Entering the European market for fresh green beans

Growing and exporting fresh green beans is a specialisation. The crop has many challenges in quality requirements as well as strict control for pesticide residues. European companies look for reliable partners. To compete in this market, it is recommended to integrate your business with European importers or find close cooperation with supermarket buyers.

Contents of this page

- What requirements and certification must fresh green beans comply with to be allowed on the European market?

- Through what channels can you get green beans on the European market?

- What competition do you face on the European green bean market?

- What are the prices for fresh beans on the European market?

1. What requirements and certification must fresh green beans comply with to be allowed on the European market?

Fresh green beans must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant, which provides an overview of export requirements (use code 070820 for fresh green beans).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products.

Green beans are a high risk product for excessive pesticide residues. Green beans containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

A high frequency of non-compliance can result in more official controls when fresh beans are imported. This leads to higher import costs. Regulation (EU) 2021/2246 dictates that 10% of the imported beans from Kenya need to be checked. Yardlong beans from Cambodia and Dominican Republic are under stricter control with a frequency of checks of 50%. Yardlong beans from the Dominican Republic must also be accompanied by an official certificate with the results of pesticide analysis.

Note that retailers in several Member States such as the United Kingdom, Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation.

Tips:

- Find out the MRLs that are relevant for green beans by consulting the EU Pesticide database in which all harmonised MRLs can be found. You can search on your product (“0260010 Beans with pods”) or pesticide used. The database shows the list of the MRLs associated to your product or pesticide.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Reduce the amount of pesticides by applying Integrated Pest Management (IPM) in production. IPM is an agricultural pest control strategy that involves an integrated approach to prevent harmful organisms and keep the use of pesticides within acceptable levels. Read about Integrated Pest Management (IPM) on the website of the European Commission.

- Make sure that contamination of lead in green beans remains below 0.10 mg/kg, and cadmium below 0.020mg/kg. These limits are according to the EU Regulation 1881/2006 setting the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

Green beans must have a phytosanitary certificate when being introduced to the European Union, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072

The United Kingdom (no longer part of the European Union) has similar rules. They provide guidance for the import of plants and plant products on GOV.UK.

Typical diseases for green beans are common bacterial blight, bacterial brown spots, halo blight, rust, anthracnose, alternaria leaf spot, and pests such as aphids, trips, whiteflies and spider mites, among others.

Figure 1: Examples of diseases that are not allowed (from top to bottom): Anthracnose (bean spot disease), rust, bacterial blight, and malformation due to pest

Source: OECD (2021), Beans, International Standards for Fruit and Vegetables, OECD Publishing, Paris, https://doi.org/10.1787/0bc40eec-en-fr.

Tips:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

- Use pest-resistant bean varieties, protected horticulture and drip irrigation to avoid that your crop gets affected by pests or diseases.

Maintain high quality standards

You can find the minimum quality requirements in the UNECE standard FFV-06 concerning the marketing and commercial quality control of beans.

Green beans must be:

- Intact; Only due to harvesting of beans (excluding needle beans), a degree of damage is permitted at the stalk end only according to certain tolerances

- sound; produce affected by rotting or deterioration such as to make it unfit for consumption is excluded

- clean; practically free of any visible foreign matter

- fresh in appearance

- free from parchment (hard endoderm)

- practically free from pests

- practically free from damage caused by pests

- free of abnormal external moisture

- free of any foreign smell and/or taste.

The condition of the products must be such as to enable them:

- to withstand transport and handling;

- to arrive in satisfactory condition at the place of destination.

For imported quality, Europe almost exclusively requires class I green beans as a minimum. Products in this class must be of good quality and appearance, without abnormalities or obvious defects. They must be characteristic of the variety and/or commercial type. Beans in ‘Extra’ Class must be of superior quality and appearance (see table 1).

The quality tolerance is 5% in ‘Extra’ Class, by number or weight, of beans not satisfying the requirements of the class but meeting those of Class I. In Class I the tolerance is 10% of beans not satisfying the requirements of the class but meeting those of Class II.

