Entering the European market for seaweed

To become a player in the European market, you need to focus on seaweed products that are not produced or processed in Europe. Examples are value-added products or seaweed extracts. The seaweed market is heavily dominated by exporters from within Europe due to local seaweed production and ease of transport. Food safety certifications are a must, but buyers are also increasingly demanding sustainability certifications. Traceability and social responsibility are also practices that European buyers look for when sourcing seaweed products.

Contents of this page

1. What requirements and certifications must seaweed comply with to be allowed on the European market?

In order to enter the European market, you must comply with Europe’s food safety requirements and focus on the sustainability and traceability of your supply chain.

What are mandatory requirements?

Food safety

Food safety is a top concern for European importers, so you must comply with the European Union’s mandatory requirements for food safety and natural food additives. Products that are found to be non-compliant will be registered and reported in the Rapid Alert System for Food and Feed (RASFF). For seaweed products that are directly destined for the food processing, food service or retail sectors, exporters must be accredited for food safety, depending on the specific requirement of the buyer.

Please be aware of the following requirements when exporting your seaweed products to Europe.

- The General Food Law, which ensures the safety of your seaweed extract. Under the General Food Law’s legislative framework, you must have a traceability system in place throughout your entire supply chain. This also includes Good Manufacturing Practice certification or GMP.

- Regulation (EC) 1333/2008, which sets the rules on food additives, including definitions, conditions of use, labelling and procedures.

- Regulation (EC) 852/2004, which requires a Hazard Analysis and Critical Control Point (HACCP) system if you are a food processor of seaweed extracts. The HACCP tests hygiene, pesticide residues, contaminants, microbiological criteria, permitted additives, and processes and systems.

- EU regulation 2012/231/EU, the Code of Federal Regulations and the Food Chemicals Codex standards have approved refined carrageenan as E407 and semi-refined carrageenan as E407a. Agar (E406) is authorised as a food additive in the EU in accordance with Annex II to Regulation (EC) No 1333/2008.

Other food safety certification schemes are the FSSC 22000, International Food Standard (IFS) and/or British Retail Consortium (BRC), and sometimes also GLOBALG.A.P. Other buyers also require your seaweed products to be HALAL-certified or Kosher-certified depending on the end market.

Tip:

- If you export seaweed extracts, take a look at the CBI-commissioned value chain analysis of Indonesia seaweed extracts to know which food safety certifications they are currently undertaking.

Contamination

For food products, the EU has set maximum residue levels (MRLs) for pesticides (EC Regulation 396/2005) and heavy metals (EC Regulation 1881/2006). You must ensure your seaweed extracts do not contain pesticides or heavy metals in amounts above the levels set by the EU.

For seaweed products, the RASFF usually flags high levels of iodine in seaweed dried seaweed or salads, cadmium (usually found in seaweed used as feed materials) or unauthorised substances such as ethylene oxide or oils.

By checking the RASFF portal, you can see how the EC classified the rejections as per the type of risk, from which country it was imported from, the country of destination in Europe and other details.

- Check the RASFF portal to know what kinds of products are recalled and the reasons for border rejection.

What additional requirements do buyers often have?

Buyers look for sustainable seaweed products

Sustainability is a key issue in the seaweed trade and its importance has been growing in the past years. As European producers themselves apply for certifications related to sustainability, exporters should also be paying attention and making their products sustainable in order to be more competitive. While, for seaweed products, this is mostly required when entering the European retail sector (and not so much in the food processing industry, where a lot of seaweed exported by developing countries ends up), importers predict that the demand for certified sustainable products will grow.

So which certifications are relevant for you as an exporter? The ASC-MSC Seaweed Standard is the most prominent certification for sustainability which covers both wild and farmed seaweed. The standard applies globally to all locations and scales of seaweed operations.

The Seaweed Standard uses the existing MSC Chain of Custody (CoC) Standard. This standard requires every distributor, processor, and retailer trading in certified seaweed to have traceability systems in place that ensures ASC-MSC certified seaweed is separated from non-certified, and can be fully traced along the supply chain. To learn more about how to apply for assessment and become certified, read more about the Chain of Custody Standard.

Products from different seaweed production categories will carry different labels.

Figure 1: Labels for seaweed

Source: ASC-MSC Seaweed Standard (2021)

The ASC-MSC Seaweed Standard sets a number of requirements for sustainable and socially responsible seaweed harvesting and farming practices, thereby contributing to the health of the natural environment and supporting workers and local communities. The standard applies globally to all locations and scales of seaweed operations, including both wild harvest and cultured seaweed production.

