Entering the European market for avocados

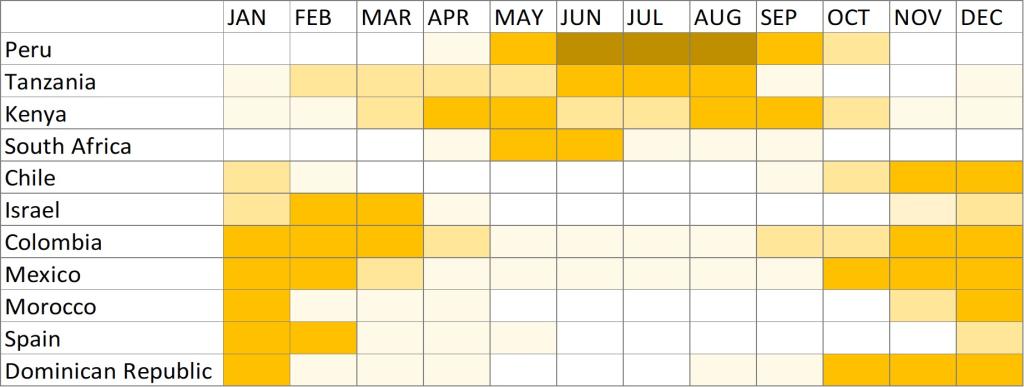

The summer supply of avocados in Europe is dominated by Peruvian producers with an abundant supply of Hass avocados. South Africa and Kenya supply at the same time as Peru. In the European winter, Spain, Colombia, Mexico, Chile and Israel take over. Supply gaps are becoming smaller due to increasing global production and this only leaves room for suppliers that meet high retail standards.

Contents of this page

1. What requirements and certifications must avocados comply with to be allowed on the European market?

Fresh avocados must meet general requirements of buyers, which you can find on the CBI market information platform. My Trade Assistant of Access2Markets provides an overview of export requirements for avocados per country (code 08044000).

What are mandatory requirements?

Pesticide residues and contaminants

Pesticide residues are 1 of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental risks, the European Union (EU) has set maximum residue levels (MRLs) for pesticides and other contaminants, such as heavy metals, in and on food products. Products exceeding the MRLs are withdrawn from the market. For substances that are not yet included in the European regulation, the default MRL of 0.01 mg/kg applies.

Note that buyers in several EU Member States, such as Germany, the Netherlands and Austria, use even lower maximum residue levels than those established by European legislation. Supermarket chains, which sell many avocados, have the strictest requirements.

Tips:

- Check the EU Pesticides database to find all MRLs and those specific for avocados. Search by product or pesticide and the database to find the list of associated MRLs. Check with your buyers if they need you to meet extra requirements in terms of MRLs and pesticide use.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management. It is also part of the ‘Good Agricultural Practice’ and GLOBALG.A.P. certification.

- Make sure that lead contamination in your avocados remains below 0.10 mg/kg and cadmium below 0.050 mg/kg, according to the Regulation 2023/915 on the maximum levels for certain contaminants in food.

Video about Integrated Pest Management (IPM) by GLOBALG.A.P.

Source: GLOBALG.A.P.

Phytosanitary regulations

The European Union requires avocados to go through plant health checks before entering the European Union. The plant health inspection must take place in the country it was produced in. The shipment must be accompanied by a phytosanitary certificate, guaranteeing that they are:

- Properly inspected;

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- In line with the plant health requirements of the EU, laid down in the Regulation (EU) 2019/2072 (updated June 2023).

Tip:

- Check the list of the National Plant Protection Organizations (NPPOs) on the FAO website to find the recognised phytosanitary authority in your country. The organisations in this list are members of the International Plant Protection Convention (IPPC). All fruits require a phytosanitary certificate, except the ones mentioned in Annex XI, part C of the Implementing Regulation (EU) 2019/2072.

Quality standard

Information on quality, size, packaging and labelling requirements for avocados can be found in:

- The UNECE standards for avocados (also available in other languages than English);

- The Codex Alimentarius Standard for avocados (‘Food code’ of WHO and FAO);

- The OECD international standard for avocados.

At the very least, avocados should meet the general quality requirements (see table 1). Europe almost exclusively requires Class I avocados. Avocados in this class need to be of good quality and any defects must be within the permissible tolerance levels. In no case may the defects affect the fruit flesh, the general appearance of the produce, the quality, the keeping quality and presentation in the avocado packaging.

Table 1: Quality requirements and permissible tolerances for fresh avocados

| General quality requirements (all classes) |

|

|

|

|

|

|

|

| Additional requirements and permissible tolerances for Class I avocados |

|

|

|

|

|

|

Figure 1: ‘Extra’ Class avocados

Source: OECD (2004), Avocados, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Figure 2: Class I avocados with slight defects

Source: OECD (2004), Avocados, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Tips:

- Maintain strict compliance with quality, delivering it as agreed with you buyer. Being careless with your standards will lead buyers to raise issues with quality. To avoid miscommunication, send images of your product before shipment.

