Entering the European market for crab

The European crab market is mainly supplied by producers from within Europe. However there are certainly opportunities to enter and be successful in this market. In Europe, crab importers are looking for quality, sustainability, availability of products and competitive price. As the convenience trend grows in Europe, especially after COVID-19, value-added crab products are increasingly in demand. In this article you will find all information required to enter the European market for crab.

Contents of this page

1. What requirements must crab comply with to be allowed on the European market?

In order to enter the European market and compete with European exporters, which supply most of Europe’s demand for crab, non-European exporters must strictly comply with all legal requirements and also focus on the sustainability and traceability of their supply chains. This section is divided into three categories: the mandatory requirements, additional requirements and niche market requirements.

What are mandatory requirements?

Catch certificates to combat illegal fishing

Like with all other fishery products, European countries are very strict when it comes to the import of crab that is caught through illegal, unreported or unregulated (IUU) fishing. The European Union uses a Catch Certification Scheme, which is a prerequisite for exporting to Europe and allows authorities to combat IUU fishing. The catch certificate contains all the information specified in the specimen shown in Annex II of the European IUU legislation. Ensuring a slave-free socio-economic condition, this certification is a must for all fishing vessels.

IUU fishing, according to the European Union, is any fishing that done is in forbidden areas, uses illegal methods or goes unreported. IUU fishing has a negative effect on the sustainable management of global (and local) fish stocks and creates unfair competition against those that fish legally and responsibly. The European Union requires that you can prove that your crab products do not come from IUU fisheries.

Tips:

- Check this link to know more about the European Union’s rules to combat illegal fishing

- Check this write up about the European Union CATCH system which will eventually replace the old paper-based catch certificate system. Currently, the CATCH system in not a requirement for non-European Union countries, however, we recommend you learn and comply with the digital system in order to ensure a smooth-flowing transaction with European buyers.

Management of crab stock

A large part of ensuring that there is no IUU fishing involved in your crab product is the management of crab fishing efforts. Crab stocks are managed primarily through fishing effort limitation and technical conservation measures. For example, brown crabs are managed through the mandatory authorisation of vessels to fish shellfish that only allows them to land a limited amount (25 crabs per day). The key technical measure is the minimum landing size (MLS), designed to ensure animals are allowed to grow to maturity to sustain breeding stocks.

This is a particularly effective way of managing crab fisheries, as undersized animals that are returned to sea from pots suffer very low mortality rates (mortality rates are probably higher in trawl and net fisheries), according to a Responsible Sourcing Guide by Seafish. This is important to know as an exporter because you do not want suppliers to think that you are unsustainably harvesting premature crab.

Let us take a look at how the United Kingdom, a major supplier of crab in Europe, manages its brown crab fisheries.

The MLS for crabs varies around the British coast because of regional variations in growth rate, size at first maturity and marketing practices. Generally, the MLS of edible crab (Cancer pagurus L.) was increased on the south coast of England and Wales from 115 mm carapace width (CW) to varying sizes of up to 160 mm CW, depending on the district. The MLS remained at 115 mm on the east coast of England. For velvet crab (Necora Puber), the MLS is 65mm.

As shown on figure 1, the carapace is the shell on the back of the crab.

Figure 1: Crabs measured across the widest part of the carapace or shell

Source: Seafood TIP (2021)

Tip:

- To know more about the minimum sizes for crabs in the United Kingdom, check out this list made by the Inshore Fisheries and Conservation Authority.

Labels and packaging

When importing crabs into Europe, all of the standard labelling requirements for Fish and Seafood apply. You can find these requirements in the CBI Buyer Requirements study. Make sure that you understand and follow them. There are no crab-specific labelling requirements but, as with all Fish and Seafood entering Europe, you are required to pack your crab in safe materials and include on the packaging all ingredients that have gone into the product.

Food safety standards must be followed

Europe has one of the highest food safety standards in the world. Products that are found to be non-compliant will be registered and reported in the Rapid Alert System for Food and Feed (RASFF).

Crab being exported to Europe must also have a health certificate accompanying the product. Hygiene and health are important to buyers, particularly for the shellfish products that are imported into Europe live, such as crab. But for processed crab, it is important to make sure that no contaminants end up in the final product. Seafood destined for the European market is generally tested before it is shipped, sometimes in the buyer’s own lab, sometimes in recognised (independent) labs, in order to prevent costly border rejections.

European Union Rules regarding Food Hygiene cover all stages of production, processing, distribution and placing on the market for all food intended for human consumption. The standard European hygiene rules can be found in the CBI buyer requirement study.

Some of the alerts that have appeared on the RASFF portal pertaining to crabs include hazardous substances such as sulphite or cadmium. Poor temperature control in frozen and live crab products and also improper health certificates are also usually flagged by authorities. As an exporter, make sure that your crab does not contain hazardous substances and make sure to monitor temperature control for crab exports.

