The European market potential for ginger

The European market for ginger offers opportunities for suppliers from developing countries. In the coming years, the demand is expected to grow. A healthy lifestyle, a growing demand for Asian cuisine and the widespread use of ginger in the food and beverage industry is driving this growth. The leading importing country for ginger is the Netherlands, followed by Germany and the United Kingdom.

Contents of this page

1. Product description

Ginger is the unevenly shaped underground plant stem of the plant Zingiber officinale (botanical name of the ginger plant). The plant is cultivated in tropical climates in different parts of the world. Large producing countries include India, Nigeria, China, Nepal and Indonesia. The top 3 exporting countries to the European Union are China, Peru and Brasil

Fresh ginger is mainly used by consumers for the following applications:

- Cooking (Asian cuisine)

- Ginger tea

Fresh ginger is processed in Europe into:

- Puree for the food processing industry, refrigerated or frozen.

- Ginger juice (as an ingredient for blends, a main ingredient for ginger shot drinks or bottled in jars for home and the food service market).

- Frozen, cut and packed ginger pieces.

This study only focuses on exporting fresh ginger to the European market. The study for dried ginger is categorised under the spices and herbs section. However, both markets are related to each other. Overall, more fresh ginger is exported than dried ginger. Also, most fresh ginger is hydrated to a 70% moisture content level before shipping.

Table 1: Harmonised System (HS) codes for ginger

| HS code | Product description |

| 091011* | Ginger, neither crushed nor ground |

*This HS code includes fresh as well as dried ginger. This means that statistics also include dried ginger pieces.

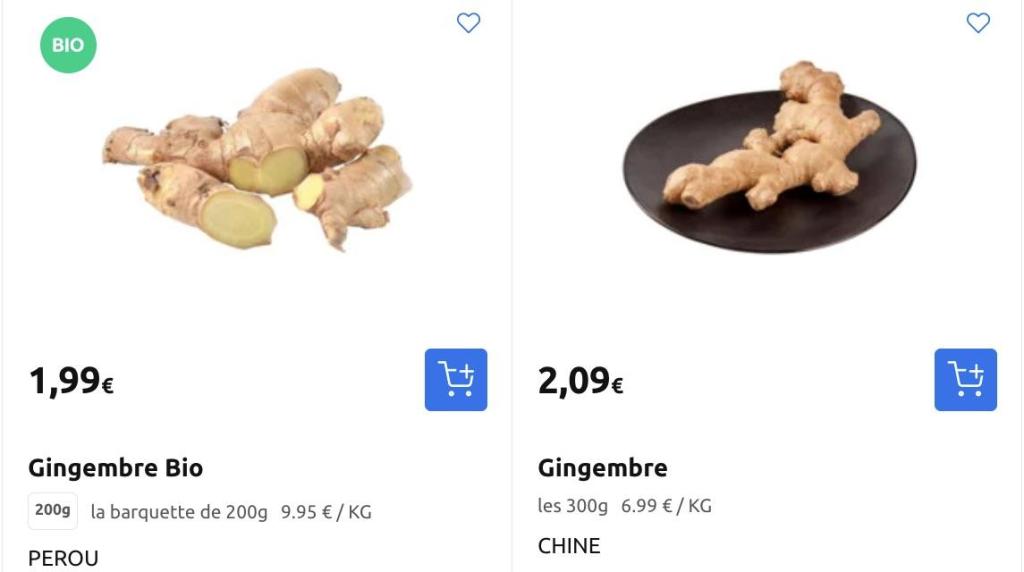

Figure 1: Peruvian fresh ginger, for sale in a supermarket in the Netherlands

Source: Globally Cool (July 2023)

2. What makes Europe an interesting market for ginger?

Europe is one of the world’s largest markets for fresh ginger. It has an above-average demand for organic-certified ginger. Europe depends on imports from developing countries and the consumption is expected to continue to grow over the next few years.

