Entering the European market for fresh coconut

The European market for coconuts is relatively small with many potential suppliers. Young and mature coconuts are very different markets, each with its own specifications and requirements. Ivory Coast (mature coconuts), Thailand and Vietnam (young coconuts) are the main players reaching large sales channels, such as supermarkets. Freshness and sustainable production are key if you want to participate in the European coconut trade.

Contents of this page

- What requirements and certifications must fresh coconuts comply with to be allowed to be sold on the European market?

- Through what channels can you get fresh coconut on the European market?

- What is the competition like in the European fresh coconut market?

- What are the prices for fresh coconuts on the European market?

1. What requirements and certifications must fresh coconuts comply with to be allowed to be sold on the European market?

Fresh coconuts must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant of Access2Markets that provides an overview of export requirements for fresh coconuts (code 08011200 and 08011900) per country.

What are the mandatory requirements?

Pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental risks, the European Union has set maximum residue levels (MRLs) for pesticides and other contaminants, such as heavy metals, in and on food products. Products exceeding the MRLs are withdrawn from the market.

Luckily the coconut is relatively well protected by its own shell, which makes it less vulnerable to pests. However, excessive leaf spraying and trunk injections meant to protect the tree can lead to chemicals ending up in the coconut water.

Young coconuts are often bleached or treated with an antioxidant. Be aware that the use of many of these chemicals, such as sodium metabisulphite, has not been authorised in the European Union.

Note that buyers in several EU Member States, such as Germany, the Netherlands and Austria, use even lower maximum residue levels than those established by European legislation.

Tips:

- Check the EU Pesticides database to find all MRLs and those specific for coconuts. Search by product or pesticide and the database to find the list of associated MRLs.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that lead contamination in your coconuts remains below 0.10 mg/kg and cadmium below 0,050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Quality standard

There are no official marketing standards for fresh coconuts. But they still must comply with the same basic standards as any other fresh fruit, which means they have to be:

- intact and sound;

- clean, practically free of any visible foreign matter;

- practically free from pests;

- practically free from damage caused by pests;

- free of abnormal external moisture;

- free of any foreign smell and taste;

- able to withstand transport and handling.

A tolerance of 10% in each lot is permitted in number or weight of product not meeting the minimum quality requirements. Within this tolerance, not more than 2% in total may consist of produce affected by decay.

Mature coconuts in the inner shells are normally expected to be:

- brown, uniform and without excessive fibres;

- free from cracks, pests or fungus;

- without sunken or wet mouldy eyes.

For young coconuts (six to nine months old), you can best follow the guideline of the Association of Southeast Asian Nations (ASEAN), which has developed a standard for young coconuts.

Tip:

- Open a representative number of coconuts before shipping and check their flesh and water content. This way you have comparable data to present to your buyer when your product is checked at arrival. It is important to show you have done your part to guarantee the quality and freshness of the coconuts.

Handling

Husked coconuts are susceptible to cracking and weight loss, and have a reduced shelf life. It is important for you to maintain coconuts fresh and prevent them from cracking by:

- taking care of post-harvest handling;

- avoiding quick temperature changes of 8 degrees Celsius or more;

- storing and shipping husked coconuts preferably in cool temperatures between 0 and 16ºC. Mature coconuts are generally shipped at 8ºC to 12ºC. Young coconuts are usually held at 3ºC to 6ºC. Higher temperatures will reduce shelf life significantly.

- maintain a humidity level of around 80% for mature coconuts and 90% for young coconuts to prevent weight loss and evaporation.

- make sure to apply sufficient ventilation to prevent mould.

Young coconuts have a softer inner shell and require extra attention at packaging and cooling to ensure shelf life. Mature coconuts also have differences in shell strength. For example, the Port-Bouet 121 has a thinner shell than the West African tall, which gives them a higher risk of cracking.

The main defects observed in coconuts are:

- broken nuts because of poor sack handling;

- nuts wetted by the juice of other fruits, enhancing the growth of moulds;

- germination of eyes.