The maximum residue level (MRL) is also a detail that exporters should pay attention to. All traces of substances must be declared since they may be harmful to people with sensitivities to these substances.

The MRL indicates the maximum amount that is allowed in the product as established by Commission Regulation (EC) No 1881/2006 (see Section 3.3 of the Annex). Sulphite, which is an allergen, is not included in this regulation, but must be declared on the labelling when levels are higher than 10mg/kg or 10mg/l in the final product. For crab, the following are MRLs for various substances that exporters should watch out for:

Table 1: Maximum residue level allowed of substances that are found in crab

|

Substances Crustaceans |

mg/kg wet weight |

|

Lead |

0.50 |

|

Cadmium |

0.50 |

|

Mercury |

0.50 |

Source: Seafood TIP (2021)

Tip:

- Check the RASFF portal to know what kinds of products are recalled and the reasons for border rejection.

What additional requirements do buyers often have?

Buyers want extra guarantees on food safety

Many European buyers want products that are processed under quality standards that exceed the standard European hygiene rules. There are certificates that guarantee these stricter standards.

Some of those additional requirements include temperature control during processing, hygiene, traceability, condition of the cold store and safety protocols. Several internationally known quality certifications give buyers those guarantees. The most requested food safety certifications are International Food Standard (IFS) and/or British Retail Consortium (BRC). Making this investment is clearly a good idea since it is not only a must for the European market, but also for other markets around the world.

Tip:

- Make sure that you can provide high-quality certifications (BRC and/or IFS) and a stable supply if you want to sell your products to retail and food service companies.

Grading, packaging and labelling

In table 2, you will find some of the crab species imported into Europe and how they are graded and packaged. Depending on your buyer’s requirements, packaging may vary. It is best to ask your buyer ahead of time what kind of sizes or packaging they are looking for.

Table 2: Grading information of crab products exported to Europe

|

Country of origin |

Species |

Grading information |

|

Norway |

King crab (Paralithodes camtschaticus) |

Grading/Sizes:

|

|

Norway |

Snow crab (Chionoecetes opilio)

|

|

|

United Kingdom |

Brown crab (Cancer pagurus) |

|

|

Ireland |

Velvet crab (Necora Puber) |

|

|

Vietnam |

Blue swimming crab meat (Portunus Pelagicus and Portunus Haanii)

|

There are four basic categories of crab meat grades:

Packed in 1lb or 4lbs Plastic Pouch Bag |

Source: Seafood TIP (2021)

Crabs are usually packaged in trays and cartons of various sizes depending on the product and requirements of the buyer. A common type of packaging is a ten-kilogram master carton (e.g. 45x27.5x47.5 cm, in which case one Euro-pallet (wooden pallet) can store 24 master cartons) with 10 x 1 kg with a number of crabs depending on the size class.

Buyers look for sustainability seals

Getting a sustainability seal helps secure your reputation as a reliable and trustworthy exporter. It is a worthwhile investment. European buyers are constantly demanding products with sustainability seals, especially in retail. There is also a growing demand for sustainable certified products in the food service sector.

The Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC) seals are the two largest certifications in Europe. Other standards like Best Aquaculture Practices (BAP) are also gaining traction. BAP producer data shows that the USA and European markets are the largest destinations for sales, with each area accounting for about one quarter of producer sales.

Around the world, there is a total of ten fisheries which are certified by the MSC. These include the snow crab and red king crab from Russia’s Barents Sea, the Louisiana blue crab, Australian West Coast Deep Sea Crab, Scotian Shelf snow crab, Newfoundland & Labrador snow crab, SSMO Shetland inshore brown crab, AQIP snow crab, Antey Sever Barents Sea crab, and the Peel Harvey Estuary’s blue swimmer crab. While MSC-certified crab is limited, it is an advantage to have it, especially if you are selling to importers – in particular those from Northern and Western Europe.

Fisheries Improvement Projects (FIP) work with the seafood industry to promote sustainability in the sourcing of wild caught seafood. They help fisheries achieving (MSC) certification. There are a few FIPs that are active with crab, and a list can be found through FisheryProgress.org. If there is the possibility to obtain a sustainability certification for your products, it will be easier to enter this market. Through FisheryProgress.org you can learn about active crab FIPs, and receive support for starting one.

Most of the crab entering Europe is wild caught. For developing countries who want to sell farmed crabs, it will be a challenge to get a certification, as crabs is not currently covered by the ASC. An aquaculture improvement project (AIP) could assist you towards certification, and engagement with one goes towards proving that you have the desire and potential to achieve certification. While there are no AIPs for crab, the Sustainable Fisheries Partnership recently launched a directory that can assist you in starting one.

