Entering the European market for mangoes

When exporting mangoes to Europe, you should expect frequent and thorough phytosanitary inspections. European authorities are very cautious about pests, especially fruit flies. Demand for non-fibrous mango varieties, such as the Kent variety, is high. Almost all suppliers export Kent or similar varieties to Europe. Make sure that you supply of Kent mangoes during a different season from Brazil and Peru, as these countries export large quantities of this variety to Europe already.

Contents of this page

1. What requirements must mangoes comply with to be allowed on the European market?

There is no specific European marketing standard for mangoes. Products that are not covered by a specific European Union (EU) marketing standard must meet the general marketing standards (GMS) noted in Annex I, Part A of the EU Regulation No 543/2011.

However, you can refer to 2 other marketing standards created specifically for mangoes. One is developed by the United Nations Economic Commission for Europe (UNECE) and the other by the Codex (CXS 184-1993). These 2 documents can be useful when preparing exports. The Organisation for Economic Cooperation and Development (OECD) has also developed a brochure with pictures based on the UNECE standard. For other information about EU requirements, please check the EU trade assistance platform (My Trade Assistant of Access2Markets). The HS Code for fresh mangoes is 080450. You can also visit CBI’s website on buyers’ requirements for fresh fruit and vegetables to find what other requirements fresh mangoes must meet to be allowed on the European markets.

What are mandatory requirements?

Pesticide residues and contaminants

Mangoes can be affected by a wide variety of diseases if good agricultural practices are not implemented on your farm. Mangoes can suffer from fungal (anthracnose, mildew) or bacterial (bacteriosis) attacks. Several chemicals are used to treat mango orchards. EU legislation on Maximum Residue Levels (MRLs) sets limits for the chemicals authorised on all crops. To find an updated list of all the pesticides that you are authorised to use on mangoes, please check the EU database for pesticide residues. Select the crop in the ‘Product box’ and the database will list all the pesticides authorised on that crop as well as their MRLs.

Note that buyers in several EU Member States, such as the United Kingdom, Germany, the Netherlands and Austria, use even lower maximum residue levels than those established by European legislation.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that lead contamination in your mangoes remains below 0.10 mg/kg and cadmium below 0.050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Microbiological criteria for fresh cut mango

The risk of microbiological contamination increases when mangoes are being processed. For fresh pre-cut fruit (ready-to-eat), the following microbiological criteria apply:

- E.coli contamination must be below 100 cfu/g during the manufacturing process. Having 2 out of 5 samples up to the 1,000 cfu/g limit is still acceptable.

- Salmonella in cut fruit must be absent throughout their shelf life, in at least 5 25 g samples.

Phytosanitary regulation for fruit flies in mangoes

Fruit flies (Tephritidae) affect the mango trade significantly. This is a very important issue for mango producers, as major markets will not import fruit fly-infested products into their territories. In order to import mangoes into Europe, a phytosanitary certificate is required, as specified in the Annex XI Parts A and B of Regulation (EU) 2019/2072. Hydrothermal treatments, also called hot water treatments, are 1 of the most effective ways to prevent the development of fruit flies. Mango exports to the US must be hot water treated. This does not yet apply yet in the case of mango exports to the European Union.

The European Directive (EU) 2019/523 requires phytosanitary certificates for mangoes to include 1 of the following statements, which must be communicated by the national plant protection organisation in the country of origin in advance:

- The fruits originate in a country recognised as free from Tephritidae (non-European);

- The fruits originate in an area established by the national plant protection organisation in the country of origin as being free from Tephritidae (non-European);

- No signs of Tephritidae (non-European) have been observed at the place of production and in its immediate surrounding since the beginning of the last complete cycle of vegetation (this includes official inspections at least monthly during the 3 months prior to harvesting and on the harvested fruit). Information on traceability must be indicated on the certificates;

- The product has been subjected to an effective treatment to ensure freedom from Tephritidae (non-European). The treatment data should be indicated on the certificates.

This requirement puts more pressure on plant health authorities. Authorities in producing countries have to be able to declare a region pest free or check on specific areas and product treatments. If local authorities are not sufficiently equipped for this phytosanitary control, it will affect your potential to export fresh mangoes to Europe.

Tips:

- The parasitic pressure is significant during the West African rainy period. When exporting from these areas, regular trapping exercises can help you know when to stop exporting so your products are not taken and destroyed on arrival.

- Read about the effects of hot water treatment in the FAO’s publication on ‘Low cost, high impact solutions for improving the quality and shelf-life of mangoes in local markets’.

- Learn more about the European phytosanitary rules in Council Directive 2000/29/EC and the new Implementing Directive 2019/523 on the protective measures against the introduction of harmful organisms to plants and plant products in the European Union.

- Check which (other) fruit and vegetables require a phytosanitary certificate in the lists of Annex XI and XII of Regulation (EU) 2019/2072).

Quality standard

Information on quality, size, packaging and labelling requirements for mangoes can be found in:

- The UNECE standards for mangoes;

- The Codex Alimentarius Standard for mangoes (‘Food code’ of WHO and FAO).

At the very least, mangoes should meet the general quality requirements (see Table 1). At minimum, Europe almost exclusively requires Class I mangoes. Mangoes in this class must be of good quality and within the permissible tolerance levels. In no case may the defects affect the fruit flesh, the general appearance of the produce, the quality, the keeping quality and presentation in the packaging.