- Make sure the sizes are uniform and that the product size per pallet is the same. Negotiate with your buyer to include different sizes and 1 mixed pallet per shipment.

- See the OECD International Standardisation of Fruit and Vegetables – Avocados, which has images of the types of avocados and damages allowed.

Maturity requirements

The development and state of maturity of avocados is very important. It must be such as to enable them to continue their ripening process and get to a satisfactory degree of ripeness. The fruit should have a minimum dry matter content. This dry matter content must be measured by drying to constant weight:

- 21% for the variety Hass;

- 20% for the varieties Fuerte, Pinkerton, Reed and Edranol;

- 19% for other varieties, except for Antillean varieties that may show a lower dry matter content.

The ideal dry matter content is different depending on the variety and producing region, and on the buyer. For most European importers and ripeners, 23% of dry matter for Hass avocados is considered the ideal maturity level. Uniformity is key in the avocado trade. Maturity must be uniform throughout the parcel.

Tip:

- Verify with your buyer their preferences on checking maturity. Suppliers use different measuring methods and product standards may differ per country and per variety. The Israeli Plant Protection and Inspection Services (PPIS) created a presentation that explains this in a step-by-step approach. There are also non-destructive tools available, such as the Felix Avocado Quality Meter.

Handling

When supplying avocados to Europe, make sure the supply chain is well organised. This means you must have a cold chain, which cools down the avocados right after harvest and keeps them climatised all the way through the supply chain. Poor infrastructure such as bumpy roads can damage the fruits and high temperatures will shorten the shelf life. The avocados may still look great when you load them into the container, but your buyer will see quality issues. When this occurs, the loss is almost always for the exporter.

Companies in Europe examine the avocados very carefully. They do quality tests and find innovative solutions to avoid waste and optimise profits. An example of this is the cooperation between Nature’s Pride and Apeel, a plant-based coating that helps maintain quality for longer periods of time.

Size and packaging

Fresh avocados are classified according to Size Codes 1 to 30 (see Table 2), with a minimum weight of 123 g or 80 g for Hass avocados. The difference between the smallest and largest fruits within a package should not be more than 25 g.

Table 2: Size codes for avocados

| Size code | Weight range (g) |

| 4 | 781 to 1220 |

| 6 | 576 to 780 |

| 8 | 456 to 576 |

| 10 | 364 to 462 |

| 12 | 300 to 371 |

| 14 | 258 to 313 |

| 16 | 227 to 274 |

| 18 | 203 to 243 |

| 20 | 184 to 217 |

| 22 | 165 to 196 |

| 24 | 151 to 175 |

| 26 | 144 to 157 |

| 28 | 134 to 147 |

| 30 | 123 to 137 |

| 32 | 80 to 123 (only Hass) |

| S | less than 123 |

Sources: UNECE standards for avocados and Codex Alimentarius Standard for avocados

In Europe, the preferred sizes for Hass avocados are 16–18, and sometimes 20 per 4 kg box. For the Fuerte variety, 14–16. Southern Europe is more flexible with sizes. Bigger sizes, such as 14, are more easily sold in southern Europe. Small sizes (26–30) are also sold in affordable boxes of 10 kg at the start of the season.

Packaging requirements vary between customers and market segments. Avocados must at least be packed in new, clean and quality packaging to prevent damage and protect the product properly. Common packaging include:

- 4 kg cardboard boxes, often wholesale packaging;

- 10 kg plastic or cardboard crates, often for importers that ripen and repack avocados.

Consumer packaging is diverse, including trays of 2 avocados or more in plastic flow packs, or nets of 500-750g for small avocados for home ripening (see Figures 3 and 4).

Figure 3: Baby Avocado in a carton tray and flow pack, in Migros Switzerland

Source: Photo by openfoodfacts-contributors per Open Food Facts

Figure 4: Avocados sold in a 500g net by Aldi, Germany

Source: Photo by kiliweb per Open Food Facts

Figure 5: Examples of avocado labelling

Source: ICI Business

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements if your product is pre-packed for retail in the Regulation (EU) 1169/2011 on the provision of food information to consumers in Europe.

- Find the legal requirements for export labelling in the buyer requirements for fresh fruit and vegetables on the CBI market information platform. Also see the examples in Figure 5.

What additional requirements do buyers often have?

Variety

Hass is the most demanded avocado variety in Europe, especially in Scandinavia, the Netherlands and the United Kingdom. The Hass variety is very suitable for transport and ripening. Green skin avocados still have their own niche but are going down in demand. Italy and countries in Eastern Europe are the largest markets for green skin avocados. They are still consumed in many countries because they are favoured for their colour, and sometimes because they sell for better prices. Pinkerton avocados, also known as pseudo-Hass, have a specifically timed demand because it is a late variety.