The BAP sustainability seal also covers crab. The Chinese mitten crab or hairy crab from China-based Zhejiang Aoling Aquatic Seeding Technology Company was the first to attain a BAP certification.

Tips:

- Read our Sustainability certification study to find out all you need to know about sustainability certifications in Europe.

- Read more about how retailers make commitments for selling sustainable seafood in the CBI study on what trends pose opportunities or threats to the European seafood market.

- An audit by an accredited certification body can be an advantage in the business. Check the list of accredited certification bodies to see which one could assist you.

- Check out the Sustainability Standards Map, which helps small and medium-sized enterprises in developing counties develop their value chain with a focus on sustainability.

Buyers want more value-added products

Retail is a key marketing channel for seafood in Europe. During COVID-19 lockdowns, people were forced to cook at home. Seafood products mainly found their way to the consumer via retail, and sales in this segment increased. Companies offered new ranges of seafood retail products targeted at consumers that are stuck at home. This provides your business with the opportunity to offer processed and value-added products, aligned to the needs of these consumers.

The sales of prepacked seafood products increased due to consumer preferences and new marketing. An increasing number of consumers is afraid that unpacked fish products are contaminated with coronavirus, which means there has been a shift toward demand for prepacked products. Prepacked products are usually sold in sizes suitable for at-home cooking, where there is not always a lot of space to prepare seafood products. An increasing amount of European companies that were used to selling fresh whole fish at fish counters also started selling more prepacked seafood products.

With the trend of convenience growing in Europe, more and more European buyers are looking into imported value-added products. You can use this opportunity to add value to your export products. As crabs are generally products that are difficult to prepare or break down in the kitchen, value-added products can offer convenience and longer shelf life for the end users.

Many crab exporters are already offering value-added products. The most common method of value addition is cooking them, pasteurising them or preparing them in portioned packages.

For example, crabs could be portioned into different parts, such as crab legs, crab claws, or crab meat. For crab meat, exporters can also categorise their exports based on the meat grade such as colossal lumps, lumps or backfin. They could be packaged in steel cans, plastic cans, or plastic vacuum bags. These are stored from 0-5 degrees Celsius and have a shelf life of up to 16 months.

Figure 2: Pasteurized blue swimming crab lump, crab colossal, pasteurised blue swimming crab claw (left to right)

Source: Trinity Vietnam (2021)

Apart from preparing the crab meat, exporters can also prepare the products in portions like half cuts or shells. As more European buyers look for pre-packed and pre-portioned products, it is best to contact your buyers directly on which format they want to receive the product. If you can add value and pre-prepare your products this could increase their value and price, while at the same time extending your portfolio.

Apart from pre-portioned or prepared products, value addition in your products could also be in the form of different packaging, or preparing the crab products in different sauces or recipes. Pre-packed and processed products can be in the form of cans, jars or pouches. Some examples of such products are crab paste in jars, crab cake mix, crab thermidor or crab terrine. The possibility for value-added products is endless as there are many ways to prepare your crab in different sauces or spices.

Figure 3: Minced crab in spices, crab meat (from left to right)

Source: Seafood TIP (2021)

Tips:

- It’s best to contact your buyer or importer on how they want their crab products packaged or portioned. This largely depends on the application of the product or where it is going to end up. To learn how to do business and communicate with your buyers, check out this study on Tips for Doing Business with European Buyers.

- The ethnic retail market could be an interesting end market for crab exporters. You can also provide unique ethnic recipes with your products to help consumers prepare their dish at home. To know more about your opportunities in the ethnic retail market, read our CBI study.

What are the requirements for niche markets?

Your social impact matters to European buyers

European importers are not only interested in how your crab is produced, they also care about the people and the community behind it. Implementing policies that are good for the people who work in the industry show that your company is committed to sustainable and socially responsible practices like human rights and gender equality. As such, obtaining certifications, developing marketing stories, and adopting Corporate Social Responsibility or CSR practices can add value to products, open up opportunities and facilitate market access. Start looking for possibilities to gain CSR certification. Some internationally known certifications are Sedex and ISO 28000.

In Indonesia, crab fisheries are a mainly staffed by women. Women are the dominant group in preparing and processing catch, collecting it from landing sites, cleaning it, sorting it, cooking it and taking it to market or packaging it for our plates. Today, the industry supports the livelihoods of at least 90,000 fishermen and 185,000 women. Check out this story highlighting the role of women in the crab fisheries published by the MSC.

Make your supply chain traceable

Making your products traceable helps buyers to believe in the quality and authenticity of your products. It is not required but very much appreciated by buyers.

