established based on the evidence of a history of consumption and no safety concerns are raised in the EU, the food will be allowed on the EU market.

- Collect technical and scientific data: Find out what type of data is required to authorise your novel food in chapter 2 of the guidance document for the authorisation of traditional foods from third countries, or in chapter 2 of the guidance document for the authorisation of a novel food.

- Submit an online application: Consult the User Guide for the e-submission system for Novel Foods (PDF) and make sure your application complies with the requirements of Article 10 of Regulation (EU) 2015/2283.

Remember that applications can be time-consuming and expensive because scientific proof and technical data may be requested.

Examples of novel foods that have been allowed on the European market are chia seeds and fonio. The assessment and authorisation procedure for a novel food can take up to 1.5 years, excluding the data collection and assessments you need to conduct yourself.

Tip:

- Read the specifics of Regulation (EU) 2015/2283 on novel foods when you are working with a novel food.

Comply with additional requirements for seeds for sprouting

After an outbreak of E. coli in 2011, the EU introduced specific regulations for sprouts and seeds intended to produce sprouts. EU imports of sprouts and seeds for sprouting must be accompanied by a certificate and be produced by an approved establishment that complies with general hygiene provisions, traceability and microbiological criteria.

The sprouting of seeds, such as mung beans, is done almost exclusively within Europe. If you export seeds to sprouting companies, you will need to complete extra paperwork and there is a higher chance of intensive food safety checks.

Tips:

- Find the model for the official certificate you will need for the export of seeds intended for sprouting in Chapter 3 of Annex I of Regulation (EU) 2020/2235.

- Make sure you understand the European requirements on general hygiene provisions for primary production (Part A of Annex I to Regulation (EC) No 852/2004), product traceability (Regulation (EU) No 208/2013), approved establishments (Article 2 of Regulation (EU) No 210/2013) and microbiological criteria (Annex I to Regulation (EC) No 2073/2005).

- Exercise extreme caution and apply the highest safety standards when exporting dried or freshly sprouted grains or pulses, using an HACCP-based food safety system and UV-C disinfection to avoid the risk of salmonella and E. coli.

Only export non-GMO grains, pulses and oilseeds

The EU is very cautious about genetically modified organisms (GMOs). Only a few genetically modified varieties have been authorised for soybeans, rapeseed and maize, and these are used primarily in the animal feed sector. For human consumption, most food businesses choose not to sell genetically modified food at all.

In August 2021, the European Commission approved several genetically engineered crops (corn, soybean, rapeseed and cotton) and renewed authorisations for two corn and one rapeseed crop used for food and animal feed.

The growing importance of sustainable agriculture has led the EU to call for a rethink of GMO rules for gene-edited crops.

In 2022 and 2023, respectively, four and eight issues with unallowed genetically modified grains, pulses and oilseeds were reported in RASFF, mostly related to added value rice products from Vietnam.

Tips:

- If your product is destined for human consumption, only sell non-GMO products. In general, genetically modified crops are not accepted in the EU. You can find the exceptions, such as maize and soybeans, in the EU register of authorised GMOs.

- Use the Fact Sheet: Questions and Answers on EU's policies on GMOs and the GMO legislation to review the current rules for GMOs in Europe.

2. What additional requirements and certifications do buyers ask for in grains, pulses and oilseeds?

European buyers often have additional requirements, over and above the legal obligations. Firstly, there may be minimum quality requirements. Others may relate to food safety, and sustainable and ethical business practices.

Product quality requirements

Product quality is an extremely important issue for European buyers. Although these are not legal requirements, they are just as important to the buyer.

Several factors determine the quality of grains, pulses and oilseeds. The Codex Alimentarius provides standards for several grains and pulses, such as couscous (PDF), sorghum grains (PDF), rice (PDF) and whole, shelled or split pulses (beans, lentils, peas, chickpeas, field beans and cowpeas). These standards cover characteristics such as moisture, purity, grain quality and appearance. Not all products have an official standard, but this does not mean that buyers of such products operate without standards.

Tips:

- Ask your buyer for a technical data sheet. This will give you an indication of the characteristics that your product needs to meet. See for example Do-It’s product specifications of organic adzuki beans (PDF).

