The European market potential for crab

The European crab market is concentrated with major consumption focused in France and Spain, representing over 60% of total European fresh and frozen crab consumption. Crab is a niche market, not considered an everyday purchase, and mostly associated with social events and special occasions. The European market has a lot of live and frozen products domestically. As such, there is more opportunity for developing countries in the prepared and processed segment. Transparency, sustainability and the story behind your products can give you an advantage.

Contents of this page

1. Product description

Crabs are decapod crustaceans characterised by a thick external skeleton. There are many species consumed in Europe but the brown crab (Cancer Pagarus) is the one that is most consumed. Other popular species are the spinous spider crab (Maja squinado) and the velvet swimming crab (Necora puber). In the European market, crab is available in frozen, fresh and processed forms. It is important to remember that many species, including the widely available brown crab, are caught in European waters. They are mostly found in the British Isles, Ireland and Northern France.

The trade data from Trademap and Eurostat do not distinguish between species but references the type of product based on the following Harmonised System (HS) codes. In this study, Europe refers to the EU28 which refers to 28 member countries in the European Union. The data used was extracted in 2019 when the United Kingdom was still part of Europe.

The vast majority of crab consumed in Europe is wild catch, and are imported under the following HS codes:

|

30614 |

Frozen crabs, even smoked, whether in shell or not, incl. crabs in shell, cooked by steaming or by boiling in water |

|

30633 |

Crabs, whether in shell or not, live, fresh or chilled |

|

30693 |

Crabs, whether in shell or not, dried, salted, smoked or in brine, incl. crabs in shell, cooked by steaming or by boiling in water |

|

160510 |

Crab, prepared or preserved (excluding smoked) |

According to a Species Analysis produced by the European Market Observatory for Fisheries and Aquaculture Products (EUMOFA), typical processing operations include:

- primary processing, like cooked whole, claws, or dressed crab

- secondary processing, like white, brown, and mixed crab meat (fresh, frozen, pasteurised, or canned)

- tertiary processing, which is crab as an ingredient in another product, including pâtés, pastes, and crab cakes.

2. What makes Europe an interesting market for crab?

In 2018, Europe imported a total of 44,082 tonnes of crab, representing 10.8% of the world’s total import of crabs. Most crab products were in the frozen and fresh categories, which are dominated by other European countries. The main commercial species in Europe is brown crab (Cancer Pagurus). According to EUMOFA, the imported crabs from outside Europe are mostly snow crab (Chionoecetes opilio), red king crab (Paralithodes camtschaticus) or blue swimming crab (Portunus armatus), and there is steady demand for prepared and preserved crab products.

European crab production seasons

In Europe, crab is usually caught during summer and autumn (May to October). Of the total catch of brown crab, approximately 90% stems from European Union member states. The brown crab lives for approximately 15 years and can reach a width of up to 30 cm (carapace) and weigh up to 2.5 kg.

The seasonality and availability of Europe-landed crab gives developing exporters an opportunity to sell their crabs to Europe by providing crab off season and by providing different species than those locally available. For king crab, for example, the main season is from October to January. Different species of crab have different seasonality, however, in Europe crab consumption is usually highest in the second half of the year, particularly during the holidays, such as Christmas or New Year.

Types of crab products imported

While 42% of the total crab imports were frozen, 37.9% were fresh, live or chilled crab (mostly brown crab), and most of this crab comes from other European countries.

Overall, crab trade in Europe is stable, particularly in the frozen and fresh categories. Importers are centred around nations such as France, Spain, Italy and Portugal, which produce, process and consume seafood. This allows the product to have a more developed market in these Southern European nations.

More preserved and processed products are also being introduced to Europe by non-European Union countries. As producers develop more ways to preserve and transport crabs more efficiently (such as the introduction of pasteurised crab meat and other value-added products), overall demand from Europe is expected to show a stable growth. In fact, according to a study by EUMOFA, per capita consumption of crustaceans in general have grown from 1.62 kg in 2014 to 1.84 in 2018.

Crab is imported in smaller volumes than some other fish and seafood species. However, it has steady demand in Europe, particularly during peak seasons (second half of the year, especially during holidays). Exporters looking to enter the European crab market must remember that crab from European countries dominates the crab market in Europe. In 2018, non-European countries only held a third of the market share in volume for crabs being imported into Europe, the rest was supplied by European countries.

