The European market potential for avocados

The supply of avocados is increasing fast, but the European market can still take on higher volumes. The healthy nature and multiple uses of avocados result in strong consumer demand. France and Scandinavian countries are already very mature markets, while Germany and Italy still have room for growth. While consumption is still on the rise, supply peaks make profitable returns more unpredictable.

Contents of this page

1. Product description

Avocados (scientific name: Persea americana) are classified into 4 main types:

- Guatemalan;

- Mexican;

- West Indian; and

- Hybrids.

Commercial varieties include:

The Hass avocado, a Guatemalan race with pebbled black skin, is the main planted variety today. Hass lends itself well to ripening and can withstand long transport times. There are new Hass varieties available, such as Lavi Hass, Lamb Hass and Gem Hass. These Hass sub-varieties help extend the supply season.

| Harmonized System (HS) code | 08044000 Avocados, fresh or dried |

| Commercial varieties |

|

| Minor commercial varieties |

|

Figure 1: Examples of avocado varieties

Top: Benik, Hass, Nabal. Bottom: Ettinger, Fuerte, Pinkerton

Source: OECD (2004), Avocados, International Standards for Fruit and Vegetables, OECD Publishing, Paris

2. What makes Europe an interesting market for avocados?

The European demand for avocados continues to grow. Higher volumes in the market will continue to drive up consumption, but production and supply volumes make the avocado market unpredictable.

Avocado will be the second best-selling tropical fruit in the world in 2030

According to the OECD/FAO Agricultural Outlook 2021-2030, avocados are expected to become the second-most traded major tropical fruit by 2030, after bananas. Avocados will overtake the export volume of both pineapples and mangoes. In Europe, avocados have become the second-most valuable imported fruit from developing countries. The avocado import from developing countries was valued €1.8 billion in 2022. The expansion has been caused by =growing demand and major investments in global production.

The growth of avocados outperforms other major tropical fruits despite the lower production. Global production volume is expected to reach 12 million tonnes by 2030, 3 times more than a decade ago. Mexico is the world’s largest avocado-producing country, although its production has proven slow to increase. In the long-term, Mexican supplies may increase by 5.2% annually, mainly to fulfil the growing demand in the United States.

In Europe, Peru is the most dominant supplier, next to a dozen other ambitious countries. Production in Peru, Colombia, Kenya, Morocco and Tanzania showed double digit growth in recent years. Most of these exports are destined for the European market.

The United States and Europe will remain the largest importers in the future. According to OECD/FAO, these regions will be responsible for 40% and 31% of global imports in 2030. This is despite the growing trade with other regions, such as China and the Middle East. It will be important for growers and exporters to focus on specific regions where demand has room to grow. It is also a good idea to diversify and anticipate on markets becoming less concentrated.

Europe can absorb supply peaks in avocados

Avocados have been the most dynamic fruit in the past years. There has been an almost insatiable demand and an unbalanced supply. In recent years, oversupply has occurred more frequently. However, Europe has proven that it can still use more avocados.

