Entering the European market for octopus

To get your octopus on the European market, first make sure that you comply with all mandatory requirements. Once in Europe, your product will have specific channels through which it can reach the end-market. Different channels and end-market segments may have more specific requirements for access. Most of Europe’s imported octopus ends up in Southern Europe. Demand there is high and frozen imports are leading. There is competition on from other European countries on the European octopus market, but 80% is imported from third countries, offering you opportunities.

Contents of this page

1. What requirements must octopus comply with to be allowed on the European market?

What are mandatory requirements?

Comply to standard labelling and packaging requirements

The content of any label must be provided in the language of the country where the product is sold. Pieces of European legislation that apply to labelling are the CMO (Regulation 1379/2013 Chapter IV) and Food Information to Consumers (FIC Regulation 1169/2001) regulations. When importing octopus to the European Union, the following information must be provided for prepacked and non-prepacked fishery products under the CMO regulation:

- The commercial and scientific name of the species;

- Production method: In the case of octopus, it must be mentioned as a wild caught product;

- Area where the product was caught / country and body of water where the product was farmed;

- Category of fishing gear (only for wild products);

- Whether the product has been defrosted;

- 'Date of minimum durability' ('best before' date);

Under the FIC regulation, the following information is mandatory for prepacked products (in addition to CMO requirements):

- List of ingredients and any ingredients or processing aid causing allergies or intolerances;

- Quantity of certain ingredients or categories of ingredients;

- Net quantity of the food;

- Any special conditions for storage and use;

- 'Use by' date for products for which the 'best before' date is not appropriate;

- Name or business name and address of the food business;

- Country of origin or place of provenance;

- Instructions for use + nutritional information.

Tip:

- Read our study on European Buyer Requirements for Fish and Seafood for more information about labelling and other mandatory requirements. The majority of the mandatory requirements related to exporting fish and seafood products to Europe apply at the fish and seafood level, rather than focusing on specific species or products.

Provide a catch certificates to prove sustainable fishing and hygiene

Your wild octopus products need to be sent with a catch certificate that is approved by your competent authority. The catch certificate must contain all the information specified in the specimen shown in Annex II of the European IUU legislation.

The European Union requires you to prove that your octopus products do not come from Illegal, Unreported and Unregulated (IUU) fisheries. IUU fishing, according to the European Union, is any fishing that is in forbidden areas, uses illegal methods or goes unreported. IUU fishing has a negative effect on the sustainable management of global (and local) seafood stocks and creates unfair competition against those that fish legally and responsibly.

Catch certificates are not only used to check if your products come from legal fisheries. European countries use them more and more to check if your products comply with the European hygiene rules. According to these rules, all octopus need to be frozen, processed or transported on board of authorised vessels or at authorised factories.

The “competent authority” is the government department in your country that the European Union finds the most capable (competent) of monitoring the seafood and fisheries products to be sent to the European Union. The European Union enters into an agreement with this department, giving them responsibility for the mandatory control measures before export.

The competent authority is a ministry department, usually one that regulates aquaculture and fisheries. In Peru, for example, the competent authority is the Organicmo Nacional de Sanidad Pesquera (SANIPES). In Costa Rica, the National Animal Health Services (SENASA). In Senegal, the Directorate of Fish Processing Industries. In Bangladesh, the Department of Fisheries in the Ministry of Agriculture, Fisheries and Rural Development.

Your competent authority is appointed to authorise factories, or vessels with on board processing facilities, for trade with the European Union. These vessels will be put on the DG Santé list of establishments from developing countries authorised to trade with the European Union. If there are establishments on your catch certificate that are not registered on this DG Santé list, it is likely that your consignment will be rejected at the European Union border.

Tips:

- Check the DG Sante list of non-European Union countries authorised establishments to see if your vessels/factories are registered for the European Union, and see if your competitors are listed.

- Send your catch certificate to your buyer so that they can check that everything is correct. This will prevent potential problems at the European border.

