Entering the European market for farmed black tiger shrimp

Although black tiger shrimp used to be a mainstream product in the European market, due to the rise of the Pacific white shrimp, it has recently become a niche product. Black tiger shrimp destined for the European market must meet a range of requirements. Regulations demand a certain level of traceability, but European buyers ask for more and have a growing interest in third-party certifications and the story behind products. Knowing your product and the requirements gives you an advantage over your competitors.

Contents of this page

- What requirements must farmed black tiger shrimp comply with to be allowed on the European market?

- Through what channels can you get black tiger shrimp on the European market?

- What competition do you face on the European black tiger shrimp market?

- What are the European market prices for black tiger shrimp?

1. What requirements must farmed black tiger shrimp comply with to be allowed on the European market?

What are mandatory requirements?

Food safety is important in Europe. The EU has therefore set boundaries to regulate the import of seafood. These requirements are often not specific to a particular species but focus on the broader range of seafood and fish. There is an increasing number of requirements (mandatory, market and niche) with which your product must comply to be able to enter the European market. These requirements are covered in the study; What requirements should your product comply with. Below, you will find the most relevant requirements specific to exporting farmed black tiger shrimp to Europe.

Specific approval for exports of aquaculture products

If you want to export farmed black tiger shrimp to Europe, your government needs to have a residue monitoring plan (RMP) in place, which has been approved by the European food safety authority. This plan needs to detail how the competent authority in your country ensures that no forbidden substances that are also important in human health, like antibiotics, are used during the production of aquaculture products that will be exported to Europe, thus ensuring that aquaculture products are safe for human consumption.

The ‘competent authority’ is the government department in your country that the European Union finds the most capable (competent) of monitoring the seafood and fisheries products to be sent to the European Union. The European Union enters into an agreement with this department, giving them responsibility for the mandatory control measures before export.

In India, the competent authority is the Export Inspection Council which delegates part of the responsibility to the Marine Products Export Development Authority (MPEDA), both under the Ministry of Commerce. In Bangladesh it is the Department of Fisheries under the Ministry of Agriculture, Fisheries and Rural Development. In Vietnam it is NAVIQAD, the Quality Department of the Department of Fisheries under the Ministry of Agriculture. In general, the competent authority is a department in the ministry under which aquaculture and fisheries are regulated.

Once the European authorities have approved your country’s residue monitoring plan, your country is allowed to export aquaculture products to Europe. However, your company itself also needs to have approval, therefore the competent authority will need to audit your facilities and management systems, and ensure that these comply with the requirements in the RMP. Your company will then get an ‘Aq’ code, which stands for Aquaculture processing facility on Europe’s list of approved facilities.

Next to approving your facility for processing, the competent authority should be able to trace back a problem to its source. An example is the case of a shipping container of black tiger shrimp being rejected in Europe due to the presence of a forbidden substance. Your government must ensure that your competent authority is able to trace the problem back to its source, if needed down to the level of the farm from which the product in the container was sourced. The European authorities will require that your company and the competent authority submit a corrective action plan to prevent future repetition of the issue.

It is crucial for you and your competent authority to work together to comply with European regulations. The case of Myanmar is a good example of why this is important. Myanmar gained approval for exports of seafood to Europe in 2013. However, only in early 2019 did the first companies in Myanmar receive approval to export aquaculture products, once the Myanmar Department of Fisheries had its RMP approved by European authorities. Until then, Myanmar’s farmed black tiger shrimp could not be exported to Europe.

European authorities will audit your country’s RMP on a regular basis. This is a separate audit, only focusing on the control of residues in aquaculture operations. You will need to work together with the competent authorities to follow up on any shortcomings identified by the audit team. If you follow up constructively and actively, it is very likely that this will satisfy the European authorities. The main aim of the audit is to ensure that the situation in your country is being continuously improved, until all requirements of European legislation are met.

Tips:

- Check whether your company, or that of your competitors, has already been approved for exports of aquaculture products to Europe, on the European Union’s website. If not, contact your competent authority to find out how approval can be achieved.

- To understand how the European Union audits your country’s RMP, check whether there is a recent audit report published on the European Union’s website. If there is no report published for your country, then check the latest audit report of India’s RMP.

- Search for information in the database of the Rapid Alert System for Food and Foodstuff (RASFF) to learn which shrimp has been withdrawn from the market and why.

You need to be able to trace your shrimp back to the farm

The European Union requires that you have the systems in place to identify the immediate supplier and buyer of your products (one supply chain step forward and back). This means when you mix products from various suppliers in one lot, you need to be able to show the different suppliers per lot. Similarly this applies when you source directly from farms or different agents. In any case you need to be able to identify the products in such a way that you can trace the raw materials back to the harvesting stage. The more precise you do this, the less product you have to recall when a problem occurs.

Compliance with food safety and hygiene regulations

The farmed black tiger shrimp that you export to Europe must be accompanied by a health certificate provided by the competent authority in your country. The health certificate proves that your products have been tested for and are free of pharmacological residues, microbiological residues, environmental residues (such as heavy metals and pesticides), and residues related to feed additives.

European Regulation (EC) No 37/2010 lists maximum residue levels (MRLs) of relevant substances in food of animal origin. For farmed black tiger shrimp, relevant substances include antibiotics, steroids, stilbenes and other veterinary drugs. Regulation (EC) No 396/2005 establishes European Union MRLs for pesticides. These are laid down in various regulations and the European Union maintains a public database.

Other MRLs that apply more generally to exports of fishery and aquaculture products to the European Union are laid down in Regulation (EC) No 1881/2006, which lists maximum levels for heavy metals (for lead, cadmium and mercury) and dioxins (such as PCBs), while Regulation No 2073/2005 outlines maximum levels for microbiological contaminants such as histamine and salmonella.