- Apply careful physical sorting and eye-hand control practices to discover foreign bodies in your products.

- Use optical, metal and similar detectors as an extra safeguard against contamination with foreign objects.

Food safety certification

Food safety is key for the European market. Although legislation already addresses many potential risks, it is not enough on its own. The large number of reported issues in 2022 in the RASFF database shows that things can still go wrong. For this reason, importers prefer to work with producers and exporters who have a Global Food Safety Initiative (GFSI) recognised food safety system certificate.

For processors and traders of grains, pulses and oilseeds, the most popular certification programme is Food Safety System Certification (FSSC 22000). FSSC 22000 is based on the ISO methodology and offers the most structured and logical approach to a Food Safety Management System.

Two other certification programmes that are common among European food processors are International Featured Standards (IFS) and British Retail Consortium Global Standards (BRCGS). These are less widely used, but may be worth considering if they are an important requirement for a potential buyer.

Certification programmes have a basic set of modules for certification, but they may also have additional voluntary modules. For example, the BRC programme has a voluntary module for traded goods (PDF). This module is designed for products that are purchased and sold by the company and received into storage facilities at the company site. All the storage facilities used for the product must be included in the scope of this module.

If a European company is certified against such an additional module, it will affect the requirements they set for their suppliers. Suppliers must maintain strict quality management procedures, including a risk-based product sampling or assurance programme and, if necessary, an analysis programme by an ISO17025-accredited laboratory.

Third-party certified programmes are an asset for your company and are likely to be valued by new buyers. Still, serious buyers might also visit and/or audit the production facilities of new suppliers.

Tips:

- Get food safety certification. Check with your buyers which food safety certification company to consult. Examples are SGS and Bureau Veritas.

- Agree with your buyer, if requested, on the laboratory and the analytical testing methods used.

- Consult your national Business Support Organisation or Export Association if you aren’t able to find an ISO17025-accredited laboratory for your analysis needs.

- Sample according to European sampling regulations.

Sustainability compliance

Although less important than product and food safety requirements, social and environmental compliance is increasingly required by European buyers. This often means that the supplier has to commit to the buyer’s code of conduct. Another possibility is that buyers require certification through a third-party scheme such as BCorp.

Codes of conduct

Codes of conduct (CoC) vary from company to company, but they are often similar in structure and in the areas that they cover. Common elements in CoC include a set of ethical, social and environmental criteria, such as:

- Companies must comply with applicable general, social and environmental legislation

- Companies must conduct business in an ethical way

- Child labour and forced labour are not allowed

- No form of discrimination is allowed

- Employees have the right of association and collective bargaining

- Working hours must comply with national laws, preferably with a maximum number of hours per week

- Wages and benefits meet the national legal standards and are enough to meet a certain need

- Working conditions must be safe

- Ongoing efforts must be made to reduce the use of resources, energy and emissions

- Safety procedures for the use of hazardous chemicals must be in place

Social initiatives such as the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative (amfori BSCI) also have codes of conduct. These are not specific to the grains, pulses and oilseeds sector, but are frequently used.

Sector initiatives for soy and rice

Major commodities are sometimes part of a specific initiative, such as the Round Table on Responsible Soy (RTRS certification) and the Sustainable Rice Platform (SRP Standard for Sustainable Rice Cultivation). The sustainable trade initiative IDH has defined targets for responsible and zero-net-deforestation soy import under a soy market programme.

The Soy Sourcing Guidelines (SSGs) of the European Compound Feed Manufacturers’ Federation (FEFAC), 2023 update (PDF) should also facilitate ‘conversion-free soy’. This refers to soy that has not been grown in converted natural ecosystems, i.e. forests, swamps and savannahs, after a specific date.

Third-party certification: Fairtrade and BCorp

Several third-party certification schemes set criteria for both social and environmental issues. The most important schemes are Fairtrade (see below) and BCorp. The Rainforest Alliance is a common certification scheme for mainstream agricultural value chains, but it does not provide certification services for grains, pulses and oilseeds.

