The European market potential for mangoes

Europe’s mango imports have gradually increased over the past years. European consumers prefer the fibreless Kent and Keitt varieties. Tree ripe, ready-to-eat or fresh-cut mangoes are in growing demand. The main European countries that import fresh mangoes are the Netherlands, Spain, Germany, France and Belgium.

Contents of this page

1. Product description

The mango tree, Mangifera indica, is native to a wide area stretching from India to the Philippines. The mango is a fleshy stone fruit (a drupe) of the climacteric type. That is to say, it is a fruit that continues to ripen after it is harvested. There are more than a thousand varieties of mangoes around the world. The Harmonised System (HS) code for fresh and dried mangoes is 08 04 50. Mangoes, mangosteen and guavas share the same HS code. Because these latter 2 are exotic products, mangoes are the main product in the trade statistics.

Fresh mangoes are available as:

- Normal whole fruit;

- Ready-to-eat (ripened at destination);

- Tree-ripened (air-freighted); and

- Freshly cut (consumer packed).

Table 1: Main varieties sold on the European market

Variety

| Main production areas | Main areas of production | Commercial Characteristics |

| Kent | Latin America (Peru, Brazil Mexico) West Africa (Côte d’Ivoire, Senegal, Mali Burkina Faso, Guinea) Spain Israel Egypt | Large, oval-shaped fruit with a rounded base. When ripe, yellow-green in colour with a red or purple coloured area. Average weight: 600 to 750 g. The flesh is yellow to orange-yellow in colour, firm with a melting texture, juicy and without fibre. | Standard variety for European markets, available all year round depending on the seasonality of origin countries. |

| Keitt | Latin America (Brazil, Dominican Republic, Porto Rico) West Africa (Côte d’Ivoire, Senegal, Guinea) Spain Israel | Large to very large oval-shaped fruit with a rounded base. When ripe, pastel colours, yellow and green with pink areas. Average weight: 510 g to 2 kg. The flesh is lemon yellow to yellow in colour, firm with some fibres near the base of the stone. | Variety well appreciated in European markets, replaces Kent during periods of lower availability. |

| Palmer | Brazil

West Africa (Côte d’Ivoire, Senegal, Guinea) | Oblong-shaped fruit with a rounded base. When ripe, bright orange-yellow with an area of dark cherry to purple or violet. Average weight: 510 to 850 g. The flesh is firm, orange-yellow to yellow in colour, few fibres. It is sweet and fragrant with good taste quality. | Available all year round. Main variety exported by Brazil. |

| Osteen | Spain

Morocco

Brazil

| Fruit with an elongated, oblong shape with a rounded base, sometimes with a small beak. When ripe, yellow-orange in colour with a purple or lavender area. Average weight: 500 to 760 g. The flesh is firm and juicy, not very fibrous, lemon yellow to intense yellow, soft and sweet with a pleasant aroma. | Well appreciated by European consumers. Main variety shipped from Spain. |

| Tommy Atkins | Brazil

Spain | Large, oval to oblong fruit with a rounded tip. When ripe, green in colour with a clearly visible intense to dark red area, often covering almost its entire surface. Average weight: 450 to 700 g. The flesh is yellow to dark yellow or orange, juicy and not very sweet, with a fibrous texture. | Available all year round, third variety exported by Brazil. |

Omer/ Kasturi | Israel | Oblong-shaped fruit. When ripe, it has an intense red colour. Average weight: 400 to 600 g. The flesh is soft, yellow in colour and not very fibrous. | Variety only produced and exported by Israel. |

| Shelly | Israel | Round-shaped fruit. When ripe, yellow to red in colour. Average weight: 400 to 600 g. The flesh is firm, orange in colour, non-fibrous. | Variety only produced and exported by Israel. |

| Maya/Aya | Israel | Small to medium-sized fruit, round with a small stone. When ripe, intense yellow in colour with sometimes a pinkish-orange-red area. Average weight: 300 to 400 g. The flesh has an intense yellow colour without fibres, with a rich flavour, very sweet and of good taste. | Kicks off the Israeli campaign. Very short seasonality. |

| Valencia Pride | West Africa (Mali, Burkina Faso) | Medium to large-sized fruit, kidney-shaped, with a rounded apex and broad beak. When ripe, yellow-green in colour with a red area tending to purple. Average weight: 600 to 900 g. The flesh is firm, intense yellow in colour and practically without fibre, with a pleasant and fragrant sweet flavour. | Very short seasonality (early variety). |