Ensure a safe seafood product: control the cold chain

The food safety standards in Europe are among the strictest in the world. Exporters must ensure that their products pass the safety standards, are free from any harmful substances and are under sufficient controls. Products that are found not to be compliant are registered and reported in the Rapid Alert System for Food and Feed (RASFF). In recent years the most frequent rapid alert for octopus was related to poor temperature control of frozen octopus products.

If a European member state notifies your product to the European Commission as having seriously or repeatedly broken these rules, a program of re-enforced checks begins. According to this program, the next ten consignments arriving in the European Union will face more stringent checks. If the results for all ten consignments arriving in the European Union are satisfactory then the program of re-enforced checks will end.

Tips:

- Check the RASFF portal to learn about the kinds of products that are recalled and the reasons for border rejection.

- Ensure your products pass the European safety standard and stay away from RASFF. Being on the RASFF list could create a negative image to buyers and will bother the importer with extra costs due to the program of re-enforced checks.

What additional requirements do buyers often have?

For octopus species, just as for all other fish and seafood, your establishment will need to be accredited for food safety, depending on the specific requirements of your buyer. The most commonly requested food safety certification schemes for seafood products are IFS (International Featured Standards) and/or BRC (British Retail Consortium).

By having food safety accreditation, you can show your buyer you have good working procedures to which controls can be applied, and through which food safety hazards can be prevented, eliminated or reduced to acceptable (critical) levels. It also shows that you are able to trace your raw materials and packing materials.

Tips:

- Read more about the British Retail Consortium (BRC) and International Featured Standards (IFS) schemes in ITC Sustainability Map.

- Invest in the IFS and BRC food safety schemes, as they are not only a must for the European market, but also for other markets around the world.

- Get your fisheries and factory audited by an accredited certification body. Check the list of accredited certification bodies to see which one could assist you.

- See our ten tips for doing business with European buyers of fish and seafood and our ten tips for finding buyers in the fish and seafood sector. These tips also offer more information on which topics European buyers look at when searching for (new) suppliers.

- Visit the EU Trade Helpdesk to find information related to European requirements, tariffs, statistics and preferential arrangements and the ITC Sustainability Standards Map for standards related to sustainability.

What are the requirements for niche markets?

In Europe, sustainability certification for octopus is still seen as a niche market requirement, although sustainability certification has become a buyer requirement for a considerable range of fish and seafood products (in Northern European supermarkets especially).

For wild seafood, the major certification scheme is run by the Marine Stewardship Council (MSC). This certification is challenging for octopus because there is often little information available about the relevant octopus stocks, and the stocks are not managed properly. At the moment, two octopus fisheries are certified by MSC.

Another globally recognised sustainability certification is Friend of the Sea. At this time, only one octopus fishery is certified by Friend of the Sea. Getting certified could open new markets, but this certificate is not fully accepted in all (especially Northern European) market segments.

Fisheries can achieve (MSC) certification through Fishery Improvement Projects (FIP). Ongoing FIPs on octopus are striving to increase or improve sustainable production. In the end, if there is the possibility to obtain a sustainability certification for your products, it will make it easier to enter the Northern European market.

Tips:

- Learn more about the MSC certified octopus fisheries by tracking the fisheries on the MSC website to check if your fishery could be MSC certified in future too.

- Discuss with your buyer if Friend of the Sea certification could be of interest.

- More information can be found on the approved fisheries list on the Friend of the Sea website.

- The Sustainable Fisheries Partnership (SFP) is one of the organisations that could help you improve the sustainability of your octopus. SFP has an octopus project organising different Supply Chain Roundtables with octopus suppliers to improve octopus fisheries sustainability. Participate in this SFP project by contacting the organisation.

2. Through what channels can you get octopus on the European market?

Most octopus comes to the European market as frozen whole products. Your (frozen) octopus products are usually shipped to Europe by specialised importers. They sell the fish to processors or directly to the relevant market segments. The most relevant European end-market segments for octopus are the supermarkets in the south of Europe. Other important market segments in Southern Europe are outdoor markets, food service and specialised fish shops. The octopus market in the north of Europe is significantly smaller than in the south.

How is the end-market segmented?

