Entering the European market for ginger

When entering the European market for ginger, make sure that you comply with the European legal requirements and additional buyer requirements. It is important to know the market dynamics and the competition you face in the European market. The strongest competition will come from China, Peru and Brazil. Make sure to stand out from these suppliers. As a beginning exporter, look for importers or wholesalers that specialise in importing exotic fruits and vegetables.

Contents of this page

1. What requirements and certifications must ginger meet to be allowed on the European market?

Fresh ginger should comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI website. You can also use the My Trade Assistant tool by Access2markets, which provides an overview of the requirements for ginger per country.

What are mandatory requirements?

Mandatory requirements concern food safety and quality. They include legal rules, quality requirements and packaging and labelling requirements.

Control of pesticide residues

Regulation (EC) No 396/2005 sets maximum residue levels (MRLs) for pesticides in or on food and feed of plant origin. An MRL is the highest level of pesticide residue that is legally tolerated in or on food products when pesticides are used.

The EU Pesticides Database provides information on the MRLs for all pesticide residues that apply to ginger. In the database, select the product code 0213040 horseradish (ginger roots fall into this category, product code 0213040-006).

Ginger that does not comply with the European food legislation is reported through the Rapid Alert System for Food and Feed (RASFF). This tool allows food safety authorities to quickly exchange information on health risks associated with the food and to take immediate action. For fresh ginger, there are hardly any alerts in the RASFF database, and thus also not for pesticide residues. Only in June 2024 was there an issue with chlorpyrifos-ethyl in fresh ginger from China.

Tip:

- Visit the website of the European Commission to get more information about MRLs.

Control of contaminants

Ginger may contain contaminants. Contaminants are substances that are not added to food on purpose. They might end up in food due to the different stages it goes through (production, packaging, transport, holding) or due to environmental contamination. As contamination has a negative impact on the quality of food and can cause a risk to human health, the EU has set maximum levels for certain contaminants in food, through Commission Regulation (EU) 2023/915.

For fresh ginger, contaminants mainly concern lead; the maximum level of lead that is allowed is 0.80 mg/kg.

Tip:

- Read more about contaminants on the website of the European Commission.

Plant health and phytosanitary regulation

Regulation (EU) 2019/2072 requires ginger to have a phytosanitary certificate before entering the EU. The exporting country's national plant protection authority issues the phytosanitary certificates. This certificate guarantees that the ginger is:

- Properly inspected.

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests.

- In line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072.

In addition, a special requirement exists for ginger originating from outside the EU. Ginger requires an official statement that the batch or lot does not contain more than 1% of soil and growing medium by net weight.

Tips:

- Contact the National Plant Protection Organisation (NPPO) in your country to arrange a phytosanitary certificate. Only these organisations are authorised to issue phytosanitary certificates.

- For an example of a phytosanitary certificate, look at Annex V of Regulation (EU) 2016/2031.

Product quality requirements

To export ginger to Europe, your product must meet quality standards, which are outlined in EU legislation and product standards. As ginger is not covered by a specific product standard, you should comply with the general marketing standard (GMS, Annex I, Part A) of Regulation (EU) No 543/2011.

Another good source for the quality requirements of ginger is FAO’s Standard for Ginger (reference CXS 218-1999), available in the Codex Alimentarius portal. This standard applies to the rhizome (underground plant stem) of commercial varieties of ginger grown from Zingiber officinale Roscoe (the scientific name of ginger), to be supplied fresh to the consumer, after preparation and packaging.

The FAO standard has defined three classes for ginger: Extra Class, Class I and Class II. For fresh consumption, European buyers mostly require Class I standard. Ginger of Class I should be of good quality, typical of the variety and/or commercial type, firm and without evidence of shrivelling, dehydration or sprouting. Slight skin defects due to rubbing is allowed provided they are healed and dry, and do not affect more than 10% of the total surface area.

To be able to meet the requirements of Class I, up to 10% of the ginger by weight or number may deviate from this class. However, this 10% does still need to meet the requirements of Class II or, exceptionally, be within the tolerances of Class II.

Product size and uniformity

FAO’s Standard for Ginger sets out requirements concerning the size of ginger. The size is determined by the weight of the ginger:

- Size code A: 300 grams

- Size code B: 200 grams

- Size code C: 150 grams

For Class I ginger, up to 10% of the ginger – by number or by weight – does not have to comply with the requirements for size.