Other varieties of mangoes are also present on the European market, but with lower volumes. Without being exhaustive, we can mention the following varieties:

- Amélie, Zill and Smith, produced in West Africa (Côte d’Ivoire, Mali, Burkina Faso and Guinea). Amélie is progressively disappearing from the market;

- Haden, produced in Latin America;

- Ataulfo, produced in Mexico and Brazil;

- Irwin, produced in Spain and West Africa (Côte d’Ivoire, Mali, Burkina Faso);

- Alphonso, Chausa and Totapuri and Sindhri, produced in India and Pakistan (especially sold on ethnic markets);

- Nam Doc Mai, produced in Thailand.

Figure 1: Mango varieties Keith, Tommy Atkins and Kent (from left to right)

Source: OECD (2012), Mangoes, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Figure 2: Mango varieties Kasturi/Israel (1), Kent/Peru (2), Kent/Peru airfreight (3), Osteen/Spain (4)

Source: Pierre Gerbaud

2. What makes Europe an interesting market for mangoes?

Mangoes are 1 of the most appreciated tropical fruits by European consumers. The demand for mangoes is stable and European mango imports have a near-linear growth. The European market is the second largest importer of fresh mangoes in the world. Mango consumption in Europe is dynamic, supported by promotions organised by mass retailers. Several countries supply the European market. If you decide to export mangoes to Europe, you must be ready to face strong competition.

Fresh mango consumption on the rise

After the COVID-19 pandemic, mango imports into Europe resumed their growth. Brazil and Peru continue to be the main suppliers. Brazilian mangoes are available all year round. Brazil exports 4 varieties (Palmer, Keitt, Tommy Atkins and Kent). Peru only exports Kent mangoes to Europe. Since 2021, Peru seems to be extending its campaign from 6 to 7 months.

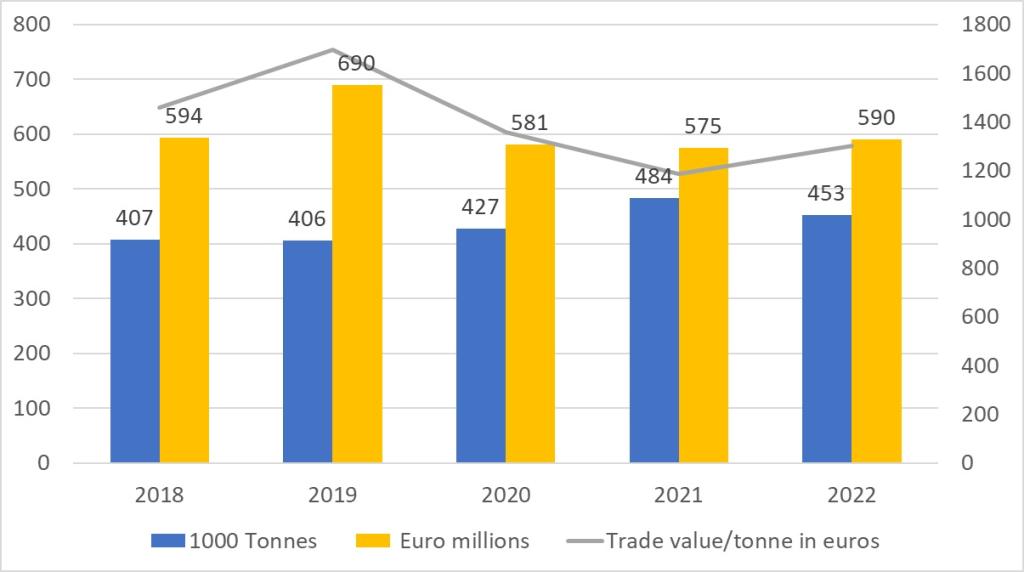

The average cost of a tonne of mango (value-weight ratio) continues to decrease as imports continue to rise. The demand for mangoes is steady. Supermarkets show an increased interest in mangoes, which are often used as a loss leader. In 2022, direct imports of mangoes from non-European third countries exceeded 450,000 tonnes.

