The European market potential for apples

Although apples are mass-produced in Europe and can be stored for a long time, there is always a window of opportunity for imported apples, especially in the off-season. Germany and the UK are the main markets, but you can also find opportunities in countries such as Sweden and Romania, which have a high dependence on imports as well.

Contents of this page

1. Product description

Apples (scientific name: Malus Domestica) are 1 of the most consumed fruits in Europe. Commercially, there is a distinction between dessert apples (table apples) and cider apples (cooking or sour apples for processing). More than 80% of the fresh apples are destined for fresh consumption.

Figure 1: Apple types and Harmonized System (HS) code

Source: Images (from left to right):

Photo by © Dllu, (CC BY-SA 4.0), via Wikimedia Commons

Photo by © Silverije, (CC BY-SA 4.0), via Wikimedia Commons

Photo by © Superbass, (CC BY-SA 4.0), via Wikimedia Commons

There are more than 7,500 known cultivars (cultivated varieties) of apples, but only a few have a large market share in Europe. The most common apple groups are Golden Delicious, Idared, Jonagold and Gala, which make up almost 45% of the production area of dessert apples in Europe.

There are also several hybrids and licensed cultivars, including apple brands such as Kanzi (Breaburn x Gala), Pink Lady, Jazz, SweeTango (new) and Junami, that only specially selected orchards can cultivate. Certain traditional production regions have protected their apple quality with a protected designation of origin (PDO), such as the Golden Delicious, Red Delicious and Renetta Canada from the Non Valley in Italy and the Golden Delicious apples from Limousin in France. Other typical local varieties can be found on TasteAtlas’ European apples and its interactive map.

2. What makes Europe an interesting market for apples?

Apples are a major consumed fruit in Europe, and further growth can be expected. The market requires year-round availability, so there will always be off-season demand. Production volumes and remaining stock in Europe are important data to plan your export.

Apples remain strong as 1 of the most consumed fruits in Europe

Apples are the second-most popular fruit for consumption in Europe, after bananas, according to a survey result published on Freshplaza. They are also 1 of the main categories in the retail fruit shelves. The consumption of apples is expected to remain strong in both the short and long term.

The COVID-19 pandemic has increased the demand for local, less perishable fruits. As a result, sales of apples have increased and a larger share of domestic production is destined for fresh consumption. Demand will remain strong after 2020/2021 with an expected consumption level of 15.4 kg of fresh apples per capita. This is 11% higher than the last 5-year average.

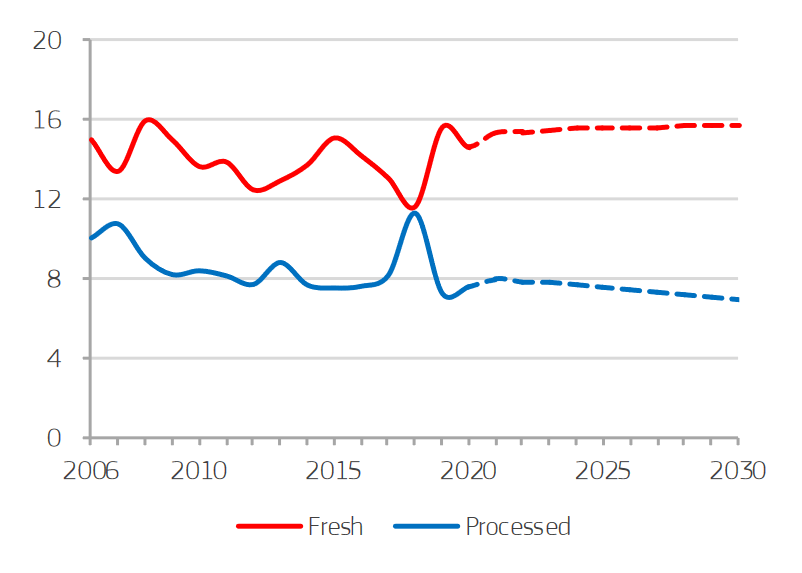

In the long term, apple consumption per capita is expected to increase to 15.7 kg in 2030 (see Figure 2), which is 1 kg more than in 2019, according to the EU agricultural outlook for markets, income and environment, 2020-2030. Competitive pricing will help maintain a strong position for apples in the fruit sector. In all main producing countries, higher consumption is anticipated, mainly from domestic production, but with a potential increasing dependence on import.

