Entering the European market for fresh lemons

A relatively large part of lemons are processed, but the fresh export trade is mostly destined for fresh use or direct consumption. This means your lemons must comply with strict quality requirements to enter the EU. This is something that Spanish suppliers master well to dominate the European lemon market. Between June and September there is a short window of opportunity in which South Africa and Argentina complement the Spanish supply.

Contents of this page

1. What requirements must fresh lemons comply with to be allowed on the European market?

Fresh lemons must comply with the general requirements for fresh fruit and vegetables, which you can find on the CBI market information platform. The Trade Helpdesk provides an overview of export requirements for lemons (code 08055010) per country.

What are the mandatory requirements?

Pesticide residues and contaminants

To avoid health and environmental risks, the European Union has set maximum residue levels (MRLs) for pesticides and other contaminants, such as heavy metals, in and on food products. Products exceeding the MRLs are withdrawn from the market.

Note that buyers in several EU Member States, such as the United Kingdom, Germany, the Netherlands and Austria, use even lower maximum residue levels than those established by European legislation. In addition, European MRLs for lemons are expected to become stricter in the coming years.

Tips:

- Check the EU Pesticides database to find all MRLs and those specific for lemons. Search by product or pesticide and the database to find the list of associated MRLs .

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that lead contamination in your lemons remains below 0.10 mg/kg and cadmium below 0,050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Phytosanitary regulation

European phytosanitary regulations and the new European Directive require lemons to go through plant health checks before entering or moving within the European Union. Lemons must originate from an area free from fruit fly (Tephritidae) or undergo effective treatment.

Tip:

- Learn more about the European phytosanitary rules in Council Directive 2000/29/EC and the new Implementing Directive 2019/523 on the protective measures against the introduction of harmful organisms in the European Union.

Quality standard

For information on quality, size, packaging and labelling requirements for lemons, see the UNECE standards for citrus fruit.

Fresh lemons, like other citrus fruit, should be at least:

- intact;

- free of bruising and extensive healed overcuts;

- sound – produce must be free from rotting or deterioration likely to make it unfit for consumption;

- clean, practically free of any visible foreign matter;

- practically free from pests

- free from damage caused by pests affecting the flesh;

- free from signs of shrivelling and dehydration;

- free from damage caused by low temperature or frost;

- free from abnormal external moisture;

- free from any foreign smell or taste;

- able to withstand transportation and handling and to arrive in satisfactory condition at destination.

For fresh consumption, Europe almost exclusively requires Class I lemons as a minimum. Lemons in this class must be of good quality and within the permissible tolerances:

- a slight defect in shape;

- slight defects in colouring, including slight sunburn;

- slight progressive skin defects, provided they do not affect the flesh;

slight skin defects occurring during the formation of the fruit, such as silver scurf, russets or pest damage;

- slight healed defects due to mechanical causes, such as hail damage, rubbing, damage from handling;

- slight and partial detachment of the peel or rind for all fruit of the mandarin group;

- a tolerance of 10% is allowed for fruit that meets Class II standard;

- a tolerance of 10%, by number or weight, of lemons not satisfying the sizing requirements is allowed.