Even though the market share of developing countries is smaller, in general, import volumes of frozen crab from non-European countries have grown by 22% between 2015 and 2018. For dried, salted and smoked crabs, volumes from non-European countries have almost doubled (95%) between 2017 and 2018. There is a stable market for prepared and preserved products, which has begun growing because Europeans are looking for cheap prices and more convenient ways to consume crab.

There are two main reasons why European crab dominates the European imports of crab. First, the quality of crab products, particularly fresh ones, is determined by their freshness. European crab producers, which are mostly from the United Kingdom, hold this advantage because of their proximity to neighbouring European countries. Secondly, because of the availability and convenience of crab produced in Europe, they are also often cheaper than the ones exported by non-European countries.

Look at figure 2. Notice that in all products, the price per kg for every crab product is considerably higher from non-European countries, particularly for fresh products, which are almost triple the price of crab imported from within Europe. The same trend is reflected for dried and smoked crab products, in which prices from non-European countries are double the cost of imports from within Europe.

The price differences are much lower for frozen crabs and prepared and preserved crabs. This is why, for non-European producers looking to enter the European crab market, these are the products that have the most potential to sell.

With Brexit (British Exit from the European Union) looming, British trade with Europe could be negatively impacted. If the country cannot agree on a trade deal with the European Union, due to new taxes, time delays with transport, custom controls and paperwork, British exporters may lose some of their advantage, according to an article by Euronews. While the United Kingdom’s long history of crab trade to Europe is undisputable, this could be an opportunity for developing countries to offer better deals to European importing nations.

Tips:

- Exporters looking into getting into European market should remember the European catch period for crabs (May to October). In this period, the supply in the market can be very high and thus demand for exported products can be low. However, towards the end of the year (holiday season), the demand usually picks up and this could be an opportunity to sell.

- Check the European Federation of National Organisations of Importers and Exporters of Fish (AIPCE-CEP) and the Seafood Importers and Producers Alliance (SIPA) to find importers that you can contact for your products. Depending on the type of your product (fresh, frozen or prepared/preserved), you can contact national associations based in specific countries.

- Learn more about finding potential buyers from CBI’s Tips for finding European Fish and Seafood buyers.

Frozen crab

Frozen crab represents the largest chunk of Europe’s crab imports. In 2018, Europe imported a total of 18,694 tonnes of frozen crab, representing 8.6% of the world’s total trade (214,970 tonnes). Europe’s purchases in 2018 were 4.6% higher than the imports in 2014. However, imports in 2018 were comparably smaller than in 2017 when imports of frozen crab reached the highest point in a five-year period. The top importers of frozen crab in Europe are Spain, France, Italy, the United Kingdom and Portugal.

There are many factors that could have led to the increase of imports in 2017. One possible factor is price. In 2017, prices from European (down by 12%) and non-European (down by 4%) exporters were generally lower, compared to 2018. This will have encouraged importers to increase their orders.

Looking forward, in the short term, these volumes could fluctuate depending on European production and prices, particularly with the uncertainty in European trade because of Brexit. In the long term, we expect a growing demand for frozen crabs, both from European and non-European exporters. Consumers are leaning towards convenience products with a longer shelf life, compared to fresh and live crabs, which must be consumed immediately.

Spain and France are the two largest importers in Europe, buying 4,9704 tonnes and 3,814 tonnes of frozen crab in 2018, respectively. They are also some of the world’s top importers of frozen crab. Next to the United States (66,049 tonnes) and several Asian countries, Spain and France are the ninth and tenth largest importers of frozen crab, globally.

Imports of frozen crab meat usually compensate for the lack of availability of fresh crabs during the off-peak season and have developed as an answer to the increased consumption of crab in Europe and the limited catch season.

Tip:

- Contact seafood processors from Spain or France and try and build relationships with them. Aside from retail, frozen crab meat also ends up in the processing sector and therefore there is opportunity to get on the European market this way.

