Entering the European market for apples

Chile, New Zealand and South Africa dominate the counter-seasonal supply. Opportunities within the European season are limited, but not impossible when your timing is right. Only by investing in quality, variety and integration will you have a chance on the EU market.

Contents of this page

1. What requirements must apples comply with to be allowed on the European market?

Fresh apples must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant, which provides an overview of export requirements for apples (code 080810, or more specific: 0808108090).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are 1 of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Fresh apples containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals, such as lead and cadmium.

Apples have a high risk of pesticide residues. They are generally near the top of the Environmental Working Group’s ‘Dirty Dozen’ list, because they contain an average of 4.4 pesticide residues, including some in high concentrations.

Note that retailers in several Member States, such as the United Kingdom, Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation.

Ripening blocking agents and post-harvest treatments

Another main concern is Diphenylamine, an antioxidant used in post-harvest to prevent chilling injury or storage scald. The allowed MRL for diphenylamine is only 0.05 mg/kg, and the limit for the active substance oxadixyl is 0.01 mg/kg.

There is also an MRL for 1-methylcyclopropene (1-MCP) of 0.01 mg/kg. 1-MCP is used in controlled atmosphere storage, but is difficult to detect as a residue. However, the use of 1-MCP can be detected by a recently developed test.

Waxes may be used for surface treatment on apples to allow better preservation. For apples, this is limited to Beeswax (white/yellow), Carnauba wax and Shellac.

Tips:

- Reduce the amount of pesticides by applying Integrated Pest Management (IPM) in production. IPM is an agricultural pest control strategy that involves an integrated approach to prevent harmful organisms and keep the use of pesticides within acceptable levels. Read about Integrated Pest Management (IPM) on the website of the European Commission.

- Find out what MRLs are relevant for apples by consulting the EU MRL database in which all harmonised MRLs can be found. You can search for your product (“apples” or product code 0130010) or the pesticide used. The database will show the list of the MRLs associated with your product or pesticide.

- Read more about MRLs on the website of the European Commission and check with your buyers if they have additional requirements on MRLs and pesticide use.

- Make sure that contamination of lead in apples remains below 0.10 mg/kg and that cadmium remains below 0,050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

As from December 2019, the new European regulation went into force for the trade in plants and plant products from non-EU countries. This regulation requires apples to have a phytosanitary certificate before being brought into the European Union, guaranteeing that they are:

- Properly inspected;

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- In line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072.

The phytosanitary certificate must include an official declaration that the apples originated in a country or region that is free from the pests mentioned below, or that the apples were effectively inspected and treated to ensure the absence of these pests.

- ‘Botryosphaeria kuwatsukai’ (fruit rot and wart bark);

- ‘Anthonomus quadrigibbus’ (apple curculio);

- ‘Grapholita prunivora’ (apple worm);

- ‘Grapholita inopinata’ (fruit moth);

- ‘Rhagoletis pomonella’ (apple fruit fly/maggot).

For apples from the United States, Canada and Mexico, the declaration also applies to ‘Grapholita packardi Zeller’ (cherry fruit worm).

Tips:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure it can issue a phytosanitary certificate on time.

- Read which additional declaration is needed on the phytosanitary certificate for fresh apples in the document of the Dutch food safety authority NVWA.

Maintain high quality standards

Part B of Annex I in Regulation (EU) No 543/2011 and the amending Regulation (EU) 2019/428 lays down the marketing standard for apples. A similar marketing standard for fresh apples is also described in:

- The UNECE Standard FFV-50 concerning the marketing and commercial quality control of apples (2020 edition);

- The FAO Standard for Apples in the Codex Alimentarius.

These marketing standards describe the minimum requirements for apples (see Table 1). Europe almost exclusively requires Class I apples as a minimum. Apples in this class must be of good quality and within the permissible tolerances (see Table 2).

