Entering the European market for fresh peas

Fresh peas are a perishable product that requires extra attention be paid to food safety management and efficient logistics. To compete with major suppliers from Kenya, Egypt, Peru and Guatemala, you must work closely with the growers and build long-term partnerships with specialised importers.

Contents of this page

1. What requirements and certifications must fresh peas meet and have to be allowed on the European market?

Fresh peas must meet the general requirements of fresh fruit and vegetable buyers, which you can find on the CBI market information platform. My Trade Assistant of Access2Markets provides an overview of export requirements for fresh peas per country (code 07081000).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid damaging consumer health and the environment, the European Union has set maximum residue levels (MRLs) for pesticides and other active substances in and on food products.

Fresh peas containing more pesticides than allowed will be withdrawn from the market. The same goes for other contaminants such as heavy metals. High-risk countries are often added to the list of origins with increased border controls.

Note that retailers in several Member States such as the United Kingdom, Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation.

New MRL for chlorothalonil threatens the fresh pea supply

One of the main impacts on the fresh pea supply to Europe is the reduced MRL for chlorothalonil. Chlorothalonil is a common fungicide that protects fresh peas during rains. Since the European Union did not renew its approval, the chemical was banned in Europe in 2019, including in the UK and Switzerland. In 2023, the MRL was reduced to 0.01 mg/kg, which practically eliminates the use of chlorothalonil on fresh peas intended for export to Europe. There is no known alternative for chlorothalonil in fresh pea production.

Tips:

- Find out which MRLs are relevant for fresh peas by consulting the EU MRL database in which all harmonised MRLs can be found. You can search for your product (“peas”) or the pesticide used. The database shows the list of the MRLs associated to your product or pesticide.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest control strategy that includes growing practices and chemical management. It is also part of the ‘Good Agricultural Practice’ and GLOBALG.A.P. certification.

- Make sure that lead contamination in your leguminous vegetables remains below 0.10 mg/kg and cadmium below 0.020 mg/kg, according to the Regulation 2023/915 on the maximum levels for certain contaminants in food (consolidated version 22-7-2024).

The Green Deal

The European Green Deal and new EU policies on sustainability will help Europe become the first climate-neutral continent by 2050. The Farm-to-Fork Strategy is at the heart of the European Green Deal, aiming to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address, for example, packaging and food waste. For suppliers of fresh fruit and vegetables, it is important to look beyond the increasing standards and try to be in the frontline of the developments.

Follow phytosanitary regulations

The European Union requires that fresh peas go through plant health checks before entering the European Union. The plant health inspection must take place in the country in which it was produced. The shipment must be accompanied by a phytosanitary certificate, guaranteeing that the shipment:

- Has been properly inspected;

- Is free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- Is in line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072 (updated June 2023).

Tips:

- See the details on the contents of a phytosanitary certificate for the European Union in ANNEX V of Regulation (EU) No 2016/2031.

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

Food safety and traceability

Imported fresh peas are a labour-intensive product, and in many cases produced by small farmers. This requires extra attention to food safety and traceability.

Because picking and processing is done manually, there is an increased risk of microbiological contamination. Proper attention to hygiene must prevent fresh peas from getting contaminated. The EU Regulation 2073/2005 (Consolidated version 8-3-2020) has set microbiological criteria for ready-to-eat or pre-cut vegetables.

Salmonella and Listeria and Monocytogenes must be undetectable in pre-cut or ready-to-eat vegetables. For E.coli a maximum 2 out of 5 representative samples are allowed to measure between 100 and 1,000 cfu/g.

When there is a microbiological issue, the product must be traceable. Traceability can be a major task when working with a large number of smallholder producers. You will need a system and continuous labelling to ensure traceability.

Maintain high quality standards

Sugar peas and mangetout are special pea varieties that are offered with no or with poorly developed seeds. Peas must be sufficiently developed, but must not be overdeveloped. The formation of harder seeds in sugar peas is a sign of advanced development. The seeds of sugar peas must be able to be crushed between two fingers without splitting in half. Pods that are trimmed and stringless are best suited for the European market.

The marketing standard regarding the quality and packaging of fresh peas is described in the UNECE Standard for peas. This standard describes the quality requirements that applies for shelling peas (without the pods) as well as mangetout (snow peas) and sugar snap peas intended for consumption with the pod.