Although these European Union regulations provide the boundary conditions, it is the competent authority in your country (which has been appointed by the European Union) that proposes in its RMP which residues the fishery and aquaculture products from your country have to be tested for if these are destined for the European market.

Tip:

- Check the website of the competent authority in India, appointed by the European Union, for example

sof which residues they are testing for.

Labelling is slightly different for aquaculture products than for wild-caught products

Black tiger shrimp products need to be labelled according to the European labelling requirements for aquaculture products. To understand the complete overview of labelling requirements read the CBI buyer requirement study. The following requirements are particularly relevant if you export black tiger shrimp to Europe.

- Contrary to wild-caught seafood products, where you need to mention the specific catch method, for aquaculture products you only need to mention the production method: ‘farmed’.

- While for wild-caught seafood products you are required to include the FAO zone (where the seafood is caught), for aquaculture products you only need to mention the country of production (for example, Honduras). If your product consists of black tiger shrimp from various origins (for example if you sourced raw materials from another country) you should include all sourcing countries on the label.

- As mentioned in our trend study, there is increased attention on how added water must be labelled. Added water must be shown in the list of ingredients. For value-added products, the added water must also be shown in the name of the food if the added water makes up more than 5% of the weight of the finished product.

- For the last couple of years, the label is required to include the net weight of the product. The gross weight may no longer be stated on the package, as this is considered to be misleading to consumers.

Tips:

- Check the European Union’s pocket guide for labelling wild-caught and aquaculture products for a full overview of how to label your black tiger shrimp products.

- Be sure that you and your client agree on how the product should be labelled. The buyer should be able to provide you with all the required input.

- Gain a more detailed understanding of European Union requirements for imports of aquaculture products. Check the commission regulation No 1251/2008 here.

What additional requirements do buyers often have?

Buyers want extra guarantees on food safety and on the wellbeing of people

Many European buyers want products that are processed under quality standards that exceed the standard European hygiene rules. There are certificates that guarantee these stricter standards.

Some of those additional requirements include temperature control during processing, hygiene, traceability, condition of the cold store and safety protocols. Several internationally known quality certifications give buyers those guarantees. The most requested food safety certifications are International Food Standard (IFS) and British Retail Consortium (BRC). Making this investment is clearly a good idea since it is not only a must for the European market, but also for other markets around the world.

Another popular requirement is to have your corporate social responsibility (CSR) in place. This proves that you involved in the wellbeing of your staff and community. Even some sustainability standards such as ASC are now developing their CSR standards, which can be combined with the production standard. However there are also more focused labels.

Different buyers use different payment terms

There is no standard way of determining terms of payment and delivery, so each party negotiates the terms that best suit them. In these negotiations, the size of the company and volume of its purchases, as well as the competition the buyer or seller faces, can determine the bargaining power of each party. In our tips for organising your exports with Europe, we go into more detail on what terms buyers might prefer, and what terms might be better for you.

Quality requirements in the supply chain

When supplying shrimp in HOSO and HLSO form toward the specialised wholesaler you need to provide a high-quality product. To reach this quality, specialised wholesalers find it important that you have a solid supply chain present which can ensure a proper cold chain from harvest towards the freezing or processing facility and onwards.

More specifically, some of the factors influencing the quality of the product are temperature control during processing, hygiene, traceability, condition of the cold store, safety protocols, etc. There are some internationally known quality certifications that provide guarantees on these factors, and as such are often required by importers. The most commonly requested food safety certification schemes for seafood products are International Food Standard (IFS) and British Retail Consortium (BRC).

Specific buyer request: sustainability certifications

If you want to do business with European supermarkets, you will need to invest in getting your farms or your suppliers certified for sustainability. At the moment the leading certification scheme within European retail is the Aquaculture Stewardship Council (ASC) shrimp standard.

However over the last years the Global Sustainable Seafood Initiative (GSSI) has worked on a benchmark system for sustainability certifications. Through this they assure all GSSI approved certifications are aligned with the FAO standard, and therefore the best to use. As there are more standards included now, a lot of retailers (and other seafood companies) align themselves with GSSI.

This provides an opportunity for you as an exporter as more seafood certification schemes will enter the market, including the Best Aquaculture Practise (BAP) of the Global Seafood Alliance certification schemes.

Tips:

- Consult the ASC supplier database to learn which farms in your area have already been certified. On the website you can download the audit reports to see the challenges these farms have in complying with the standard.

- Check ASC’s Chain of Custody database to see which of your competitors have already been ASC certified so you understand your competition.

- Check the list of accredited certification bodies on this website (select ASC in search filters) to see which one could assist you to get your farms and factory audited.

- Check out the GSSI website, to understand which schemes have been approved or are still being processed.

- Try to find sustainable sourcing policies on retailers’ websites, like Marks & Spencer in the United Kingdom, and compare it to Albert Heijn in the Netherlands, for example, to get a better overview of commitments that have been made to one type of certification or the other.

Other requirements are specific to the production requirements of each product (the HOSO size required to produce peeled blocks for reprocessing, for example). This summary is provided in the table below.

Table 1: Main products required by the European market and the required size range

|

Market segement |

Main products required |

Sizes required |

|

Wholesale and (ethnic) retail (bags) |

HLSO and peeled products |

16/20 – 51/60 |

|

Wholesale and (ethnic) retail (cartons of HOSO products) |

HOSO products |

U4 – 21/26 |

|

(Re)-processing industry |

HOSO, HLSO and peeled blocks |

16/20 – 51/60 |

Source: Seafood TIP (2021)

What are the requirements for niche markets?

Europe’s black tiger shrimp market has a niche market for organic products. According to the EU organic aquaculture standard, only species that are native to the production area can be certified as organic. This means that you can only certify black tiger shrimp farms as organic if located in Asia, Oceania or Africa. The European Union organic aquaculture standard is the minimum requirement buyers for the organic niche will have. Some buyers may require additional certificates like Naturland from Germany or Agriculture Biologique from France. Please read our organic study to understand the organic marketplace in Europe.