Table 1: General quality requirements and permissible tolerances for apples

| Minimum quality requirements (all classes) |

|

|

|

|

|

|

|

|

|

Table 2: Marketing standards per class

| ‘Extra’ Class | Class I | Class II |

| Apples in this class must be of superior quality. They must be characteristic of the variety, and the stalk must be intact. | Apples in this class must be of good quality. They must be characteristic of the variety | This class includes apples which do not qualify for inclusion in the higher classes but satisfy the minimum requirements specified above. |

Apples must express the following minimum surface colour characteristic of the variety*:

—3/4 of total surface coloured red in case of colour group A

—1/2 of total surface coloured mixed red in case of colour group B

—1/3 of total surface coloured slightly red, blushed or striped in case of colour group C

The flesh must be perfectly sound. | Apples must express the following minimum surface colour characteristic of the variety*:

—1/2 of total surface coloured red in case of colour group A

—1/3 of total surface coloured mixed red in case of colour group B

—1/10 of total surface coloured slightly red, blushed or striped in case of colour group C

The flesh must be perfectly sound. | The flesh must be free of major defects.

|

They must be free of defects with the exception of very slight superficial defects provided these do not affect the general appearance of the produce, the quality, the keeping quality and presentation in the package:

—very slight skin defects,

—very slight russeting such as:

| The following slight defects, however, may be allowed, provided these do not affect the general appearance of the produce, the quality, the keeping quality and presentation in the package:

—a slight defect in shape,

—a slight defect in development,

—a slight defect in colouring,

—slight bruising not exceeding 1 cm2 of total surface area and not discoloured,

—slight skin defects which must not extend over more than:

—slight russeting such as:

The stalk may be missing, provided the break is clean and the adjacent skin is not damaged. | The following defects may be allowed, provided the apples retain their essential characteristics as regards the quality, the keeping quality and presentation:

—defects in shape,

—defects in development,

—defects in colouring,

—slight bruising not exceeding 1.5 cm2 in area which may be slightly discoloured,

—skin defects which must not extend over more than:

—brown patches that may go beyond the stem or pistil cavities and may be slightly rough and/or

—thin net-like russeting not exceeding 1/2 of the total fruit surface and not contrasting strongly with the general colouring of the fruit and/or

—dense russeting not exceeding 1/3 of the total fruit surface, while thin net-like russeting and dense russeting taken together may not exceed a maximum of 1/2 of the total surface of the fruit. |

*See Non-exhaustive list of apple varieties in regulation in the appendix of Regulation (EU) 2019/428

Figure 1: Examples of different classes and tolerances

Source: OECD (2021), Apples, International Standards for Fruit and Vegetables, OECD Publishing, Paris.

Figure 2: Examples of packaged apples of – respectively – ‘Extra’ Class, Class I and Class II

Source: OECD (2021), Apples, International Standards for Fruit and Vegetables, OECD Publishing, Paris.

Maturity

The apples must be sufficiently developed and display satisfactory ripeness. The development and state of maturity of the apples must be such as to enable them to continue their ripening process and to reach the degree of ripeness required in relation to the varietal characteristics.

In order to verify the minimum maturity requirements, several parameters may be considered, for example: morphological aspect, taste, firmness and refractometric index.

Tip:

- Maintain strict compliance with quality requirements and deliver the quality agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

Check on product size uniformity

Size is determined either by the maximum diameter or by weight. The minimum size shall be 60 mm, if measured by diameter, or 90 g, if measured by weight. Fruit of smaller sizes may be accepted if the Brix level of the produce is equal to or greater than 10.5° Brix and the size is not smaller than 50 mm or 70 g.

Uniformity in size is compulsory for apples packed in rows and layers (all classes) and for apples of ‘Extra’ Class and Class I. To ensure uniformity in size, the range in size or weight between produce in the same package must be within the tolerances (see Table 3).

Table 3: Size tolerances

| Diameter | Difference in size | Weight (g) | Weight difference (g) | |

| — For ‘Extra’ Class and Classes I and II apples packed in rows and layers: | >60 mm/>50 mm (if Brix is higher than 10.5°) | 5 mm/10 mm for Bramley's Seedling and Horneburger | 70-90 | 15 |

| 91-135 | 20 | |||

| 136-200 | 30 | |||

| 201-300 | 40 | |||

| >300 | 50 | |||

| For Class I fruit packed in sales packages or loose in the package: | 10 mm/20 mm for Bramley's Seedling and Horneburger | 70-135 | 35 | |

| 136-300 | 70 | |||

| >300 | 100 | |||

| Class II fruit packed in sales packages or loose in the package | no requirement for uniformity in size | |||

| Varieties of miniature apples | exempted from the sizing provisions |

Keep your apples fresh in storage

Apples can be stored for several months in controlled atmosphere chambers. Low oxygen chambers and high air filtration delay ethylene production and early ripening.