Peas are divided into two classes: Class I and Class II. In Class I the seeds of sugar snap peas must be small and underdeveloped. Class II applies to peas that are slightly more developed, making the pods more fibrous, or that have some slight defect in shape, colouring or skin. Europe almost exclusively requires Class I peas as a minimum. Peas in this class must be of good quality and within the permissible tolerances (see table 1).

Table 1: Quality requirements and permissible tolerances for fresh peas

| General quality requirements (all classes) |

| The pods must be: |

|

|

|

|

|

|

|

| *Similar requirements apply to the seeds, which need to be fresh and normally developed in shelling peas |

| Additional requirements and permissible tolerances for class I peas |

| The pods in Class I must be: |

|

|

|

| *For shelling peas other quality standards apply |

| Tolerances: |

|

|

Mangetout are normally picked when they are between 6.5 and 9 cm, sugar snap between 5 and 8cm. There are no specific size requirements. Nevertheless, the contents of each package must be uniform and contain only peas of the same origin, variety or commercial type and quality. The visible part of the contents of the package must be representative of the entire contents.

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

Follow handling recommendations

The development and condition of the fresh peas must be of a level that is able withstand transportation and handling and to arrive in satisfactory condition at the place of destination. Post-harvest processes, such as temperature, storage and lead time are crucial to protect quality and freshness.

- Peas should be stored as close to 0°C as possible without freezing and sustaining chilling injuries.

- Maintain good storage conditions. Avoid brown spots due to misting or exposure to water or excessive moisture.

- Make your supply chain as efficient as possible with short lead times. Long storage and inefficient supply chains will result edible pods to wilt, discolour and lose tenderness.

- Experiment with controlled atmosphere that can extend the quality of fresh sugar snaps and mangetout. According to the BMT Cargo Handbook an atmosphere of 2-3% O2 and 2-3% of CO2 with high relative humidity of 95-98% are considered the best.

Tip:

- Check the BMT Cargo Handbook on recommendations on handling fresh peas and the recommendations for maintaining the postharvest quality of snow and snap pods of the Postharvest Center of the University of California.

Use protective packaging

Packaging requirements differ between different customers and market segments. In all cases you must use protective packaging to maintain the freshness and quality of your fresh peas.

Fresh mangetout peas (snow peas) and sugar snaps can be packed in 2kg carton boxes, and occasionally in larger 4.5 or 5 kg boxes, with perforated plastic liners. Pre-packed they are sold in trays, flow bags or micro-perforated bags, for example in 12x150g, 10x250g or 12x250g. If packed in trays or punnets, the peas are often laid together in the same direction (top and tail).

Figure 1: Example of perforated packaging with mangetout / snow peas in the Netherlands

Source: ICI Business

Figure 2: Example of a tray mangetout (top and tail) with slightly excessive moisture

Source: Photo by agamitsudo per Open Food Facts and licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license. (Original Image)

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 (consolidated version 1-1-2018) on the provision of food information to consumers in Europe.

- See also the Code of Practice for Packaging and Transport of Tropical Fresh Fruits and Vegetables (CAC/RCP 44-1995) with recommendations on how to maintain produce quality during transportation and marketing.

What additional requirements do buyers often have?

Certifications as a guarantee

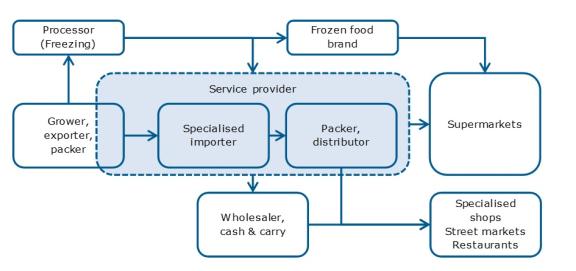

There are many actors involved in the fresh pea supply chain (see figure 3). Quality and food safety management is therefore a must. European buyers almost always require certifications as a guarantee for quality and food safety. Common certifications for fresh peas are GLOBALG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Using food safety management systems recognised by the Global Food Safety Initiative (GFSI) is highly recommended.