Packaging and labelling requirements

According to the FAO’s Standard for Ginger, the contents of each package must be uniform and contain only ginger of the same origin, variety and/or commercial type, quality and size. The visible part of the contents of the package must be representative of the entire contents. The heaviest rhizome (underground plant stem) may not be more than twice the weight of the lightest rhizome in the same package.

Ginger must be packed in a way that protects it properly. This means:

- Materials used inside the package should be new, clean and avoid causing any damage to the ginger.

- The printing/labelling should be done with non-toxic ink or glue.

- Ginger should be packed in compliance with the Recommended International Code of Practice for Packaging and Transport of Fresh Fruits and Vegetables (CAC/RCP 44-1995).

Tips:

- Make sure to discuss specific packaging requirements and preferences with your European buyers.

- Get familiar with the packaging and labelling requirements in the European market. Read CBI’s Buyer requirements for fresh fruit and vegetables and especially the section ‘Labelling and packaging’.

- If you pre-pack ginger for the food retail segment, check the additional requirements in Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

What additional requirements and certifications do buyers often have?

In addition to legal requirements, European buyers often have additional requirements. These include, for example, GLOBALG.A.P. certification and compliance with social and environmental standards. Last but not least, organic certification has become quite important in the European ginger market.

Certification

Food safety is essential in the European market, and therefore several European buyers will require certain certifications. A common certification programme for good agricultural practices is GLOBALG.A.P. Buyers in Europe will often request this certificate, especially those that supply to supermarkets. For these buyers, it has become a minimum requirement.

Some retailers have their own additional standards. For example, the Dutch retailer Albert Heijn and the Belgian retailer Delhaize have developed a GLOBALG.A.P. add-on – called AH-DLL GROW – to meet increasing consumer expectations concerning product quality and food safety. Producers that supply to these retailers should have this farm-level risk management system in place. It sets out rules for hygiene, residue monitoring and the prevention of foreign body contamination.

Sustainability compliance

Social and environmental compliance is increasingly demanded by European buyers. This often means that you should undersign the buyer’s code of conduct or a third-party code of conduct. You can also opt for third-party certification schemes. Examples include:

- GLOBALG.A.P. Risk Assessment on Social Practice (GRASP): a GLOBALG.A.P. add-on for the evaluation of the well-being of workers at the farm level.

- Supplier Ethical Data Exchange (Sedex): a global initiative to make global supply chains more transparent. Sedex has also developed a social auditing standard – SMETA – to help companies assess the working conditions and environmental performance in their business and supply chains.

In addition, some supermarket chains have their own standards, such as Tesco’s Nurture (add-on module to GLOBALG.A.P.) and Marks & Spencer’s Field to Fork.

Tips:

- Implement at least one environmental and one social standard. See the SIFAV Basket of Standards developed by the Sustainability Initiative Fruit and Vegetables (SIFAV).

- For requirements related to payment and delivery terms, see CBI’s study on organising your export of fresh fruit and vegetables to Europe.

Organic certification

If you want to have an advantage over your competitors, you could choose to supply organic ginger to the European market. Organic ginger has become quite commonly available in supermarkets in Western and Northern Europe. An example of a company that offers organic-certified ginger in Europe is Now Organic.

If you want to market fresh ginger you should comply with Regulation (EU) 2018/848. It lays down the rules on organic production and labelling for organic products.

Tip:

- Consider organic production carefully, as getting organic-certified is expensive. For some markets, organic certification is important while for other markets it is not a must.

2. Through which channels can you get ginger on the European market?

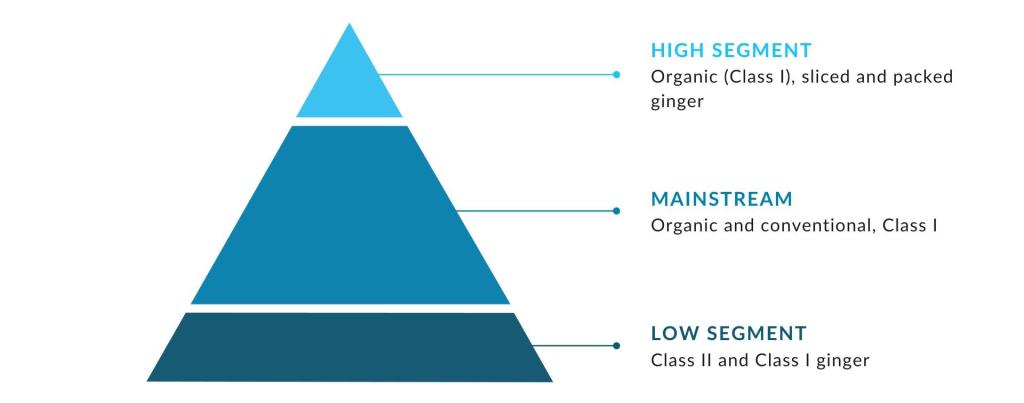

The fresh ginger market can be divided into three different segments, mostly defined by the quality of the ginger, whether it is conventional or organic and whether it is packaged or not. Most ginger finds its way to the European market through European importers.

