Entering the European market for fresh culinary herbs

Quality and freshness are key for entering the European fresh herb market. Product handling, expensive air freight, certifications and strict buyer requirements are a big hurdle for most suppliers. Successful herb growers and exporters supply the market mainly from Kenya, Morocco and Israel with tropical or off-season herbs. The best way to achieve similar results is through partnerships with importers and international growers in Europe.

Contents of this page

1. What requirements must fresh culinary herbs comply with to be allowed on the European market?

Fresh herbs must meet the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also find an overview of export requirements for fresh herbs for each country using My Trade Assistant and the code ‘other vegetables’ (code 0709 99 90).

What are mandatory requirements?

Pesticide residues and contaminants

Pesticide residues are a crucial issue for fruit and vegetable suppliers. They are even more important for fresh culinary herbs because these are meant to be consumed raw without processing.

To avoid health and environmental damage, the European Union (EU) has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

Note that supermarkets in several Member States – such as the United Kingdom, Germany, the Netherlands and Austria – use stricter MRLs than those laid down in European legislation.

Tips:

- Check the EU Pesticides Database to find the allowed MRLs for fresh herbs. You can search for ‘herbs and edible flowers’ or for specific pesticide. The database shows the list of the MRLs associated to your product or pesticide. You should also check with your buyers if they require additional requirements on MRLs and pesticide use.

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management. It is also part of ‘Good Agricultural Practice’ (GAP) and GLOBALG.A.P. certification.

- Make sure that lead contamination in fresh herbs remains below 0.30 mg/kg, cadmium below 0.20 mg/kg, and perchlorate below 0.50mg/kg. This is in accordance with Regulation 2023/915 on the maximum levels of certain contaminants in food. For borage leaves, there is a maximum level of pyrrolizidine alkaloids of 750 μg/kg.

Video about Integrated Pest Management (IPM) by GLOBALG.A.P.

Source: GLOBALG.A.P.

Phytosanitary regulation

The European Union requires fresh herbs to go through plant health checks before they enter the European Union. The plant health inspection must take place in the country of origin. The shipment must be accompanied by a phytosanitary certificate that guarantees the herbs:

- Have been inspected properly;

- Are free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- Are in line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072 (updated June 2023).

Plant health authorities provide phytosanitary certificates. For example, fresh herb exporters in Kenya can obtain an export licence with the Agriculture and Food Authority (AFA) and a phytosanitary certificate through the Kenya Plant Health Inspectorate Service (KEPHIS).

Tip:

- Read the list of National Plant Protection Organisations (NPPOs) on the FAO website to find the recognised phytosanitary authority in your country. The organisations in this list are members of the International Plant Protection Convention (IPPC). All fruits require a phytosanitary certificate, excluding the few mentioned in the lists of Annex XI, part C of Implementing Regulation (EU) 2019/2072.

Prevent microbiological contamination

Fresh herbs and leafy vegetables carry microbiological risks. Leafy vegetables are grown and packed in diverse ways, and they have been associated with multiple disease outbreaks. Microbiological contamination – including salmonella and E.coli – can occur during picking, packing, irrigation and soil improvement.

Food business operators must take measures at each stage of food production, processing and distribution. They must apply Good Hygiene Practices (GHP) and work according to the Hazard Analysis Critical Control Point (HACCP) principles.

Tips:

- Increase your knowledge of potential microbiological risks in fresh herbs by reading the FAO Meeting Report on Microbiological hazards in fresh leafy vegetables and herbs and follow the hygiene and handling guidelines for leafy vegetables in Annex III of the Codex Alimentarius Code of Hygienic Practice for Fresh Fruits and Vegetables. This Annex also provides information on the safety, storage, packaging and transport of fresh herbs.

- For more information, read the FAO’s Good Hygiene Practices (GHP) and HACCP Toolbox for Food Safety and related publications.

Quality standard

There are no specific marketing standards for fresh herbs defined by the United Nations Economic Commission for Europe (UNECE). The general marketing standards laid out in Regulation (EC) No. 543/2011 (Annex 1 Part A) apply.

The general marketing standards require fresh herbs to be:

- Intact;

- Sound: products affected by rotting or deterioration that makes them unfit for consumption are excluded;

- Clean, practically free of any visible foreign matter;

- Practically free from pests;

- Free from damage caused by pests affecting the flesh;

- Free of abnormal external moisture; and

- Free of any foreign smell and/or taste.

The condition of the products must enable them to:

- Withstand transportation and handling; and

- Arrive in satisfactory condition at the place of destination.

For fresh herbs, leaf quality is most important, including its colour and the balance between stem and leaves. You must also avoid decay, bruising, blackening, yellowing, pesticide residue, uneven colour and the lack of leaves. Product uniformity is important.