Fresh, live and chilled crab

Products from the fresh, live and chilled category (mostly live) are the second most in-demand crab products in Europe, reaching 16,688 tonnes in 2018. However, this market is mostly dominated by exporters from within Europe, taking 97% percent of the market share in 2018. The remaining 3% exported by non-European Union countries mostly come from Norway (114 tonnes) and Sri Lanka (113 tonnes).

The greatest potential opportunities for fresh crab are in France and Spain, which are Europe’s largest buyers. While live crab has its advantage of being perceived as fresh and more authentic, live crab suffers from availability and seasonality issues, particularly in France, Portugal and Spain, which have the highest demand for these products. Take a look at figure 4 below, and notice that the peak for fresh crab imports starts in the third quarter of the year, reaches its peak fourth quarter, and then drops in the beginning of the year.

It is also difficult to hold stock for more than a few weeks, adding to the mismatch between crab condition and peaks in demand. High demand usually begins in October, thus importers from outside Europe must focus on selling during this period.

If you are a crab producer or exporter, you should also consider the possible effects of climate change to stock. The increased levels of carbon dioxide in the ocean may cause pH levels to drop and affect marine life. For crustaceans like crabs, it could affect their chances of survival and the mortality among young crabs. The high acidity level in the ocean can also damage shells of crabs, according to this study.

Tips:

- Take advantage of the mismatch in timing between peak supply and peak demand. Make sure to get your products in time for the holidays. Interruptions in supply-demand due to climate conditions and demand peaks usually fall in the weekends and in the second half of the year, like during holidays.

- Make offers to companies in importing nations, especially those in France, Spain and Portugal, in advance in order to fill this demand.

Prepared or preserved crab (excluding smoked)

In 2018, a total of 8,192 tonnes of prepared or preserved crab was exported to Europe. The market is split between European and non-European suppliers, 53% and 47% respectively.

The trade of these products within Europe dropped by 12% between 2017 and 2018, mostly from trading nations like the Netherlands and Belgium. Imports by Netherlands and Belgium are usually transported to other European nations through harbours in Rotterdam or Antwerp. There was a slight rise in Europe’s purchases from non-European countries (3.33%) in the same period. Indonesia and Vietnam saw their exports into Europe decrease, while other countries such as China, Chile and Norway increased their sales in 2018.