To maintain good quality, you need to have a well-organised cold chain. It is best to have refrigerated transport throughout your entire supply chain, including right after the harvest from the field to the packhouse.

Table 1: Classification and specific requirements for ‘Extra’ Class and Class I

| ‘Extra’ Class | Class I |

Beans in this class must be:

| Beans in this class must be:

|

Source: Based on the UNECE standard FFV-06 concerning the marketing and commercial quality control of beans.

Figure 2: Example of green beans ‘Extra’ Class, Class I, Class II (from top to bottom)

Source: OECD (2021), Beans, International Standards for Fruit and Vegetables, OECD Publishing, Paris, https://doi.org/10.1787/0bc40eec-en-fr.

Tips:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

- Pay attention to your presentation. Nicely sorted and packed beans look much better, and buyers are sensitive to this. A good presentation will also help you get a good price for your beans.

- Read the UNECE standard FFV-06 concerning the marketing and commercial quality control of beans and the OECD standard for beans to get more details on the quality standards and allowed tolerances.

Check product size and uniformity

Grading and sorting is extremely important for green beans. The contents of each package must be uniform and contain only beans of the same origin, variety or commercial type, quality and size (if sized). The visible part of the contents of the package must be representative of the entire contents.

As an exporter of needle beans, you must be very accurate when it comes to sizing. The sizes for needle beans are expressed as “very fine”, “fine” and “medium”. Other beans can be sized by the width of the pods.

Table 2: Provisions concerning sizing

| Classification for needle beans | Size shall not exceed |

| Very fine | 6 mm |

| Fine | 9 mm |

| Medium | 12 mm |

Source: UNECE standard FFV-06 concerning the marketing and commercial quality control of beans.

For all classes (if sized) there is a total tolerance of 10%, by number or weight, of beans not satisfying the size requirements.

Use quality packaging

Fresh green beans, in particular fine beans, are a highly perishable vegetable. It is harvested immature with a high moisture content. Choosing the right type of packaging is crucial.

There are different packaging options according to the origin and segment. Common green beans are often traded loose in a box or crate. Tray or telescopic cardboard boxes usually hold around 4 or 5kg of beans. For example, Morocco uses 5kg wooded crates for snap beans, sometimes with additional netting on top and cardboard separation in the middle for a more attractive presentation (see figure 2).

Unlike common snap beans, needle beans or (very) fine haricots verts are sold as a more exclusive product and need to be neatly sorted. Sometimes they are top cut or top-and-tail cut for a perfect presentation. These fine beans are very perishable and are often flown in from distant sources such as Kenya. They are usually packed in perforated polyethylene bags or film-covered punnets in cardboard boxes, or even better, in Modified Atmosphere Packaging (MAP) that allows lower oxygen levels. Different box sizes are possible, ranging from 2 to 5kg, for example: 12x 250g, 6/8/10x 500g or 8-24x 150-200g punnets.

Figure 3: Example of consumer packaging, Class I top-and-tail cut haricots verts from Kenya

Source: Photo by ICI Business

Figure 4: Fine green beans from Senegal, sold by Waitrose in the United Kingdom

Source: Photo by tacinte per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

Tips:

- Always discuss the specific requirements for size and packaging with you buyer.

- Make sure your fresh beans are well packed and maintain a perfect cold chain to preserve quality and freshness. European retailers are very much focused on product shelf life.

Handling and transport

Fine beans are hand-picked and sorted to guarantee high-quality pods. They are harvested in the morning to avoid heat injury. After harvest, the pods must be immediately cooled.

Common green beans can be shipped by seafreight, lorry (from Morocco) or by air. Extra fine beans are almost exclusively shipped by air.

The ideal temperature for storage and transport is between 4 and 8 degrees Celsius, with a high relative humidity of around 95%.

Tip:

- Read the Review of best postharvest practices for fresh market green beans by El-Mogy, Mohamed & Kitinoja, Lisa (2019) on ResearchGate to get a better understanding of how to handle green beans for export.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh green beans are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are the most commonly recommended to use.