Table 1: Quality requirements and permissible tolerances for fresh Class I mangoes

| General quality requirements (all classes) |

|

|

|

|

|

|

|

|

|

|

|

| Additional requirements and permissible tolerances for Class I mangoes |

|

|

|

|

|

|

|

|

Figure 1: Mango with quality ‘Extra’ Class, Class I and Class II (from left to right)

Source: OECD (2012), Mangoes, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Tips:

- Maintain strict compliance with quality, delivering it as agreed with your buyer. Being careless with your standards will lead buyers to raise issues with quality.

- See example images of mangoes in different classes and types of damages in the OECD International Standard for mangoes.

- Find out how to apply the best quality management for mangoes by reading the ‘Mango postharvest best management practices manual’ on Mango.org.

Size and packaging

Fresh mangoes are classified according to Size Codes A, B, C and D. Size is determined by the weight of the fruit or by count.

Table 2: Size codes for mangoes

| Size code | Weight in grams | Maximum permissible difference between fruit within the package in grams |

| A | 100-350 | 75 |

| B | 351-550 | 100 |

| C | 551-800 | 125 |

| D | >800 | 150 |

Source: UNECE standards for mangoes

The common mango varieties are mostly traded in packing size 7 or 8, meaning 7 to 8 mangoes per 4 kg box, which is the preferred size in the Netherlands, the United Kingdom and France. In Germany, size 6/7 is also common, since large mangoes are popular. In Scandinavia mostly smaller sizes are sold individually. Spain is more flexible with sizes and can handle both large and small sizes. Mango seasons always start with smaller fruit, but prices generally adjust when mangoes reach size 9.

Packaging requirements vary among customers and market segments. They must at least be packed in new, clean and quality packaging to prevent damage and protect the product properly. Common packaging for mangoes includes 4 kg cardboard boxes.

Additional protection to extend shelf life

To protect the fruit, coatings can be used, such as beeswax (white or yellow), carnauba wax, shellac or microcrystalline wax. When supplying organic mangoes, the coating should be organic as well, such as organic beeswax or carnauba wax. There is also research being done with other natural coatings, such as tests with natural coatings of cassava starch and citric pectin by the National University of Colombia.

There are several developments in protecting the shelf life of mangoes. As a supplier, you should follow these developments. For example, new innovations include Apeel, a plant-based protection that keeps moisture in the fruit and slows down the influence of oxygen and spoiling rate. The technology was recently adopted for the mangoes of Nature’s Pride in the Netherlands. Another solution is offered by Hazel Technologies, which uses 1-MCP technology to reduce the respiration rate and increase resistance to ethylene. This technology was adopted by the Peruvian mango exporters Fundo Los Paltos and FLP of Peru SAC.

Note that there is a European MRL for 1-methylcyclopropene (1-MCP) of 0.01mg/kg, although it is difficult to detect as a residue. However, the use of 1-MCP can be detected by a recently developed test.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Offer your buyer different sizes to make it easier for you to sell different sizes from your production. Negotiate to include 1 mixed pallet per shipment but make sure the other sizes are the same per pallet.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

- See the buyer requirements for fresh fruit and vegetables on the CBI market information platform for the legal labelling requirements.

What additional requirements do buyers often have?

Variety

Fibreless and low-fibre mangoes are the most appreciated by European buyers. The Kent variety has become the standard in Europe, followed by the Keitt variety. Keitt is a variety that enters the market a little later in the season. Peru is the main supplier of Kent to the European market. Since 2021, Peru seems to be progressively stretching the mango season from 6 to almost 7 months. Buyers are aware that these varieties cannot meet the entire demand and that more varieties are needed.

The Palmer variety is almost fibreless and often replaces orchards with the less popular Tommy Atkins, especially in Brazil. These mangoes are very common in Brazil and grow in areas where the cultivation of Kent and Keitt is more complicated. Tommy Atkins is still commercialised in Europe, but at a fast-decreasing pace due to the fibrous flesh.

As long as the market for mangoes depend on different climate zones, Palmer and other varieties can coexist with Kent and Keitt. Specialist mango buyers and ethnic wholesalers only require the most exotic varieties.

Maturity

Mangoes must be harvested when there is still time to continue their ripening process. Colour and texture may vary depending on the variety, but the consistency in colour and texture of the entire batch should be the same.

In addition, buyers often have specific preferences in terms of ripening and delivery to specific end customers. This is why it is important to discuss specifications, such as internal maturity level and Brix level, with your buyer beforehand.

Tips:

- Consider the mode of transport used when determining the best moment to harvest your mangoes based on buyers’ specifications.

- Check with your buyer on the required maturity level, such as brix (sugar content) and dry matter (usually between 14% and 16.5%). This can vary depending on the variety, time to market and buyer preference.

- See the stages for mango maturity in the Mango Maturity & Ripeness Guide from Mango.org.

Certification

Common certifications for mangoes include GLOBALG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommended.

Tip:

- Start with your GLOBALG.A.P. certification before trying to export to Europe. It is almost a basic requirement, especially when you want your product to end up in large retail chains.

Sustainability and social compliance

Mango cultivation often involves small growers. For fruit collectors and exporters, it is important to show that they are engaged in the well-being of their production sources, both socially and environmentally. This is a growing concern for many buyers and retailers. The best way to do this is through adapting social and environmental standards, such as Sedex Members Ethical Trade Audit (SMETA) and GLOBALG.A.P..

