The European market potential for fresh coconut

Health, convenience and innovation contribute to a larger consumption of fresh coconuts. Large volumes are sold in Germany, the United Kingdom and France. But there are also opportunities for freshly-cut coconut and young, drinkable coconuts. You can stand out as a supplier with innovative packaging and product development. Keep in mind that your supply volumes must be reliable.

Contents of this page

1. Product description

Coconut (scientific name: Cocos nucifera) is a stone fruit with a liquid and solid endosperm inside its core. A full-grown coconut fruit weighs almost 1.5 kilos. Coconut trees are highly tolerant of salty soils and grow best in warm climates with high humidity.

There are only two distinct types of coconut, the tall and the dwarf variety. The tall variety takes more years to bear its first fruit but has a longer lifespan. Hybrid varieties (tall x dwarf or dwarf x tall) are often used in commercial cultivation to get high and consistent yields.

Coconuts in Europe are sold in many forms, both fresh and processed:

- fresh mature coconut: husked coconut in the inner shell with mature flesh

- fresh young coconut: soft outer shell (often trimmed), soft flesh and high liquid content

- freshly cut coconut: packaged coconut in pieces

- frozen coconut (chunks)

- dried or desiccated coconut (often grated)

- coconut cream or milk (often canned)

- coconut water (often bottled and mixed)

- coconut oil (often in jars)

It also forms an ingredient for many applications in health food, cooking and cosmetic products. Virgin coconut oil (VCO) is currently explored as an additional treatment for patients with COVID-19 due to its antiviral and anti-inflammatory properties.

This product study focuses on all fresh coconut varieties. Mature or fresh brown coconuts are sometimes mistakenly referred to as dry or desiccated coconut. It is not sure to what extent this influences trade data. Trade statistics may also include a percentage of frozen coconut.

| Harmonized System (HS) code | 08011200 Coconuts in the inner shell “endocarp” 08011900 Coconuts, whether or not shelled or peeled |

| Examples of commercial varieties |

|

For other coconut applications see the CBI’s market information on:

- Exporting desiccated coconut to Europe

- Exporting virgin coconut oil to Europe

- Exporting coconut water to Europe

What makes Europe an interesting market for fresh coconut?

The import of coconuts has slightly decreased in recent years (2019-2021). The COVID-19 pandemic, the cost of transport and the availability of quality coconuts have hindered growth. But despite the higher costs, coconut specialists remain positive about the future of coconut exports. Consumption of fresh coconut flesh and water are expected to increase.

Coconut prospects good despite higher costs

The European market for coconuts grew until 2018. In recent years, import has somewhat stabilised and costs have risen since the COVID-19 pandemic. But according to coconut specialists, prospects remain good.

Fresh coconuts are registered under two statistical HS codes, which are often used interchangeably. Therefore, it is difficult to estimate the exact volume of fresh coconut as opposed to frozen, mature coconut as opposed to young, and inner-shell coconuts as opposed to whole ones or freshly cut coconuts. However, premium young coconuts are becoming more popular, as well as freshly cut coconut pieces. Several players have entered the young coconut market, such as Genuine Coconut and Nature’s Pride. You can expect more of these to be imported combined with an increasing average price throughout the coconut segment over the next few years.

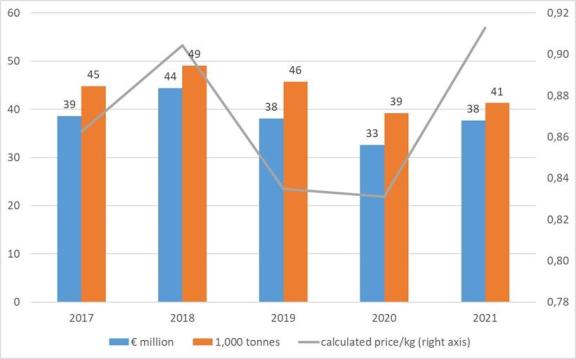

Peak imports of coconuts in 2018 reached 49,000 tonnes, after which it dropped to 39,000 tonnes in 2020. 2020 in particular showed a dip due to the COVID-19 pandemic and several lockdowns. Normally, coconut prices fluctuate according to annual availability. In 2021 there was a notable price increase. This was mainly due to continuous logistical problems and higher freight rates, especially from Asia. Despite the price increase, 2021 showed an upward trend in the European market.