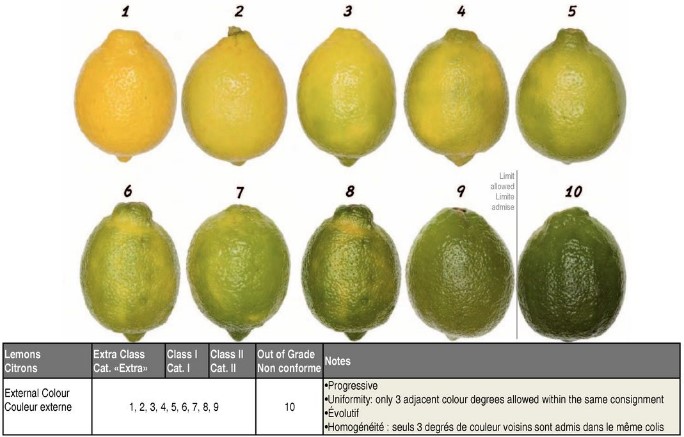

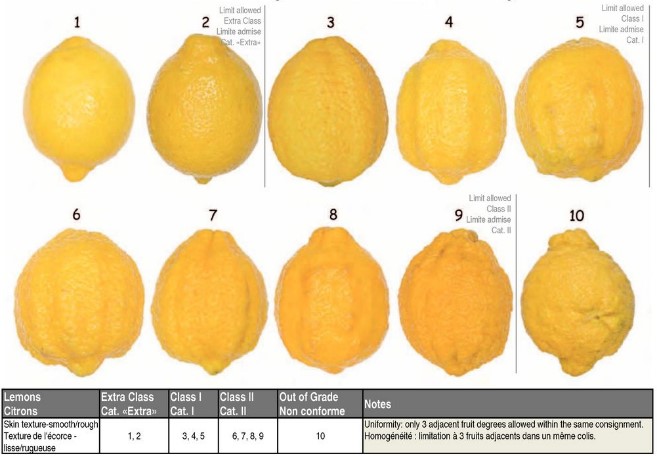

Image 1: Examples of lemon grading according to external colour

Image 2: Example of lemon grading according to skin texture

Tip:

- See more sample images of lemons in different classes in the OECD International Standards for Fruit and Vegetables: Citrus Fruit.

Maturity

The UNECE standards for citrus fruit prescribes a minimum juice content of 20%.

Colouring must be typical of the variety. Light green coloured lemons are allowed as long as they satisfy the minimum juice content.

In addition to the legal requirements, buyers often have specific preferences for brix levels or sugar-acid ratios.

Size

The UNECE standards for citrus fruit has set a minimum size of 45 mm in diameter (see table 1).

Uniformity: The maximum difference in diameter between fruit in the same package shall be limited to:

- 10 mm, if the diameter of the smallest fruit as indicated on the package is <60mm.

- 15 mm, if the diameter of the smallest fruit as indicated on the package is >/=60mm but <80mm.

- 20 mm, if the diameter of the smallest fruit as indicated on the package is >/=60mm but <110mm.

- There is no limitation of difference in diameter for fruit >/= 110mm.

Table 1: Size codes for lemons

| Size code | Diameter (mm) |

| 0 | 79–90 |

| 1 | 72–83 |

| 2 | 68–78 |

| 3 | 63–72 |

| 4 | 58–67 |

| 5 | 53–62 |

| 6 | 48–57 |

| 7 | 45–52 |

In the lemon trade, size is often indicated by fruit count per box, often varying from 60 to 140 per 14–15 kg.

Packaging

The content of each package must be uniform and contain only lemons of the same origin, variety or commercial type, quality, and size, including a same degree of ripeness and development.

The lemons must be packed in such way as to protect them properly to withstand transport and handling and the packages must be free from foreign matter.

- Materials used inside the package: clean, not causing damage to the lemons, printing or labelling only with non-toxic ink or glue.

- Stickers: Stickers on the produce must not leave traces when removed.

- Wrapping: only dry, new and odourless paper must be used.

- Use of substances: any substance tending to modify the natural characteristics of the lemons, especially in taste or smell, is prohibited.

Common packaging:

- Lemons loose or organised in boxes of 14kg–18kg, open or closed;

- Lemons in nets or bags in boxes of 14kg–18kg.

Additional labelling requirement

Besides the general labelling requirements, there is a compulsory labelling for citrus fruits that are subject to post-harvest processing using preserving agents or other chemical substances. This is because of the culinary use of lemon skin.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

- See the buyer requirements for fresh fruit and vegetables on the CBI market information platform for the legal labelling requirements.

What additional requirements do buyers often have?

Certification

Common certifications for lemons are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommended.

Sustainability and social responsibility

It has become common for buyers to ask for assurances of good agricultural practices. The best way to do this is to adopt social and environmental standards, such as Sedex Members Ethical Trade Audit (SMETA) and GlobalG.A.P.

Tips:

- Implement at least one environmental and one social standard. See the Basket of Standards of the Sustainability Initiative of Fruit and Vegetables (SIFAV).

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

What are the requirements for niche markets?

Organic certification can be a plus

The market for organic lemons is relatively small compared to the total volume, but the demand is increasing and the availability is limited. For non-European suppliers, it remains a niche because most organic lemons are sourced from within Europe.

