The European market potential for aubergine

European consumption of aubergines is most common in oriental and Mediterranean cuisines. But healthy and vegetarian diets also contribute to a gradually increasing demand. The main potential for non-European import and more exotic varieties can be found in Northern European countries such as Germany and the United Kingdom.

Contents of this page

1. Product description

Aubergine or eggplant (scientific name: Solanum melongena) is a vegetable that is typically used in the Mediterranean cuisine. You can find them in stews, oven dishes, Greek moussaka, French ratatouille, but they are also popular on the barbeque or Asian dishes.

Aubergines come in all kinds of colours and shapes, but the purple or black oval shaped aubergine varieties are most common in Europe, probably followed by the Graffiti aubergine. Special or less common cultivars in Europe include for example the African aubergine (Solanum macrocarpon), the orange aubergine (Solanum aethiopicum) and the Asian pea aubergine (Solanum torvum).

The Visual guide of Kitchn food magazine and the Eggplant varieties of The Spruce Eats provide a quick overview with images.

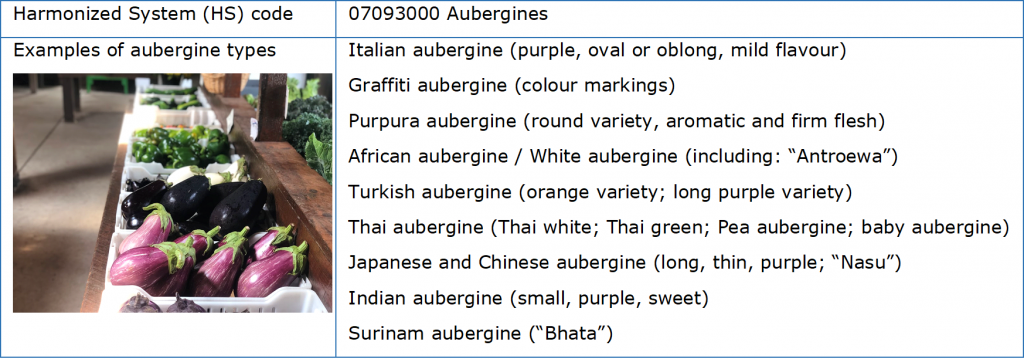

Figure 1: Aubergine types and Harmonized System (HS) code

See also: “Know your eggplants”, a broad overview of aubergine types and varieties by the University of Melbourne

2. What makes Europe an interesting market for aubergine?

Import numbers from non-European countries are low compared to the European production, but ethnic communities and vegetarians have a positive influence on import growth. Bilateral trade relations and ethnic consumption offer opportunities for different varieties and origins of aubergines.

Small, but growing supply from outside Europe

The main supply of aubergines is generated within Europe. Import from non-European countries is relatively small, but steadily growing. This indicates a modest opportunity for suppliers outside Europe.

In total, European countries together imported 280 million euros worth of aubergines in 2019. Trade value and prices fluctuate, but the total volume is stable with some increase in 2018 and 2019. From the 280 million euros, only 26 million euros was imported from non-European countries. Over a period of 5 years (2015-2019) the total trade increased with 7 or 8%, while the import value from non-European suppliers was 44% higher.

For exporters it is important to watch the market and price developments closely and use the right timing for export. Low availability can drive up the price and the demand for imported aubergines.

Aubergines are popular in Oriental and Mediterranean cuisine

Europe is diverse in its ethnicity and food cultures. The demand for imported aubergines often comes from Oriental and Mediterranean buyers. Aubergines attract a larger proportion of Asian and Southern European consumers than other mainstream vegetables. Ethnic consumption is an important segment for exporters of specific aubergines varieties.

Ethnic consumption becomes clear in several trade relation between countries. For example aubergines from Surinam are exclusively imported by the Netherlands, and Germany imports the majority of Turkish aubergines. There are also specific trade relations developed for aubergines between the United Kingdom and Kenya, and between Switzerland and Thailand. Ethnic populations and the influence of international cuisines continue to grow. This will help the adoption of new or more exotic aubergine varieties.

When you are exporting Chinese, Thai or African aubergine varieties, it is important to know where your specific target group is located and make use of ethnic trade contacts.

Aubergine foresees in a vegetarian need

More and more European consumers choose vegetarian or vegan lifestyles. With their unique flesh structure Aubergines are suitable as a meat substitute in vegetarian diets. Vegetarianism can make a difference for places where traditional consumption of aubergines is low.

Aubergine consumption in Northern Europe is generally lower than in the south, but vegetarianism can help increase the demand for aubergines. In countries such as Germany, The United Kingdom, Sweden, Switzerland and Poland an estimated 7 to 10% of the population follows a vegetarian diet. As such, the import growth of aubergines in these countries between 2015 and 2019 was higher than the European average.