Europe’s ginger market expected to continue to grow in the upcoming years

Imports of ginger into the European market were relatively stable in the period from 2019 to 2023. There has been a slight annual average growth of 0.9% over the past five years. The imports peaked in 2021, when 185,000 tonnes of ginger were imported. In 2023, ginger imports declined; it dropped to a volume of 168,000 tonnes.

Over the next few years, the European market for ginger is expected to continue to grow. This growth is driven by several factors: the widespread use of ginger in the food and beverage industry, the health benefits of ginger and research studies on the medical properties of ginger. Overall, the market growth of ginger will remain highest in the organic segment, although that segment is also relatively sensitive to economic recession and inflation dynamics.

In 2023, 80% of the ginger imported was sourced from developing countries. The other 20% was imported through other European countries. This can be mostly attributed to the Netherlands, as it is an important re-exporter of fresh fruits and vegetables. 7.7% of Europe’s total imports of ginger are supplied by the Netherlands. Germany is also a re‑exporter of ginger, however in smaller volumes (share of 2.6%).

Source: UN Comtrade (May 2024)

*Developing countries following the OECD-DAC list of ODA recipients; “Rest of the world” refers to all other countries outside Europe.

Tips:

- Follow news on ginger in the European market on a regular basis. Websites like Freshplaza can give you valuable information on the fresh produce industry, including ginger. For example, check out Freshplaza’s global market overview about ginger.

- To get to know why Europe in general is an interesting market for fresh fruit and vegetables, read our study What is the demand for fresh fruit and vegetables on the European market?.

3. Which European countries offer the most opportunities for ginger?

The Netherlands is the European country that accounts for the largest import of fresh ginger. The country accounts for 39% of all European imports. It is an important trade hub for fresh fruit and vegetables. The Netherlands is followed by Germany (16%) and the United Kingdom (13%). The top six countries that import fresh ginger, mentioned in Figure 3, account for 82% of all ginger imports into Europe.

Please note that in this section, the focus is on import volumes. These figures are crucial when selecting the most potential markets for suppliers of ginger from developing countries.

Source: UN Comtrade (May 2024)

The Netherlands: the European ginger hub

With a total volume of 65,000 tonnes in 2023, the Netherlands is the leading importer of ginger in Europe. Imports have increased slightly over the past five years (0.7% on average per year). In 2020, imports grew by 22% compared to 2019. However, in the period from 2021 to 2023, imports have declined again.

Most (95%) of this ginger is imported directly from developing countries. China is the largest supplier (39%); however, the Netherlands depends less and less on supplies from China. The imported volume dropped from 44,000 tonnes in 2019 to 25,000 tonnes in 2023. This was also partly caused by the logistical problems that China experienced due to the Red Sea conflict.

Peru (25%) and Brazil (21%) are the second and third largest suppliers of ginger to the Netherlands. Both of these countries saw their exports increase significantly over the past five years. Thailand – the fourth largest supplier to the Netherlands – showed remarkable growth as well. Until 2022, Thailand made limited exports to the Netherlands, while their exports increased up to 5,000 tonnes in 2023.

The Netherlands is an important trade hub for fresh fruits and vegetables, including ginger. This means that part of the ginger that is important by the Netherlands is re-exported to other European countries. Overall, the Netherlands is the fourth largest exporter of ginger to Europe. Important destinations for ginger are France (4,200 tonnes), Denmark (2,300 tonnes) and Italy (2,300 tonnes). The Netherlands is the leading exporter of ginger to these countries.

Due to the good logistical position of the Netherlands, a relatively large number of importers of exotic fruits and vegetables are located there. The Netherlands is therefore an important entry point for suppliers from developing countries. An example of a Dutch importer is Fruitfactor. Fruitfactor imports ginger in large volumes from China, after which the company dries, sorts and packs the ginger. Fruitfactor offers ginger (either in bulk or in specific packaging) to European retailers, catering suppliers, wholesalers and the processing industry.