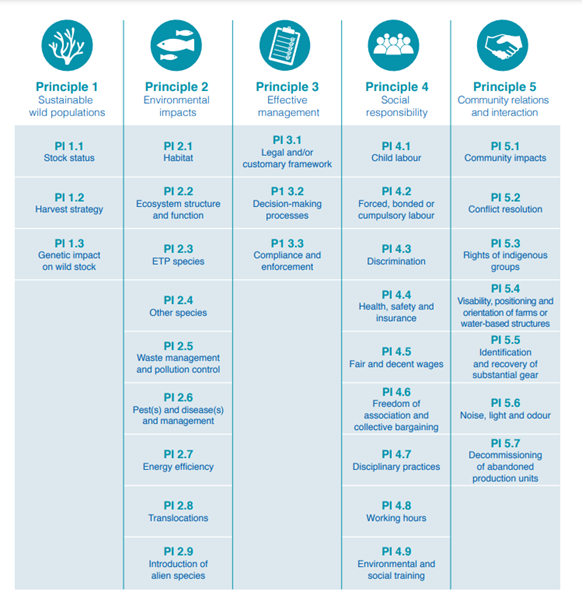

There are 5 guiding principles in seaweed harvesting, namely:

- Sustainable wild populations: Seaweed harvesting and farming must be conducted in a manner that does not lead to the depletion of the exploited wild populations.

- Environmental impacts: Seaweed harvesting and farming activities must allow for the maintenance of the structure, productivity, function and diversity of the ecosystem (including habitat and associated dependent and ecologically related species) on which the activity depends.

- Effective management: Seaweed harvesting and farming operations must have an effective management system in place that respects local, national and international laws and standards.

- Social responsibility: Seaweed harvesting and farming activities are required to operate in a socially responsible manner. Operators must ensure that workers are protected from harmful practices including child labour and any degree of forced labour or discrimination, while supported in their rights to collective bargaining, fair disciplinary practices, health and safety, fair and decent wages, and appropriate working hours. Environmental training must also be provided.

- Community relations and interaction: Seaweed harvesting and farming activities must operate in a manner that minimises impacts on other farms, activities and communities. Operations must adhere to strict requirements regulating the appropriate positioning and orientation of farms or water-based structures, identification and recovery of substantial gear, good management of noise, light and odour, and the proper decommissioning of abandoned farms or other water-based structures.

If you decide to begin the audit process, an accredited third-party conformity assessment body (CAB) will provide an assessment team to independently score your farm or wild harvest operation to some or all of the 31 performance indicators (PIs) that make up the ASC-MSC Seaweed Standard. To ensure complete independence from the certification process, a third-party organisation – Assurance Services International (ASI) – manages the accreditation of CABs to conduct assessments.

The number of PIs scored depends on the type of seaweed production system that you use. Your CAB will explain exactly which of the PIs will be scored for your operation. In the table below, you will find some important performance indicators in the ASC-MSC Seaweed Standard.

Figure 2: Performance Indicators in the ASC-MSC Seaweed Standard

Source: ASC-MSC Seaweed Standard (2021)

As of September 2021, there are only 8 suppliers around the world which have been certified by this standard and 6 of them are from South Korea. The other 2 companies are from the US and Taiwan. You can check out the names and specifications of the certified seaweed suppliers via this link.

Tips:

- Read the ASC MSC Seaweed Standard in the brochure to find out more about the standard.

- To learn more about the audit process and get a step-by-step guide, read the Get Certified! guide produced by ASC-MSC.

- In response to the coronavirus outbreak and consideration of the welfare of all individuals participating in the Seaweed certification system, the ASC and MSC have issued a derogation to allow for scheduling and conducting of remote site visits and audits for Seaweed assessments.

What are the requirements for niche markets?

Obtaining organic certifications, adopting Corporate Social Responsibility practices (CSR) and developing marketing stories can add value to your products, open up opportunities and facilitate market access.

Organic certifications

Apart from sustainable certifications, organic certifications could also be a useful feature for your seaweed product. To produce organic certified seaweeds, companies must have a system to monitor the quality, i.e. the concentrations of toxins, of the water in which the seaweed is grown.