Tip:

- Make sure the post-harvest handling, including cooling, is well organised to ensure product quality and shelf life. Read more about the handling of coconuts in the cargo handbook.

Size and packaging

Mature coconuts are generally husked and packed in jute bags or sacks, and mostly come in 40 or 50 units per 25 kg bag (size 40 and 50). Alternatively mature coconuts are sometimes packed in open or closed cardboard boxes of 8 to 20 units. The weight of the coconut is an important aspect for the final seller.

For young coconuts, you have whole, trimmed or polished fruit. Trimmed coconuts are the most common in Europe. According to the ASEAN Standard for young coconuts the size is determined by the weight of the fruit (see table 1). Young coconuts are almost always packaged in cardboard boxes.

Table 1: size codes and weight in grams

| Size code | Whole fruit | Trimmed fruit | Polished fruit |

| 1 | >2400 | >1500 | >600 |

| 2 | 1901-2400 | 1201-1500 | 451-600 |

| 3 | 1401-1900 | 901-1200 | 300-450 |

| 4 | 901-1400 | 601-900 | |

| 5 | 400-900 | 300-600 |

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Consider laser labelling for the individual labelling of your coconuts, if you have access to such technology. This is a sustainable way to label your products without using extra materials, which will therefore become more popular in the future. It is also a good way to label organic coconuts.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

- See the buyer requirements for fresh fruit and vegetables on the CBI market information platform for legal labelling requirements.

What additional requirements do buyers often have?

Variety

For mature coconuts, the varieties with high flesh content are preferred, but price also plays an important role. As a producer or exporter, you can get the best returns on high-yielding and disease-resistant varieties. These are often hybrid varieties.

For young coconuts, the quality of the coconut water is the most important feature. Fresh, young coconuts are meant for direct and natural consumption without processing and are a luxury fruit. Therefore, the aromatic coconut varieties, such as the Thai Nam Hom, are highly preferred.

Certification

Common certifications for fresh coconuts include GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommended.

Coconut production in most countries often involves small farmers. For small coconut producers, for example in Vietnam, the certification costs are high and GlobalG.A.P. is difficult to obtain. But to get your product in major retail chains it is almost a necessity.

Tip:

- Work with other producers to get the certifications you need for supplying to European buyers. A joint effort can make certifications come within reach for small farmers. Just make sure product traceability is well organised.

Sustainability and social responsibility

Supply chains are becoming more transparent and consumers better informed about environmental and social issues. They expect you to have a sustainable approach to production and processing. Buyers act on this by requiring transparency and certifications from your company. Social and environmental certification schemes include actions to strongly reduce and register the use of pesticides, take action on the safety of employees or even include price guarantees or ‘living income’ for producers.

For fruit collectors and exporters, it is important to show they are engaged in the well-being of their production sources, both socially and environmentally. The best way to do this is through adopting social and environmental standards, such as:

- Sedex Members Ethical Trade Audit (SMETA)

- Amfori BSCI

- GlobalG.A.P. and GlobalG.A.P. Grasp

- Rainforest Alliance

- Ethical Trade Initiative (ETI)

FairFood launched the first initiative to make the coconut trade fully transparent with blockchain technology, aiming for a ‘living income’ for farmers.

With a large number of small farmers, traceability is another hot issue to solve. Market players require sustainable production and must be able to verify sustainable practices. To achieve this, some companies, such as Tesco and AAK (a vegetable oil company), have partnered up with Rainforest Alliance. AAK is also one of the founding partners of the Sustainable Coconut Charter, supporting the coconut sector.

Tips:

- Implement at least one environmental and one social standard. See the Basket of Standards of the Sustainability Initiative of Fruit and Vegetables (SIFAV).