Quality requirements should not be underestimated. Israel is 1 of the main suppliers to Europe and has a lot of experience with quality requirements. The Israeli Plant Protection and Inspection Services (PPIS) has published a presentation on the quality inspection of fresh herbs for export from Israel.

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with your standards will give buyers a reason to claim on quality issues.

Packaging

Fresh herbs need protective packaging to maintain their freshness and quality. Packaging requirements vary between different actors in the supply chain, such as importers, re-packers, wholesalers and retailers. However, most imported herbs are re-packed by the importer.

Trade: If the herbs are exported for re-packing in Europe, you can send your product bundled in 10–12 bunches in cardboard boxes with a plastic liner or bag. Fresh herbs can be packed lying down or standing upright, as shown by the Israeli company Carmel Agrexo. Perforated polyethylene or poly propylene bags will protect the herbs and reduce water loss. Weight per box is often 1 kg but not more than 3 kg.

Retail and wholesale: When you pack directly for retailers, you must be able to offer the required consumer packaging. Freshly cut herbs are usually packed in convenient plastic flow packs, sealed plastic trays, re-closable punnets or clamshells. Regular packaging sizes are between 10 and 60 grams; see examples from the assortment of the supermarket Albert Heijn. Locally produced fresh herbs are also offered as potted plants in plastic and paper sleeves, especially in Northern-European markets, such as the Netherlands, Germany, Belgium and the United Kingdom. For example, see Tesco’s pot of British basil online.

Wholesalers often require packaging of 50–100g bags, trays or 1–2 kg boxes for their clients, such as restaurants and other bulk users. The most common herbs such as parsley, mint or coriander are usually offered in larger packages. Industrial users of fresh herbs may require 3 kg boxes.

Figure 1: Examples of retail packaging in Europe (Belgium, Switzerland and the UK)

Source: Photo by kiliweb (Pictures 1 & 2) and by tacinte (Picture 3) per Open Food Facts

Figure 2: Example of wholesale packaging ‘bag in box’ (Netherlands)

Source: Globally Cool

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Investigate new innovations in packaging that improve shelf life and reduce waste. For inspiration, you can read about previous introductions of new forms of packaging, such as the Fresh Lid packaging by Tadbik and the German supermarket Rewe, packaging potted plants entirely in paper.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 (version 01/01/2018) on the provision of food information to consumers in Europe.

- Find the legal requirements for labelling in the Buyer requirements for fresh fruit and vegetables on the CBI market information platform.

Handling

Fresh herbs are highly perishable. When shipping fresh herbs, make sure they are transported quickly and kept at a proper temperature. Maintaining an unbroken cold chain is crucial to maintaining quality. For most herbs, the ideal temperature is 0°C. Basil is the exception and is best kept at 10°C.

Time to market is also an important aspect. Fresh herbs from Morocco can be transported by truck, but countries further away depend on airfreight. This way, the period between harvesting and the arrival at the re-packer or wholesale market is less than 24 hours.

Tips:

- Minimise the time between harvesting and packaging to ensure maximum freshness and quality. Use pre-cooling when your herbs are harvested.

- Check the Recommendations for Maintaining Postharvest Quality of the Postharvest Center of the University of California. Also read about effective cold chain management through temperature monitoring.

What additional requirements do buyers often have?

Transparency and demand-oriented delivery

Buyers can be very specific in their preference, especially when they supply supermarkets. They will be demanding in the way your herbs are cultivated, selected and packaged. As a supplier, you need to be transparent about every step in the process. Volume, quality and uniformity are essential for your product to end up at large retail chains. Variety, appearance and flavour can also be important, for example to satisfy culinary professionals. There is more emphasis on service and assortment choice for smaller products.

Tips:

- Work closely together with your buyers and invite them to your farm. Showing your production is the best way to convince your buyer.

- Get information from herb seed breeders to select the right sub-varieties that are best adapted to your climate and provide the best characteristics for your target market.

- For additional requirements such as payment and delivery terms, see the CBI Buyer Requirements for fresh fruit and vegetables and Tips for doing business with European buyers.

Certification

Fresh herbs are a common product in retail programmes. As a result buyers almost always require a set of certifications to demonstrate good practices and food safety. Common certifications are GLOBALG.A.P. for agricultural production and BRCGS, FSSC 22000, IFS or similar HACCP-based food safety management systems for packing houses. These management systems are recognised by the Global Food Safety Initiative (GFSI).

Sustainability and social compliance

There is growing attention for the social and environmental conditions in the producing areas. Most European buyers have a social code of conduct which they will expect you to adhere to. For fresh herbs, social compliance is important, although product quality has top priority.

To show compliance, you can choose to use standards, such as amfori BSCI, GRASP (a GLOBALG.A.P. add-on) or do a Sedex Members Ethical Trade Audit (SMETA).