Tip:

- Read the detailed information of the Cargo Handbook and apply the proper conditions for handling and storing apples.

Use protective packaging

Apples can be packed in different box sizes, for example:

- 2-layer box with 12/13 kg;

- 1-layer box with 6/7 kg;

- 1-layer box with 4 kg;

- Loose in box with 13 kg;

- Loose in box with 18 kg (with closed top).

The boxes with apples arranged in layers normally include plastic trays.

Retail requirements may be more specific, such as:

- Stickers on apples with variety information;

- 4-pack trays;

- Freshly pre-cut apple pieces;

- Plastic bags (see Image 3).

Figure 3: Example of consumer packed apples

Image by ICI Business

Tips:

- Always discuss the specific requirements for size and packaging with your buyer.

- Make sure your apples are well packed and preserved to ensure optimal freshness and taste. Supply chain logistics should not affect the product taste in any significant way.

- Read the CBI Buyer Requirements for fresh fruit and vegetables to learn what you need to include in the labelling of fresh fruit and vegetables including apples.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh apples are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. We highly recommend management systems recognised by the Global Food Safety Initiative (GFSI).

Apply additional social and sustainability standards

Complying with social and sustainability standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

In the coming years, the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe for becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address, for example, packaging and food waste. EU trade agreements with Argentina, Brazil (Mercosur) and Moldova, which supply apples, already include rules on trade and sustainable development. For suppliers of fresh fruit and vegetables, it is important to look ahead of the increasing standards and try to be in the frontline of the developments.

Retailers can also impose their individual standards, such as Tesco Nurture. Especially larger retail chains in Northern Europe are more prepared to buy your product if your compliance with social and sustainability standards is in order.

Tips:

- Implement at least 1 environmental and 1 social standard. See the Basket of Standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

- For other additional requirements such as payment and delivery terms, see the CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

Organic certification can be an interesting way to set your apples apart and market them at a higher value. The demand for organic apples is growing, although this is also strongly linked with the preference for locally produced apples.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that, from January 2022, the new legislation Regulation (EU) 2018/848 will come into force after being postponed for a year.

You must use sustainable and organic production methods. For example, organic beeswax or carnauba wax can be used as organic coating. But organic apples must not be sprayed with 1-methylcyclopropene to prevent them from ripening.

Tips:

- Strive for residue-free apples and certify your production as organic if possible. This will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the actual list of control bodies and authorities to see which certifiers are active in your region.

2. Through what channels can you get apples on the European market?

Fresh apples belong to 1 of the most integrated supply chains in the fresh produce business. Service providers and producer organisations have an important role in the distribution of fresh apples, especially to supermarkets. Apple traders also play a role in the import, including overseas import, to guarantee year-round availability. Class, variety and presentation will define in which segment your apples are sold.

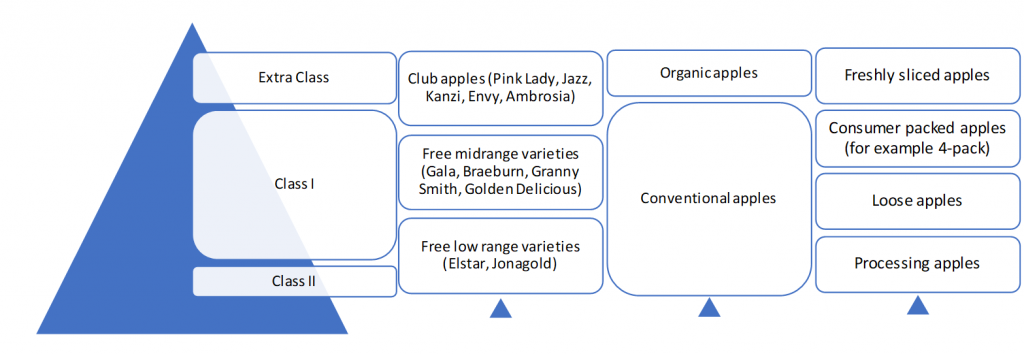

How is the end-market segmented?