How is the end-market segmented?

Fresh ginger ends up on the market through different segments: the retail segment, the food service segment and the processing industry. Below is a visual presentation of the different segments, after which each segment is explained in more detail. Most of the fresh ginger belongs to Class I, which is also visible in Figure 1, in which Class I ginger is connected to each segment. Figure 1 clearly shows that the mainstream segment is by far the largest ginger market in Europe.

Figure 1: Market segments for fresh ginger in Europe

Source: Globally Cool (June 2024)

High and mainstream segment

In the retail segment, fresh ginger is available in supermarkets (either physical stores or online shops), independent grocers, Asian food stores and street markets. In supermarkets, large quantities of fresh ginger are sold. Supermarkets require quality ginger of Class I, which is offered loose or in small packages.

Both conventional and organic ginger are available in supermarket outlets in Western and Northern Europe. The high segment of Figure 1 mainly reflects organic-certified ginger sold in organic supermarkets, and also freshly packed ginger available in Western and Northern European supermarkets.

Foreign supply stores, street markets and small specialised fruit and vegetable retailers also mostly offer Class I ginger, yet they may also offer lower class ginger. These retailers are more focused on selling conventional ginger. Organic ginger is available in some of these markets and stores, but in much smaller quantities compared to the supermarket chains.

Fresh ginger is also popular in the food service segment and it is used a lot in hotels, restaurants and catering. Fresh ginger is used in a variety of recipes (such as Asian and global dishes), in tea (fresh ginger tea) or in smoothies. The food service segment mostly uses conventional ginger. Ginger is distributed through wholesalers on the spot market, via cash & carry (non-specialised wholesalers) or food service distributors.

Processing industry – low segment

Lastly, fresh ginger is used in the processing industry to make juices and smoothies, for example. This segment buys mostly from traders that are specialised in fresh products for industrial use. Here, you can find Class II and Class I ginger.

Tip:

- Make sure to use your best quality ginger for the European market. European buyers mostly require Class I ginger.

Through which channels does ginger end up on the end-market?

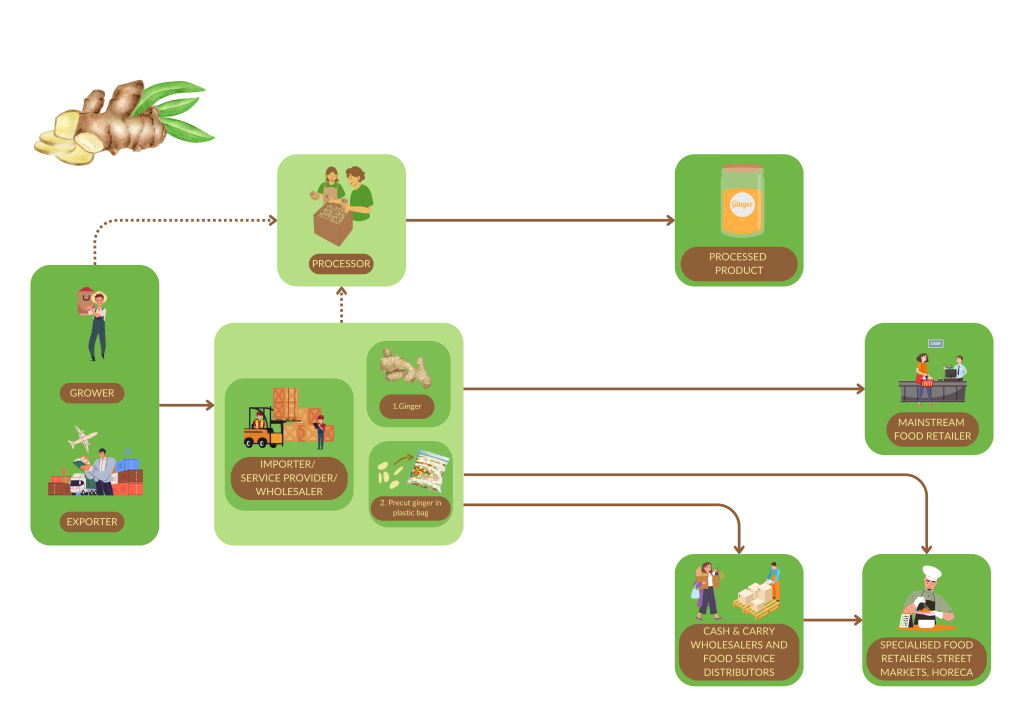

There are different channels through which fresh ginger ends up on the European market. Figure 2 shows the different channels that exist. After that, each channel is explained in more detail.