Some markets may prefer to have their black tiger shrimp certified by the other most widely used certification bodies, GlobalGAP, Friends of the Sea and Best Aquaculture Practices (BAP), instead of just by ASC. BAP, for example, is accepted by some retail buyers in the United Kingdom, Friends of the Sea by some retail buyers in Italy, and Global GAP by some retail buyers in the Netherlands and Germany.

Each of these voluntary third-party certification schemes assesses specific parts of the supply chain of a product against a specific set of criteria. Producers who are awarded one of these certifications can prove to their customers that they match the criteria of that certification body. As the different organisations develop their criteria separately, they differ and therefore are of varying relevance to regional popularity.

Tips:

- To understand which requirements you have to comply with for organic certification, check the EU organic aquaculture standard or the standard published by the Germany based Naturland. You can also see in the list which companies around the world Naturland certifies for black tiger shrimp.

- Try to find sustainable sourcing policies on retailers’ websites to get a better overview of commitments that have been made to one type of certification or another.

- Use Google Translate if you are trying to access a company website linked in this study and the website is not available in a language you are familiar with. Companies that you might be interested in may only have their websites translated into the languages that they use most often.

2. Through what channels can you get black tiger shrimp on the European market?

How is the end market segmented?

The largest markets for black tiger shrimp, in Europe, are in the broadline wholesale market, the specialised fish and seafood wholesale market, the ethnic wholesale market, and in the ethnic retail market. Nowadays, mainstream supermarkets in most countries in Europe play a minor role in the European black tiger shrimp market; most supermarket chains choose Pacific white shrimp options. France is the main exception to this as Black tiger shrimp from Madagascar are more common on store shelves.

Figure 1: End market segmentation for black tiger shrimp

Source: Seafood TIP, 2021

Figure 1 shows the main retail and wholesale/food service end-market segments in Europe. The segments that are darker are those that are most interesting for you, as a producer of black tiger shrimp, since these are the segments where there is the highest demand for your products.

Retail

Over a period of years, black tiger shrimp has been losing its market share in the large mainstream retail chains of Europe. With consumers being price oriented and certified sustainability demands rising, retailers have collectively shifted the majority of their exotic shrimp assortments to Pacific white shrimp. Outside the United Kingdom and France (where you might see some black tiger shrimp in the refreshed section), black tiger shrimp is normally found in the frozen section of European retailers.

As Europe has a large ethnic community, there are also specialised ethnic retail shops selling a wide range of food products, including seafood. Usually they offer a different range of products than the mainstream retail. Shrimp is the leading frozen seafood product in this channel. Shrimp in this sector accounts for around 50% of the SKU (stock keeping unit), an SKU can be seen as a unique item. As shelf space is limited there can be only so much SKU’s. Moreover, ethnic supermarkets offer the possibility to sell black tiger shrimp to consumers directly, as certification requirements are not necessary. This provides a good opportunity for you as an exporter to enter the European market through this channel as it means that an ethnic retail store with around 8-10 SKU for frozen seafood, has around 4-5 SKU stocked with shrimp, for larger stores this is around 30-50%.

Shrimp is offered in different varieties, from black tiger to Pacific white shrimp, and from IQF to blocks. A typical offer could be black tiger shrimp 21–25 IQF P&D or HLSO (P&D: peeled and deveined; HLSO: headless shell on).

In mainstream retail, frozen peeled black tiger shrimp products are mainly sold in 250 g to 1 kg bags. IQF or Semi-IQF HOSO black tiger shrimp will occasionally also be offered in 250 g to 1 kg bags or in 500 g to 1 kg carton boxes. Most of the larger retail organisations sell frozen shrimp under their private label but also have some other brands in their assortments.

In our study on how to do business in Europe’s ethnic fish and seafood market, we elaborate in much more detail on doing business in this market. One of the most important takeaways, however, is that shrimp is one of the most important items in the fish and seafood assortment of ethnic retail shops. In ethnic retail, most products are sold under supplier brands: either the brand of the importer or the brand of the exporter. The amount of black tiger shrimp on offer is especially large in the Asian retail segment, and a bit smaller in the African retail segment.

Figure 2: Wholesale packaging of black tiger HOSO shrimp

Source: Makro.nl (2021)

Wholesale

Within the wholesale sector we can distinguish two end markets: broadline wholesalers (including ethnic wholesalers) and the specialised fish and seafood wholesalers. Broadline wholesalers are less likely to have black tiger shrimp on offer in a large variety, since fish and seafood is just one of their many types of product, and (like mainstream retail) they often require larger volumes. Also they offer more and more Pacific white shrimp, as well as other premium species, such as Argentine red shrimp. Volumes handled by broadline wholesalers are often relatively large, as they operate many shops throughout a country or even in multiple countries. These wholesalers also have delivery services where supplies are delivered straight to restaurant kitchens. Examples of international wholesalers active in Europe are Hanos and Bidvest.

The ethnic wholesale market for black tiger shrimp consists mainly of Asian wholesalers supplying Asian restaurants in Europe. Shrimp is a standard menu item in Asian cuisine, whether it is Chinese, Japanese or Vietnamese. Traditionally, the Asian market would be buying more black tiger shrimp, but nowadays, with Pacific white shrimp prices down, we see some wholesalers changing their product assortment towards selling more Pacific white shrimp products.

Asian wholesalers buy a variety of products, a significant part of which are headless shell-on and peeled blocks that will be thawed and sold to Asian restaurants. Sometimes the reprocessing is done by specialised shrimp importers and sometimes by the wholesalers themselves. Examples of specialised seafood importers that supply the Asian wholesale market are companies like Mooijer in the Netherlands and Seamark in the United Kingdom. Examples of specialised Asian wholesalers are the Brouwers Groothandelsgroep in the Netherlands and Delight Foods in the United Kingdom.