You can distinguish different segments in the apple market, according to class, variety and presentation. Because apples are among the main consumed fruits in Europe, the range of varieties and presentations is extensive.

Figure 4: Segments in the apple market

Source: ICI Business

Apples in the higher segment are often club apples or licensed varieties. With controlled production and a budget for marketing, these varieties compete on brand and characteristics such as taste and colour, and quality is also an important feature. Therefore, you will only see ‘Extra’ Class and Class I grade as a minimum. These apple varieties are often consumer packaged to give them a more exclusive appearance. Most producer organisations and service providers offer consumer packaging (see market channels below).

Organic apples can also be placed in a higher segment as a separate category. Consumers pay more for natural and sustainable apples, especially when they are domestically cultivated.

The bulk of apple consumption still consists of ‘free’ variety apples, with mid-range and lower-value varieties and pricings. Popular varieties include Gala/Royal Gala, Braeburn, Granny Smith and Golden Delicious within the mid-price range and Elstar and Jonagold in the lower price range. Most common apples are sold loose from the box, but consumer packaging and added value are optional and mainly depend on the requirements of the retailer.

The market shares for classic varieties, except for Gala, have levelled out or are declining, while new varieties and a selection of club varieties are gaining market share.

On the low end of the market, you will find Class II apples and apples for processing. Appearance is less important in this segment, but the sales as fresh table apples are limited. Some supermarkets will sell a special category of deformed apples as a way to create a market for these leftovers (only local), such as Tesco’s Perfectly imperfect apples or AH’s ‘buitenbeentjes’ (apple misfits).

Tips:

- Adjust your focus according to the segment you are selling to. Focus on good quality and competitive apples when aiming for the main segments, or get a higher price by prioritising quality or offering branded varieties or additional packaging options. The company Fruit Masters, with its efforts in apple sorting, cooling and packing, is a good example.

- Activate the ‘Translation’ function of your browser to make foreign hyperlinks available in your own language or change to an English version.

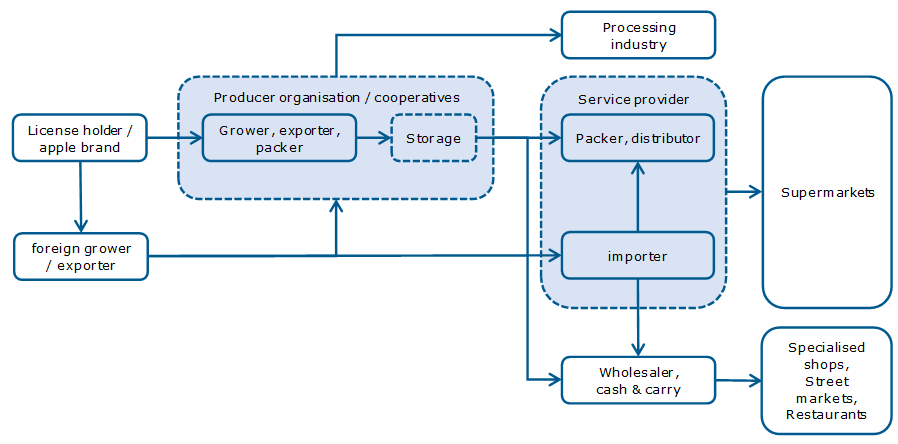

Through what channels does a product end up on the end-market?

The apple market has a high level of integration. Producer organisations focus on cultivation and cooperation, while importers still play an important role in the international trade as well. Successful suppliers often become service providers by adding packaging and distribution and form a direct link from farm to retailer.

Figure 5: European market channels for fresh apples

Source: ICI Business

Producer organisations have the majority of supply

The main market channels for apples are local growers and grower organisations. Locally produced apples can be stored in controlled atmosphere storage long after their harvest. Therefore, they fulfil the local demand throughout most of the year.

Grower organisations and cooperatives with an important share in the apple supply are, for example, Melinda in Italy, Appolonia in Poland, Elbe Ost in Germany, Blue Whale in France, BelOrta in Belgium and Fruit Masters or the Greenery in the Netherlands. Their supply is well integrated with auctions and distribution.