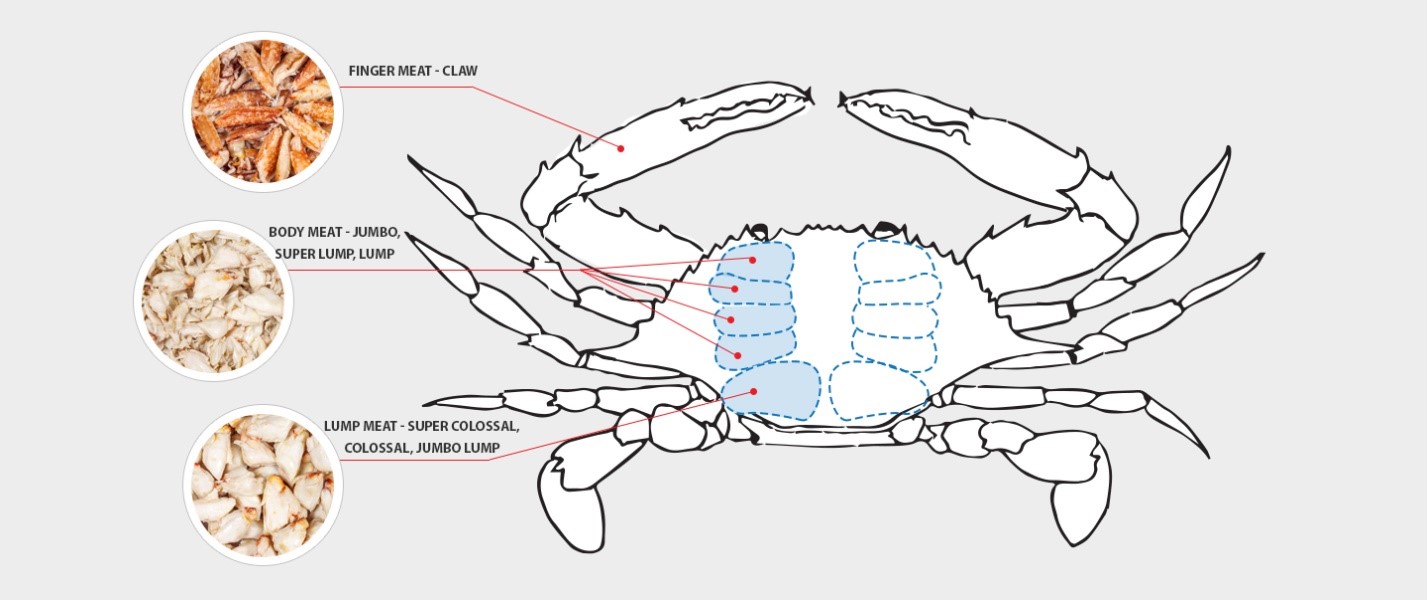

Below, you will find the grading of crab meat used for the processing industry. The colossal lump is the most prized crab meat product because it has the largest size of crab meat. It is followed by the super and jumbo lump and lastly, the finger meat claw, which is the cheapest crab meat.

Figure 5. Grading guide for prepared and processed crab

Dried crab, smoked crab, crab in brine

As shown in Figure 1, dried crab, smoked crab and crab in brine represents the smallest category (1.2%) of all crab products exported to Europe. Almost a quarter (24.7%) of the world’s imports of dried crab, smoked crab or crab in brine are imported by Europe (514 tonnes) with France (267 tonnes) and Spain leading the purchases.

Note that 86% of these volumes come from within Europe, particularly the United Kingdom and Ireland. However, imports from non-European countries have almost doubled (95%) from 2017 to 2018, representing a huge opportunity for non-European countries to enter the market. This was mostly caused by a drop in intra-import from the United Kingdom, which was down by 54% from 2017 to 2018. In that period, some non-European countries increased their share, like Norway (up by 121%) and Indonesia (164%), with attractive prices.

While it is too early to call this a trend, there is an opportunity for non-European countries to increase their sales through dried, smoked and brined products. Prices are a factor to be considered in making your products competitive as European buyers look for cheaper prices.

3. Which European countries offer most opportunities for crab?

The greatest potential in the crab market lies in the major seafood producing and consuming countries in Europe: France, Spain and Portugal. This section includes the top markets for crab as well as some emerging markets in Europe. While Southern European countries mostly demand frozen and fresh crab, there is room in the market for it to absorb other products. For exporters from developing countries, there is an opportunity to introduce more “convenience” products in the prepared, preserved and processed segments, which are showing the most growth.

Europe’s diverse and stable crab consumption

If you are an exporter looking to establish your business in Europe, know that there are various differences in how European countries consume crabs. In broad terms, there is a stark contrast in how consumers from the United Kingdom and Ireland view crabs as opposed to consumers in France, Spain or Portugal, for example.

It is important to study consumer behaviour in order to get the right market. In the United Kingdom, for example, brown crab is seen as “fiddly”, according to a report by Seafish. This means that it is a risky product that has the potential to make people sick if the product is bad. Therefore, when dealing with these consumers, it is important to ensure the quality, freshness, and health of the crabs.

Remember that the United Kingdom is also a major producer of brown crab and are therefore more or less familiar with crab consumption. If you are going to introduce a new crab species, make sure it has been checked for quality and sustainability.

For Southern European countries such as France or Spain, eating crab is seen as something that is enjoyed socially. As these countries are major seafood consumers and are already exposed to eating a variety of seafood, there is a more intimate relationship between the crab and the consumers.

In France, for example, it is considered a delicacy and is eaten with playfulness. There is joy and satisfaction in breaking the claws, scooping the meat and dipping it into the sauce. In Spain, crabs are usually prepared for social celebrations and holidays such as Christmas or New Year.

Below, find specific information about the countries that offer the most opportunity for crab and why.

France is the king of crab importers

The French market is the most developed in terms of the type of products and volumes it absorbs. In fact, in 2018, France was the leading European importer of fresh crab; live and chilled crab; prepared and preserved crab; and dried crab, smoked crab and crab in brine. For prepared and processed crabs, France represented 33% of total European imports.