The consumption of octopus varies greatly within Europe. In general, the per capita consumption of fish and seafood in Southern Europe is much higher than the European average. All types of octopus products are frequently consumed in homes and food service in Southern Europe. Having them as a domestic product, they are familiar to people and people are comfortable cooking them at home. In Northern Europe, octopus is more of a niche product and are on restaurant menus or sold as a value added products to end users.

At the end market, octopus are sold in different types of products, such as fresh whole raw, whole raw frozen, chilled and thawed, cooked and as processed and value added products.

In the section below, we will focus on supermarkets in the south of Europe and the European broadline wholesalers. This is the market segment that offers you the most opportunity for getting your octopus product on the European market.

Tip:

- Learn more about regional fish and seafood consumption differences in our study on the demand for fish and seafood on the European market. It will give you insights into what might be the best markets for your product.

Southern European supermarkets

The opportunities for the export of octopus to the supermarkets are highest in Southern Europe, where buyers are familiar with octopus and supermarkets are not yet as sustainability-driven as supermarkets in Northern Europe.

Larger supermarkets in the south have a big variety of octopus products on their shelves. These supermarkets buy their products from importers, wholesalers and processors in Europe, depending on the product specification and volume. Examples of Southern European retailers that sell octopus are Carrefour and Eroski in Spain, Auchan in Portugal, CONAD in Italy and Sklavenitis in Greece.

Wholesalers

There are two types of wholesalers relevant for you. The first is the broadline wholesaler who sells a full range product portfolio to chefs.

Broadline wholesalers often have a relatively limited range of seafood products, which often includes octopus. Where in Europe the wholesaler is active determines the range of octopus products in the assortment. The volumes of broadline wholesalers are often relatively big as they operate many shops throughout the country. Examples of international wholesalers active in Europe are Metro, Mercabarna and the MART.

Specialised wholesalers are those who only sell seafood (sometimes in combination with meat). In general, they would have a broader and maybe more exclusive product range. Octopus is more common in the sales portfolio of these specialised wholesalers. Examples of specialised wholesalers are Bullmeat in the Netherlands and Discefa in Spain.

If the wholesaler works with volumes that are big enough, they may aim to source directly from you, the exporter. However, most of the wholesalers make use of an importer. Importers are often more experienced in sourcing octopus products and are specialised in importing these cephalopods into Europe. For both broadline wholesalers and specialised wholesalers, octopus is just one out of many items.

Through what channels does a product end up on the end-market?

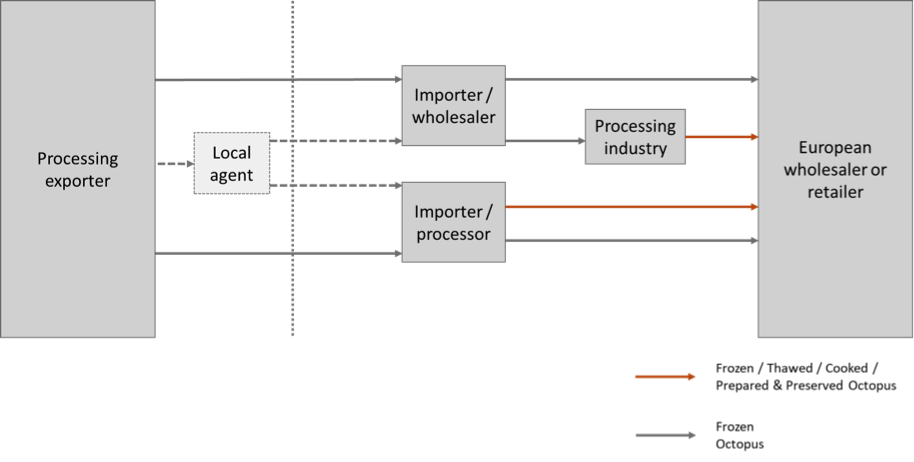

Although there are many channels through which octopus ends up on the end-market, the most important ones are those that supply wholesalers and retailers in (the South of) Europe. Let us focus on those by looking at figure 1. Figure 1 shows how products move along the supply chain from an exporter in a developing country to the wholesaler or retailer in Europe. Below the figure, we will explain the role of each actor in the supply chain.