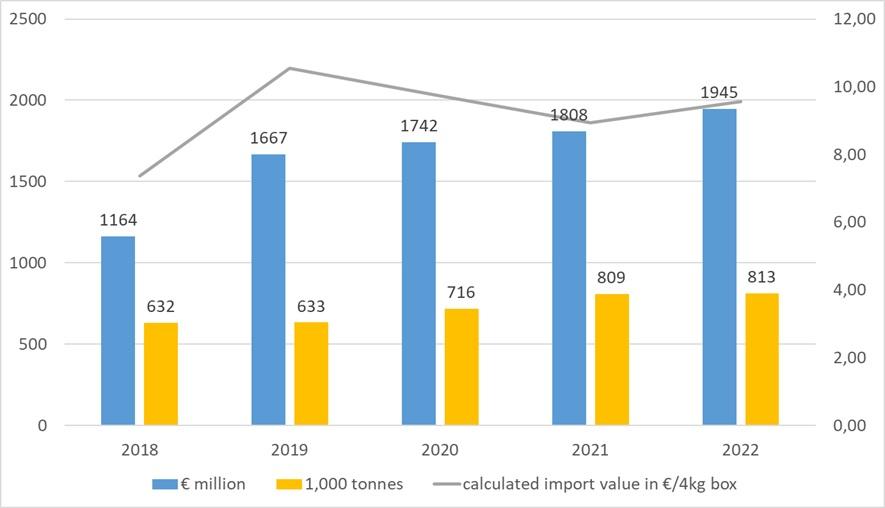

Avocados are already a standard product in most grocery stores in Europe. Over the next few years, more European markets will reach a stage of maturity. European imports continue to increase, although the volume growth was limited in 2022. According to trade statistics, European imports totaled 813,000 tonnes in 2022. On average, prices were slightly better than the year before. At the same time, price fluctuations will become more common in the future, as will regular price drops if there is too much supply.

The advantage of avocados is that they are programmed (contractually planned) by retailers. Their promotions can help sell additional volume. This way a much larger volume can be pushed into the market for lower prices and boost consumption. These price drops are especially noticeable during the Peruvian season. Growing import volumes from other countries also contribute to oversaturation of the market.

Despite the strong demand for avocados, there is a limit to Europe’s ability to keep up with the speed in which avocados are being cultivated for export across the world. According to CIRAD’s Fruitrop magazine (2023), the growth of new avocado plantings in the main supplying countries is slowing down. This may give the market some room to breathe in the next 5 to 10 years.

Right now, avocado companies need new markets in and outside of Europe to support the growing supply in the long run. In the mind of some exporters, China could become the next market to release some of the global production. Mexico, Peru and Chile are already exporting to China, and Kenya and Tanzania recently got access to the Chinese market as well. However, the 65,000 tonnes import in the greater China region is nothing compared with the sheer volume of imports in Europe. In the short term, it will not relieve the pressure on the European market.

Tips:

- Combine your export to Europe with the development of new markets outside Europe (and the USA), for example in Asia and the Middle East. Diversification will help you spread trade risks and make you less dependent on 1 region. Make sure you have access to new target markets by checking if your country has a phytosanitary agreement with that country. Contact your local food safety authority.

- Prioritise quality over quantity. Ultimately, wholesalers and retailers do not only look for supply certainty. They primarily want good quality products and trustworthy suppliers.

Figure 2: European import (EU-27+UK+EFTA) of avocados with non-European origin

Source: Eurostat / Access2Markets (EU-27) & ITC Trade Map (UK)

Still room for growth in consumption

Avocados are appreciated because they are a unique and healthy product. Avocados contain oil and have many culinary applications. However, compared to North America, European consumption is still underdeveloped.

There are major differences in consumption between Europe and North America, as well as within Europe itself. This shows that there is still potential for growth in Europe. In 2020 and 2021, the average consumption in Europe was approximately 1.4 kg per capita. In the United States, this is approximately 4 kg and almost 3 kg in Canada. Mexico, the world’s largest avocado producer, consuming 6.5–7 kg per capita.

According to Cirad’s FruiTrop Magazine, the consumption of avocados in Europe has grown by 17% from 2019/20 to 2020/21. The recent growth in consumption between 2021/22 and 2022/23 has stagnated. Overall, price inflations for food have made consumers more conscious about their spendings. This may have influenced consumer purchases.

In large markets like France, Germany and the UK, the consumption rate remained the same in 2022. It declined in Scandinavian countries where avocado consumption per capita is already quite high. Inflation may have played a role here. In the next few years, more European markets will reach a higher level of maturity. There is potential for growth in Germany, Italy and Poland. The steepest growth will likely come from countries in Eastern Europe that have relatively small avocado markets.