You should also expect requirements to become more strict and more detailed. A good example is the Sustainability Initiative Fruit and Vegetables (SIFAV). SIFAV is an initiative of almost 50 traders, retailers and other stakeholders to contribute to more sustainable fresh fruit and vegetable supply chains. They will focus on priority products until 2025. Their ambitions include the reduction of their carbon footprint and food loss, the implementation of water management and social standards, and the commitment to a living wage.

Many of the large supermarkets in Europe also have their own guidelines on sustainable sourcing and social compliance.

Fair trade certifications are less common for fresh herbs. In dried herbs and spices, you have more options for fair trade and other initiatives, such as the Sustainable Spices Initiative.

The Green Deal

In the coming years, the European Green Deal will change the use of resources and reduce greenhouse gas emissions. The new EU policies on sustainability will prepare Europe to become the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal. It aims to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address a range of topics including packaging and waste. Sustainable development has also been integrated in EU trade agreements. For suppliers of fresh herbs, it is important to look ahead and try to be in the frontline of the developments.

Tips:

- Start measuring your ecological and social impact and make your supply chain transparent and traceable. You will gain valuable insights in your business conduct by measuring and registering all your processes. This will help you improve your production become a more serious supplier for European importers.

- Upgrade your performance by using SIFAV’s Baskets of social standards and the Basket of water standards as a guidance.

- Find out about specific sourcing information of large retail chains. You can usually find this on their corporate websites, for example the REWE Guidelines for sustainable business practices or Marks & Spencer Global Sourcing Principles.

- Consult the Standards Map app for more information on different social and sustainable labels.

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and the tips for doing business with European buyers.

What are the requirements for niche markets?

Organic labelling can give you a competitive advantage

Fresh herbs are meant for direct consumption, which is why organic labelling can be relevant. Organic is most common for European-grown potted herbs. Imported organic herbs are less common. For exporters, organic cultivation can be a competitive advantage. However, you should be aware that airfreight and organic herbs are contradictory in terms of sustainability.

To market organic products in Europe, you need to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. The Regulation (EU) 2018/848 (version 21/02/2023) on organic production and labelling came into force in January 2022.

Inspections of organic products will become stricter to prevent fraud. Producers in third countries have to meet the same set of rules as those producing in the European Union. Other requirements are:

- Use of soil: Your herbs need to be cultivated in soil (no hydroponic or soilless systems).

- Organic production methods: Your production has to be cultivated according to organic methods for at least 2 years.

- Certification: Your product needs to be certified as organic by an accredited certifier.

Tip:

- Consider organic herbs as a plus, not as a must. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process to market organic products. If your production is far away from Europe, you will need to find buyers that are willing to import organic herbs by air.

Selling ethnic and exotic herbs

Ethnic and exotic herb varieties are also part of niche markets. Due to their smaller trade volume they are often part of a spot market with more risk of fluctuation. If the fresh herbs are not pre-ordered by an end client, importers will likely ask you to provide your product in consignment. As an exporter you must understand the risks of quality claims and fluctuating returns when selling your herbs on commission base.

Tip:

- Only do business on commission with buyers that have a proven record and that preferably have a longstanding relation with your company.

2. Through what channels can you get fresh herbs on the European market?

Fresh herbs have different end-markets in retail and food services. The best way to get your herbs to these markets is through partnerships with herb importers or international growers.

How is the end-market segmented?

Fresh herbs are mainly marketed for culinary uses in 2 different segments. One is the convenience segment, where you will find retailers such as supermarkets, specialised shops and street markets. The other is the hospitality industry and food service segments such as restaurants and bars.

