The European market potential for fresh lemons

The demand for fresh lemons has little flexibility, but a growing consumption and regular shortfalls can provide opportunities. Northern Europe has the most demand for imported lemons, although Spain is often their dominant supplier. Most non-European lemons enter Europe via the Netherlands.

Contents of this page

1. Product description

Lemon (scientific name: Citrus limon) is a sour citrus fruit which is used for both culinary and non-culinary purposes. Fresh lemons can be processed (mostly at origin) or marketed as a fresh fruit for consumers or professional users in the food service industry for drinks or food preparation.

The main purpose of fresh use is because of its flavour and all parts of the lemon can be used. Lemon juice is used for drinks while the lemon with zest or skin is used as garnish, in marmalades or deserts. Industrial processing of lemons has uses in the food and non-food segments (cleaning, cosmetics, pharmaceutical) and include for example (concentrated) juice, pulp, essential oil, pectin, citric acid, limonene and dehydrated peel.

| Harmonized System (HS) code | 08055010 Fresh or dried lemons “citrus limon, citrus limonum” |

| Commercial varieties (examples) |

|

2. What makes Europe an interesting market for fresh lemons?

The consumption of lemons is increasing and regular shortfalls in the Spanish supply will result in more demand for non-European lemons.

Opportunities arise when European supply falls short

The European market heavily relies on Spain’s production, which supplies 75 to 80% of the lemons. Shortfalls in the Spanish lemon season can increase opportunities for lemon exporters from outside Europe.

In 2016 and 2018 imports of lemons into Europe were higher than expected. In the 2015-16 season Spain suffered a tremendous reduction in lemon production of 23% due to adverse weather conditions at the flowering stage. The production decreased from 1.1 million to 0.85 million tonnes. The lack in supply led to record prices and was largely compensated by non-European lemon growers.

Spain is by far the most dominant supplier, but in summer there are only three significant additional suppliers: Argentina, South Africa and Turkey. The limited number of supplying countries put the lemon trade at risk of strong fluctuations. If one of these countries is impacted by adverse climate or fruit diseases, you can expect prices to increase. However, for exporters it is impossible to predict the non-European demand and most of the time you must be able to deal with strong competition.