Sustainability is becoming more important in the Dutch market. Organic ginger has become the standard in large Dutch supermarket chains. For example, Jumbo and Albert Heijn only offer organic ginger in their stores. The two leading groups of specialised organic retail chains are Odin and Ekoplaza.

Eosta, a Dutch importer and distributer of organic produce, sees a growing demand in Europe for high-quality, socially and ethically produced fruits and vegetables. Eosta has started a project in China to make organic ginger Fairtrade certified and also recently set up a project to cultivate organic ginger in four locations in Europe.

Germany: biggest consumer of ginger

Germany is the largest consumer market for ginger in Europe and also the largest market for organic-certified fresh fruits and vegetables, including ginger. The annual consumption peaked at about 30,000 tonnes in 2021 and 2022. Demand is the highest in the winter months. As ginger is thought to help fight the flu, it is especially high in demand during the flu season.

Germany is the second largest importer of ginger in Europe. In the period from 2019 to 2021, ginger imports increased. However, Germany’s imports of ginger dropped from 32,000 tonnes in 2022 to 27,000 tonnes in 2023 (-14%). Overall, the average annual growth has been quite positive (+7.1%). In 2023, the consumption of health-related and relatively expensive ingredients like fresh organic ginger was under pressure due to the high inflation that year.

97% of Germany’s ginger is imported directly from developing countries. Just like in the Netherlands, the countries China, Peru and Brazil are the leading suppliers of ginger. They hold a share of 59%, 27% and 6.6%, respectively. Imports from these countries have increased significantly over the past five years, ranging between 7.4% of average annual growth (China) to 35% (Brazil). Germany imports less and less ginger through the Netherlands. In 2019, the Netherlands still had a share of 14%, but this decreased to 3% in 2023. In other words: Germany is now relying more heavily on imports from developing countries.

According to Freshplaza, more and more ginger is being offered as a loose product in mainstream supermarkets, instead of being packaged. For example, Aldi Süd used to offer ginger in nets of 300g, but in early 2024 it switched to offering loose ginger. Through this development, how ginger is offered in mainstream German supermarkets is becoming more and more similar to how it is offered in organic German supermarkets, such as Alnatura.

United Kingdom: large market for Asian cuisine drives demand for ginger

The United Kingdom is a relatively stable market when it comes to importing ginger. In the period from 2019 to 2023, the compound annual growth rate was slightly negative, at -0.2%. The largest decrease happened in 2023, when volumes dropped by 11% compared to the previous year. The total imported volume was 22,000 tonnes in that year.

Almost all the ginger (99%) in the United Kingdom is imported directly from developing countries. This is the highest share compared to other leading importing countries. China is the most important trading partner, accounting for 66% of the market share. Although China’s share was between 80-87% in previous years, this share significantly dropped in 2023. Peru, on the other hand, increased its exports to the United Kingdom. Its market share went up from less than 1% in 2019 to 18% in 2023.

Ginger is used a lot in Asian cuisines. The Asian cuisine is popular amongst British consumers. According to Tesco, one of the United Kingdom’s largest supermarkets, consumers are increasingly cooking international dishes from across the globe at home. Indian and Chinese recipes are the most popular. For example, Tesco’s sales of ingredients to make Indian curry have gone up by 33%, and ingredients for Chinese recipes by 32%. In addition, Thai, Korean and Japanese recipes are becoming more popular too; sales for these ingredients have gone up by 15%. Tesco is expanding its offering to meet the consumer demand for Asian cuisine.

British consumers mostly buy conventional ginger. In the British market, there appears to be limited interest in organic-certified fresh ginger. Unlike other European countries where supermarkets offer both organic and conventional ginger, most British supermarkets, such as Tesco and Sainsbury’s, predominantly stock conventional ginger imported from China. The exception is retail outlets with a strong focus on sustainability, such as Waitrose. Whole Foods and Planet Organic are also two specialised organic retail chains in the United Kingdom.