Some of these organisations have their own trading houses, complementing the available production with imported apples. For example, the Greenery combines the produce from grower association Coforta and the import via its subsidiary Hagé to ensure a year-round supply. Blue Whale, a trademark company that leads the apple export in France, has united growers and cooperatives in France. Additionally, it looks for international partnerships, for example in Chile.

Supermarkets are dominant in apple assortment

Supermarkets have a great influence on the apple market. Most fresh apples are sold via supermarkets, and every retailer wants to differentiate with appealing varieties. They usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency in their supply chain. The introduction of the new apple variety ‘Sprank’ by Albert Heijn supermarkets in the Netherlands, developed in cooperation with local growers, is evidence of the close relation with growers.

The dominant role of supermarkets and their continuous search for differentiation may lead to more exclusive relations in the future or even retailer-owned apple brands.

Service providers provide access to supermarkets

Successful suppliers to supermarkets often position themselves as service providers. Service providers can be extensions of grower organisations that have their own distribution, packing and branding, but they also include some of the leading fresh companies such as Greenyard and TotalProduce. From March to July, Total Produce B.V. imports apples from Argentina, Brazil, Chile and South Africa. It orchestrates the supply chain from production to a consumer-ready product and according to the needs of its clients. You can become part of this supply chain if you are able to offer the right volume, quality and logistics that a service provider requires.

Importers complement with counter-seasonal apples

Importers and traders, such as Jan Oskam and Staay Food Group in the Netherlands and Global Fruit Point in Germany, still have an important role in the international trade of apples. Traders offer an international market for European grown apples, but they also arrange the import of counter-seasonal apples. They are familiar with all the different requirements of end clients and distribute to different European markets. At the same time, they are able to select the right sources and perform quality control for imported apples.

Wholesalers supply the spot market

Wholesalers often supply smaller quantities of fresh apples to secondary channels such as hospitality and food services, specialised fruit retailers and street markets. Without a retail programme, they mainly cover the spot market, moving with the fluctuations of the market.

Import can be among the activities of the larger wholesalers, often from within Europe, but sometimes also from non-European sources. For example, the Dutch wholesale company Van Gelder offers apples forms a direct link between growers or suppliers in France, Italy and Chile and professional users in the Netherlands.

Tip:

- Use the major market channels of service providers and supermarkets when offering large volumes of apples. Their retail programmes and supply contracts may provide some stability, but remember that supermarkets maintain strict rules and do not allow you to change supply conditions.

What is the most interesting channel for you?

The best way to sell foreign apples in Europe will be through a supply chain that is not entirely focused on local production. The chance that you will encounter such a business relation will depend on your professionalism, volume, origin and ability to differentiate.

When you have established yourself as a leading apple producer, you can target larger sourcing companies and service providers. This will increase your opportunities to supply larger retailers, the main channel for fresh apple sales. Building a good relationship with these buyers will put your company in a favourable position when European availability runs low (after April/May) or when the quality from abroad is better than the local stock.

Minor apple suppliers may be best off with specialised importers, but it will be crucial to find a point of differentiation. This can be a specific supply window, competitive pricing or unique apple varieties.

As an apple grower, you can also try to connect with the sales organisation of a grower group, which will only be interested in you if it complements its own production with additional supplies.

Tip:

- Visit trade fairs to find buyers and connect to leading apple companies in Europe. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid. The Macfrut fair in Italy is smaller, but can also be an interesting place to meet Italian apple suppliers.

3. What competition do you face on the European apple market?

The best option for suppliers from the southern hemisphere is to target apple importers or service providers in Europe that are looking to complement the low-season supply. Northern hemisphere suppliers compete directly with the European supply and will have to find a point of differentiation. This can be location, a specific supply window or an attractive price level. Either way, competition will remain strong and requires you to invest in quality, variety and cooperation in the supply chain.

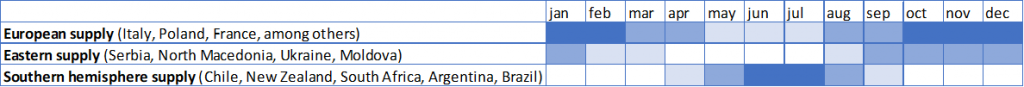

Which countries are you competing with?