Probably the fastest-growing sustainability certification scheme is BCorp. While Fairtrade certification (discussed in the section on requirements for niche markets) ensures that individual products meet high social and environmental standards, BCorp certifies entire companies. BCorp certification requires companies to meet high standards of performance, accountability and transparency on a wide range of criteria, including:

- employee benefits

- charitable giving

- supply chain practices

- input materials

Companies can acquire BCorp certification by:

- Demonstrating a high social and environmental performance. The company must achieve what is known as a ‘B Impact Assessment score’ of 80 or above and pass a risk review.

- Making a legal commitment by changing its corporate governance structure to be accountable to all stakeholders (and not just to shareholders).

- Ensuring transparency by allowing information about the company’s performance on the standards to be publicly available on their BCorp profile on B Lab’s website.

The few BCorp-certified companies in the grain, pulses and oilseeds sector are frontrunners in their respective markets, as well as prominent importers in organic markets. The best examples are Do-It from the Netherlands and Quinola from the UK.

Transparency initiatives

The Supplier Ethical Data Exchange (SEDEX) is a well-known global initiative to make global supply chains more transparent. Sedex is a collaborative global forum where buyers, suppliers and auditors can store and share information.

The aim of this information-sharing is to manage performance on sustainability. This covers labour rights, health and safety, the environment and business ethics. As such, Sedex is not a certification scheme or a standard-setting body. However, by participating in this platform companies show their willingness to share data and use information to manage and improve ethical standards across the supply chain.

Sedex has also developed a social auditing standard called SMETA (Sedex Members Ethical Trade Audit). This auditing model helps companies assess a supplier’s working conditions in the social, ethical and environmental domains.

Overview of certifications and CoC

Table 4 shows the most important certifications and codes of conduct for the grains, pulses and oilseeds sector, along with information on the associated costs and process. Note that some of the costs of certification are ‘hidden’, which means that they are hard to quantify, but you will likely find them in the offer of potential service providers. The most important hidden costs are:

- Travel costs for the auditors – time and expenses

- Accommodation costs for the auditors

- Non-Conformity / Corrective Action Review

In addition, preparing for certification may mean that you need to invest in your facilities or quality assurance and control system.

Last, if a company is applying for certification under different schemes with the same certification body, the certification body may offer a discount on the total certification costs.

Table 4: Most important certifications and CoC requested by buyers in the grains, pulses and oilseeds sector

| Name | Type | Cost for companies | Most used in European end market(s) | Further information on getting certification |

|---|---|---|---|---|

| Food Safety System Certification (FSSC 22000) | Food safety | There is no fixed fee. It depends on company size, number of audit days and number of products. The number of products influences the cost for companies with <20 employees, but it is typically €1600-3800. This excludes fees for annually recurring ‘surveillance’ audits. The audit certificate is valid for 3 years. | Germany, Netherlands Spain, Italy France, UK Denmark, Sweden, Norway | Preparation: courses per country. Service providers: certification bodies. |

| Sedex Members Ethical Trade Audit (SMETA) | Social audit focused on working conditions | Costs include a membership fee of £133 per production site and audit costs paid to the SMETA-approved agency. The costs of the first audit are agreed with the agency and are not fixed, but for most SMEs the cost is €900-1300. | UK, Germany Also used in many other European markets. | More information about the process: SMETA Guidance documents. |

| Fairtrade | Sustainability, including working conditions, environment, and ethical trade criteria. | There is no fixed fee. Certification costs for spice companies depend on number of workers hired, number of products and number of facilities. For example, the fee for an SME with 20 employees and 2 products would be more than €3000 for the first year. This includes application, certification and processing fees. However, certified suppliers are likely to benefit from higher prices paid for their products (and a minimum price). | UK, Germany, Switzerland, Austria Belgium, Netherlands | First assessment of potential certification costs: Flocert Cost Calculator. |

| BCorp | Social and environmental criteria: employee benefits, charitable giving, supply chain practices, input materials. | There are fee bands in place to ensure BCorp Certification is affordable for all businesses. Contact the BCorp contact point for an idea of the certification costs. For African companies with annual sales below USD150,000, the annual certification fee is USD600. There is a fee of USD100 to be paid in the assessment phase, but that will be deducted from the first annual certification fee. | Started in North America. Now it is a global movement with offices in every continent. BCorp-certified organisations can be found all over Europe, but predominantly in Western and Northern Europe. | Learn more about BCorp certification by watching their YouTube videos, such as this introduction to BCorp. Read the BCorp Small Enterprise Guide (PDF) to get an idea of how to become ready for BCorp certification. Check the B Global Network to find the BCorp contact point in your region or country. |

