The European market potential for fresh peas

Fresh peas such as mangetout and sugar snaps are typical import products with a steady demand. The United Kingdom offers the largest market but there are also opportunities in Netherlands and Belgium (trade) and Germany, France and Scandinavia (consumption). Consumers in these countries are interested in exotic vegetables that are healthy, convenient and socially responsible.

Contents of this page

1. Product description

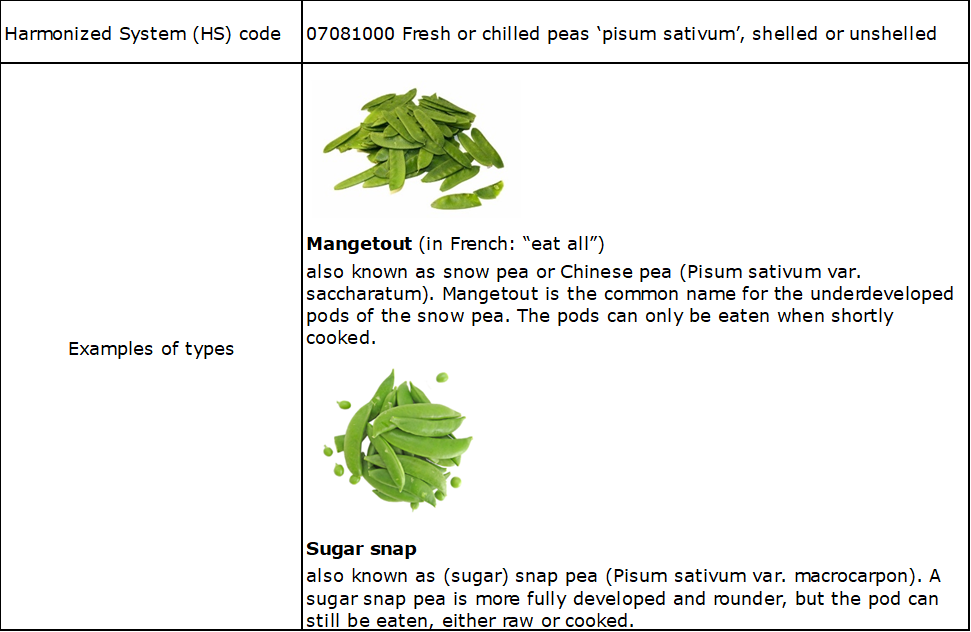

Fresh peas refer to the seeds or the seed pods of the Pisum sativum species. Shelled garden peas are the main consumed peas in Europe, but this study focuses principally on the main imported edible pea pods, which are mangetout and sugar snaps. The products are traded with HS code 07081000.

Table 1: Types and HS code for the main imported fresh peas

2. What makes Europe an interesting market for fresh peas?

Europe depends on a foreign supply of sugar snaps and mangetout. The demand for these higher value vegetables has a steady gradual growth.

Mangetout and sugar snaps are typical import products

Mangetout and sugar snap peas are seasonal and labour intensive products. For that reason most of these peas are imported from countries outside of Europe.

Europe produces almost a million tonnes of fresh peas per year, but the local supply of young edible pea pods such as mangetout and sugar snaps is very limited. Major fresh pea producers such as the United Kingdom and France do have some production of mangetout and sugar snaps, but it is seasonal and not sufficient to fulfil the European demand.

Practically all importers in Europe source fresh peas from several non-European countries year-round. They are especially interested in producing countries with long or extended seasons and suppliers that can fill potential gaps between different seasons.

A steady demand for high value vegetables

The European market for fresh imported peas increases gradually. The relatively high value of these peas and the steady market provide a profitable business for producers and exporters of mangetout and snap peas.

Mangetout and sugar peas are more expensive than common local vegetables and become more in demand with economic prosperity. The only dip in fresh pea export was at the start of the global economic recession after 2008. Since 2010 the import has continued to grow to around 30 thousand tonnes in 2019. The import value showed a higher growth rate, indicating a higher appreciation and demand for imported peas.