Figure 3: EU apple consumption (kg per capita of fresh equivalent)

Source: EC (2020), EU agricultural outlook for markets, income and environment, 2020-2030. European Commission, DG Agriculture and Rural Development, Brussels

Always a need for counter-seasonal import

Production fluctuates, but there will always be demand for non-European apples. Apples are among the 5 most traded fruits in Europe with a total trade value of €2,270 million in 2020. Most of this trade concerns European apples. A value of just over €600 million was imported from non-European countries, mainly counter seasonal from the southern hemisphere.

In most years, Europe has a positive trade balance, meaning the European apple export is higher than the import. Still, there is a stable need for imported apples, depending on the European harvest and stocks. If stored well, apples can be kept for months before being put on the market. But there is always a gap to fill.

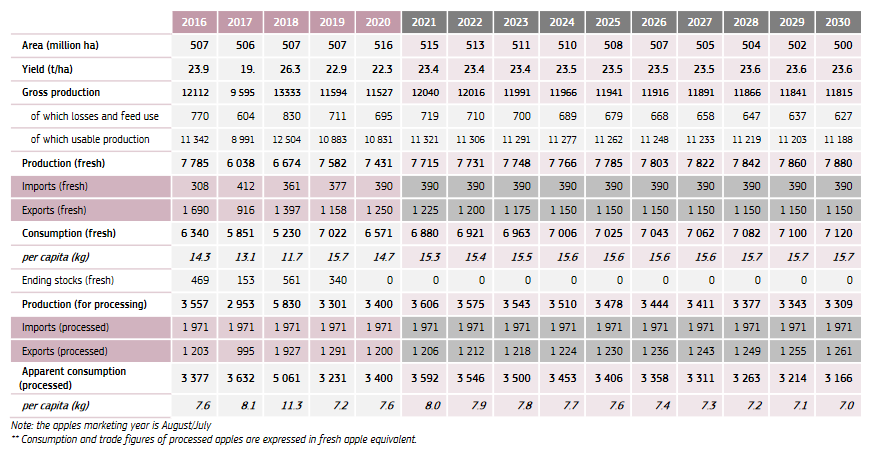

Low production or stock can increase opportunities

The production volume in the European Union was 11.5 million tonnes in 2020 (12 million if you include the UK). Nearly 70% was destined for fresh consumption. Despite a shrinking production area, EU apple production is expected to remain stable thanks to increasing yields. EU imports of fresh apples should also remain stable because of EU demand in the summer months and the need to ensure year-round availability. The best time to supply to Europe is between May and July.

Apple stocks are important data to measure the potential on EU markets. For example, European production was exceptionally high in 2018. This led to less import in 2019 due to high remaining stocks. In March 2021, Europe had 2.7 million tonnes in stock, about 12% less than in the peak year 2019. The World Apple and Pear Association provides overviews of apple and pear stocks in the northern hemisphere. It is also important to look at different apple varieties, as specific stocks and prices may vary.

Figure 5: EU apples market balance (1000 tonnes fresh equivalent)

Source: EC (2020), EU agricultural outlook for markets, income and environment, 2020-2030. European Commission, DG Agriculture and Rural Development, Brussels.

Changing production and local focus create opportunities for import

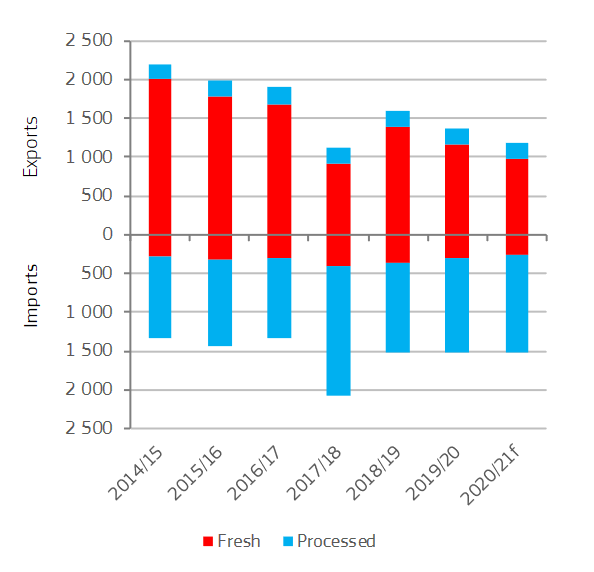

Stronger domestic consumption and the expected stabilisation of production could change some of the trade dynamics and provide opportunities for non-European suppliers.