| Organic | Environmental criteria | Products must be certified at the farmer level before being processed. The fee for individual farmers is considerably lower if farmers join an association and pay a joint fee. Average fees are around €1000 for SMEs and the certificate must be renewed every year. | European Union, note that all European countries have their own national organic labels. | Certification costs: authorised control bodies per country. |

| International Featured Standards (IFS) | Food safety for suppliers to food retail | There is no fixed fee. It depends on number of products, number of certification days and company size. The average price for a 2-day audit for SMEs and 3-5 products is €2600-3600. Re-certification must be done every year and involves recurring costs. | Germany France Also recognised in several other European markets. | More information about IFS Food version 8. |

| British Retail Consortium Global Standards (BRCGS) | Food safety for suppliers to a selection of UK food retailers | There is no fixed fee. It depends on company size, number of products and role in the supply chain. Typical certification costs for a small company with up to 3 products are €3100-4200. Audit frequency depends on the number of non-compliance instances (known as ‘minors’) in the initial audit. If the result from the first audit was sufficient, the auditing frequency is once per year, otherwise it is once per six months. There is an additional annual BRCGS service fee of £725 (2022). | Mainly UK retail Also recognised in other West-European markets. | See an overview of all BRCGS standards, among which Food Safety is the most relevant for you. Find certified sites from your country or in your potential destination market in the BRCGS directory.

|

Source: Globally Cool, May 2024

Tip:

- Consider implementing a management system focusing on or incorporating sustainable or ethically responsible production.

3. What are the requirements and requested certifications in the niche grains, pulses and oilseeds markets?

Most buyer requirements apply to the mainstream grains, pulses and oilseeds markets, but some niche markets have their own, specific requirements. While Fairtrade lays down requirements for sustainability in the social, environmental and ethical domains, product certification for the organic market mainly focuses on environmental requirements.

Sustainability certification

Although less important than product and food safety requirements, sustainability compliance is increasingly required by European buyers. The most obvious market in Europe for sustainably sourced products is the fairtrade market.

Fairtrade

The fairtrade market is based on fairtrade certification. Each player in the supply chain needs to be certified in order to participate in this market, and certification is privately regulated. Fairtrade-certified products are permitted to display the Fairtrade logo, which can help the product stand out from the rest and attract more aware consumers. Fairtrade certification is most suitable for products from smallholder farms.

In the global fairtrade market there are a few fairtrade certification organisations – Fairtrade International is the largest. It gives you access to the European market and most other international markets (except for the US market).

Fairtrade International has two specific standards for small-scale producer organisations of grains, pulses and oilseeds:

- Fairtrade Standard for Cereals, which covers fonio, rice, quinoa, amaranth and millet. Secondary products and their derivatives are also covered.

- Fairtrade Standard for Oilseeds and Oleaginous Fruit, which covers coconuts, olives and olive oil, soya beans, natural white sesame seed, shea tree nuts (which are defined as dried, roasted shea kernels processed into shea butter) and flax seed (linseed).

Both standards define minimum prices and price premiums for conventional and organic products from several countries and regions. For cereals and oilseeds without a fixed Fairtrade Minimum Price or fixed Fairtrade Premium, the Fairtrade Premium is set at 15% of the commercial price.

The global fairtrade market is fairly transparent. You can easily find importers and other players in this market through the Flocert database, the global certification body for the Fairtrade supply chain. Within the European market, in supermarkets you can find private label products with the fairtrade logo, but also several brands that are sometimes 100% fairtrade, such as Fairglobe (Lidl’s brand for fairtrade-certified products) or Fairtrade Original from the Netherlands.

Tips:

- Watch Fairtrade International’s introduction video to learn how the Fairtrade system works.

- Check Fairtrade International’s standard for Cereals or for Oilseeds and Oleaginous Fruit to find out exactly what the requirements are.