In the near future you can expect new environmental and social initiatives, with standards that become more extensive and with regular audits. For example, the Sustainable Trade Initiative for Fruit and Vegetables (SIFAV), a private covenant between European importers and retailers, has formulated new goals towards 2025 that include a fair living wage and the reduction of the carbon footprint.

Retail chains sometimes have their own standards, such as Tesco and the Tesco Nurture programme, an add-on module to GLOBALG.A.P..

The Green Deal

Some of the most relevant legislation to make Europe climate-neutral is incorporated into the European Green Deal (EGD). The EGD is a set of policies that aim to lead Europe to climate neutrality by 2050. Climate neutrality means reaching a balance between greenhouse gas emissions and removals, which is expected to limit global warming. This state is known as ‘zero emissions’ and is reached if global warming is limited to 1.5°C.

The most important impacts of the EGD for mango suppliers are the following:

- Stimulation of organic production (and consumption) – 1 of the goals of the Farm to Fork Strategy is to increase the share of organic agricultural land in Europe to 25% by 2030.

- Introduction of the environmental footprint methodology – In line with sustainable food systems, the European Commission will publish official methods for green claims to prevent greenwashing and better inform consumers about the food choices they make.

- Endorsing greater corporate responsibility and sustainability standards through the Corporate Sustainability Due Diligence Directive.

- Reducing packaging waste – The main aim of the packaging waste directive is that “All packaging in the EU is reusable or recyclable in an economically viable way by 2030.” Some countries are aiming to reduce plastic even faster than proposed by the EGD. For example, France has already imposed a ban on plastic packaging for fresh fruits and vegetables in containers of less than 1.5 kg.

- Reducing the usage of pesticides by 50% by 2030 – A proposal for the directive of sustainable use of pesticides has been adopted.

Tips:

- Implement at least 1 environmental and 1 social standard; complying with both is often necessary. See the Basket of Standards of the Sustainability Initiative for Fruit and Vegetables (SIFAV).

- Find out about specific sourcing information of large retail chains. You can usually find these on their corporate websites, for example the approach to sourcing fruit, vegetables and salad crops by Marks & Spencer.

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

What are the requirements for niche markets?

Quality for special varieties and tree-ripened mangoes

Special mango varieties such as Nam Dok Mai and Alphonso as well as common varieties that are tree ripened and airfreighted are sold in a high market segment. It is crucial for your buyer to receive a perfect product. To achieve this, you must have a perfect timing for fruit picking, reduce post-harvest transit times, maintain a perfect cold chain and excellent quality control, and pay extra attention to packaging.

Tip:

- Invest extra in packing when supplying airfreighted mangoes or special varieties. This will protect the fruit, but also helps in the presentation of your product.

Organic

Organic certification for mangoes is required by a small, but growing niche market. Organic mangoes are mostly traded by specialised organic fruit importers, such as ProNatura (France), Biotropic (Germany), Eosta and OTC Organics (Netherlands).

To market organic products in Europe, you must use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier.

Import of organic products is covered by the Regulation (EU) 2018/848. Please note that this regulation places stricter controls on these products. Your European partner must be able to provide detailed documentation to various control agencies at all times to demonstrate the organic integrity of imported products. Traceability of all the growing processes must be available to control authorities.

A new technology for labelling organic mangoes is laser, which avoids the use of plastic packaging and stickers to mark organic mangoes. This is for example implemented in the Spar supermarkets in Austria.

Tips:

- Consider organic mangoes as a plus, not as a must. Remember that implementing organic production and becoming certified can be expensive; you must be prepared to comply with the entire organic certification process.

- Document all your growing processes.

- Keep up to date on the new developments in the organic market, such as innovative packaging and labelling for organic fruit. Laser technology is likely an investment that your buyer will do, although it may become a new standard for exporters in the future.

- Read the buyer requirements for fresh fruit and vegetables on the CBI market information platform to learn more about organic.

2. Through what channels can you get mangoes on the European market?

Specialised traders import most mangoes, some of which have their own packaging and ripening facilities. Ready-to-eat and fresh cut mangoes are popular in supermarkets, where they are often sold at premium prices. Wholesale markets supply speciality retailers, ethnic stores and street markets.