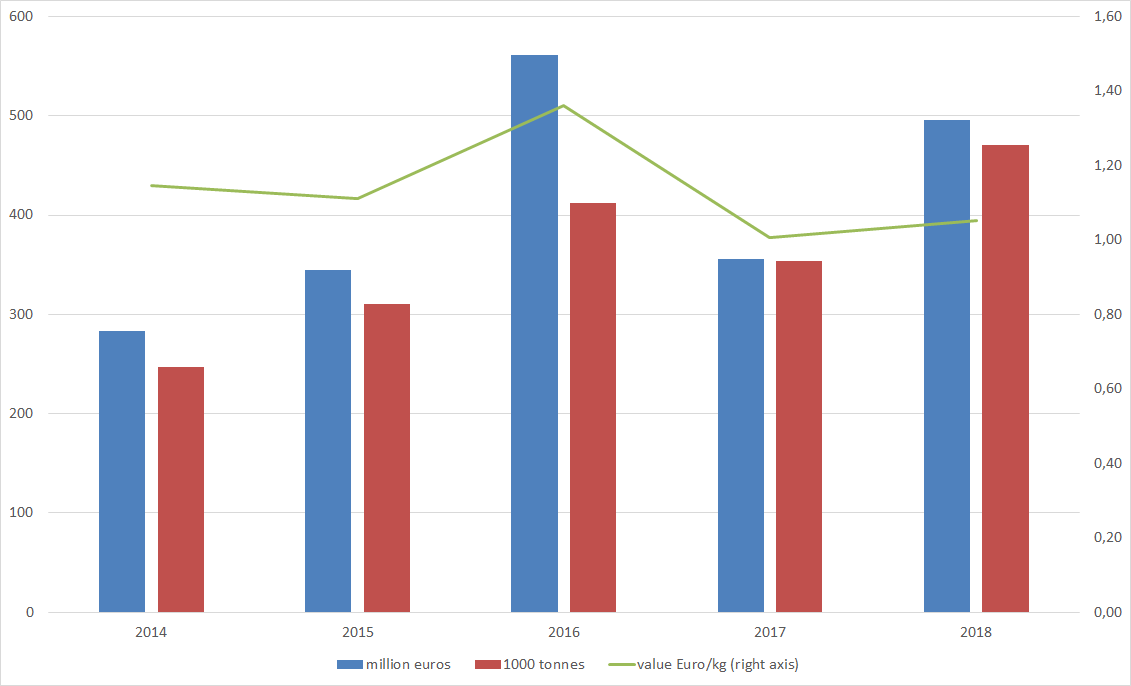

Figure 1: European lemon imports from non-European suppliers

Source: Eurostat / Market Access Database

Tip:

- Stay up to date with the seasonal supply, production volumes and possible shortfalls in supply. Check the news and market overviews regularly on platforms such as Freshplaza, Eurofruit and FreshFruitPortal.

Lemon consumption is growing, but booming production raises concerns

The use of lemons in producing countries such as Spain and Italy is generally high due to the processing industry. But in non-producing countries up north, consumption of fresh lemons is gradually increasing as well. Between 2012 and 2017 the consumption in Western Europe increased by 27% (see Figure 2).

The consumption growth provides opportunities for exporters; however, there are deep concerns about the global increase in production. Production areas in both the northern and southern hemisphere have been booming and new plantations are still coming into production. The lemon market does not have the flexibility to absorb large additional volumes. Lemons are mostly a culinary product and do not compare to direct consumption or snack fruit, which is easier to promote.

2019 showed the first signs of a saturated demand in Europe. In Spain, production reached 1.3 million tonnes and part of the cultivation of Fino lemons between October and March will remain unharvested. It shows that despite the opportunities provided by consumption growth, there is a good chance you will face several years of overproduction in which the sector has to resettle itself.

Tips:

- Secure your market before expanding your production and make sure you have reliable sales contacts. Finding buyers can take time, especially when there is too much lemon on the market.

- Read the CBI Tips for finding buyers and the CBI tips for doing business with European buyers of fresh fruit and vegetables.

3. Which European countries offer most opportunities for fresh lemons?

Northern Europe has most demand for imported lemons, but Spain is often their dominant supplier. Most lemons from non-European origin enter Europe via the Netherlands with the largest destination markets being Germany, France and the United Kingdom. Poland offers a particular demand for Turkish lemons, while Italy uses imports to complement its own production.

Germany: large market with preference for Spanish lemons

Germany has a preference for lemons that are sourced from within the European region. Spanish growers dominate the supply, and are a reference for lemon suppliers from other parts of the world.

Germany is the main non-producing destination for lemons, importing 168,000 tonnes of lemons in 2018. The majority is supplied by Spain (120,000 tonnes, mostly of the primofiori variety). South Africa is the largest non-European supplier with 14,000 tonnes and with an above-average growth, exporting 138% more than five years ago. Argentina and Turkey complement the non-European supply.

Less than 10% of the lemons are re-exported from Germany, which means that the country is mainly a final destination market.

Lemons are a standard product for large retail chains, however, German retailers are among the strictest buyers in terms of food safety and pesticide residues. By sourcing the majority in Spain and Italy, buyers maintain the highest degree of control over the supply chain and fruit quality. Germany is also one of the better markets for organic lemons.

Netherlands: trade hub for non-European supply

The Netherlands has a good logistical position for the import and distribution of lemons. You can consider the Netherlands either as a logistical hub or as a trading country. As an exporter this can be interesting to find lemon importers or logistical partners.

Contrary to other European countries, Dutch imports consist for the most part of non-European lemons, mainly from Argentina (52,000 tonnes in 2018) and South Africa (46,000 tonnes). Non-European imports increased by 90% since 2014. Imports from South Africa even tripled in five years’ time.

When Spanish supply becomes less, the Netherlands imports large volumes from elsewhere, not only for the domestic market, but also for the rest of Europe. Dutch imports increase significantly between June and September. This is a period that offers the most potential for non-European suppliers and the Netherlands will likely continue to play an important role in the import of non-European lemons.