Certification

Avocados have become a typical product in retail programmes. As a result, buyers almost always require a set of certifications to demonstrate good practices and food safety. Common certifications include GLOBALG.A.P. for agricultural production and BRCGS, IFS or similar HACCP-based food safety management systems for packing houses. These management systems are recognised by the Global Food Safety Initiative (GFSI).

Sustainability and social compliance

It is common for buyers to ask for assurances of good practices. This is due to concerns about excessive water use in avocado cultivation in arid production areas of Peru, Chile and South Africa. Buyers are also aware of social issues and deforestation, for example, in Mexico. The best way to show good practices is through adopting social and environmental standards, such as Sedex Members Ethical Trade Audit (SMETA) and GLOBALG.A.P.. These are the minimum requirements to get your avocados into large supermarkets in Europe. Several large retailers have upgraded their requirements to meet the standards of the Rainforest Alliance.

Major avocado buyers have environmental and ethical policies in place. Westfalia Fruit UK is a leading avocado company in the United Kingdom. They audit suppliers at grower level with standards such as SMETA, Fair for Life, Rainforest Alliance, and GLOBALG.A.P. GRASP. Westfalia Fruit UK uses the Sedex Radar Tool, which contains risk data on different topics such as forced labour, water risk and biodiversity. And they use the Sedex Forced Labour Indicators tool to understand where potential indicators of forced labour have been identified within the supply chain.

In the near future, you can expect new environmental and social initiatives with standards that become more extensive with regular audits. For example, the Sustainable Trade Initiative for Fruit and Vegetables (SIFAV) has formulated new goals towards 2025 that include reducing the carbon footprint, which will increase social standards and sustainable water use. SIFAV is a private covenant between European importers and retailers. One of the SIFAV members is Nature’s Pride, a big player in the avocado trade. With this in mind, it is sensible to measure your environmental impact and explore new standards. Think about standards such as SPRING, a GLOBALG.A.P. add-on for sustainable irrigation and groundwater use, or the Corporate Carbon Footprint of TÜVRheinland.

Retail chains sometimes have their own standards, such as Marks & Spencer Field to Fork and Tesco’s Nurture programme, an add-on module to GLOBALG.A.P.

The Green Deal

In the coming years, the European Green Deal will change the use of resources and reduce greenhouse gas emissions. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal, aiming to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address for example packaging and food waste. EU trade agreements with several countries, such as Peru, Colombia, Guatemala and Brazil (Mercosur), already include rules on trade and sustainable development. Other countries are expected to follow. For suppliers of fresh fruit and vegetables, it is important to look ahead of the increasing standards and try to be in the frontline of the developments.

Tips:

- Start measuring your ecological and social impact and make your supply chain transparent and traceable. You will gain insight into your supply chain by measuring and registering your processes. This will help you improve your production and become a more serious supplier for European importers.

- Implement at least 1 environmental and 1 social standard. See the Basket of Standards of The Sustainable Trade Initiative for Fruit and Vegetables (SIFAV).

- Find out about specific sourcing information of large retail chains. You can usually find these on their corporate websites, for example the REWE Guidelines for sustainable business practices or Marks & Spencer Global Sourcing Principles.

- For other additional requirements such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and the tips for doing business with European buyers.

What are the requirements for niche markets?

Organic can be a specific requirement for health-focused consumers

The market for organic avocados is relatively small, but with growing demand and limited supply. Organic avocados are especially interesting for consumers who value avocados for their healthy aspects.

To market organic products in Europe, you must use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. The new legislation Regulation (EU) 2018/848 came into force in January 2022 after a year’s delay due to COVID-19. Inspection of organic products will become stricter to prevent fraud and producers in third countries will have to meet the same set of rules as those producing in the European Union.

Organic integrity is very important for specialised organic buyers. They will ask for proof of a transparent and certified supply chain. The EU legal standard (see above) is usually sufficient as a certification, but you will also find buyers in specific markets that require you to have Naturland, Biosuisse (Demeter) or similar certifications.

A current issue for organic avocados is the level of phosphoric acid, which is measured in Fosetyl-Al. These residues can be a result of chemical inputs, but they also seem to occur naturally. They are not permitted in organic avocados. Producers in Mexico and Peru sometimes struggle with higher residues, which can be a reason for buyers to look for organic avocados in other countries.

Tips:

- Consider organic avocados as a plus, not as a must. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the entire organic certification process. Download the current list of control bodies and authorities to see which certifiers are active in your region.

- Learn about the differences between the EU organic standard and Naturland in the Standard Comparison.

- Read the SKAL information sheet to understand the origin of phosphonic and phosphoric acid and what you can do to monitor it.

2. Through what channels can you get avocados on the European market?

Avocados are a typical retail product. Importers that supply supermarkets and other major retailers offer you the most stable and largest supply chain. The main market segment for this channel is Class I Hass avocados.