Figure 1: Main trade flows for octopus

Source: Seafood Trade Intelligence Portal, 2020

In the figure above, the actor in the lighter box is only a service provider. They are often not involved in making financial transactions but only provide a service to a buyer or a seller. The actors in the darker boxes in the figure are those who actually buy and sell the product.

Local agents play a crucial role in the trade of octopus. Although buyers will visit potential suppliers regularly, they need someone there that can ensure that quality requirements are met, that the best suppliers are selected and that the best prices are secured. Although there is a tendency among certain importers to want to do business more directly, quality control often remains outsourced.

In general, exporters of octopus from developing countries enter the European market through large traders such as importers, processors and wholesalers. The vast majority of the octopus are imported from third countries as a frozen product. Fresh products come mainly from own European fisheries.

Frozen products are exported to Europe in reefer containers. You can decide what shipping line and what reefer container you want to use together with your buyer. It is important to load your container in the right way to prevent freezing problems. Your frozen products require free flowing air to circulate, so it is important that you do not stow your cartons above the maximum red line of the reefer container. An incorrect airflow can mean that your products do not stay cold enough.

At the European border, the competent authority checks all product groups in the container. Most of the time it will be an administrative check, but products will regularly be checked on organoleptic aspects (like colour, smell, taste and structure) or (to a lesser extent) sent to a laboratory for biological or chemical tests. If no abnormal results are found the container can enter European territory for further distribution.

Most secondary processing and other octopus value‑adding activities occur at seafood processing companies in Europe. Most large retailers and food service companies that sell octopus do not source the product themselves. Instead they make use of a few large importing and wholesaling companies as their preferred suppliers.

Examples of importers who supply European wholesalers, processors and retailers of frozen octopus are Sebastia congelados and Asturpesca in Spain. Examples of octopus processors in Spain are Fesba Seafood products and Angulas Aguinaga.

What is the most interesting channel for you?

The retail market in the south of Europe is the most interesting market for octopus. Especially people in the coastal areas of Southern Europe are familiar with the product. They prepare octopus at home on a regular basis. There are enough opportunities to provide them with consumer-ready products.

Your client would normally be an importer who takes care of all logistics and customer service for the retailers. You will only be responsible for placing your consignment on a container vessel/airplane.

Tip:

- Visit websites of sector associations for octopus importers in Europe. Here you can find member lists that will allow you to quickly have an overview of the relevant buyers. An example of a sector association is Conxemar in Spain. Be sure to study the companies in detail before you approach them. You only have one chance to make a first impression.

3. What competition do you face on the European octopus market?

Your biggest competitor for entering the European octopus market is Morocco. Other important competitors are the European Union itself, Mauritania, Indonesia and Mexico.

However, though most of the octopus products are imported whole frozen, you can find a lot of value-added octopus products on the end markets. It is mainly the European processing industry to add extra value to these octopus products and compete on this market. If you are able to add value to the octopus products yourself you might also become a competitor for this product market. Having import tariff preferences, however, could be necessary to be price competitive.

Which countries are you competing with?

There are many countries offering octopus for the European seafood market. Below we will highlight the five most important of them.

Morocco

Morocco is the number-one non-European country exporting octopus to the European market. In 2019 almost 47,000 tonnes of (frozen) octopus was exported from Morocco, mainly to Southern European countries.

Octopus imported from Morocco is considered a high-quality product. The octopus from this third country is identifiable with the European-caught octopus due to its colour: grey and red and small suckers on tentacles.

Morocco and The European Union have a Euro-Mediterranean Association Agreement, which entered into force in March 2000. Under this agreement the European Union and Morocco established a Free Trade Area liberalising two-way trade in goods.

The European Union

The European Union has its own fleets targeting octopus. The European Union produced almost 29,000 tonnes in 2018. Common octopus represented almost 60% of the total EU octopus production in 2018. The main producers inside the European Union are: Italy (32% of the octopus landings in 2018), Spain (24%), Portugal (22%) and Greece (11%).

