The European market potential for fresh green beans

Fresh beans are a common vegetable in Europe. There are opportunities to export off-season beans to ensure a year-round supply. But there is also a good demand for fine beans from more distant sources. The Netherlands and the United Kingdom remain the largest importers of these specialty beans. But the future of air freighted beans will partly depend on whether they can be packed and transported in a sustainable way.

Contents of this page

1. Product description

Green beans are part of the Phaseolus and Vigna genus. Most commercial fresh beans are the common green beans (Phaseolus vulgaris), also snap bean or string bean. These include a variety of types and names, sometimes even used interchangeably. This study has simplified the varieties as in table 1 below.

The statistics of the study are based on the Harmonized System (HS) commodity code for green beans: 070820 "Fresh or chilled beans" "Vigna spp., Phaseolus spp.", "shelled or unshelled"

Fava beans and edamame beans (immature soybeans) are also sold in Europe, with or without pods. But they are not part of this study because they do not belong to the Phaseolus or Vigna bean family. For peas such as sugar snaps and snow peas, see CBI’s study on exporting fresh peas to Europe.

Table 1: Bean varieties, types and names

| Bobby beans | Sometimes referred to as French bean, common green bean, haricots verts, snap bean or string bean. Bobby beans are larger than 8mm in diameter, typically from a species such as ‘Nerina’, ‘Bronco’, or ‘Paulista’. They are produced mostly in large plantations, as they are less labour intensive than the extra fine beans. |

| (extra) Fine beans | Fine beans and extra fine beans tend to be smaller, more tender, and quicker to cook. These fine beans are also called haricots verts, filet beans or needle beans. They require more manual labour and do therefore better in smallholder farms. Examples of varieties that are grown for fine stringless ‘needle’ beans are ‘Samantha’, ‘Teresa’ and ‘Amy’. Varieties such as 'Julia' and 'Sagana' are very fine varieties. |

| Flat beans | Flat beans can be of the common bean variety (Phaseolus vulgaris). They are also commercialised as helda beans, romano beans, stringless beans or Italian green beans. |

| Runner beans | Runner beans are similar to common flat beans. They are sold under similar names. Runner beans have rough wide and flat pods, but they belong to the ‘Phaseolus coccineus’ variety. They are a productive variety and therefore cheaper than common green beans. |

| Yardlong beans | Yardlong beans, also known as asparagus beans, snake beans, or long-podded cowpea, are a subspecies of the cowpea bean (Vigna unguiculata subsp. sesquipedalis). It has long pods of 35 to 75 centimetres. In Europe, yardlong beans are considered an exotic bean. |

| Wax beans | Wax beans are yellow beans, also known as butter beans (‘haricots beurre’ in French). |

| Purple string beans | Beans can come in different colours. Besides yellow wax beans, there are also purple string beans, a variety of the common green bean. |

Figure 1: Haricots verts (needle beans), string beans, romano beans

Source: OECD (2021), Beans, International Standards for Fruit and Vegetables, OECD Publishing, Paris, https://doi.org/10.1787/0bc40eec-en-fr.

Figure 2: Packaged fine beans or needle beans

Source: Photo by openfoodfacts-contributors per Open Food Facts

Figure 3: Different coloured beans

Source: Pixabay

Figure 4: Yard-long beans

Source: Pixabay

2. What makes Europe an interesting market for fresh beans?

Europe needs to import fresh beans for a year-round supply. The import increases gradually and the best prices are seen with high quality and fine beans.

Year-round demand

Common fresh beans are consumed throughout the year in Europe. This means that there are ample opportunities to supply green beans. Most beans imported from non-European suppliers arrive between October and June, outside the local production season.

Special varieties, such as extra fine beans or yardlong beans, are generally not produced in Europe. These are imported all year round, often with a peak during the Christmas holiday season.

A relevant share of beans is imported

Almost a fifth of the total available volume (local production and import) is sourced from suppliers outside Europe.