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

In the coming years, the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally-friendly. It will ensure a sustainable food production and address for example packaging and food waste. EU trade agreements often include rules on trade and sustainable development. For suppliers of fresh fruit and vegetables, it is important to look ahead of the increasing standards and try to be ahead of the developments.

Retailers can also impose their individual standards, such as Tesco Nurture. Especially larger retail chains in northern Europe are more prepared to buy your product if your compliance with social and sustainability standards is in order.

Tips:

- Implement at least one environmental and one social standard. See the Basket of standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

- Find sustainable packaging options for fresh beans, such as biodegradable plastics.

- For other additional requirements such as payment and delivery terms, see CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

The demand for organic vegetables is growing, although it is mainly fulfilled by European growers. Organic certification can be an interesting way to set your product apart and market them at a higher value.

However, it is not easy to grow and export fine green beans organically. And as a supplier of green beans by air you need to take into account that airfreight is increasingly being rejected by organic market channels.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Since January 2022, the new legislation Regulation (EU) 2018/848 has come into force. This legislation includes new rules for group certification, new approaches for dealing with suspected non-compliances and residues, new rules at the EU borders for imported products, among other things.

Social consumer labels

Smallholder bean production lends itself to highlighting social aspects. But consumer labels such as Fairtrade are not often seen for fresh green beans. The support base to invest in these labels is thin. Nevertheless, there are specialised companies in Europe that can offer fair trade certified beans, such as FV Seleqt in the Netherlands and Flamingo group International in the UK.

Tips:

- Strive for residue-free beans, and certify your production as organic only if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the actual list of control bodies and authorities to see which certifiers are active in your region.

- Explore the possibility for social actions to make your product more socially responsible. For example, think about living wage for workers, education, and working conditions on the farm. Communicating these actions sometimes mean more in the market than a label.

2. Through what channels can you get green beans on the European market?

Most beans are sold by supermarkets. Food service is an important segment for fine beans. As a supplier you can aim for a retail supply programme, or find specialised buyers that wholesale fine bean varieties.

How is the end-market segmented?