Most competition in the apple market comes from Europe itself; high-quality producers and storage facilities keep European apples in the market for a long time. The biggest non-European suppliers are Chile, New Zealand and South Africa. Most of the non-European supply takes place from May to July, except for countries closer to Europe such as Serbia and North Macedonia. Producers to the east of Europe have a logical advantage in Eastern Europe.

Figure 7: Indicative supply seasons for apples in Europe

Provided by ICI Business based on various sources

Chile

Chile is the largest exporter in the southern hemisphere, exporting well over 700,000 tonnes and in peak years passing 800,000 tonnes. About 20 to 30% of Chile’s export is destined for Europe, making the country the main counter-seasonal supplier for Europe. The supply is well diversified in Northwestern Europe.

Chilean growers are competitive, and with a stretched production in different regions from north to south, they benefit from a relatively long season from late January up to November.

Because of the strong focus on export, producers try to adapt to international standards and preferred varieties. There is an active attitude towards varietal renewal and improvement.

Over 40 different varieties are exported, with Gala, Cripps Pink and Red Delicious making up 75% of the export. The export of newer (club) varieties such as Ambrosia, Jazz and Kanzi is still much smaller, but is increasing. Improved clones of the traditional varieties and new plantings of new varieties will guarantee Chile’s place on the international market.

New Zealand

Exporters from New Zealand have close ties with the United Kingdom (also a Commonwealth country) and Germany. The Netherlands is an important trade country for the New Zealanders as well. From here, the apples are partly re-exported.

New Zealand’s success in apples dates back to the mid-1990s, when it introduced an Integrated Fruit Production (IFP) programme. This programme was intended to improve orchard management and reduce the use of chemicals and pesticides. Several years later, it continued to be a frontrunner in low-residue apples with the ‘Apple Futures’ project, using strict European requirements as an opportunity to excel in meeting these requirements.

The country is involved in some of the most advanced apple breeding and research and development. It is home to well-known apple varieties Gala and Braeburn, and the Jazz and Envy apples have also been developed by a New Zealand company (T&G Global). These leading companies will continue to invest in apple breeding and make sure to maintain their strong position in the future.

The combination of intellectual property rights for popular varieties and the production of ultra-low residue apples gives New Zealand a competitive advantage over other producing countries in the southern hemisphere. When competing with New Zealand, you are competing on the premium market.

South Africa

South Africa cultivates apples mainly for export. The main market for South African apples is the United Kingdom, which imported almost 80,000 of the total 116,000 tonnes of apples destined for Europe in 2020. Smaller volumes also find their way to the Netherlands and Germany.

The produced varieties are adjusted to these export markets. According to southafrica.co.za, the main ones include Golden Delicious (24%), Gala/Royal Gala (17%), Granny Smith (15%), Cripp’s Pink and Pink Lady (11%), Topred/Starking (11%), Fuji (9%), Cripp’s Red, Joya (5%) and Braeburn (3%).

Golden Delicious apples are popular with British consumers, and the small sizes from South Africa are ideal for children’s school lunches. To fulfil the European and international demand for new varieties, growers have also started to produce Cripp’s Pink and Pink Lady, Cripp’s Red, Joya and Kanzi. Kanzi is 1 of the fastest growing new varieties, with an increase in production from 12,000 cartons in 2015 to 250,000 cartons in 2019.

Argentina

Like Chile, Argentina has diversified its supply markets in Europe. Germany is the main destination in Europe, followed closely by France, the Netherlands, the United Kingdom and Spain – all of these countries imported between 1,000 and 5,000 tonnes from Argentina in 2020.

Although Argentina is the fourth-largest supplier to Europe, it has gradually lost market share over the years. The decreasing volumes are mainly due to lack of variety renewal. Argentina relies mainly on traditional varieties such as Red Delicious (64%) and Granny Smith (14%). The production peak of more than a million tonnes in 2011/2012 has been reduced to 539,000 tonnes in 2019.

Argentina has also struggled with a number of climate and economic issues that have increased the operating costs of apple orchards. This has mainly impacted the competitiveness of small and medium producers. 1 of the main strengths of Argentina is its organic cultivation. Argentina is 1 of the top countries in organic agriculture. The organic area for temperate fruits such as apples counts up to 4,900 ha. Due to the country’s economic instability and the higher production costs of manual pruning, biological weed control and certification fees, it will be difficult for organic apple cultivation to expand in the next few years.