Figure 2: Market channels for fresh ginger to Europe

Source: Globally Cool (June 2024)

Figure 2 highlights the importer as the most potential type of buyer in Europe.

Specialised importers

Importers specialised in exotic fruits and vegetables play a central role in the distribution of ginger and therefore can be considered the main entrance to the European market. They distribute to different market channels and therefore have expertise in the requirements of different types of clients, such as supermarkets and wholesalers.

There are specialised importers that serve multiple channels and importers that are focused on a specific segment/channel. For example, Bel Impex is an importer/wholesaler specialised in importing exotic vegetables, root vegetables, fruit and herbs. Its customer base includes large supermarket chains, (catering) wholesalers, foreign supply supermarkets, specialty stores, retail and food service companies.

Other importers are more focused on a specific client base. Eosta is specialised in organically grown fresh produce, while Exotimex Europe is focused on the foreign food markets within Europe.

Due to a good logistical position, there is a relatively large number of importers of exotic fruits and vegetables located in the Netherlands, such as Bud Holland, Bel Impex, TFC Holland, Nature’s Pride, Denimpex and Exotimex Europe. Specialised importers in other EU markets include, for example: Neta (France) and Tropifruit (the United Kingdom).

Service providers

Companies that work closely with large supermarkets often act as service providers. They manage the entire supply chain, including sourcing, packing and branding, thereby meeting the needs of the supermarket chains. They are responsible for guaranteeing a reliable supply of fresh fruits and vegetables. If you can meet the quality and logistical requirements expected by these service providers, you may find opportunities to join this supply chain.

An example of a full-service provider is Greenyard Fresh, an international supplier of fresh fruit and vegetables with many offices around the world. For example, Greenyard Fresh Belgium has large retailers as its main customers. It delivers a full assortment of fresh produce all year round and systematically supports retailers. For the European market, Greenyard sources organic ginger from Peru and conventional ginger from China.

Wholesalers (spot market)

Ginger is also sold through wholesalers that operate in the spot market. Spot markets are those in which the transactions are settled within just a few days. They serve ginger in smaller quantities to a diverse range of clients, such as restaurants, catering, hotel chains, street market sellers, specialised fruit and vegetable retailers and shops. Examples of wholesalers that sell on spot markets include Primoeust Impex (France) and Anika Fruit & Veg (the United Kingdom).

Important wholesale markets in large EU importing countries of ginger include Rungismarket (Paris, France), Mercabarna (Barcelona, Spain), Grossmarkt Hamburg (Hamburg, Germany), SogeMi Mercato Agroalimentare Milano (Milan, Italy) and New Spitalfields Market (London, the United Kingdom).

Food service

In addition to wholesalers, the food service sector (hotels, restaurants and catering) relies on cash & carry and food service distributors for the supply of fruit and vegetables. Cash & carry refers to wholesale stores where businesses can buy a broad range of food and non-food articles. An example of a cash & carry store is Makro (the Netherlands). They collaborate with the importer Nature’s Pride for the supply of several fruits and vegetables, including ginger.

Food service distributors can deliver to the food service sector on a daily basis. They have large storage facilities and a fleet of trucks to deliver all kinds of food and also non-food products. They either purchase products from manufacturers, from importers or directly from foreign exporters.

An example of a food service distributor is Bidfood. They buy fruit and vegetables from the wholesaler Van Gelder Groente en Fruit. This wholesaler (and/or their suppliers who fall in the category of importers) sources conventional ginger from China and organic ginger from Peru.

Processors

Ginger exporters can also find clients in the processing industry, which produces a variety of products, such as (ginger) juices, smoothies and other drinks. This segment tends to source ginger directly from traders specialised in fresh fruits and vegetables for industrial use. An example company in this category is Now Organic.