The average European green bean production is just over a million tonnes. France, Italy and Spain are the largest producers, followed by producers in countries further north, including Belgium, the Netherlands, Germany and Poland. Most of the beans produced are common green beans (bobby beans) or flat beans (romano beans). In France, butter beans are also a popular variety. A part of the green beans is sold as fresh produce, the rest is processed into preserved foods such as canned or frozen vegetables.

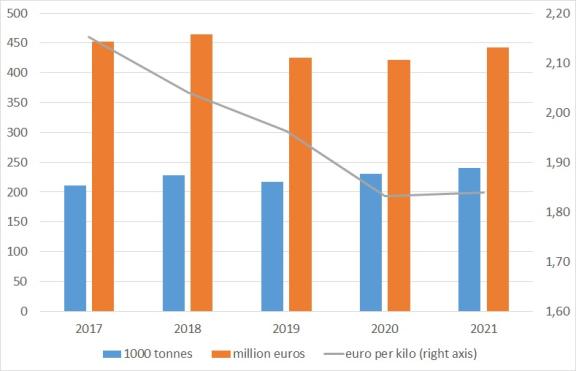

The import in Europe is growing slightly in the long term. In the five years up to 2021, the import from non-European countries increased from 210,000 to 241,000 tonnes. There is no notable growth in the local production. Therefore, the share of imported beans has increased as well.

*Calculations based on Eurostat and ITC Trade Map (*Europe: EU+UK+EFTA)

Most countries maintain higher prices than average

The import volume from non-European countries has increased. However, the average price shows a decrease. This is mainly caused by Morocco. Most supply countries have a stable or rising product value.

Morocco exports such a large volume, that it influences the average prices for imported fresh beans. Between 2017 and 2021, the trade value per kilo from Morocco decreased by approximately 28%. Most other relevant suppliers such as Kenya, Senegal and Egypt maintained their price level. Rwanda and Ethiopia showed increases between 17 and 25%.

The price differences can be explained by the bean varieties and shipment method. Morocco mainly supplies common bobby beans and flat beans. These beans are produced on a large scale in and around Europe with a continuous pressure on prices. Fine beans are flown in from countries such as Kenya, Rwanda and Ethiopia. During the COVID-19 pandemic, the logistical costs have increased, which explains some of the price increases in these countries.

Suppliers will face higher costs to produce and ship their fresh beans. Producing high-quality fine beans is a specialisation, but a good product will usually get a good price.

Figure 6: European import value and volume of fresh green beans from non-European sources, in 1,000 tonnes, € million and €/kilo

Source: Eurostat and ITC Trade Map

Tips:

- Stay informed about the latest updates in the European fresh bean market through news items on Freshplaza, Eurofruit, Fruitrop and FreshFruitPortal.

- Maintain a good balance between efficiency and quality, depending on the type of market you are aiming for. Price will be crucial aspect for common bobby beans or flat beans, while quality will be a main point of attention for airfreighted fine beans.

3. Which European countries offer most opportunities for fresh beans?

From the main importing countries, the United Kingdom and the Netherlands offer the best opportunities and growing imports of fresh beans. These are also important destinations for airfreighted beans from Eastern Africa, because you can find consumers that pay a premium for very fine beans. Spain and France are major markets, but decreased in value due to a declining price of Moroccan beans. Germany has potential to expand its fresh bean consumption, while Belgium is known to process and freeze beans.

Spain: main market for Moroccan supply

Spain imports the highest total value of green beans from developing countries. But the Spanish market is mostly interesting for Moroccan suppliers.

Moroccan green beans dominate in the Spanish market. Almost all of the €125 million worth of imported fresh beans originate in Morocco. Additionally, Senegal occasionally supplies a minor value of less than €1 million. Morocco offers an ideal location for supplying fresh beans in addition to the Spanish supply, and at competitive costs. For this reason there are Spanish companies such as Agroatlas that have their own farms in Morocco to grow fresh bobby beans and flat beans.

The trade relations between Spain and Morocco are close and mutually beneficial. The import volumes of green beans are high, but the limited growth suggests it is close to its full potential. For exporters of fine beans or specialty beans, northern European markets are probably more interesting.