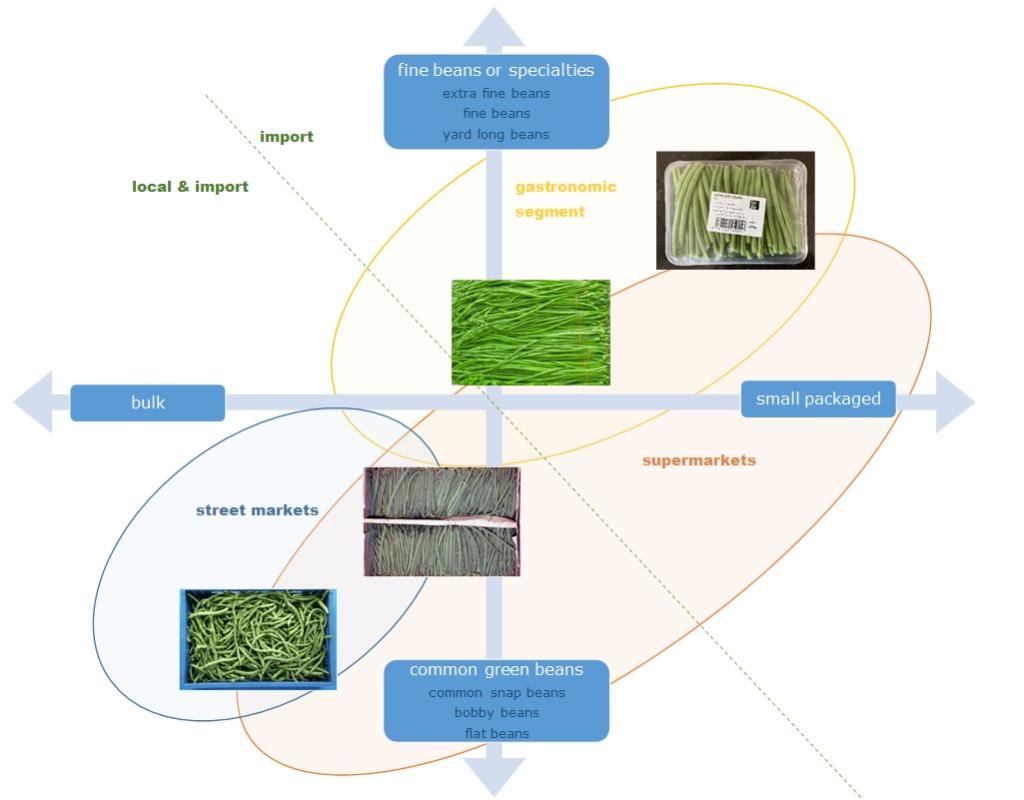

The fresh bean market can be segmented in different varieties, from common green beans to more exclusive and niche varieties. Each market channel has its own preferences in bean variety, quality and packing.

Figure 5: Segmentation of the fresh bean market

There is a distinction made between common green beans (bobby beans and flat beans) that are mainly cultivated locally or nearby Europe, and fine beans (or extra fine beans) that are imported. Common green beans represent most of Europe’s fresh bean consumption and attracts the largest consumer group. These beans are very affordable and offered in bulk per weight or prepacked in larger plastic packs. Fine and extra fine beans are often neatly packed and more expensive because they are always imported and have a relatively short shelf life.

Specialties such as yardlong beans are mainly imported for the ethnic market or Asian cuisine. Other varieties include for example wax beans and purple beans. These coloured beans are generally produced in Europe. Wax beans, also known as butter beans (in French: Haricots Beurre), have a strong consumption in France. French retailers such as Carrefour have a wide selection of fresh and preserved beans. Purple beans are more niche and have a very limited availability.

The larger retailers or supermarkets are the main segment for a wide variety of fresh beans: both for local and common green beans and for more luxurious import products such as fine beans or long beans. Fine beans are also popular in the food service segment due to their superior taste and softness. Street markets mostly sell common green beans in bulk.

Generally the fresh bean quality is at least Class I, but from local sources there may be discounted offers of lower grade products through street markets, or to the processing industry (cut and frozen).

Figure 6: Example of green haricots verts from Morocco on a street market

Source: rosier, CC BY-SA 3.0, via Wikimedia Commons

Tip:

- Strive for excellence to get your product into different market segments more easily. Invest in varieties that give the best result in taste and quality and use attractive packaging when supplying supermarkets.

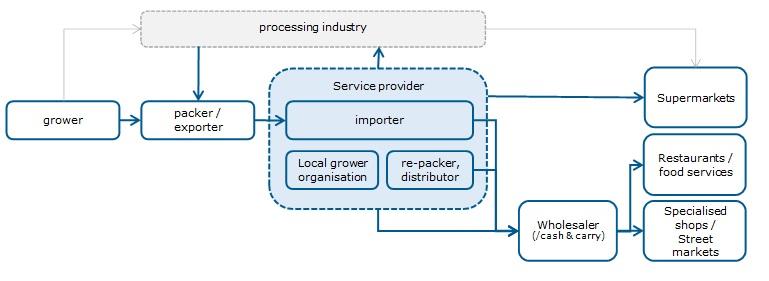

Through what channels does a product end up on the end-market?

The most reliable channel is that of service providers that supply supermarket programmes. Importing wholesalers are also a relevant channel because they supply fine beans to the food service sector. Take into account that many specialised importing companies have integrated their business with producers.

Figure 7: European market channels for fresh green beans

Importers and trade specialists

Importers play a central role in the distribution of green beans. They are familiar with all the different requirements of end clients and are able to distribute to different market channels, such as wholesalers and supermarkets.