Now Organic imports fresh ginger from China and Peru and processes the ginger in a factory in the Netherlands into juices, purees and ice cubes. Now Organic has a cold storage capacity of 3,000 tonnes. The ginger juice is bottled in drums for industry applications, such as the production of blends, or is bottled in jars to be sold as pure ginger in the retail and food service market.

In addition, Now Organic processes the ginger into puree and IQF (individual quick freezing) ginger dices for the food processing industry and wholesale market. Increasingly, ginger is an ingredient in consumers packaging for smoothies.

Tips:

- Select the type of buyer that best fits your company and product. There are several channels to choose from, but each type of buyer will have its own specific requirements. For example, retailers are often the most demanding in terms of certifications and compliance. Make sure to be aware of the different target groups and discuss the preferences and requirements for ginger with your buyer.

- Visit the websites of wholesale markets to find wholesalers that import fresh ginger, for example the business directory of Rungismarket (France) or the tenants directory of New Spitalfields Market (the United Kingdom).

What is the most interesting channel for you?

The most interesting channel depends on what you are offering. You should find a channel that fits best with what you want to export. What you wish to export should also fit with the requirements of the different types of buyers.

Beginning exporters can best select a smaller importer or wholesaler that is specialised in importing exotic fruit and vegetables. This also applies if your volumes are relatively small. This type of importer is less demanding than importers that supply the large retailers. This entry strategy allows you to build up a solid base in the European market. Examples of European buyers in this category include Denimpex and Exotimex Europe.

If you are more experienced and able to sell a larger volume of ginger, the bigger importers of fruit and vegetables could be an interesting channel. This will also give you access to the large retail channels, as the larger importers often also supply retailers. Be aware that large retailers have strong buying power and they require a high form of professionalism. Serving this channel means more formalities and stricter requirements, and certifications will be requested from you. Examples are importers that supply to large supermarket chains such as Bel Impex, or full-service providers such as Greenyard Fresh…

If you can supply organic-certified ginger to Europe, make sure to look for importers that specialise in organic exotic fruit and vegetables, such as Eosta and OTC Organics. They supply organic ginger to different countries, channels and clients in Europe and know the requirements of the different clients.

Organic ginger is often re-exported by importers who are mostly located in the Netherlands (important hub), but you can also find them in smaller hubs, such as in Spain, Italy and Germany. Organic certification, including traceability, is essential for getting access to the European organic ginger market.

Be aware that European buyers prefer to create long-term relationships to make sure they have a reliable, steady supply of ginger and can rely on you for quality fresh ginger.

Tips:

- Carefully select your target market and segment. If you have a sufficient volume and can ensure high quality ginger, importers that supply the retail segment may be attractive. For smaller volumes, shift your focus to importers/wholesalers on the spot market.

- Attend trade fairs to connect with potential buyers. Key events for fresh fruit and vegetables in Europe are Fruit Logistica (Berlin, Germany) and Fruit Attraction (Madrid, Spain).

- Consult CBI's tips for finding European buyers on the European fresh fruit and vegetables market.

3. What competition do you face on the European ginger market?

China is the top supplier of ginger to the European market. However, Peru and Brazil are gaining more and more market share. While China is known for offering ginger in large volumes for low prices, Peru focuses more on sustainability and mostly offers organic-certified ginger.

Which countries are you competing with?

The main country you are competing with in the European market is China. With a market share of close to 40%, China is the leading supplier of ginger to Europe. China is followed by Peru and Brazil, who have a share of 21% and 14% respectively. Thailand is a relatively small player and holds the fifth position in the European market, behind China, Peru, Brazil and the Netherlands (re-exporter). Whereas China’s exports have decreased substantially over the past five years, Peru, Brazil and Thailand saw their exports increase.

Source: UN Comtrade (May 2024)

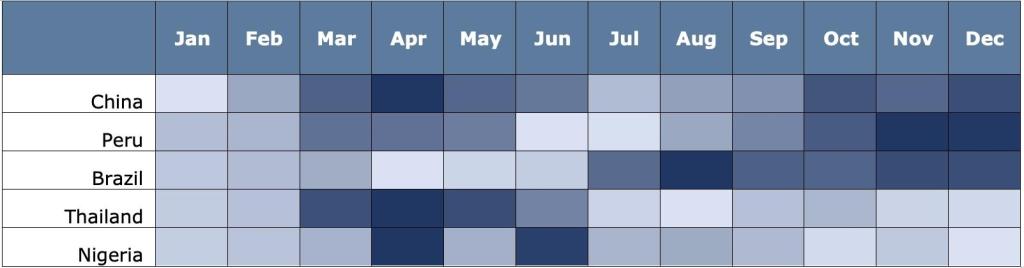

The supplying countries have different supply windows. Figure 4 shows the months in which each country exports their ginger to Europe. The dark blue colour shows the months in which the exports to Europe were the highest. For example, in 2023, China and Peru exported most ginger in the period from March-May and October-December. China had a peak in April, whereas the peak for Peru was in November and December.