As an exporter you can benefit from the developing demand in Europe. You can maximise your chances by maintaining flexibility in the type of coconut products you supply (fresh, frozen, cut) and use the strengths of your coconut variety (for its fresh flesh or for liquid content).

Figure 1: European imports (EU+UK+EFTA) of coconut (HS 080112 & 080119)

Source: Eurostat & ITC Trade Map

Tips:

- Explore the opportunities for different coconut products and focus on your strengths as a company to confront the competition. Find out who are your main competitors in fresh coconuts in ‘Entering the European market for fresh coconut’.

- Stay up to date with the European coconut market, for example by following news items on Freshplaza, FruiTrop, and FreshFruitPortal.

Health awareness and a stable supply can boost consumption

Coconuts in Europe have moved from being a traditional exotic product to a hip health fruit. As long as the supply can be guaranteed, you can expect long-term growth for coconut in Europe.

Coconut used to be an exotic product in Europe, but with the promotion of all kinds of healthy by-products coconut is not a strange fruit to consumers anymore. For example, the coconut water market has an expected growth of 13% (CAGR) for the period 2021-2025. Part of the growth can be attributed to fresh young coconuts. However, the consumption of fresh whole coconuts is still underdeveloped, probably due to the lack of knowledge about how to open a coconut.

Europe is responsible for only 3-4% of the total coconut trade worldwide. Europe may not be a traditional consumer of coconut, but considering its small share in the worldwide volume it offers potential for growth. Today’s consumption is relatively steady throughout the year with slightly higher imports during the summer and towards Christmas in December. While demand is higher, the supply of young coconuts is scarcer in summer due to slower production in Asia. This can drive up the prices.

The future consumption growth of coconut will depend on a stable supply and acceptable consumer prices. The main concerns are the stabilising global production and the increasing demand for coconuts in China. The world production is around 60 million tonnes but does not (yet) show signs of growth. In 2017 it was suggested that Asia would produce 80% less coconut in the next decade. It is estimated that as many as 90% of all coconut trees in Asia are nearing the end of their productive life cycles. The production in Ivory Coast, the key supplier of mature coconuts to Europe, has also declined in recent years.

Still, with new coconut plantations being set up it is unlikely that production will fall short. But importers in Europe will have to compete more to meet the increasing demand and to get a quality product. Opportunities will increase for new suppliers and origin countries that can match the quality and buyer expectations.

Tip:

- Get familiar with how buyers do business and how you can make your coconuts available to them. Read the study on Doing business in the European market for fresh fruit and vegetables.

2. Which European countries offer most opportunities for fresh coconut?

Fresh coconut imports in European markets show different preferences and growth. Spain and Belgium show the best growth figures in the last 5 years. Germany and Spain offer relatively good markets for young, drinkable coconuts. Mature markets such as the United Kingdom, France and Italy also absorb a relatively large volume. A large part of the European supply is imported and distributed by the Netherlands.

Germany: moving towards high-value young coconuts

The German import from developing countries is smaller in scale, but highest in terms of value. With the largest population of 82 million inhabitants, Germany will be among your target countries with the most export potential. A focus on health, natural and exotic products could help increase the consumption of fresh coconut too.

The German coconut market is relatively open for suppliers of different regions. Germany does not have a principal source for fresh coconuts as supplies come from different supplying countries such as Indonesia (2,100 tonnes in 2021), Thailand (1,500 tonnes), the Dominican Republic and Ivory Coast (both 800 tonnes). Several thousand tonnes are shipped through the Netherlands, but not clearly registered by German statistics.

In volume, German consumption per capita of fresh coconut seems to lag behind compared to other large European countries. However, it is the largest market for desiccated coconut and it is one of the few countries that offers more year-round opportunities for young coconuts. For German people fresh young coconuts are a reminder of their holidays and its consumption often goes together with a special event, such as a consumer fair or Christmas.