France: lemon is a common product in France

With a connection to the Mediterranean area, Spain and Italy are logical suppliers for France. But as a non-European exporter you can find plenty of opportunities to export lemons to France when regional supply fails or runs out.

In market size France shares the second place with the United Kingdom. The imported volume is slightly larger than the United Kingdom, but France also (re-)exports more. In total France imported 139,000 tonnes of lemons. The reduced supply from Spain in 2018 was partly compensated by more imports from Argentina, Italy and South Africa. France is also one of the few countries that imports lemons from Israel.

In the south of France you can also find lemon production and new plantings from a few years ago are now starting to bear fruit. There is little exact data about the national production volume, but it does not take away the need for imported lemons nor will it be replaced by foreign lemons.

When exporting lemons to France you can expect flavour and aroma to be important values for French consumers. The French “Citron de Menton” is registered in a Protected Geographical Indication (PGI) since 2005 and praised for its high aromatic characteristics. Each year a lemon festival is organised to celebrate the lemons from Menton.

United Kingdom: large destination market with direct import

The United Kingdom is one of Europe’s largest consumption markets for lemons. There are a lot of direct imports from producing countries and imports from non-European countries could further increase with the current perspective of the country leaving the European Union.

The United Kingdom imported a total lemon volume of 120,000 tonnes in 2018. Practically all of these lemons remained in the country for consumption. Spain was responsible for almost half of the supply, but the United Kingdom also has a strong trade relationship with South Africa which exported 28,000 tonnes in 2018.

Brexit (the United Kingdom leaving the European Union) may give a further impulse to non-European imports. Without the advantages of the European Union, for the United Kingdom it may be more attractive to explore more sourcing in non-European countries. However, devaluation of the British pound may put pressure on price levels.

Poland: increasing demand for price-competitive lemons

With 38 million consumers Poland is the biggest (consumption) country in Central Europe. Suppliers that are price competitive and that have a decent supply route into Poland are best positioned to develop the lemon trade with Polish buyers.

Poland depends mainly on Spain, Turkey and re-export from the Netherlands for the supply of lemons. Spain supplies the largest volume: 46,000 out of the 120,000 tonnes in total in 2018. Turkey also exports a significant amount of 24,000 tonnes and is developing fast. Polish imports from Turkey are already three times higher than five years earlier. This is likely due to the geographical position as well as the price-competitive suppliers.

Prices in Poland tend to be lower. Statistics indicate a trade value of 1.08 euro per kilo for imported lemons in Poland, compared to 1.53 euro in Germany and 1.41 euro in France. Poland is a price–driven market. As a lemon supplier you will have to match the price level that Polish buyers are used to. Nearby suppliers are your main threat.

Italy: large imports despite national production

Lemons are well integrated in Italian life. The use of lemons is high, but so is the production. As an exporter you will have to focus on the additional need besides the Italian production and imports from Spain.

Italy produces around 400,000 tonnes of lemons annually. The majority of the production takes place in Sicily, but the country is also known for its traditional lemons on the Amalfi coast with Protected Geographical Indication (PGI). Lemons in Italy are not only consumed as fresh fruit or for culinary purposes, but are also a popular ingredient for ice cream and limoncello.

As a lemon producer Italy has less need for imported lemons. Nevertheless, Italy imported 115,000 tonnes of lemons in 2018 and (only) exported 47,000 tonnes. This makes Italy a net importer. Almost half of the imported volume came from Spain.

In years when Spanish yields are low, Spain starts to import more lemons and becomes a more attractive market for non-European suppliers than Italy.

The opportunities in European markets depend on the year to year conditions

In general forecasting the demand for lemons on the European market is a difficult task. The consumption in each of the countries is growing, but the opportunities vary from year to year and depend largely on two factors:

- Production in Spain: When Spanish production is low, the demand for non-European lemons will increase.

- The weather: Hot weather in Europe can boost the consumption of lemons.