United Kingdom: large consumption of imported beans

The United Kingdom (UK) is an important consumer of imported fresh beans. Green beans are a popular vegetable in a variety of food preparations. Two thirds of the beans consumed in the UK are imported.

Bobby beans and flat (runner) beans are easily grown in the UK from July to the end of September. During this time, most of these beans sold in the supermarkets will be UK grown with additional supply from Spain. The interest in locally produced vegetables is growing. This trend has been strengthened by Brexit (Britain leaving the EU) and the COVID-19 pandemic.

Despite the focus on local produce, the import of fresh beans has been growing all over. The import increased by 37% from 2017 to 2021, and the import value by 44%. Moroccan suppliers realised an incredible growth from only 250 tonnes in 2017 to 8,800 tonnes in 2021. Morocco is expected to increase its export to the UK through new direct shipping lines. The import from Kenya, Egypt, Gambia and Ethiopia also increased. And even EU suppliers in Spain and the Netherlands supplied more fresh beans to the UK in 2021.

Kenya is the largest supplier to the UK, followed by Morocco and Egypt. In Europe, the UK is the largest importer of fresh beans from Kenya and Egypt. Kenya exports all year round, offering fine beans that cannot be produced easily in the UK. Egypt, Morocco and Senegal are much more seasonal, exporting mainly common green beans in the off-season.

The Netherlands: a trading hub

If you are looking for a trade hub, the Netherlands offers opportunities for exporters of fresh beans. Dutch traders look for the right product from suitable sources (by air or by sea) and supply different markets in Europe.

The Netherlands is an important market for exporters from developing countries. In addition to the 60,000 tonnes of locally produced beans (July-September), the country also imported a similar volume in 2021 with a value of €106 million. This is more or less average compared to the previous 4 years. About 45,000 tonnes originated in developing countries. Over the last five years, there has been less import from Spain (-16% in 5 years) and Egypt (-44%), but more from Morocco (+30%) and Senegal (+35%). The supply from Kenya (fine or extra fine beans) is relatively stable.

About 30,000 tonnes of fresh beans were traded by or via Dutch traders. This makes the Netherlands the second largest exporter after France. Most fresh beans were (re)exported to Germany and Belgium.

To stand a chance in the Dutch trade, you will need to cooperate or compete with integrated companies such as Primeale United and Kamps. Companies like these have their own production sites in Morocco and Senegal. Several of these Dutch traders are noticing a growing resistance to airfreighted vegetables. Unnecessary airfreight is not considered sustainable. This means that some end clients and certain periods are off-limits for exporters that depend on airfreight.

France: strong consumer of beans

France leads green bean production in Europe. Therefore, it is also an important consumer country. This provides opportunities for counter-seasonal supply, as well as high-quality fine beans.

In 2021, the domestic production was 375,000 tonnes. This is much more than any other European country. Italy and Spain, the second and third largest producers, produced 170,000 and 147,000 tonnes respectively. The large production allows France to be a prominent exporter of beans. French bean exports were close to 125,000 tonnes.

French import fluctuates around 50,000 tonnes, of which 40,000 is supplied by developing countries. In 2021, a significant volume of 54,000 tonnes or €99 million was imported. The main non-European suppliers are Morocco, Kenya and Senegal.

The import value from developing countries decreased (see figure 7), but this was mainly due to a lower value of Moroccan beans. However, the import from Kenya and Senegal remained strong and even increased in 2021.

There is a clear difference in the types of beans and the way they are transported. France uses mainly Morocco and Senegal for counter-seasonal supply, mostly by road or sea freight. The volume from Morocco is very large (27,000 tonnes), but the trade value is relatively low (€43 million). With Kenya, this is the other way around. From Kenya finer beans are flown in – which was only 6,000 tonnes, but with a value of €24 million.