To market organic products in Europe, you have to use organic production methods according to the European legislation and apply for an organic certificate from an accredited certifier.

Tip:

- Consider organic lemons as a plus, not a must. Remember that implementing organic production and becoming certified can be expensive; you must be prepared to comply with the entire organic certification process.

2. Through what channels can you get fresh lemons on the European market?

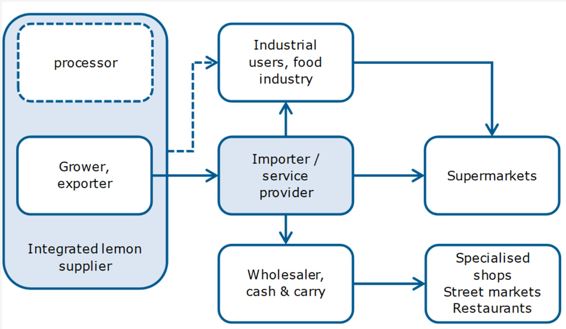

Fresh lemons enter the market through importers, producer groups and large distribution channels of supermarkets. Class I lemons are the main segment.

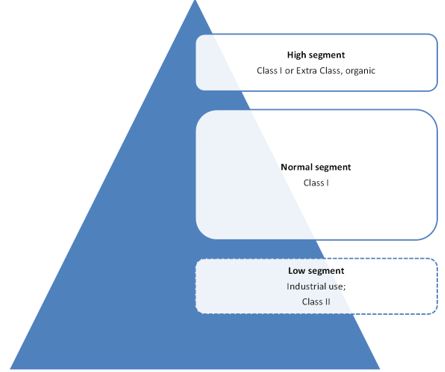

How is the end market segmented?

Supermarkets normally require Class I or Extra Class fresh lemons. This is the main segment for fresh lemons. Appearance is everything for these large retailers.

You can assume there is a relevant market in the food service industry because lemons are often used for culinary purposes. For food services, taste is more important than appearance.

Class II lemons may still have potential in food service, ethnic shops and street markets, supplied by wholesalers. But these lower class fruit are most suitable for the processing industry. Globally, an estimated 40% of all fresh lemons are processed, while in Europe this share amounts to 20%. However, most processing takes place in the producing country, such as Argentina and Spain, and most of the exported fresh lemons are destined for fresh consumption.

Figure 1: Market segments for fresh lemons in Europe

Tip:

- Maintain your focus on the demand for fresh lemons, which are generally Class I or higher. Exporting lemons for processing is relatively expensive and generally not attractive to buyers.

Through what channels do lemons reach the end market?

Importers and service providers

Importers play a central role in the distribution of lemons. They are familiar with all the different requirements of end clients and are able to distribute to different market channels, such as wholesalers or supermarkets.

Importers can become part of the sourcing structure of large retail chains, providing various services. Their main responsibility is to guarantee a reliable supply of quality product. For example, Bakker Barendrecht, part of Greenyard, supplies the leading Dutch supermarket Albert Heijn with lemons and other citrus fruit, being responsible for logistics, quality control and forecasting the clients’ needs. They recently started a project to transport citrus from Spain by train instead of road transport, reducing the carbon footprint by 70%.

Supermarket programmes

Most fresh lemons are sold through supermarkets, often as part of their citrus supply programmes. The large scale distribution of supermarkets, hypermarkets and discounters is most dominant in the northern European markets.

Large retail chains have also become increasingly involved in the sourcing of lemons in recent years. It is relatively easy for them to be close to production because of the large supply from Spain and Italy. But they tend to have different structures. Some work with annual supply contracts, while others select a dedicated service provider, such as the German discounter Lidl with OGL Food Trade.

Wholesalers (spot market)

Traditional fruit wholesalers cover the spot market, moving according to trade fluctuations. They supply to specialised and ethnic shops, street merchants and restaurants. The food service channel, restaurants for example, requires a relatively large volume of lemons because of their culinary function.

Sometimes the same company does import and wholesale activities, but a traditional wholesaler does not take many risks with importing long-distance lemons. Typical wholesale markets include Rungis in Paris and Mercabarna in Barcelona.

Large fruit wholesalers, such as Staay Food Group, maintain a large international network and offer their own cash & carry service point where clients can purchase a wide variety of fruits and vegetables.

