Entering the European market for aubergine

When looking for opportunities on the European aubergine market, differentiation will be your main objective. Distant suppliers such as Kenya, Mexico and Thailand can achieve this by supplying niche varieties and finding specialised buyers. Other countries such as Turkey and Morocco mainly compete on price and export during the winter in Europe. In both cases your product quality must be spotless.

Contents of this page

1. What requirements must aubergines comply with to be allowed on the European market?

Fresh aubergines must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use the Trade Helpdesk that provides an overview of export requirements for aubergines (code 07093000).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid damaging consumer health and the environment, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Fresh aubergines containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

For the Dominican Republic there is an increased frequency for pesticide checks. European Regulation 2019/1793 states that 20% of the imported aubergines from the Dominican Republic must be checked for pesticides.

Note that retailers in several Member States, including the United Kingdom, Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation.

Tips:

- Find out the MRLs that are relevant for aubergines by consulting the EU MRL database in which all harmonised MRLs can be found. You can search on your product (“aubergines/eggplants”) or pesticide used. The database shows the list of the MRLs associated to your product or pesticide.

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that contamination of lead in aubergine remains below 0.10 mg/kg and cadmium below 0.050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

In December 2019, the new European regulation for the trade in plants and plant products from non-EU countries came into force. This regulation requires aubergines to have a phytosanitary certificate before being brought into the European Union, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072

At least until June 2021 the phytosanitary certificate on aubergines must ensure full traceability and include an additional declaration that they are free from specific pests such as:

- Spodoptera frugiperda

- Keiferia lycopersicella (Walsingham)

- Neoleucinodes elegantalis (Guenée)

- Thrips palmi Karny

Tips:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

- Read which additional declaration is needed on the phytosanitary certificate for aubergine in the document of the Dutch food safety authority NVWA.

Maintain high quality standards

The marketing standard for fresh aubergine is described in:

- The UNECE Standard FFV-05 concerning the marketing and commercial quality control of Aubergines

- The FAO Standard for Aubergines in the Codex Alimentarius

These marketing standards describe the minimum requirements for aubergines (see table 1). Europe almost exclusively requires class I aubergine as a minimum. Aubergine in this class must be of good quality and within the permissible tolerances.

The development and condition of the aubergines must be of a level that enables them to withstand transportation and handling and to arrive in satisfactory condition at the place of destination.

Table 1: General quality requirements and permissible tolerances for aubergines

General quality requirements (all classes) |

|

|

|

|

|

|

|

|

|

|

|

permissible tolerances for class I aubergines |

|

|

|

|

|

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

Check on product size uniformity

Size is determined by either:

- the maximum diameter, or

- weight, or

- count

Uniformity in size is compulsory for Extra Class and Class I aubergines. To ensure uniformity, you must follow a maximum deviation in size between aubergines in the same package (see: table 2).

Table 2: Maximum deviation in size for aubergines

| (a) For sizing by diameter | (b) For sizing by weight | (c) For sizing by count |

|

|

|

Use protective packaging

The boxes containing aubergines in bulk are usually arranged in layers and may include mulching materials to prevent rubbing. For regular aubergine varieties 5kg boxes are common. The number of units varies depending on the size. Fresh aubergines are often pre-packed individually to preserve shelf life:

- Stretchable plastic wrapping

- Plastic bags with breathing holes or flow pack (with or without tray)

Image 1: Example of aubergine in a perforated flow pack

Maintain temperature during product handling

During transport, your products should not be exposed to temperatures below 10 degrees Celsius, because this may damage your aubergines. For non-European supply airfreight is often necessary to guarantee sufficient shelf life after arrival.

Tips:

- Always discuss the specific requirements for size and packaging with your buyer.

- Study the proper post-harvest practices and handling for fresh aubergines on Frutas-hortilizas.com and cargohandbook.com, or the vegetable produce facts of the postharvest center of the University of California.

- Make sure your aubergines are well-preserved to ensure optimal freshness and taste. Supply chain logistics should not affect the product taste in any significant way.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh aubergines are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are also highly recommended.

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

Retailers can also impose their individual standards, such as Tesco Nurture. Especially larger retail chains in Northern Europe are more prepared to buy your product if your compliance to social and sustainability standards is in order.