Specialised importers integrate their supply chain to make supply and product quality more reliable. The company Fresh2you has its own production of fresh snap beans and fine beans in Senegal. And through their partnership with X-Fresh they can deliver haricot verts (and peas) from Kenya and Guatemala. The company Kamps has growing locations for bobby beans and flat beans in the Netherlands, Germany, Morocco and Senegal. FV Seleqt, part of the Best Fresh Group, has their own production locations in Zimbabwe, Kenia, Uganda and Guatemala. Fresh beans are one of the legume products they have specialised in. Other examples of companies that import fresh beans are Elbe Fruit in Germany and Jami Trading in the Netherlands, which is specialised in sourcing from Kenia.

Service providers provide access to supermarkets

Successful suppliers to supermarkets often position themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to (re-)packing and branding.

Supermarkets usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency in their supply chain. They require volume and reliable quality all year round, and they look for partners that can organise this and unburden them. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider and supermarket require.

Companies that can guarantee a year-round supply often combine local production and different import sources, working closely together with growers. Examples are Minor, Weir and Willis Ltd (MWW) in the United Kingdom, which combines local production with import and specialises in dwarf / green beans, runner beans, broad beans, podded peas. Primeale United uses its extensive cultivation experience in Europe and Africa to become a year-round producer and supplier of fresh vegetables. All their processes and services are in-house, which is an advantage for supermarket buyers. They supply bobby beans from Europe and (mainly) Northern Africa and fine haricots verts from Morocco, Senegal, Kenya and Ethiopia.

Processors

The processing sector represents a large channel for fresh green beans. Freezing and canning are common ways to preserve fresh beans. In this sector you can find companies such as Bonduelle, Coroos, d’Aucy, Ardo and Greenyard Frozen. For non-European exporters of fresh beans it is a less relevant industry, because these companies mainly focus on beans that are cultivated close to their processing facilities to avoid unnecessary transport time. So there is little fresh import for processing.

Wholesalers (spot market)

The wholesale channel is crucial for gastronomic clients, and a relatively big segment for green beans. Wholesalers and Cash & Carry outlets supply restaurants and other food service establishments.

Traditional wholesalers cover the spot market and move according to the fluctuations of the fresh trade. Wholesalers may also have import activities, such as Exofi, a wholesaler and exotic importer in Belgium, or MBF Savannah B.V., an independent importer of exotic fruit and vegetables in the Netherlands. Many wholesalers also display their assortment on wholesale markets such as New Spitalfields market in London and Rungis in Paris.

Non-specialised, “cash & carry” wholesalers, such as Metro, cater to a similar end-market (especially restaurants and catering) but depend more on the service of importing companies or have their own purchase centres. Just like supermarkets, they are able to work with long-term contracts.

Tips:

- Select the type of buyer that fits your company and product. Retailers and their programmed supply will provide you with stability, but are most demanding in certification and compliance. The wholesale channel may provide best opportunities for smaller grower groups and more exclusive varieties for gastronomic segments.

- Visit wholesale markets in Europe to see what is on offer and who is buying fresh beans.

What is the most interesting channel for you?

Choosing the most suitable channel for your fresh beans depends on your profile as a supplier.

The best way to arrange a reliable supply chain is by working together in supply programmes with major service suppliers, or integrate your production with European partners. This is doable if you have a large and high-quality production volume. Several of the import companies with cultivation projects in Africa manage their own production with western investment and management. These integrated supply chains can make it difficult for other producers and exporters to enter the main channels.

When working with many small growers, it will also be difficult to enter the larger retail chains. For every grower you will need to do product testing and have certifications in place. This requires a lot of paper work and the complexity is often underestimated. When you cannot compete in the major supply chains, orient yourself on reliable traders and importing wholesalers. Give a preference to buyers that have a regular demand and reasonable purchase conditions.

Tips:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

- Read the CBI tips for doing business with European buyers of fresh fruit and vegetables, and learn how to select reliable business partners in Europe.

3. What competition do you face on the European green bean market?

Competition in fresh beans mainly comes from the African continent. There is off-season supply of regular bobby and flat beans, and an all year round import of fine beans from integrated companies that manage to export a high-quality product.