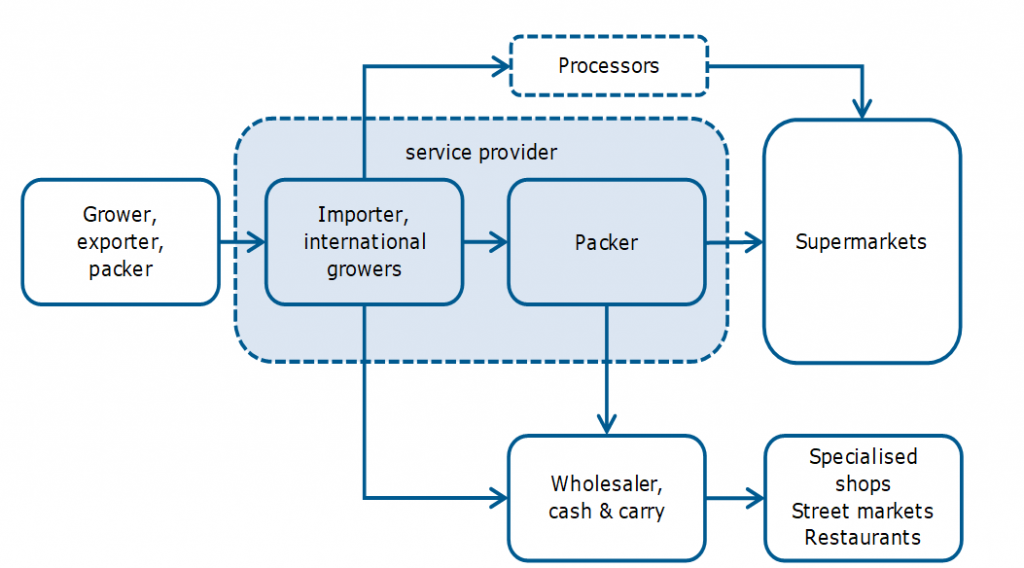

Figure 3: Market segments for fresh herbs

Retailers promote fresh convenience

Convenient fresh products are typical for retailers such as supermarkets. Fresh herbs are sold as quality ingredients in handy packages, as ultra-fresh potted products or frozen. Here, you can also find a wide assortment of processed food products that contain fresh herbs such as ready-made meals, salads, fresh juices, soups and sauces. Good examples are the salad with parsley and chives in the German supermarket Rewe and fresh tomato soup with basil sold in Tesco supermarkets.

Street markets, ethnic shops and small retailers of fresh vegetables are also in the market for fresh herbs, but their market share is much smaller than that of the large supermarket chains. These traditional channels are more suitable if you do not work with retail packers or when you are supplying a niche variety. On street markets, vendors sell fresh bundles of herbs for reasonable prices, saving costs on expensive packaging.

Food service providers introduce and promote new flavours

The culinary value of fresh herbs makes food service an important segment. The food service segment can be important for the introduction of new types of fresh herbs as well as larger packaged deliveries.

Food service providers such as restaurants use fresh herbs for specific recipes or ethnic cuisines. Cafes and bars also use herbs, mostly mint, to make fresh mint tea or mojitos. Food service innovators are often responsible for introducing new flavours. They distinguish themselves with creativity and taste. Therefore they are more open to experimenting with different flavours and herbs, such as purple basil, Thai basil, Chinese chives, shiso and edible flowers.

Tips:

- Offer something unique. In all segments quality must be your priority, but you can differentiate by offering a unique variety in a niche segment or an organic or sustainable label in a main retail segment.

- Research different supermarkets, wholesale markets (such as Rungis in France) and specialised shops when visiting Europe. See for yourself which kind of stores sell your type of herbs and find out who is supplying them. The less common your variety the more specific your segment and potential buyer will be.

Through what channels does a product end up on the end-market?

Service providers and international growers have a central role in the import and distribution of fresh herbs. They are familiar with all the different requirements of end clients and are able to distribute to different markets. By sourcing fresh herbs in different regions, both from local and foreign origin, fresh herb companies can assure their clients with a year-round supply.

Figure 4: Supply channels for fresh herbs in Europe

Service providers provide access to supermarkets

Fresh herbs have become a normal retail product. Large retail organisations such as supermarkets usually work with supply programmes and offer both packed and potted herbs to consumers.

Successful suppliers to supermarkets often position themselves as service providers. They organise the supply chain according to the needs of their clients, from growing and sourcing to re-packing, mixing and branding. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider requires. It is common for fresh herbs to be packed or re-packed according to retailer standards. Luxury supermarkets distinguish themselves by offering an attractive assortment of fresh herbs. Discount retailers like Lidl and Aldi limit their offer to the main herbs such as parsley, chives, dill and basil.

Large companies that supply supermarkets are for example as Europe Retail Packing and Vitacress. Europe Retail Packing is 1 of the largest suppliers in the Netherlands of fresh cut herbs from local suppliers as well as Israel and Kenya. They work directly with farmers and offer a wide range of packing and mixing solutions. Vitacress is a UK based leading supplier of fresh herbs, watercress and salads. They have farms in the UK, Portugal, Germany and Spain, a global sourcing network to offer fresh herbs under private label or with their own brand.

International growers look for partnership

Growers and grower organisations are very important in the supply of fresh herbs. Some of these grower organisations work at an international level and actively seek foreign partnerships. They cover local demand themselves much of the year, but they fill in gaps with imported produce. Examples of growers with international networks include:

- Hermann Kräuter, a German grower that supplies fresh herb and cress varieties from 350 hectares of its own production in summer and find additional supply in winter from Italy, Spain, Kenya, Israel and Morocco.

- Van Vugt, a Dutch producer with an international growers’ network in Belgium, Spain, Germany, Italy, Hungary and Kenya.

- Dreesen Kräuter, a German grower with import of freshly cut herbs from Spain, Israel, Italy and Morocco in winter.

- VDV-Herbs, a Belgian grower and importer of herbs.