Figure 3: Activities and actors in the supply chain of beans and peas in pods

Source: COLEAD Good Practice Guide – Beans and Peas in pods

Apply additional sustainability and social standards

Compliance with sustainable and social standards is common for all fresh fruit and vegetables. Besides GLOBALG.A.P., Sedex Members Ethical Trade Audit (SMETA) has become a basic requirement for retailers in northern Europe (Germany, Benelux and Scandinavia). Also consider reviewing the carbon footprint of fresh peas. Southern Europe, including France, may be less demanding, but importers often stick to the stricter standards. The reason for this is that shipments are often split for different end clients. Therefore, the strictest retail requirements are leading for the whole shipment.

Another topic that will become more important is the sustainable use of water. As a supplier it is wise to start familiarising yourself with water standards. Retailers can also impose their individual standards, such as the GLOBALG.A.P. Nurture Module for suppliers to Tesco.

Tips:

- Learn about how to comply with European standards in the COLEAD Good Practice Guide – Beans and Peas in pods based on the Kenyan example.

- Implement at least one environmental and one social standard. See the Basket of Standards of SIFAV, the Sustainability Initiative for Fruit and Vegetables. For sustainable water use, see the SIFAV Basket of Water Standards.

- For other additional requirements such as payment and delivery terms, see the CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

Organic certification can be an interesting way to set your fresh peas apart and find a high-value market segment. The demand for organic vegetables is growing and the supply of organic sugar snaps and mangetout is limited. However, the current market size for organic fresh peas is still very small. It is a niche within a niche market.

To market organic products in Europe, you must use organic production methods according to European legislation and comply with Regulation (EU) 2018/848 (consolidated version 21-2-2023). You can apply for an organic certification with an accredited certifier.

Tips:

- Strive for residue-free peas, and only certify your production as organic if possible. It can broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the List of Recognised Control Authorities and Control Bodies to see which certifiers are active in your region.

Address consumers with a fair-trade label

- In the cultivation of sugar snaps and mangetout there are often many small farmers involved. This is ideal for implementing a fair-trade label that can be featured on your product towards consumers. It will help your company to comply with a social standard and at the same time address the conscious consumers.

- A good example of fair-trade beans and peas there is the company Fair-fruit, which is an initiative of Durabilis of an integrated supply chain that provides a market for small producers in Guatemala, Peru and Ethiopia.

When you choose to get fair-trade certified yourself, you could use for example Fair for Life or Fairtrade International (Fairtrade Labelling Organizations International). Be aware that social circumstances have become a key element in the trade of fresh peas, but a Fair Trade label is still a niche requirement.

2. Through which channels can you get fresh peas on the European market?

Imported fresh peas such as sugar snaps and mangetout are exclusive vegetables but common in most supermarkets. Excellent quality and Class I peas are the standard in practically all market segments. Most of these fresh peas enter the market through importers that are specialised or well-integrated in the sourcing and production of exotic vegetables.

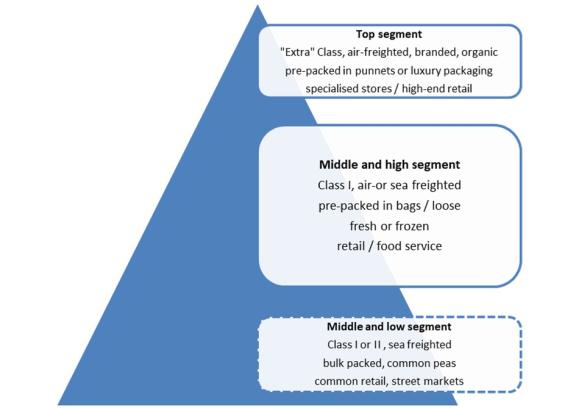

How is the end-market segmented?

Sugar snaps and mangetout (snow peas) are mostly imported and sold as fresh products, placing them automatically in a medium to high price segment. This is different from common shelled garden peas (without pods), which make up most of the pea sales. Unlike sugar snaps and mangetout, common peas are most often sold as a preserved or frozen product.

Figure 4: European market segments for fresh peas

Source: ICI Business

Most markets demand Class I quality peas, either air-freighted or efficiently transported by sea. Sugar snaps and mangetout in this class are often pre-packed in small bags for major retailers or sold loose or in larger bags for Cash & Carry, food service clients or specialised shops. Optionally the fresh peas in the middle segment are blanched and frozen, which extends the shelf life and therefore can be sold for a lower retail price. Frozen peas are often directly processed after harvest. It is a smaller segment than fresh but especially in Northwest Europe it is growing due to the demand for convenience products.

