Entering the European market for exotic fruit

The European market offers opportunities for both regular exotic fruit in conventional retail and niche products for ethnic and culinary segments. Several Latin American and Asian countries such as Colombia and Vietnam have an ample supply of exotic fruit. Suppliers from Africa and the Middle East, like Madagascar, South Africa and Turkey have become more important. To compete in this trade, you must be able to supply high quality products at specific times of the year and find buyers that are familiar with the characteristics and the market segment of your product.

Contents of this page

For the product description and HS Codes for exotic fruit, see the CBI study on the European market potential for exotic fruit.

1. What requirements must exotic fruit comply with to be allowed on the European market?

Fresh exotic fruit must meet the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My trade Assistant by Access2Markets, that provides an overview of export requirements for exotic fruit (code 08109020 or 08109075).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are 1 of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union (EU) has set maximum residue levels (MRLs) for pesticides in and on food products. Exotic fruits containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

Exotic fruits sometimes carry a higher risk of pesticide residues. For some fruits and origin countries there may be increased measures or a temporary increase of official controls at borders. ANNEX I and II of European Regulation 2019/1793 indicate increased physical checks for:

- Pitahaya from Vietnam: 10% is checked on pesticide residues;

- Jackfruit from Malaysia: 20% is checked on pesticide residues;

- Goji berries from China: 20% is checked on pesticide residues.

Note that large retailers in several European countries, such as the United Kingdom, Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation. Other channels, such as wholesalers and food services, pay more attention to the physical appearance and taste of the product and follow the general European guidelines.

Besides complying with the MRLs, you must only use products that are registered and approved by the phytosanitary authority of your country. In other words, products must be legal both in Europe and in your country. Although this rule applies across Europe, several British buyers actively check this information before starting a business relationship. Therefore, make sure that the inputs you are using are approved by both your local phytosanitary authority and by the European authorities before developing an application protocol for your crop.

Tips:

- Find out the MRLs that are relevant for your exotic product by consulting the EU MRL database in which all harmonised MRLs can be found. You can search for your product (for example ‘pomegranates’, ‘carambolas’ or ‘prickly pears/cactus fruits’) or the used pesticide. The database shows the list of the MRLs associated to your product or pesticide.

- Check the RASSF window to see if your product and country have had recent food safety notifications by the European Member States. For example, type in ‘passion fruit’ in the ‘Subject’ field to get a list of recent notifications for this product.

- Talk to potential buyers and ask for their support when needed. Their technical departments are often willing to support you on the process of complying to and/or understanding the regulation.

- Reduce the amount of pesticides by applying Integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Make sure that contamination of lead in the fruits remains below 0.10 mg/kg (0.20 mg/kg for berries and small fruit) and cadmium below 0.050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

In December 2019, the European regulation for the trade in plants and plant products from non-EU countries came into force. The Implementing Regulation (EU) 2019/2072 (ANNEX XI part A & B) requires all exotic fruits with HS codes 08109075 and 01809020 to have a phytosanitary certificate before being brought into the European Union.

For pomegranates there are special requirements for suppliers in countries on the African continent, Cape Verde, Saint Helena, Madagascar, La Reunion, Mauritius and Israel (see ANNEX VII of the above regulation). Pomegranates with these origins require an official statement that the fruits originate in a country, area or production place recognised as being free from Thaumatotibia leucotreta (Meyrick) or have been subjected effective treatment. Information on traceability and official inspection in the place of production may be required.

Tips:

- See the details on the contents of a phytosanitary certificate for the European Union in ANNEX V of Regulation (EU) No 2016/2031.

- Make sure your plant health authority is able to meet the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

The European Green Deal

In 2020, the European Union implemented a set of policies and actions called the European Green Deal. Their aim is to make the European economy more sustainable and climate neutral by 2050. The action plan includes a 50% reduction in the use of pesticides. By 2030, the share of agricultural land used for organic farming needs to be increased to 25%. This means that many pesticides will be banned, and residue levels will decrease gradually over the next years.

When supplying exotic fruit to the European market, you must make sure your product is in line with these changing regulations. With the new environmental and social requirements, you can expect a growing demand for certification as a proof of compliance.

Maintain high quality standards

All exotic fruit need to comply with particular quality standards.

The minimum quality requirements state that these fruits must be:

- Intact;

- Sound; products affected by rotting or deterioration such as to make them unfit for consumption are excluded;

- Clean, practically free of any visible foreign matter;

- Practically free from pests;

- Practically free from damage caused by pests affecting the flesh;

- Free of abnormal external moisture;

- Free of any foreign smell and/or taste.