Importers have strong foreign relations

Most importers of fresh herbs have steady commercial relationships with growers in different countries. They work together with different supply countries and can specialise in more unique herb varieties. Companies that are more focused on imported herbs and exotic produce include R&G Fresh, Xfresh, BUD Holland and Greenfresh. Importers like Fresh Organic Choice focus entirely on organic herbs. There are also foreign suppliers that have established themselves in Europe, such as the Israeli Gaia Herbs. They grow and import fresh herbs from Israel, Kenya, Tanzania, Ethiopia and Uganda.

Companies that specialise in imported herbs or niche products usually sell at wholesale level and to the food service segment. Re-packing is often 1 of their additional services, which brings them closer to being a full-service provider. They often work with multiple origins. Their expertise in import and logistics make them into valuable partners for foreign suppliers.

Wholesalers supply the spot market

Wholesalers often supply smaller quantities of fresh herbs to secondary channels such as hospitality and food services, specialised retailers and street markets.

Import can be among the activities of a wholesaler, but they are not equipped to organise a global network of growers. Instead, they prefer to buy from local growers and international import specialists. Without a retail programme they mainly cover the spot market, moving with the fluctuations of the trade. Typical wholesalers that sell fresh herbs are, for example, Van Gelder in the Netherlands and Herzog in Austria. Ernst & Schlösser is a wholesaler that has a wider international network.

Suppliers to the food industry require continuity

Europe’s food industry requires large quantities of herbs for products ranging from sauces and soups to prepared meat and meals. Food processors need continuity and stability and often work with supply contracts and fresh herb specialists. Herbs Unlimited in the United Kingdom is such a specialist. Besides packing herbs for retail businesses they supply freshly cut herbs to food manufacturers like Cranswick Gourmet Sausage Co.

In the food industry you can expect most purchasing to happen with local companies and a strong competition from the dried herb industry.

Tip:

- Make sure to have a reliable partner if your herbs are re-packed in your destination country. Quality claims are easily transferred to your company if the product is rejected by the retailer even if it is not your fault. Be sure to document your product quality (make pictures before shipment) and production process (such as processing time, temperature and laboratory tests).

What is the most interesting channel for you?

As a foreign supplier, your best chance to enter the European market is through a partnership. A partnership with a large European grower, importer or service provider helps you sell your fresh herbs in the European off-season, for example to supermarkets. Importing wholesalers can distribute your fresh herbs to a variety of segments, including niche markets.

Being part of retail supply programmes gives you the best security for a stable demand and margins are often most profitable. However, the requirements are high and room for negotiation is minimal. Supplying supermarkets directly is challenging for non-European suppliers. This is easier with a European partner. Their supply is programmed and the local seasonal production weighs heavy in retail preference.

The most likely route to become part of a retail programme is to cooperate with a service provider. Service providers have a local infrastructure for re-packing and distribution and established supply contracts with retailers. If you cannot find a service provider, be prepared to integrate your business with European herb growers. Together you can offer reliable year-round volume including supply from local European sources.

Supermarkets’ requirements can be tough. If you cannot meet the high standards, service level or supply contracts required by large retailers, it is best to work with an importer or importing wholesaler. Wholesalers buy fresh herbs from European growers and offer imported herbs during the off-season. Specialised importers may also look for different herb varieties or quality that is better available abroad to fulfil the demand of culinary or ethnic buyers; for example large Moroccan mint from open field production or Thai basil and lemongrass from Thailand.

Tip:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

3. What competition do you face on the European fresh herb market?

For European buyers it can be worthwhile to complement the supply from local growers of imported herbs. Other countries can offer a more favourable climate and competitive production costs. This provides opportunities for horticulturalists in countries such as Kenya and Morocco. Differences in variety, quality and season are the main reasons to buy herbs in non-European countries. Weather conditions will play an increasingly important role in the availability and sourcing of fresh herbs.

Which countries are you competing with?

Due to lack of detailed trade statistics it is difficult to measure the exact trade value per country. Based on industry sources and research the largest non-European supply countries are Morocco, Kenya and Israel. Smaller shipments of fresh herbs come from a variety of other countries, such as Ethiopia, Jordan, Uganda and more recently from Ghana and Tanzania. Thailand is known for specific Asian and exotic herbs. Most of the import takes place between September and May during Europe’s off-season.

Source: Eurostat and ITC Trade Map

Kenya: Europe’s source for counter seasonal supply

Kenya has made major steps in fresh herb production, with basil being the dominant crop. Production is cheaper in Kenya than it is in Israel and European countries, and it has a favourable climate allows for a year-round supply. Some buyers also argue that the herbs have a more intense flavour because of the country’s geographic location.

Kenya is the main non-European supplier of fresh herbs and other niche vegetables (product code HS 07099990). The country has successfully increased its trade with Europe, almost doubling in value over the space of 5 years. With several larger growers and a good climate, Kenya offers supply certainty, traceability and control of residues. The country also has good airfreight connections to Europe, which are crucial to get herbs fresh into the market.