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

The Green Deal

In the coming years the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe for becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal, aiming to make food systems fair, healthy and environmentally friendly. This strategy will ensure sustainable food production and address packaging and food waste for example. For suppliers of fresh fruit and vegetables, it is important to look beyond the increasingly stringent standards and try to be at the frontline of the developments.

Organic can be a requirement in fresh coconuts

Organic coconut is a growing segment. Coconuts fit very well in the growing consumer attention to health and natural foods. That is why there is a relatively strong focus from buyers on organic cultivation.

Fresh organic coconuts are most in demand by supermarkets and specialised organic buyers. Processed products, such as bottled coconut water and virgin coconut oil, are also popular as organic products. In ethnic channels, organic certification is less required. The demand for organic products is strongest in Germany, the Alpine region and Scandinavia.

In order to market organic products in Europe, you must use organic production methods in accordance with European legislation and apply for an organic certificate from an accredited certifier. Since January 2022 the new Regulation (EU) 2018/848 has been in force. This legislation includes new rules for group certification, new approaches for dealing with suspected non-compliance and residues, and new rules at the EU borders for imported products.

Tip:

- Consider organic coconuts as a plus to open more markets, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the entire organic certification process.

What are the requirements for niche markets?

Consumer labels for sustainable and fair trade coconuts

Health benefits have put coconuts in the spotlight for conscious consumers and food media. But this attention can easily be directed to potential negative sides in cultivation practices, such as concerns with poor labour conditions. Since coconuts are a typical smallholder and labour-intensive product, some buyers want to assure end consumers that their coconut product is socially and environmentally responsible.

Consumer labels such as Fairtrade and Rainforest Alliance are most common for coconut products. You will find them often on processed products, but they also touch the fresh coconut trade as a niche requirement, providing additional value to the product.

For example, the British supermarket Tesco sells Rainforest Alliance coconuts from Ivory Coast under private label. Importing companies, such as AgroFair, commercialise Fairtrade coconuts from Ivory Coast.

Tip:

- First focus on complying with the BSCI Code of Conduct or ETI Base Code and do the Sedex Self-Assessment Questionnaire (SAQ). This is your main priority before looking into getting certification from social and environmental consumer labels.

2. Through what channels can you get fresh coconut on the European market?

Fresh coconuts are marketed through supermarkets and ethnic or specialised wholesalers. Where your coconuts will end up depends on the type of coconut (mature or young) and the volume you are able to supply.

How is the end market segmented?

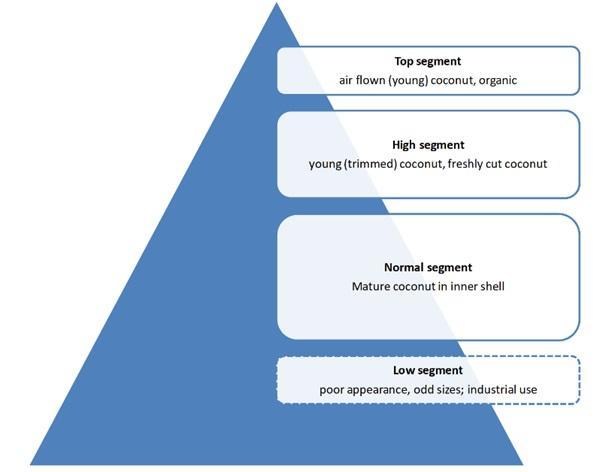

The market for fresh coconuts is mainly divided into drinkable young coconuts and mature coconuts (in shell or in pieces). These markets are very distinctive and not necessarily comparable. Mature coconuts are still the dominant segment, but most growth is to be expected in the young drinkable coconut and freshly-cut pieces segments.

Young coconuts

Young coconut is most perishable and is mainly consumed because of the coconut water. It requires more care, and therefore they can be found in a higher segment. Coconut water is also associated with health properties, which can be strengthened by organic certification. Air freight can be used to ensure the freshness of organic non-treated coconuts, but the additional costs of certification and logistics put these young coconuts in an exclusive segment. Supermarkets that offer a variety of exotic fruit will likely also offer young, drinkable coconut, especially throughout the summer. But these coconuts are also appreciated in trendy beach clubs. See the section on buyer requirements above for the marketing standards of young coconuts.