Most of the octopus are sold in the fresh segment in Europe. Other octopus are sold frozen or are processed by the domestic processing industry, mainly in Southern Europe, into value-added products and exported both within the European Union and to the rest of the world.

An advantage for European Union’s octopus exporters is that they do not have import tariffs and (as much) transportation costs. On the other hand, labour is very expensive in the European Union.

The European Union’s octopus production decreased between 2009 and 2018 by more than 30%. Volumes are not enough to fulfil European Union demand. The EU octopus market is still (and will be) highly dependent on imported materials, importing about 80% of the octopus consumed from external sources.

Mauritania

Mauritania is the number two exporter of octopus to the European Union, among non-European countries. In 2019 almost 28,000 tonnes of (mainly frozen) octopus was exported to the European Union.

Mauritania benefits from a preferential tariff system to help least developed countries to use trade to grow their economy and reduce poverty, called Everything But Arms (EBA). This special arrangement for least developed countries, providing them duty-free European access for all products except arms and ammunition, if combined with a General System of Preference Certificate of Origin Form-A, which serves to prove where the octopus was imported from.

Indonesia

Indonesia is another important non-European country producing octopus for the European market. Almost 10,000 tonnes of (frozen) octopus was exported from this country to the European Union. Existing Indonesian suppliers and European importers have built up relationships with each other.

Indonesia benefits from another preferential tariff system called General System of Preference (GSP), which provides lower tariffs on various products. Octopus originating from Indonesia have reduced import tariffs if combined with a General System of Preference Certificate of Origin Form-A. For frozen octopus the import tariff will be reduced from 8% to 2.8%, under GSP.

In July 2016, negotiations started for a Free Trade Agreement between Indonesia and the European Union. At the moment, however, the European Union and Indonesia are still in negotiation and no Free Trade Agreement is expected in the short term.

Mexico

Mexican octopus fisheries are among the largest and most productive worldwide. Total production in 2018 accounted to almost 44,000 tonnes. 66% of the octopus caught in Mexican fisheries in 2018 was Mexican four-eyed octopus (Octopus maya) and 28% was common octopus (Octopus vulgaris). Over 5,500 tonnes of Mexican (common) octopus was exported to the European Union in 2019.

A Free Trade Agreement between the European Union and Mexico came into force on October 1, 2000. This Free Trade Agreement eliminated import duties for octopus from this country.

Tips:

- Build up a good relationship with your buyers. Do not focus on quick wins but go for long-term benefits.

- Use the European Union trade helpdesk to check the tariffs that you would have to pay when exporting octopus species to the European Union. Compare your tariffs with that from your competitors to understand how competitive your prices are.

- Compare the price of your octopus product with prices from other origin to understand how competitive your prices are.

Which companies are you competing with?

There are many exporters of octopus around the world. Here, we will discuss the examples of Univela Morocco, Veveros Merimar in Spain and PT. Tridaya Jaya Manunggal in Indonesia. Each of these companies is a major player in their respective countries and exports octopus products to Europe.

Univela Morocco

Univela Morocco is one of the processors and exporters of octopus products in Morocco. This company was established in Agadir, Morocco over 15 years ago. This company is processing in compliance with HACCP and IFS and octopus products are Friend of the Sea certified.

Take a look at the Univela Morocco website to know more about the octopus products they sell. Pay extra attention to the way the company is presenting itself on their website. They highlight their unique selling points and give insights in accepted payment terms and product specifications.

Viveros Merimar

Viveros Merimar is located in Palencia (Spain) and has been working in the fish and seafood sector for decades. Viveros Merimar claims to be a leader in the commercialisation of cooked octopus in both Spain and Europe, distributing it under the brand name “Meripul”.

Viveros Merimar has refrigeration and freezer units, a cooking room and tasting room to realise the optimal octopus product for consumers both in and outside of Europe. Furthermore, Viveros Merimar has its own float of refrigerated isothermal vehicles to export the octopus regionally.

More information about Viveros Merimar can be found on their website.

PT. Tridaya Jaya Manunggal

PT. Tridaya Jaya Manunggal is a processor and exporter of octopus products in Indonesia. This company was established in 1991 and has access to the European market since 2013. This company is processing in compliance with HACCP.