Trust is an important factor in doing business in Europe. It is crucial not only for importers, but also for consumers. Full traceability and transparency means that documentation is available for all the steps of the supply chain, and that you communicate in an open and honest way about your company.

There are many ways to ensure your product is traceable. Blockchain and DNA technology are two of the most commonly used in the seafood sector. Exporters can look into these technologies in order to monitor their supply chain and digitise all relevant information, which exporters can use in pitching their products to European importers.

Not many exporters from developing countries have traceability for their crabs yet, but in North America Vancouver-based Smokey Bay Seafood Group has partnered with blockchain-based traceability platform Wholechain to “capture data, increase visibility, and share the full product story of their USA Dungeness Crab supply chain.”

Another example are Norwegian King crabs, which are being tracked and ID’d so consumers will know the journey of the crab from sea to plate. Norway King Crab checks and registers every crab which includes the monitoring of the weight, catch location, time of catch and information about the fisherman with a unique ID number and a QR code.

Tip:

- Read the recently published study on Digitalisation to know more about traceability and how to apply it in your business.

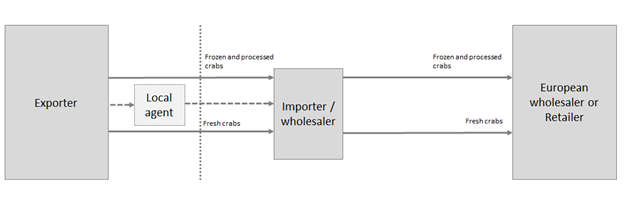

2. Through what channels can you get crab on the European market?

Live crab and frozen or processed crab undergo different processes in the supply chain. However, their end market is the same. The main channels through which exporters can gain access for their crab products are the retail and food service sectors. There is also an opportunity to enter niche markets for crab, since European consumers are looking for variety and diversity in product range.

How is the end market segmented?

Imports of crab primarily cater to the retail and food service sectors. The business of crab is all about targeting the end consumers. If consumers love your crab, then it is more likely that European importers will buy your product. As mentioned in the crab market analysis, the European markets, especially for frozen and fresh/live crab, are already saturated with crab supplies from the United Kingdom, Ireland and other European countries.

The best way for developing countries to enter the crab market is through value-added products: dried or smoked crab, crab in brine and other prepared and preserved crab, as these present more opportunities.

Figure 2: End market segmentation for crab

Source: Seafood Trade Intelligence Portal, 2020

Figure 4 shows the main retail and wholesale/food service end-market segments in Europe. The segments that are darker are those that are most interesting for you, as a producer of crab, as they are the segments in which your products have the highest demand. Depending on the seasonality and availability, crab may also be sold by fish mongers and street markets, as well as specialised fish and seafood wholesalers.

It is important to remember that every type of crab product has its own developed market. Live crabs are usually sold to wholesalers, retail and food service customers, largely from France, Spain, Portugal. These nations have a developed affinity for seafood, and the market is particularly busy during the second half of the year with a peak in December. Live crab is regularly available in hypermarkets and sometimes at fishmongers. These countries are also where most seafood processors are found.

Fresh crab is considered attractive for its freshness and quality, especially when it is stored in viviers, which are storage tanks with clean and chilled water. According to a study by SeaFish, live crab is more popular amongst heavy consumers of brown crab, who tend to be over 50 years of age and consuming crab at least three times per year, purchasing for in-home consumption. Live crab is less appealing to light consumers who consume crab less than twice a year, who usually purchase out of home and avoid the difficulty of preparation.

Because of the seasonality and the risks of mortality, frozen and processed crab are good alternatives to live crab. They are found in the frozen section of major retailers and ethnic supermarkets. The United Kingdom and Ireland are the biggest markets for these products and you can find frozen crab and crab claws in major retailers across these countries. For other European countries, however, the best chance to find frozen crab is in ethnic supermarkets.

Tips:

- Consider trading with the Netherlands and Germany. Dutch and German traders often also supply Eastern European markets. Discuss what products may be of interest to markets in Eastern Europe and what can be supplied through these channels.

- Be strategic in tapping into the European market. Since crab is not considered an everyday purchase, consider offering discounts, especially during the holiday season, when consumers usually buy crab. Be imaginative in presenting your product to the food service sector. Think in terms of how the sector can use canned fish on their menus or their range of dishes.

- Check out European associations such as the EU Fish Processors and Traders Association (AIPCE-CEP) or the Seafood Importers & Processors Alliance (SIPA). If you are selling raw materials of crab meat that would further be processed, contact Spanish processors through groups like Asociación Nacional de Fabricantes de Conservas de Pescados y Mariscos (ANFACO) (National Association of Canned Fish and Seafood Manufacturers) or the Asociación Española de Importadores Mayoristas de Alimentos del Mar (ALIMAR) (Spanish Association of Seafood Wholesale Importers).