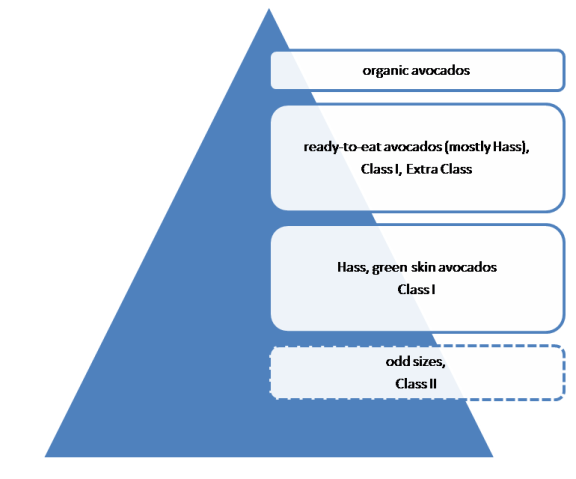

How is the end market segmented?

The main segment for avocados are Class I Hass avocados. This main segment mostly concerns the Hass variety with standard retail requirements, which means certified and low pesticide residues. Ready-to-eat avocados have become very popular in end-markets and will continue to generate consumer interest.

High-end markets

In the high end, you can find organic avocados, which are usually sold for 25–45% more than conventional avocados on retail shelves, when the market is favourable. Organic avocados are especially in demand in German speaking countries and Scandinavia, as well as France, where the market share of organic food has increased significantly in recent years. Examples of companies that specialise in organic fruit, including avocados, are Eosta, OTC Organics and Lehmann Natur.

Bottom segment

In the bottom segment are the Class II avocados, which are generally not fit for supermarkets, but may still serve for processing into fresh salads or guacamole. Odd and small sizes are usually sold for promotional prices. It should not be your goal to supply Class II or less demanded sizes. It is usually part of the trade and a small percentage of the regular shipments.

Figure 6: Market segments for avocados in Europe

Source: ICI Business

Tip:

- Make sure to maintain a maturity level of 23% of dry matter in the avocados you supply for the ready-to-eat segment.

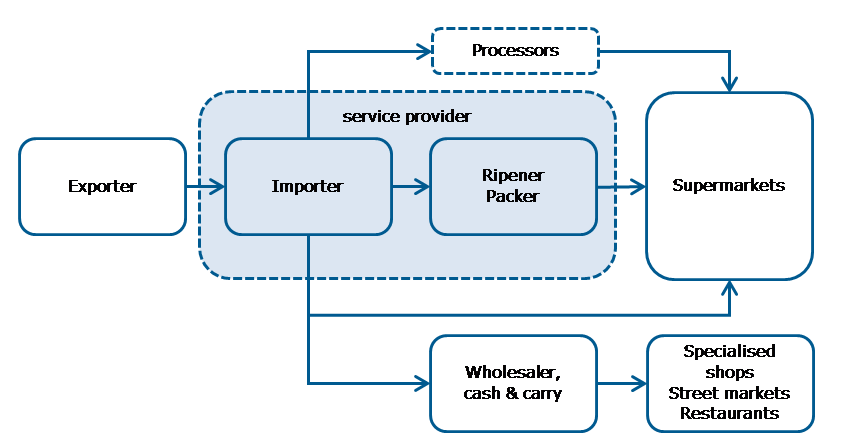

Through what channels do avocados end up on the end market?

Importers play a central role in the distribution of avocados. They are familiar with all the different requirements of end clients. They distribute to different market channels, such as wholesalers and supermarkets.

Importers and service providers

Several avocado importers have their own ripening and packing facilities, such as Nature’s Pride in the Netherlands and Ripenow in the United Kingdom. Ripening facilities are important for the growing segment of ready-to-eat avocados in supermarkets.

When import companies provide different services, such as ripening and retail packing, they can also become service providers to large retailers. For example, Bakker Barendrecht, part of Greenyard, supplies the leading Dutch supermarket Albert Heijn. This company ripens and packs avocados and takes responsibility for quality control and forecasting its client’s needs.

Supermarket programmes

Avocados are a typical product that is programmed under supply contracts of large retailers. Large-scale distribution networks of supermarkets, hypermarkets and discounters are responsible for the sales of more than two-thirds of the avocados sold to consumers. These distribution channels are even more dominant in the northern European markets.

Supermarkets have become increasingly involved in the sourcing of avocados but tend to have different structures. Some work with annual contracts, while others select a dedicated service provider, such as the German discounter Lidl with OGL Food Trade. Supermarket channels may have their own supply preferences and requirements. Depending on which supermarkets you are aiming for, you may need to make changes to meet their specific standards.

Wholesalers (spot market)

Traditional fruit wholesalers cover the spot market and move according to the fluctuations of the fresh trade. They supply specialised shops, street merchants, restaurants and hotel chains. Sometimes import and wholesale activities are combined, but a traditional wholesaler does not take many risks with importing whole containers of long-distance avocados. Most local wholesalers purchase avocados by the pallet. Typical wholesale markets for avocados and other fruit include Rungis in Paris and Mercabarna in Barcelona.