Take a look at the PT. Tridaya Jaya Manunggal website to know more about the octopus products they sell.

Tips:

- Look at your management team. Do you have some fresh highly-educated team members who can support you to make your company future proof and to take it to the next level?

- Look at the websites of some of the major octopus exporters from different origin to better understand how they present themselves and who are managing the companies. Think about how you can present your unique selling points to your potential buyer.

- At a trade show, do not only look for buyers, but also try to engage with your competitors and ask them about the challenges and opportunities they are confronted with. See what you can learn from them.

Which products are you competing with?

Octopus is a unique but traditional product in the south of Europe. Consumers will choose this product when enough is available and prices are reasonable. However, recent years showed that octopus can be substituted by other cephalopod species like squid and cuttlefish, when octopus prices reach certain levels.

Tip:

- Read the CBI product fact sheet for squid and cuttlefish to learn more about how this product competes with your octopus.

4. What are the prices for octopus on the European market?

The price of octopus products differs a lot, depending on presentation form and country. In this table you find an impression of the price level in Europe.

Table 1: Examples of prices for octopus products in European countries, August 2020

|

Country |

Market |

Production form |

Product description |

Price per kilogram (euros) |

|

Spain |

Carrefour |

Frozen |

1 kilogram frozen whole octopus, raw |

9.99 |

|

|

Carrefour |

Chilled |

500 gram cooked octopus |

29.86 |

|

|

Carrefour |

Frozen |

900 gram frozen whole octopus, raw |

13.44 |

|

|

Carrefour |

Chilled |

250 gram cooked sliced octopus |

35.96 |

|

|

Carrefour |

Frozen |

250 gram frozen cooked octopus arms |

31.80 |

|

|

Eroski |

Chilled |

1 kilogram thawed whole octopus, raw |

9.99 |

|

|

Eroski |

Chilled |

600-800 gram cooked octopus, whole |

19.95 |

|

Greece |

AB |

Chilled |

425 gram chilled whole octopus, raw |

20.82 |

|

|

AB |

Chilled |

600 gram chilled whole octopus, raw |

18.50 |

|

|

Sklavenitis |

Frozen |

1 kilogram frozen whole octopus, raw |

13.90 |

|

Germany |

Metro |

Frozen |

2.5-3.0 kilogram octopus whole, raw |

18.89 |

|

|

Metro |

Frozen |

1 kilogram octopus tentacles, raw |

7.49 |

|

Portugal |

Auchan |

Chilled |

2.5 kilogram chilled octopus whole, raw |

11.99 |

|

|

Auchan |

Frozen |

500 gram baby octopus whole, raw |

14.50 |

|

|

Auchan |

Frozen |

1.0-2.0 kilogram cooked octopus whole |

12.99 |

Source: Seafood Trade Intelligence Portal, 2020

Processed octopus products show higher wholesale prices. For example, smoked sliced octopus can be found in wholesale for triple the price of frozen whole octopus (raw). This high price is a combination of prime material use and relatively high processing costs.

The margins in the value chain vary a lot from low-end to high-end products. For low-end products, margins can be as low as 5% for each company, with a retail margin as low as 10%. For high-end products, these margins can be as high as 20-25% for fishermen and processors, and 100% for importers and retailers.

In the example above, the retail price for one kilogram of thawed whole octopus is €17.99, including 9% VAT. Exclusive VAT the retail price will be €16.35.

The profit margin for the retailer is about 35-45%. For the processor/wholesaler the margin is about 15-20%. The ex-wholesaler price will be around €11.65.

By thawing the octopus, there will be some loss of weight. To compensate the drip loss, 5% more frozen octopus is needed to realise one kilogram of thawed octopus end product. For the importer, the margin is about 10%. The import price for octopus lies around €8.60. Transport from third countries to Europe is about €0.15-0.20 per kilogram of frozen octopus.

The producer/processor in the third country will get €7.65 for the octopus.

The study has been carried out on behalf of CBI by Seafood Trade Intelligence Portal.

Please review our market information disclaimer.

Search

Enter search terms to find market research