The condition of the products must be of a level that enables them to withstand transport and handling, and to arrive in satisfactory condition at the place of destination. This also means paying attention to the minimum maturity requirements:

- The products must be sufficiently developed but not over-developed, and fruit must display satisfactory ripeness and must not be overripe.

- The development and state of maturity of the products must of a level that enables them to continue their ripening process and to reach a satisfactory degree of ripeness.

The Codex Alimentarius, the ‘food code’ of the World Health Organization (WHO) and the Food and Agriculture Organization (FAO), provides several specific marketing standards for several exotic varieties:

- Standard for Pomegranate;

- Standard for Pitahaya;

- Standard for Passion Fruit;

- Standard for Carambola;

- Standard for Litchi (lychee);

- Standard for Cape Gooseberry (physalis);

- Standard for Rambutan;

- Standard for Longan;

- Standard for Prickly Pear (cactus fig).

The OECD has also written several international standards for fruit and vegetables. Some of these standards are updated on a more regular basis. Specific standards for exotic fruit include passion fruit and pomegranates. UNECE, which also has a standard for exotics like pomegranates, is also a relevant reference in terms of quality standards for several European buyers.

These specific exotic fruits are classified in 3 classes: ‘Extra’ Class, Class I and Class II. European buyers almost always require Class I fruit as a minimum.

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

Check on product size and uniformity

Exotic fruits are often a luxury product. Presentation and uniformity in size are crucial aspects for selling them to your clients. The size for exotic fruit can be determined by the maximum diameter, weight or count.

Table 1: Size codes for pitahaya, passion fruit, carambola, physalis and cactus fig

| Yellow pitahaya | Red/white pitahaya | Passion fruit | Passion fruit | Carambola | Physalis | Cactus fig / Prickly pear | |

| Size code | (grams) | (grams) | (grams) | Diameter (mm) | (grams) | Diameter (mm) | (grams) |

| A | 110-150 | 110-150 | >139 | >78 | 80-129 | 15.0-18.0 | 90-105 |

| B | 151-200 | 151-200 | >128-139 | >67-78 | 130-190 | 18.1-20.0 | 105-140 |

| C | 201-260 | 201-250 | >122-128 | >56-67 | >190 | 20.1-22.0 | 140-190 |

| D | 261-360 | 251-300 | >106-122 | ≤ 56* | ≥22.1 | 190-270 | |

| E | >361 | 301-400 | >83-106 | >270 | |||

| F | 401-500 | ≥74-83 | |||||

| G | 501-600 | ||||||

| H | 601-700 | ||||||

| I | >701 |

* The minimum diameter for golden passion fruit is 56 mm

Table 2: Size codes for rambutan and longan fruit

| Rambutan single fruit | Rambutan single fruit | Rambutan in bunches | Longan | Longan | |

| Size code | (grams) | Number of fruits per kg | Number of fruits per kg | Number of fruits per kg | Diameter (mm) |

| 1 | >43 | <23 | <29 | <85 | >28 |

| 2 | 38-43 | 23-26 | 29-34 | 85-94 | >27-28 |

| 3 | 33-37 | 27-30 | 35-40 | 95-104 | >26-27 |

| 4 | 29-32 | 31-34 | 41-45 | 105-114 | >25-26 |

| 5 | 25-28 | 35-40 | ≥115 | 24-25 | |

| 6 | 18-24 | 41-50 |

Table 3: Size codes for pomegranate

| Pomegranate | Pomegranate | |

| Size code | Diameter (mm) | Weight (g) |

| 1/A | ≥81 | ≥501 |

| 2/B | 71-80 | 401-500 |

| 3/C | 61-70 | 301-400 |

| 4/D | 51-60 | 201-300 |

| 5/E | 40-50 | 125-200 |

Table 4: Size code for lychee

| Lychees | |

| Minimum size | Diameter (mm) |

| “Extra” Class | 33mm |

| Class I and II | 20mm |

Use protective packaging

Packaging requirements differ between different products, customers and market segments. In all cases you must use protective packaging to maintain the freshness and quality of your exotic fruit.

Small exotic fruits such as lychees, rambutan and passion fruit come in cardboard boxes of 1.5 to 2.5 kg. Physalis are sometimes prepacked in small consumer sized trays, for example 10/12 x 100 grams. Pomegranate and red pitahaya often use 3.5 to 4 kg boxes. Fresh pomegranate arils can come in wholesale plastic bags or consumer trays of around 150 grams.