Specialised fish and seafood wholesalers usually carry a wider assortment of products in their portfolio and cater into a premium market. This means they are not price-driven, but focus on quality and offer for instance a wider range of sizes and species. As such, they are always looking for new products to include in their assortment to offer to their clients. Realise that this is a high-value, low-volume segment, so to enter this market you have to bring products of the highest quality. Examples of specialised wholesalers are Schmidt Zeevis in the Netherlands and Rari in Germany.

Specialised wholesale channels sometimes partner up with chefs to work on their menus and combine it with storytelling. Working which such partners can provide you a competitive advantage to get your product onto the Dutch markets. However, you should realise these chefs are always looking for new products, so these opportunities are sometimes short-lived, but it is an opportunity to get you into the product portfolio of the specialised wholesaler. A well-known player in this segment is Jan van As from Amsterdam, working with chefs to promote different seafood items. They are focused on season products, sustainability and storytelling.

Broadline wholesalers mostly work with importers, while specialised importers sometimes import directly. For the broadline wholesaler, shrimp is just one out of many items; for the specialised wholesaler, shrimp is one of the key products. If the volume is big enough, direct sourcing may be worth the additional costs and risks. However, if the volume is too small, it makes more sense to buy from an importer. For the Asian market, there are specialised traders who import full container loads for Asian wholesalers, like Belgium importer Seacorin.

Tips:

- See our detailed study on the ethnic retail market in Europe and how to access this market segment. This study is significant if you want to export black tiger shrimp to this market.

- Check the websites of broadline wholesaler Bidfood, specialised wholesaler Schmidt Zeevis and Asian wholesaler Amazing Oriental for a better understanding of their shrimp assortments.

- Use Google Translate if you are trying to access a company website linked in this study and the website is not available in a language you are familiar with. Companies that you might be interested in may only have their websites translated into the languages that they use most often.

Through what channels does a product end up on the end market?

We will now look at through which market channels black tiger shrimp is supplied to the European market. In principle, the market channels are the same as for Pacific white shrimp. However, as black tiger shrimp is more dominant in various wholesale market segments, we will take first take a closer look at those and then a short look at the mainstream retail segment.

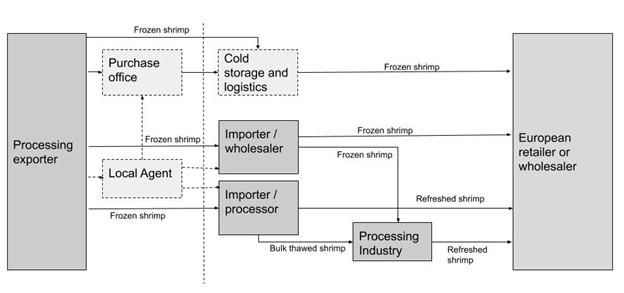

Figure 3: Market channels in the European shrimp market

Source: Seafood TIP (2021)

In the figure above, the actors in lighter boxes are those who are only a service provider to a buyer or seller. These actors never actually own the shrimp and are often not involved in making financial transactions to do with the shrimp ownership. Examples of these actors are the local agents who support buyers in sourcing products or quality control, and logistics providers who ensure the cold-chain during transportation but never own the product. The actors in the darker boxes in the figure are those who actually buy and sell the product.

Wholesale

Local agents play a crucial role in the black tiger shrimp trade. Although buyers will visit potential suppliers regularly, they need boots on the ground that can ensure that quality requirements are met and that the best prices are secured. Sometimes Europeans or Americans own local agencies. In Vietnam, examples of agents and service providers owned by Europeans are OFCO and Fresh Studio. In Bangladesh, a big European agent and service provider is Lenk Frozen Foods.

Some larger importers have set up local offices in countries like Vietnam, where they have local staff who ensure the quality of products destined for Europe and who facilitate price negotiations with potential suppliers. In such cases, agents are no longer needed. Seafood Connection, for example, has its own office in Vietnam, which is responsible for coordinating all purchases, quality control and logistics for the company.

Some bigger broadline wholesalers, for example Bidvest and Metro, also have their purchase offices in Asia. The purchase offices are responsible for buying the products required by their branches in Europe. The European buyer will submit its requirements to the purchase office and they will take care of finding the right supplier, managing quality control and representing the buyer in price negotiations. For you as a supplier it is important to realise that companies like Metro and Bidvest buy directly at origin but also source through traditional importers.

The smaller the wholesaler is, the less likely they are to buy products directly at origin. Instead, smaller players depend largely on the importers who manage larger volumes of products for their customer portfolio. Especially for a high-value product like black tiger shrimp, risks associated with direct imports, and the financial position needed, make it hard for smaller players to import products directly. Sound knowledge of suppliers and business practices is required, and smaller players often do not have this readily available in-house.

There is a wide variety of importers supplying black tiger shrimp to the wholesale markets in Europe. There can easily be about 50 importers per country. The black tiger shrimp import volumes of these companies may range from a couple of hundred tonnes to a couple of thousand tonnes each. In general, the larger the wholesaler, the larger the importer they will purchase from. Importers sometimes specialise only in shrimp, but often have a broader product assortment in order to be able to be a full service supplier to their clients.

While some importers only import and sell full container loads, other importers act as a specialised wholesalers as well. These importers often have their own cold storage and logistics facilities, which they can use to sell the seafood they import on a pallet or even a master carton basis. While importers who only import and sell full container loads will only need an office and a strong administrative set-up, importers who also sell wholesale will often have more facilities and employees.

Examples of importers who supply the wholesale market with black tiger shrimp are companies like Fisherman’s Choice, Seafood Connection and Dayseaday in the Netherlands, Gelazur and Frial in France, Anduronda and All-fish in Germany, Seamark in the United Kingdom, and Hottlet Frozen Foods and Thalassa in Belgium.