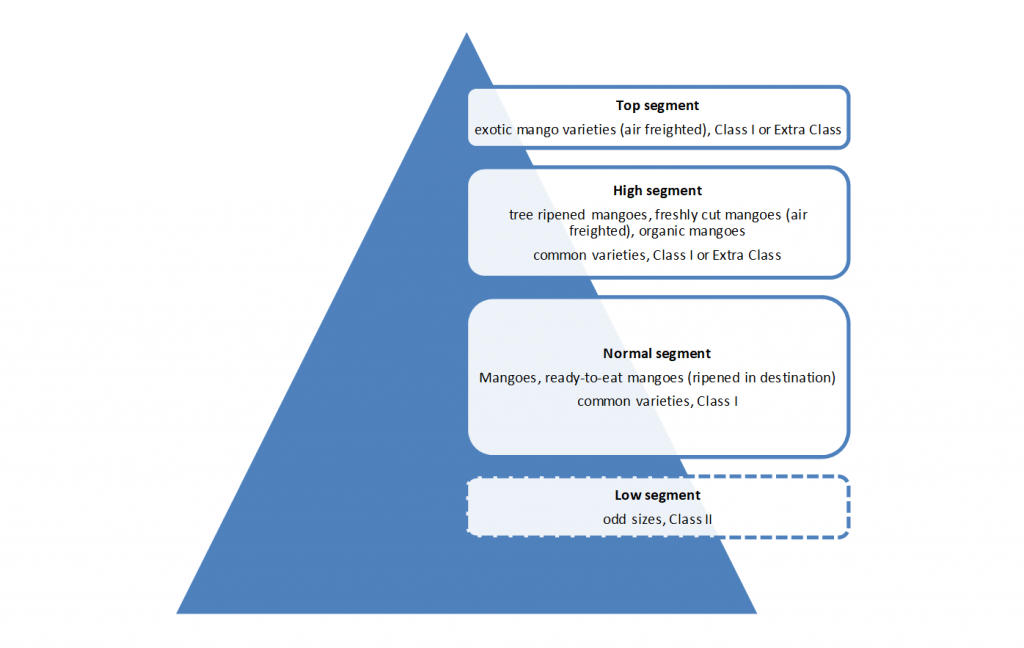

How is the end market segmented?

Main segment

The main segment for mangoes are Class I mangoes and common varieties such as Kent and Keitt, either conventional or ripened in the destination country. Class II mangoes are not common, but odd sizes or mangoes that fail to meet the usual specifications are sold for any acceptable price. See also the buyer requirements above.

High segment: Tree-ripened, fresh cut and organic

Common tree-ripened mango varieties are transported by air and sold in the higher segment. These transportation costs ensure that these mangoes can be sold in the high-end segment. Demand for air-freighted mangoes is high at the beginning and end of the season when sea shipments are not yet on the market or are scarce. Since they are high-quality products, airfreight mangoes are usually sold through specialist retailers or specialist supermarkets, such as Grand Frais in France.

Fresh cut and organic mangoes are becoming more popular and are also part of a high segment. Fresh cut mango is available throughout the year in European supermarkets sold at high prices due to the processing and airfreight costs. However, it does save on shipping weight (no peel, no pit) and provides the consumer with a practical and quality product. Organic mangoes can be difficult to source and are not always available in standard retail.

Top segment

In the top segment, you can find exotic, tree-ripened varieties for luxury and specific ethnic markets. They are valued for their superior taste and sweetness, but their total volumes are very small compared to the common mango trade. The niche demand and the air-freight costs are what makes these mangoes expensive for consumers. They are generally sold by specialist and ethnic retailers or used in the food service industry.

Figure 2: Market segments for mangoes in Europe

Source: ICI Business

Tip:

- Make regular contact with your buyers to follow the market developments. This will help you in planning and segmentation. For instance, picking your mangoes later and ripening them for airfreight means you will be able to enter the market earlier, before the start of the sea freight campaign, or later, after the last sea freight shipments. This works best for markets that have relatively low supply of the variety you are shipping.

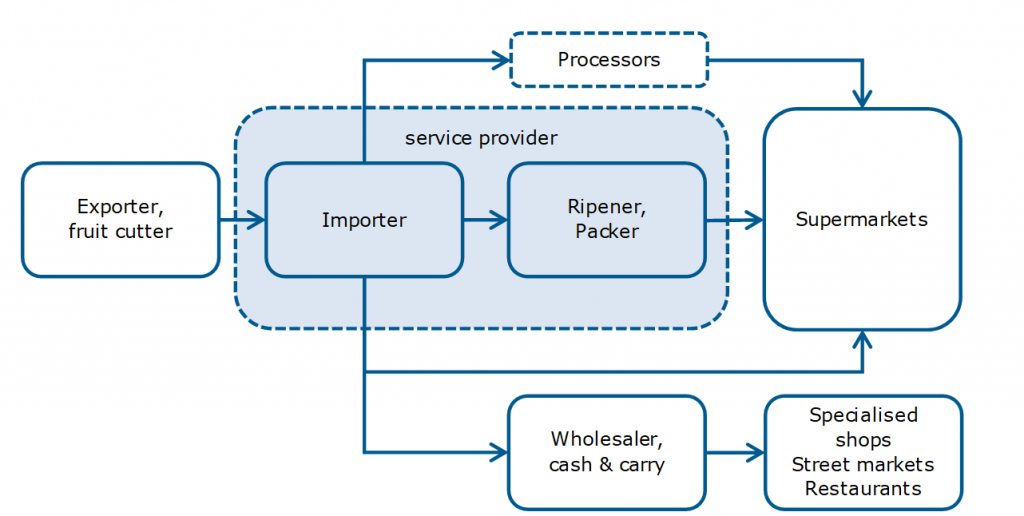

Through what channels do mangoes end up on the end market?

Importers and service providers

Importers play a central role in the distribution of mangoes. They are familiar with all the different requirements of end clients and are able to distribute to different markets.

Some importers have ripening and packing facilities, which are important for the growing segment of ready-to-eat mangoes and for supplying to supermarkets. This is how mango importers such as Nature’s Pride and TFC Holland become full-service providers to supermarkets.

Supermarket programmes

Most mangoes are sold through supermarkets, which become increasingly involved in sourcing. This is relatively easy when mangoes are sourced from Spain. For example, German supermarket Rewe established Eurogroup in Spain to oversee production and sourcing.