Obtaining organic certification can be quite difficult. Organic compounds require each ingredient to be organic certified. For organic seaweed products entering Europe, it is useful to know about Regulation 834/2007 which provides details on labelling, production and trade. These controls are made by control bodies or authorities which are themselves accredited.

Compliance with the provisions contained in this regulation is guaranteed by a system of controls based on Regulation (EC) No 882/2004 and precautionary and control measures drawn up by the Commission. This system guarantees the traceability of food in accordance with Regulation (EC) No 178/2002. The acquisition of EU certification is made recognisable through the EU logo, also called Euro leaf. The name or the code of the control authority or the control body which carried out the control is also mentioned on the label.

Tips:

- Check out The European Organic Certifiers Council (EOCC) which is an association of control bodies and authorities.

- Read the CBI factsheet on Exporting Certified Organic Seafood to Europe in order to learn more about organic certification.

Be socially responsible

Exporters from developing countries should also look at adopting a Corporate Social Responsibility (CSR) policy for their production process. CSR refers to a business model that helps a company become socially accountable not just to its own employees and stakeholders, but also to the local community and environment. CSR assesses the company’s impacts socially, environmentally and economically.

European importers are interested in your products and in the people and the communities behind them. Implementing policies that care about the people who work in the industry show that your company is committed to sustainable and socially responsible practices which promote human rights and gender equality.

These practices are included in CSR certifications which you can apply for. CSR practices help you improve your business by supporting social and ethical practices that help your employees as well as the community. This is important in the seafood industry, and more specifically in the seaweed sector, as community members are usually impacted by the production of seaweed either through economic purposes (they are employed within the sector) or they live in the coastal area where seaweed is harvested.

Global food corporation Cargill, for example, has launched the Red Seaweed Promise programme in order to ensure a long-term sustainable seaweed supply chain. Social aspects such as community support and empowerment of seaweed producers through training and coaching tools are also part of the project.

Tips:

- Start looking for possibilities to certify CSR. Some internationally known certifications are Sedex and ISO 28000.

- Check out companies such as the Philippines’ Ecolife/Trading Room which provide jobs for coastal communities and at the same time help clean shorelines through seaweed harvesting.

Share your story

European buyers are constantly looking for sincere and genuine stories that make the product stand out, so storytelling is an important aspect when marketing your seaweed products. Stefan Kraan, Chief Scientific Officer at the Seaweed Company had the following to say about this, “Storytelling is important for importers. Show your sustainability and traceability. It could start from the farmer level and you can tell your story as the seaweed moves up the supply chain. You can show this through a two-minute video or other creative means.”

The Seaweed Company, for example, highlights the impact of the company on all 61 families they work with and how it contributes to their economic development, especially those who live in the coastal communities.

Figure 3: Women preparing Ulva seaweed in the Philippines

Source: Ecolife/Trading Room

Through what channels can you get seaweed on the European market?

You can get your product on the market through foodservice and retail. Seaweed mostly arrives in Europe as processed items like powdered, dried, pre-packed or in other forms. Seaweed that is exported as food for consumption mostly ends up in the foodservice and in the (ethnic) retail sectors. Seaweed that is used as extracts in the food processing industry may end up in shops as a meat replacement, pre-packaged drinks, dairy alternatives or bakery products.

How is the end market segmented?

Imports of seaweed go into various end-market segments. Seaweed extracts that are used as dairy or meat replacements usually go to the food processing sector and eventually end up in retail or foodservice sectors. Seaweed for direct consumption ends up at Asian wholesalers, restaurants in the foodservice sector, ethnic supermarkets and, in some cases, even in mainstream supermarkets.

Figure 4: End market segmentation for seaweed

Source: Seafood TIP (2021)

Figure 4 shows where the most opportunities for your seaweed products lie. The darker the grey is, the more opportunities there are for your products to reach the end market. In the retail sector, your seaweed products can be mostly sold to ethnic supermarkets which specialises in the sales of value-added seaweed products such as frozen seaweed salad (wakame salad), dried seaweed (nori) and other seaweed snacks or dehydrated seaweed products. They are mostly found in the Chinese, Japanese or Korean sections where seaweed is often used as a staple ingredient in their cuisines.

There is some opportunity for your products to be sold in mainstream retail, however, not as much. It is difficult to tap directly into the mainstream retail market as seaweed is not that popular yet. If seaweed products do appear in mainstream supermarkets, they are mostly found in the ethnic section.