West African mango exports are subject to greater pressure from parasites than their Latin American counterparts. This pressure often occurs at the end of the campaign when the rainy season starts in these countries.

There is a wide range of mango varieties on the European market. The non-fibrous Kent variety is the most popular with European consumers, making it the market standard. Almost all the supplying countries export Kent mangoes to Europe.

Figure 3: European imports of mangoes (EU-27 + United Kingdom, incl. mangosteens, guavas) and average cost in EUR/tonne CIF

Source: FRUITROP/Eurostat

Tips:

- When targeting the European mango market, give preference to non-fibrous varieties.

- When you are exporting from an area where parasitic pressure is high, carry out frequent trapping tests to find out when it's time to end your export campaign. This could prevent you from losing money and losing the benefit of your campaign.

- Check regular news updates to see current developments in supply and demand, such as the ‘Overview global mango market’ on Freshplaza.com. Other sources you can try to find market updates, include Eurofruit of Fruitnet, FruiTrop and FreshFruitPortal.

Several countries supply the European market with mangoes

Several countries supply the European mango market. The seasons in these countries mean that European buyers have a diverse range of mangoes on offer all year round. So, competition is fierce between suppliers. To succeed in making your mark, you need to supply the varieties most appreciated by buyers, according to your seasonality.

The European mango market is very dynamic. In 2022, it represented over 490,000 tonnes of mangoes, including the European production. Latin American countries exported the most mangoes to the European market, with over 347,000 tonnes (70% of the market share). They are followed by countries from Africa (15%), the Middle East (3%) and Asia (2%). The vitality of the European market is also shown by Europe’s mango production, which accounted for 6% of the market share in 2022.

Brazil is the only country that produces and exports 2 varieties year-round (Palmer and Tommy Atkins). The other mango-producing countries supply the European market according to the seasonality of the varieties they grow. In the early days, overlapping seasons between competitors were rare, but this is no longer the case.

Source: FRUITROP/Eurostat

Tips:

- Increase your chances in Europe by providing both a reliable and quality supply. Make sure to do whatever you say you will be doing and be honest about the volume and quality you can offer. Communicate proactively with your buyer whenever you expect quality issues. Any success you appear to have by making things seem better than they actually are will be short-lived.

- Before targeting a market, don't hesitate to gather information about quality of your competitors, to find out whether you can offer mangoes of equivalent or superior quality.

- Reduce your risks in the mango trade by diversifying your markets (focus on both local and export markets).

- Find out how to apply the best quality management for mangoes by reading the ‘Mango postharvest best management practices manual’ on Mango.org.

3. Which European countries offer most opportunities for mangoes?

6 countries play a key role in the marketing of mangoes in Europe. The Netherlands is at the heart of the mango import thanks to the efficiency of its port infrastructures. The demand in the domestic markets of Germany, the United Kingdom, France and Portugal is quite sustained. Spain is the main European country producing mangoes. Its production continues to develop.

Source: ITC TradeMap

The Netherlands: Your main trade hub for mangoes

The Netherlands is 1of the main entry points for fruit and vegetables into Europe. Most, if not all, shipping lines include a stopover in the Netherlands. Fruits imported to the Netherlands are often re-exported to other European countries. In 2022, Brazil and Peru represented more than 37% and 36% of mangoes imported by the Netherlands, respectively.

In 2022, mango imports to the Netherlands accounted for more than 36% of the total mango imports to the European Union (EU) (including the United Kingdom). As a trading hub, the Netherlands re-exported more than 168,000 tonnes of mangoes to other European destinations. This is more than 75% of its imports. The main destinations to which these volumes were re-exported are Germany (37%), France (10%), Belgium (6%), the Russian Federation (5%) and the United Kingdom (5%).

The Netherlands itself offer a medium-large market for mangoes. Mangoes are generally sold by supermarkets and increasingly as convenient freshly cut products (see trends below). But it is because of the challenges in sourcing mangoes and the logistical experience which will allow the Netherlands to maintain its leading role in the import and re-export of mangoes for several years to come.