However, overseas mango imports during the rest of the season are often complicated. Fluctuations in price, volumes and quality continue to provide opportunities for independent traders. Supply contracts for mango are often combined with purchases on the spot market.

Wholesalers (spot market)

Traditional fruit wholesalers cover the spot market, moving according to trade fluctuations. They supply to specialised shops, street merchants, restaurants and hotel chains. Sometimes these companies combine import and wholesale activities, but a traditional wholesaler does not take many risks with importing long-distance mangoes – with the exception of ethnic mango varieties which are flown in. Typical wholesale markets include Rungis in Paris and Mercabarna in Barcelona.

Due to the COVID-19 pandemic, the sales of air-freighted mangoes in Europe from certain countries such as India, Pakistan and Thailand dropped. This is also true for the sales revenue in the food service sector. The trade from these countries has recovered since the pandemic.

Large fruit wholesalers such as Staay Food Group maintain a large international network and offer their own cash & carry service points, where clients can purchase a wide variety of fruit and vegetables.

Non-specialised (cash & carry) wholesalers such as Metro supply to the same end markets but depend more on the service of importing companies. They are also able to work with long-term contracts, just like supermarkets.

Figure 3: Market channels for mangoes

Source: ICI Business

Tip:

- Choose an importer based on the size and ambition of your company, keeping in mind that importers and distributors vary in their relationships with the retail sector and their level of requirements. Some supply to large retail chains where volume and compliance is strict, while others specialise in the spot market.

What is the most interesting channel for you?

Participating in a retail programme gives you the maximum security and often more profitable margins. However, the demands are high and the room for negotiation is minimal.

The most likely way to become part of a retail programme is to partner with a service provider that has local facilities and supply agreements with retailers. Selling directly to supermarkets is much more difficult because they do not want to deal with quality issues from individual exporters. It is therefore easier for them to interact with service providers.

Because mangoes are difficult to source, there are many trade options besides direct retail. Trading companies that supply the spot market are the easiest to contact. In a good market, they can provide very profitable returns. However, there are no guarantees. Spot market prices fluctuate more and the risk for exporters is greater. It is best to look for a mango specialist with experience and a wide network in the industry, such as the Dutch-German company Hars & Hagebauer.

Tip:

- Go to trade fairs to find buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and Fruit Attraction in Madrid.

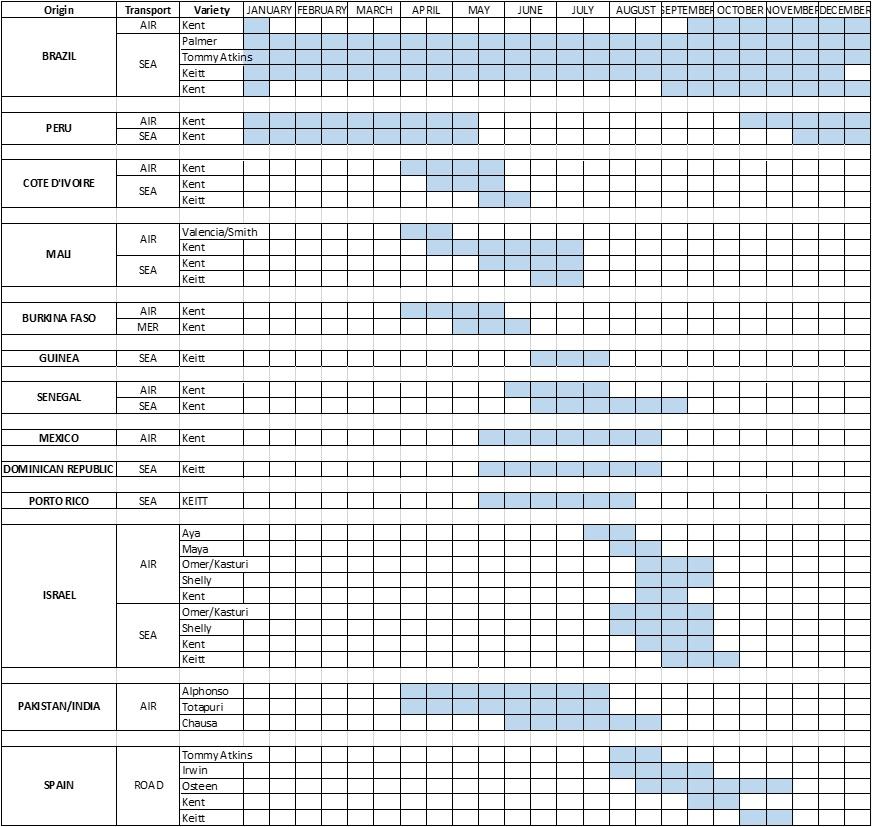

3. What competition do you face on the European mango market?

Brazil and Peru are the main mango suppliers to the European market. Brazil is the only country that supplies mangoes all year round. In winter, mangoes in Europe mainly come from these 2 countries. In summer, several other countries supply the European market with mangoes. West African, Central American, Caribbean, Middle East and Asian countries, and Spain then supply the market. Climate changes affect seasonality, causing certain campaigns to overlap.

Which countries are you competing with?