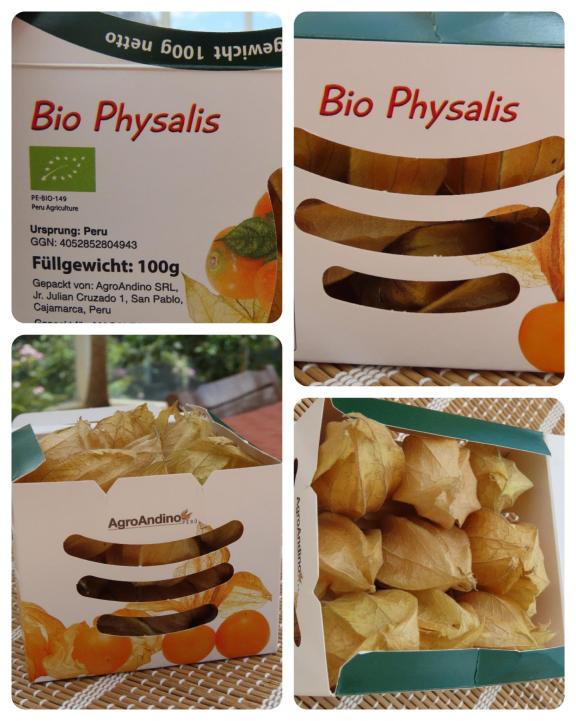

There is a growing preference to use sustainable materials for fruit packaging, especially if your fruit is pre-packed at the country of origin. For example, AgroAndino from Peru developed high-quality stackable and recyclable 100 g boxes with 100% FSC certified material (Figure 1).

Figure 1: Sustainable packaging for physalis

Source: courtesy of AgroAndino Perú

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- If your product is pre-packed for retail, check the additional requirements on the provision of food information to consumers in Europe. If in doubt, ask your buyers.

- Find the legal requirements for labelling in the Buyer requirements for fresh fruit and vegetables on the CBI market information platform.

- See also the Recommended International Code of Practice for Packaging and Transport of Tropical Fresh Fruits and Vegetables (CAC/RCP 44-1995) for recommendations on how to maintain produce quality during transportation and marketing.

What additional requirements do buyers often have?

Obtain commonly used certifications

GLOBALG.A.P. is one of the most common certifications in the fresh fruit sector to show buyers you maintain good agricultural practices. Generally this also applies for exporters of exotic fruit. The chances of selling your product in Europe without the GLOBALG.A.P. certification are very low, especially if you are targeting demanding market channels such as Northern European retailers.

Other certifications that can support your activities in handling, packing and processing are HACCP-based food safety management systems such as BRCGS, IFS or similar schemes. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommendable to use.

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GLOBALG.A.P. to ensure good agricultural practices, a social certificate is highly recommended to get your product up to retail standards. Common standards are (Sedex Members Ethical Trade Audit), and GRASP, a social and accessible add-on of GLOBALG.A.P. SMETA is in particularly high demand amongst buyers of exotic fruit in Switzerland and the United Kingdom. Having this certification is a way to differentiate yourself from your competitors, as it is not easy to find among exotic fruit suppliers.

Retailers can also impose their individual standards, such as Tesco Nurture. Especially larger retail chains in Northern Europe are more prepared to buy your product if your compliance with social and sustainability standards is in order.

Tips:

- Check the SIFAV (Sustainability Initiative for Fruit and Vegetables) basket of social standards and the basket of water standards. If you are in a high water risk region or in a high and medium social risk country, consider the corresponding certification in consultation with your potential buyers.

- For other additional requirements such as payment and delivery terms, see the CBI Buyer Requirements for fresh fruit and vegetables and Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

Organic certification can be used to emphasise the healthy characteristic of a certain exotic fruit and market them at a higher value. The demand for organic fruit is growing, but the market for exotic fruit remains a niche in a niche. Nevertheless, the exclusive value and higher price segment of exotic fruit could justify the added value of an organic certification.

Examples of companies that offer organic exotic fruit include AgroAndino, with organic physalis from Peru, Ecuaexotics, organic pitahaya from Ecuador and Colombian Fruit Group, with an assortment of several exotic fruit varieties from Colombia. An example of an organic specialised buyer in the European market is Eosta in the Netherlands. They have a big assortment of exotics and serve different market segments from retailers to wholesalers all around Europe.

In order to market organic products in Europe, you have to use organic production methods that meet European legislation, and apply for an organic certificate with an accredited certifier. Note that the new Regulation (EU) 2018/848 came into force in January 2022. You must use sustainable and organic production methods and apply for an organic certificate with an accredited certifier.

Tips:

- Strive for residue-free exotic fruit and only certify your production as organic if possible. It will broaden your market opportunities but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the to see which certifiers are active in your region.

- Check Eosta’s ‘tropical wonders’ range. The catalogue contains information about packaging, origin countries, transport and availability, and it offers a seasonal calendar.