Brazil

According to the Brazilian Apple Growers Association, over 90% of the cultivated apple varieties are modern clones of Gala and Fuji. Brazil has a large domestic market for these apples and therefore depends less on export.

In 2019, of the 1.2 million tonnes of cultivated apples, only 57,000 were exported, of which 18,000 to Europe. In Europe, the import value from Brazil further decreased from €19 million to €11 million. In 2020, Russia and Bangladesh were the preferred export destinations of Brazilian apples.

Although Europe has seen a slight decline in imported apples from Brazil, the country is still well represented in the counter-seasonal supply to Portugal and Ireland. Ireland, for example, is where Total Produce still has its headquarters – a leading fresh company with ties to Brazil.

Serbia and other eastern suppliers

Serbia is increasing its hold on the European apple market. The country is investing in new orchards, complete with irrigation, hail protection nets, new machinery, controlled atmosphere storage and state-of-the-art sorting and packing machines.

Contrary to some of the larger apple producing countries, Serbian production is increasing. In 2019, almost 500,000 tonnes of apples were harvested, twice the volume of 7 years earlier. Besides a number of local apple varieties, producers also follow the global trends with the cultivation of varieties such as Gala, Fuji, Golden Delicious, Granny Smith, Idared, Jonathan, Red Delicious and Jonagold. Serbia is also a substantial producer of organic apples.

The country is becoming a stronger competitor for other exporters in the region, such as Moldova, North Macedonia and Ukraine. These countries are all strategically based near Eastern Europe, where Serbia has had the most success with exports to Hungary and to Romania and the UK as growing destinations. But other EU importers have also shown interest. Recently, the Dutch Staay Food Group has started to source apples in Serbia, helping it to arrange a year-round supply of Granny Smith apples and become a more attractive supplier to its clients.

Quality produce is an important key for these countries to enter the European market, something that more and more producers in the east have come to understand.

Tips:

- Work together with sector organisations and breeding companies. As a supply country, it is crucial to develop the apple sector and build a strong reputation to get the attention of major buying groups.

- Evaluate your opportunities in Europe and the rest of the world annually. Experienced apple traders and news updates (for example, on FreshPlaza) are the best sources. Every year is different, depending on the production volume and stocks in Europe and the apple quality in the main competing countries. The best period to supply apples from outside Europe will likely be from May to July. But there can also be specific opportunities throughout the year. Meanwhile, do not underestimate the importance of your local market and other export destinations other than Europe.

- Use advanced storage methods to keep your apples fresh and extend your supply season. Asses the best method for your apples and local circumstances, for example, Ultra Low Oxygen (ULO), Controlled Atmosphere (CA), Temperature control, Dynamic Control System (DCS) or the use of 1-MCP such as in SmartFresh technology.

Which companies are you competing with?

Strong competitors often cooperate with leading fruit companies or have integrated their business with other growers, apple breeders and professional apple marketeers.

Exportadora Magna Trading – Chile

Chile has a dominant role in the counter-seasonal supply to Europe with several large, professional growers. In Chile, 1 of the largest apple and pear growers is Exportadora Magna Trading S.A. This company integrated 2 producers with 1,800 ha of fruit production and has its own certified packing and export facilities. It grows popular apple varieties such as Royal Gala and Fuji, as well as the club varieties Kanzi and Pink Lady, in combination with other pip and stone fruits.

Its size and level of organisation enables it to supply large retailers through partners in Europe such as Total Produce. Total Produce has also announced a merger with Dole, the largest apple exporter in Chile. This makes Magna Trading a major competitor on the European market for apples from the southern hemisphere.

T&G Global – New Zealand

T&G Global is the largest fruit exporter of New Zealand and owner of the apple brands Envy and Jazz. The company focuses on the best apple genetics and building premium brands. Because of its merger with Enzafruit, it can market its high-quality apples through its own sales office in Belgium. This local presence gives it direct access to the European market.

The company T&G Global has positioned itself as a premium supplier with the ability to differentiate with the local marketing of its own apple brands. This gives T&G Global an advantage over most counter-seasonal exporters to Europe.