Being a strong producer of high-quality fresh beans, France expects nothing less from its suppliers. As a supplier you need to monitor the quality of your exported beans. There is little room for intermediate quality beans. Organic beans can also be a niche opportunity for exporters. France itself is one of the largest producers of organic vegetables in Europe.

Germany: potential for growth

Fresh beans are moderately popular in Germany, but with 83 million inhabitants, Germany offers a large potential consumer market. Most beans are imported from or via EU countries.

The import of fresh beans fluctuated around 25,000 tonnes from 2018 to 2021. In 2021, more than 8,000 tonnes were imported from or via the Netherlands. Morocco, Egypt, Senegal and Kenya are the main non-European suppliers with a combined volume of between 9,000 and 10,000 tonnes. The import value from developing countries remains stable at €28 million. Green beans are also produced in Germany, generally with a harvest of 40,000 to 50,000 tonnes.

According to the Federal Ministry of Food and Agriculture the bean (‘bohnen’ in German) consumption per capita in 2020/2021 was 2.2kg. But the production and trade data suggest an actual fresh consumption of not even half this amount. German consumers are also known to purchase a large amount of preserved vegetables – often imported from other EU countries.

An increasing attention for healthy foods may help increase the consumption of fresh beans. For nearly 70% of German consumers, health is one of the most important factors in purchasing fresh products.

The focus on health is closely related to sustainability and food safety. There are policies in place to reduce plastic packaging and airfreighted vegetables are not automatically accepted by every retailer. And more importantly, Germany is one of the strictest countries concerning pesticide residues. These are typical barriers that you have to deal with when supplying the German market.

Belgium: leading in processing

Belgium is a relatively large importer of fresh beans. The total import in 2021 was 114,000 tonnes. Only a small share (6,600 tonnes) came from developing countries, mainly fine beans from Kenya, Ethiopia and Egypt.

France and the Netherlands are responsible for most of the Belgian supply. The main reason for this is that Belgium has a very large processing industry for freezing green beans, with leading companies such as Ardo and Greenyard Frozen. For processors, it is important to source beans close to the processing facility to ensure freshness. Limiting transportation is also considered to be most sustainable.

Despite of the dominant local sourcing, Belgium is still among the six main importers of beans from developing countries. Companies such as SpecialFruit and FairFruit import fine beans from overseas. The apparent import from these countries experienced a dip in 2021 to €15.9 million (6,600 tonnes), from €23.5 million (10,000 tonnes) in the year before. But over a longer period of time, the import is gradually increasing, indicating a positive attitude towards special imported beans.

Tips:

- Participate in the Fruit Logistica trade fair in Berlin to gather more knowledge on different markets and find potential buyers. There will be many companies present – see the exhibitor list.

- Go to the website of the Fresh Produce Centre to find Dutch importers and service providers that can be helpful when exploring the Dutch market.

- Read what makes Germany an interesting market for fresh fruit and vegetables on the CBI market intelligence platform.

- Visit the Fruit Attraction trade fair in Madrid to connect with Spanish fresh produce companies. You will also find companies from other European countries.

4. Which trends offer opportunities or pose threats on the European fresh bean market?

Fine fresh beans are a luxury that do well in Europe’s culinary experience. Consumers are also used to always having fresh beans available, all year round. For fresh beans to maintain positive growth, it is crucial to make sure the supply is reliable and sustainable. Sustainability is a key issue for fresh beans from developing countries.

Product availability drives innovation

Green beans are a very common vegetable in Europe. They are widely available and consumers are very familiar with them. The availability and consumption volume gives way to product development. This leads to a larger variety of bean products.

Consumers can choose a range of bean products, such as pre-packed, topped or pre-cut, fresh, frozen or preserved. There are even freeze-dried beans offered as a healthy snack.

Exporters of fresh beans have the option to add services in pre-cutting and packing. A number of Kenyan companies have specialised in sorting, cutting and packing fine beans. One of these is AAA Growers, a leading exporter that has its own processing facilities and connections to the European retail. Nicely sorted and packed fine beans offer the best chance of a high return.