Tip:

- Make sure that the expansion of your production is in line with market demand by keeping an eye on market developments on the European avocado market and beyond, for example on FreshPlaza, Fruitnet, FruiTrop, and FreshFruitPortal.

3. Which European countries offer most opportunities for avocados?

France is the leading end market for avocados, while Scandinavian countries have the highest consumption per capita. Although the growth in some of these leading consuming countries is slowing down, Germany, Italy and Eastern European countries still have potential to grow in the coming years. Many of these countries receive their avocados through traders in the Netherlands. Spain, Europe’s largest avocado-producing country, has also started to fulfil the role of international distributor.

Table 1: Estimated avocado consumption and growth in Europe in 2022

| Consumption in 1,000 tonnes | Population | Consumption per capita | Growth 2015/16 - 2020/21 | Growth 2016/17 - 2021/22 | Growth 2019/20 - 2020/21 | Growth 2020/21 - 2021/22 | |

| France | 163 | 67.9 | 2.40 | 41% | 31% | 11% | 8% |

| United Kingdom | 109 | 67.3 | 1.62 | 29% | 10% | 1% | 0% |

| Germany | 111 | 83.2 | 1.33 | 156% | 107% | 15% | 3% |

| Spain* | 52 | 47.4 | 1.10 | 203% | 189% | 27% | 8% |

| Italy | 45 | 59.0 | 0.76 | 179% | 201% | 39% | 37% |

| Poland | 26 | 37.7 | 0.69 | 161% | 94% | 23% | 14% |

| Netherlands* | 23 | 17.6 | 1.31 | -2% | 70% | ||

| Sweden | 19 | 10.5 | 1.81 | 19% | -1% | 4% | -2% |

| Switzerland | 19 | 8.7 | 2.18 | 19% | 45% | 4% | 17% |

| Denmark | 14 | 5.9 | 2.37 | 18% | 25% | -1% | 9% |

| Norway | 15 | 5.4 | 2.78 | 26% | 23% | 12% | -3% |

| Belgium | 14 | 11.6 | 1.21 | 133% | 78% | ||

| Finland | 5 | 5.6 | 0.89 | 6% | -15% | 3% | -12% |

Calculated consumption based on import. export and production statistics. sources: UNComtrade. Eurostat. and compared with data of Cirad / FruiTrop. *Netherlands & Spain: not reliable due to transit/production and partly based on data Cirad / FruiTrop

Source: ITC Trade Map

Source: ITC Trade Map with added data via Eurostat / Access2Markets

The Netherlands: Your main trade hub for avocados

The Netherlands is the main trade hub for avocados in Europe. You will find several major avocado importers in the Netherlands. Here, avocados are ripened and distributed to many European destinations.

The Netherlands is responsible for more than half of Europe’s avocado imports. The country is also the largest non-producing exporter of avocados in the world. Large volumes are re-exported to Germany, France and Scandinavian countries. Exports are to Spain, Poland and many other countries are also growing. Dutch traders have become specialists in avocado ripening, packing and logistics. They are also used to working with different sustainability requirements of European retail chains.

Because of the leading role in avocado trade, the Dutch market is familiar with avocados and has a large consumer market. With a relatively small population of 17.6 million people, it is among the stronger consumption countries in Europe. Dutch retailers offer a variety of avocados from pre-packaged, ready-to-eat avocados to small-size avocados in a net for home ripening (see Figures 5 and 6 as examples).

The Dutch import declined slightly in 2022. A possible reason for this is the growing direct trade with major markets, such as Germany and France. In the coming years, the Netherlands will remain a main trade hub for avocados. Over time, its function may become more logistical and less commercial as other avocado specialists emerge throughout Europe.

Tips:

- Meet with potential buyers by presenting yourself at international fairs like Fruit Logistica or Fruit Attraction. You can also connect with companies through Fruit Logistica’s digital industry platform.

- Find Dutch importers on the member list of the Fresh Produce Centre. Please also see our study on Exporting fresh fruit and vegetables to the Netherlands.