Copa – Serbia

Copa is a newly founded cooperative created by merging Južni Banat and ATOS FRUCTUM, 2 Serbian apple producers.

It combines 400 ha of orchards with production of 40,000 tonnes of apples per year, including 8 different apple varieties: Gala, Golden Delicious, Red Delicious, Granny Smith, Red Jonaprince, Braeburn, Fuji and Idared. The company also has its own nursery, sorting line and storage.

It is an example of how cooperation has been used to scale up and find synergy in the apple business. This strategy has worked to reach different markets such as France, Germany, Austria, the United Kingdom and the Netherlands.

Tips:

- Clearly define your strengths as a company and your competitive advantage before entering the European market. You can differentiate on different levels, distance to the market, services, varieties and quality.

- Invest in quality production and apple varieties. Look for strategic partnerships with apple breeding companies and large fruit companies.

Which products are you competing with?

Apples are 1 of the biggest categories in the fruit assortment and a standard product for every fresh fruit retailer. The main competition for apples comes from within the product group with the development of new varieties. The communication towards consumers concerning taste and other apple characteristics is important.

Popular apple cultivars are soft but crisp, with a colourful skin and a sweet flavour, which is sometimes slightly sour. Other desirable qualities in commercial apple breeding are absence of russeting, ease of shipping, good storage ability, high yields and disease resistance.

Apples that are imported throughout the European summer may experience competition with local, seasonal fruits such as stone fruits and strawberries. Consumers generally prefer fresh fruit that is in season, instead of imported apples or apples from long storage. Nevertheless, apples remain an important product all year long, and imported apples will continue to be in demand.

Tip:

- Check the Seasonal calendar for fruits and vegetables for Western/Northern Europe to see when different fruits are in season and which fruits will compete with your apples.

4. What are the prices for apples?

Prices for apples depend mainly on their availability and marketing value. When the supply is large in autumn, prices are under pressure. During this time, you can expect supermarkets to sell higher volumes with more promotions. At the end of the season, usually after April, apple stocks decrease and prices go up. In this period, there is more room for imported apples, which tend to be slightly more expensive than locally produced apples.

Recent price developments

In general, there is an ample availability of fresh apples, and prices are often under pressure. However, recent prices have been 20 to 30% higher than in previous years. The COVID-19 pandemic has boosted the demand for apples, while the apple stocks in 2020 were lower than usual (especially in Poland, 1 of the leading apple producers in Europe). The higher prices continued in 2021 and may stay high due to severe frost in springtime.

European versus imported apple prices

European production prices per 100 kg in 2020-2021 varied from €40 in Poland (including apples for processing) to as high as €125 in France. In wholesale channels, these apples were sold for between €100 and €250. The value of imported apples generally varies between €100 and €150 per 100 kg and reaches slightly higher wholesale prices in Europe of between €130 and €270. Importers generally maintain a profit margin of around 8% of the wholesale price, excluding handling costs.

Apple varieties and prices

Branded apples get the highest return. Common varieties such as Golden Delicious, Gala and Granny Smith fetch prices of between €100 and €150 per 100 kg on the wholesale market. Jazz, Kanzi and Pink Lady easily go for more than €200 per 100 kg. This means that retail prices also vary a lot, from €1.50 per kilo (sold in bags of 1.5-2 kg) up to €4.50 per kilo (for a 4-pack of club varieties). Retail prices for organic apples vary between €3.00 and €5,50 per kilo (wholesale approximately €2.00 to €2.50).

Table 4: Indicative prices for apples in Europe, in euros per 100 kilos

| Price (euro per 100 kg) | 2020-2021 | 5-year average | |

| Grower (European apples) | 40-125 | 78-80 | 60-65 |

| Import (non-European apples) | 100-150 | 100-150 | n/a |

| Wholesale (EU/non-EU) | 80-240 (EU) 140-270 (non-EU) | 100-250 (EU) 130-270 (non-EU) | n/a |

| Retail | 165-445 | n/a | n/a |

Based on various sources

Tip:

- Follow price developments through various websites with available information, such as the European Commission Pip fruit statistics, the wholesale prices via the German Federal Office for Agriculture and Food (in German: apple = äpfel) and the French Agrimer network of market news (in French: apple = pomme).

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research