Culinary influences provide room for different varieties

Europe has a mixture of food cultures and ethnic influences. This translates to a wide range of culinary uses for fresh green beans, and also a wide range of bean varieties.

The most commonly consumed varieties are bobby beans and flat beans. Fine beans have found their way into European-style cuisine, for example wrapped in bacon (see figure 8). Coloured beans such as purple beans are more of a niche, and mainly brought to the market by European growers or home grown. Yellow wax beans or butter beans are quite popular in France, often sold as a preserved vegetable (see figure 9). Runner beans are popular for cultivation in the United Kingdom, because they do well in a colder climate.

Fresh beans are not only popular in traditional consumption, but also in non-European dishes such as Asian cooking. Generally, consumers in Europe are open to new food experiences, in particular in northern Europe and areas where there is a strong influence of foreign cultures. This provides opportunities for other bean varieties. For example, yardlong beans are popular in Chinese, Indian and Thai stir-fries, but also served as a Surinamese dish with flatbread (roti) in the Netherlands.

Each bean variety offers a different experience. However, certain exotic types are more difficult to source. Sometimes there is a lack of supply of suitable yardlong beans for the European market. According to specialised traders there are often problems with excessive residues.

Figure 8: Beans wrapped in bacon

Source: Pixabay

Figure 9: Example of yellow wax beans or butter beans (frozen) sold by Intermarché in France

Source: Photo by kiliweb per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license

Green beans as part of a healthy diet

There is a growing number of European consumers that want to adjust to a healthier lifestyle. These consumers will look for fresher and plant-based foods. Like many other vegetables, fresh green beans are considered to be a healthy food.

In the eyes of consumers, fresh beans are often considered more natural and healthier than preserved beans. A stronger focus on fresh produce will increase the opportunities for fresh bean exporters. As an exporter you must make sure your product has an excellent fresh appearance. You can do this by maintaining a perfect cold chain from the harvest up to your client.

Less plastic packaging

Finding a sustainable way to package your fresh beans has become an important part of the trade.

Fine fresh beans with immature pods are often imported by air from countries such as Kenya. Unlike the rougher beans that are produced in Europe, these imported fine beans are much more perishable and require protective packaging.

European policy makers as well as food retailers are aiming on a reduction of plastics. This often goes against the preservation of shelf life (a must for supermarkets) and the consumers’ hunger for prepacked convenience food.

As a supplier of fine fresh beans you need to be creative when supplying the European market. Think wisely about what type of packaging to use and make sure it is recyclable or even biodegradable.

Airfreight goes against sustainability

Retailers today have high environmental standards. Airfreighted vegetables are not part of sustainable sourcing, but unavoidable for fresh beans from large, distant countries.

Locally produced beans, when in season, are preferred over imported beans. And fresh beans that can be transported by road or sea are preferred over airfreighted ones. If retailers can avoid air freight, they will. The UK's largest food services company, Compass Group UK & Ireland, has even banned the use of air freight for fresh fruit and vegetables. Also, the air freight rates have gone up significantly amid the COVID-19 pandemic and cargo costs have remained high ever since.

It puts countries with fast sea and road connection at an advantage. For example, Morocco and even Senegal can make use of sea freight and road transport. From Senegal it takes 6 or 9 days to reach northern Europe by sea or road. However, growing and exporting extra fine beans requires experience and a specific climate. Countries in eastern Africa such as Kenya, Ethiopia and Rwanda depend on air shipments, but they have a better climate to produce thinner beans.

Tips:

- Use refrigerated transport from the field to the pack house and from the pack house to the (air)port. This will maintain the fresh quality and preserve the shelf life of your product.

- Look for specialised importers when selling a niche product or exotic bean variety. Specialised companies usually provide better access to ethnic and exotic markets.

- Discuss with your clients how to reduce the use of plastic. European companies often have ideas or know good examples of sustainable packaging in their market. Either way, you will also give a positive signal that you are concerned about the sustainability of your product.

- Read more about which trends offer opportunities on the European fresh fruit and vegetable market on the CBI market intelligence platform.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research