In the food processing sector, there is plenty of opportunity for you as an exporter, especially for seaweed extracts. In this sector, seaweed extracts are already commonly used in meat replacements, alternatives to dairy, and drinks. To know more about specific requirements for seaweed exported as extracts, read the full study on CBI.

There is a potential for your products to end up in the foodservice sector, due to the growing number of:

- Asian restaurants around Europe;

- traditional European restaurants adding seaweed to their menu items.

The next section will provide more information about the end-market segments and the channels you can use to get to them.

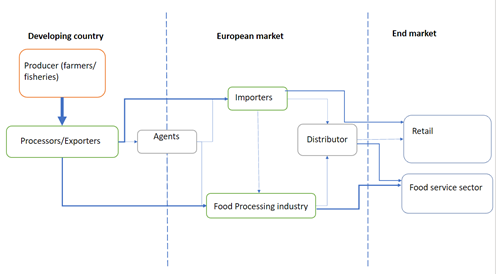

Through what channels does a product end up on the end-market?

The foodservice and retail sectors are the main markets for your seaweed products. However, the food processing industry also presents a strong opportunity. Most seaweed comes from European producers, so your opportunity lies in the export of value-added or processed items.

The seaweed sector in Europe is heavily characterised by importers and distributors. In some cases, if you have no prior knowledge or contacts within the sector, you may need an agent to make introductions to European importers or distributors.

Figure 5: European market channels for seaweed

Source: Seafood TIP (2021)

What is the most interesting channel for you?

To know what is the most interesting channel, you first need to know what your target market is. The food processing industry (seaweed extracts) is different from the retail or the foodservice sectors. As it is difficult to gain access to all end markets, it is good to be in touch with an importer who can give you access to a food processing company or distributor that already knows the seaweed end market.

The diversity of your portfolio also matters. The food processing industry for seaweed is quite established in Europe. If you are already doing business in this sector, you may have the opportunity to link to other end markets such as retail or food service. You need to be able to successfully network within the industry and communicate effectively what you can offer from your seaweed portfolio.

Valuable advice from Stefan Kraan, Chief Scientific Officer at the Seaweed Company, “In your company, you must designate a person who is in charge of reaching out to European companies. Tell your story and talk about the different products that you offer.”

Food processing industry

In the food processing industry, carrageenan and agar-agar are used mainly due to their wide range of functional properties. According to Mordor Intelligence, the global market for carrageenan is projected to grow at a CAGR of 8.12% for 2021-2026 while the agar-agar market is projected to grow at a rate of 5.55%. The major driver for this is the rising demand for processed foods. Within the processed food ingredients, the rising demand for organic ingredients is driving the market for carrageenan. Another very important factor for market growth is the many functional benefits of carrageenan.

In the meat industry, seaweed extracts are able to increase the stability of the meat emulsion and improve its water-binding properties. It can also be used as a binding agent in smoothies, soups and cakes. In the beverage industry, seaweed improves the consistency and homogeneity of the drinks. Seaweed extracts are also widely used in alternative dairy beverages as they provide the uniform suspension of extracted particles during prolonged storage at high temperatures. They also give structural integrity, melting resistance for frozen desserts and act as a thickener for sauces and dressings.

As an exporter to Europe, you must provide a product of the highest quality. In addition, speak to buyers and find out if they have specific requirements for seaweed extracts. For example, food manufacturers may require carrageenan and agar-agar to meet specific compositional requirements, such as certain viscosity levels, depending on their application in the food industry. To know more about specific requirements for seaweed exported as extracts, read the full study on CBI.

Some of the major distributors for seaweed extracts in Europe include Cargill, CEAMSA (Spain), TER Ingredients (Germany), and Kerry (Ireland).

Foodservice

With the growing number of Asian restaurants in Europe and the increased use of seaweed in more traditional European restaurants, there is a potential for your products to end up in the foodservice sector.

The restaurant industry is an obvious end market to introduce your product to, either through in-person dining or takeaways and deliveries. The most popular food that uses seaweed is sushi, but there are also other interesting and delicious dishes like poke bowls, for example, which have grown popular in Northwestern Europe: this is Hawaiian cuisine usually made with raw fish and seaweed.

In Europe, high-quality dried seaweed is very sought-after. This product is commonly used in Japanese restaurants (for sushi and ramen) and in all-you-can-eat Korean and Chinese restaurants. According to Oliver Nikolovski of Ocean Treasure, a French seafood export company based in China, European buyers mostly only import Grade A nori to be used for the foodservice sector. There is also, to a lesser extent, a demand for Grade B nori.