Through what channels does crab end up in the end market?

The retail and food service sectors are the end market for your crab products. As said in the previous section, it is important to know your target market for your product. There is a stark contrast in the markets for fresh, frozen or processed products. Most supplies also originate from within Europe. Therefore, the best chance to enter the European market is through traders and agents, particularly those based in the major importing nations in Europe (Spain, Italy, France, United Kingdom and Portugal) or trading nations (Germany and the Netherlands).

In both markets, it is best to deal with importers and wholesalers who can give you access to the retail and food service sectors. This section is divided into two parts: the retail sector and the food service sector. We will also discuss the pros and cons for each crab product in each market.

Figure 5: European market channels for fresh, frozen and processed crabs

Source: Seafood TIP (2021)

Retail

The markets for retail are usually supplied by dedicated suppliers. Thus, in order to get into the retail market, it is best to contract a middleman or a trader that can help introduce you to huge retailers. Quality is very important, so if you are new in the business, make sure you comply with all the mandatory and additional requirements (refer to section above).

As an exporter, you can also deal directly with the retailer. There are risks that go along with a shorter supply chain as you will have to be responsible and accountable for a steady supply of crab that matches the agreed upon quality and specifications. On the other hand, it allows you to increase the margins that you gain from the sales.

Crab quality and shelf life are strongly affected by duration of captivity, transport, handling and storage conditions along the supply chain. Usually, in the trade of crab, the exporter is responsible for the processing, packaging and transport of the crab, as they are the most knowledgeable in handling and maintaining the quality. However, as an exporter, you should always check with the importer or retailer how they want the product to be delivered and handled.

On its product website, Trinity Vietnam, for example, has already provided details on how its products are packaged and stored for importers to choose from. However, it is always good to ask if a buyer has a specific request in packaging or delivery.

Tips:

- Give tips to the consumer on how to best cook the crab; they often lack knowledge on how to cook and prepare live crabs. This is considered a barrier in retail. For frozen and processed crab, instructions on storage and preparation are equally important.

- Check out large retailers in your target country, for example, Carrefour in France, Mercadona in Spain, Aldi, Edeka, and Lidl in Germany, Sainsbury and Tesco in the United Kingdom and Albert Heijn in the Netherlands.

- Make use of the available logistic facilities of the European ports, from where products are further distributed, if you want to distribute your products further into Europe. In Europe, the ports of Rotterdam (the Netherlands), Antwerp (Belgium) and Hamburg (Germany) are crucial distribution hubs.

- Go to events and exhibits such as the Seafood Expo Global, which is usually held in Brussels, Belgium. However, starting in 2022, the trade event will be held in Barcelona, Spain. You can meet a lot of potential importers there. A tip for spotting crab buyers: they usually also deal with other related crustaceans such as lobster or shrimp.

- Use Google Translate if you are trying to access a company website linked in this study and the website is not available in a language you are familiar with. Companies that you might be interested in may only have their websites translated into the languages that they use most often.

Food Service

The food service market for live crab is limited in Europe and particularly focused in France, Spain and Portugal. Markets are usually found in specialised fish restaurants, particularly high-end restaurants that do not use ready-to-eat products. It is considered a niche feature in the food service.

The food service sector for live crab is strongly based on appearance and quality because those are the qualities that consumers are looking for and are willing to pay for. Factors include price and quality (intensity, smell, date of capture), origin, assurance of wild product, size (as a guarantee of meat content) and appearance (colour, hardness of carapace, presence of claws).

Meanwhile, there is a huge opportunity for processed and frozen crab products in the United Kingdom. Pre-cooked and ready-to-cook products are also convenient when it comes to restaurants, hotels and catering services. It is important to remember that food service companies usually have their own suppliers or are the owners of the entire supply chain including fishing for crabs. As such, it is best to contact restaurants directly or have traders arrange for an initial meeting. Price, quality and reliability of supply are crucial in the food service sector.

In the United Kingdom, crab in the food service sector is a huge business. In restaurants, they usually serve red king crab, which is exported frozen from the non-European Union countries. Creative menus involving crab are key in the food service sector. As an exporter, you have to check what types of crab are usually prepared in these restaurants.

As you can see from figure 5, to enter the European market, you should go through a local agent or an importer or wholesaler. Local agents can be individual consultants that have further connections with importers or working under an importer. They allow the exporter to gain insight into the European market from someone in the industry. Traders or importers can also provide you with connections into markets like retail or food service that would otherwise be difficult to reach. They can also give you updates on changes in the market and competition.

Tips:

- Check out the species and products offered in the food service sector. For example, some of the restaurants that offer live crab are Crabe Marteau in France, D’Berto in Spain or Marina Terrace and Sol Dourado in Portugal.