In the top segment you can find the highest value and best quality peas. Although the “Extra” Class is not a very common standard, there are several other quality indicators that can place fresh sugar snaps and mangetout in a superior segment. These indicators can be for example an organic label, attractive packaging or a guarantee of an ultra-fresh (air-freighted) product. A branded product can also deliver a certain promise of exclusivity.

The market for Class II sugar snaps and mangetout is very small. It is an additional segment automatically stocked by the produce that is rejected in higher segments. It is not really a segment to supply pro-actively. Class II sugar snaps and mangetout often end up in street markets or smaller shops that compete on price.

Tips:

- Plan carefully and make sure your product meets all expectations of the main market segments. Use quality materials for packing and precise logistical planning (by sea or air). Do not ship your product if you have doubts about the quality on arrival.

- Brand your product for clients that do not require private label packing such as food service clients or small retailers. Do this preferably in cooperation with a trading partner of fresh vegetables. A branded product can create value if it is well marketed and provides continuity in quality.

Through what channels does a product end up on the end-market?

Service providers and importers have a central role in the import and distribution of fresh peas. They are familiar with all the different requirements of end clients and are able to distribute to different markets. Through sourcing fresh peas in different regions, importers can ensure their clients have a year-round supply.

Figure 5: Supply channels for fresh peas in Europe

Source: ICI Business

Specialised and integrated importers are important for foreign suppliers

Most importers of fresh peas have steady commercial relationships with growers and exporters in different countries. They are specialised in working together with multiple supply countries. Most of them have strengthened their position through specialisation and integration.

Several fresh pea importers are specialised in exotic vegetables, such as MWW (UK), SpecialFruit (Belgium) FV SeleQt and Yex (both part of Farmhouse), BUD Holland and Nature’s Pride (Netherlands). There are also importers that differentiate themselves through organic and fair-trade produce such as Eosta (Netherlands) and Fair-Fruit (Belgium).

Through further integrating with the pea production, trade companies gain more control over the supply and supply chain. This is necessary to supply major retail channels. Companies such as ElbeFruit Company (Germany), Flamingo Horticulture (United Kingdom), FV SeleQt and Primeale United (previously known as Van Oers United in the Netherlands) promote themselves with international cultivation projects or integrated partnerships. The British company Barfoots has their own office in Peru for the purchase of fresh peas among other products.

Service providers provide access to supermarkets

Sugar snaps and mangetout are common retail products. Large supermarkets usually work with supply programmes and mostly sell pre-packed sugar snaps and mangetout. In this retail market it is very common for producers to have supply contracts with their buyers.

Successful suppliers to supermarkets often position themselves as service providers. They organise the supply chain according to the needs of their clients, from growing and sourcing to re-packing and branding. You can become part of this supply chain if you are able to offer the quality, packing and logistics that a service provider demands. This often requires close cooperation.

Larger importers can supply supermarkets, but there are also service providers that maintain exclusive supply relations with large retail chains. Examples are Bakker Barendrecht, part of the Greenyard group, supplying the leading Dutch supermarket Albert Heijn and OGL Food Trade, which is an exclusive fresh supplier for Lidl supermarkets.

Frozen vegetable suppliers

Frozen peas are supplied by frozen food brands, but also by private label processors. The freezing process usually takes place directly after harvest to preserve the freshness. This means these companies work with processing facilities nearby the product’s origin or with importers of frozen vegetables. Well-known companies that are involved in the processing and supply of frozen vegetables are, for example, Bonduelle, Ardo and the Pinguin (a Greenyard brand). Other companies that offer a channel for fresh peas are producers of ready-made meals, vegetable mixes and salads such as Vezet in the Netherlands or Bama in Scandinavia.

Wholesalers supply the spot market

Wholesalers supply fresh peas to smaller retailers and food service companies. Import can be among the activities of a wholesaler, but usually they are not equipped to organise a global network of growers. Instead, they prefer to buy from local growers and international import specialists. Without a retail programme they mainly cover the spot market, moving with the fluctuations of the trade. They often operate from typical wholesale markets such as Rungis in Paris and New Spitalfields market in London.

Larger wholesale activities are covered by Cash & Carry companies such as the Bidcorp group and Metro. Metro’s global sourcing of fruit and vegetables takes mostly place in its Valencia Trading Office (VTO).