Non-specialised (cash & carry) wholesalers supply a similar end market and are able to work with long-term contracts, just like supermarkets. For example, the cash & carry company Metro has its own trading office in Valencia, Spain, which is ideal for purchasing lemons in Spain but also for organising non-European imports.

Industrial users

Industrial users, such as Coca Cola European Partners, mostly use processed lemons. The processing is primarily a task of integrated lemon suppliers, for example Citromil, Citromax and San Miguel, so the export of fresh industrial quality lemons to Europe is limited.

Figure 2: Market channels for lemons

Tips:

- Be aware of your target group and discuss with your buyer the different preferences in product characteristics and presentation, since lemons are destined for both consumers and businesses. For example, individual fruit stickers can be an added value for a retailer, but a professional user will find them a burden.

- Use your best quality lemons for fresh exports to Europe and find local solutions in processing lesser quality fruit.

What is the most interesting channel for you?

Most of the non-EU lemon supply to Europe covers only a few months of the year, mainly from June to September (see table 2). It is best for small and medium-sized lemon suppliers to find existing supply structures with experienced importers. These importers have already established a supply chain for lemons and it will be easier to use their network than trying to get directly to the retailer or wholesaler.

There are specialised importers for citrus fruit, such as Don Limon, Van Ooijen Citrus or Jaguar TFC. Some importers, especially those with steady supply contracts, have associated growers or production contracts. Companies with a presence in producing countries, such as Hijos de Alberto del Cerro (Spain) and the Jupiter group (United Kingdom), will have a good negotiating position with clients because they sell from the source. Buyers and trade companies like these can be a good step to enter the market. Those that are willing to commit to you as a supplier are most recommendable.

As an alternative, you can also consider partnerships with lemon producing companies in Europe which complement their own supply with imported lemons. Most of these are in Spain, for example, via the member list with fresh lemon companies of Ailimpo, the association for professionals in lemons and pomelos.

Producers that are able to supply larger volumes and add lemons to a wider assortment, sometimes have direct access to retail purchase centres or maintain their own commercial infrastructure in Europe, such as San Miguel, Capefive or Fruitone. Their presence in Europe increases their sales power and credibility.

There are different structures to get your lemons on the European market, but practically in all cases there must be an important link to the primary production.

Tips:

- Make yourself attractive as a supplier for supply programmes by committing a minimum volume and guaranteeing regular shipments. With smaller volumes, your market and potential buyer group is narrower and you will depend more on a less reliable spot market.

- Go to trade fairs to find buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and Fruit Attraction in Madrid.

- Read the CBI tips on how to find buyers in the European market for fresh fruit and vegetables.

3. What competition do you face on the European fresh lemon market?

In the lemon trade, you will find Spanish suppliers are the principal competitors for most of the year. The main opportunities for non-European suppliers are during temporary shortfalls or in the off-season supply between June and September. South Africa and Argentina have covered the off season, followed by Turkey. Experienced off-season suppliers within short distance to Europe can break these traditional supply chains.

Where are your competitors?

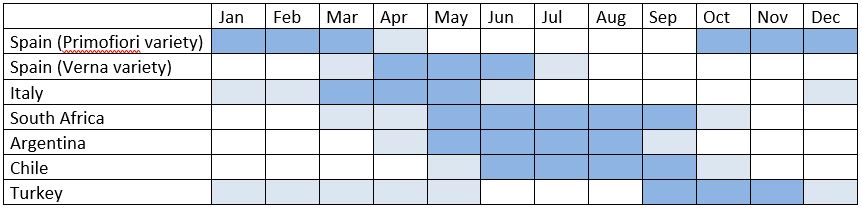

Table 2: European indicative supply calendar for fresh lemons per origin

Spain

At a comfortable distance, Spain is the dominant and by far the most preferred supplier of lemons to other European countries for most of the year (see figure 4), supplying between 75% and 80% of the total European demand. Spain is the second-largest lemon producing country in the world, after Argentina (see figure 3 and table 2) and the leading global exporter of lemons for fresh consumption. Fresh lemons from Spain are preferred because of their quality and phytosanitary advantages.