- Check out European associations such as the EU Fish Processors and Traders Association (AIPCE-CEP) or the Seafood Importers & Processors Alliance (SIPA). If you are selling raw materials of crab meat that would further be processed, contact Spanish processors through groups like Asociación Nacional de Fabricantes de Conservas de Pescados y Mariscos (ANFACO) (National Association of Canned Fish and Seafood Manufacturers) or the Asociación Española de Importadores Mayoristas de Alimentos del Mar (ALIMAR) (Spanish Association of Seafood Wholesale Importers).

- Storage and handling, especially for live crab, are very important to both retailers and the food service sector, so you have to make sure that you will be able to handle these delicate species with care during transportation.

- Vivier trucks are also an option, especially for live crabs. In the case of a company in Ireland, these lorries have aerated tanks and can hold up to 12 tonnes of live crab with average delivery time to mainland Europe of 36 hours. When live crabs are not being held in vivier tanks, they are stored in boxes with regulated temperature and moisture and shipped by airfreight.

3. What competition do you face on the European crab market?

Your biggest competition in entering the European market for fresh and frozen crab are European countries themselves, particularly the United Kingdom and Norway. Outside Europe, your main competition will be Madagascar and China. For processed crab, Indonesia and Vietnam are your strongest competitors. In all of the producing countries, there are companies that are successfully exporting their crab to Europe but remember that you are competing with more than just other crab producers; there are also other products that your crab will have to compete with.

Which countries are you competing with?

In this section, we will highlight some of the main non-European countries that export crab to countries in Europe. But before that, as exporters you must realise that your biggest competition comes from within the European Union.

The United Kingdom

For both live and frozen crab, the UK was a major competitor with 3,413 tonnes of frozen crabs exported to other European countries in 2020. However, these volumes have dropped from 2019, with British suppliers suffering from a 24% decline in exports.

In 2021, trading seafood products between the EU mainland and the UK proved to be extremely difficult due to the transition to Brexit. Newly developed legislations demanded a lot of paperwork and other requirements for seafood to be traded and, as a result, trade in seafood clearly suffered. These effects are expected to last for some time. For you as an exporter, this can be an opportunity to enter the market. As the UK mostly provides brown crab to European countries such as France and Spain, finding opportunities to meet this demand could benefit your business.

If you are exporting to the UK, it is important to know that they left the European Union (EU) on 31 January 2020. As of 31 December 2020, a new trade deal applies. The deal outlines the changes to seafood product trade between the EU and UK, and imports from non-EU countries. If you are exporting to the UK, you may have to adapt your business to the new rules. Brexit and the new trade deal affect customs, tariffs, food safety checks and labelling. For exporters, it is important to know that the EU and UK will regulate their own food safety standards. You can check the changes via the UK government website.

Tips:

- Read this news item to understand the effects of Brexit and keep yourself updated through the UK government website.

- To understand how to find new buyers for your crab product in the EU, you should read the study on Finding Buyers and Doing Business in Europe.

Norway

Norway is an important competitor among non-European Union suppliers with 686 tonnes of frozen crab and 170 tonnes of fresh crab delivered to Europe in 2020. Exports of Norwegian crab were the highest in 2018, but prices were at an all-time low. While this improved during 2019, the impact of COVID-19 had not reduced prices and export volumes. Norway mainly supplies edible crab, king crab, snow crab and brown crab to Europe.

Norwegian crab is known to be of high quality coming from clean and cold waters. Companies usually also have a unique tracking system for the crab they export, adding to their reputation of reliability as a supplier.

Norwegian frozen and fresh crab exports are expected to increase in the long term as companies invest more in sustainability and traceability, particularly for live crabs. Examples of this include Marine Stewardship Council (MSC) certifications as well as tracking methods and logistical improvements in shipping and delivery.

Madagascar

Imports of frozen crab from Madagascar have been on the rise since 2019, and were up even during COVID-19 in 2020 reaching 724 tonnes. Due to historical ties with France, Madagascar crab are mainly imported by France which imported 700 tons in 2020. The main species imported are mud crabs, and the majority is frozen. In Europe, mud crabs can sell for almost 15 times the price in local Malagasy markets.

According to the FAO, crab fisheries are overexploited in Madagascar. This could be a disadvantage for Malagasy exporters who want to enter Europe, especially for buyers who commit to sustainable sourcing. While the government imposed fisheries regulations, enforcement has been difficult as there is no data available.