Tips:

- Build long-term relationships with your buyers in Europe. Importers that serve large end-clients need a reliable supply. The supply chain of fresh peas can be complex and for them selecting and assessing new suitable suppliers of fresh peas is time consuming. As an exporter you must create confidence and provide continuity to build a structural business in Europe (hit and run is not the way to go).

- Explore your opportunities in the frozen vegetable market by studying the CBI publications on Exporting frozen vegetables to Europe.

What is the most interesting channel for you?

The most interesting channels for supply steady volumes of fresh peas, are supermarket channels and their service providers. For smaller suppliers more specific channels could be a better choice.

When you are able to offer high production volumes, you can focus on strategic partnerships with importers that offer supply contracts. This allows you to plan your production. Developing such relations takes time.

Small farmers and cooperatives may be better off with specialised importers that differentiate with fair trade or organic produce. Importers of exotic vegetables often provide the best experience and diverse market to represent your fresh sugar snaps and mangetout.

Tips:

- Go to trade fairs to find buyers and get insight information from different specialist buyers. The main trade fairs for fresh vegetables are the Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

- Read the CBI tips on how to find buyers on the European fresh fruit and vegetable market and further information on how to export fresh exotic vegetables to Europe.

3. What competition do you face on the European fresh peas market?

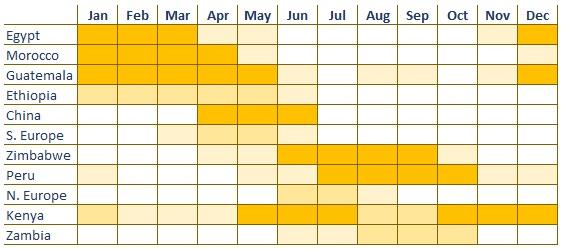

Kenya, Egypt, Peru, Guatemala and Zimbabwe fill in most of the annual supply of fresh sugar snaps and mangetout. These fresh peas are labour intensive and there is only minor competition from European growers. Successful suppliers are able to export a weekly volume by air or sea-freight and maintain a well-organised supply chain with growers. Countries with efficient sea-freight logistics to Europe have the best opportunities to export larger volumes of fresh peas to Europe.

Figure 6: Indicative supply calendar for fresh peas (sugar snaps and mangetout) to Europe

Source: Based on industry sources and trade data

Which countries are you competing with?

Europe imports fresh peas year-round from countries with different growing seasons such as Guatemala, Kenya, Zimbabwe, Peru, Egypt, Morocco and several smaller supply countries. Efficient logistics are a pre-condition for competing with these suppliers. The climate is a major influence on the development of the season and the annual availability per country.

Source: ITC Trade Map

Kenya: well-developed and year-round pea supplier

The horticultural sector in Kenya is well-developed with a number of professional growers and exporters of fresh peas, beans and herbs. Most of the export to Europe is realised between October and January, but the climatic circumstances allow Kenyan farmers to produce and export fresh peas throughout the year. This makes it an interesting country for European buyers to source from, because they often look for a year-round supply. However, occasional heavy rains make the production less reliable than some of its competitors.

Until recently, Kenya mostly exported their fresh peas by air. But just like many other supply countries, they were able to make the switch to sea freight. It takes 28 to 32 days to reach the European market by boat. Experts say that sea-freighted peas actually remain fresher because the cold chain is maintained from farm to destination market. Other struggles that farmers have encountered in the past, such as excessive pesticide residues, have been under control. As a result, European import remained stable and even increased from around 5,000 tonnes in the past to close to 7,000 tonnes in the 2021-2023 period. The Netherlands and the United Kingdom are the main importers from Kenya according to European trade statistics.

In the coming years, ocean routes may be more difficult to access due to rebel attacks near the Suez channel. Many shipments have been re-routed via South Africa, which is time-consuming and expensive. For some, this has a negative effect on fresh exports. Most of the experienced fresh pea suppliers have been managing the longer route fairly well.

Figure 8: Kenya is well developed in fresh pea packaging and export

Source: Photo by sebleouf per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license. (Original Image)

Egypt: short distance supplier

Egypt is among the world’s largest producers of green peas. The Egyptian offer does not only include sugar snaps and mangetout, but also a large amount of fresh garden peas or shelling peas. In general, there is a large offer of vegetables from Egypt, but the number of suppliers is sometimes overwhelming for European buyers and many of these potential suppliers do not meet their standards. However, the exporters that comply with all the requirements are gaining market share. Another advantage is the presence of larger producers.