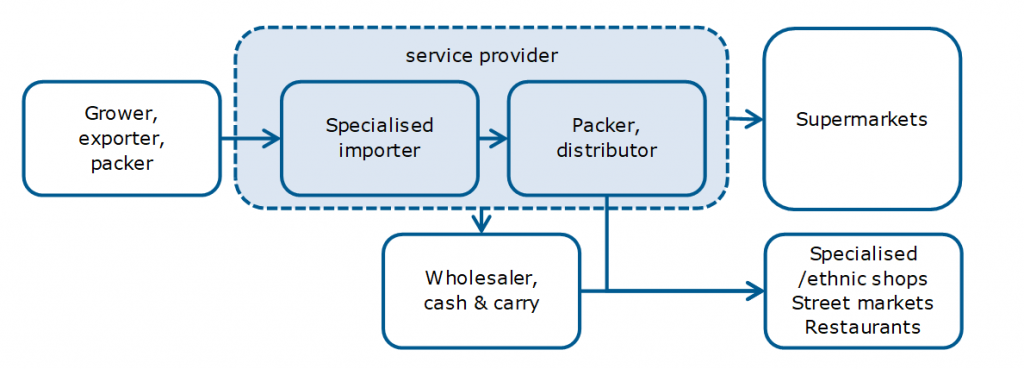

2. Through what channels can you get exotic fruit on the European market?

Fresh exotic fruits are typically sold through specialised channels. Specialised traders and wholesalers supply a variety of large to small markets, including ethnic and culinary segments. Supermarkets often prefer doing business with a limited number of suppliers and partner with service providers that arrange their exotic assortment.

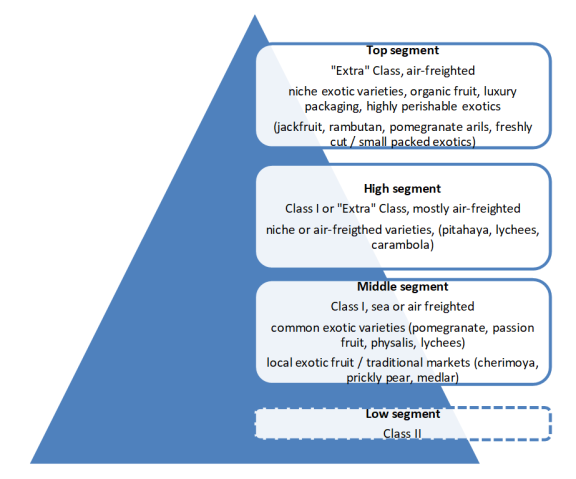

How is the end-market segmented?

There are different factors that define the segmentation of the exotic fruit market and where your product will be sold. The type of fruit is a main factor, but you can also use quality and presentation to target specific market segments. Organic labels or product transformation can create additional value.

Figure 2: Market segments for exotic fruit in Europe

The top segment consists of well-presented, high-quality exotics. Examples are highly perishable niche products and air-freighted fruit such as jackfruit, rambutan and yellow pitahaya. These exotic fruits must appear flawless, which is characteristic for the ‘Extra’ Class. They are air-freighted to preserve their quality and freshness and are sent to luxury or ethnic food retailers and culinary professionals.

The middle and high segments are divided in niche and more common exotic fruits. Most of these are sold in specialised segments, but the variety in conventional supermarkets is increasing as well. For example, lychees are typical fruit in Asian shops and Chinese restaurants, but they are also available in several supermarkets during Christmas.

Common tropical and exotic fruit such as pomegranates, physalis and passion fruit have a much higher coverage in conventional supermarkets than niche exotics. Some of the high-value products that you can typically find in larger supermarkets include fresh pomegranate arils, exotics with organic label and a seasonal offer of lychees, pitahaya or carambola.

Other commonly sold exotics are traditional and locally grown products, mostly in the south of Europe. Fruit such as cactus figs, cherimoya and medlars may be exotic to the Northern European market, but they are common in Mediterranean food culture. They have a typical traditional and seasonal consumption. Local cultivation makes import less necessary and consumption more affordable.

Tips:

- Adjust your focus and timing: For the niche exotics you may need to focus on special holidays or ethnic markets. For common exotic products it is best to maintain supermarket standards. For exotics that are also produced in Europe, time your fruit before or after the local season.

- Look at the online assortment of different European supermarkets to see what type of exotic fruit they typically sell to consumers. You can find an extensive list of supermarket chains in Europe here. Many of these show their fresh products online.

Through what channels does a product end up on the end-market?