Consumers are becoming selective in their purchases and as long as they have economic purchasing power, there should be enough room for a continuous gradual market growth over the next three years.

Tip:

- Keep up to date with news on fresh peas, sugar snaps and mangetouts by following the publications on Freshplaza, FreshFruitPortal and Eurofruit (Fruitnet).

3. Which European countries offer most opportunities for fresh peas?

The United Kingdom is the main market for imported peas such as sugar snaps and mangetout. The Netherlands and Belgium provide a hub to other European countries where consumption is high or growing, including Germany, France and the Scandinavian countries. Norway is often supplied directly from the origin country.

United Kingdom: Leading importer of mangetout and sugar snaps

The United Kingdom (UK) was one of the first countries to import mangetout peas and especially sugar snaps. The UK market is well-developed, directly supplied from origin and continues to grow.

Mangetout and sugar snaps have become standard products in the already diverse offer of fresh produce of British retailers. Almost all mangetout and sugar snaps are purchased directly from non-European suppliers. The main suppliers in 2019 included Guatemala (17.9 million euros), Peru (11.1 million euros), Kenya (7.0 million euros) and Zimbabwe (6.8 million euros, but with a higher volume than Kenya). The total value for fresh peas with a non-European origin was nearly 50 million euros, which makes the United Kingdom the main European market for these peas.

The United Kingdom will remain a valuable market for non-European suppliers for several reasons. The local production of fresh mangetout and sugar snaps, which starts in June, is very limited. And affordable labour forces are decreasing because many Eastern European workers have gone home. Due to Brexit (Britain leaving the European Union), importers will also become more motivated in maintaining their non-European supply sources. However, inflation may hamper the demand for exclusive vegetables that are more expensive than the more common vegetables.

Tips:

- Find wholesalers and see which kind of fresh peas are available via the trade directory of the New Spitalfields Market in London.

- Stay informed about the developments of Brexit and the transition period on GOV.UK.

The Netherlands: Hub for Northern European markets

The Netherlands is a trade hub for many exotic fruit and vegetables, including mangetout and sugar snaps. These fresh peas need efficient logistics which the Netherlands can offer, and it is also home to a number of specialised trading companies.

With a strong focus on trade, the Dutch import value of fresh peas varies from year to year. However, the volume is steady. The import value from non-European countries was 38.4 million euros in 2019. Guatemala was the main (non-European) origin with 12.9 million euros in 2019, followed by Kenya (8.1 million euros), Zimbabwe (7.1 million euros) and Peru (6.1 million euros). Most of these fresh peas are re-exported to Germany, Belgium and several Scandinavian countries.

The fresh pea (re-)export from the Netherlands is still increasing, so the country’s trade position remains important for foreign exporters. As mangetout and sugar snaps become more familiar products in many European countries, the trade may become more direct. The market share of Dutch traders may eventually stagnate, but it is unlikely the Netherlands will lose its logistical position.

Tips:

- Find importers on the member site of the sector association Fresh Produce Centre. You can find several exotic specialists such as BUD Holland and Yex, but there are many more that are not on this list.

- Connect with Dutch traders at relevant trade events and use their experience to get to know the market. Exotic specialists such as Nature’s Pride, Roveg and BUD Holland are well represented at the Fruit Logistica trade fair in Berlin.

Germany: Focus on clean and healthy vegetables

Mangetout and sugar snaps are far from being traditional vegetables in Germany, but a large population and a focus on health provide opportunities for exporters that are able to supply fresh pesticide-free peas.