France: Your largest destination for avocados

France is a leading market for avocados in Europe with a focus on high-quality avocados. Potentially you can find decent margins when you can fit your product into the major retail chains.

France imported over 200,000 tonnes of avocados in 2022. More than 60% came directly from developing countries. With a calculated local demand of 163,000 tonnes, France is the largest destination for avocados in Europe. Consumption growth has been slower than in several other European markets (see Table 1). This can be attributed to the fact that France is a more mature market, with an estimated consumption of 2.4 kg per capita in 2022.

There is year-round demand in France. Although local or regional products from Spain are preferred, Peru is the main supplier of avocados, accounting for nearly 60,000 tonnes in 2022. Peru mainly supplies a different season than Spain, Israel and Morocco, but it is unbeatable in volume and price. Promotions are common. Figure 5 shows a retail promotion in France of 2 large-sized avocados (size 14) for 1.49 EUR.

Spain and Israel are not necessarily the most economic sources for avocados. But price is less of an issue for buyers who focus on quality and local products. Despite the higher prices, France offers a good market for organic avocados, which it imports mainly from Spain.

Figure 5: Promotion in French hypermarket for large-sized avocados

Source: ICI Business (august 2023)

Tips:

- Find buyers that supply larger retailers in France and be prepared to commit to extra quality requirements. Prices and margins are likely to be better on average when working with retail contracts compared to the traditional wholesale markets.

- Check organic and conventional avocado prices in French import. wholesale and retail on the Market News Network of FranceAgriMer (search for ‘avocat’ in French).

Germany: Provides most growth perspective

Germany is in full development. Promotion of health benefits and discount offers are important drivers for a rising avocado market. This makes it an interesting country for exporters.

Germany is 1 of the bigger countries in Europe. It has the most growth perspective besides Italy. Germany has the largest population in Europe and is still developing its avocado market. Currently, the consumption is just over 1.3 kg per capita and rising. Avocados are praised because of their health benefits and the German consumption is expected to catch up with other northwest-European markets.

Favourable consumer prices and the interest in healthy eating contribute to strong growth. Imports from developing countries continue to grow too. Almost 84,000 of the 127,000 tonnes of imported avocados came directly from developing countries. Peru, Colombia, Kenya and South Africa were the biggest suppliers to the German market in 2022.

Germany is the home country of discount retailers such as Lidl and Aldi. These retailers often take the lead in promoting avocados. At the same time a retailer like Lidl is known to be 1 of strictest when it comes to pesticide residues. This can be a barrier for avocado exporters. The aversion to pesticides also make Germany a promising candidate for selling organic avocados. Germany has the highest sales revenue for organic food in Europe.

Tips:

- Maintain Lidl standards for supplying the German market. It is known as being 1 of the strictest. This means the pesticide residue level of your avocados must be a third of the European allowed limits.

- Focus on the facts when presenting your product such as the results of a laboratory analysis or your registration of used chemicals. German purchasers are not very sensitive to emotional sales arguments.

- Read about all the specifics of the German market in CBI’s market information on Exporting fresh fruit and vegetables to Germany.

United Kingdom: Important consumer but with increasing economic pressure

The United Kingdom (UK) is among the largest markets for avocados, but with high standards and increasing price pressure. As a supplier you must be competitive and well organised.

Like in France, consumption in the United Kingdom increased fast until 2016. Since then, the United Kingdom has remained a stable market for avocados, despite rising prices and a cost-of-living crisis. Recent news from Freshplaza confirmed this again.

The United Kingdom imported 116,000 tonnes of avocados in 2022. This was slightly more than in the previous year. Direct import replaced some of the former supplies via the Netherlands and Spain. Imports from Peru continued to grow. Supply from Kenya, Tanzania and Morocco also increased. A growing interest in plant-based diets will keep up the demand. However, the sustainability of avocado orchards, or lack thereof due to their intensive water use, has also had a negative effect on some avocado enthusiasts.