Europe’s dependence of Spain also provides temporary opportunities for non-European suppliers when shortfalls arise. For example, European lemon import increased significantly in 2016 when Spanish production declined by 23% due to adverse weather conditions.

Current forecasts predict Spain will return to a normal crop after a record season in 2018-2019 and maintain its leading position in quality, quantity and food safety.

Primofiori (Fino) and Verna are the leading lemon varieties grown in Spain with a production share of respectively 70% and 30%. The Primofiori variety is supplied from October to March, is also often used for processing, making Spain the second global producer of processed lemons. The Verna lemon has its main season from April to June. This leaves most supply opportunities for non-European suppliers for between July and September.

Tip:

- Find out more about your Spanish competitors as well as potential trade partners in Spain by browsing the company database at Interempresas and the member list of Ailimpo (in Spanish), the Inter-professional Association of Lemon and Grapefruit.

Argentina

Argentina is the world’s largest producer of lemons with an estimated volume of around 1.6 million tonnes (see figure 3). Argentinian growers have extensive experience in producing and processing lemons, and because of this experience they play an important role in the summer supply of lemons to Europe.

Argentine producers service different market channels, which gives them flexibility. Their primary business is lemon processing: more than 75% of their lemons are processed and sold as lemon juice and oil. Because of the processing industry, Argentina does not entirely depend on the fresh trade.

In 2018, Argentina exported 185 thousand tonnes of fresh lemons to Europe. Due to recent low prices for processed products, you can expect fresh exports to increase. An increasing part of this fresh volume will be destined for the United States, which opened its borders again to fresh Argentinian lemons, relieving some pressure on the European market.

The main challenge for Argentina is the long distance to the European market and the narrow supply window.

Turkey

As a large lemon producing country near the European Union, Turkey competes with Spanish lemon growers, especially early in the Spanish season, around the month of October. The lemon production increased from 850 thousand tonnes in 2016-2017 to 1,100 thousand tonnes in the 2018-2019 season (see figure 3). This growing production volumes is pushing Turkish lemon companies to further develop their exports, resulting in a record export to Europe of 147 thousand tonnes in 2018 (see figure 4).

Turkey is competitive in production costs, but in terms of quality and food safety it is not yet at the same level of Spain. One of the main advantages of Turkish exports is the low value of the Turkish lira. As a supplier, they are attractive for eastern European countries, which are within short distance and often focus on low prices. If Turkish suppliers make an effort to improve the quality of their supply chain, they can become a stronger competitor compared to suppliers in Europe and nearby.

But the Spanish producers’ lobby is strong and the extra controls for EU conformity remain in place for the import of Turkish lemons. At the same time, Egypt is increasingly competing within the same season, but despite recent strong growth, Egyptian lemon exports to Europe were still under 5 thousand tonnes in 2018.

South Africa

South Africa is a major counter seasonal supplier of citrus fruit, specialised in the fresh trade. European buyers, especially in the United Kingdom and the Netherlands, are very familiar with the South African trade and quality of citrus fruit.

The South African planting rate of new lemon trees has led to increased production and this volume will continue to develop further over the next few years. South African growers have a strong position with lemons in the Middle East and Asia, but their supply to Europe is also growing fast.

South Africa’s exports to Europe reached 110 thousand tonnes in 2018 (see figure 4), three times as much as five years ago. This makes South Africa the fastest rising competitor in counter seasonal lemons. Large growing South African companies are aiming towards diversification in organic or wax-free lemons. With these lemons, South Africa will be able to meet the growing demand for naturally fresh lemons.

Italy

Italy is a relatively steady supplier of lemons, exporting around 45 thousand tonnes annually to other European markets (see figure 4). As a competitor, Italy is much smaller than Spain and Italian growers are much more oriented to the domestic market. Nevertheless, Italy is Europe’s fifth-largest lemon supplier after Spain, Argentina, Turkey and South Africa.

Italian suppliers stand out in the export trade with high-quality lemon varieties and organic lemons, which allow them to compete with quality suppliers from other countries. Most Italian lemon exports go to Germany, France, Austria and Switzerland, where there is also a relatively high demand for organic lemons. The Italian supply volume is not likely to increase much, so you can still explore similar quality export markets without experiencing heavy Italian competition.