Retail

Taking a very short look at the mainstream retail channel, you will see that the group of importers who sell black tiger shrimp to the supermarkets is much smaller than the number of importers selling to the wholesale market. Normally, the same importer who supplies the other exotic shrimp products in a supermarket also supplies the black tiger shrimp items. Most black tiger shrimp items are found in the frozen range. However, in France and the United Kingdom, some black tiger shrimp can also be found in the refreshed/chilled range.

As we described more extensively in the Pacific white shrimp study, the number of importers selling frozen shrimp to supermarkets is much smaller than the number of importers selling to wholesale, while the number of importers selling refreshed products is even smaller. There are only 10-15 companies importing peeled shrimp in bulk to further process it for industry and supermarkets. Most of these companies will also handle certain volumes of black tiger shrimp, but these are negligible compared to their Pacific white shrimp business.

The main activity of these companies is to thaw the products, further process them, re-pack them in bulk for industry or in consumer packages for supermarkets, and then distribute the product. The facilities required for processing and logistics are substantial, and only a few groups are able to make these kinds of investments. The role of these companies is much bigger than for the previous group of importers.

If a retailer or wholesaler buys directly from source, it is likely that they have a strong logistical partner who takes care of all logistics that are normally the responsibility of the importer, or that the supplier has its own import division in Europe (as is the case with Unima from Madagascar). Often, this service provider is a cold storage company that also offers freight handling services. Examples of such companies that handle significant volumes of shrimp are Antwerp Coldstores in Belgium and Frigocare in the Netherlands.

Examples of companies that supply frozen black tiger shrimp to the mainstream retail segment are the Big Prawn Company in the United Kingdom, Escal in France and Seafood Connection in the Netherlands. Large reprocessors that also handle certain volumes of black tiger shrimp are Seamark in the United Kingdom, the Dutch Seafood Company (Klaas Puul) and Heiploeg in the Netherlands, and Morubel (Shore) in Belgium.

Tip:

- Familiarise yourself with the product portfolio of major retailers in your target European countries. It will give you some insights into the market demands of your European retail consumer and some common product types.

What is the most interesting channel for you?

The supermarket channel in Europe is only interesting for you if you already have certified your farms, factory and processing establishment with a sustainability or organic certification, or can realistically do so in the short or mid-term. If not, it is better to focus on finding customers in the wholesale market or the ethnic retail channel, where it is less common to have these certification requirements, although they offer ample opportunities.

The number of European importers of frozen black tiger shrimp that supply to wholesale and ethnic retailers can easily add up to more than 300 or 400. The disadvantage is that the supply, demand and prices in wholesale and ethnic retail are more volatile and unpredictable than for the supermarket channel. This forces you to be flexible and to have a wide network of buyers in order to always have a market for your product.

In general, in the wholesale and ethnic retail channels, it should be noticed that the supply chain between the end seller and the exporter is becoming shorter. While importers in Europe often used to work with an agent in Bangladesh or Vietnam, nowadays importers try to import directly from exporters, in order to build stronger relationships, and as a way to cut the commission costs of the agent. However, importers do still rely on local agents for quality control. If an agent merely acts as a quality controller, the importer will pay a fixed fee instead.

Similar to importers attempting to reduce their dependency on agents, wholesalers and retailers try to be less dependent on importers. There are already many cases where a wholesaler or retailer imports fish directly, without the use of an importer. However, shrimp is still regarded by many as a risky product, thus few wholesalers and retailers import shrimp directly. If they do so, they normally use a strong service provider or a centralised purchase organisation close to the origin, which takes over some responsibilities from the end buyer.

For you, the tendency of importers and end buyers to shorten the supply chain is an opportunity. Although doing business more directly requires investing more time in the account management of your clients, it also offers you the opportunity to increase your margins. Moreover, it will allow you to build stronger partnerships with the buyers as they are increasingly looking for long-term strategic partnerships instead of spot market relationships, which often prevail when agents coordinate purchase at origin for the importer or end buyer.

To give you an example of one market, in the Netherlands, potential end buyers of your black tiger shrimp products are broadline wholesalers Hocras or Sligro, specialised wholesalers Schmidt Zeevis or Jan van As, or ethnic retailers Ebo van de Bor and Brouwer Groothandelgroep. Examples of big Dutch importers of black tiger shrimp who supply the wholesale and ethnic retail market are Seafood Connection, Dayseaday, Fisherman’s Choice, W.G. den Heijer and Mooijer.

Tips:

- If you have made up your mind about which market in Europe you want to enter or expand in, hire an agent or consultant who can help you to identify buyers in that market that match your profile.

- Visit websites of sector associations such as the Dutch Fish Importers Association and the Seafood Importers and Processors Alliance in Europe, in which shrimp importers have organised themselves. Here you can find member lists that provide a quick overview of the relevant buyers. Be sure to study the companies in detail before you approach them. You only have one chance for a first impression.

- For some origins it is possible to purchase customs data that will allow you to see who is buying what from whom. This level of detail may be very helpful, as it allows you to see more clearly who is buying what at what price levels.

3. What competition do you face on the European black tiger shrimp market?

During the rise of the Pacific white shrimp, many countries and companies that had predominantly produced black tiger shrimp shifted their production species, turning black tiger shrimp into more of a niche product. What this means is that while you may not have as many competitors as Pacific white shrimp producers, your competitors will be specialising in targeting specific markets with specific demands. Read on for information on some of the major producing countries, and examples of companies there that successfully reach the European market.

Which countries are you competing with?

Bangladesh

Bangladeshi shrimp producers claim to have one of the most sustainable shrimps in the world, and they are right. Shrimp farming in Bangladesh is dominated by small-scale extensive shrimp farmers. Black tiger shrimp is produced in extensive ponds where shrimp from the natural backwaters are trapped and additional post-larvae are stocked. The density of stocking is less than one shrimp per square metre. Shrimp is largely fed with natural feeds such as rice bran, while commercial feeds are still rarely used.