Spain: Peru as the leading supplier

With a market share of 5.9%, Spain is the fourth largest importer of ginger in Europe. Spanish imports increased by an average of 4.9% per year in the period from 2019 to 2023. In 2023, Spain imported 10,000 tonnes of ginger. This was mainly sourced from developing countries (92%).

Whereas China is the leading supplier to the top three importing countries, Peru ranks first in the Spanish market. In 2023, Spain imported 3.9 million tonnes of ginger from Peru, which comes down to a market share of 39%. Peru experienced a strong increase in its ginger exports to Spain since 2019. Peru benefits from the fact that they speak the same language, which makes trading and developing connections with Spanish companies more likely. Peru has registered an annual growth of 25%.

China used to be the leading supplier to Spain, but dropped to second place in 2023. Its market share decreased from 56% in 2019 to 33% in 2023. Other suppliers to Spain include Brazil (with a share of 15%), the Netherlands (with a share of 5.2% via re-exports) and Costa Rica (with a share of 2.9%).

Spanish supermarkets offer fresh ginger in a variety of ways. Conventional ginger is offered loose (price per weight) and/or packed in cardboard trays of 200g, 300g or 400g. Organic ginger is mostly packaged and offered in smaller quantities, usually 150g or 200g.

Supermarkets are supplied by Spanish fruit and vegetable wholesalers. For example, El Corte Inglés purchases conventional ginger from Cultivar, S.A. (offered loose) and ARC Eurobanan, S.L. (offered in packages of 300g). Ibereco Producciones Ecológicas, S.L. supplies organic ginger to the supermarkets El Corte Inglés and Alcampo. Their organic ginger originates from Peru, China and Thailand. Fernández, one of the largest wholesalers of fruits and vegetables in Spain, supplies organic ginger to Carrefour. Veritas is Spain’s largest organic supermarket. Another is Bio c’ Bon, which is originally from France.

France: relies on imports from other European countries

France imports most of its ginger from other European countries. Only 25% is imported directly from developing countries. This is in contrast with the other leading importing countries, which import the majority directly from developing countries. Moreover, the importance of intra-European trade has increased. Between 2019 and 2023, intra-Europe trade grew by an average of 52% per year, while imports from developing countries decreased by 30%. This pattern is in line with the trend that France is importing less fresh produce from outside Europe directly.

Exporters who want to access the French market can also consider focusing on European countries that re-export large quantities to the French market. This is mainly the Netherlands and – to a lesser extent – Spain.

The Netherlands is by far the largest supplier of ginger to France, accounting for 60% of French imports (4,200 tonnes). The Netherlands became an important supplier as from 2020. In 2019, its share of French imports was only 1.7%, but this increased to 50% in 2020. In the same period, China’s share dropped from 49% (first position) to 19% (second position). Currently, China takes the fourth position in the French market.

Brazil is the most important non-European supplier of ginger to France. With a share of 12%, it ranks second in the French market. Brazil is followed by Spain (7.9%), China (5.3%) and Italy (3.6%).

France’s imports of ginger have shifted quite a lot in the period from 2019 to 2023, with two years of decline (-1.4% in 2020 and -3.8% in 2021), a positive year in 2022 (+4.5%), followed by a sharp drop in 2023. Over the whole period, imports decreased from 8,600 tonnes in 2019 to 6,900 tonnes in 2023, which comes down to -5.2% on average per year. In the period under review, the consumption of fresh ginger stabilised and ultimately even dropped.

France is known for its large-scale retailers (called hypermarkets). These retailers sell both conventional and organic ginger, or only organic ginger. Examples are Carrefour and Auchan.

Figure 4: Organic and conventional ginger available in a French hypermarket

Source: Globally Cool (June 2024)

France has Europe's second-largest number of organic-certified importers of fresh fruit and vegetables. This contributes to the importance of France as an organic market. Organic-certified fresh ginger is imported directly by France's certified importers or through certified importers from the Netherlands. France is home to quite a number of organic retail outlets, including Biocoop, Naturalia, La Vie Claire, Les Comptoirs de la Bio, Bio c’ Bon and naturéO.