Mature coconuts

Mature coconut is mainly used for its flesh, not its water. For these products, price is the focal point. Consumers can enjoy a relatively large exotic fruit for a reasonable price. Coconuts are sold to consumers through retailers but are also used for culinary purposes in the food service segment, especially for exotic or ethnic recipes. Supermarkets expand their product range with freshly-cut coconut, adding extra value and processing costs which are compensated by more efficient logistics. The freshly-cut segment is growing. It has become a new way for retailers to offer high quality tropical fruit in a convenient way.

It is difficult to evaluate the quality of a coconut. For the end market, appearance and size are the most important features for coconuts. When the product has an inferior appearance, it becomes unsuitable for selling it for fresh consumption and can be best used for processing in the origin country.

Figure 1: Market segments for fresh coconut

Tip:

- Organise a cost-efficient supply chain without compromising on the quality of the product. For mature coconuts, you must be efficient to be price competitive. In a high segment, such as young coconuts, you can save on airfreight by using sea freight and proper packaging (wax or film wrap) to keep your product in good condition. See the cargo handbook for details on shipping and storing coconuts.

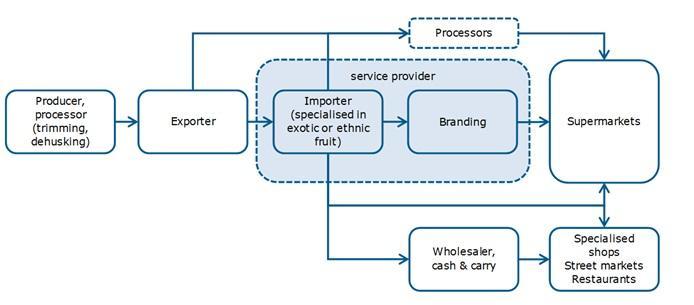

Through what channels do coconuts reach the end market?

Coconuts are usually traded by a selection of specialised importers. They are your principal points of entry into the European market. Further down the chain you will find supermarkets, wholesalers, and processing companies that like to work with coconuts.

Specialised importers and service providers

Importers play a central role in the distribution of fresh coconuts. These importers are often specialised in exotic or ethnic fruit and vegetables and maintain a wide network of clients in retail and food service wholesale. Because coconuts are a very specific product, importers often have wholesale activities as well. Companies that import coconut are, for example: BUD Holland, N&K (Kinobé group) and Exotimex.

The introduction of coconut water brought about new businesses that exclusively sell drinkable young coconuts, such as Genuine Coconut in Spain. Other companies, among which the British Coconutty, combine the sales of green or young coconuts with other coconut products, such as oil, cream and flour.

Some importers, such as Nature’s Pride, take the role as service providers, developing concepts for supermarkets and organising the supply chain. They can brand coconuts, provide easy-to-open young coconuts or add consumer labelling with instructions on how to open the coconut. For perishable young coconuts, it is especially important to maintain an efficient and short supply chain.

Processors

Coconuts are part of a versatile sector, with many derivatives, added-value products or product innovations. Most of the basic processing is done in the countries of origin. For example, Blue Skies processes and sources coconut chunks from Ghana. Companies that add value to coconuts in Europe include Ponthier, which processes coconuts from Sri Lanka to make a natural coconut puree, and First Grade International, a food ingredients company and the biggest importer of coconut and coconut ingredients in the United Kingdom.

Supermarkets

Supermarkets are responsible for a large share of fresh coconuts on the market, although it remains a very specific fruit. For many supermarkets, coconuts are a seasonal product, promoted mainly during the summer. Processed products such as canned coconut cream, desiccated coconut and bottled coconut water are standard in every main grocery store in Europe. But as coconuts become a large segment, you can expect supermarkets to make fresh coconut available throughout the year.