In a bid to solve overexploitation of the fisheries, stakeholders including NGOs, local authorities and local communities are working together to protect and conserve the crab fisheries, which is an important part of livelihood of the local people. Blue Ventures, in collaboration with MIHARI and the Ministry of Fisheries and Aquatic Resources (MPRH) launched the Good Practice Guide to Crab Fishing to highlight recent advances in strategies for reducing post-capture losses. The guide describes sustainable crab fishery management interventions in western Madagascar, and provides practical recommendations to help fishermen secure better incomes, whilst reducing pressure on crab stocks and protecting the mangrove environment.

China

Between 2018 and 2019 imports of frozen crab from China were stable at 840 tonnes. However, in 2020, imports decreased considerably. This drop was caused by the logistical and production difficulties in China due to COVID-19 lockdowns and restrictions. In addition, the closure of the food service sector in Europe (which is the main outlet for Chinese crabs) also impacted trade heavily.

Out of all the non-European exporters of frozen crab to Europe, China has the lowest price for its crab, with an average of €4.52/kg in 2020. Compared to the top exporters, this is almost a third of the price of Norway’s frozen crab, which is sold at an average of €15.14/kg, and also lower than Namibian crab, which has an average price of €7.78/kg.

However, keep in mind that these species are different from what other major exporters are delivering. China is focused on exporting Chinese mitten crabs and mud crabs, which are sold for lower price than other species such as mud crab or king crab.

Vietnam and Indonesia

Among non-European countries, Vietnam is the leading exporter of prepared and processed crab to Europe, with 891 tonnes exported in 2020. While Vietnamese suppliers take the lead, their exports have significantly dropped since 2016 (down by 51%) and have shown a steady decline since then.

The drop was mainly due to a “yellow card” issued by the European Commission because of Vietnam’s failure to address IUU fishing. Crab exports to Europe should continue dropping if this warning has not been removed. While Vietnam aimed to lift the yellow card in 2020, it failed to do so as COVID-19 impacts made the implementation of an improved tracking and management system in fishing vessels more difficult.

France, the United Kingdom, the Netherlands and Belgium are the top four biggest crab importing markets from Vietnam in the EU. Vietnamese producers specialise in mud crab and blue swimming crab. The blue swimming crab is the most commercially used species for prepared and processed crab products, such as crab meat.

Primary products include crab meat packed in cans or jars. The colossal lump is the most expensive crab meat product because it has the largest size of crab meat. Meanwhile, claw crab meat is the cheapest meat.

Another Southeast Asian nation that is a competitor in the sales of prepared and processed crab to Europe is Indonesia. European imports of prepared and preserved crab reached 732 tonnes in 2020. Like Vietnam, Indonesia also focuses on the export of crab meat derived from blue swimming crab to Europe.

Blue swimming crab (BSC) is one of Indonesia's important fisheries commodities. More than 90,000 fishermen and 185,000 women are directly involved in the value chain of its fishing industry and mini plant. Indonesia’s largest market is the US comprising around 85% of the exports from Indonesia, however, European countries such as France, Netherlands and United Kingdom comprise 8% of Indonesia’s markets.

Tips:

- If you want to know more about Vietnam’s crab meat business, check out this website for further information on grading.

- Check out this website to find Indonesian suppliers of crab to Europe.

Table 3: 2020 Average European Union Import Prices

|

USD/kg |

2018 |

2019 |

2020 |

|

China |

$4.70 |

$4.30 |

$4.52 |

|

Greenland |

$8.48 |

$12.64 |

$14.54 |

|

Madagascar |

$5.18 |

$5.73 |

$5.47 |

|

Namibia |

$8.28 |

$9.22 |

$7.78 |

|

Norway |

$16.88 |

$21.63 |

$15.14 |

Source: Eurostat 2021

Which companies are you competing with?

The following companies have been successful in exporting their crab to the European market. Use these examples to learn what is successful in Europe.

HitraMat

HitraMat is currently Norway’s leading producer of edible crab, representing over 50% of the total Norwegian crab catch. The company specialises in producing crab for the retail, hotel and catering sectors. Crab are caught in traditional crab traps by professional fishermen. The local fishing fleet ensures high-quality raw produce, which is then processed. The company’s new processing plant ensures efficient production, resulting in top-quality products for the benefit of its customers.

The company produces a wide range of products including fresh, frozen and processed crab, ranging from crab meat and crab claws to dressed crabs. HitraMat also markets its products as gourmet, premium products through the brand Gourmat, which includes crab rolls in different flavours.

Trinity Vietnam

Trinity Vietnam is focused on producing, processing and canning crab meat. They specialise in the production of pasteurised and sterilised claw, lump and jumbo crab meat from the red swimming crab (Portunus Haanii) and blue swimming crab (Portunus Pelagicus). They export to France, the United Kingdom, Germany and Italy.

The company also produces sterilised white claw meat in brine. Sterilisation kills all microbial pathogens while pasteurisation is a process that kills the pathogenic bacteria by heating to a certain temperature for a set period of time.