The focus on healthy nutrients and ingredients for vegans is expected to result in a positive demand for coconut in the future. Thus, fresh coconut is not only linked to an exotic holiday memory, it also offers an answer to the consumer’s healthier lifestyles. Several coconut promoters and brands such as Dr. Goerg and Kalua will contribute to a variety of coconut products and be a stimulant for the consumption of fresh and natural coconuts. Because of the association of coconut with health, exporters with an organic supply will have an advantage.

Tips:

- Supply Germany through the Netherlands. Young coconut is a niche product that needs an efficient supply chain. The Netherlands is specialised in logistical services and shares a border with Germany.

- Participate in the Fruit Logistica trade fair in Berlin. At this International fresh trade event you will find not only coconut buyers from Germany but also from many other European countries.

Netherlands: trading coconuts as main business

A majority of the imported coconuts finds its way to Europe through the Netherlands (see Figures 2 and 3). From there other important markets are supplied, such as Germany, France and Italy. But it also functions as a distribution hub for smaller markets throughout Europe. This means you can reach different markets via the Netherlands.

Exotic fruits, including coconut, is often a specialty of Dutch trade. Coconuts are imported year-round for the European market. In the Netherlands, demand for fresh coconut is highest around the summertime.

There are a number of specialised Dutch importers that deal with fresh coconut such as N&K (by Kinobé), Exotimex and Nature’s Pride. These specialists purchase mostly fresh coconuts from Ivory Coast (10,000 tonnes in 2021), mostly mature coconut, and young coconuts from Thailand (2,100 tonnes). Growing attention to sustainability may reduce the potential for young coconuts transported by airplane. Lidl, in the Netherlands, recently announced its decision to no longer import any fruits transported by air. Supermarket PLUS had already committed to this ambition.

Coconut is expected to remain a specialty product for several years to come, which means that Dutch companies will maintain a strong position in the coconut trade.

Tips:

- Make use of Dutch traders when you have difficulties in entering different European markets. Dutch importers often have wide experience in trading and there are several companies that are familiar with exotic fruit. Dutch fruit companies have a no-nonsense mentality, so calling or visiting them often works better than e-mailing.

- Find some of these importers on the member list of the Dutch Fresh Produce Centre, the organisation that looks after the interests of the fresh fruit and vegetable sector in the Netherlands.

United Kingdom: an interesting end market

With 9,600 tonnes imported in 2021, the United Kingdom consumes a large number of coconuts. It is an interesting end market for developing countries, although it is also a highly competitive market.

The United Kingdom is a versatile market for many coconut-based products. Fresh coconut represents only a fraction of this market. Brexit (Britain’s decision to leave the European Union) and the COVID-19 pandemic have not been favourable circumstances for the coconut trade. Import statistics show a decline in 2020 and 2021.

The market in the United Kingdom is relatively well developed. It will have less potential for strong growth in the near future, but it is a market that can be directly supplied from the origin country. The United Kingdom has a strong connection to India from where 2,600 tonnes were imported in 2021, giving Indian suppliers an advantage over other origins. Their supply volume is followed by Costa Rica (2,000 tonnes) and Ivory Coast (1,000 tonnes). Sri Lanka exports slightly less, but reaches a higher value per product.

When targeting the United Kingdom, keep in mind that certified ethical trade can be an advantage or even a requirement. When the foundation People for the Ethical Treatment of Animals (PETA) revealed that a coconut brand was using chained monkeys for harvesting, many UK retailers delisted the brand.

Tip:

- Learn about finding your way into the UK market and their different standards by reading CBI’s information about exporting fresh fruit and vegetables to the United Kingdom.

Spain: recent interest in coco-water

Since 2016 Spain seems to be catching up with the rest of the European coconut market. This recent development is related to the increasing interest in coconut water, offering specific opportunities for suppliers from Thailand and Vietnam.