Germany has a positive import growth of fresh peas. In 2019, direct non-European imports were worth 12.3 million euros – more than half of the total import value. The main origins from outside Europe were Kenya (though its numbers are declining due to Germany’s strict pest control), Zimbabwe (increasing), Peru (increasing fast), Egypt (with a relatively high volume of common peas) and Guatemala. However, the highest value of sugar snaps and mangetout was imported via the Netherlands, with 6.2 million euros in 2019. Dutch importers have good coverage in Germany and also German traders use the Netherlands as the fastest way for import.

Sugar snaps and mangetout are often available in the main supermarkets, but it is not yet standard in the vegetable assortment. German consumers are traditional and very conscious of origin and food safety, but among the 83 million inhabitants there is a significant group that is open to new vegetables. According to the German producer cooperative Landgard eG in the Fruit Logistica 2020 edition of AGF Primeur, new concepts and storytelling will continue to play an important role in 2020. Also the demand for organic vegetables is still booming.

In order for sugar snaps and mangetout to successfully keep growing, it is crucial to supply a clean, pest free product. Or even better: organic, to match the local quality expectations.

Tips:

- Take away potential concerns of German buyers and guarantee them a product with little pesticide residues. Use the Lidl standard of 33% of the legal European limit. Learn more about the German market and its specific requirements in the CBI study on Exporting fresh fruit and vegetables to Germany.

- Find potential partners in Germany in the database Lieberanten.de (in German), for example by selecting suppliers of “zuckererbsen” or “zuckererbsenschoten”.

France: Multichannel opportunities

Fresh peas are a popular vegetable in the French cuisine, although edible pea pods such as sugar snaps are still somewhat of an exotic. The French market for exotic peas has a multichannel character.

France is by far the largest fresh pea producer in Europe with 280 thousand tonnes in 2019. These peas are typically shelled garden peas. According to specialists the interest in sugar snaps and mangetout peas is increasing. These exotic peas, also sold as “pois gourmand”, are generally imported. The highest import value is from Kenya (4.3 million euros in 2019). There is also some import from Zimbabwe, Guatemala and Madagascar, and a high volume from Morocco and Egypt of lower-value peas. The import growth of fresh peas with non-European origin is similar to that of Germany.

Mangetout peas are more common in France than sugar snaps. Most supermarkets offer mangetout peas while sugar snaps are more of a specialty. This means the wholesale channel is also relevant for the marketing fresh peas to specialised shops and culinary outlets such as Asian restaurants.

Tip:

- Find wholesale buyers of fresh peas at the French wholesale markets such as the Rungis.

Norway: Part of a high Nordic consumption

Norway has a high consumption per capita and a significant import from suppliers outside the European region.

Sugar snaps and mangetout peas are very popular in Norway, as well as in other Scandinavian countries. Sugar snaps are often consumed raw as a snack.

Trade statistics show a slightly decreasing trend in import. This may be an indication of a saturated market, but it could also be an adverse effect due to different reported outbreaks of the Shigella bacteria traced back to imported peas in 2009 and 2019. However, Norwegian consumers can only rely on a very short season of locally grown sugar snaps in July and August, so the dependence on import will continue to exist.

In the Scandinavian region, Norway has the highest share of direct import. Norway is not part of the European Union (only part of the European Free Trade Association), and therefore there may be open to more direct trade with producer countries of fresh peas. Norway’s main imports of sugar snaps and mangetout in 2019 were from Guatemala (2.7 million euros) and Peru (1.5 million euros). One of the principle suppliers is the import company Nature’s Pride, a Dutch fresh company that has been started up with capital and cooperation from the Norwegian distributor Bama Gruppen.

Belgium: Processor and re-exporter of fresh peas

The fresh pea business in Belgium comprises the processing of common garden peas and the trade of exotic pea pods. Belgian commerce is especially well connected to France, the Netherlands and Scandinavia.