Tips:

- Use traditional trade relations if your country has a historical connection with a specific European country. There is a good chance you will find a large group of ethnic consumers of aubergines from your country.

- Stay up to date with market developments of aubergines and other fresh fruit and vegetables by subscribing to news publishers such as FreshPlaza, FreshFruitPortal or Eurofruit (Fruitnet).

3. Which European countries offer most opportunities for aubergines?

Southern European countries such as Italy and Spain have the highest consumption, but they are also big producers themselves. France also has a strong consumption, but mostly purchases French or Spanish aubergines. For non-European suppliers, Germany and the United Kingdom are the best markets. A strong presence of vegetarians can be a driver for additional aubergine sales, especially in Germany, Italy, Switzerland and Sweden.

Table 1: Percentage of vegetarians and vegans in European countries

| vegetarian | vegan | estimated number of vegetarians | |

| Germany | 10% | 2% | 8.000.000 |

| Italy | 10% | 3% | 4.246.000 |

| France | 5% | 0% | 3.300.000 |

| UK | 7% | 1% | 3.250.000 |

| Poland | 8% | 7% | 3.072.000 |

| Switzerland | 10% | 4% | 1.176.156 |

| Sweden | 10% | 4% | 969.000 |

| Belgium | 7% | 800.000 | |

| Netherlands | 5% | 1% | 800.000 |

| Austria | 9% | 765.000 | |

| Spain | 2% | 0% | 697.000 |

Source: Wikipedia “Vegetarianism by country” (different sources and dates 2016-2018)

Germany: consumers getting familiar with aubergines

Germany is not a large consumer of aubergines. Despite of this it is the main importing country as it holds the largest population in Europe (83 million) and only a very minor aubergine production.

In 2019 Germany imported over 52 thousand tonnes of aubergines. The Netherlands and Spain are responsible for nearly 90% of its supply. Outside Europe, Turkey and increasingly Mexico are Germany’s principle suppliers. German consumers are getting more familiar with aubergines. The overall import increased with 14% between 2015 and 2019. Immigration from aubergine consuming countries and a growing number of vegetarians can further support the growth of aubergines in the future.

Tip:

- Find German suppliers of aubergines on Lieberanten.de (in German). You will find there several wholesalers and importers.

United Kingdom: high import dependence

The United Kingdom is the third largest importer of aubergines, but for non-European exporters it is as important as the German market.

The United Kingdom is highly dependent on imported aubergines as the country does not produce much itself. The total import volume was 31.1 thousand tonnes in 2019, 16% more than five years ago. Although Spain and the Netherlands are its main suppliers, there is a significant amount sourced from Kenya (1.4 thousand tonnes in 2019). In the future you can also expect more import from Mexico and the Dominican Republic as these countries have shown growing figures in the past years, reaching several hundred tonnes in 2019. Furthermore, non-European imports will become extra relevant if the United Kingdom is not able to achieve a Brexit deal with the European Union.

Tips:

- Find wholesalers and see which kind of aubergines are available via the trade directory of the New Spitalfields Market in London.

- Stay up to date on the developments and transition period of Brexit on GOV.UK.

France: preference for French products

While France and Germany import a similar amount of aubergines, consumption is higher France because of the larger production volume.

Locally grown vegetables are most in demand in France. French growers produced 32 thousand tonnes of aubergines in 2018. Besides the local production, the import has been relatively stable over the past five years at around 50 thousand tonnes. In 2019, 42.8 thousand of the 52.1 thousand tonnes of imported aubergines came from Spain. Only 1.3 thousand tonnes were imported from non-European suppliers, mainly from Morocco and the Dominican Republic. The wholesale market of Perpignan and its National Syndicate of Fruit and Vegetable Importers and Exporters (SNIFL) of Saint Charles is a hub for both French, Spanish and Moroccan aubergines.

Italy: number one consumer

Italy has the highest consumption of aubergines in Europe. Most are locally produced, but there is also demand for imported aubergines.

Italian aubergine production reached 314.3 thousand tonnes in 2018. Additionally, Italy generally imports over 20 thousand tonnes, while export remained around five thousand tonnes. As such, most aubergines are destined for the internal market. Aubergines are common in the local cuisine, but the number of vegetarian people can be a driver for consumption as well.

Opportunities for non-European suppliers have been limited until today, because Spain dominates the additional supply to Italy. A very minor volume, usually several dozen tonnes, is shipped from Egypt.

Netherlands: producer and trader

The Netherlands is a hub for many of Europe’s fresh fruit and vegetables, but for aubergines its own production is more significant than trade. Nevertheless, the country imports many smaller volumes from a very diverse number of supply countries.