Chile

Compared to the five-largest lemon suppliers to the EU, Chile is only a minor competitor in the European market with an export of 9 thousand tonnes (see figure 4). But Chile’s lemon producers can fill supply gaps in Europe when needed.

For Chilean exporters, most lemon sales go to the United States and Japan. And, with improved export conditions to the United States and a decreasing lemon cultivation, it is unlikely that Chile will become a major competitor in the European lemon trade.

This means Chile barely competes with the large volumes exported from Argentina and South Africa to Europe.

Tips:

- Find out which lemon variety provides you with the best harvest season and timing for the European market.

- Build a reputation in the lemon trade, especially if your country is not known for its lemon production. Your production process must be comparable to that of professional growers in Spain, Argentina and South Africa and inviting buyers to your farm will be important to convince them to buy your product.

Which companies are you competing with?

The main competitors outside the Spanish season are in Argentina and South Africa. Lemon companies in these regions are generally well organised. The size of the operation and the product quality are their main success factors. Examples include San Miguel in Argentina, which focuses on multinational cultivation, and Grown4U in South Africa, which prioritises grower cooperation.

San Miguel

The Argentinian company San Miguel is one of the largest lemon suppliers in the world. They have acquired production sites for citrus in Argentina, South Africa, Uruguay and Peru and have a growing sales of both fresh and processed citrus fruit. Of the 154 thousand tonnes of fresh fruit that the company exported in 2018, 41% were fresh lemons.

The size and the international production of San Miguel facilitate the company’s access to Europe’s largest buyers and retail chains. They also have a professional approach towards sustainability and human resources, which is in line with the general expectations of companies in Europe.

Grown4u

Grown4u is a grower-owned company based in South Africa. They provide a marketing platform for a group of citrus growers, which makes them a more attractive supplier through the direct sourcing of a larger combined production. The company claims that the direct export model allows growers to control the channels where their fruit is marketed, making them part of the decision-making process. The company exports high quality edible skin lemons

Together with Everseason, a similar grower-owned company, Grown4u established a joint operation in the United Kingdom to service supermarkets and supply programmes.

Tips:

- Save on marketing costs by working with other lemon growers.

- Find strategic partnerships and create an integrated supply chain similar to that of the business model of San Miguel, with access to nurseries, packing plants and logistics.

Which products are you competing with?

Lemons have minor competition from other fruit. The demand for lemons is not flexible: it cannot be promoted to replace other fruit nor can it be easily replaced. Limes have the most similarities with lemons, but their uses are often slightly different.

Consumers who buy lemons to make juice can opt for a more convenient ready-made juice or lemon syrup. But in restaurants and bars, lemons are a standard product that cannot be substituted.

Tip:

- Make your logistics as efficient as possible and keep lemons at a temperature between 10ºC and 14ºC. The sooner your product is on the market, the fresher its appearance and the higher the chance that consumers will notice your product.

4. What are the prices for fresh lemons?

Trade prices for fresh lemons are subject to large fluctuations, mainly depending on availability. Consumption is gradually increasing but demand is relatively stable and therefore has less influence on prices. The main influences are the total harvested lemons, the time of the season, the fruit sizes and the origin. In the future, the increasing global production can have a negative influence on fresh lemon prices, but with the many fluctuations in seasonal yields, your profit will mostly depend on short-term developments.

There is a difference between European and non-European lemon prices. Wholesale prices for imported, counter seasonal lemons are higher due to transport costs. Supplies shift to Spain as soon as Spanish lemons are available.

Wholesale prices for 15 kg boxes in 2019 were lower than in previous years: roughly between €11 and €19 for imported counter seasonal lemons and €8 to €13 for Spanish lemons. In 2016, wholesale prices were much higher between €28 and €36 during a long part of the year, but mainly because of the low production in Spain and the consequent increase in imports.

The annual price fluctuations are difficult to predict. If you work with an importing company or trader, expect to pay approximately 8% commission plus handling costs.

Retail prices are more stable, independent from trade prices. Supermarkets work with supply contracts and therefore manage more stable price levels. They also have the option to offer lemons in promotional nets when prices are low or only offer more expensive lemons per piece.

Retail prices are usually between €2 and €3.50 per kilo. Organic lemons are sold for roughly between €4 and €5.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research