Italy: stabilising market, organic ginger is popular

The Italian ginger market has stabilised in recent years. Italy shows some similarities with France. The total imported volume is almost equal to France; in 2023, Italy imported 6,200 tonnes of ginger. Italian imports are decreasing, with an annual decline of 4.4%. Lastly, Italy also strongly relies on intra-European trade for ginger (52% of the total imports), however to a lesser extent than France. Imports from European countries increased by 13% on average in the period from 2019 to 2023, while imports from developing countries decreased by 14%.

Italy’s most important supplier is the Netherlands, accounting for 37% of Italy’s ginger imports in 2023. Imports from the Netherlands increased from 1,300 tonnes in 2019 to 2,300 tonnes in 2013 (+15% per year). Imports from Peru and Brazil are also on the rise, with a strong annual growth of 44% and 18% respectively. With this growth, both countries managed to get the second (share 20%) and third position (18%) in the Italian market. Germany takes the fourth position with a market share of 8.9%.

China used to have a strong position in the Italian market. With a market share of 59% in 2019, it was the leading supplier to Italy. However, this decreased drastically to a share of 6.1% in 2023.

Consumers mostly buy fresh ginger in conventional supermarkets:

- Conad is the largest food retailer in Italy, known for its extensive network and market presence.

- Coop Italia operates a large network of consumers’ cooperatives and offers a relatively high number of organic and Fairtrade-certified products, including ginger.

- Selex Gruppo Commerciale operates numerous supermarkets and hypermarkets.

- Esselunga has high-quality stores particularly in Northern and Central Italy.

Figure 5: Organic and Fairtrade certified ginger (150 grams) available in an Italian supermarket

Source: Globally Cool (June 2024)

Although exact data are not available, the organic ginger market is believed to have outperformed the market for conventional ginger. This can be also seen from the strong growth of imports from Peru, which are mostly of organic-certified ginger. As ginger is considered to be a healthy product, there is a growing demand for the organic version. Consumers add ginger to teas and smoothies, but they also use it as a spice in recipes. Organic ginger is mostly sold in trays of 150g. The two leading specialised organic outlets are Bio c’ Bon and NaturaSì.

Tip:

- Make use of Dutch traders when you want to get access to different European markets. As a trade hub, the Netherlands re-exports large amounts of ginger to other European markets. It holds a strong position in multiple markets, such as France and Italy. For that reason, the Netherlands has extensive knowledge and experience in trading ginger in the European market.

4. Which trends offer opportunities or pose threats in the European ginger market?

The ongoing trends of consumers’ desires for a healthy lifestyle, a growing demand for Asian cuisine and widespread use of ginger in the food and beverage industry is driving growth in the European market.

Healthy lifestyle increases demand for ginger

European consumers are very health conscious. They are increasingly focusing on a healthier lifestyle, which includes improving their eating habits. According to Statista, about 60% of EU consumers try to actively eat healthy. Consumers are looking to reduce their consumption of processed foods and artificial additives and preservatives. Instead, they are preferring to choose natural ingredients, natural remedies and functional foods.

Ginger fits into this trend. It is known for its potential health benefits and European magazines mention that ginger can help against nausea, has anti-inflammatory properties and can help boost your immune system. These benefits support the consumption of ginger. In addition, ginger is valued to enhance the flavour of dishes, without needing to use artificial flavourings.

European consumers use ginger in a variety of ways:

- Ginger drinks shots: consumers either make ginger shots themselves or buy the shots in mainstream supermarkets like Albert Heijn and Tesco, or in specialised organic food retail outlets like Ekoplaza.

- Smoothies: consumers add ginger as an ingredient to smoothies (see, for example, the ginger smoothie recipes of die Ingwerianer, a German organic ginger juice producer).

- Ginger tea: consumers infuse ginger in hot water (for example, lemon and ginger tea).

- Dishes: consumers add ginger to a variety of dishes, such as soups, curries, stir-fries and salad dressings.