Large fruit wholesalers, such as Staay Food Group, maintain a large international network and offer their own cash & carry service point, where clients can purchase a wide variety of fruit and vegetables.

Non-specialised (cash & carry) wholesalers, such as Metro, supply the same end-market but depend more on the service of importing companies or have their own purchase centres. Just like supermarkets, they are able to work with long-term contracts.

Figure 7: Market channels for avocados

Source: ICI Business

Tips:

- Find importers that also have ripening activities. They tend to be more involved in the avocado business and probably need larger volumes for retailers.

- Check with your buyers what type of specific standards supermarkets require if you cannot find this information yourself. Importers and service suppliers are usually familiar with the different retail standards.

What is the most interesting channel for you?

Because avocados have become a typical product in the retail market, becoming part of a supermarket supply programme is the most interesting channel for any supplier. It provides stability and almost guaranteed volumes, but the requirements are high and the room for negotiation is minimal.

As an exporter, you have different routes to try to become part of a retail programme. The most likely route is to cooperate with a service provider that has a local infrastructure and supply contracts with retailers. Exporters with their own avocado production have the best chances to find cooperation with large buyers and service providers. These are companies such as Bakker Barendrecht, OGL Food Trade and the purchase centres of supermarkets. Another option is to work together with large integrated companies, such as Westfalia. Westfalia has its own offices and facilities in the producing countries and sales markets.

Direct sales to supermarkets are difficult and only feasible for companies that can arrange a year-round supply. You need to have a presence in Europe to supply retailers directly. A joint venture can be an interesting way to establish yourself in Europe. For example, the Colombian Cartama group has a presence in Europe and the United Kingdom and established a close partnership with The Avocado Company in the United Kingdom.

It is not easy to get accepted in supply programmes. It takes time and a lot of effort. Most avocado suppliers will start on the spot market with smaller traders or importers. Smaller importers are often the only companies that accept new suppliers. It involves more risks, but it will help you gain experience. In a good market, they can provide you with a very profitable return, but there are no guarantees. Spot market prices fluctuate more than in supply programmes. The market decides the value of your product, and your returns will depend on the selling price.

Tips:

- Make yourself attractive as a supplier to supermarket supply programmes by committing minimum volumes and guaranteeing regular shipments. A long supply window with regular volumes will widen your potential buyer group and make you less dependent on the spot market.

- Go to trade fairs to find buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and Fruit Attraction in Madrid.

3. What competition do you face on the European avocado market?

The level of professionalism and the large sizes of companies in the avocado business make it difficult for new suppliers to compete. But the growing demand still offers opportunities for companies that are able to match the quality in the right supply windows. Buyers work with different countries to make sure they have year-round supply. Climate change will play an important role for buyers who want to work with parallel markets.

Which countries are you competing with?

Peru, South Africa and Kenya dominate the European summer supply of avocados. In the winter months, avocados come to Europe mostly from Chile, Colombia, Israel and Morocco. During this time, Spain supplies a large proportion of its domestic production to the rest of Europe.

European imports are completed by a number of other supply countries. This includes Mexico, the world’s biggest avocado producer, as well as emerging suppliers, such as Tanzania.

Global production keeps on expanding

According to FruiTrop, the worldwide planted areas of export avocados has increased with 200,000 hectares in the last 7 years. In 2022, the total area was 492,000 hectares. The speed of new plantings is expected to decrease, but the sheer production volume will keep the market unbalanced. This will continue to boost global competition. According to the OECD‑FAO Agricultural Outlook 2021‑2030 about 74% of avocado production is expected to remain in Latin America and the Caribbean, given the favourable growing conditions in this region.

As a supplier, you must expect more turbulent trade. Periods of market saturation will become more common, followed by moments of shortages due to climatic stress. Buyers in Europe continue to look for parallel sources to guarantee a year-round supply of quality avocados. If production in 1 country fails, buyers will have alternative sources to meet demand. They will always look for the producing countries with the best options in availability, quality and price.

A low supply during the start and end of a season can provide good returns for regions that can fill the supply gap. This is particularly true when Europe switches from harvests in summer to harvests in winter.

Figure 8: Indicative supply calendar for the avocado trade to Europe

Source: ICI Business

Source: ITC Trade Map

Peru remains the most dominant supplier

In the last decade, Peruvian avocado exports to Europe have grown the most. Peru is now the leading supplier of avocados to Europe. The country accounts for more than 40% of the total foreign supply to Europe. This development has also turned into a handicap for Peruvian growers: as soon as the Peruvian harvest starts, the large volumes drive prices down.

European imports of Peruvian avocados have increased to a value of 950 million EUR in 2022. This is 80% more than 5 years earlier. In the next years, trade flow is still expected to increase, although growth may slow down. In 2023, the production in Peru is expected to be lower due to the El Niño weather phenomenon.

Peruvian suppliers are competitive, well-organised and can manage large volumes. They are able to keep supplies available for a long season (April to September), although not year-round. July to August are the peak months for avocados. When Peru is in full harvest, it is difficult to compete, and profit margins will often be lower. Countries with similar seasons, like South Africa and Kenya, feel the impact of the Peruvian season.