Avocado companies consider the United Kingdom to be 1 of the main markets. Investments and product branding confirms this. California-based Mission Produce has announced plans to open a state-of-the-art ripening, packaging and forward distribution centre in the UK in 2023. Westfalia Fruit will invest more in the United Kingdom as the centre of excellence for avocado ripening. They also introduced the ‘gourmet’ GEM avocado through the British main retailer.

The United Kingdom is an interesting market to supply directly from developing countries. But there is little room for informality or mistakes. In this developed market you can expect continuing pressure on prices, while the quality and certification standards remain 1 of the highest.

Tip:

- Find more opportunities for market entry in CBI’s report on Exporting fresh fruit and vegetables to the United Kingdom.

Spain: Complements production with import

Spain is a producer, consumer and also an emerging trade hub for avocados. For an exporter Spain is an interesting target country, because it is likely you will find a broader market than just Spain itself.

Spain is the main producer of avocados in Europe. According to Eurostat, production hit a record 117,000 tonnes in 2021. Production in 2022 was 106,000 tonnes less. On top of that, the country imported over 200,000 tonnes of avocados that year. Almost 85% was sourced in developing countries such as Peru and Morocco. Mexico, the second largest supplier to Spain in 2021, experienced a decrease in production and reduced its supply from 34,000 to 10,000 tonnes.

Production and trade statistics are not fully aligned. For that reason, the consumption rate in Spain is difficult to estimate. Either way, Spanish traders also purchase more and more avocados from abroad to complement their own production season and comply with international supply contracts. This makes Spain Europe’s second-largest exporter of avocados after the Netherlands. In the years to come you can expect Spain to become a larger consumer of avocados. but more importantly, it will also play a bigger role in the European avocado supply.

Most of the avocados traded from Spain have France as their destination (65,000 tonnes), followed by the Netherlands and Germany (28,000 and 11,000 tonnes respectively).

Tips:

- Use Spanish avocado importers and traders mainly to strengthen your position in France and southern Europe. Visit the Fruit Attraction trade fair to get in contact with Spanish avocado companies.

- See how Spain is developing its trade in the reports on Exporting fresh fruit and vegetables to Spain.

Italy: An emerging country for avocados

Italy is still emerging as an avocado country. The potential of its large population and underdeveloped consumption should be a reason for exporters to maintain a focus on Italy.

The avocado consumption in Italy is very small in comparison with the population size (less than 800 g per capita). It is far behind the Western European average. In Italy consumers hold on to traditional fruit and vegetables. ‘New products’ such as avocados take time to be introduced. Green skins and smaller sizes are popular, but people are getting more used to the Hass variety as well.

Despite the traditional consumers, Italian traders are optimistic about avocados and with reason. Import volumes were up by 22% in 2022 compared to the year before. Most of the 47,000 tonnes were imported from European traders in the Netherlands and France. However, suppliers from Peru, Israel and Chile are increasing their exports too, trying to create a direct supply line to Italy.

Although Italy is currently not among the top consumer countries in Europe, its avocado market must be counted among the ones with the highest potential.

Tip:

- Take advantage of the potential growth of avocados in Italy and start building relations with importers. Italian companies are normally most focused on their internal market. So to meet them you must go there. A popular gathering place for Italian fruit companies is the Macfrut trade fair in Rimini.

4. Which trends offer opportunities on the European avocado market?

Avocado consumption is boosted by its reputation as a healthy fruit, product promotion and the innovation in ready-to-eat avocados. Due to the increased attention, sustainability has become an important factor in the avocado trade.

Ready-to-eat fuels consumption

Avocado consumption is boosted by its reputation as a healthy fruit, product promotion and ripening innovations. Due to the increased attention, sustainability has become an important factor in the avocado trade.