Companies such as Coco Wilson and Genuine Coconut commercialise young coconuts with coconut water. Their work has boosted the import of young coconuts in recent years. But also, mayor drink brands such as Goya have adopted coco-water as one of their principal sales items. Many of these products are re-distributed throughout Europe, for example to Germany, the Netherlands and the United Kingdom.

Thailand was the most important country of origin until 2018. After 2018, Vietnam started to replace most of the young coconut supply from Thailand to Spain. In 2021 Vietnam was responsible for nearly 70% of Spain’s coconut imports in terms of volume (5,800 tonnes). Ivory Coast is the main supplier of mature coconuts (1,300 tonnes in 2021).

With innovations of easy-to-open coconuts, Spain’s market share in the coconut trade continues to increase. Their processing and marketing have become a huge success. As a result, you may find opportunities with processing companies, in addition to the regular retail and food service channels.

Tip:

- Meet with potential buyers on the Fruit Attraction trade fair in Madrid, the second-largest fair for fresh fruit in Europe.

Belgium: strong import growth

Belgian imports of coconuts have increased significantly in 2020 and 2021. Coconuts did not only sell well in Belgium, but the country also provides a good logistical point of entry into Europe.

The increased imports have overtaken large consumer markets such as France and Italy. Good weather has driven up domestic consumption, but also re-export to other European markets. In 2021, around 55% of coconuts were re-exported. Most of the export is to the Netherlands. This indicates that Belgium, or the port of Antwerp, is an important entry point for coconuts intended for the Dutch market and for trading.

Mature coconuts from the Ivory Coast dominate Belgian import. Ivory Coast is by far the largest supplier with 4,200 tonnes in 2021. This is over 80% of the total import. There is also potential for young coconuts and other supply countries. For example, the Vietnamese company Betrimex distributes (packaged) fresh coconut water through the Belgian start-up firm South Export Alliance. And the company SpecialFruit has partnered up with the Spanish supplier of ‘genuine coconut’ that is sourced from Thailand.

France: growing towards a stable market

France has experienced strong growth in coconut import, but is slowly becoming a more mature market. Especially African suppliers can profit from the increased demand for coconuts.

France is showing a promising future for fresh coconuts. Coconuts were much more ignored before, but recent trend shows an increasing demand for all kinds of coconut products, both fresh and processed products such as desiccated coconut and coconut water.

French imports of fresh coconut increased from around 3,000 tonnes in 2014 to 8,400 tonnes in 2018. In the period between 2019-2021 the volume was around 5,000 tonnes. Most of the import concerned mature coconuts. France could still show growth in the consumption of young coconuts, which has an estimated volume of between 500 and 1,000 tonnes.

Ivory Coast supplies the majority of the coconuts destined for France (3,100 tonnes in 2021). France is commercially well connected with the French-speaking Ivory Coast. The growing demand for coconuts will offer opportunities for Ivorian suppliers as well as other exporters that have a competitive offer. Especially French-speaking suppliers in West Africa can take advantage of this growth.

Tip:

- Visit the Rungis wholesale market in Paris if you have the chance. Here you will find a wide variety of wholesalers and exotic fruits. It is a good starting point to get to know the French market.

3. What trends offer opportunities or pose a threat on the European fresh coconut market?

Fresh coconuts fit in with the healthy lifestyle many European consumers are looking for. This health focus together with product innovations creates a better market for coconuts. But consumers need to be facilitated in the use and consumption of fresh coconuts. Therefore, more value is being added in fresh processing and packaging.

Young coconuts promote health benefits

Consumers in Europe are becoming more aware of their health and have started to pay more attention to their diet. This trend has a positive impact on the marketing of coconut products, including fresh coconuts.

Coconuts are associated with health benefits thanks to their fibres and minerals. The promotion of these health benefits is of major influence on the commercial success of coconuts. A wide diversity of coconut products is being marketed such as coconut water, coconut oil and desiccated coconut. The most natural way to consume coconut water is from the coconut itself, which is an interesting selling point for young coconuts (see figure 4).