Egypt’s supply window falls together with that of Guatemala. Although their campaign from December to March/April is shorter, Egyptian exporters have the advantage of being much closer to the European market. This helps to keep logistical costs low and the products as fresh as possible. While European imports from Guatemala declined between 2019 and 2023, Egypt profited by supplying more. In 2023 Egypt became the second most valuable pea supplier to Europe with a value of €19.1 million.

Peru: productive powerhouse

Over the last decade Peru has become a production powerhouse for a wide range of fruit and vegetables. The export of sugar snaps and mangetout has benefited from this commercial development and its increase of professional growers.

Peru is able to cover a supply gap from June to October when the volumes from Guatemala are low, partially competing with growers in Zimbabwe. Growers in Zimbabwe can outcompete Peru on pricing, while Peruvian producers stand out because of their stable quality and faster transit time. As such, they do well with retail end clients. Its main destinations in Europe are the United Kingdom and the Netherlands. Among the largest suppliers with multiple million euros of fresh pea exports in 2024 according to Agrodataperu are Fair Fruit Peru (a subsidiary of Fair Fruit that works with small farmers), FRG Farms and Andean Growers Group.

After several years of continuous growth, European fresh pea imports from Peru stabilised after 2020. Cost increases and low performance in 2023 have defined the trade in recent years. Some of the producers changed their focus to more profitable crops such as blueberries. FreshFruitPortal concluded: “In 2023, Peruvian agriculture faced one of its most formidable challenges in over three decades, grappling with global fertiliser shortages, rampant inflation, adverse weather conditions in both the northern and southern regions, and water stress.”

2024 is expected to turn out better for Peru. The country will continue to play an important role in the supply of a whole range of fresh fruit and vegetables, including sugar snaps and mangetout.

Guatemala: changing relation with Europe

Guatemala is able to produce large volumes during a relatively long season. The main export takes place from December until May, which is counter-seasonal to Zimbabwe and Peru. The Guatemalan peak season is often characterised by high volumes which have a suppressing effect on trade prices.

The strong supply is the result of a large number of small farmers that are competitive in labour intensive crops such as sugar snaps and mangetout. Smallholder engagement can also result in social initiatives that fit the goals of the IDH Sustainable Trade Initiative, such as the integrated cooperation between smallholder cooperatives and Asuncion Export in Guatemala, Nature’s Pride (importer) and the supermarket ICA Sweden.

However, in recent years Europe’s import from Guatemala has declined rapidly. Due to lower production and increasing requirements and costs to supply Europe, Guatemala’s preference to supply other markets has increased. Moreover, the shipping company Seatrade stopped its direct connection to Europe, adding another week to transit times. As a result, the Netherlands and the UK received fewer fresh peas from Guatemala in 2022/2023, while the trade with Mexico and the United States remained more stable.

Tips:

- Look for supply gaps to define potential opportunities and monitor the production of competing countries.

- Invest time in selecting logistical suppliers that can transport your fresh peas safe and efficiently.

- Explore ways to extend the shelf life of your fresh peas, for example in the way you process and package your product or in innovations in seed breeding or modified atmosphere.

Which companies are you competing with?

Successful exporters are efficient and able to process and supply decent volumes (full container loads on weekly basis during peak season). This requires a well-organised supply chain of growers and excellent management of packaging facilities. Experience counts in the trade of fresh peas.

Frutesa: pioneer in exporting peas to Europe

Frutesa in Guatemala is one of the pioneers in exporting fresh peas to Europe, starting out with the United Kingdom as the first destination country. Nowadays they export to the United Kingdom, the Netherlands, France, Spain, Sweden, Switzerland and Germany. This experience and track record comes in handy when they present themselves to new buyers.

The company works with a very large number of associated and contracted producers. They support these producers by offering technical assistance, training in pesticide use, quality and hygiene, and agricultural input. The large number of small farmers give the company a positive social image and sufficient volumes for export markets. But it will also take effort to support them and manage traceability.

With their own packing facility they are able to offer different packing options. Flexibility and tailored packaging are necessary to get into the supply chain of larger retailers. During the peak season sugar snaps and mangetout can be shipped by sea, which helps to maintain a competitive price level.