A minor share of the Peruvian avocado export is certified organic. Organic avocado exports are around 1.2%, based on the information provided by the Servicio para el Desarrollo Integral (Sedir) and Agrodataperu.

Colombian avocado growers fill in the seasonal gaps

Colombia has taken a big step forward in production. In a matter of years, its export to Europe surpassed that of Kenya, South Africa and Mexico.

Colombian producers have built a stronger reputation in avocados after dealing with initial issues in product quality and internal logistics. These efforts have resulted in successful exports. The European import value from Colombia has grown from 68 million EUR in 2018 to over 200 million EUR in 2022, making Colombia 1 of the most successful emerging suppliers. The largest destinations are The Netherlands, the United Kingdom and Spain. Spain has a favourable transit time for Colombian produce of 10–12 days.

In the next few years, Colombia’s avocado production is expected to further increase. Figures of the Colombian Ministry of Agriculture and Rural Development estimate that the planted avocado area reached 92,700 hectares in 2021. A productive area of 67,000 hectares yielded 661,000 tonnes of avocados. Just over a quarter consists of Hass avocados, the most popular variety in Europe.

Colombia is interesting for European buyers because they can fill the gap between 2 supplying seasons. The main supply takes place in the European winter. In sea freight they have a logistical advantage over Chile, which supplies a similar season. Major avocado groups have put their focus on Colombia, leading to international investments and cooperation in the Colombian avocado sector, for example by Eurofresh (Spain), the Fresca Group (UK) and Westfalia. The Colombian suppliers Cartama, Westfalia Fruit Colombia and Hass Colombia are responsible for more than a third of Colombian avocado exports.

Europe is still the main export market for Colombian avocados, but the United States will become more important in the coming years. Colombia can easily supply both the East and West Coasts of North America. This market is also less demanding in terms of certification and post-harvest quality. In 2022, the European import from Colombia declined slightly, while American imports continued to grow. Colombia will remain a strong competitor for the European market, but their growth in other markets may reduce its pressure.

Kenya is building a reputation

The Kenyan avocado trade keeps growing, despite the fact that Kenyan suppliers do not yet have a flawless reputation in Europe. Long transport times and issues with product handling and the cold chain sometimes prevent avocados from reaching the European market in good shape. In recent years, European buyers are seeing improvements in quality, traceability as well as communication. The general export quality has improved significantly because of strict government controls. As a result, the import value increased year-on-year to a value of 161 million EUR in 2022. With this value they surpassed South Africa (156 million EUR), making Kenya the largest supplier of African avocados to Europe.

Kenyan suppliers benefit from a long season and are price competitive. European buyers consider it to be a good alternative for Peruvian supply. An additional strength is its high percentage of organic produce; according to FiBL statistics, more than 50% of the avocados are grown organically.

Chile exports fluctuating volumes in winter

Chilean avocados are available from September to February and traditionally cover the supply gap between the Peruvian and the Spanish productions (see the supply calendar in Figure 8). The export volumes to Europe fluctuate, it remains an important producing country.

European buyers are generally very satisfied with the constant and reliable quality of avocados from Chile, which has been a stable and a long-term supplying country. However, structural problems with drought and adverse weather conditions reduces the production and export capacity for Chilean growers. During the last campaign of 2022/23, the production fell from 220,000 to 186,000 tonnes due to severe spring frost.

Avocado buyers in Europe have concerns about water availability in Chile and fitting Chilean avocados into their commitment to sustainable sourcing. Although these problems are not unique to Chile, it has slowed down the Chilean avocado production growth and sales. Instead, Chilean professionals have invested in the avocado production in Peru, Colombia and Brazil.

Unlike Peru, whose producers focus almost exclusively on export markets, Chile’s domestic market actually consumes approximately 30% of the country’s avocado production. The other 70% is exported. With a smaller production ahead in 2022/23 this percentage will be around 55%. The Netherlands and the United Kingdom are the most important markets in Europe. Chile will continue to play a role in the winter trade with Europe, but there is little expectation it will follow the fast growth of its competitors.

Israel excels in quality, not price

Israel is not the strongest competitor in volumes or price. In a good market, the country competes in quality and innovative breeding and production programmes.

The harvest provides an average volume of around 120,000 tonnes per year. Hass avocados make up around a third of this. The 2022/23 season was an off-year, as the harvest yielded 30–40% fewer avocados.

Israeli companies are innovative when it comes to the cultivation of avocados. A recent development includes the use of sterile tissue culture to produce seedlings. These cultured seedlings speed up the long production times and avoid plant protection regulations when exported.