Figure 4: Indicative supply calendar for ginger to Europe

Source: Globally Cool, based on UN Comtrade monthly data for 2023

Below is a short profile of the ginger supplying countries China, Peru, Brazil and Thailand.

China: competitively-priced ginger in large volumes

China is by far the largest supplier in the European market. However, its exports decreased significantly in the period from 2019 to 2023, from 100,000 tonnes in 2019 to 65,000 tonnes in 2023. This was an average annual decline of 10%. About 86% of the ginger exported to Europe goes to the Netherlands, Germany and the United Kingdom.

China has faced some challenges with the transport of ginger. Due to the Red Sea conflict since 2023, ships have had to detour. Firstly, this has increased shipping costs drastically. For example, the costs of a 40-foot container shipped to the United Kingdom has increased from USD 1,300 before the conflict to USD 7,000 in January 2024. As a result, Chinese factories have faced losses. However, in 2024, container prices have been decreasing again, to USD 4,500 to 5,000 in March 2024.

Secondly, the detour has resulted in shipping delays of over 10 days, sometimes even more than 25 days. This has partially impacted the quality of the ginger and made trading riskier.

Overall, China is known for offering good quality ginger for a low price. Because of that good value, European consumers often prefer Chinese ginger. At the beginning of 2024, China dominated the ginger market, as there was not much ginger available. Its largest competing countries, Peru and Brazil, did not have enough ginger to cover the demand in Europe. This situation allowed Chinese suppliers to increase their market share in the first quarter of 2024.

The Shandong province is the region in China where most ginger is produced. Producers make use of flat lands, and the production and processing of ginger is mostly done in a mechanised way. This allows producers to work efficiently and offer ginger at lower prices.

Figure 5: Fresh ginger from China sold in a Dutch street market

Source: Globally Cool (April 2024)

Overall, the outlook for Chinese fresh ginger exports to Europe is optimistic, driven by strong production capabilities, strategic market positioning with relatively low prices and an ability to meet the Class I quality demanded by European consumers.

Peru: leading supplier to the European organic market

Peruvian ginger is different from Chinese ginger. Whereas Chinese ginger is characterised by high volumes and low prices, Peruvian ginger is known to be organic and certified ginger, with a stronger focus on sustainability. Peruvian ginger is noted for its superior quality, smell, flavour and colour compared to Chinese ginger. Therefore, the prices for Peruvian ginger are higher. Moreover, Peruvian ginger is spicier and thinner than Chinese ginger.

With an average annual growth of 31%, Peru has seen a strong upward trend in its exports of ginger to Europe. In 2020, the exported volume doubled compared to 2019, from 12,000 tonnes to 25,000 tonnes. In 2021 and 2022, the exported volume was quite stable, after which there was another significant increase in 2023 (+34%). In 2023, the total volume amounted 35,000 tonnes.

In the first months of 2024, there was limited availability of Peruvian ginger. The season ended two months earlier than normally and this created a shortage in the European market. This allowed China to fill in this gap. According to a Peruvian supplier, this shortage was caused by the large drop in the planting of ginger (-60%) in 2022 compared to 2021. Farmers had limited working capital in 2022 because of the low prices in 2020 and 2021.

For the 2024 season, Peru expects to export around 2,500 containers in total. The first new ginger arrived in the European market at the beginning of April. As the ginger has not fully matured yet, for the months April and May, ginger will be exported via airfreight. The next harvest is expected to take place in May and sea shipment will start from that point onwards. The peak harvest period lies between July and February.

Overall, the long-term outlook for the Peruvian ginger export remains positive due to its high-quality produce, strong demand in Europe and ongoing efforts to enhance sustainability in production.

Brazil: robust export infrastructure, competitive prices and focus on July/August

Brazil is the third largest supplier of ginger to Europe. Like Peru, Brazil also saw its exports increase over the past five years, from 14,000 tonnes in 2019 to 24,000 tonnes in 2023, which is an average growth of 14%. Brazil exports the most ginger to the Netherlands, which imports over 55% of the total ginger exports to Europe. Poland is Brazil’s second largest destination in Europe, with a share of 8.2%. Brazil is the leading exporter of ginger to Poland. Next comes Germany, the United Kingdom and Spain, each having a share between 6.4% and 7.5%.