Source: FRUITROP/Eurostat

Brazil: available all year round thanks to 4 varieties

Brazil’s mango production is spread all over the country, allowing it to have mangoes all year round. The northeast region produces the most volumes. Its large production is supported by a range of varieties and suitable cultivation techniques.

Brazil supplied more than 172,000 tonnes of mangoes to Europe in 2022, making it the main supplier. Its supplies of mangoes have been rather stable these past 3 years, ranging between 170,000 and 175,000 tonnes. Brazil exports 4 varieties to Europe; Palmer and Tommy Atkins all year round, Keitt and Kent during summer and winter, respectively.

Over the last few years, Brazil has been implementing changes to its production. Within the last ten years, Palmer exports have now become Brazil’s number 1 shipment to Europe. Despite its attractive colours, consumers have lost interest in Tommy Atkins because of its fibrous flesh. Tommy Atkins now accounts for less than 20% of Brazil’s exports, when ten years ago it represented the majority.

Tips:

- Read how the British retailer Marks & Spencer managed to introduce fresh cut mangoes together with the Brazilian Company Tropical Fresh in the article ‘With love from Brazil: the mango's journey to Britain’ of The Telegraph.

- Learn from successful mango companies in Brazil. You can find several of these companies on the member list of Abrafrutas, the Brazilian association of producers and exporters of fruit and derivatives.

Peru: the main supplier of Kent to the European market

Peru is the second largest supplier of mangoes to the European market. Several varieties (Edwards, Ataulfo, Haden, Keitt and Kent) are grown in Peru, but the country is mainly known for its exports of the Kent variety. Its sea freight season runs from November to April. Its airfreight season starts earlier (Mid-October) and ends later (May). Currently, Peruvian Kent is the benchmark for mangoes on European markets. Peruvian exports are uniform in appearance, with attractive colours that are recognisable. Mangoes from other countries that have the same supply season are often sold for lower prices compared to Peruvian mangoes.

In 2022, Peru exported more than 138,000 tonnes of mangoes to Europe. Peru has been gradually spreading its export seasons. Sea freight exports used to run from November to March and airfreight exports used to run from mid-October to April. They now run to April and May, respectively. These extended marketing seasons are said to be partially related to climate changes, which causes trees to flower later. But climate change does not explain it all. Peru is also taking advantage of its good mastery of the production of Kent to gain the best advantages in the very active European market. This trend will undoubtedly be confirmed and perhaps even intensified in the years to come. This situation somewhat complicates the marketing of the first Kent mangoes from West Africa, as the last Kent mangoes from Peru are still on the market.

Tip:

- Check the mango section of Agrodata Peru to see export development and the main Peruvian exporters.

Spain: the main mango-producing European country

Spain is the third largest supplier of mangoes to the European market. Spain is the main European country that produces and exports mangoes. Its supplies (32,000 tonnes) are very similar to that of Côte d’Ivoire. Spain produces several mangoes (Tommy Atkins, Irwin, Kent, Keitt), but its most well-known variety is the Osteen, which is well-liked by European buyers and sold at high prices. Spain’s mango season starts in August and ends in November. Spain supplies European markets by road.

In 2022, the estimated volume of Spanish mango exports was 32,000 tonnes. Aside from during the COVID-19 pandemic, Spanish mango exports are rather stable, fluctuating between 30,000 and 32,000 tonnes.

Côte d’Ivoire, leading West African origin

Côte d’Ivoire is the fourth largest supplier to the European market. Côte d’Ivoire exports a wide variety of early mangoes (Amélie, Valencia Pride, Zill, Smith) that mark the start of the West African season, all of which are mostly airfreighted. However, Côte d’Ivoire’s main campaign centres around Kent and lasts eight weeks, from April to May.

In 2022, Côte d’Ivoire exported a little more than 31,000 tonnes to Europe. Its airfreight season is short and the country has to deal with airfreight exports from Peru as well as from Mexico. Côte d’Ivoire is the leading West African country (before Senegal, Mali and Burkina Faso) that exports mangoes to Europe. It has a robust logistics infrastructure that allows it to be a major hub for sea cargo exports from landlocked countries, such as Mali and Burkina Faso. Because Côte d'Ivoire is close to Europe in terms of transit time, exporters can harvest the mangoes a bit later, which gives them a better taste.

Côte d’Ivoire suffers from fruit fly infestations. Several management projects have been tackling this issue without really reducing this issue. The best solution so far is to regularly set traps to monitor fruit fly populations and quickly stop sea freight exports when fruit flies start to emerge at the start of the rain season. These new phytosanitary rules are used to reduce excesses, with preliminary positive results for West Africa in 2020.

Tips:

- Compare the performance of your country in the number of interceptions of harmful organisms in imported mangos in the European Union Notification System for Plant Health Interceptions – EUROPHYT. To make a good impression, take the phytosanitary requirements seriously.

- Set up regular and frequent fruit fly trapping to find out when to stop exporting. The presence of fruit flies can lead to the destruction of an entire consignment. The cost for this is often charged to the exporter. For you as an exporter, the cost of losing just 1 container could make the difference between a profitable and a non-profitable campaign.

Dominican Republic: a good supplier of Keitt

The Dominican Republic is a consistent supplier to the European market. Its campaign starts with Mingolo mangoes shipped by air, but these volumes are limited. The Dominican Republic mainly exports Keitt mangoes by sea. Its campaign lasts 6 months from April to September.