Figure 3: European supply channels for exotic fruit

Specialised importers

Most exotic products are brought to the market by specialised importers. These importers are used to working with small volumes and different sourcing countries. They have an important responsibility in introducing new exotic fruits to the European market. Specialists have a strong network of retail clients, wholesale, food services and ethnic buyers and often supply these directly with small or large orders, including mixed pallets.

Throughout Europe you can find many exotic fruit traders, with a relatively high number of importers in the Netherlands such as BUD Holland, a true specialist in exotic fruit and vegetables, and TFC Holland, an international trader with over 200 tropical and exotic fruits (see Table 5).

Table 5: Selected importers and their assortment of fresh exotic fruit

| Bud Holland | TFC Holland | Yex | OTC Organics | Special Fruit | HLB tropical fruit | Roveg | Nature's Pride | Minor Weir Willis & Exo-Fresh | Greenyard Fresh | Cultivar | Spreafico | |

| NL | NL | NL | NL | BE | DE | NL | NL | UK / DE | BE | ES | IT | |

| Organic | x | |||||||||||

| Conventional | ||||||||||||

| Org. & conv. | x | x | x | x | x | x | x | x | x | x | x | |

| Pomegranate | x | x | x | x | x | x | x | x | x | |||

| Passion fruit | x | x | x | x | x | x | x | x | x | x | x | x |

| Physalis | x | x | x | x | x | x | x | x | x | x | x | |

| Lychees | x | x | x | x | x | x | x | x | ||||

| Rambutan | x | x | x | x | x | x | x | |||||

| Pitahaya | x | x | x | x | x | x | x | x | x | x | ||

| Cherimoya | x | x | x | x | x | |||||||

| Carambola | x | x | x | x | x | x | x | x | x | x | ||

| Cactus fig | x | x | x | |||||||||

| Jackfruit | x | x | x | x | ||||||||

| Medlar | x | x | ||||||||||

| Granadilla | x | x | x | x | x | x | x | x | x | x | ||

| Feijoa | x | x | x | |||||||||

| Soursop | x | x | x | |||||||||

| Kiwano | x | x | x | x | x | |||||||

| Kumquat | x | x | x | x | x | x | x | |||||

| Tamarillo | x | x | x | x | x | x | x | |||||

| Tamarind | x | x | x | |||||||||

| Maracuja | x | x | x | x | ||||||||

| Pepino | x | x | x | x | x | x | ||||||

| Mangosteen | x | x | x | x | x | x | x |

Sources: Company online listings

Service providers

Several fruit companies have a wide assortment of tropical and exotic fruits and use their own packing facilities to become full-service providers. These companies can position themselves as suppliers of large retailers and supermarkets. They can fulfil an exotic fruit supply programme for a longer period and offer a more stable market for their foreign supply relations.

Importing companies that pack for supermarkets include Eosta, Nature’s Pride, Roveg, Greenyard Fresh and Minor Weir Willis (MWW). Supermarkets that have a wider fresh assortment and exotic fruit are often leading national supermarkets – such as Waitrose in the United Kingdom, Rewe in Germany and Migros in Switzerland – and formulas with a strong focus on fresh products, such as Grand Frais in France.

Wholesalers

Wholesale channels are very relevant for exotic fruit because they reach typical niche markets such as culinary professionals and ethnic shops. Most of the wholesalers focus on typical local produce or purchase exotics through their import or ethnic trade relations. They do not often have their own import of exotic fruit but maintain close relations with import specialists instead. However, there are some exceptions of wholesalers that import directly from the origin country. An interesting example is Bonabio in France, an organic fruit importer based at the Rungis Market in Paris.

Tip:

- Find wholesalers with import activities and ethnic fruit traders at specific wholesale markets such as Rungis in Paris, New Spitalfields Market in London and Marcabarna in Barcelona.

What is the most interesting channel for you?

Specialised exotic fruit importers cover both the wholesale and retail channels/sales/markets. Therefore, they are the most interesting channel for exporters of exotic fruit.

The type of importer and their network are important. For niche exotics your importer must have relevant clients in the food service industry or ethnic markets. Small distribution and knowledge are also important factors to consider. Margins in the wholesale channel and spot market will strongly depend on your timing and the market situation (supply and demand). You will need an importing or service partner that can represent and defend your product on the European market. As such, they must be knowledgeable about your product and their potential in the market.

For common exotic fruit such as pomegranates, physalis and passion fruit you can also rely on the regular retail channels and their service providers. The programmed supply to retailers may provide more stability, although the requirements will also be more extensive.

Tips:

- Go to trade fairs to find buyers and gather information from different specialist buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and the Fruit Attraction in Madrid. Due to the proximity to the Christmas season, Fruit Attraction is an interesting trade fair for suppliers that are ready to deliver some trial shipments right after the fair.