Ready-to-eat fuels consumption

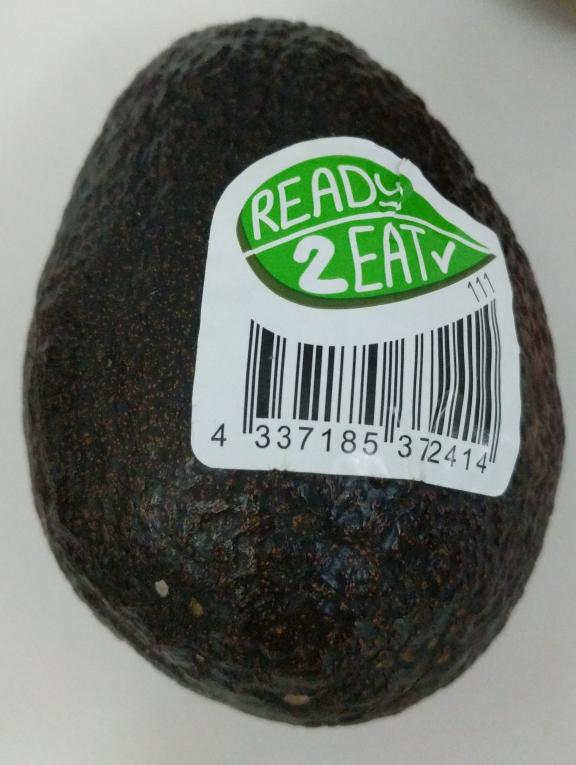

The consumption of avocados has been supported by developments such as ‘ready to eat’. Ripening helps provide convenience and quality at the same time. Consumers are prepared to pay a premium price for high-quality ‘ready to eat’ avocados. It is a safe and easy choice.

The ‘ready to eat’ trend started in the United Kingdom and the Netherlands. It has become a common product in most European countries. It will continue to develop further and help boost the consumption.

Companies offer fruit ripening as a service or large fruit suppliers implement their own ripening facilities. Examples of specialist ripeners are Nature’s Pride and LBP (service provider) in the Netherlands, and Westfalia and The Avocado Company (Fresca Group) in the United Kingdom.

Ripening facilities will grow larger and more professional. More and more large companies invest in European-based facilities with the latest technologies. Technology providers like Felix Instruments, the Experience Fruit Quality company and Aweta offer non-destructive solutions for testing the quality of avocados. This will contribute to optimal quality for ready-to-eat avocados.

As an exporter you can best capitalise on this trend by focusing on importers with ripening facilities. In doing so, you should always be aware of supplying uniform quality and an acceptable level of dry matter content.

Figure 6: Example of a ready-to-eat avocado

Source: Photo by smias per Open Food Facts

Tip:

- Always check the fruit maturity and dry matter before shipping. Supply avocados with a minimum dry matter content of 22-23%, especially when destined for ripening. You can find more information on buyer requirements for avocados in the CBI study ‘Entering the European market for avocados’.

Sustainability has become a precondition

Environmental and social issues are becoming more and more important in the supply of fresh fruit and vegetables. This is no different for avocados. To stay in business, you must work on a sustainable and responsible production.

There are increasing concerns about water resources and deforestation in avocado production. These concerns touch Peru, Chile, Mexico and Brazil, among others. Because avocados are a popular fruit in health food media, negative attention resonates in the public sphere. Although this has had little impact on general consumption so far, it influences the sourcing preferences and the pressure on certifications. For suppliers, this requires greater supply chain transparency.

A large number of retailers and importers are committing to social standards such as Sedex Members Ethical Trade Audit (SMETA), or initiatives such as the Sustainability Initiative Fruit and Vegetables (SIFAV). For example, together with SIFAV, the company Eosta has increased the transparency of ‘Living Wages’ in Kenya.