At the beginning of Brazil’s season, the country ships young ginger via air transport. This younger ginger has a shorter shelf life. Even though it is shipped via air, it can still compete with the prices for Peruvian ginger. On the other hand, Brazilian ginger is more expensive than Chinese ginger. Brazil’s high season for ginger runs from June/July until November/December.

Most of the ginger is grown in the state Espirito Santo. According to Santana Ginger, Brazilian ginger is known for its low pesticide use; a large part of the ginger is grown without chemicals. However, most exporters do not have organic certification. In addition, the ginger is known for its large size.

The Brazilian ginger export sector is well-positioned for growth in Europe, supported by increased production, competitive pricing, rising demand and robust export infrastructure.

Thailand: tiny player in the European market for organic ginger

Compared to the top three suppliers to Europe, Thailand is only a tiny player in the European market. In the period from 2019 to 2022, it had relatively low exports to Europe, varying between 800 tonnes and 1,900 tonnes per year. However, it exports increased significantly in 2023, to a volume of 5,700 tonnes. With this volume, Thailand holds a market share of 3.4%. Overall, the average annual growth from 2019 to 2023 was 31%. Almost all Thai ginger exports to Europe are organic-certified.

Usually, the peak export season for Thai fresh ginger starts in mid-October and runs until mid-March. From August to November, Thai organic ginger is the best available organic ginger in the European market. In 2023, this pattern was slightly different, as Thailand exported the highest volumes of ginger in the months March, April and May. Almost the whole volume (93%) was exported to the Netherlands.

Tips:

- Get familiar with the harvesting calendars of the major ginger producing countries. Harvesting periods vary amongst the countries and will influence your competitive position during the year.

- Make sure to analyse your opportunities in the European market regularly. Each year can be different, depending on the situation of the competing countries. Stay up to date on the ginger season in the competing countries, when they start harvesting and exporting ginger, how much volume they have available, etc.

Which companies are you competing with?

Your main competitors will come from China, Peru, Brazil and, to a lesser extent, Thailand. Chinese competitors are mainly focused on selling high volumes for low prices, whereas the strength of the Peruvian suppliers lies in offering high-quality organic ginger. Below are the highlights of a few companies that supply ginger to the European market.

Shandong Sanhui Foods: large-scale production of ginger at low costs

Shandong Sanhui Foods Co. from China produces, supplies and markets conventional and also organic-certified ginger to over 30 countries, including those in Europe. Annually, Shandong exports more than 20,000 tonnes of ginger. Shandong grows ginger across 300 hectares of land and has a 20,000 square-metre processing plant with an automatic processing line. Additionally, there is a constant-temperature warehouse that has room for over 10,000 tonnes of fresh ginger.

The production of ginger is strictly managed according to GLOBALG.A.P., which includes careful management of pesticide and fertiliser use to ensure food safety. In addition, the company has the GRASP certification to ensure the well-being of workers.

Agroexportaciones Llacta: high quality organic ginger between August-January

Agroexportaciones Llacta is a Peruvian company that produces, processes and exports ginger, turmeric and other produce to all parts of the world. It has great experience in the European market; it supplies to all the leading importing countries in Europe. The company is committed to producing high-quality organic ginger in a social and environmentally-friendly manner. It is GLOBALG.A.P., GRASP and EU Organic-certified.

Its high season for ginger runs from August to January. Its low season includes the months of February, March and July. In the remaining months, baby ginger is available. It offers ginger to the European market in cardboard boxes of 13kg and plastic boxes of 7.5kg.

Pommer Fresh Foods: ginger from July-December

Pommer Fresh Foods is a Brazilian family company focused on growing, packing and exporting fresh ginger. It sells ginger – both conventional and organic – from more than 300 producer families. In the months from April to June, it offers young ginger via air shipments, while in the months from July to December, mature ginger is offered via boat shipments. The company is working on its social certifications. It is already GLOBALG.A.P. and GRASP-certified and is working on obtaining the SMETA certification.

Thai Vege Farm: Thai ginger from March-June

Thai Vege Farm is specialised in producing fresh ginger for export. The company collaborates with local farmers to promote sustainable farming and ethical production. This way, it supports the economic development of the local community and ensures good-quality ginger at the same time. It has a variety of packaging options available (for example, 10kg export cartons or 20kg mesh bags), but it can also adjust to the customer’s requirements.