Geographically, Israeli growers are closer to Europe than their Mexican and Chilean competitors. Most of the Israeli exports to Europe consist of Hass avocados. But the country can also offer a variety of green avocados, such as Ettinger, Fuerte, Pinkerton, Arddit, Nabal, and Arad. The proximity to Europe and the local growers’ experience with improving varieties make Israel a high-level competitor in the European avocado market. Over the past 5 years, Europe’s import value from Israel fluctuated between 110 and 214 million EUR. Israeli avocados are a favourite in quality retail outlets.

Morocco on course to become a strong winter supplier

Morocco is ideally positioned to supply avocados during the European winter season, but it will also have to deal with established suppliers from Spain and Israel. On the other hand, Morocco is an affordable alternative, especially when the supplies in other countries run short. The trade value with Europe doubled in 2020 and 2021 and increased again by another 56% in 2022.

It is unknown whether Morocco can continue this steep growth. The country faces droughts and the Moroccan government ended irrigation subsidies on avocado in 2022 because of a water shortage. Despite of this, the production in on track to reach 100,000 tonnes in 2027.

Competition from multiple origins

Besides the countries described above, the number of competitors is much larger:

- Spain is a major competitor within Europe. Spain’s peak season is not enough to fulfil the entire demand, but it is a preferred choice for retailers because it is located nearby. Around 24% of its production is organic.

- South Africa has a stable supply to Europe. It is also the base country for several multinational avocado companies, such as Halls and Westfalia Fruit.

- Mexico is the world’s largest avocado-producing country. It often shifts its focus from the United States to the European market. A new sea-freight route between Veracruz and Rotterdam will facilitate future growth.

- Brazil is still underestimated as an avocado supplier, but its production volume is increasing and there is a growing interest in export.

- The Dominican Republic is most known for its green avocados, but with a European trade value of 35 million EUR, it is still among the ten largest suppliers.

- Tanzania is fast emerging as an avocado supplier, although the country is still behind South Africa and Kenya in terms of traceability and controlled cultivation.

- Other countries like Zimbabwe, Guatemala and Ethiopia all have ambitions to play a role in the international avocado trade. Usually, only part of the production is suitable for export to Europe. Quality and compliance with European standards are often the main challenges for these new suppliers.

Tips:

- Try to extend your season by gathering avocados from different climate zones in your country, if possible. Season is an important factor when considering supplying to Europe. The longer your season, the more attractive you are for buyers that want to fill a year-round supply. This will help you compete with the larger avocado companies.

- Maintain close contact with buyers about market conditions and act accordingly. For example, if other suppliers have extended their supply season to Europe, you could decide to postpone your harvest or find more attractive markets.

- Analyse the avocado trade flows by downloading the Rabobank World Avocado Map 2023.

- Read the country profiles of the Hass Avocado Board (HAB), such as the Country profile Colombia, to learn more about your competition and developments worldwide. To get complete access, you can register with the HAB for free.

Which companies are your competing with?

The avocado trade has become a mature business with many professional players. This has raised the bar to a very high level. There are several large multinational companies with associated growers or grower associations. Professional exporters such as Peru’s Camposol, Colombia’s Cartama and Kakuzi in Kenya increase their businesses through acquisitions and mergers.

Camposol

Camposol is the largest fruit company in Peru. Peruvian companies like Camposol are well financed and have invested in new, professionally managed and fully certified avocado orchards. This has turned them into 1 of the leading exporters of avocados.

The downside of the enormous production capacity of Camposol and other Peruvian companies is the concentration of high volumes in a short period. The supply peak results in lower prices. In other words, they have gained a top position in volume and reputation but lost in flexibility. When Peru’s total production hits record highs, it pushes prices down. Producers have to sell for whatever the prices may be. It is the reason for Peruvian exporters to explore new markets, such as China.

To secure their market, Camposol has set up their own trading office in the Netherlands and invested in avocado cultivation in other origins, such as Colombia. By doing this they will reach the strategic goal of becoming a year-round player. With a reliable, year-round supply and presence in Europe, Camposol has the tools to negotiate directly with European supermarkets.

Tips:

- Try to match the commercial presentation of leading avocado suppliers. Check Camposol’s website, for example, to see how they promote themselves and their produce.

- Go to Agrodataperu.com to find the top exporters from Peru and their export volumes.

Cartama group

Colombia’s Cartama group is 1 of the fast-emerging exporters to Europe. Cartama was founded by a group of avocado growers. Boasting their own packing house, they have reached high volumes and high-quality fresh produce through cooperation. This has been a success recipe for Cartama in the European market. Their export ambition for 2022/23 was close to 900 containers.

In 2016, British retail chain Marks & Spencer awarded the Cartama Group its annual Growers best quality award. In 2017, the Cartama Group signed a joint venture with the British Fresca Group and together invested in 422 hectares of avocado orchards. In 2019, the international avocado trader Mission Produce announced a partnership with the Cartama Group. And in 2020, the company established another sales office in the Netherlands. Cartama uses this local sales office to better prepare for supermarket promotions.

Tip:

- Work with other producers in a joint venture or integrate your supply chain to reach supermarkets and their service providers. Having a direct relation with your growers or having your own production is necessary to trade with large buyers.