Source: ITC TradeMap

Tip:

- Include the Netherlands into your European export plan. Even if you do not manage to sell through the Netherlands, just by meeting and talking to Dutch mango importers or traders you can learn a lot about the mango market in Europe. Some of the mango traders you can find on the website of the Dutch Fresh Produce Centre.

Germany: Your largest destination market for mangoes

In 2022, Germany imported more than 87,000 tonnes of mangoes and re-exported less than 11,000 tonnes. This shows the domestic demand for mangoes. Mango consumption is strong in Germany, which is supported by frequent promotions organised by hard discounters (Aldi, Rewe, among others). Brazil and Peru are the main suppliers of the market, with 37% and 29% of market shares, respectively. Because most of the trade is done through these hard discounters, private certifications (GLOBALG.A.P., Organic) are key elements in supplying these buyers. German supermarkets conduct regular testing on pesticides and on Maximum Residue Levels (MRLs). A country can be banned from supplying this market for wrongful residue practices.

German consumers are interested in buying good quality crops. Trade concerns mostly use sea freight to ship mangoes. The mango airfreight market is almost non-existent. The German consumer is well aware of environmental issues, so the demand for organic or fairtrade certified mangoes is quite big in this market.

This market is expected to continue its growth. This is mainly thanks to the support of hard discounters that frequently use mangoes as a loss leader to increase their sales on other products. A loss leader is a product sold at a loss or at a cheap price to draw customers to supermarkets.

Tips:

- Test your mangoes regularly on pesticide residues to see if they are fit for the German market. Maintain a residue standard of 30% to 50% of the European guideline as provided by the MRL database.

- In terms of certification, you must be at least GLOBALG.A.P. certified if you plan on supplying this market.

United Kingdom: Convenience is dominant

The United Kingdom is a very dynamic and active market for mangoes, thanks to a demand that is fuelled by a strong ethnic population that really likes mangoes. Mangoes are sold in supermarkets and ethnic convenience stores.

In 2022, the United Kingdom imported more than 78,000 tonnes of mangoes. Brazil and Peru account for 27% and 21% of mango imports, respectively, followed by the Dominican Republic (10%) and Pakistan (6%). The United Kingdom re-exported less than 3,000 tonnes, which is less than 3% of its imports. This makes it 1 of the markets where mango consumption was very high in 2022.

Current developments are mostly focused on diversification such as tree-ripened and premium mango, freshly cut mangoes (see trends below), but also on other added-value products such as frozen mango lollies and ice cream produced by the company Blue Skies. Another specific market segment is the ethnic mango market: the United Kingdom offers an important market for specific mango varieties from Pakistan and India such as the air freighted Alphonso and Kesar mangoes.

Tips:

- Make the United Kingdom your priority market when you want to export Indian mango varieties. The United Kingdom is by far the best market for mango varieties such as Alphonso or Kesar.

- Find British mango traders in the trader search option of UK Trade Info (Search in commodities for mango with HS-code 080450). You can also check the Exim World United Kingdom buyer and importer directories to see which British companies are importing mangoes mainly from India.

France: An interesting market for West African suppliers

Due to its ties with West African countries, as well as its proximity to the African continent, France is an interesting market for West African suppliers. However, in 2022, France imported around 68,000 tonnes of mangoes. The main supplier was Peru, with 29% of market shares. Peru exclusively exports the Kent variety mangoes. Spain follows with 18% of market shares. Brazil is third largest supplier, with 15% of market shares. Israel and Côte d’Ivoire, which is the main African supplier, each have 9% of the market.

The French market is quite special in the sense that it is 1 of the markets where the mango airfreight trade is as active as the sea freight trade. Only the Netherlands and Belgium have an airfreight market that is as active. Tree-ripened mangoes are in demand and sold at rather high prices. During summer, competition is quite high because of the wide variety of seasonal fruits available. These tend to attract buyers more because they are offered at very attractive prices.

France re-exports 20% of the mangoes it imports, so buyers have become increasingly aware of issues regarding certifications such as GLOBALG.A.P. over the years. Mangoes are largely available in supermarkets, where they are often used as a loss leader to attract buyers in stores, depending on the supplying country. There is an increasing number of organic mangoes marketed either fresh or for the catering segment.