Social and environmental standards and certifications such as GLOBALG.A.P. GRASP, SMETA and amfori BSCI have become a precondition for the import of fresh tropical fruit such as avocado. Several European retailers have also upgraded their sustainability standards for avocados to the Rainforest Alliance and GLOBALG.A.P. SPRING certifications to meet their more stringent requirements.

As an exporter, you must be able to prove your good practices and convince importers and retailers in Europe. This is why many avocado exporters are implementing certifications and have also started to actively work on reducing their carbon footprints. Companies such as the Chilean Subsole have realised several projects to confront different environmental issues, including their management of water, soil, energy and waste. The Kenyan smallholder farms that work with Olivado Direct are carbon neutral. They use only natural rainfall for their avocado production and they turn waste into bio-energy and organic fertiliser.

Tips:

- Promote sustainable agriculture and proactively show your actions to reduce water usage. Pay extra attention to this in water-scarce regions.

- Get certified and implement social and sustainability standards. See the SIFAV Basket of Standards for relevant standards. Also try to think creatively and undertake activities to guarantee a sustainable production and sustainable water use.

Attention to the health factor of avocados

Avocados have a good reputation for their health benefits. In the future, you will continue to see avocados more popular as a versatile and healthy product. You can also profit from the increasing demand for organic-certified avocados.

Consumers in Europe are becoming more aware of health issues and pay more attention to their diet. Avocado fits well in this trend thanks to its good fats, fibre, vitamins and minerals. It also serves specific consumer groups that prefer a plant-based diet, such as vegans, vegetarians and flexitarians. All these aspects are used in the promotion of avocados and contribute to the increasing consumption throughout Europe. Avocados turn up in all kinds of recipes, like the Healthy avocado recipes of BBC Good Food, the 9 Healthy Avocado recipes for Breakfast, Lunch, Dinner, and even Dessert! from EverydayHealth, and the Jamie Oliver’s 70 avocado recipes.

Thanks to the increased attention to health and the environment, the interest in organically produced avocados is growing. Organic specialists estimate that the organic market makes up between 13 and 15%. The current supply does not fully satisfy a year-round demand due to the difficulty of producing organic avocados. Organic avocados can be an opportunity for growers that are able to produce according to the strict European guidelines for organic production. You can expect a premium price for organic avocados – however, when avocado prices become too high, consumers stop purchasing organic or fall back on conventional supply.

Tip:

- Familiarise yourself with the organic guidelines and organic farming in Europe before getting into the organic trade.

Promotion, innovation and branding improve consumer experience

The promotion of avocados has reached extreme levels. This explains why avocados followed a strong upward trend. However, it is also a reason to be cautious as food hypes never last forever. As a supplier you can best add to the promotional strength of avocados by providing a positive background story about the origin and the growers of your product.

Figure 7: Example of Italian branding of ‘creamy, organic avocado with soft pulp’

Source: ICI Business

Branding and promoting can contribute to consumers’ experience and quality perception. Avocados have great promotional value and are unique in the fresh sector for their level of innovation.

Avocado suppliers create ready-to-eat or organic avocado brands in an attempt to link their brand to quality. Examples of importer brands are Best Choice Ready-to-eat from Special Fruit and Nature’s Pride Eat Me label.

Retailers try to steal the show with all kinds of variations and niche products. Besides ready-to-eat avocados, supermarkets like Tesco offer avocados for home-ripening and special gourmet varieties, such as the Gem variety. In larger consumer markets, such as France, you can also find large tropical avocados. Dutch supermarkets try to meet the demand for fresh convenience with ready-made guacamole and combined fresh packs to make guacamole at home.

Figure 8: Large tropical avocados next to packaged ready-to-eat avocados in a French supermarket

Source: ICI Business

Tips:

- Create and communicate the story of your product (what promise does it deliver?) and be consistent with your supply. Avocados benefit from their promotion, but your contribution as a foreign supplier is limited. Your actions must be targeted at your buyer.

- See the CBI Trends in fresh fruit and vegetables for more information on trending topics.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research