The character of the shrimp-farming sector has consequences for the structure and dynamic of the supply chain. Between the farms and the factories, shrimp changes hands and ownership multiple times. There are just a few processors or exporters who are directly involved with the farmers. This creates problems with regard to the quality of the shrimp, but also with regard to its traceability. Although various companies and NGOs are trying to improve the supply chain dynamics, this is still challenging, and success has been gradual.

As a result of the supply chain issues, Bangladeshi exporters are rarely able to sell to high-end markets where traceability, quality and sustainability certification are often a requirement. Instead, Bangladeshi black tiger shrimp often ends up in the lower ends of the food service market. Being stuck in this market segment sometimes creates a downward spiral, as buyers from these market segments often request packers to mislabel glazing and treatment of products in order to manipulate the price.

Bangladeshi shrimp exporters and the Bangladesh government, together with NGOs like Winrock, World Fish and Solidaridad, are working to improve not only farming practices and the supply chain dynamics but also the market image of Bangladeshi black tiger shrimp in the international market. Part of this effort is to push for ASC certification, while the first ASC-certified Bangladeshi shrimp were expected to be on the market in 2020, COVID-19 and other issues have slowed this down. Bangladesh also exports a small volume of organic certified black tiger shrimp, which is mainly sold in the German market.

A big advantage for Bangladesh in the European market is that the country benefits from its GSP+ status, which provides exporters with exemption from import duties. As a result, Bangladeshi shrimp is fairly competitive on the European market, especially in the middle sizes (16/20 up to 36/40 counts). Bangladeshi exporters can only offer a limited amount of larger sizes of black tiger shrimp, as the extensive production systems in Bangladesh cannot produce these sizes, and exporters can only source such sizes from the limited number of semi-intensive farms.

Vietnam

Vietnam is the world’s largest black tiger shrimp producer, and the second-largest exporter of black tiger shrimp to Europe. Contrary to black tiger shrimp from Bangladesh, a lot of the black tiger shrimp from Vietnam ends up in European supermarkets and high-end food service markets. The main reason is that there is already a substantial number of ASC-certified black tiger shrimp producers in Vietnam, so these producers have access to the markets where ASC is an entry requirement. In these markets, the exporters from Vietnam face little or no competition.

Some of Vietnam’s biggest shrimp exporters are involved in the production, processing and exports of black tiger shrimp. Most of these exporters (companies like CASES, Quoc Viet and Minh Phu) originate from Ca Mau, the historical heart of Vietnam’s shrimp industry, where large areas of lands are still used for the production of black tiger shrimp.

Provincial regulations require certain black tiger farming belts in Ca Mau to maintain a certain percentage of mangrove forest coverage. As a result, Ca Mau has become famous for its mangrove-integrated shrimp farming systems; companies like Binca and Blue You (Selva shrimp) promote products from Ca Mau in the European market. Some of the exporters involved in sourcing shrimp from these farms have invested in getting part of the production organic certified. Vietnam is currently the largest exporter of organic black tiger shrimp.

Not all black tiger shrimp from Vietnam is grown in mangrove-integrated farming systems. At least 50% is produced by extensive farmers who grow shrimp at a density of one to ten shrimps per square metre. Although still extensive, this is considerably more intensive than the extensive shrimp farmers in Bangladesh. These extensive farmers in Vietnam sometimes use more commercial feed to manage their ponds in a more efficient way. Of course this means that there are a few challenges with regard to sustainability.

In 2019, Vietnam signed a free trade agreement (FTA) with the EU. As a result, import tariffs on most raw shrimp products were removed and the import tax on processed shrimp will return to 0% in 7 years from the signing date of the FTA. It was expected that Vietnam would be much more competitive on the European market, however this has not been the case, mostly due to COVID-19. It is expected that the impact of the FTA will be more apparent in the future.

Vietnam is currently the most competitive on the larger sizes of black tiger shrimp (HOSO/kg). Contrary to Bangladeshi exporters, Vietnamese exporters are able to offer full container loads of larger sizes to European buyers. With the import tariffs removed, Vietnam might be able to also compete with Bangladesh on the middle sizes.

Madagascar

Madagascar produces a much smaller amount of farmed black tiger shrimp than its competitors in Bangladesh and Vietnam. However, the way in which the exporters from Madagascar (mainly Unima and OSO) have been able to develop a country image for their products, especially in the French market, is impressive.

Just like in Vietnam and Bangladesh, black tiger shrimp in Madagascar is produced in extensive production systems, with mangroves sometimes being integrated in the production systems or otherwise located around the shrimp ponds. The two leading exporters from Madagascar, Unima and OSO, have been able to capitalise on this story in the French market. Almost all black tiger shrimp exported from Madagascar is organic (OSO), Label Rouge or ASC-certified (Unima).

If you want to enter the European black tiger shrimp market, in France you will be competing with Madagascar black tiger shrimp. In north-western Europe, however, Madagascar black tiger shrimp cannot compete with cheaper alternatives from Bangladesh and Vietnam.

Indonesia, India and Myanmar

Small pockets of black tiger farming still exist in other countries in Asia as well, mainly in Indonesia (East Kalimantan), India (West Bengal and Orissa), and Myanmar (Rakhine and the Ayeyawaddy Delta). However, most products from these origins are exported to other markets than the European market, particularly to Japan and increasingly to China. Both India and Indonesia produce a small volume of organic black tiger shrimp, a portion of which is exported to the European market.

Tips:

- Check farm gate prices for different sizes of black tiger shrimp between origins by looking at the farm gate price portal of Seafood Trade Intelligence Portal. It will help you understand the prices your competitors are selling their product for. Take a free one-month trial to try it out.