There are growth perspectives for mangoes from Côte d’Ivoire, Senegal, Mali and Burkina Faso. But as an exporter you must be aware of 2 strong competitive factors:

- Peru’s campaign is extending over the years and tends to overlap with that of African countries. This complicates the marketing of minor varieties (Amélie, Smith, Zill, among others). It prevents them from being better valued and forces them to be withdrawn from the market quickly.

- France has a strong preference for locally produced fruits (see also trends below). This means the mango supply from neighbouring Spain is relatively high and is expected to remain strong, but you can also expect competition from local summer fruits such as French-grown stone fruit.

Tips:

- Check the seasonal calendar of northwest Europe to see which fruits are possibly competing with your mangoes. Where possible try to plan around these seasons or export when prices for local seasonal fruit are still high.

- Go to Rungis wholesale market when you are visiting France. This will be a good reference and starting point when you want to enter the French market.

Spain: 1 of the fastest-growing markets for mangoes

Spain is 1 of the fastest-growing importers of mangoes. With both production and exports increasing, Spain is developing itself as a trade hub for mangoes. This means that Latin American suppliers can reach different markets through Spain, in addition to the internal market.

Spain is a rather specific market in several respects. First of all, it is a European production leader, with the Osteen variety being its best-sold mango. Although Osteen mangoes are expensive to grow due to labour costs, they are in high demand when their season begins. In 2022, Spain imported about 68,000 tonnes. The main suppliers to the market were Brazil (59% market share), followed by Peru (15%) and Côte d’Ivoire (3%). Second, Spain continues to play a key role as a leading country, re-exporting almost 90% of its imports. This trend is somewhat problematic to the dynamics of its domestic market. As a hub country, Spain's exports are destined for many other European countries. However, Portugal is the main re-export destination, accounting for 32% of re-exported volumes. France is the second largest destination, accounting for 26% of volumes.

Table 2: Spanish estimated production, trade and consumption of mangoes, in tonnes

| 2018 | 2019 | 2020 | |

| Import | 53,510 | 60,590 | 70,302 |

| Production (estimate) | 36,000 | 25,000 | 28,276 |

| Export | 61,580 | 47,207 | 59,491 |

| Consumption (calculated) | 27,930 | 38,383 | 39,087 |

Source: ITC TradeMap & industry sources

Tip:

- When exporting from Latin America, use Spanish mango importers and traders mainly to strengthen your position in France and southern Europe.

Portugal: The country with the highest consumption per capita

With a little over 10 million inhabitants, Portugal is not a large country. Nevertheless, it has the highest mango consumption per capita. It is an interesting market for those that are competitive with, or additional to, Spanish and Brazilian suppliers.

In 2022, Portugal imported nearly 38,000 tonnes of mangoes. 51% of imports came from Spain, followed by Brazil (26%) and the Netherlands (17%).

An estimated net import volume of 26,677 tonnes (import minus export) indicates that the average person consumes around 2.5 kg per year. Spain is undoubtedly Portugal's main supplier, followed by re-exporters from the Netherlands and Brazil, which export mangoes both by sea and air. Supply gaps are mainly covered by mangoes that are traded through the Netherlands. Portugal has strong ties to Brazil and offers limited direct opportunities to suppliers from other regions.

It can be challenging to find Portuguese importers who are willing to do business with unknown supply sources. Most of them will be comfortable with the trade they are used to with Spain, Brazil and the Netherlands. Portugal is a mature market for mangoes, so it may be worth exploring more direct trade opportunities, especially between the Spanish and Brazilian seasons.

Source: FRUITROP/COMTRADE/EUROSTAT

Tip:

- Direct your export to the Netherlands or Spain when you have difficulties getting your mangoes onto the Portuguese market.

4. Which trends offer opportunities on the European mango market?

The demand for ready-to-eat and freshly cut mangoes in Europe is steadily rising. The demand for mangoes often fluctuates, depending on the varieties and suppliers. During summer, the demand for mangoes tends to be less sustained, which is the case for all exotic fruits. European buyers then prefer to buy season fruits (pears, peaches, apricots, watermelons, among others).