Supermarkets would normally use their preferred service providers to source coconuts or find a brand with an original concept that adds more value to the product. A supermarket that is known for its ample and high-quality fresh assortment, for example, is Grand Frais in France.

You will also see more and more coconuts under private label because supermarkets are increasingly involved with sourcing to ensure reliable and sustainable sources. Examples of these private label coconuts include Tesco’s Rainforest Alliance coconut, a ASDA’s Grower’s Selection coconut and Albert Heijn’s organic coconut.

Wholesalers (spot market)

Traditional fruit wholesalers cover the spot market, moving according to trade fluctuations. Many of these companies can be found on wholesale markets such as Rungis in France and New Spitalfields Market in the United Kingdom. Examples are Tropibana (France) and Tropifruit (UK). They supply to specialised and ethnic shops, street merchants and restaurants. In the case of coconuts, import and wholesale sometimes are performed by the same company.

Large, non-specialised cash & carry wholesalers, such as Sligro Food Group in the Netherlands and Belgium, also service food professionals and the food service industry. Importing exotic products is not part of their business, so they depend on the expertise of their partner. In this case from Sligro this is the fruit and vegetable specialist Smeding, in which Sligro is a large shareholder.

Figure 2: Market channels for fresh coconut

Tip:

- Do not make it too hard for yourself in the beginning. Focus on specialised importers when first entering the market, then explore other channels and coconut products. For most retailers, coconuts are a minor product.

What is the most interesting channel for you?

The most interesting channels for exporters are supermarkets with an exotic fruit assortment, as well as wholesalers that supply the food service segment. Most important is finding a buyer or importer that knows the fresh coconut business and these different channels. In most cases, you can rely on ethnic or exotic fruit specialists, such as Exotimex, Kinobé Groupe and Special Fruit.

Working closely with an importer that has wholesale activities can help connect with different users in the end market, such as ethnic shops and juice bars. Cocobomb (fresh and frozen) and SIIM (at Rungis wholesale market) are two of such companies, providing clients with both single case deliveries and bulk orders. Direct trade can improve profits, but it is not a guarantee.

For large volumes, you will need large buyers, such as supermarkets. Being part of the supply chain of large retail chains gives you most security and relatively stable margins. However, the requirements are high and the room for negotiation is minimal. The most likely route to become part of a retail programme is to cooperate with a service provider that has a local infrastructure and supply contracts with retailers. Typical importers that deal with exotic fruit and that have the capacity to commit to supermarkets include, for example, Roveg, Nature’s Pride and Greenyard Fresh France (formerly known as Katopé).

Tips:

- Go to trade fairs to find buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and Fruit Attraction in Madrid.

- Visit wholesale markets, such as Rungis in Paris and Mercabarna in Barcelona. These markets include companies that have exotic products and can be good starting points to find coconut buyers in France and Spain.

3. What is the competition like in the European fresh coconut market?

There are many producing countries that could participate in the coconut trade. Production volumes went down in recent years, but new plantations will help meet future demand. In mature coconuts, producers from Ivory Coast will be your main competitors. Ivorian exporters are relatively close to Europe and have dominated the European market with affordable coconuts for a long time. Fresh coconut exporters in Asia are mainly focused on young coconuts. Thailand is best positioned to supply these drinkable coconuts, while Vietnam is gaining ground fast.

Which countries are you competing with?

Ivory Coast

Ivorian exporters are relatively close to Europe and have dominated the European market with affordable coconuts for a long time. They are considered to be the best cost-efficient source for mature coconuts.

Ivory Coast is Europe’s largest supplier of coconuts, almost exclusively mature brown coconuts in the inner shell. Price and distance are the main drivers for European buyers to continue sourcing mature coconuts in Ivory Coast. Although Asia is many times larger in coconut production, Ivory Coast has the logistical advantage of being close in distance to Europe – with a transit time of around 10 days. This makes it less attractive for other countries to compete in the European market. With the very high container prices from Asia, the country is expected to maintain its current market position.