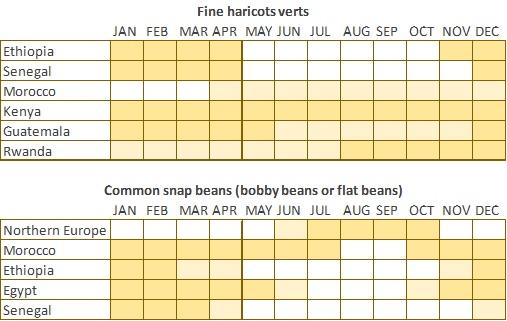

Which countries are you competing with?

The European production runs roughly from the mid-June to mid-October. The counter-season of bobby beans and flat beans from (mainly) northern Africa starts in October/November up to April. Morocco is the largest supplier of these common beans.

Fine haricots verts are generally imported with all year supply from Kenya and additional supply from Ethiopia, Senegal, Guatemala, Rwanda and some from Morocco. These countries have favourable climates to grow high-quality fine beans, but they sometimes also have an irregular reputation in post-harvest and handling.

Figure 8: Indicative supply calendar for fresh green beans to Europe

Morocco

Morocco is currently the leading supplier of fresh beans to the European market. With different regions and greenhouses, growers in Morocco are able to produce fresh beans year round.

Much of the Spanish production of green beans has moved to Morocco due to the labour costs and limitations in the production climate. Among the companies that moved production to Morocco is AgroAtlas, a major Spanish supplier of beans to European supermarkets.

Morocco mainly produces common snap beans: flat beans and bobby beans. These beans are much easier to produce than fine or extra fine beans.

The main destinations for Moroccan beans is Spain (mostly flat beans). Flat beans and bobby beans are also exported to the Netherlands, while France has a preference for finer haricots verts. The trade value of Moroccan beans has declined, but the volumes have been more stable.

The main strength of Morocco is its proximity to the European market. Transport by lorry takes two or three days up to the Perpignan wholesale market, an important hub in France for fresh produce from the south. This makes Morocco competitive in price and the ideal country to extend the European season.

Kenya

Kenya is the reference market for fine and extra fine haricots verts. Kenyan suppliers are specialised in added-value and pre-packaging fine beans and shipping them by air to Europe. The country offers a combination of larger exporting growers and small farmers that complement the supply. Important buyers are France, the United Kingdom and the Netherlands.

The different climate zones and altitudes make Kenya into a year-round supplier of fine beans. Only the rainy season with heavy rainfall can damage the open-field crops and makes production less stable. Due to a large number of smallholders, there is not always a closed cold-chain. Another common issue mentioned by European buyers are the excessive pesticide residues that are sometimes found on Kenyan beans.

European sources expect Kenya to remain a leading exporter of fine beans. This is mainly due to the low-cost production and labour sources and their specialisation in cultivating and processing fine beans. However, other countries in the area could benefit from a more stable climate and product quality. A growing number of end markets will not receive air freighted vegetables with enthusiasm because it is not considered a sustainable transport mode, but for extra fine beans there is not really an alternative.

Egypt

Egypt exports beans by air and by sea. Growers can easily reach different European markets, such as the United Kingdom, the Netherlands, Italy, Germany, Belgium and France – all significant markets for Egyptian beans.

The country is very price competitive when it comes to common snap beans, but it is less equipped to produce the superfine or extra fine beans.

The trade with Europe is generally stable, or even slightly decreasing in the past few years. The growth that Egypt realised from 2020 to 2021 was mainly due to the increased import in the United Kingdom. This suggests that Egypt, together with Morocco, are partly replacing the EU supply to the United Kingdom.

Senegal

Senegal has become one of the main exporters of fresh beans to Europe. The export volume has mainly been established by a few larger producing companies linked to European companies, such as Primeale United in the Netherlands and SCL by Barfoots in the United Kingdom. Another company, Safina sells most of its green beans to the Dutch supermarket Albert Heijn via Bakker Barendrecht.