Freshly cut and ripened mangoes attract more consumers

To increase their sales, some importers supply ready-to-eat mangoes to their clients. As mangoes are climacteric fruits, they continue to ripen once they have been harvested. The ripening process is mainly applied to mangoes transported by sea or by road that are harvested unripe. There are 2 levels of ripening, the ready-to-eat stage (found in supermarkets) and the slightly ripened 1 sold by wholesalers, such as Rungis (France).

Tree-ripened and ready-to-eat mangoes

Tree-ripened mangoes are used for the airfreight trade. They are more expensive because of transport costs. To improve mango sales supermarkets, do not hesitate to promote ready-to-eat mangoes.

Specialised companies offer fruit ripening as a service, such as the Dutch LBP (Logistic Business Partners), while large fruit suppliers such as Ripenow and Nature’s Pride have implemented their own ripening facilities. The best way to supply ripening companies is to work together closely and optimise the fruit picking time.

Freshly cut mangoes

Freshly cut and packed mangoes are in a high-end segment that is growing in popularity because it adds value to mango sales. Because of hygiene and safety regulations as well cold chain issues, very few suppliers can provide these types of products to the European markets. African companies that are closer to Europe can take advantage of their proximity to explore this segment. Several supermarket chains have developed specialised facilities where they prepare freshly cut mangoes for their customers. This also allows them to make better use of the mangoes they sell.

A company that successfully entered the market for freshly cut mangoes is the British-Ghanaian fruit company Blue Skies. Their product can be found in supermarkets such as Tesco and in 2019 Blue Skies introduced their fresh-cut range in Carrefour. Besides Ghana and the United Kingdom, the company also has cultivation and processing operations in Brazil, Egypt and South Africa to maintain flexibility and deal with fluctuations.

It is best to first establish European alliances that ensure you have a market for cut mangoes. With the right alliances freshly cut mangoes can provide you with a segment that not everyone is able to enter. In the long term you must anticipate on keeping your product sustainable. This is important because the market more and more requires reducing plastic packaging and air-freighted fruit.

Figure 8: French supermarket promotion of freshly cut mangoes

Source: Fruit Consultancy Europe

Tips:

- Learn how to determine the right time to harvest your mangoes depending on the variety and the means of transport used (air, sea or road) and only supply the level of ripeness requested by your buyer.

- Check the ins and outs of freshly cut fruit in the FAO Technical Guide for the Processing of fresh-cut tropical fruits and vegetables.

- Respect international labour standards and implement a HACCP management system when you are planning to process and hand-cut fresh mangoes. To meet European expectations you will need to invest in food safety, human resources and professional mango growers. It is crucial to organise all aspects well, because only doing half of the required work does not provide you with a market in Europe.

- Stay up to date with innovations in packaging and freight solutions to make freshly cut mangoes more sustainable.

Growing preference for sustainable and local in-season fruit

During summer, when seasonal fruits are available in large quantities and at cheap prices, the demand for exotic fruits is less consistent. As a supplier who exports during summer, you must keep in mind that your mango season will be competing with that of seasonal fruits in Europe. Therefore, mango sales could be slower and prices lower.

There is also a concern among European buyers about sustainability. European consumers will then prefer to buy seasonal fruits that have lower transport costs compared to most exotic fruits. This explains why sales of airfreight exotic fruits are lower during summer.

Supermarkets also support this process, and during summer they promote local fruits instead of imported fruits. That is why, for example, the Carrefour Group is initiating a transition to promoting mainly local, seasonal and organic products.

It is not likely that local fruit will affect the popularity of mangoes, but it can definitely have an influence on its consumption. Mango consumption will continue to grow as long as mangoes can compete with local fruit. But you can expect stronger fluctuations in demand, especially in the summer and during the Spanish mango season. As a supplier you must accept being flexible in your pricing as well as your export markets. Since mangoes are not the most stable fruit in trade, it can be difficult to find a buyer that is willing to commit to fixed volumes and prices.

Tips:

- Read the CBI Trends in fresh fruit and vegetables to get more insights into fresh trends.

- See the study Entering the European market for mangoes to learn more about competition.

Thierry Paqui in partnership with ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research