- Give your potential buyers information about your export experience to the European market, including details about the logistics and the packaging you can offer them. Give them ideas on how to market your fruit, especially if they are serving supermarkets.

3. What competition do you face on the European exotic fruit market?

Competition in the exotic trade is especially strong from Latin America and Asia. Peru, Turkey and South Africa compete mainly in the pomegranate sector and Madagascar and South Africa compete mainly in lychees. Colombia and Vietnam have a more diverse exotic supply. The competitive field is diverse, but there is a common thread throughout: high product standards and pro-active commercial strategies.

European countries such as Spain, Italy and Portugal are also important competitors to consider. Portugal and Italy have recently emerged as new producers of tropical fruit such as passion fruit and physalis. Spain also harvests exotics like red pitahaya. The Spanish Canary Islands are becoming the new sustainable supplier of tropical fruit. However, climate change is affecting harvests throughout Europe, creating new opportunities for overseas suppliers.

Figure 4: Local pitahaya and cherimoya at Spanish high-end supermarket El Corte Inglés

Source: photo taken by Dana Chahin

Which countries are you competing with?

Source: ITC TradeMap

Table 6: Description of Europe’s main suppliers of exotic fruit

| Colombia | Peru | Turkey | Madagascar | Vietnam | South Africa |

|

|

|

|

|

|

Colombia: Number 1 in exotics

Colombia supplies the highest value of exotic fruit to Europe. With different microclimates, the country can produce a wide variety of exotic fruit and still have large potential to expand its cultivation area.

The main fruits exported to Europe are passion fruit (43.5 million EUR in 2022) and physalis (27.7 million EUR). For both fruits, Colombia is the main supplier in the European market. Other exported fruits include granadilla, (yellow) pitahaya, maracuja or yellow passion fruit and tamarillo. The total European import value increased from 78 million in 2018 to 112 million EUR in 2022, a 5-year increase of 43.6%. The main destination markets in Europe were the Netherlands, Germany, Belgium and the United Kingdom.

The forecast for Colombian exotic fruit exports to Europe is positive. Because of the trade agreement between Colombia and the European Union, there are no import tariffs on exotic fruit. Meanwhile more and more producers have aligned their supply to European standards. Examples of Colombian companies specialised in exotics and active in the European market include Caribbean Exotics, Nativa Produce, C.I Colombia Paradise and Novacampo S.A.S.

Peru: Increasing in pomegranates and potential in organic

In the last decade Peru has developed into one of the strongest competitors in the global fresh fruit business. In the exotic fruit segment, European imports from Peru have increased by 85% in the last 5 years, reaching a value of 83.2 million EUR in 2022. Peru mainly competes in pomegranates, which are the primary reason for Peru’s fast export growth to the European market. The country has become the main competitor of this fruit in the months between February and May.

Peru has potential in other exotic fruits as well, but its current export share in fruits such as passion fruit and physalis is still very minor. However, Peruvian companies have proven that they are able to increase cultivation in new fruits and have them export ready in a short amount of time. That is why it is important for other suppliers to keep following the developments of exotic fruits in Peru.

The top 3 exporters of pomegranates to Europe in 2022 were Grupo Athos, Pomica and Agrícola Pampa Baja S.A.C. Examples of Peruvian companies providing exotic fruit aside from pomegranates include Nativa Organics and AgroAndino. Both companies are focused on organic produce, which is a growing niche market in Peru.

Turkey: Nearby supply of pomegranates

Just like Peru, Turkish exotic exports mainly consist of pomegranates. In terms of quantity, Turkey is still the number 1 supplier of pomegranates to Europe. However, Turkey’s tropical fruit exports are on the rise and the export to Europe has gradually expanded to include exotics like medlar, passion fruit and dragon fruit.

In fact, European imports of exotics from Turkey have increased by 57% over the past 5 years, reaching exports of 69.6 million EUR in 2022. The main advantage of Turkey is its proximity to the European market. Turkey is an important supplier to Germany, United Kingdom and the Netherlands, as well as to Eastern Europe.

Everfresh is an example of a producer and exporter of pomegranates to the European market.

Madagascar: Competes mainly in lychees

The reason that Madagascar is among the main exotic fruit exporters is because of Europe’s seasonal demand of fresh lychees. The export of lychees fluctuates, but over the years the average supply has not changed much and remains around 50 million EUR. It is a high value for a seasonal fruit that is concentrated mainly in the December month.

Madagascar also produces passion fruit, jackfruit and tamarinds, but there is no indication that these are included in the export value. France is by far the most important end-market for lychees from Madagascar.