Tips:

- Implement at least one environmental and one social standard. See the Basket of Standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

- For other additional requirements such as payment and delivery terms, see the CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

Organic certification can be an interesting way to set your aubergines apart and market them at a higher value. The demand for organic vegetables is growing, although it is mainly fulfilled by European growers.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that the new Regulation (EU) 2018/848 will come into force in January 2021. You must use sustainable and organic production methods and apply for an organic certificate with an accredited certifier.

Tips:

- Strive for residue-free aubergines, and certify your production as organic if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the actual list of control bodies and authorities to see which certifiers are active in your region.

2. Through what channels can you get aubergines on the European market?

The aubergine market is divided in common and more specific aubergine varieties. Foreign suppliers have the option to market common aubergines through service providers to general retailers, or use specialised import channels to sell less common or exotic varieties.

How is the end-market segmented?

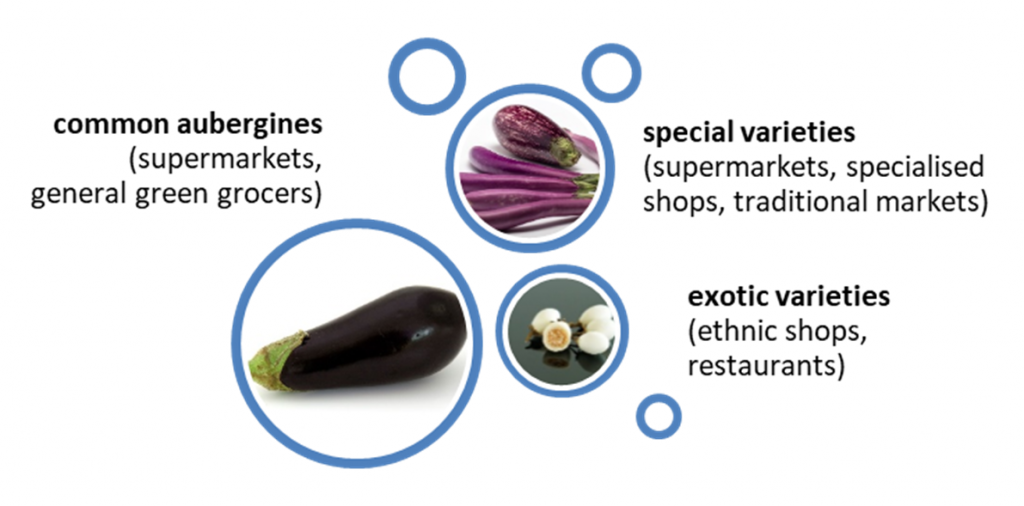

The demand for aubergines is divided in traditional and niche segments. Each segment contains typical varieties and channels (see figure 1).

Figure 1: Market segments for aubergines

Most traditionally sold aubergines are dark purple or black aubergines, either round or long oval shaped. This is the most common variety and the one that is best known among consumers. These common aubergines represent the main segment in general grocery shops and supermarkets.

The niche segments include more specific and exotic aubergine varieties. The graffiti aubergine and Japanese aubergine are sometimes available in general supermarkets, especially in southern European markets. The most exotic varieties, such as white or Thai aubergine, are mainly sold in the gastronomic sector, specialised shops or by retailers of ethnic products.

Tip:

- Adjust your focus according to the segment you are selling to. The more specific your variety the better it will suit a specialised gastronomic or ethnic segment. Prioritise taste and uniqueness for gastronomic use. Focus on appearance and uniformity for common aubergines.