Local production plays an important role in consumers’ apple demand, but volumes are expected to stabilise. Farmers in Europe will keep improving their yields with better varieties, but the decrease in agricultural area and incentives for organic production will hamper further growth. Poland and Hungary will grow in importance in the European markets in the coming years, while production will decrease in other countries, including France and Germany, but also Italy, a major apple producer.

While producing countries will prioritise fulfilling the growing consumption in their own local market, other markets with less production will face more difficulties in sourcing apples within Europe. This creates an opportunity for non-European suppliers to sell their apples in markets with large net apple imports, such as Germany, the United Kingdom and the Scandinavian countries, as well as Romania, Spain and Ireland.

Because more European apples are expected to be sold for fresh consumption, part of the opportunity for non-European suppliers will be in the apple processing industry.

Figure 6: EU trade of fresh and processed apples (1000 tonnes of fresh equivalent)

Source: EC (2021), Short-term outlook for EU agricultural markets in 2021. European Commission, DG Agriculture and Rural Development, Brussels

Tips:

- Follow the development of the apple stocks in the northern hemisphere via the World Apple and Pear Association (WAPA) and plan your export.

- Learn about the long-term perspective in Europe by analysing the statistics on pip fruit production, prices and trade on the European Commission’s website.

3. Which European countries offer most opportunities for apples?

Germany and the United Kingdom have the largest demand for imported apples. The Netherlands and Belgium are also among the main importers, but with a much higher export/re-export. Most non-European import is counter seasonal. In France, consumption is mainly driven by local production.

For suppliers outside of Europe, it can be interesting to monitor markets such as Romania and Sweden. These countries have a relatively high net import value.

Germany: growing net importer

According to industry sources, German apple consumption is increasing. According to traders, Germany is becoming more self-sufficient, but in trade statistics, there is no clear proof of this. The fact remains that German production is not sufficient to fulfil demand. This makes Germany 1 of the main importers of apples in Europe.

In 2020, Germany produced 973,000 tonnes of apples, and approximately 70% was destined for fresh consumption. Domestic varieties such as Elstar, Delbare and Jonagold dominate the German market, although these traditional varieties are making place for newer varieties such as Red Jonaprince. German traders had to fill a gap of €521 million (import value minus export). The net import may be increasing over the next few years. However, it is important to note that apples are already overpromoted and represent a disproportionate share on the retail shelves compared to sales and the margin. A way to differentiate is by supplying organic apples, as Germany is 1 of the countries with the highest consumption of organic fruit.

During the European season, there is supply from (1) Italy, in particular South Tyrol with apple varieties such as Royal Gala, Golden Delicious and Granny Smith, (2) Poland, Europe’s largest apple producer, and (3) the Netherlands. France is another main supplier to Germany, but its share is expected to decrease, leaving more opportunities for other suppliers.

A total of €132 million came from outside of Europe, with Chile, New Zealand and South Africa as the leading supply countries. Only very limited amounts, often up to a few 100 tonnes, are imported from countries with a similar production season such as Serbia, Turkey and North Macedonia.

United Kingdom: highest import value from non-European sources

The United Kingdom has the largest import from non-European countries. With limited national production and in the post-Brexit market, the demand for overseas apples will continue.

The United Kingdom is an important end market for dessert apples. 80% of the apples are sold through supermarkets. In the new post-Brexit situation, import from mainland Europe requires more paperwork. The UK market will have to rely more on its own cultivation, but there could be a growing potential for non-European import as well.

There is growing production of British apples and extended availability through investments in productive orchards, pack houses and advanced cold storage. But the total production is not sufficient to meet the entire demand. Only around 40% of apple production are dessert apples: between 166,000 and 207,000 tonnes in 2019 according to different sources.

Gala is a very popular variety (74,600 tonnes in 2019), followed by Breaburn (32,000 tonnes), Bramley (14,800 tonnes) and Cox (13,500 tonnes). According to Freshplaza Club, varieties such as Jazz, Cameo, Junami, Rubens, Evelina and Opal also account for an increasingly important share of national production. On the website of British Apples & Pears, you can see which apples are in season. This website also claims that British apples in supermarkets are accredited under the local Red Tractor Scheme with strict sustainability guidelines, and the industry also works together with the Ethical Trading Initiative (ETI). For external suppliers, it is important to match these strict guidelines with available standards such as ETI, SMETA or GRASP.