Figure 6: Organic ginger drinks in a Dutch organic supermarket

Source: Globally Cool (April 2024)

Sustainability has become mainstream

Sustainability has become mainstream in the fruit and vegetables sector. European buyers are increasingly interested in sustainable fruits and vegetables and want to have a transparent supply chain. Sustainability includes a variety of aspects, including social and environmental aspects. European buyers are more likely to accept products that fit in with sustainability initiatives.

Sustainable sourcing is an important trend in countries including Germany, the Netherlands and the United Kingdom. This means that you will increasingly have to deal with sustainability requirements from European buyers. For example, the Dutch fresh produce importer Eosta has developed Nature & More; a ‘trace and tell’ consumer trademark and online transparency system. Eosta products are given a unique (QR) code that provides retailers and consumers with online access to the producer and reports its ecological and social impact with full transparency.

To assess a company, Eosta makes use of the Sustainability Flower, a framework to monitor and manage the sustainability impacts of an organisation and its production process regarding seven key aspects: society, economy, climate, water, soil, bio-diversity and individual well-being and development. Read the story of Eosta’s Chinese supplier of organic ginger: Weifang Jiahe.

Organic ginger

According to the European Commission (DG Agriculture and Rural Development), imports of organic agricultural food products in the EU dropped from 2.87 million tonnes in 2021 to 2.73 million tonnes in 2022, marking a decrease of 5.1%. This reflects a decline in demand because of the significant rise in food prices in that year. Part of the decline can be linked to the reduced imports of fruits and vegetables. Imports of organic vegetables in particular declined from 138,000 tonnes in 2021 to 109,000 tonnes in 2022, which is a decline of more than 20%.

The Netherlands and Germany import the highest volume of organic agri-food products into the EU (53%). They are followed by France. It is important to mention that a significant part of Dutch imports is re-exported to other EU countries. Germany saw a decline in organic imports in 2022 (-13.1% compared to 2021), while the Netherlands saw an increase (+4.6%).

As can be read in the country sections too, organic ginger has gained in importance in the EU retail sector. Most leading supermarkets in the top six European importing countries (except for the United Kingdom) offer organic ginger. Examples are: Albert Heijn (the Netherlands), REWE (Germany), Carrefour (France), Día (Spain) and Coop (Italy).

An example of a successful exporter is the Peruvian company La Grama. La Grama was the first Peruvian company to export organic ginger and has been the leader for 18 years. It has a team to specifically handle organic integrity, traceability, food safety, social responsibility and compliance with labour laws. It has multiple certifications to prove its organic and Fairtrade products, such as EU organic, Fairtrade and Fair for Life.

Figure 7: Organic ginger in a Dutch supermarket

Source: Globally Cool (April 2024)

Asian cuisine drives consumption of ginger

Numerous consumers across Europe have begun to include Asian and foreign dishes in their diet, which now compete with some of the more traditional local dishes. A key factor for the continuous rise in demand for Asian and foreign food is the exposure to foreign cuisines through international travel and tourism. Asian cuisine accounts for an important part of the foreign food market in Europe.

Asian cuisine typically uses a lot of different flavours in a single dish. Over the past decades, Asian food has been adopted into the European food culture. In Europe, you can come across a wide range of Asian stores and restaurants, for example Chinese, Indian, Japanese and Thai, in a growing number of cities. Also, Asian food products are more and more present in mainstream supermarkets. In recent years, interest in Asian cuisine has expanded to include flavours and dishes from Malaysia, Vietnam and Korea.

As ginger is widely used in Asian cuisine, this trend is an important driver of the European ginger market.

Tips:

- Learn about other trends that can influence your ginger exports and read CBI’s study on trends that offer opportunities or pose threats on the European fresh fruit and vegetables market.

- Read FiBL and IFOAM’s yearbook The World of Organic Agriculture 2024 to get more insights on emerging trends and statistics in the organic agro-food sector.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research