The production climate is ideal for counter-seasonal bobby beans, but also fine beans can be produced here for the European market. Most beans are shipped by reefers, but Europe can be reached by road as well. Its main markets are the Netherlands, Italy and United Kingdom. Italy in particular has increased its import from Senegal.

Generally, Senegal is highly esteemed for the quality of its produce. This is mainly because the large supply companies have organised everything internally to maximise control in the supply chain. However, the season is relatively short. So growers need to combine green beans with other crops to build a profitable business.

Guatemala

Guatemala is the ideal supplier when Kenya has problems with the rainy season. The country has a good climate to grow fine beans with competitive prices. Guatemalan beans can fill the gap when demand is high, for example during the Christmas holidays. However, European buyers still prefer the quality from Kenya.

The production prices have gone up in the past years and the European import has slowed down. But there is also growing competition from Egypt that is coming on the market earlier than usual. However, Guatemala does not depend that much on the European market. The United States is the main export market for Guatemalan fresh beans. The only European market of significance is the United Kingdom. According to Guatemalan statistics the export to the USA was 29,000 tonnes to the USA and 1,200 tonnes to the UK. Freight to the UK is delivered by air on direct flights to Heathrow airport or via Mexico.

Ethiopia

Ethiopia has an interesting potential to grow and export quality fresh beans. Ethiopia has land available, a favourable climate and good soils. The stable climate helps maintain a reliable and constant product quality. There is also an opportunity for organic cultivation due to limited pesticide use. Much of the cultivation is still clean due to limited access to chemicals and fertilizers.

The European import value is gradually developing, from €2.7 million in 2017 to €5.6 million in 2021. This is mainly thanks to foreign investment and initiatives. One of the examples is Greenpath Food, which has organised a supply chain for bobby beans and fine beans, among other fresh produce. The Ethiopian government has a positive attitude towards agricultural development and foreign investments. However, political unrest has prevented western companies to establish a continuous trade relation.

Currently Ethiopia often functions as a back-up for regular suppliers from Kenya or Zimbabwe. According to European buyers, the quality is generally good, but Ethiopia is also less cost-competitive in production and logistics. Most fresh bean exports are destined for the Netherlands. Industry sources report that there are regular direct flights with Ethiopian airlines. However, airfreight is expensive, the space must be reserved a week in advance and the exporter pays for any space that is not used.

Tips:

- Check if your country has a trade agreement with the European Union or the United Kingdom. A favourable import tariff will make your product economically more attractive to buyers. The current main exporters all have favourable tariffs.

- See CBI’s EU Market Research – Ethiopia Fresh Fruit and Vegetables to learn more about the Ethiopian potential as an exporter of fresh fruit and vegetables.

Which companies are you competing with?

In the fresh bean trade, you are competing with companies that have strong ties to the European market. Several exporters are vertically integrated or are even foreign owned. For example, Societe de Cultures Legumieres (SCL) in Senegal is linked to the Barfoots of Botley Ltd company in the UK, and Greenpath Food is a Perennial Foods Group brand in Ethiopia. Specialisation and production size can also be a competitive advantage, such as seen with Vegpro in Kenya.

Other examples of competition are Zimflex in Zimbabwe (associated with FV SeleQt) and Safina in Senegal (supplier to Albert Heijn supermarkets). Competitors closer to Europe are for example Helwan Export in Egypt and AGCO Fruit in Morocco.

Vegpro Kenya Ltd

The Vegpro group has integrated the production of flowers, fresh produce and logistics. The company has its own freight forwarding business, shipping around 550 tonnes of vegetables per week.

Vegpro Kenya Ltd is specialised in cultivating and preparing vegetables such as fresh beans for export, in particular to the United Kingdom. It is an example of a large-scale operation with big farms and several outgrower schemes.

A large and integrated company has the advantage of scale, but can also invest in the post-harvest process and manage product quality.