In the frozen crab category, France was the second largest importer in 2018, importing 3,814 tonnes. This is mostly used in high-end restaurants and caterers.

France imported a total of 4,610 tonnes of fresh crab, which represents 29.5% of the total market share in Europe. Most of these volumes were sourced from the United Kingdom (66%) and Ireland (29%). France also buys almost half of its frozen crab purchases from the United Kingdom (32%) and Ireland (23%). Some volumes also come from non-European Union countries such as Madagascar (12%), Norway (9%) and Russia (5%).

In 2018, France purchased 2,727 tonnes of prepared and processed crab, which was slightly less (down by 6%) than volumes imported in 2017. According to a study for brown crab, conducted by Seafish, independent fishmongers also demand cooked claws, which were chilled or frozen. There is a preference for large claws in the market.

Vietnam, which held 33% of the market share in 2018, is the major supplier of these products to France. Vietnam is followed by Belgium (26%), Indonesia (13%), Chile (10%), Ireland (6%) and other countries, which also export some small volumes to France.

Meanwhile, a total of 270 tonnes of dried crab, smoked crab and crab in brine was exported into France in 2018, which represents 52% of total European imports of these products. Convenience and the ease of use of processed products make this category attractive to European consumers.

Portugal’s promising potential for preserved crab

The biggest opportunity for crab business in Portugal is in the fresh and live crab segment. In 2018, Portugal purchased 2,255 tonnes of fresh crab, which was 3.95% less than it imported in 2017. This volume was almost double Portugal’s demand for frozen crab, which reached 1,241 tonnes in the same period.

Portugal’s imports of frozen crab were quite steady from 2015 to 2018, with only a minor drop of 1.66% from 2017 to 2018. Note that 60% of its frozen crab purchases come from European suppliers such as the United Kingdom and Ireland, while a minority is supplied by non-European countries such as Mauritania, Senegal, Angola and others.

Interestingly, Portuguese buyers are showing a growing interest in the prepared and preserved crab segment as import volumes continue to increase. While Portugal only imported 279 tonnes in 2018, this was 134% higher than its imports in 2015, and 63% higher than those of 2017. However, these imports mostly come from Spain and Ireland.

Spain’s focus on fresh and frozen crab

If you are looking to explore the Spanish crab market, the largest potential is in the sale of frozen and live crabs. While the growth is relatively slow, there is also an increasing demand for prepared and processed crab.

Spain is Europe’s top importer of frozen crab, at 4,704 tonnes, followed by France and Italy. Spanish importers like the frozen category because of the increased longevity of these products.

Aside from whole frozen crabs, there is also a market for frozen white meat, which is used by high-end restaurants, hotels and caterers. According to a study conducted by Seafish, there may also be an opportunity to explore the white meat frozen (machine extracted) market in Spain that is destined for the processing sector, which also imports white meat.

Supplies of frozen crab are most filled by exporters from Britain (1,065 tonnes), Namibia (997 tonnes), Ireland (647 tonnes and Portugal (603 tonnes).

There is also a huge opportunity to export live and fresh crab to Spain. In 2018, the Spanish market was the second largest importer of fresh crab in Europe, at 4,585 tonnes. Spain’s demand for fresh crab, particularly brown crab or snow crab, especially grows during the last quarter of the year, during the holiday season.

Processed and preserved crab is not yet popular in Spain as Spaniards usually see it as an inferior product to fresh or frozen crab. In 2018, Spain only imported 132 tonnes of preserved and processed crab, taking only 1.61% of the total market share of this segment. There has been slight increase in imports in the recent years (up by 20% from 2015 to 2018), however, they are unlikely to grow as large as the frozen market.

The same trend can be seen for crab that is dried, smoked or in brine. From being the top importer of crab that is dried, smoked or in brine in 2017, Spain dropped to third place following France and Sweden in 2018. Exports to Spain have significantly lowered from 2017 to 2018 (down by 77%). This can be mostly attributed to a spike in the import prices of this product which increased from €5.03 in 2017 to €24.29. While almost all import prices increased in European countries in 2018, it is unclear why the import prices for Spain jumped this much.