Most of Kenyan’s supply to Europe is off-season, but growers can supply Europe year-round. According to an Italian herb company, in July 2023, Kenya was responsible for 80% of Europe’s supply of basil due to extreme temperatures in Italian basil production.

However, changing climate circumstances are also an issue in Kenya. Extreme droughts alternate with floods. According to Bayer, Kenyan farmers are amongst the most concerned about the effects of climate change. 73% of farmers in Kenya have experienced increased droughts in recent years.

If the quality or volume in Kenya is insufficient, buyers can use alternative sources, such as Israel, Ethiopia or Uganda.

Morocco: Leading in mint, thyme and chives

Morocco is a powerhouse when it comes to the production of vegetables and the supply to Europe. Fresh herbs such as mint have some of the highest demand in Europe.

The main advantage of Morocco is its proximity to Europe and its warmer production climate. This can extend the production season in Europe and fresh herbs can be transported to Europe by truck. This makes it an attractive source for European buyers.

Herb cultivation in Morocco also offers some differences in herb quality. For example, mint from Morocco has strong stems and more flavour, thanks to the open-air cultivation and large amounts of sunshine. Moroccan mint is a hardy and bushy perennial and available year-round. It is a popular herb for making tea. Morocco is also 1 of the main suppliers of chives (part of HS code 07039000) and a strong producer of rosemary. Moroccan rosemary is known for its high content of carnosic acid, which is used as food additive or medicinal purposes. For fresh basil Kenya and Israel are known to be superior in quality over Morocco.

Moroccan companies have become valuable options for European buyers because of their improvement in product quality. In 2022, Europe imported €14 million worth of ‘other vegetables’ (HS 07099990) including fresh herbs. The fresh herb production still has potential to increase in the future, but Morocco will be competing with other Mediterranean and Northern African producers. Spain, Italy, Egypt, Tunisia and Turkey all have overlapping production seasons.

Thailand: Supplier of exotic herbs

Competition from Thailand is mainly oriented on specific herbs, such as Thai basil, lemongrass, Chinese chives, Thai parsley, Thai coriander and kaffir lime leaves, as well as various exotic herbs and leafy vegetables. They do not really compete with products from Morocco or Kenya. Fresh herbs only represent part of the €15 million imports in 2022. Products are airfreighted to European buyers along with a wide variety of exotic vegetables, including baby corn, bamboo shoots and okra. Switzerland and France are among the main buyers, accounting for almost 60% of the imported value.

The exotic and unique varieties allow Thai growers to address specific ethnic markets and differentiate their products in the wholesale channel. Thai herbs and mixes are offered by Egli’s in Switzerland and Thai Food Online in the UK flies in common fresh herbs for Thai cooking on a weekly basis.

Israel: Superior quality

Israel has a well-developed horticulture and very experienced fresh herb growers. Prices for fresh Israeli herbs are somewhat higher than prices for herbs from other origins, but the reputation in quality is high. Fresh herbs are efficiently processed and packed. Companies such as Genesis Herbs use automated greenhouses to avoid human contact and use sustainable cultivation practices to reduce waste and chemical use. International logistics are well organised to ensure a short transit time to Europe.

In 2022, Europe imported €3.9 million of Israeli miscellaneous vegetables (mostly herbs). Important fresh herbs from Israel include basil, chives, mint and coriander. The Netherlands and Belgium are the largest markets that import and re-distribute Israeli fresh herbs.

Growers have also invested in production outside Israel. Companies such as ADA Fresh and Agriver have extended their cultivation capacity to farms in countries such as Kenya and Ethiopia. This way Israeli growers will maintain a significant role in the future fresh herb trade.

Jordan: Export potential to Europe

The Jordan valley, neighbouring with Palestine and close to Israel, is a productive area for fresh herbs such as basil, tarragon and thyme. The reputation of Jordan’s horticultural sector is mostly positive, but logistics to Europe may be difficult.

According to the trade statistics Jordan is a significant and stable supplier of fresh herbs to Europe. European statistics show an import value of €3.8 million of imported ‘other’ vegetables (including fresh herbs) from Jordan in 2022. This is nearly as much as Israel. Germany and the United Kingdom were Jordan’s main export market, but trade values fluctuate a lot from year to year.

Additional export in the future will be driven by increased attention for Jordan’s potential. There has been support for the sector by CBI’s export promotion programme until 2023 and by the Jordan Exporters and Producers Association for Fruit and Vegetables (JEPA).

Ethiopia and other supply countries complete the supply

Besides the 5 aforementioned principle sources of fresh herbs, there are a lot of other supply countries. These include Ethiopia, Uganda, Ghana and Tanzania, and Egypt to a lesser extent.

Ethiopia is mentioned as source most often by European importers. Favourable climate zones allow Ethiopia to produce high quality herbs, in particular basil. The country is attractive in production costs, but it is not as competitive as Kenya. Ethiopia often functions as a back-up market for this reason.