Prices also have influence on consumption, although less than with other fruit because consumers only buy the amount of lemons they really need. When global supply volumes are high, prices drop and consumption has some room to grow. But the lemon market is easily oversupplied. For profitability a lack of supply is often much better for exporters.

Tips:

- Find potential trade partners at the Fruit Logistica in Germany or at the Fruit attraction trade fair in Spain.

- Monitor exchange rates to determine which markets offer best purchasing power. The United Kingdom and Poland are relatively large markets for fresh lemons, but neither uses the euro as a national currency. These countries will have more purchasing power when their currency is strong.

- Make use of Dutch traders when you have difficulties in entering different European markets. Dutch importers often have wide experience in trading and are familiar with the different European preferences. Dutch fruit companies have a no-nonsense mentality, so calling or visiting them often works better than e-mailing.

4. What trends offer opportunities on the European lemon market?

The interest in natural food

Lemons often undergo chemical treatment to reduce diseases and prolong shelf life. With the increasing consumption of fresh lemons and more attention to health, the European consumer has a preference for a natural and clean lemon. To reach a wide consumer group it is important that you avoid direct chemical use on lemons as much as possible. Natural (residue-free) lemons gain terrain over treated lemons.

The peel of lemons can be used for culinary purposes, and they are even promoted in Europe because of their health benefits. That is why conscious consumers will pay more attention to the label. As a matter of fact, a few years ago the Court of Justice of the European Union confirmed the mandatory use of labelling in citrus fruit indicating the preservatives and other chemicals used in the post-harvest treatment. As an exporter you must be clear to your buyer about your chemical usage.

In the near future the allowed Maximum Residue levels (MRLs) will be further sharpened. For now the lemon sector in Europe was able to slow down these measures, for example in the case of using Imazalil for which a three-year transition period was negotiated.

Tips:

- Verify the allowed Maximum Residue levels (MRLs) in the European MRL database. You can search on product as well as active substances or pesticides.

- Try to diminish the use of chemicals, even if they are legally allowed. Use organic substitutes, for example.

Fewer trade barriers change trade flows

Now that the United States have eased some of the trade barriers for South American lemon producers, there is less need to supply the European market. This leaves room for lemon suppliers from other countries.

Argentina regained access to the United States lemon market in 2017, after a ban of fifteen years. Although Argentinian exporters are cautious and exports to the United States are still very low, a higher volume of Argentinian lemons could be destined for the east coast of the United States instead of Europe.

In the neighbouring country Chile, lemon exporters benefit from improved relations with the United States, allowing lemons that meet specific requirements to enter the market without methyl bromide fumigation. This results in a better controlled cold chain and longer shelf life. For Chile the United States is already the most important market, but with trade conditions improving there is less reason to develop alternative markets.

It is important to stay up to date with changing trade conditions that can influence future trade flows. The improved trade conditions for Argentina and Chile will contribute in channelling more lemons to the United States and at the same time help these countries deal with their surplus production. But it can also relieve pressure on the European market and create opportunities for other origins with a similar season such as South Africa, Uruguay and Bolivia.

Increased global production and low processing value threaten lemon margins

A large volume of lemons is destined for the processing industry. The combination of processing and fresh exports is good because it gives flexibility in an inelastic lemon market. But at the moment the prices for lemon derivatives are very low. This makes it difficult to get rid of the excessive production of lemons and has put extra pressure on the fresh lemon trade.

The demand of large processors such as Citromil, Citromax and end users of lemon derivatives such as Coca Cola are of great importance to the lemon industry. In Argentina the majority of the lemons are processed and Spain is the second-largest processor. But also in other countries with limited fresh export potential, companies such as Totaí in Bolivia invested in large orchards and managed to step into the lemon ingredients market.

The demand and the supply contracts in derivatives play a role in the development of the lemon sector. When spot prices for lemon derivatives decrease, you can expect growers to spend more attention to the fresh market. Adding this to growing lemon production in Spain, South Africa and Turkey, you can expect markets to become saturated again in the near future.

Tips:

- Check out the developments in lemon oil in the market reports of essential oil specialist Ultra International.

- Find out what other trends influence your lemon exports by reading the CBI trends for fresh fruit and vegetables in Europe.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research