Traditionally Europe markets mature coconuts because of their high flesh content. In recent years you can see an increasing demand for young coconuts, which is mainly sold for its liquid. The flesh of young coconuts is much thinner and softer, but their principal selling point is the coconut water. This trend started in northern Europe with exotic fruit specialists, but is gradually expanding to other markets. Some of the main processors of young coconut are now located in Spain.

Keep in mind that fresh coconut is still a niche market, especially for young coconuts. It offers opportunities for suppliers of quality products, but there is not yet room for many large-scale operations. Because of the association with health, there is a growing market for organic fresh coconuts.

Figure 4: Example of young coconut brand in a Dutch supermarket

Source: Image by ICI Business

Tip:

- Establish sufficient buying relations in and outside Europe before investing in a high-quality supply chain of trimmed, young coconuts. It is still a niche product in Europe and it is best to first secure your market.

Companies make coconut easy for consumption

Coconuts can be a difficult product for consumers to open and to prepare for consumption. Innovative solutions and packaging are making coconut more accessible.

Food companies are finding new ways to transform coconut into a convenient, easy-to-consume product. Coconut brands such as Tic Toc Coco include instructions on how to open and use coconuts. Young coconuts often come with innovative opening systems and ready-to-drink packaging, making them an attractive and easy product for consumption. Special coconut openers have been invented as well for mature coconut, but have not had a real breakthrough yet – likely because whole coconuts are still a niche product.

Retailers more and more offer packaged, freshly cut coconut (see figure 5). Freshly cut coconut has seen strong growth just like other freshly cut, tropical fruit, such as mango, pineapple and papaya. It is convenient and practical in logistics and distribution. Therefore, you can expect this pre-packaged segment to increase. A supplier that has successfully tapped into the freshly cut trend is INI Farms in India that works exclusively with Sous Fresh (part of the Best Fresh group) for the distribution to wholesalers and food services in Europe.

Figure 5: Example of fresh-cut coconut in an Italian supermarket

Source: Image by ICI Business

Sustainable packaging

Parallel to the growing demand for pre-cut and packaged fruits, there is an increasing interest in sustainable packaging. Many retailers, as well as public authorities, aim to reduce plastic packaging.

As an exporter you can increase your success by cooperating with buyers to supply convenient solutions. In doing so, make sure you find a sustainable option with the least impact on the environment.

Consider using fully biodegradable packaging. For labelling or promoting whole coconuts you could use laser labelling. Try to be creative when it comes to sustainability. The Vietnamese company True Fruits includes a bamboo straw with their drinkable coconut.

Tip:

- Share ideas with your clients on making coconut more convenient for consumers. You need both supplier and buyer to realise creative ways to present coconuts to the European consumer.

Sustainable innovation is important to improve quality and profitability

Coconuts are a very diverse product, but also difficult to handle due to its size and, in case of young coconut, its shelf life. To maintain its value and profitability you can find inspiration in innovations that improve the quality and efficiency of coconuts.

Innovation can help maintain the quality of coconuts, for example improving the shelf life of young coconuts. The Brazilian agro-technological company Embrapa developed a biodegradable coating for young green coconuts. This innovation can extend the shelf life up to four times, allowing Brazilian coconuts to travel further than before. The company Genuine Coconut uses a similar, but plastic-based film for their trimmed coconuts to protect it from exterior contamination and maintain freshness.

Another example that can make coconut more efficient and profitable is the use of its by-products. Harvesting and trimming coconuts will result in a high quantity of organic waste. By finding solutions for coconut husk, instead of burning, you can make coconut business more sustainable and possibly create a side business. The Dutch company CocoPallet has developed a pallet from pressed coconut husk.

As exporter you can keep ahead of your competitors by being inventive and continuously offering new sustainable solutions that improve the quality of your coconut and the image of your business.

Tips:

- Make coconut exports more profitable through diversification and innovation. Try to make use of all parts of the coconut and offer both fresh and processed coconut, depending on the quality of your product and the strengths of your company.

- Read the CBI Trends in fresh fruit and vegetables to get more insights into fresh fruit trends.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research