Tips:

- Check out Spanish companies such as Nueva Pescanova and King Crab Spain which specialise in the import of frozen crabs.

- If you do not speak Spanish and are doing business in Spain, get a Spanish-speaking translator. This can be an advantage, as it shows the buyer that you are serious about doing business and that communication with you will be relatively easy, even if it has to be done through a translator.

Italy prefers crab frozen and cheap

Italy is fourth largest importer of frozen crabs in Europe, with purchases growing by 18% from 2015 to 2018. This country offers a huge opportunity for non-European countries as their imports from developing countries more than doubled (up by 143%) from 2015 to 2018. From 354 tonnes in 2015, imports from non-European countries reached 863 tonnes in 2018. Conversely, imports from within Europe dropped by 33% in the same period.

Looking at prices for frozen crabs from non-European countries, Italy pays the cheapest rate among European importers (€2.97/kg). The average price per kg from non-European countries was €9.55/kg in 2018. As such, if you are a supplier to Italy, prices are a major consideration during negotiation.

There is much less opportunity to sell fresh crabs to Italy if you are a non-European supplier since 96% of Italy’s imports of fresh crab (1,134 tonnes) come from within Europe. Like Spain, Italy has not developed a strong market for processed and preserved crabs. In fact, imports dropped quite consistently since 2015. In 2018, the imports of these products were 32% lower than the 2015 numbers.

In a study by Seafish regarding crustacean consumption, Italy only consumes 1.7 kg per capita per year, which is lower other major crab importing nations such as France (4.1 kg per capita) and Spain (4.7 per capita).

The United Kingdom as a supplier and buyer

The United Kingdom is an important supplier and exporter of crab in and out of Europe. However, they mostly focus on brown crab and velvet crab, which are abundant in the country. Let us talk briefly about how the British crab business has grown.

Fresh crab is the United Kingdom’s largest crab business, with exports reaching 9,243 tonnes in 2018, an increase of 398 tonnes since 2017. These are mostly sent to Spain, China, France and Portugal. China’s imports of fresh crab from the United Kingdom has grown 87% from 2017 to 2018 and the growth is likely to continue over the coming years.

On the other hand, frozen crab exports have grown 215% in just a decade (1,763 tonnes in 2008 to 5,565 tonnes in 2018) and have been showing a steady increase over the years.

British exporters have found a new market for frozen crab in China and it is now the biggest buyer, reaching 2,037 tonnes in 2018, from a very minor share in in 2011 (68 tonnes). Aside from China, the country’s largest buyers are France, Spain and Portugal.

While the United Kingdom is an important supplier of crab, it is also one of Europe’s largest crab importers. Overall, imports of crab reached 2,971 tonnes in 2018. The United Kingdom is the fifth largest importer of frozen crab and preserved/processed crab and the sixth largest importer of fresh crabs and dried/salted crabs.

The United Kingdom buys most of its frozen crabs from Denmark (46%), Norway (19%) and Germany (7%). Some small volumes also come from China, Thailand and Bangladesh. Live crabs are mostly sourced from Ireland (86%) and Denmark (6%) and some small volumes from Sri Lanka (5%), Norway (0.8%) and India (0.8%).

While there is only a minor share from developing countries in the fresh and frozen crab segment, there is much more opportunity to explore in prepared and processed crab. In 2018, the United Kingdom imported 572 tonnes of prepared and processed crab, which were mostly sourced from Vietnam (258 tonnes) and Indonesia (238 tonnes). Indonesia also supplies 96% of dried, salted and smoked crab to the United Kingdom.

Brexit is likely to affect the trade relations among dominant suppliers. The country left the European Union on 31 January 2020, but there will be no changes to how the United Kingdom deals with trade until the end of 2020. This period is to allow the country to negotiate new trade deals or risk a 24% tariff being applied to crab products from exporting nations.

Tips:

- British suppliers are the main competition for non-European suppliers when it comes to the crab market. Check out local brown crab and velvet crab suppliers which include Direct Seafoods, Macduff Shellfish or Devon Crab (The Blue Sea Food Company).

- Check retailers such as Sainsbury’s and Tesco or readily available prepared and preserved crab products in the market. This will let you know the types of products and product forms that are interesting for this market.