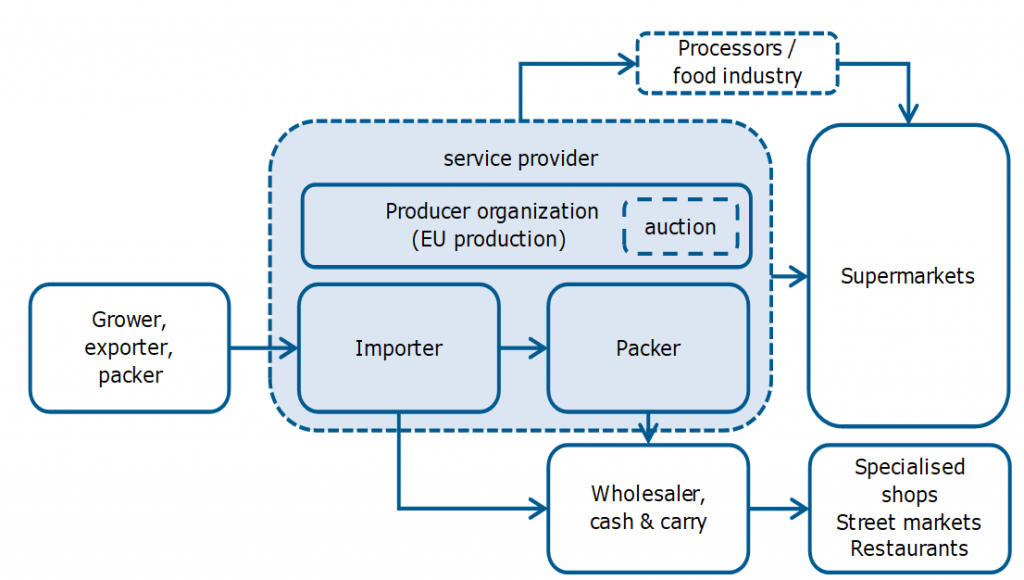

Through what channels does a product end up on the end-market?

Service providers and producer organisations (cooperatives) have an important role in the distribution of fresh aubergines. They are the link with growers and provide packing and logistical solutions. Importers are responsible for additional volumes of aubergines when regional supply is low, and fulfilling the minor demand for special or exotic varieties.

Figure 2: European market channels for fresh aubergines

Producer organisations supply a mayor share

Europe has a relatively large production of aubergines and growers are often organised in cooperatives or producer organisations. Producer organisations such as BelOrta (Belgium), Hortamar (Spain), the Greenery (Netherlands) and Purple Pride (Netherlands) form a connection between production and the demand from retailers, food services and the food industry. Part of the local produce is still sold through an auction system.

Purple Pride is the largest grower association in Northwest Europe that specialises in aubergines. The company has an annual harvest of over 27 thousand tonnes. Some producer organisations also import aubergines. For example, BelOrta trades Turkish aubergines in addition to the 14 thousand tonnes of their own local Flandria brand, and ZON fruit & vegetables imports aubergines from partner cooperatives in Spain during the winter months.

Service providers provide access to supermarkets

Successful suppliers to supermarkets often position themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to packing, repacking and branding. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider requires.

Supermarkets are an important channel for aubergines. They usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency in their supply chain.

Most producer organisations or cooperatives (see above) have turned into service providers. They provide complete services to retailers. For example, The Greenery is officially owned by the cooperative Coforta, packing and supplying aubergines to supermarkets as well as wholesalers, the food industry and catering companies year-round.

Importers focus on additional supply and niche varieties

Several exotic or ethnic vegetable specialists import aubergines from non-European countries. These imports generally include specific or niche varieties, such as mini-aubergines.

For example, Nature’s Pride, Wealmoor and Asia GmbH are specialists in exotics. Nature’s Pride imports mini aubergines from South Africa. The German company Asia GmbH imports mini aubergines from Spain but also from Jordan. Wealmoor has a long standing relation with suppliers in Kenya, which is the UK’s principle source of non-European (mini-)aubergines.

Importers of ethnic vegetables include Amar Import & Export and Belimpex (Netherlands) that imports the Surinam Antroewa aubergine, for example, which is an African white variety. Thai Fruit Imports (UK) commercialises aubergines from Thailand, a country that offers various different aubergine varieties. Many of these niche varieties end up in the gastronomic channels as well as ethnic food shops or greengrocers.