Belgium has the highest import volume of fresh peas in the world: 106.8 thousand tonnes in 2019. But these concern mostly fresh garden peas for the processing industry (canning and freezing). Common peas are mainly imported from France. A second business in Belgium is the import and re-export of the more exotic sugar snaps and mangetout peas. These pea pods generally have a non-European origin, coming from countries such as Zimbabwe, Kenya and Egypt. Zimbabwe has become a more significant supplier recently, increasing its value from 21 thousand euros in 2016 to 1.3 million euros in 2019.

Belgium is a good hub from which to supply the French and Dutch market, which are its main markets for fresh peas. However, high-value peas such as sugar snaps often find their way up north to Sweden, Belgian’s second export market for peas in terms of value. Strong companies such as Fair-Fruit (fair trade peas), SpecialFruit (exotic specialist) and Greenyard (fresh and frozen peas) will continue to reinforce Belgium’s position in fresh peas and other vegetables.

Tip:

- Find a potential trade partner in Belgium by using the tool Find a Supplier on Belgianfruitsandvegetables.com.

4. Which trends offer opportunities on the European fresh pea market?

There is a growing interest in healthy and exotic vegetables such as sugar snaps and mangetout. But as an exporter you must be able to offer them in a socially responsible way and anticipate an increasing demand for convenience products.

Interest in exotic vegetables, but socially responsible

The variety of vegetables in Europe is extensive. Besides the large volume of locally grown and seasonal vegetables there is also room for exotic types of vegetables such as sugar snaps and mangetout – but with an increasing focus on responsible sourcing.

A good number of consumers like buying things that are out of the ordinary, such as special vegetables to enrich their cooking for example. Food blogs, culinary professionals and retail marketing are positive drivers behind the consumption of more exclusive vegetables such as sugar snaps and mangetout.

At the same time, consumers in Europe are increasingly concerned about the impact of their consumption on society and the environment. They want to feel good about the food they eat and local vegetables provide the most peace of mind. To maintain the interest in imported fresh peas the produce must be sustainable and socially responsible. For example, the Guatemalan company Asunción implemented the “For Life” certification standard for Corporate Social Responsibility (CSR) and became part of a pilot project to include smallholder farmers in the supply of fresh peas to ICA, Sweden’s largest supermarket chain.

Tips:

- Show social compliance through your actions and by following social standards. See the CBI study on Entering the European market for fresh peas [VT(1] about different social and sustainable standards.

- Offer good logistical routes that reduce carbon footprint. Efficiency is important but avoid air-freight when possible.

Increasing demand for convenience

European consumers, especially in the north, take less time for cooking and convenience starts to dominate more and more. This is good news for fresh peas, because they are quick and easy to prepare.

Sugar snaps and mangetout peas can be blanched, steamed, cooked or stir fried. Sugar snaps can even be eaten raw, although not many consumers in Europe are aware of this. Fresh peas and pea pods are also pre-mixed and used in fresh meals to make them even more appealing and convenient. For example, British retailer Sainsbury’s offers several packaged mixes of mangetout with baby corn and sugar snaps with asparagus and tenderstem broccoli.

Fresh processing and packaging are important must-haves to profit from the growing interest in convenience products. To fulfil consumer satisfaction buyers often demand pea pods to be without strings and sometimes trimmed (cutting of the ends). Offering a wider variety of small vegetables and packaging options can also be a unique selling point for exporters to address the convenience trend.

Healthy diets require fresh vegetables

Consumers in Europe are becoming more aware of a healthy diet. Leguminous vegetables such as fresh peas can contribute to a healthy lifestyle.

Fresh peas are a good source of vitamin C answer and plant proteins. They provide an excellent option to a growing number of consumers that are looking for healthy food or vegetarian and vegan alternatives. Because of this, fresh companies in Europe are positive about the potential of fresh peas.

To keep the healthy reputation of fresh peas it will be crucial to guarantee a safe and pesticide-free product. Also an organic label, which is often associated with health, will help you gain support from consumers.

Tip:

- Read the CBI Trends in fresh fruit and vegetables to gain more insight into the fresh trends.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research