- Think of how to enter the United Kingdom’s market in terms of availability of species. Offer other types of crab than the brown crab; use this as a selling point to the British market to offer diversity of products.

- Protect your business by knowing the status of trade agreements between your country and Europe, particularly the United Kingdom. This will become very relevant at the start of 2021, when Brexit is finalised.

- Read our tips for finding European Fish & Seafood buyers to get a better understanding of how to choose the right market for your products.

4. What trends offer opportunities on the European crab market?

Like other seafood exported into Europe, importers are very particular in terms of sustainability and transparency. Freshness and quality are also among the top consideration of European buyers. Since crab is a delicacy that is often prepared during the holidays or special occasions, studying consumer habits as well as trends are important to reach your target market. Consider investing in value-added products. Read the CBI trends study for Fish and seafood to better understand general trends in the industry.

Consumers care about the story behind your product

As with other seafood products, consumers want to know more about the product they are buying. The story behind your product is important. Through effective storytelling and positioning of your product towards conscious consumers, you can highlight some characteristics that could make your products stand out. Here are some examples.

Though in relatively small volumes, Sri Lanka’s export of live and frozen crabs (particularly blue swimming crabs and mud crabs) is able to successfully enter the European market more often than other developing countries. Crab fisheries in Sri Lanka are considered a “Good Alternative” by Seafood Watch because the management systems in place are expected to effectively protect the crab stocks.

This achievement has helped the Sri Lankan crab producers to tap new premium markets in Europe, North America (particularly the United States) and Australia. The achievement is a collaborative effort from government, cooperatives and also major producers through a Fishery Improvement Project (FIP).

A FIP ensures that the stock of crab is sustainable and protected through campaigns against illegal, unreported and unregulated (IUU) fishing, monitoring of supply chain and improvement in social responsibility. The Seafood Exporters’ Association of Sri Lanka (SEASL), established in 1996, also represents and promotes the interests of companies engaged in the export of seafood products from Sri Lanka.

IUU fishing, according to the European Union, is any fishing that is in forbidden areas, uses illegal methods or goes unreported. IUU fishing has a negative effect on the sustainable management of global (and local) fish stocks and creates unfair competition against those that fish legally and responsibly.

While Sri Lanka’s fisheries improvement is a good story to tell, there are also stories that have bad endings. In Europe, while crabs are considered a special treat during holidays and a delicacy, they can also be portrayed in the European press as an invasive species. For example, in this article by The Telegraph, Chinese mitten crabs are said to invade the canals of Belgium.

Mitten crabs have no natural predators in Europe and compete with native species for food. This is why it is important for the European market to know the story of the crab they are buying.

In a latest ruling by the European Commission in 2016, Chinese mitten crabs have been added to the European Union’s list of “invasive alien species” that “represent a major threat to native plants and animals in Europe, causing damage worth billions of euros to the European economy every year.” Since entering Europe in the early 1900s on board merchant ships, these species can be found in some areas in Europe such as Belgium, the Netherlands or France. In the Netherlands, it is being targeted for commercial purposes, mostly exported to Asia.

This ruling makes it hard for developing countries to export Chinese mitten crabs to Europe. If exporting live crab species, exporters should also consider whether it can potentially be tagged as an invasive species in Europe in order to assess medium to long term investments.

Transparency and sustainability are important and gaining momentum

The European consumer is becoming increasingly focused on the sustainability of the products that they buy. Consumers want to know where their products come from, and are demanding that companies know, and are open about, their whole supply chain. By ensuring sustainability and communicating transparently, you can make yourself a preferred supplier to the European market. While sustainability (certification) might not be a must for all markets, increasingly, it is becoming a hard market entry requirement across sectors, across Europe.

Some companies in Norway give each live crab a unique ID number once they arrive in the facility. From then on, the individual crabs are tracked, and the information is available to the importer, their customers. They are inspected for quality then kept in tanks for a few days before shipment.

The region or locations that the crab originates from, as well as how the crab was caught and handled, are important factors to European consumers. Some companies use this as one of their main selling points. For example, Jeka Group, a Denmark-based processor, boasts that the source of the live brown crab directly comes from the North Sea and is being processed on the same day. According to their website, they “use a humane stunning method whereby the crab begins to hibernate before being brought to further processing.”