The Ivorian coconut success is related to large industrial plantations established in the past and a price-competitive supply. Ivorian exports to Europe remain strong and were valued at nearly €12 million in 2021.

However, the reputation of West African coconuts is far from perfect. Local infrastructure is insufficient and the sector is poorly organised. The trade is managed by a large number of small collectors and exporters and there is a lack of investment, which may lead to the weakening of the sector.

Tip:

- Plant high yielding coconut varieties to compete with Ivorian exporters, but also make sure you are close to logistical exit points or seaports.

Thailand

Thailand is a preferred country of origin for fresh young coconuts for European buyers, especially the aromatic Nam Hom variety. The Thai coconut has excellent organoleptic qualities (fragrance and sweetness) and is considered superior to other coconuts in Asia or Africa, making the Thai young coconut the preferred product by buyers in Europe.

Thailand needs coconuts not only for fresh export, but also for local consumption and processing. The Thai industry had become dependent on imported coconuts, ignoring local production. As a result, Thailand has struggled with crop shortages in recent years and exports to Europe decreased from 2017. Europe imported €4.4 million worth of Thai coconuts in 2021, almost 40% less than five years earlier. The import from Thailand decreased in Spain and the United Kingdom. In the Netherlands and Germany, Thai coconuts are still going strong.

Another issue that has not been favourable for Thai exports is the negative attention regarding the use of monkeys for harvesting. Several retailers have since become more hesitant to buy Thai coconut products. This has given Vietnamese producers the opportunity to extend their exports to Europe.

Vietnam

Just like Thailand, Vietnam’s main fresh coconut export to Europe product is young coconut. In a short time, exporters have managed to take a significant market share on the European market. In 2021, Vietnamese coconut exports to Europe reached €5.5 million, growing from less than €1 million prior to 2016.

Vietnam is traditionally highly dependent on demand from China, but has recently started to diversify its export markets. As the Chinese demand is volatile, Europe has become an interesting growth market. Vietnamese have proven to be commercially competitive and exporters are improving their standards to get better accepted in Europe.

Spain has partly shifted its (young) coconut supply from Thailand to Vietnam. In the Netherlands, interest in Vietnamese coconuts is also growing. In the next few years, expect their presence to become more widespread in Europe. Nevertheless, demand in less strict markets, such as China and the Middle East, will continue to influence the direction of Vietnamese coconuts.

India

India is a relatively stable coconut supplying country. You will find the strongest competition from Indian exporters when working with the United Kingdom. In 2021, over two-thirds of the European coconut imports from India were destined for the British market.

The United Kingdom has a long trade relation with India and a large Indian community, suggesting that much of the Indian coconut supply to the UK is directed at the ethnic market. This market mostly purchases mature coconuts and processed coconut products. A few Indian suppliers have gained market access to mainland Europe, such as INI Farms, supplying fresh cut, mature coconut via their own Dutch distribution channel (see competing companies below). Indian suppliers also offer young coconuts, but until now have not had the same success as those in Thailand and Vietnam.

In the short term, it is unlikely that European buyers will shift their focus to Indian coconuts. But being one of the top three coconut producers in the world, after the Philippines and Indonesia, India will remain in the picture. They can be an alternative supplier to Ivory Coast or expand as a supplier of processed coconut products, such as freshly cut pieces.

Sri Lanka

Sri Lanka has a long history in coconut production and trade. The King coconut is a key variety in Sri Lanka, which is full of nutrients and mainly used for its naturally sweet liquid.

Sri Lanka is a valued and well-known source for both fresh and processed coconut. However, product scarcity sometimes results in high prices and an unpredictable supply. And two-thirds of the production is consumed locally. For long-term international buyers this is a risk. The country will become a stronger competitor once it has scaled up production volumes.