Kakuzi

Kakuzi is 1 of the leading exporters of avocados from Kenya. The company has full control over the entire value chain. They work with over 900 hectares and with a smallholder programme. The difficulty with small-scale farming is often traceability, quality control and uniformity. By sharing avocado-growing skills and knowledge they improve the agricultural practices of smallholders.

One of the company’s strengths is that they have diversified their markets, exporting not only to Europe but now also to China.

Tip:

- Diversify your markets. Europe will certainly be 1 of your main destinations, but having a diverse client portfolio will help you manage the risks of trade fluctuations.

Which products are you competing with?

Avocados are not an easy product to substitute. They are unique in their taste, characteristics, applications and health benefits. Ready-to-eat and supermarket promotions are important factors for consumers buying avocados instead of other fresh fruit.

Within the avocado trade, the Hass variety is the most popular. They do well in overseas travel and are considered best for ripening. Over time, it is not unusual for popular varieties to get replaced by improved cultivars or other available varieties, such as the licensed Gem avocado. In Eastern Europe and Italy, green skin avocados, such as the Fuerte, may be sold instead of Hass. Specific Hass sub-varieties, such as the Hass Lamb, can also become more relevant as the market further develops, not only to diversify taste, but also because different varieties can extend the supply season.

Tip:

- Make sure you can offer Hass avocados, but keep an open mind about new varieties that offer advantages in production season, ripening or otherwise.

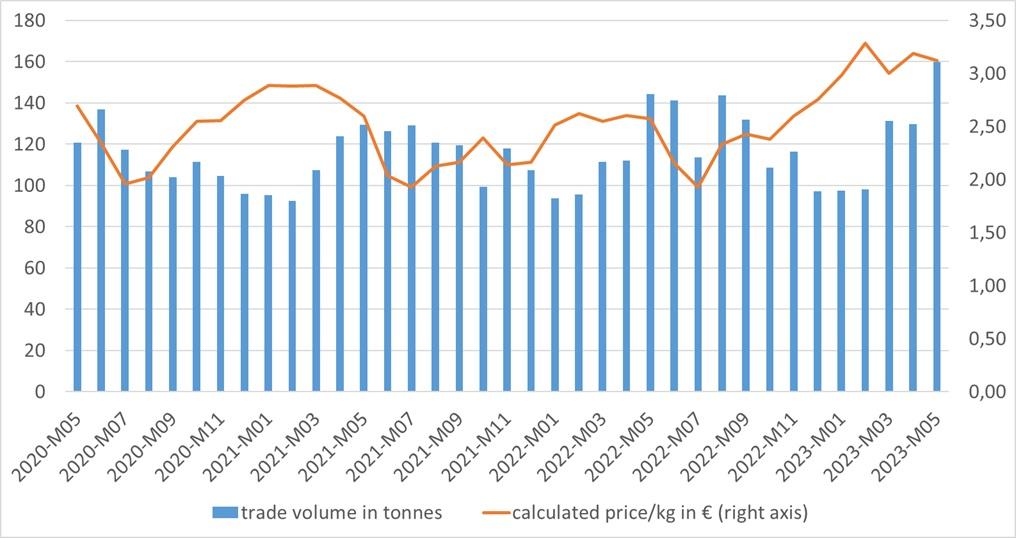

4. What are the prices for avocados on the European market?

Trade prices for avocados fluctuate depending on the available volume. The summer prices are generally lower due to the higher offer, especially from Peru. In the coming years, prices will be far from stable. Excessive supply volumes will become more regular, but climate change will also have a larger influence. Other influences that determine prices are quality, size and variety. The highest average prices are generated by Class I Hass avocados with popular sizes (16–18).

Selling prices (importer’s wholesale price) are approximately 8 to 10 EUR per 4kg box. Peak prices go up to 14 EUR per box for excellent quality and when supply is scarce. Bottom prices of 4 or 5 EUR have also been recorded during periods of strong oversupply. Monthly import data shows an average kilo price of 2.50 EUR (see Figure 10). The price premium for organic avocados is generally 10–20%. When avocado become very expensive for consumers, the demand for organic diminishes and the extra margins can go down. Importers generally maintain a profit margin of at least 8% of the wholesale price, excluding handling costs, ripening and packaging.

Figure 10: Avocado trade volumes and calculated import prices in Europe per calendar month

Source: ITC Trademap

Retail prices are between 1.10 and 1.60 EUR for regular sized, ripened avocados. On sale, they can be sold for as low as 0.99 EUR each or 1.49 EUR for a pair. These retail prices do not reflect trade prices because large retail chains or supermarkets often have supply programmes for avocados with fixed prices.

The retail prices and promotions are managed independently from those on the free spot market. A retail programme provides the stability and security of a steady supply volume, but prices are not negotiable.

Source: ICI Business

Tip:

- Monitor price developments through sources such as the Market News Network of FranceAgriMer. You can find price indications for import, wholesale and retail.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research