Outside Europe, one important exporter of mud crab is Madagascar. Originally, the mud crab fishery in Madagascar is an exclusively traditional fishery, according to FAO, composed of on-foot or pirogue (small boat) fishers using very simple fishing techniques and gears. Handlines or hooks mounted on sticks were often used. However, because of the high demand for export, the fishery has become more complex, with various channels for trade and also increases in production.

The story of Madagascar’s mud crab is an important one since it represents the potential of a country to export large, healthy, crab to Europe. However, because of the commercialisation of the mud crab fishery, something must be done to ensure sustainability. This is where the Smartfish programme comes in. This project monitors the value chain of the mud crab fishery and is focused on improving the efficiency and sustainability of the crab sector.

Tips:

- Read the CBI Trend study to learn more about sustainability, transparency and other trends that are important to the Fish and Seafood market in Europe.

- Health certificates as well as sustainability seals such as the Marine Stewardship Council (MSC) are huge advantages when entering the European market.

Consumers move towards easy-to-cook and eat products

The geographic differences across Europe are not the only factors in play here. The age of the consumer is also a determining aspect. Younger consumers, who tend to look for convenience, prefer to consume crabs outside their homes. Older consumers are more likely to enjoy the crabs at home and cooking the crabs themselves.

Preparation is an important challenge for consumers who want to eat crab at home. Consumer trends reveal that more products that are ready-to-eat, are in easy-to-cook forms or are already preserved and processed are gaining popularity in the market. Younger generations, and North-Western Europeans in particular, appreciate ease of use. Crabs are notoriously difficult to eat, because of their hard shells and many legs. This trend offers opportunities for producers from developing countries to enter the value-added market, particularly as your processing costs are lower.

Exporters should explore different uses of crab and diversify their product range, particularly in the value-added segment. New crab formats include crab cake mix, crab meat, or crab claw used for cocktail parties.

Other sellers also include value added products that use their crab and are especially targeted to Europe’s change of seasons. For example, a crab cake mix can be combined with Asian flavours such as ginger or chili for a staple croquette menu during summer or spring. In winter, crab thermidor is a product that can be used as a warm meal, a dish that is both filling and tasty.

You can also sell processed crab such as crab terrine with flavours such as spring onion and wasabi already infused in the product. These products are usually sold frozen and simply need to be defrosted to enjoy a modern twist on crab flavours.

Tips:

- Check British websites such as Blue Seafood Company for the range of new products and value-added segments available. As one of the major exporters to Europe, they are one of the best ways to monitor the consumption trends in Europe.

- Use flavours and cuisines that are authentic to your own country and introduce them to the European market. Exporters outside of Europe have a unique advantage in making the prepared and preserved segment work for them.

Animal welfare questions the transportation and cooking of live crustaceans

With advances in sustainability and animal welfare, the way that animals are being treated and the way that animal products are produced has become increasingly important. Animal welfare groups have been fighting for a greater acknowledgement of animals’ ability to experience pain and fear and that (some) animals are self-aware. This movement has been gaining ground and both governments and consumers are starting to demand better treatment of all animals, including crab.

There are ongoing discussions in Europe about whether lobsters, crabs or other crustaceans should be boiled alive. An article published by the European Commission concluded that crustaceans have a certain degree of awareness and can therefore feel pain if cooked alive and that humane killing should be applied to these species. In Switzerland, for example, a government act mandates that crustaceans must be stunned before they are killed.

This new law prohibits the transportation of live crustaceans on ice or in ice water. This is not a statutory requirement in many European countries, and has, so far, no concrete effects on trade. As an exporter, however, it is better to have a foresight and awareness on these issues as this might change in the future. Being prepared will help you to remain competitive.

The freshness of crab has traditionally been a sign of quality, leading to the popularity of live-transportation and cooking. If these methods become banned, it may open up the market for frozen crab products and offer an additional opportunity to the crab producers from the developing world.

The study has been carried out on behalf of CBI by Seafood Trade Intelligence Portal.

Please review our market information disclaimer.

Search

Enter search terms to find market research