- Compare the tariffs that you would have to pay when exporting shrimp to Europe and compare these to what your competitors from other origins would have to pay.

Which companies are you competing with?

With the decline of black tiger shrimp production, the number of companies that export farmed black tiger shrimp has been shrinking rapidly. Nevertheless, there are still about 200 to 300 factories around the world (mainly in Asia) that process and export farmed black tiger shrimp. Here, we will look at three companies, one from each major origin of black tiger shrimp.

MU Seafood – Bangladesh

MU Seafood is a small family-run shrimp exporter from Jessore, Bangladesh. The company has a turnover of around $11 million and exports about 1,000 tonnes of black tiger shrimp annually. Although the company is small, it is regarded as one of the most reliable shrimp exporters in Bangladesh. Its owner and managing director is well known to European buyers, and when not travelling to customers around the world, he is always working from his office inside his factory in Jessore, Bangladesh.

The company’s director is active in the Bangladeshi Frozen Foods Exporters Association and also involved in development projects implemented by Solidaridad in Bangladesh. His involvement in the exporters association gives him with influence over domestic policies regarding the shrimp sector in Bangladesh. His involvement with Solidaridad provides him with access to raw materials from farmers who are being supported in improving their production and marketing methods. It all helps to build his image in the market.

What makes MU Seafood a reliable supplier, according to some of the European buyers, is not his factory. His factory is well managed but old. What makes MU Seafood a reliable partner is the way the company’s management team communicates with its clients, the fact that the company always delivers on agreed contracts (or finds a mutually acceptable solution when needed), and that the company’s owner is so deeply involved in daily operations.

Although earlier the company sold most of its products through a partnership with an agent in Europe, nowadays they manage most of their clients in Europe themselves. New buyers are queuing, and his company often has to refuse new orders as stocks are already sold out.

The Minh Phu Seafood Cooperation – Vietnam

Vietnam’s top exporter is Minh Phu Seafood Cooperation. Minh Phu has parts of it supply chain dedicated to the production of extensively grown black tiger shrimp. Several business units focus on the production of black tiger post-larvae and farming black tiger shrimp, while one division works with external farmers. Part of its black tiger exports is organic certified. Although the majority of Minh Phu’s exports consist of Pacific white shrimp, the company aims to expand its black tiger shrimp exports to 50% of the company’s total revenue.

The Minh Phu Seafood Corporation, like MU Seafoods, also works with NGOs. The company has agreed to work with the Monterey Bay Aquarium to help bring some 20,000 small-scale shrimp farms in Vietnam's Mekong Delta to a level of sustainability equivalent to the Monterey Bay Seafood Watch programme's green ‘Best Choice’ rating by 2025, according to a jointly issued press release. The company is also the partner of Blue You. Jointly, the two companies produce the well-known Selva shrimp brand.

The company can offer a broad product range and as such can be a one-stop shop for its clients. The size of Minh Phu makes it difficult for the company to deal with smaller clients. Some buyers also dislike the power that big companies have, as it minimises their bargaining position. This is where you could come in. If you can deal with smaller orders and can cater to smaller buyers’ needs (often buyers in wholesale), you might have a role to play.

Minh Phu already claims to be the world’s largest shrimp producer and recently a Japanese business conglomerate, Mitsui, invested heavily in Minh Phu to further expand its business.

OSO (Overseas Seafood Operations) – Madagascar

OSO was the first shrimp exporter in the world that received official organic certification under France’s AB National Agriculture Biologique standards. Although exact figures are not available, the company produces anywhere between 1,500 tonnes and 2,500 tonnes of black tiger shrimp annually. A considerable part of this volume is organic certified, and OSO is the only supplier of organic black tiger shrimp from Madagascar to the French market. Other key markets for OSO in Europe are in the United Kingdom, Switzerland and Luxembourg.

R&O Seafood Gastronomy, the parent company of OSO, resulted from a merger of OSO with Reynaud, a specialised French seafood wholesaler. R&O Seafood Gastronomy has a turnover of nearly €250 million, with 1,250 employees around the world, and is a leading supplier of premium seafood to the French market. With this partnership, OSO has excellent access to the French market and does not have to invest in further marketing and sales efforts.

OSO’s strong position in the French market is built on 1) capitalisation of the strong country brand of Madagascar in the French market, 2) the fact that part of its production is organic certified, and 3) its partnership with R&O Seafood Gastronomy, which provides extensive market access. This position allows OSO to sell its shrimp at premium prices in mainstream and premium markets in France and some other European countries.

Tips:

- Look at your management team. Do you have any highly educated team members who can support you in making your company future-proof and taking it to the next level?

- Look at the websites of some of the major black tiger shrimp exporters in different origins to better understand how they present themselves and who is managing the companies. Think about how you can present your unique selling points to your potential buyer.

- At trade shows, besides looking for buyers, also try to engage with your competitors and ask them about the challenges and opportunities they face. See what you can learn from that.

Which products are you competing with?

Farmed black tiger shrimp faces competition from two directions. With regard to medium sizes of shrimp (26/30 and smaller), black tiger shrimp mainly competes with Pacific white shrimp. For the larger sizes, it mainly competes with wild-caught species such as Argentine red shrimp and wild-caught black tiger shrimp which is usually referred to as sea tiger (Penaeus monodon).

Pacific white shrimp

Pacific white shrimp is currently the price fighter of the exotic shrimp species offered on the European market for the middle sizes (30 to 100 HOSO pieces per kilogram). Pacific white shrimp is cheaper than almost every other species. Besides price, sustainable certified Pacific white shrimp is widely available to any market player who requires it.

There are two exceptions where black tiger shrimp still is able to compete with Pacific white shrimp. One is where Pacific white shrimp is not available in the desired sizes. In general, farms do not grow Pacific white shrimp into sizes over 26/30 HOSO count per kilogramme and more often this size is not even reached.