Europe: Main competition in summer

Your main competition in fresh herbs comes from European production. The local availability peaks between June and September, and some herbs are even cultivated year-round in milder climates and greenhouses. During the summer, Europe is supplied by herb growers in Italy, Spain, Greece as well as greenhouse growers in the Netherlands and other northern European countries. This makes it difficult for some suppliers from overseas to supply the European market all year round.

Most of Europe switches to local production around June. The presence of foreign herbs increases starting in October. Poor weather conditions can increase demand during the European summer.

Tips:

- Discuss with potential buyers in Europe if your supply window and costs (both in production and logistics!) are competitive and attractive for the European market. Use the advantage of your specific climate and plan your production accordingly.

- Invest in knowledge, technology and farm management. As a company you can only compete successfully when you invest in excellent horticultural practices and the highest product quality. Find knowledge in countries with a strong horticultural tradition such as Israel, the Netherlands and Spain.

Which companies are you competing with?

International presence or partnerships can be a good way to trade fresh herbs. However, to compete with leading exporters, it is best to set yourself high standards and specialise your business.

European growers are your main competitors when fresh herbs are in season during the summer. You will find producers throughout Europe, such as the Dutch company Especia Organic, which works with Vitacress Real, Vegobel in Belgium or FREShPANIA in Spain.

There are other companies that compete in fresh herb supply outside of Europe. Ada Fresh from Israel, Evergreen Herbs in Kenya and Beleco in Morocco are examples of fresh herb companies that have strategies to export to the European market.

AdaFresh: Competing through international presence

Some companies in the fresh herbs segment compete on an international level with growers from different countries. This gives them the advantage of having a year-round supply from different climates. AdaFresh is an example of an Israeli company that combines horticultural knowledge with an international network of growers. They supply herbs from Israel and Kenya, but with their own logistical branch office in the Netherlands they can source from basically any country.

By taking responsibility of the supply chain from cultivation to international commerce AdaFresh has become a strong competitor in the fresh herb sector. But as an international sourcing company they could also become a partner for exporters that manage their own farms. Many European grower organisations work in the same way.

Evergreen Herbs: Complying with high standards

To export to Europe a supplier must comply with several high standards. Evergreen Herbs in Kenya (part of the Agris Group) is showing the relevant practices. The company is certified GLOBALG.A.P. and implemented SMETA and GRASP for social compliance. They also work with surveys on their environmental impact and they monitor water, soil, plants and their cold chain to maintain a high-quality product.

The better a company complies with high standards, the easier it becomes to compete on the European market. Buyers in Europe will always look for a good price, but they also avoid risks and need to show social commitment to their end clients. For fresh herb producers it can be a good strategy to start locally and look for international partnerships when the company is ready for the requirements of European buyers.

Beleco: Competing in organic herb cultivation

Beleco is a Moroccan company that has taken the opportunity to improve product quality. They have developed a range of organically grown herbs. The company certified its organic production with Ecocert in France. It is a specialisation that satisfies the European demand for more natural fresh products. For planning, monitoring and sampling they work together with an external expert. The company shows the importance of differentiating in quality, but also of making the most out of the local circumstances and external knowledge.

Companies that can export fresh herbs by truck will have an additional advantage when producing organic herbs. Organic specialists in Europe prefer sustainable logistics for certified organic products.

Tip:

- Expand your business and international presence through strategic partnerships. Fresh herbs is a specialised business which requires a solid network of growers, packers and marketers to coordinate trade and manage information. Emphasise your strengths as a partner when talking to potential buyers.

Which products are you competing with?

Although fresh herbs are highly perishable, they are a welcome substitute for dried herbs, especially as a culinary addition. Consumers increasingly prefer the fresh option. For everyday cooking, however, dried herbs are still more common because of their shelf life and convenience. Another in-between solution is the use of frozen herbs, to give the consumer the satisfaction of a fresh product and the convenience of a dried product.

Among herb varieties there is less competition, as each has its own unique flavour and purpose. The main threat for your product are locally produced herbs, including potted herbs that may limit the demand for imported freshly-cut herbs. Popular herbs that thrive in the tropics, such as basil and coriander, have year-round demand as imported products. Other common herbs such as parsley and chives are mostly imported during the off-season.

In some cases, buyers prefer fresh herbs from specific origins because of their unique characteristics. Almost all herbs can be cultivated in Europe, but it is difficult to imitate the exact growing conditions such as climate and soil. This is why Thai basil from Thailand and strong mint from Morocco are sometimes preferred over the local (greenhouse) production in Europe. According to Dreesen Frische Kräuter, the development of varieties drives the entire herb segment forward.