Vietnam: Diversity of exotic fruits

Vietnam is an important supplier of exotic fruit, particularly to France and the Netherlands. The fruit diversity is great, with exports in passion fruit, pitahaya (mainly red), lychees, rambutan, jackfruit, carambola, among many others. The diversity of commercial exotics and a good air-freight route to Europe are competitive strengths.

Europe is a relevant and increasing market for Vietnam with a total import value of 35.4 million EUR of exotics in 2022. But this value is not even close to the value of Vietnam’s most important export market China, which is almost 30 times bigger and often less demanding than Europe.

To reduce its dependency on China there is an active search for new markets and more and more producers are able to comply with the high-quality requirements of European markets. The export to Europe is expected to continue its growth with the European Union – Vietnam Free Trade Agreement (EVFTA) that entered into force in August 2020, dropping the import tariffs on Vietnamese fruit and vegetables to zero.

An example of a company from Vietnam supplying the European market with pitahaya and some exotic mango varieties is Hoang Phat Fruit. They are certified with GLOBALG.A.P., HACCP, SMETA and ISO9001. Their export markets include China, Australia, Korea, Singapore and several European countries.

South Africa: A recognised supplier with strong ties with the Netherlands

European imports of exotics from South Africa experienced a 52% growth over the last 5 years, reaching 34 million EUR in 2022. The Netherlands is the main destination market of South African exports of exotics, with 40% of the exports going to this market. The Netherlands is also the main export partner of South Africa worldwide, not only for exotics but for fresh fruit in general. The United Kingdom is also a relevant partner, both for exotic and other fresh fruit.

Pomegranates are the main exotic fruit exported to Europe, and South Africa is a recognised origin country for this product. A big portion of South Africa’s pomegranates go for processing in the United Kingdom. However, the European market has decreased in importance for South African producers of pomegranates, not so much in volumes but in percentages. The Middle East has grown remarkably over the last years, and it has become a very important market.

Europe is also the main market for South African lychees. However, only a small portion of early growers are benefiting from this market, as it is difficult to compete on prices with Madagascar. This is why many South African lychee growers are looking into the U.S. market to diversify. South Africa is also a supplier of passion fruit, but in the last years the exports to the European market have been going down.

Examples of South African exporters include SAPEX, Freshness First, Star South and Core Fruit.

Tips:

- Partner with research centres or universities to explore transport alternatives to airfreight. There is a trend to stop flying fruits to Europe, and your company will differentiate from others by looking into this.

- Compare air-freight costs on freightos.com. Airfreight is often a major influence on the price of your exotic fruit. See if and how you can compete in logistical efficiency.

- Be inventive! If you have difficulty competing, explore additional markets such as fresh processing or combining exotic fruit shipments.

Which companies are you competing with?

Strong competitors are highly professional. They try to differentiate their product offer, but also maintain high quality standards and invest in marketing and commercial activities.

Ocati - Colombia

Ocati is 1 of the top 3 exporters of exotic fresh fruit from Colombia. They have checked all the boxes for becoming a successful exporter to Europe:

- Product range: Offering a wide selection of exotic fruit such as passion fruit, physalis, yellow pitahaya, maracuja, granadilla, tamarillo, cactus fig and feijoa, among others. In 2015, Ocati expanded its production to Ecuador to increase its existing yellow pitahaya offer and to complement its portfolio with other fruits like red pitahaya.

- Product quality: Precisely managing the product quality and food safety with IFS and GLOBALG.A.P. certification and pesticide usage kept at a minimum

- Social and environmental responsibility: Paying attention to social and environmental responsibility and certifying with SEDEX, Rainforest Alliance and EU Organic.

- Marketing: Participating proactively in important trade fairs in Europe such as Fruit Logistica since 2005. Their excellent marketing material is adapted to the current trends and European market requirements.

The Fruit Republic – Vietnam

The Fruit Republic (TFR) in Vietnam was able to grow into an international supplier in a matter of years. The company started with pomelos and limes and expanded with a number of other fruit and vegetables, including passion fruit and pitahaya.

Besides a clear focus on product quality and social compliance, they have invested in commercial activities such as trade fair participation in Europe and a dedicated logistic service provider in the Netherlands. This gives them the advantage of meeting new clients and allows them to supply these clients by the pallet.

Grupo Athos - Peru

The company Grupo Athos, also known as Exportadora Fruticola del Sur, was the largest exporter of pomegranates in Peru with an FOB export value of 15.21 million EUR in 2022, according to export data of PromPeru.

Grupo Athos is a professional family business. They cultivate fruits that prosper well in their region: pomegranates, dates, figs, blueberries and asparagus. With these products they offer something different from the exotic fruit countries Colombia and Vietnam. Using the ample space of the Peruvian coast they, as well as other Peruvian farms, are able to compete strongly in the pomegranate trade during the first 6 months of the calendar year.