Dried nori leaves have four quality grades: Grade A, Grade B, Grade C and Grade D. Made from the middle part of nori leaves, Grade A nori usually has a darker colour and has a shinier gloss compared to other grades. Grade A nori also tastes a little sweeter and is known for its umami seafood flavour. Grade A nori is also crispy and easy to chew, unlike other grades.

Table 1: Nori leaves specification

|

Specification |

Photo of nori leaves Grades A-D |

|

Scientific Name: Porphyra yezoensis |

|

Courtesy: Ocean Treasure

Figure 6: Sample of seaweed-based dishes in Europe

Source: Creative Commons (2021) (left: poke bowl, right: seaweed noodle soup)

Tip:

- Read the study conducted by the Wageningen University on the perception of seaweed from various literature to gain insight into the perception of European consumers.

Ethnic retail

There is an opportunity for your products to get into the (ethnic) retail market. Retailers do not usually purchase this directly from exporters but from Asian wholesale distributors. The mainstream retail market usually sources from European producers for fresh or frozen seaweed because of 2 main factors:

- Logistics are simpler. It is more convenient and less expensive to source from neighbouring European countries.

- Many importers prefer European seaweed producers because of their commitment to sustainability.

For exporters from developing countries, there is much more opportunity in the ethnic retail market (compared to mainstream retail), especially for value-added products. As indicated in the Seaweed Market Analysis, the growing ethnic population in Europe as well as the increasing popularity of seaweed consumption among European consumers contribute to the growth of opportunities in ethnic retail.

To help consumers get more familiar with seaweed (and create more demand), you can consider partnering up with your buyers in educating consumers about the taste and use of seaweed. Many consumers are already familiar with seaweed due to Japanese sushi or other ethnic cuisines. This could be a good take-off point for you to explore and introduce how seaweed is used and applied in the food industry in your own culture.

Below are some examples of products you can typically find in ethnic retail stores in the Netherlands:

Figure 7: Dried seaweed, dehydrated Seagrapes

Source: Amazing Oriental, Ubuy.co.nl

Ethnic retail shops range in size from small to medium. Small shops are usually owned by families. Some examples are:

- Angkor-Store in Bonneville, France

- Thien Hung in Zwolle, The Netherlands

- DS Asia Supermarket in Heilbronn, Germany

- Hello! Food Store in Parma, Modena and Piacenza, Italy, owned and operated by the importer Global Trading

- Wai Yee Hong in Bristol, UK

There are also larger retail chains found in Europe, especially in densely populated countries where a lot of migrants are living. Some examples are:

- France: Paris Store is an Asian supermarket chain with 19 stores across France.

- France: Tang Frères (“Tang Brothers”) is an Asian supermarket chain with seven stores in Paris.

- Netherlands: WNH is an Asian supermarket chain with five stores in the western part of the Netherlands.

- Netherlands: Amazing Oriental has more than 20 stores plus a webshop. Most locations are in the southwestern and south-eastern parts of the Netherlands.

- Netherlands: Tanger Markt with 13 stores (including a few in Belgium) offering a range of food products for the ethnic population.

- UK: Wing Yip has four stores across the UK with a focus on Chinese products, although they also stock other Asian food products.

- Germany: Go Asia has 20 branches in Germany.

There are also online webshops, including Asia-Market. It and AsiaMach in Italy, Red Rickshaw and JohnandBiola in the UK, and AsianFoodLovers in the Netherlands.

Tips:

- Read the CBI study about ethnic supermarkets in Europe for more information about the European ethnic market.

- Offer a variety of seaweed products with different flavour profiles to your potential customers. Include recipes to educate them about how to cook and prepare seaweed products. This can help them get (and stay) interested in your products.

Marketing supervisor Jem Ramirez believes in targeting a variety of channels. This is what he says about the strategy of his company, W Hydrocolloids from the Philippines: “We tried to ensure our channels are as diverse as possible in order to maximise our reach. We have direct connections with manufacturers in the food processing industry, but we also have connections with distributors. We also deal with sales agents and importers in order to have direct contacts from our markets and know the situation from the ground.”

2. What competition do you face in the European seaweed market?

The biggest competition comes from within Europe itself. Outside Europe, the biggest competitors among developing countries are China, the Philippines and Indonesia.