European coconut imports from Sri Lanka in 2021 were worth around €2.5 million. This is a reasonable value when looking at the past few years, but the country has the potential to export more. The main importer is the United Kingdom. This country has a historic relationship with Sri Lanka and coconuts are an important ingredient for Sri Lankan cuisine in the UK.

Ghana

There is a lot of interest from Ghana to increase coconut exports to Europe. The Ghana Export Promotion Authority (GEPA) is strengthening coconut sector associations and the Ghanaian government is making short-maturing, improved-quality and disease-resistant seedlings available to farmers and allowing them to expand their coconut farms. The country considers itself to be a competitive source for (organic) coconuts due to its proximity to Europe and government support.

Ghanaian coconut exports to Europe have been increasing in the past 5 years up to 2020. Until then, the United Kingdom imported the highest value. But since 2020 trade has shifted more to mainland Europe, in particular to Belgium.

In the near future, production will be further boosted with the investment of the Ghana Export-Import Bank. Ghana will become a stronger competitor for coconut suppliers from Ivory Coast and Sri Lanka.

Tips:

- Learn from the quality processes used in Thailand to prepare and export young coconuts. To compete with Thai coconuts, you must be able to supply similar quality. See for example the basic process described by the Thai Farm Fresh company.

- Differentiate in volume, coconut variety and, above all, in your level of organisation. The main difficulty in most countries is the small size of the coconut operations. Organise your supply chain by gathering several producers and make sure all the farmers maintain the same production methods.

- Improve your network and knowledge of the coconut trade by connecting with experts and organisations, for example the International Coconut Community.

Which companies are your competition?

The large and growing number of coconut producers means competition in coconuts can be fierce. However, only a few companies really manage to get large volumes to Europe. Their success shows that as an exporter you must not only stand out in quality and presentation, but you also need a dedicated partner or presence in the European market.

True Fruits

True Fruits in Vietnam offers easy-to-open and ready-to-eat young coconuts, in addition to polished, husked, green, and mature brown coconuts. The company organises the entire supply chain; they work with large farms in the Mekong Delta and use modern packaging factories and wide distribution channels.

True Fruits presents a credible story of a quality product and a sustainable approach. No less important is the fact that they also invest in communication. The company has a LinkedIn profile and publishes news about their activities on the news site Freshplaza. These initiatives help them build their reputation and show that they are open to communicating with potential buyers, both of which are crucial in the fresh trade.

Tip:

- Have a convincing story and make sure buyers can find your company easily. Use a modern and accessible website and an active profile on social media platforms, such as LinkedIn. See the CBI study on finding buyers for more tips.

INI Farms

INI Farms has a branch office located in Amsterdam to service customers in Europe. From there, INI Farms works closely together with Sous Fresh to commercialise their freshly cut coconuts.

Although it is not necessary for you to have your own office in Europe to sell coconuts — and not always wise, as importers may see you as a competitor — having a trusted partner is all the more relevant.

Besides integration with the market, the supply side is also important. INI Farms works with contract farming and small growers, which creates an extra challenge for them in grower management. Although small farms are common in the coconut trade, having your own production is always an advantage.

Tip:

- Explore different ways of cooperating with European buyers. Exclusive relations and joint ventures could help to involve your buyer in the sourcing of coconuts, offering both parties continuity in supply and demand.

Import Coconut

Thailand’s Import Coconut specialises in trading coconuts and related products. In 2015, they launched the premium brand Coco Wilson to market raw organic coconuts in Europe. According to their website, 35% of their exports go to Europe.

A well marketed brand will attract attention and give your product exposure, but you must not underestimate the investment and effort that such a project requires. To market a branded product, it is important to have an entity that can represent your product in Europe. Import Coconut decided to do the marketing through an office in Spain.

The limitation of Import Coconut is their sole focus on coconut water. They do not have another product to fall back on, which is recommended for any business.