With 55 thousand tonnes of nationally produced aubergines, the Netherlands is among the top producer countries and it is the most important supplier of aubergines after Spain. A large part of this volume is exported to neighbouring Germany.

One of the Netherlands’ is the controlled season in greenhouses and the variety in aubergine colours and shapes, which is different from the Mediterranean region. This local production in combination with small import quantities from countries such as Turkey, Surinam, Mexico, Dominican Republic, South Africa and Uganda, makes Dutch suppliers suitable partners for exporters of exotic aubergine varieties.

Tip:

- Use the experience of Dutch aubergine specialists to get to know the market, find the right marketable aubergine varieties and connect with trade partners. Go and meet fresh companies at the Fruit Logistica trade fair in Berlin. Dutch businesses are dominantly present at this fair, including aubergine seed breeders such as Rijk Zwaan and importers of exotic vegetables such as Nature’s Pride.

Belgium: well-developed in vegetables

Belgium has a well-developed vegetable sector. The country has a relatively high consumption of vegetables and is an active participant in the production and trade of aubergines.

According to Eurostat, Belgium is one of the strongest consumers of vegetables with 84% of the population having a daily consumption in 2017 (while the European average was 64%). Over the past years the local production of aubergine has grown to 10.1 thousand tonnes in 2018, while the import volume has stayed around 10 thousand tonnes. You can find companies such as BelOrta that play an important role in the aubergine supply chain, both as producer and importer.

The Netherlands and Spain are major suppliers to Belgium, but the market also counts with non-European aubergines from Uganda, Turkey and Cameroon. The export volume is more or less equal to the Belgian import, making it the third largest exporter of aubergines in Europe after Spain and the Netherlands. For aubergine suppliers outside the European Union the opportunities in Belgium are found both in national consumption and re-export.

Tip:

- Use Belgium to reach Belgian consumers as well as nearby markets such as France and the Netherlands. These are main markets for Belgian growers and importers. Find potential partners and wholesalers in Belgium by using the ‘Find a Supplier’ tool on Belgianfruitsandvegetables.com.

4. Which trends offer opportunities on the European aubergine market?

Aubergines sales can be positively influenced by an increasing number of consumers with a curiosity for ethnic cuisine and exotic vegetables. It provides opportunities for different aubergine varieties, while the increasing attention for healthy and vegetarian food may further drive the demand for pest-free common aubergines.

Curiosity in ethnic cuisines and exotic vegetables

The demand for exotic and ethnic vegetables continues to increase. As an exporter of special aubergine varieties you can benefit from the diversity in food interests in Europe.

Image 1: Green (Thai) aubergine

The consumption of specific aubergine varieties is triggered by a growing ethnic population and the increasing familiarity with ethnic cuisines. Restaurants play a role in the learning experience of consumers, but retailers can also promote new products. For example, British Supermarket Waitrose has sold white aubergines before as “snowbergines” during the winter. For home cooking it is important for consumers to understand the different uses of aubergines as an ingredient and how to prepare them.

To sell specific varieties, you must either look for specialised importers or organise your own local supply chain. An integrated supply chain has been realised for example by the Namdhari’s Thai Fresh brand that specialises in exotic fruit and vegetables from Thailand and holds a subsidiary in the Netherlands.

Interest in healthy eating makes aubergine attractive

Consumers in Europe are becoming more aware of the need for a healthy diet. Aubergines can definitely be a part of this for consumers, but product presentation is important to communicate the health benefits of aubergines.

Even though for some consumers in Europe aubergines are not the best known nor the most attractive vegetable, health can be a good reason for their purchase. Aubergines are high in fibre, magnesium and folate. Supermarkets and online recipes show aubergines as an alternative for meat or as ingredient in vegetarian burgers. For exporters it is important to meet the consumer expectation of a healthy vegetable. You must supply a clean, sustainable and pesticide-free product.

Tips:

- Find ways to reduce pesticides by using natural or integrated pest management (IPM). Check in your country if there are guidelines for pest management or read more about integrated pest management on the website of the Food and Agriculture Organization (FAO).

- Take into consideration the legislation on nutritional or health claims in the European Union and avoid making claims that are not allowed.

Aubergine as a combination in convenience products

Fresh aubergines can easily be combined with other fresh products in convenient packages. This can give exporters the opportunity to sell more than just aubergines.

Aubergines are sometimes sold in mixed ingredient boxes, for example in combination with courgette, tomato, onion and bell peppers. These are typical ingredients to make ratatouille or Moroccan tajine. The Belgian company BelOrta offers an “Oven & Grill pack” with aubergine, oil and herbs. Most of these products are packed by a company in the destination country. However, you can always try to add value by developing and packing a product at the production stage.

Tip:

- Test the potential of your aubergine variety by contacting specialised buyers of exotic or ethnic vegetables. Best contact them by telephone, not by email.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research