Tips:

- Find the right varieties to grow. Work together with seed breeders that can supply cultivars that do well in your local climate and provide a good return on investment. Commercial seeds are more expensive, but they can make up for this in terms of disease resistance, high production, shelf life and flavour.

- Highlight the characteristics of your product on your website and in your communication to potential clients. Describe taste, size and other additional value of your product.

4. What are the prices for fresh herbs?

Prices for fresh herbs are relatively stable and vary according to the quality and variety. Higher production and logistical costs have made fresh herbs more expensive. However, rising costs do not mean that the profit margins for farmers have increased. Retail prices have changed little over the past 2 years.

Importers often work with different origins to balance product availability, quality and costs. However, the final price is always subject to the way fresh herbs are handled, packed and transported. Re-packing for small retail products is a particular driver of price per weight for consumers. Organic herbs can also be 20–40% more expensive in the retail shelves.

According to Synnefa, average farmers in Kenya sell basil for between €2 and €4 per kilogram. Wholesale prices from importers in Europe are between €7 and €11 per kilogram. This includes the import and handling costs as well as the regular profit margins for the importing wholesaler (approximately 8–12%). Non-European herbs are almost always airfreighted. Accordingly, logistical costs are a large part of a product’s value when it arrives in Europe. As an exporter, you need competitive air-freight prices.

Source: calculations based on online and industry sources

Retail prices can be several times the wholesale prices. Prices of small packages of herbs in supermarkets are the highest; anywhere between €25 and €100 per kg, depending on the herb variety and packaging size (usually between 15 and 40 g). These retail prices include re-packing after import as well as presentation, store-cooling, left-over disposal and taxes. Being a highly perishable product, fresh herbs have a relatively high waste rate.

Consumers get much better value for their money when buying herbs in bundles on street markets and in traditional grocery stores. There, they pay around €1 for medium-large bundles (€8 to €20 per kg). Potted herbs are also attractively priced, between €1.50 and €2.

Table 1: Examples of fresh herb prices: wholesale (kilogram boxes) and retail (pre-packed freshly-cut)

Wholesale (March 2020) | Retail (October 2023) | ||||

| based on price lists of Dutch importing wholesalers (in €) | Tesco United Kingdom (prices in GBP): | Rewe Germany (prices in €): | Hipercor Spain (prices in €): | AH Netherlands (prices in €): | |

| Basil | 7.50 (Kenia), 8 (Ethiopia), 9.25 (Israel) | 30g 0.52 (17/kg)* | 15g 0.99 (66/kg) | 20g 1.49 (75/kg) | 15g 1.19 (79/kg) |

| Chives | 8.5 (Kenya), 8.75 (Ethiopia), 10.75 (Israel) | 20g 1.00 (50/kg) | 25g 0.99 (40/kg) | 20g 1.25 (63/kg) | 25g 1.29 (52/kg) |

| Coriander | 7.5 (various origins), 8.75 (Israel) | 30g 0.52 (17/kg)* 100g 1,25 (13/kg) | 15–25g 0.99 (40-66/kg) | 20g 1.49 (75/kg) | 15g 1.19 (79/kg) 40g 1.39 (35/kg) |

| Dill | 7.75 (various origins) | 20g 0.60 (30/kg) | 25g 0.99 (40/kg) | 20g 1.49 (75/kg) | 15g 1.19 (79/kg) |

| Flat parsley | 7.5 (Netherlands) | 30g 0.52 (17/kg)* 100g 1.25 (13/kg) | 30–40g 0.99 (25–33/kg) | 50g 0.75 (15/kg) | 15g 1.19 (79/kg) |

| Thyme | 7.5 (various origins) | 20g 0.52 (26/kg)* | 15g 0.99 (66/kg) | 20g 1.49 (75/kg) | 15g 1.19 (79/kg) |

| Rosemary | 7.5 (various origins), 8.25 (Kenya), 8.5 (Israel) | 20g 0.52 (26/kg)* | 15g 0.99 (66/kg) | 20g 1.49 (75/kg) | 15g 1.19 (79/kg) |

| Mint | 7.5 (various origins) | 30g 0.52 (17/kg)* | 15-25g 0.99 (40-66/kg) | 20g 1.49 (75/kg) | 15g 1.09 (73/kg) 40g 1.39 (35/kg) |

| Sage | 8.25 (various origins) | 20g 0.60 (30/kg)* | 15g 0.99 (66/kg) | 15g 1.29 (86/kg) | |

| Tarragon | 10.5 (various origins), 11 (Israel) | 20g 0.60 (30/kg) | |||

| Oregano | 8.25 (various origins) | 15g 1.29 (86/kg) | |||

| Marjoram | 8.75 (various origins/Israel) | ||||

| Thai Basil | 9 (various origins), 11.5 (Israel) | ||||

Sources: Industry sources and published retail prices (*with several 20-30g packages Tesco matches the price of Aldi)

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research