Which countries are you competing with?

The top five supplying countries for imported seaweed in Europe in 2020 are China, Germany, South Korea, the Netherlands and Chile. This is based on Trade Map imported value. However, in this section, we will focus on the three main developing countries to supply seaweed, namely China, the Philippines and Indonesia.

China

China is the top developing country to supply seaweed to Europe. According to data from Trademap, the exported value from China in 2020 reached $9,178,000 in 2020, which is slightly lower than in 2019, when it reached $11,100,000.

China started seaweed farming in the early 1950s, mostly from the northern coast in Dalian down to Fujian. Seven seaweed species are farmed on a large scale from Liaoning Province in the north of China to the sub-tropical Hainan Island in the south of China. With the exception of Guangxi and Hebei, the other coastal provinces also have their independent seaweed farming industries. The two of the most commercially important seaweed species in China are Saccharina japonica and Undaria pinnatifida – of which the country produces 90 per cent and 71 per cent of the global figures, respectively – generating $4.79 billion in the process.

In Shandong and Dalian, the cultivated kelp harvest season normally runs from mid-May until the end of June. In Fujian province, it normally starts at the end of March and lasts until early June.

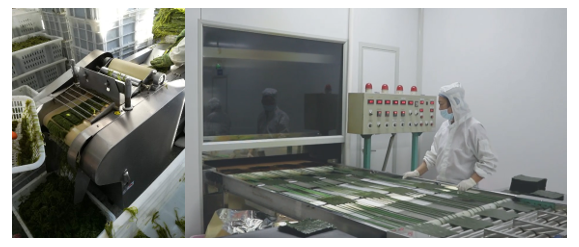

As a global supplier of seaweed, China has been able to master the technology, preservation methods and packaging needed to upgrade their seaweed industry, and expand their product portfolio as well as their reach. If you want to compete with China you may need to compete on the technology level. Many exporters have already invested a lot in making their production, harvesting, processing and packaging more efficient.

Figure 8: A processing facility in China for seaweed salad and nori leaves

Source: Ocean Treasure

Despite the success of China in seaweed farming, many Chinese seaweed producers face challenges that include ocean warming, ocean acidification and genetic cross-contamination between wild and farmed kelp populations. On the trade side, a major problem with Chinese seaweed products was the low cost for wholesale prices due to massive cultivation.

As such, Chinese seaweed exporters focused on adding value to their products such as the use of seaweed for food applications. This is something that developing country exporters can learn from China’s strategy. By adding several steps to increase the value of your product, you can increase the prices of your seaweed products and expand your market reach.

Philippines

With a rich and diverse array of natural resources, the Philippines fosters an abundance of diversified seaweed. The export value to Europe reached $2,401,000 in 2020, according to TradeMap.

Based on published information from the National Seaweeds Technology Center (NSTC), there are 1,065 identified species and 5 species are commercially farmed. Only a few seaweeds are cultivated commercially in the country, namely Caulerpa lentillifera, Gracilaria firma and G. heteroclada in brackish-water ponds. E. denticulatum, K. alvarezii and K. striatum are cultivated in marine waters. Eucheuma sp. and Kappaphycus spp. comprise almost 95% of the country’s total production and are considered to have been the flagships of the seaweed industry since the early 1970s.

There is an estimated 700,000 hectares of farmable area for seaweed in the Philippines, consisting of 500,000 hectares of deep-sea areas, 200,000 hectares of coastal area, and 60,000 hectares of farmed coastal areas, which amounts to 8% of the total farmable area).

According to NSTC, 94% of the Philippine seaweed exports focus on processed hydrocolloids and a small percentage produce edible seaweeds for human food consumption and raw dried seaweeds for further processing. At the moment, the Philippines focuses on producing seaweed extracts (semi-refined and refined carrageenan, mainly for food ingredients) destined for the food processing industry.

Clearly, there is a need to diversify the Philippine seaweed products in order to ultimately increase the revenue and market share in Europe along the whole value chain. These changes are required to enable the country to cope with the increasingly varied demands of the European market. Some of the challenges in the Philippines' seaweed production include climate instability, pollution and disease outbreaks.

Philippine seaweed exporters now want to explore the production and trade of Ulva or sea lettuce, a type of green seaweed that is not yet commercially grown in the Philippines but offers potential in exports.