SCL – Senegal

The Societe de Cultures Legumieres (SCL) started out as a test farm in 2006 by the Barfoots of Botley Ltd company. Now they supply a range of products to the United Kingdom, for example to Waitrose supermarkets. With the involvement of European produce companies, SCL has invested in growing, packing and exporting fresh beans and other vegetable products. They can farm on 3,000 hectares of land and produce both fine beans (6-9mm) and bobby beans (>9mm).

For exporters that want to enter the European market, it helps to cooperate with a European company for cultivating green beans. A joint venture with common interests lays a good basis for growth.

GreenPath Food

Greenpath Food is an Ethiopian producer of different types of legumes, such as fine green beans and bobby beans. It is a brand that belongs to the Perennial Foods Group. This company has a mission to become Africa’s largest producer of regeneratively-grown food. Regenerative agriculture is recognised as a sustainable production method. Their main focus is on small-scale, organic cultivation. They select farmers and organise the supply chain with all necessary certification and traceability. It has the support of several international funds and agencies, including the Oxfam’s Enterprise Development Programme.

Companies that are able to organise their supply chain well, will be able to get the recognition and the interest of European buyers.

Tips:

- Define well your strengths as a company and your competitive advantage before entering the European market. This can be product related (quality, characteristics), but also in efficient logistics to Europe.

- Organise a reliable and stable production of high-quality fresh beans and use this to look for long-term partnerships in Europe. Integration with a European partner is a good way to get continuity in your export.

Which products are you competing with?

When fresh beans are in-season, your product will compete with European grown beans. But also outside the season, local convenience products such as frozen and preserved beans will still be an alternative for consumers.

The fine bean varieties are popular as a culinary vegetable. These fine beans compete with other exotic and culinary vegetables, for example with sugar snaps or mangetout. When prices for fine beans become too high, restaurant chefs are more likely to switch to other vegetables. In retail, consumers also have the option to buy cheaper green beans such as bobby beans or flat beans. See also price information below.

Tips:

- Compare your product with the fresh beans that are available in European markets. Visit wholesale markets and supermarket to see how competing fresh beans look and how they are presented. Use this to differentiate your product.

- Stay up to date with varietal development and preferences. Choose a variety that you can produce with competitive costs or one that is superior in taste and quality.

4. What are the prices for fresh beans on the European market?

Bean type (common, fine, or extra fine), origin, type of logistics and packing size have great influences on the final price for consumers. There is also a fluctuation in prices due to changing availability and quality. Due to recent cost increases for agricultural inputs and logistics, consumer prices are expected to be higher than usual. At the same time, producer margins may be pressured in an attempt to maintain stable retail prices.

Fine beans require more manual labour than larger bobby beans and are often air-freighted. This raises the costs and the price that consumers have to pay. Additional costs include sorting and packing according to retailer standards. Regular green beans are usually sold for a lower price. Unlike fine beans, common bobby beans can be sold loose. Flat beans are highly productive and tend to have higher yields and lower costs.

Regular beans can be imported for (FOB) prices anywhere between 1.00 and 2.00 euros per kilo. Trade prices for fine and extra fine beans are higher between 1,50 and 2,50 per kilo, excluding air freight costs. Importers usually calculate a minimum profit margin of 8% in addition to their commercial costs such as custom clearance and inspections.

When fresh beans are on the shelves at supermarkets, regular bobby and flat beans are priced between 4 and 5 euro per kilo. Fine, air-freighted beans are sold for between 7 and 9 euros. Very fine beans have a premium, resulting in a retail price that is 1 or 2 euros more, depending on the quality and packing size.

Figure 11: Fresh bobby beans from Senegal on retail promotion in the Netherlands

Source: Photo by ICI Business.

Tips:

- Calculate your costs of production and shipping and check with European importers what price you can get for your fresh beans. If the calculation does not work out, get professional help and make improvements in production or post-harvest before further exploring the European market. Read up on fresh bean farming through easy-to-read websites such as Check Farm Tips.

- Find price information for the French market on the Market News Network of FanceArgiMer and an overview of international price information sources on the German Fruchtportal. The information is in French and German, but you can use the “Translation” function of your browser.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research