In 2020, the United Kingdom imported €378 million worth of apples, of which at least €167 million with non-European origin. France is the largest supplier from Europe, but its export to the UK is decreasing. This provides potential for other producing countries nearby but also, for example, for Serbia, which increased its apple trade with the UK from a few dozen tonnes to almost 4,800 tonnes. The largest non-EU supplier is South Africa, followed by 2 other counter-seasonal producers, New Zealand and Chile.

The Netherlands: combination of trade and production

The Netherlands, similar to Belgium, has an apple market that combines local production with high import and high export. The high import value makes the country an ideal trade hub for non-European producers.

In the local Dutch market, Elstar and Jonagold are the most produced and stocked apples, but club varieties such as the Kanzi apple are also increasing in demand. Recently, in November 2020, the largest supermarket chain Albert Heijn announced it would add the new variety ‘Sprank’ together with apple supplier Vogelaar Vredehof. This apple is sweet, crisp and juicy, has been adjusted to Dutch preferences and should grow to a volume of 4,000 tonnes in the future.

With a relatively stable production of 273,000 tonnes, it can supply a large part of the national demand. Still, the trade in foreign apples is 1 of the greatest in Europe. In the European season, there is additional supply mainly from Belgium and France. In the opposite season, especially Chile and New Zealand take advantage of the Dutch trade potential. Dutch traders purchased almost €271 million in fresh apples in 2020, and nearly 50% of this was non-EU supply.

The Netherlands is expected to remain an important hub for apples, but the import volume depends on local and regional production and therefore fluctuates significantly.

France: high consumption with preference for local

France is a strong producer and consumer of apples. French consumers have a strong preference for local apples, but the high demand provides opportunities to supply apples during the off-season.

France is the third-largest dessert apple producer in Europe, reaching almost 1.4 million tonnes in 2019. With nearly 25 kg per capita, apple consumption in France is far above the European average of 15.4 kg. Traditionally popular varieties are Golden Delicious and Granny Smith, but there is also a growing volume of Gala and Cripps Pink apples. The preference for local apples goes hand in hand with increasing production of organic apples. More and more apples will be destined for fresh consumption, creating a possible shortage of processing apples.

France has always been a significant apple exporter. However, both import and export have slightly declined over the past few years. Due to increased domestic consumption, the export is expected to decline further over the next 10 years. The re-positioning of France in the apple trade could increase opportunities in countries where France has been a major apple supplier, such as the UK, Germany and Spain. The extreme cold weather in the spring of 2021 has further reduced the availability of French apples in the market.

Sweden: depends on imported apples

Sweden, as well as the rest of Scandinavia, is highly dependent on the import of apples. Although Sweden is not among the largest importing countries, the unequal trade balance can be interesting for foreign suppliers.

Sweden has barely any export of apples, and the total import value of €89 million in 2020 is higher than that of most other European countries. Without substantial domestic production, the import of apples is relatively stable. Nearly 80% of the consumed apples are imported. Most apples are supplied by other European countries, but there is also off-season import, mainly from Chile and New Zealand, as well as growing import from Ukraine.

Romania: potential market for eastern supply

Romania is another country with a relatively large need for external supply. Unlike Western European countries, it specifically offers a market for eastern suppliers.

Romania had production of 493,000 tonnes in 2019, but its export is minimal. The market is large enough for additional supply. In 2020, Romania imported 95,500 tonnes of apples. Most apples were imported from Poland (56,500 tonnes), but there is also supply from further east, such as North Macedonia (9,000 tonnes), Serbia (5,000 tonnes) and Moldova (>1,000 tonnes, fluctuating). On the other hand, Romania imports very few counter-seasonal apples from the southern hemisphere.

Traditionally, there is a preference for red apple varieties such as Gala, Fuji, Red Delicious and Florina. Suppliers will have the best opportunities if they are nearby, so they can keep the costs low.

Tips:

- Stay informed about the latest updates in the European apple markets through news items on Freshplaza and its regular overview of the global apple market, East Fruit, Eurofruit, FreshFruitPortal and the Prognosfruit conference and its archives.

- Adjust your target country according to your location and apple cultivars.

4. Which trends offer opportunities or pose threats on the European apple market?

A general promotion of fruit consumption will be a positive driver for apples. The most significant trends are a focus on health, organic and local apples. Meanwhile, new varieties and club cultivars are increasing and help to differentiate in the apple market.

Health awareness and promotion encourage apple consumption

A growing awareness of the importance of a healthier diet is 1 of the main drivers for fruit consumption. The COVID-19 pandemic has given an extra boost to the fruit demand, especially for common, preservable fruit such as apples. Apples are a very common and affordable fruit that appeals to a lot of consumers in Europe. They are considered an ideal fruit as a healthy snack and to give children at school. Being such a common fruit, apples are a very suitable product to promote.