One Filipino company that focuses on the development of Ulva products is Ecolife. Filipino scientists are looking into the use of Ulva in animal feed as they are rich in unique soluble fibres called Ulvans which are known to boost immunity in a range of animals.

Figure 9: Harvesting of Ulva in the Philippines

Source: Ecolife/Trading Room

The Philippines continues to focus on value addition and scientific research on the potential of seaweed exports. Exporters from developing countries could study and get to know more about how Filipino seaweed farmers and exporters are continuing to expand their portfolios to reach other markets.

Tips:

- To learn more about the seaweed industry in the Philippines and to connect with seaweed processors, check out the Seaweed Industry Association in the Philippines. As of today, SIAP membership has grown from a few carrageenan processors to more than 100,000, which includes raw seaweed exporters, seaweed traders and seaweed farmers and their families.

- Check out this presentation by the Philippine government on seaweed production and markets in the Philippines.

Indonesia

Indonesia is one of the world’s leading sources of tropical seaweed. Indonesia’s exports to Europe have been growing throughout the years. In 2018, the export value reached $149,000, and by 2020, this had grown by 170% to a total of $401,000.

Like the Philippines, the most important products processed from these seaweeds are the hydrocolloids agar-agar and carrageenan. In Indonesia, agar-agar is produced mainly from the raw material Gracilaria, while smaller quantities are produced from Gelidium. Carrageenan may be produced from the raw material Cottonii (Kappa Carrageenan) or from Spinosum (Iota Carrageenan).

While hydrocolloids have many applications in the food processing industry, recently, Indonesian exporters have been focusing on developing value-added seaweed products destined for the foodservice or retail sectors in order to expand their market and product portfolio in Europe. This includes dried or processed seaweed.

The expansion of the seaweed industry in Indonesia is the result of the increased utilisation of its extensive coastline due to both government support for the growth of this sector and increased shelter from extreme climatic events such as typhoons. Securing the necessary certificates is also key to market access for Indonesian exporters. Furthermore, they also have a lot of experience in servicing international markets and certifications ranging from Kosher and Halal to BRC, HACCP, FSSC, GMP, Organic and ISO 9001.

Moreover, exporters focus on how the seaweed industry is transforming the lives of coastal communities by enhancing farmers’ welfare and conservation of marine resources.

If you want to be as successful as Indonesia you should focus on getting the necessary certificates and on Corporate Social Responsibility (CSR). Read more about it in the niche requirements section of this study.

Figure 10: Infographic on Indonesia’s seaweed industry

Source: ASTRULI

Tips:

- To know more about the value chain analysis of Indonesia for seaweed which outlines the opportunities and challenges for the Indonesian seaweed sector, check out this study by CBI.

- Check out the seaweed farmers of Indonesia and how the seaweed industry is developing through the Indonesia Seaweed Industry Association (ASTRULI) website.

Which companies are you competing with?

Kowa Foods

Kowa Foods Company is one of the largest China-based manufacturers of seaweed. They are specialised in value-added products such as seaweed salad, salted seaweed, hijiki salad and others. Certificates that the company has include ISO, IFS, HALAL, HACCP, and BRC certificates. Kowa farmed and processed 25,000 tonnes of farmed seaweed in the Bohai sea.

Food safety is a top priority for European consumers. Kowa Foods strategically places its qualifications and certificates on food safety and integrity on the homepage of its website in order to appeal to its buyers. For exporters from developing countries, this could be a good way to introduce your company and appeal to European buyers.

W Hydrocolloids

W Hydrocolloids is a leading exporter of natural ingredient solutions and carrageenan from the Philippines. They have been in the business for more than 50 years and have pioneered the local carrageenan production in the country serving different industries around the world including the food, beverage, pharmaceutical and personal care industries. They have clients from five main regions: Asia and the Pacific, the Americas, Europe, the Middle East and Africa. Some of the applications for their carrageenan products include vegan burgers, beer, confectionery and dairy products.

Aside from the many food applications that W Hydrocolloids caters to, the company also focuses on CSR efforts as well as sustainability. The company website highlights its efforts on using renewable energy in its processing plants, along with community efforts done in the Philippines to help vulnerable families. This is a good example of how seaweed exporters can communicate their USPs to their target buyers.