Table 3: Examples of importers of non-European aubergines

| Importer | description | products | origin |

| Nature’s Pride (Netherlands) | Specialist in exotics | Mini aubergines | South Africa |

| Wealmoor (UK) | Specialist in exotics | General fruit and vegetables (incl. off-season and exotic) | Kenya |

| Asia Import & Export GmbH (Germany) | Specialist in exotics | Mini aubergines | Jordan |

| Thai Fruit Imports (UK) | Specialist in Asian produce | Thai aubergine | Thailand |

| Belimpex (Netherlands) | Specialist in ethnic vegetables | Surinam aubergine (bhata) White aubergine (antroewa) Thai and Chinese aubergine | Surinam, Thailand |

| Amar Import & Export (Netherlands) | Specialist in ethnic vegetables | white African aubergine (antroewa) | Suriname |

Wholesalers (spot market)

Wholesalers often supply smaller quantities of fresh aubergines to secondary channels such as hospitality and food services, specialised fruit retailers and street markets. Some wholesalers also import aubergines, but most of them mainly handle local produce and products supplied by importers. Without a retail programme they only cover the spot market, moving with the fluctuations of the trade. Typical wholesale markets include Rungis in Paris and New Spitalfields market in London.

Tip:

- Use the major market channels of service providers and grower cooperatives when you are offering larger volumes of regular aubergines. Their retail programmes and supply contracts may provide some stability, but remember that supermarkets maintain strict rules and do not allow you or your buyer to change supply conditions.

What is the most interesting channel for you?

The best channels to market your aubergines in Europe depend on your product and competitive advantage.

Most aubergines find their way to consumers through producer organisations and service providers in fresh products. The majority of these aubergines are common aubergine varieties. If you are able to grow aubergines professionally and compete on a similar quality and price level, you can try to find a form of cooperation with these companies. Suppliers that are best positioned to fill in this role are well-organised growers in countries close to Europe, such as Turkey, Morocco and Egypt.

When you are supplying a niche product or exotic variety, there is more margin for air freight cost and aubergines can come from further away. For exotic aubergine varieties, you can best approach specialised importers.

Tip:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

3. What competition do you face on the European aubergine market?

Aubergines are widely available throughout the year, mainly from regional cultivation but also from non-European producers. Most non-European supply slows down during the summer months when European production is at its peak. Distant suppliers often compete in specific (air freighted) aubergine varieties.

Which countries are you competing with?

Turkey is a strong competitor due to its competitive prices and short distance to the European market. Other significant exporters include Kenya, Mexico, Thailand, Uganda and the Dominican Republic which supply Chinese, white and mini-aubergines among other special varieties.

Turkey

Aubergines are among the most popular vegetables in Turkey. The country produces almost as many aubergines as the entire European Union. With its competitive prices and its proximity to Europe, Turkey is the main non-European supplier of aubergines.

Turkish exports to Europe are successful as long as quality standards are met and the price is interesting enough for European wholesalers. One of the reasons for the recent growth in export is the Russian ban on Turkish vegetables in 2016-2017. Therefore more aubergines are directed to the European market. Most of the Turkish aubergines go to Germany, where there is also a large Turkish community.

The preliminary data of 2019 in figure 3 are probably inaccurate and should be more similar to the value of 2018, close to 7 million euros. Most exported aubergines from Turkey are long and purple, but Turkey also offers a unique orange tomato-like variety for niche markets.

Kenya

Kenya has a developing horticultural sector. Its higher temperatures allows the country to produce more tropical aubergine varieties, such as the mini-aubergines, locally known as ‘Ravaya’. These mini-aubergines from Kenya are mainly sold in the United Kingdom as a higher valued product, for example by Ocado. Although still a niche product, mini-aubergines are no longer an ethnic specialty and are nowadays sold by several British supermarkets. Because of this Kenya is the largest non-European supplier of aubergines to the United Kingdom, and the second largest supplier to Europe.

Mexico

Mexico mainly supplies aubergines to the United States, but Europe is becoming an alternative market. From nearly zero supply in 2016, Mexican exports to Europe went up to 2.5 million euros in 2019. The main destination was Germany with 1.5 million euros in 2019, followed by the United Kingdom and the Netherlands.

Mexico produces several aubergines varieties, but most likely European import almost exclusively consists of a higher valued aubergine variety such as the Chinese or Indian aubergine. An advantage of Mexico is that it can produce aubergines practically the whole year round by using different producing regions.

Thailand

The aubergine production is very diverse in Thailand, with varieties in all kinds of sizes, shapes and colours. This gives Thailand a unique offer of exotic aubergines ideal for the ethnic food channel and culinary users. Among the varieties Thai growers can offer are small white, green, yellow and pea Thai aubergines.