Both public policies and sector organisations such as Freshfel Europe, the European Fresh Produce Association, aim to encourage the consumption of fresh fruit and vegetables. There is an annual EU school scheme budget up to €150 million to promote fruit and vegetables at schools, and 1 of the priorities of Freshfel Europe for 2019-2024 is to get European consumption of fresh fruit and vegetables up to the WHO recommended minimum of 400 g a day.

The year 2021 is the International Year of Fruits and Vegetables (IYFV). This will give an additional impulse to promoting fruit consumption, in particular for fruits that are also common in European cultivation, such as apples. Non-European suppliers of apples can benefit from these promotional efforts too.

“Awareness of the potential benefits of adopting a diet rich in fruit and vegetables, as well as public initiatives to promote their consumption, might also contribute to growing consumption of apples.”

Source: EC (2020), EU agricultural outlook for markets, income and environment, 2020-2030. European Commission, DG Agriculture and Rural Development, Brussels.

Tip:

- See what other opportunities you can find in the general trends in the fresh fruit and vegetable sector in the CBI trend report.

Focus on local and organic apples

According to industry sources, the apple market is becoming more nationalistic. A preference for local apples has started to emerge. This is often triggered by increasing consciousness of the local economy and sustainability and in combination with organic production and better tasting club varieties.

The preference for local apples is strong in France, but a similar trend has also been noticed in Germany. The focus on local apples will likely result in a decline in export from EU countries. The valuation/revaluation of local production and apple varieties will also provide room for more organic cultivation.

In the case of French apple production, the share in organic area has increased from 20% in 2017 to 28% in 2019. In Italy, 1 of the main apple producers, the organic share has increased from 10% to 14% in the same period. The European Commission expects that the increase in organic production will hamper the yields, and thus also the overall production. Although the preference for locally grown products is not good news for apple exporters, the slowdown in production may still provide an opportunity to fill the gaps.

Tip:

- Follow the development of organic production in Europe on Research Institute of Organic Agriculture (FiBL) and read the CBI report on what you must do to enter the European apple market in the organic segment.

Growing market share for club varieties

Apples are 1 of the main fruit categories, and you can find many varieties on the supermarket shelves. Your apple variety is important when finding your place on the European market. Think about differences in taste, productiveness and shelf life.

In the last decade, especially the past 3 years, the market share of new varieties has increased. Some producers are trademarking these newer varieties as brands and sell licenses to other growers, turning them into ‘club’ or ‘managed’ varieties.

Premium lines of club apples are important for retailers to differentiate. Also, they can be lucrative for growers, as their price can be significantly higher. A great advantage of a club variety, besides greater attention for quality and marketing, is the control of production volume. This way, supply and demand are better matched with a stable price for the grower. Specific club varieties such as ‘Pink Lady’ (Cripps Pink variety), Jazz, Envy and Kanzi have experienced a strong growth (see stock volumes in Figure 8) and have become some of the biggest brands.

However, with dozens of breeding programmes around the world, the chance for a big success in branding apples has become narrower. The bulk of the apple sales still consists of open or ‘free’ varieties, such as Golden Delicious and Gala. Gala apples are a safe choice, because they are 1 of the most widely grown apples, with a pleasant flavour and good keeping qualities. Other growers opt for other ‘free’ cultivars, such as Pinova, a high-yielding variety which is commonly produced in Northern Italy. The relatively new Red Jonaprince variety has also done well since it became a ‘free’ variety in 2006 (the ‘Red Prince’ brand is still protected).

Successful apple growers often combine different cultivars to widen their market potential and extend their supply season. Combinations of open and club varieties are also common. For example, the company Exportadora Magna Trading S.A. in Chile offers Kanzi and Pink Lady apples as well as main varieties such as Royal Gala and Granny Smith. This allows it to work with some of the largest fruit companies in Europe, such as TotalProduce.

* Other new varieties: Ariane, Belgica, Cameo, Diwa, Greenstar, Goldrush, Honey Crunch, Jazz, Junami, Kanzi, Mairac, Rubens, Tentation (temptation), Wellant, ...

Tip:

- Read about the pros and cons of club varieties on FreshFruitPortal. Whatever your apple choices are, try to be innovative and listen to what the market wants. The best way to select new apple varieties is by working closely together with large buyers and retailers.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research