Tips:

- Become as good as your most important competitors. Selling your exotic fruit is not just about offering a well-priced product. It is about teamwork with your buyer and being able to maintain excellent communication, product quality and compliance.

- Find your strength as a company. Analyse which fruits are most suitable for production in your region and find ways to differentiate, for example by focusing on specific supply gaps (seasons), improved varieties, additional services, transport alternatives or packaging options.

Which products are you competing with?

The key factors on which exotic fruits compete with each other are consumer experience and fruit attractiveness, familiarity and seasonality. In the next couple of years, a new factor will become relevant: whether the fruit can be sent by boat or not.

Consumer experience and fruit attractiveness

Unique features such as taste, appearance or health benefits can help exotic fruit to obtain a competitive advantage over common tropical fruit such as mango or papaya. For example, pitahaya and physalis (with decorative leaves) have a unique appearance and are excellent fruits for culinary presentation. Pomegranate is an attractive and healthy ingredient in salads and drinks, which gives them an advantage over other tropical or exotic fruit. Health benefits could also increase the competitiveness of passion fruit, carambola and physalis.

Familiarity

Unknown exotic fruits often need promotional effort to compete with products that are more familiar to the general consumer. For example, (purple) passion fruit is much more known as a fresh fruit than the similar maracuja and granadilla. The same can be said for lychees compared to rambutan and longan.

Practicality and information to consumers also play a role. Consumers need to know how to eat or prepare the fruit. For example, jackfruit is a difficult fruit to introduce to the average consumer due to its size, unusual flesh and lack of familiarity. In regular retail markets it will have to compete with fruit that is more practical and better known, like pieces of watermelon for example. In the ethnic market, however product loyalty is strong and jackfruit is not easily replaced by other fruits.

Seasonality

Imported exotic fruit is most popular during holiday seasons. Outside the holiday season there is more competition with tropical fruits as well as typical local seasonal products like stone fruit or strawberries. The latter is especially relevant during the summer months. Local fruit is considered more environment friendly and is often more affordable. During specific periods there may also be competition from local exotic fruits such as cactus figs from Spain and Italy from August to October and cherimoya from Spain in October to November.

Transport mode

The trend to stop flying fruit to Europe is expected to become more important. Due to environmental reasons, several buyers are planning to stop trading fruit that can only be transported by air. Importers like Eosta, for example, are doing their best to transport their exotics by boat. When this is not possible, they inform their customers about this. For this reason, you can expect competition from other exotic fruit that can be sent by sea, like physalis, passion fruit and pomegranates. For pitahaya, there are companies already doing delivery tests by boat, such as Ecuaexotics and Social Deal from Ecuador.

Tip:

- Make exotic fruit accessible and acceptable to consumers. Work out a strategy with your buyer relations, for example by supplying smaller portions of large exotic fruit or by communicating potential uses and recipes.

4. What are the prices for exotic fruit?

In general, prices for exotic fruit are high compared to those of regular fruit. Expensive air-freight and small-scale distribution can drive up the prices significantly. The availability and the season of the fruit is another important factor. In the end the market (supply-demand) will determine the final price.

The trade value per kilo of the product group with HS code 08109020 (lychees, pitahaya, physalis, and so on) has been increasing more than that of product group 01809075, which mainly consists of pomegranates. This is probably because of the pressure on pomegranate prices. The market for pomegranates has increased, but so has the supply from Peru, Turkey, Israel and several other producing countries.

Importers generally maintain a net profit margin of around 8% over the wholesale price, excluding handling and packing costs.

Retailers calculate between 50% and 100% on top of the purchasing price to cover sales costs and margin. The margins and mark-up on exotic fruit can be considerably higher due to the higher distribution costs and often shorter shelf-life. The prices for local exotics such as cherimoya and cactus fig are often lower in Southern European retail.

Source: My trade Assistant by Access2Markets

Tips:

- Find indicative fruit prices (in France) on the Market News Network of FranceAgriMer from producers, importers, wholesalers (‘gros’) and retail (‘détail’).

- Use the translate function in your web browser to understand the content of websites mentioned in this study that are not available in English or in your language.

- Check the market reports of FruiTrop. They publish information with market prices on a regular basis.

- Monitor retail prices by checking the e-commerce platforms of supermarket chains such as REWE in Germany, Waitrose in the UK and Migros in Switzerland. You might need to include a zip code to browse the online shopping platform of German supermarkets. Just type in any German zip code to simulate a purchase.

Dana Chahin and ICI Business carried out this study in partnership with Globally Cool on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research