Tip:

- Stand out from the competition by developing your unique value proposition (UVP). Make sure to include your UVP in your marketing. Create a story behind your product. You can, for example, focus on the origin of the ginger, the agricultural and climate characteristics of the production region, the quality of your ginger, sustainable farming and ethical production, sustainable certifications, and profiles of the local farming communities.

Which products are you competing with?

Fresh ginger competes with various products in the European market. These substitutes can be categorised into processed ginger and other fresh root spices.

Fresh ginger is most likely to be substituted with processed ginger. For example, ground ginger can be used as a spice to add flavour to dishes. The advantage of ground ginger is that it is convenient to use and it has a long shelf life. The disadvantage is that it loses some of its smell and flavour when used in powdered form. Dried ginger pieces could be used as a substitute for fresh ginger when making ginger tea.

As ginger has a typical flavour and taste, it cannot easily be substituted with other fresh root spices. A root that comes close is the galangal, which is related to ginger and turmeric. It adds a spicy flavour to dishes and is commonly used in some Asian cuisines. However, the taste is less citrusy than ginger and fresh galangal is not as widely available. It can be found in some foreign supply supermarkets. Companies that import and distribute galangal are, for example, Fruiver and Cultivar.

Tips:

- When positioning fresh ginger, highlight the freshness of the product and market it as a premium product with a superior flavour and smell compared to ground or dried ginger.

- Emphasise the particular flavour and taste it has to offer, in a way to stand out from other fresh roots.

4. What are the prices of ginger on the European market?

Consumer prices show a variation of a maximum of 100% for the same type of ginger (conventional or organic, and packed versus loose). Import prices can be calculated based on import values and volumes. Based on these import prices, an (estimated) price breakdown can be made to show how margins can be divided through the value chain.

Consumer prices

Consumer prices of ginger vary widely amongst the leading importing countries. The prices for conventional ginger mostly lie between €6.46 and €8.90 per kg, with the exception of prepacked ginger in the United Kingdom, which varies between €11.75 and €14.10 per kg. Prices of organic ginger are higher. Organic ginger is sold between €7.90 up to €16.60 per kg.

Table 1: Consumer prices of fresh ginger in large European supermarkets*

| Conventional ginger (price per kg) | Organic ginger (price per kg) | |

| The Netherlands | €8.90 | €13.27 |

| Germany | €7.90–€13.99 | |

| The United Kingdom | €6.46 (loose) €11.75–€14.10 (packed) | |

| Spain | €7.25–€8.65 | €8.45–€11.93 |

| France | €6.99 | €9.95–€16.60 |

Source: Globally Cool (June 2024)

Import price

Over the past five years, import prices have shown considerable fluctuations. The lowest average import price was observed in 2019, at €1.51 per kg. Although there was an increase in prices in 2020, they dropped again in 2021 and 2022. Notably, 2023 saw a significant rise in import prices, reaching an average of €2.43 per kg.

In addition, import prices differ per import country. The Netherlands has the lowest import price every year, €1.97 per kg in 2023. For Germany, the import price is significantly higher: in 2023, it was €3.12 per kg.

Source: Globally Cool (June 2024)

Moreover, prices depend on the origin of the ginger. China has the cheapest ginger. It March 2024, the FOB price for Chinese ginger was €20.24 per box of 10kg. Peru offers organic-certified ginger and takes sustainability aspects into account. This makes Peruvian ginger more expensive. The FOB price of Peruvian ginger was €46.00 per box of 13.60 net kg (€33.82 per 10 kg).

Prices can also rise and fall throughout the season for various reasons. For instance, in the Netherlands at the beginning of 2024, ginger prices dropped rapidly within a few weeks, falling from €43.00 to €28.00–€30.00. And because of the Red Sea conflict, the price of Chinese ginger increased by €0.20 per kg due to high sea freight costs. This shows how important it is to keep up to date on the market dynamics.

Price breakdown

Figure 7 shows the margins of several players in the value chain. It gives an indication for a 10kg box of conventional ginger, which is sold for about €77 in the supermarket. In terms of margins, the food retailer receives the largest share, followed by the producer/exporter.

Source: Globally Cool (June 2024)

Tips:

- Read FruiTrop’s roots & tubers quarter review: Q4 2023 to see the development of wholesale prices of ginger in the French market.

- Visit Réseau des Nouvelles des Marchés (RNM) to see import prices, wholesale prices and retail prices of ginger in the French market.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research