In 2022, the Dominican Republic exported a little more than 20,000 tonnes of mangoes to Europe. Keitt mangoes are much appreciated by European buyers, especially when the supply of Kent is low.

The Dominican cultivation of mango continues to increase. But the summer is a difficult period to supply mangoes to Europe because there are many origin countries involved. On the other hand, when the global demand is high, Europe has to compete with purchasers in the United States too.

Israel: the only country supplying Omer/Kasturi and Shelly varieties to the European market

Israel produces a wide range of mangoes and is a consistent supplier to the European market. Like most suppliers, Israel exports Kent as well as Keitt mangoes. But most of all, Israel supplies 3 varieties that are only produced in Israel: Omer/Kasturi and Shelly mangoes. These are very well-liked by European buyers. Israel also markets an early Aya/Maya variety that kicks off the start of the Israeli campaign.

In 2022, Israel exported a little more than 13,000 tonnes of mangoes to Europe. Israel supplies the European market by air or by sea. The Israeli season runs from July to October. There is no indication that Israel will deviate much from their normal supply in the coming years.

Interesting developments: Mexico, India, Pakistan and West Africa

Mexico is the world’s number 1 mango exporter, producing around 400,000 tonnes per year. These exports are mainly destined for the North American Market (USA and Canada). Mexico’s exports to Europe are minimal and only by airfreight. Mexico’s season to Europe runs from May to August, while Mexico’s season to the North American market runs from February to October. In 2022, Mexico exported slightly over 5,000 tonnes to Europe.

India and Pakistan produce several varieties. They export Alphonso, Chausa, Kesar Totapuri and Anwar mangoes to Europe, which are mainly sold through the ethnic market. In 2022, Pakistan exported little more than 6,000 tonnes of mangoes, while India’s exports were slightly below 4,000 tonnes. India and Pakistan also face fruit fly issues, which caused some restrictions to be imposed on Indian mango exports to Europe in 2019.

West Africa is of interest to many European buyers. They see this region as a logical place to source mangoes because of its proximity to Europe. Besides Côte d’Ivoire and Senegal, other West African countries (Mali, Burkina Faso and Ghana) show signs of growth despite their sometimes unreliable quality or their difficulties in managing phytosanitary issues.

Figure 5: Indicative supply calendar for mangoes

Source: Pierre Gerbaud-Compiled by Thierry Paqui

Tips:

- Identify your direct competitors according to the supply calendar and check their status. Knowledge is key in taking advantage of supply gaps. Previous seasons and supply volumes can also have great influence on mango demand — try to adapt to these developments.

- Communicate to buyers when your offer is most ideal in terms of quality and variety, preferably Kent.

Which companies are you competing with?

The European market is supplied by various types of dealers. These suppliers can be large integrated growers, small growers who export through cooperatives, or individual enterprises that have their own orchards or buy their mangoes from small growers. The quality of the final products is highly dependent on the level of integration or control exercised before export.

Agrodan – Brazil

Agrodan is 1 of the main mango suppliers from Brazil. They produce mangoes on 1,000 hectares and their export is fully prepared to enter several supermarkets in Europe. Besides GLOBALG.A.P., which is a necessity, they adopted the specific retail standards of Marks & Spencer’s Field to Fork, Tesco Nurture and Albert Heijn protocols. By working according to these standards, they are perceived as a serious and well organised supplier.

The mango cultivation of Agrodan’s is concentrated in 1 region in the north of Brazil. This means that in spite of being a large supplier, they depend on the yields and the climate of a single region.

Tip:

- Use your size to promote yourself, if possible, or try to combine forces with other mango companies. When you become a medium or large producer, you have better chances with larger buyers in the supermarket channel.

Dominius – Peru

Dominus works with a group of 30 farmers with a total of 500 hectares growing mangoes and avocados. Having the Fair for Life label on their mangoes, they have an added value in the European market, being recognised for their social responsibility and their efforts for local communities in Peru.

Their client, Nature’s Pride in the Netherlands, appreciates the social focus of the company and has been buying their mangoes since 2007. However, it will be a challenge for Dominus to keep up with the fast developments taking place in Peru, where other producing exporters are rapidly increasing standards and production volumes.

Tips:

- Add value by adapting social certifications or organising community projects.

- Try to integrate or join forces with strategic buyers. Large fruit buyers such as Total Produce Group and Greenyard, and sometimes specialist buyers such as Nature’s Pride, often support or participate financially in the businesses of their suppliers.

Domaine Nembel – Côte d’Ivoire

Nembel is 1 of the leading brands exported from Côte d’Ivoire. Its orchards mainly grow Kent, Keitt and Zill mangoes. Its production is roughly around 10,000 tonnes per year. The Nembel brand can be found in France, the Netherlands and Switzerland, which are its main target markets. The brand can also be found in other European countries, where it is re-exported. The company supplies the domestic as well as neighbouring markets.

Tips:

- Achieve fairtrade certification to access other market segments.

- Use the translate function in your web browser to access information on websites that cannot be accessed in English.

Les Saveurs du Sud – Senegal

It is difficult for small farmers to reach international markets. Senegal’s Copex-Sud cooperative, which has 3,500 producing members, managed to get investors and support organisations on board such as Oiko Credit and CBI. By setting up the commercial company Les Saveurs du Sud and a processing plant for mangoes, they were able to secure export markets in Europe.