Switzerland is responsible for almost all aubergine import from Thailand and the demand is stable. Thai aubergines are part of a niche market. There are several countries in Europe besides Switzerland where it can be introduced as a new product, but the total growth potential may be limited.

Uganda

Ugandan aubergine growers compete with Kenyan growers. Their export value to Europe has increased slightly at the expense of Kenyan supply. However, the Daily Monitor reports that the Ugandan government has recently imposed additional costs and inspections, forcing growers to export their produce via Kenya. So competitiveness may be under pressure in the coming period.

Uganda produces mini-aubergines and white aubergines for the export markets. Belgium and the United Kingdom are the most important markets for Ugandan suppliers.

Dominican Republic

Growers in the Dominican Republic cultivate mainly Chinese aubergines for the export. They are among the leading non-European suppliers to Europe. However, over the last five years the country has a declining market share. There is more competition from Mexico, which exports similar aubergine varieties. A potential reason for the Dominican downfall are pesticide residue issues and increased control. France and Germany are main markets with 531 and 237 thousand euros in 2019, but both are declining. The British market has stayed strong with 404 thousand euros of imported aubergines from the Dominican Republic.

Europe

Most aubergines in Europe are supplied by local producers. Italy is the largest with an annual production of over 300 thousand tonnes, most of which is consumed locally. Spain and the Netherlands produce large volumes for export to neighbouring countries, which makes them the main competitors in the aubergine trade. The grow seasons in Spain and the Netherlands are well-attuned to each other. Spain is able to grow aubergines throughout the year, but exports most between October and April. In the Netherlands greenhouse production can extend the season from February to November.

Common purple and black aubergines generally have a wide availability from local production with are of a good quality in colour and size. For suppliers outside the European Union it can be challenging to meet the same standards.

Table 4: Main aubergine producing countries in Europe, in 1000 tonnes

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Italy | 309 | 300 | 318 | 286 | 314 |

| Spain | 208 | 245 | 243 | 226 | 238 |

| Romania | 81 | 81 | 68 | 78 | 88 |

| Greece | 67 | 69 | 70 | 63 | 71 |

| Netherlands | 51 | 53 | 54 | 53 | 55 |

| France | 30 | 31 | 32 | 30 | 32 |

| Bulgaria | 9 | 10 | 8 | 12 | 11 |

| Belgium | 8 | 8 | 8 | 8 | 10 |

Source: Eurostat

Tips:

- Focus on the winter months to supply northern Europe. This is the principle period when supply from European producers is lower and often more expensive due to greenhouse cultivation.

- Differentiate in aubergine variety when supplying Europe from a larger distance and make sure new varieties get adopted. Find a promoter or specialised partner to market your differentiated product.

Which companies are you competing with?

Mertpa Tarum: Competing in service and short distance

Turkish suppliers such as Mertpa Tarum are relatively close to Europe. This gives them an advantage over suppliers that are further away. Mertpa Tarum has different distribution points throughout Turkey and offers a variety of fresh fruits and vegetables. With their own packing facilities and brand they can be competitive in the supply of common aubergines to the European market.

SM Impex: Competing in niche varieties

SM Impex is a privately owned farming and exporting company in Uganda. The company distinguishes itself with specific airfreighted aubergine varieties, such as small white aubergines (Solanaceous aethiopicum), also known as garden eggs. These aubergines are available throughout the year.

One thing that this company seems to understand well is quality and presentation. This is especially important when marketing exotic aubergine varieties. Their focus is on quality and they pride themselves in the rich volcanic soil they use for cultivation. Explaining how farms and out growers are managed contributes to confidence with European buyers. As a result, SM Impex has succeeded in reaching the European market and claims to do business in the United Kingdom, Spain and Italy.

Purple Pride: High-end competition within Europe

Europe remains your main source of competition for aubergines. For example, Dutch grower associations such as Purple Pride specialises in cultivation of aubergines, including some niche varieties such as the “Nasu” and mini-graffiti aubergine. Purple Pride has grown into the leading aubergine brand in Northern Europe.

Forming part of the DOOR cooperative for fruiting vegetable growers, the company counts with market knowledge, advantaged cultivation techniques, optimal breeding varieties and product branding. This makes them a strong competitor, but superior quality and branding comes at a cost. Clients that are not prepared to pay a higher price will divert to more affordable production sources in southern Europe or just outside of Europe.