FRG Farms: Peru’s second largest exporter

FRG Farms also works with smallholder farmers. In the current European market it can be difficult to manage quality and residue limits while working with many small producers. However, the company uses over 20 years of agricultural experience and long-term partnerships to develop a stable supply of high-quality sugar snaps and mangetout. The company is GLOBALG.A.P. and GRASP-certified.

In 2024 FRG Farms grew into the second-largest exporter of fresh peas in Peru (after Fair Fruit Peru). The company shows that experience and compliance are key to becoming successful.

Interveg: support to growers as key element for success

Interveg in Kenya claims that it owes its success to local farmers. Local farmers grow the crops and in return Interveg provides them with farm inputs like seeds and fertiliser and technical expertise on good agricultural practices. The company proves the importance of grower cooperation.

In addition to their close cooperation with growers, the company has used the support of CBI and COLEACP to successfully prepare and organise their export to Europe. They comply with standards that are important in Europe such as BRC, GLOBALG.A.P. and SMETA.

According to the company’s website, they handle over 50 tonnes of fresh peas and other vegetables every week. Supply volume is important and for new, smaller companies it is very difficult to grow as an exporter.

Tips:

- Support your farmers with training on good agricultural practices and get involved in their needs. Agricultural producers are the basis of a quality product.

- Check the e-learning platform and e-library of COLEACP for production guides and training material that are also applicable for fresh peas (membership may be required).

- Work with experienced agronomists that can advise you and your growers on pesticide management and good agricultural practices.

Which products are you competing with?

Frozen as alternative for fresh peas

The main competition for fresh peas are frozen (or preserved) peas. Sugar snaps and mangetout are most often sold as a fresh product, while common garden peas (without pods) are mostly conserved in jars and cans. As an alternative there are frozen peas available (with or without pods) for consumers that look for a balance of freshness and shelf life.

Frozen peas do not give the consumer the same experience, but in reality the freshness of frozen vegetables is often better than the fresh import. Frozen peas are blanched and frozen just after their harvest which maintains their quality. One of the leading companies in frozen peas is Greenyard with their Pinguin brand.

Competition from local in-season vegetables

During the European summer there is a great variety of local peas and beans which compete with imported products. This local produce includes cheaper common green beans as well as some fresh sugar snaps and mangetout. During this time the consumer often prefers local products, which are fresher, more sustainable and widely available for a good price. So between June and September the demand for imported sugar snaps and mangetout sometimes declines depending on the availability of local products.

Tip:

- Make your fresh product as attractive as possible. Use nice packaging, visible quality and sort the fresh pods nicely when using trays or punnets.

4. What are the prices of fresh peas in the European market?

Prices for imported fresh peas mainly depend on their availability throughout the year. Sugar snaps and mangetout have more or less the same price level. Climate and changes in availability have a great influence on price development.

During supply gaps and in between the seasons of different supply countries prices can go up due to lower availability. Prices are usually the highest in the months of May and June. At this time there is more room to ship fresh peas by air. At the beginning of a season the young pea pods are also most fragile, which is another motivation to use faster air freight. During the peak season prices may settle down and larger volumes are then often sea freighted. Sea freight has also increased in importance due to sustainability as well as rising transportation costs. February and March catch the lowest prices when Egypt is in its peak season.

Prices in the past three years have been volatile. The average trade prices increased in 2022-2023, mainly due to higher costs and lower availability. Kenya exports the highest value per kilo, likely because of its intensive use of air freight, followed by Peru and Guatemala. Zimbabwe is more price competitive. Egypt and Morocco are the nearest to the European market and export both high-value snap peas and common peas.

Source: Eurostat

Wholesale purchase prices in Europe average around 4.5 to 7 euros per kilo. Bulk boxes of 2 to 5 kilos are lower priced than the pre-packaged peas for consumers. Importers generally maintain a net profit margin of at least 8% over their selling price, excluding handling and packing and repacking costs.

Consumer prices for fresh peas fluctuate according to their quality, packing and segment. Supermarket prices for sugar snaps and snow peas range between 9 and 16 euros per kilo. Supermarkets commonly sell 200g or 250g packages. Retail prices are relatively stable and have little connection with the trade and wholesale prices.

Source: various data sources and average calculations

*the price breakdown varies depending on the timing, the origin and the value added (packaging)

Tip:

- Find a price history in France on the Market News Network of FranceAgriMer from producers, importers, wholesalers (“gros”) and retail (“détail”). Look for “POIS GOURMAND”.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research