Tip:

- Become investable as a supplier. Show social impact through a great number of growers and organise your supply chain and export potential well.

TROPS - Spain

TROPS is 1 of the Spanish brands well-known for its tree-ripened quality mangoes. The brand markets a wide variety of mangoes (Tommy Atkins, Irwin, Osteen, Kent, Palmer and Keitt). Like several Spanish mango producers, TROPS is also involved in the avocado trade.

Which products are you competing with?

Competition between varieties

European consumers prefer fibreless mangoes. The demand for Kent is very high, which has become the benchmark for good-quality mangoes. When supplies of Kent are low, the demand tends to shift to other less fibreless varieties, namely Keitt and Palmer. Consumers are also attracted to varieties with strong and bright colours (Osteen Aya, Maya, Shelly, Omer/Kasturi). All these fibreless or colourful mangoes are available in the high-end markets and are supplied by air.

Competition with local summer fruit

During summer, when many fruits are in-season and often low-priced, sales for exotic fruits like mangoes are more difficult. Consumers in southern European countries that produce a lot of seasonal fruits (France, Italy, Portugal and Spain) return to these fruits as they become more available. Mango imports continue during the summer months but with less consistent volumes.

Tip:

- Make sure to have alternative markets you can supply to when Europe is not able to provide acceptable prices for your mangoes.

4. What are the prices for mangoes on the European market?

Price development

Several factors can affect prices over the course of a season. The massive and cumulative supplies from Brazil and Peru at certain times throughout the year or the lack of demand can impact sales significantly. Demand and sales are also affected by increasingly frequent logistical problems, such as ship delays. The social-political environment should also be considered. In recent years, social-political movements in Peru have severely limited its exports. Finally, the current European economic context is defined by inflation resulting from the war in Ukraine. The war has led to inflation in several areas, including fuel and transport. This inflation has, in turn, led to higher costs for end consumers.

However, we can see market trends that seem to be repeating themselves. At the beginning of the year, the market is generally quite low before demand gradually improves. With the arrival of the first seasonal fruits in spring and their continuing development in summer, demand gradually shifts away from exotic fruits. In autumn, there are a large number of varieties available without volumes exceeding the absorption capacity of the market. The market then gradually strengthens until December, when it reaches a turning point under the cumulative pressures of Brazilian and Peruvian supplies.

Figure 6: Average sales prices (import level) for sea freight Kent mangoes (all suppliers combined) in France per week, in EUR/kg

Source: Pierre Gerbaud

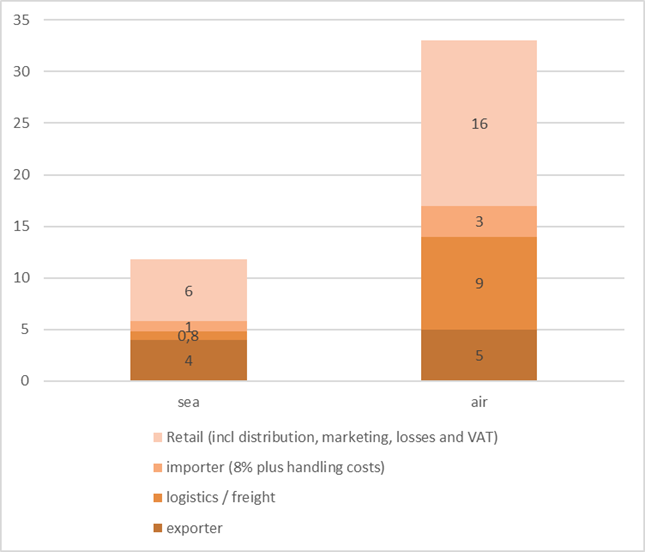

Prices per channel

The mango market can be unreliable due to fluctuations in availability and prices. European prices (importers’ sales prices) for mangoes transported by sea are typically between 3 and 8 EUR (see Table 3). Availability has a relatively large influence on mango prices. The biggest influences on mango prices are temporary shortages and oversupply from countries that supply the market.

Wholesale prices for tree-ripe mangoes shipped by air are much higher. Airfreight prices are about 3 times normal costs, mainly due to additional shipping costs. Importers and retailers largely benefit from these higher prices, but there is also a higher risk of losing overripe fruit. Prices of mangoes sent by air have increased significantly due to rising transportation costs. These prices are expected to remain high, as costs involved in air transport are much higher than those of sea transport.

Importers typically make a profit margin of at least 8% of the sales price. For niche varieties, these profits can be significantly higher, which corresponds to lower volumes and higher risks.

In retail, mangoes usually sell for between 1.50 and 2 EUR. Fresh cut mango is available in European supermarkets for approximately 2 EUR up to 200g or 10–12 EUR per kilogram. Airfreighted whole mango sells for a little under 5 EUR per piece.

Figure 7: Indicative price breakdown for sea and airfreighted mangoes, in euros per 4 kg box

Source: ICI Business

Table 3: Importer spot prices in EUR per 4 kg box for Kent mangoes on the French market

| High | Low | |

| 2019 | 8 | 3 |

| 2020 | 8 | 3 |

| 2021 | 7 | 2 |

| 2022 | 7 | 3 |

Source: Pierre Gerbaud

Tip:

- Check wholesale price information at France Agrimer to get a rough idea about mango wholesale prices in France.

Thierry Paqui carried out this study in partnership with ICI Business on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research