Tip:

- Make sure your strengths as a company and your competitive advantage are well defined before entering the European market. You can differentiate on different levels, including distance to the market, services, varieties, quality

Which products are you competing with?

Aubergine is a unique vegetable, so there is little competition from other vegetables. For health-conscious consumers aubergines may interact somewhat with vegetables such as beetroot, Brussel sprouts, courgette and broccoli. However, the main competition on product level takes place between different aubergine types and qualities.

For the common aubergines in Europe there are breeding varieties that may perform differently in yield, quality, shape, taste and resistance for diseases. This affects the end-product and its value, thus also its competitiveness. Breeding companies such as Rijkzwaan and Enza Zaden in the Netherlands develop aubergine varieties and hybrids for different markets.

In traditional cuisines the preference for a specific aubergine is often fixed and not replaced by other types. You can expect these specific types to have a stable demand. Several niche or special varieties, such as mini aubergines, could also be promoted by retailers to increase market share. But they are unlikely to become a large-scale product and replace the lower-cost standard aubergines in the market.

Tip:

- Choose the aubergine variety or hybrid that fits you best as a supplier. Do not only consider the market demand, but also your growth climate and local production circumstances. Compare the offer of different local and international seed suppliers.

4. What are the prices for aubergines?

Prices for aubergines depend on the origin (transport, quality, brand), the type (common or niche varieties) and the availability (supply and demand). Be aware that prices for common aubergine and air-freighted specialties cannot be compared to each other.

Common aubergines maintain a wholesale price level that averages at around 1.80 euros per kilo and originate mainly from Europe and its surrounding countries. Prices may vary up to 50% up or down due the factors described above.

According to trade statistics Morocco is increasing its aubergine prices as an emerging supplier, calculating a growth in the export value per kilo of 0.56 euro in 2015 to 1.17 euros in 2019. Turkey has maintained its price value over the past five years, fluctuating between 0.90 and 1.05 euros per kilo.

The earnings for growers may vary significantly between Northern Europe, Southern Europe and nearby suppliers in Turkey and Morocco. The price paid to grower in Morocco and Turkey comes down to 0.25 euros per kilo. In comparison, in 2018 Spanish growers received 0.52 euro per kilo and Dutch growers earned 0.78 euro per kilo (see Hortoinfo for comparable grower prices of 2018). Over the past three years European produce shows a slight decline in prices (see the auction prices on the Dutch website of Groenten & Fruit).

Air freighted varieties from countries such as Kenya, Uganda, Mexico and Thailand, are valued at 2 to 2.5 euros per kilo, according to trade statistics. Mexico is the only country that shows significant growth in value for air-freighted aubergines since 2016, while the value per kilo from African countries show a recent decline.

Retail prices for common aubergines are normally around 3 to 4 euros per kilo. Graffiti aubergines are usually on the higher end, because they are still less common than the common purple or black aubergine. For common aubergines there is often little relation between the fluctuation of supermarket prices and the development of trade prices.

Special varieties are often sold through gastronomic channels or smaller specialised retail. Their final prices go easily up to 10 euros per kilo and beyond depending on the unique quality and variety. The value is driven up by high air freight and small distribution costs.

Table 5: Indicative price breakdown for aubergines in Europe, in euro per kilo

| EU production | Nearby producers of common aubergine (Turkey, Morocco) | Air-freighted aubergines (Kenya, Thailand) | |

| grower | 0.60 | 0.25 | 0.35 |

| transport & packing | 0.30 | 0.50 | 2.00 |

| trader | 0.10 | 0.20 | 0.75 |

| wholesale & distribution | 0.90 | 0.90 | 1.25 |

| retail | 1.50 | 1.50 | 5.50 |

| Consumer price (€ per kilo) | 3.40 | 3.35 | 9.85 |

Tips:

- Find a price history in France on the Market News Network of FranceAgriMer from producers, importers, wholesalers (“gros”) and retail (“détail”).

- Get regular market and price updates from the fruit and vegetables webpage of the Federal Agency for Agriculture and Food (BLE) in Germany (in German). Scroll down to the “Markt- und Preisbericht” (market and price news). The information is available and most extensive in German.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research