Pasteurised products have a shelf life of 6-18 months while sterilised crabmeat has a shelf life of up to 36 months from production date. Unlike other canned seafood like tuna or mackerel, pasteurised crab meat cannot be stored at room temperature but must be stored at 0-5 degrees Celsius. Sterilised crabmeat, on the other hand, could be stored at room temperature.

Some buyers request pasteurised and sterilised crab meat, especially when they want to have products stored for a longer period. Trinity Vietnam is a good example of how a processor enters the European market through diversification of its products and tailoring it to buyers’ needs and requirements.

PT Toba Surimi Industries

PT Toba Surimi is an Indonesian company that specialises in the production of pasteurised crab meat products such as jumbo lump, super lump, crab claws and other value-added processed crab like whole unbroken meat in lumps. Toba Surimi’s markets include Europe, Canada, Japan and Australia, and the company has an annual turnover of $24 million. Pasteurised crabmeat products can be packaged in cans or plastic tubs depending on the requirement of the buyer.

Like Trinity Vietnam, Toba Surimi invests in the integrity of their crabmeat facilities and products through comprehensive microbiology analysis of sterilised products tailored for the European market’s needs.

Which products are you competing with?

Fresh and frozen lobster

Being in the same shellfish and crustacean category, lobster is the primary competition for crab in the European market, specifically in the frozen and fresh categories. In France, for example, chilled cooked lobster is popular and widely used in catering and retail. Lobster is also considered a luxurious seafood, also eaten during the holidays and with peak consumption in December, just like crab.

Live lobster also has its niche market in France, and is usually supplied by Ireland in storage tanks at €25 per kilo. Like crab, lobster production is concentrated in European fisheries, particularly in the United Kingdom and Ireland. Lobster imported to Europe is mostly sourced from Norway. Lobster and other crustaceans compete with crab in the end market (retail or food service sectors).

Surimi

Surimi is direct competition for exporters from developing countries, particularly for those that supply prepared and processed crab to Europe. There are two factors why it is a direct threat to exporters from developing countries. First, surimi is often mistaken as crabmeat, which is why it is often referred to as imitation crab. However, surimi is actually a paste made from white fish such as Alaska Pollock or Pacific hake combined with starch and egg white. This common misconception can be a barrier when consumers decide to buy prepared and processed products.

Second, it is a product that comes with an attractive price. Compared to crab meat, which is already cheaper than fresh and frozen crab, surimi can be significantly cheaper.

Figure 8: Surimi crabsticks

Source: Carrefour (2021)

For exporters of prepared and processed crab, it is important to highlight the fact that crab meat is made from actual crab and not from other white fish, as is the case with surimi. You can also focus on the taste as crab meat also has a distinct taste from surimi. Focus on new recipes and improve marketing campaigns in order to entice European consumers to buy this product.

4. What are the prices for crab?

It is difficult to get a specific price for crab as there are several considerations to factor in. Prices can vary based on seasonality of crab, type of species, size, shelf life, origin and product type. In general, live crab is more expensive than frozen crab because of the costs of management, storage or transfer. Live crab is also fresh and, in the seafood industry, a product is considered more premium the fresher it is.

Table 4: Average import prices from exporters outside European Union and exporters within European Union in 2018

|

Product |

Import price from outside EU USD/kg |

Import price from within EU USD/kg |

|

Frozen crabs |

12.31 |

10.71 |

|

Live, fresh crabs |

25.48 |

5.42 |

|

Dried, salted, smoked, brined |

13.30 |

11.56 |

|

Prepared and preserved |

14.53 |

12.69 |

Source: Eurostat, 2019

Looking at table 4, import prices from European countries definitely have the advantage over countries outside the European Union. This is because countries such as the United Kingdom or Ireland, which are both major producers of crab, benefit from the access and proximity to other European countries.

Price is definitely a consideration among European buyers, so if you can offer products at a competitive rate without compromising on quality, your product becomes more attractive.

In the graph below, you will find the average percentage allocated for each part of the supply chain. This is only an estimation and will vary depending on your product type.

As mentioned in our study on the European market potential for crab, developing countries should focus on the prepared and processed segment as the live and frozen crab segments are already dominated by European suppliers. A sizeable chunk of the price is due to processing, like removing shells for processed crabs and handling and storage for live or frozen crabs. Shipment costs also affect the price and these can be even higher for the transportation of live crab exports. As an exporter, carefully plan the best way to transport your crab and maintain quality.

Tips:

- Discuss with your clients to better understand their specific needs. Shelf life is a very important factor, especially for live products.

- Decide what is the smartest way to transport your crab without risking the quality. Transportation, handling and processing are important parts of the supply chain because this will determine the quality of your crab from country of origin to destination.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research