- Find a Fairtrade-certified trader of your product and contact them to find out more about the potential of Fairtrade certification.

Organic certification

If you want to sell your grains, pulses and oilseeds as organic in Europe, they must be grown using organic production methods that comply with EU organic legislation (Regulation (EU) 2021/2306 supplement of Regulation (EU) 2018/848). Growing and processing facilities must be audited by an accredited certifier. Regulation (EU) 1235/2008 lists the arrangements to be made for organic products imported to the EU from third countries.

Broadly speaking, the certification procedure follows these five steps:

- Develop an organic farm management plan and implement organic production practices as described step-by-step in Regulation (EU) 2018/848. You must have used these production methods for at least two years throughout the conversion period before you can certify your produce as organic. Familiarise yourself with all the requirements for organic production, and if possible use local consultancy services.

- Apply for certification. Select and negotiate a certification fee with an EU-recognised control body from Annex III of Regulation (EU) 1235/2008.

- Arrange for inspection. An inspector verifies whether your organic farm management plan is being implemented properly. If they find serious instances of non-conformity, you must correct these.

- Receive the certificate, which is valid for one year. You may then display the EU organic logo on your products. Together with the logo, you must print the certifier code number.

- Manage batch documentation. Each batch of organic products imported into the EU must be accompanied by an electronic certificate of inspection (e‑COI), as defined in Annex V of Regulation (EC) No 1235/2008. This electronic certificate of inspection has to be generated via the Trade Control and Expert System (TRACES).

Figure 3: The logo for certified organic products in the European Union comes in three different colour schemes

Source: European Commission, 2023

The above-mentioned regulations are not the only ones stipulating European organic production requirements. Among the other relevant regulations are Regulation (EU) 2021/1165, authorising certain products and substances for use in organic production, and Regulation (EU) 2021/2307, describing in detail the certificate and documentary process for exporting organic products to Europe.

Sometimes there is confusion about the MRLs permitted for organic products. There is actually no official guideline on chemical residue levels for organic products. In practice, these must not exceed the default MRL for substances without specific MRLs, which is 0.01 mg/kg.

Another common question concerns the difference between the EU organic certification scheme and national certification schemes of individual EU countries. In certain countries, like Germany or Switzerland, companies may prefer the national certification scheme – comparable to the EU organic certification but often exceeding EU requirements. For this reason, national certification schemes can be a valuable asset when supplying specific markets. Examples are Naturland (Germany), KRAV (Sweden) and BioSuisse (Switzerland).

Double certification of organic and fairtrade

Having organic and fairtrade certification together is a clear advantage in both the European fairtrade and organic markets. Consumers in these markets are typically more aware than mainstream consumers, and therefore more likely to buy products that have both a fairtrade logo and an organic certification logo. Two grains, pulses and oilseeds producers that have obtained both organic and fairtrade certification are:

- Bioherbs Egypt, which produces and exports a wide range of herbs and seeds, including oilseeds like sesame, sunflower and black cumin seeds. They have obtained fairtrade certification for flaxseed and sesame seed, and organic certification for the EU, the USA and Japan.

- Viru, from Peru, produces and exports quinoa and other miscellaneous products like a range of fresh and frozen vegetables and quinoa-based meals. Viru’s quinoa has obtained fairtrade and EU organic certification.

Figure 4: Double-certified quinoa products of the British BCorp certified company Quinola

Source: Quinola UK @ Instagram, 2023

Tips:

- Consider investing in organic production. Conduct a cost-benefit analysis to determine if this is worthwhile for you. Investigate the market potential and potential customers. Even if demand is growing, you need to know what the price premium will be and whether this will cover the likelihood of higher production costs.

- Find a current or potential customer that is interested in your existing or planned certified organic grains, pulses and oilseeds. You can use the international directory of organic food wholesale & supply companies (Organic-bio) or participate in trade fairs for organic products like Biofach in Germany. Engage the customer in the process and ask for support where relevant, such as for the batch documentation procedure.

- Try to combine organic certification with other sustainable initiatives to increase your competitiveness.

- Consult Standards Map for a full overview of the relevant certification schemes and their requirements.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research