The second exception is those markets where customers appreciate the particular characteristics and premium quality of black tiger shrimp over Pacific white shrimp. This is mainly the case in the wholesale market where chefs buy their shrimp, and in the retail markets in Belgium, France and in the United Kingdom. In Belgium and France, there is a more sophisticated group of consumers that is more quality oriented than price oriented. In the United Kingdom, the large Indian and Bangladeshi community has a significant preference for black tiger shrimp.

Argentine red shrimp

Argentine red shrimp has a consolidated position on the Southern European market, with supply volumes increasing rapidly over the past couple of years, including on the Northwestern European market. It is sold in larger and smaller sizes and is available as land-frozen or sea-frozen, and as head-on shell-on and headless shell-on products as well as peeled products.

Wholesalers have been happy to include Argentine red shrimp in their offering as an alternative to black tiger shrimp as premium product. Argentine red shrimp, with its darker colour and distinctive taste, is often offered as a HOSO product but sometimes also HLSO or peeled. Just like the black tiger shrimp, it is promoted as a shrimp for grilling.

With increased supplies of Argentine red shrimp, prices have come down. Parts of the Argentine shrimp fishery are about to become MSC certified. With this achievement, it is likely that larger volumes of Argentine red shrimp will be sold into the mainstream retail market. This might increase space for other species in the wholesale segment.

Even though the fisheries in Argentina are likely to obtain MSC certification, some industry insiders doubt whether the current fishing intensity and catch levels can be maintained. Production increased so rapidly over the past couple of years that there are serious doubts about whether these levels of exploitation are sustainable.

Fluctuation of supply is also a challenge for Argentinian exporters, since price and supply stability are crucial to develop a stable market. This can be interpreted as an advantage for exporters of farmed black tiger shrimp who have a more stable supply scenario.

Wild-caught tiger shrimp

Wild-caught Asian tiger shrimp can be sourced from either West Africa or Asia. The distribution of its landings is highly concentrated. Most products are sourced from Nigeria and distributed by agents that work directly for the Nigerian companies, or are distributed by joint venture partners in Europe.

Wild-caught Asian tiger shrimp from Asia is normally sold in mixed containers as a secondary product (rather than the main export product) and can come from countries like Bangladesh, India, Myanmar, Vietnam or Indonesia. Imports from Asia are more fragmented than for the products that are sourced from West Africa.

In the market, wild-caught Asian tiger shrimp is mostly offered as a HOSO product in carton boxes. In terms of pricing, it is normally positioned at the higher end. The products compete in the high-end market in north-western Europe with the larger sizes of HOSO farmed black tiger shrimp products that are also packed in carton boxes. However, these products are normally regarded as being of the highest possible quality and are priced as such, and therefore serve a different clientele than the farmed black tiger shrimp products.

Wild-caught Asian tiger shrimp is rarely seen in supermarkets in north-western Europe, as almost no Asian tiger shrimp fisheries are certified by MSC, which is the most common market access requirement for wild-caught fish and seafood. Therefore, competition from wild-caught Asian tiger shrimp is limited to the wholesale and specialised and ethnic retail segments only.

- Check out MSC’s website to see which shrimp fisheries around the world are already MSC certified. Also check the MSC fisheries standard to better understand the MSC certification requirements.

- Check the FIP database to see which fisheries are involved in an FIP and to check the progress they are making. The FIP profiles will also give you a better understanding what types of interventions you need to make to work towards a sustainable fishery.

4. What are the European market prices for black tiger shrimp?

The table below provides an overview of black tiger shrimp prices at a major broadline wholesale company in the Netherlands and the biggest supermarket chain in Belgium. Looking at the products offered, it is clear that Pacific white shrimp and black tiger shrimp species are often packed in different product types, sizes and specifications, and as such do not necessarily compete directly with each other. It is also interesting to observe that the Belgian supermarket chain Colruyt has a budget line and a premium line. In its budget line, Everyday, all products are made with Pacific white shrimp. In its premium line, the Boni brand, the retailer uses both Pacific white shrimp and black tiger shrimp. For you as an exporter these online shops provide an opportunity to see how the different products are branded.

Table 2: Consumers price of different products of black tiger shrimp at retail level

|

Country |

Supermarket or wholesaler |

Company name |

Product description |

Price per kilogram (euros) |

|

Netherlands |

Broadline wholesaler |

Makro |

Black tiger shrimp bodypeel 13/15 |

28.35 |

|

Black tiger shrimp easy peel 16/20 |

27.65 |

|||

|

Black tiger shrimp easy peel 8/12 |

24.35 |

|||

|

Black tiger shrimp easy peel 13/15 |

21.35 |

|||

|

Black tiger shrimp head-on shell-on 8/12 |

24.40 |

|||

|

Black tiger shrimp head-on shell-on 13/15 |

22.60 |

|||

|

Black tiger shrimp head-on shell-on 31/40 |

14.95 |

|||

|

Belgium |

Retailer |

Colruyt |

Black tiger shrimp head-on shell-on blanched peeled ASC certified 16/20 (premium brand) |

19.10 |

|

Black tiger shrimp headless shell-on ASC certified 31/40 |

23.90 |

|||

|

Black tiger shrimp headless shell-on blanched peeled ASC certified 16/20 (premium brand) |

28.90 |

|||

|

Black tiger shrimp easypeel ASC certified 8/12 (premium brand) |

33.32 |

Source: Seafood TIP (2021)

Although the exact distribution of margins differs significantly from one product to the other, we can give a rough estimation up to wholesale level, since black tiger shrimp is more dominant in various wholesale market segments. The margin of the importer in this case is usually 5-10% and is largely dependent on the imported volume. When considering the retail perspective, we would expect a higher margin and contribution to the value of the retailer.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research