Tips:

- Try inter-cropping as a solution to reducing your dependence on coconut as a single fresh product, if you are a producing exporter. Inter-cropping includes planting other fruits and vegetables among the coconut trees, such as banana, pineapple and sweet potato. Check which are best suitable for your area.

- Only work with branded products in Europe when you have a strong local representative or partner.

Which products are you competing with?

As an exotic product in Europe, fresh coconut competes with other exotic and tropical fruit, such as mango and papaya. Especially mango is much more known to consumers in Europe and consumed in larger volumes. Familiarity plays a role in the European consumer’s decision to purchase exotic fruit, as well as ease of consumption. Fresh whole coconuts are more difficult to prepare than most other exotic fruits. However, none of the exotic fruits in the market have the same characteristics of coconut.

Coconut is unique. Besides having an exotic image in the minds of European consumers, the coconut has a unique combination of pulp and liquid. Another strength of coconut is the price per kilo, which is lower than most other tropical fruit. See FruiTrop’s comparison of trade volumes and prices between different exotic fruits.

In addition to fresh coconut, there are many other coconut products available, including canned coconut cream, desiccated grated coconut and bottled coconut water. Fresh coconut chunks replace some of the whole coconut consumption. But all products are part of the demand for coconut. A growing availability of coconut products will have a positive effect on consumer awareness and generate more attention to both fresh and processed coconut in the future.

Tip:

- Exploit the unique characteristics of fresh coconuts, such as their natural state and their price compared to other exotic fruit. Discuss with your buyer how to promote these strong points on the labelling or packaging of your coconuts.

4. What are the prices for fresh coconuts on the European market?

The market for fresh coconuts is relatively stable, although prices fluctuate due to availability. According to import volumes and values, the average calculated price per kilo varies between €0.85 and €0.91. Prices have slightly increased in recent years due to higher costs of – mainly – logistics. However, these calculated prices are not very reliable because the trade data includes a mix of different origins and types of coconuts (young and mature).

Timing and origin are relevant factors for coconut prices. Prices in the European summer are generally higher, because of increased demand. During the European winter, some coconut importers plan promotions in the weeks around Christmas and New Year’s Eve.

Prices also depend on origin: According to the economic analysis of FruiTrop, mature coconuts from Dominican Republic, Costa Rica and Sri Lanka cost more than the ones from Ivory Coast, due to higher transport costs and larger fruit size.

The import prices for bulk mature coconuts from Ivory Coast are approximately €12.00 to €12.50 per bag of 50 units and €13.50 to €15.00 euros per bag with 40 (larger) units. The larger King Coconuts from Sri Lanka sell for up to €20 per bag. Coconuts in bags are usually repacked in boxes in the destination country. When sold and shipped in boxes, prices are slightly higher.

In Europe, wholesale prices for mature coconuts vary depending on quality and demand. Wholesale prices of large boxes with 15 to 16 units generally range from €8 to €11. Smaller boxes of approximately 8 units go for €5 or €6.

Young coconuts are almost always sold in boxes and get trade prices of approximately €0.80 to €1 euro per piece (FOB). Young coconuts can be shipped by sea freight when well stored, but occasional air freight can significantly increase the price of young coconuts in Europe. Importers generally keep a profit margin of 8% over the sales price, excluding handling costs.

In retail, consumer prices for fresh, mature coconuts vary between €1 and €1.50 per piece. For young coconuts, the consumer price varies between €2 and €4 euros per piece. As an exporter, you have to be aware that there is not always a direct relation between trade prices and consumer prices.

Tips:

- Find wholesale prices for coconuts (noix de coco in French) on the website of France Agrimer, to get an idea of asking prices from wholesalers. Remember that final sales prices are often lower. The International Coconut Community publishes weekly prices for coconut products and derivatives.

- Get familiar with consumer prices and presentations in the online assortment of European supermarket chains. For example, look at the online offer of Tesco in the UK, Albert Heijn in the Netherlands, Rewe in Germany, Carrefour in France.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research