PT Java Biocolloids

Java Biocolloid is a company from Indonesia that specialises in the production of red seaweed extracts, such as agar-agar, used in the food industry and the pharmaceutical sector. The company was established in 2011 as part of the Hakiki Group, a Southeast-Asian food distributor. Hakiki Donarta also owns Landkrone, one of the most advanced manufacturers of oils, fats and filling creams in Southeast Asia. Landkrone has been able to stay ahead of the competition using technology developed in cooperation with Java Biocolloid.

In 2017, Java Biocolloid Europe was created to fulfil the increasing demand from the Western market (including Europe) to pursue innovation and research in the sector. The location chosen for Java Biocolloid Europe is Trieste, a free port in northern Italy that facilitates the distribution of products across Europe and the USA. With a company established in Italy, Java Biocolloid has maintained a good connection with European buyers.

3. Which products are you competing with?

Seaweed used for direct human consumption is still a young and niche market, especially in Europe. As seaweed has a distinct flavour and specific market, it is challenging to find a competitor. However, the products below may provide some competition for seaweed products imported by Europe.

Irish moss

Irish moss is a type of red algae which grows abundantly along the rocky parts of the Atlantic coast. Like other types of seaweed, they are also a rich source of minerals, antioxidants and carrageenan that is used in food applications.

Since Irish moss is usually harvested wild from the Northern Atlantic, it could present some competition, particularly for Asian seaweed suppliers such as China, Indonesia or the Philippines. Irish moss is usually sold as powdered, flaked or dried.

Figure 11: Irish moss products

Source: Unlimitedhealth.nl

Canned fish

Value-added seaweed products could also compete with other shelf-stable products such as canned fish. European consumption of canned fish has increased in recent years as more people turn to home cooking and retail purchases. This reinforced the trend that European consumers want simple, ready-to-eat and convenient seafood.

Shelf-stable canned fish products have a long shelf life, much like value-added seaweed products such as canned seaweed, dried seaweed, seaweed snacks and other innovative seaweed products. As such, these products could also compete within the shelf-stable segment.

Moreover, seaweed could also be exported as a raw material for further processing in Europe. This is also the case for raw materials for canned fish products.

Tip:

- To learn more about the market potential of canned fish products in Europe, read this CBI study.

Acacia/Guar/Tara Gum

Within the category of seafood used for food processing, there are other hydrocolloid products that compete as alternatives such as acacia gum, guar gum and tara gum.

For more information about these products, check out the seaweed extract market entry study produced by CBI.

4. What are the prices for seaweed on the European market?

Prices for dried seaweed on the international markets vary considerably according to the species, quality, harvesting costs, end-user demands and the prices of substitutes. In this section, we will present a sample of both export prices and market prices in the retail market.

The table below provides a sample of FOB prices for seaweed products from China. FOB means Free on Board. Under FOB terms, the seller is responsible for costs up to the point that the goods are loaded onto a ship at a named port in the country of origin, and ready for transportation.

Table 2: FOB Prices of nori and seaweed salad from China

|

Products |

Specification |

FOB Price in $ (USD) |

|

Wakame salad, 5% sauce |

1kg/bag |

$2.90/kg (Qingdao/Dalian) |

|

Nori Leaves |

Grade A |

$4.15/bag (50sheets) Note: Nori Leaves is a bulky cargo. The price is not offered as $/kg, but $/bag(sheets) |

Source: Ocean Treasure

This next table sets out some of the prices of seaweed products as displayed in ethnic retail stores.

Table 3: Prices of value-added products on the ethnic retail market

|

Product |

Retail Price |

Store |

|

Nori Sushi sheets (125 grams) |

€5.65 |

Tjin’s International Foodstore (NL) |

|

Hijiki seaweed (56.7 grams) |

€2.70 |

Tjin’s International Foodstore (NL) |

|

Kiridashi Kombu (45 grams) |

€5.65 |

Tjin’s International Foodstore (NL) |

|

Dried wakame (200 grams) |

€7.00 |

Angkor-store (FR) |

|

Seaweed paste (180 grams) |

€5.70 |

Angkor-store (FR) |

|

Seaweed soup (18 grams) |

€1.81 |

Oriental mart (UK) |

|

Seaweed rice crackers (60 grams) |

€1.23 |

Oriental mart (UK) |

|

Takaokaya Yakiknori 10 dried and roasted Sushi Sheets (Nori-Tang). |

€3.59 |

Nanuko (DE) |

|

Bibigo Gimbap Seaweed (20 grams) |

€2.98 |

Nanuko (DE) |

Source: Seafood TIP (2021)

This study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research