Entering the European market for fresh plums and other stone fruit

Plums and other stone fruit are mass products in Europe, of which Spain is the main supplier. But European domestic production varies according to weather influences, which leaves room for other suppliers. The large channels for stone fruit can help foreign fruit enter supply programmes, but competition is fierce between different stone fruit as well as from local producers and from exporters in Spain and Italy. International partnerships and specialisation will be helpful for a successful market entry.

Contents of this page

1. What requirements must fresh plums comply with to be allowed on the European market?

Fresh plums must comply with the general requirements for fresh fruit and vegetables, which you can find on the CBI market information platform. My Trade Assistant of Access2Markets provides an overview per country of the export requirements for plums (code 08094005).

What are mandatory requirements?

Pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental risks, the European Union has set maximum residue levels (MRLs) for pesticides and other contaminants, such as heavy metals, in and on food products. Products exceeding the MRLs are withdrawn from the market.

Note that supermarkets in several EU Member States, such as the United Kingdom, Germany, the Netherlands and Austria, use even lower maximum residue levels than those established by European legislation.

Tips:

- Check the EU Pesticides database to find all MRLs and those specific for blueberries. Search by product or pesticide and the database to find the list of associated MRLs.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that lead contamination in your fresh plums and other stone fruit remains below 0.10 mg/kg and cadmium below 0,050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs. Be aware that there are additional requirements for processed products such as dried plums.

Phytosanitary regulation

European phytosanitary regulations and the European Directive (EU) 2019/523 require fresh plums and other stone fruit of the Prunus genus to go through plant health checks before being introduced into or moved within the European Union.

The plant health inspection must take place in the country of origin and the shipment must be accompanied by a phytosanitary certificate, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072.

Tips:

- Learn more about the European phytosanitary rules in Council Directive 2000/29/EC and the new Implementing Directive 2019/523 on the protective measures against the introduction of harmful organisms in the European Union.

- Check which (other) fruit and vegetables require a phytosanitary certificate in the lists of Annex XI and Annex XII of Regulation (EU) 2019/2072).

Quality standard

Information on quality, size, packaging and labelling requirements for plums can be found in:

The United Nations Economic Commission for Europe (UNECE) also has specific marketing standards available for other stone fruits:

- UNECE STANDARD FFV-26 PEACHED AND NECTARINES, 2017

- UNECE STANDARD FFV-13 CHERRIES, 2019

- UNECE STANDARD FFV-02 APRICOTS, 2017

Plums must comply with the general quality requirements (see Table 1). Europe almost exclusively requires Class I plums. In less formal channels and for processing channels the fruit quality may be lower – these are mostly locally produced plums. Plums in Class I must be of good quality and within the permissible tolerance levels. In no case may the defects affect the fruit flesh, the general appearance of the produce, the quality, the keeping quality and presentation in the packaging.

Table 1: Quality requirements and permissible tolerances for fresh plums

| General quality requirements (all classes) |

|

|

|

|

|

|

|

| Additional requirements and permissible tolerances for Class I plums |

|

|

|

|

|

|

|

Source: UNECE STANDARD FFV-29 concerning the marketing and commercial quality control of PLUMS, 2020

Tips:

- Maintain strict compliance with quality, delivering it as agreed with your buyer. Being careless with your standards will lead buyers to raise issues with quality.

- Negotiate with your buyer to include different sizes and a mixed pallet per shipment. This will enable you to sell all sizes from your orchard. But make sure the sizes are the same per pallet.

- Check what defects are allowed by studying the images in the OECD International Standard for Plums (2021).

Size and packaging

Plum size is determined by the maximum diameter of the equatorial section.

Table 2: Minimum sizes for plum varieties

| Classes Extra and I | Class II | |

| Large-fruited varieties* | 35 mm | 30 mm |

| Other varieties | 28 mm | 25 mm |

| Mirabelles and Damsons | 20 mm | 17 mm |

Source: *See list of large-fruited plums in the UNECE standards for plums

Commercially different size classifications and packaging are used. Sometimes letters are used for calibre sizing (AAA to C), but as an exporter it is best to use a size indication with the fruit diameter, such as 40-45mm, 45-50mm, 50-55mm, etcetera. Uniformity in the calibre is important.

Table 3: Commercial size codes and calibres

| Size code | Group AAA | Group AA | Group A | Group B | Group C |

| Diameter (mm) | 60–65mm | 55–60mm | 50–55mm | 45–50mm | 40–45mm |

The most common packaging for plums is the corrugated cardboard box.

- Open boxes of 5 kg are preferred, sometimes also in 4.5 or 6.5kg, with a loose cover to remove the content easily. Cell separators are frequently used, especially for Class Extra and Class I, packed in single or double layer (see Figure 1).

- Boxes with flaps are folded and inserted to form a cover that can be removed when the fruit is displayed.

- Plums can also be packed in plastic baskets or punnets, in clamshells, top seal or inside a net, and shipped in a box (for example 10x500g) (see Figure 2).

Figure 1: Package with cell separators

Source: OECD (2021), Plums, International Standards for Fruit and Vegetables, OECD Publishing, Paris, https://doi.org/10.1787/dda2dfce-en-fr.

Figure 2: plastic baskets inside a net

Source: OECD (2021), Plums, International Standards for Fruit and Vegetables, OECD Publishing, Paris, https://doi.org/10.1787/dda2dfce-en-fr.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- See the buyer requirements for fresh fruit and vegetables on the CBI market information platform for the legal labelling requirements.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

What additional requirements do buyers often have?

Variety

Buyers evaluate plum varieties on characteristics such as sweetness and firmness. Important features for marketing fresh plums are:

- firmness;

- crunchiness;

- brix level;

- sweetness-acidity ratio;

- soluble solid content;

- freestone (flesh comes easy off the kernel).

Plum buyers and marketers are often interested in new varieties with superior characteristics and taste, but traditional European varieties maintain great importance as well. In general, sweet varieties are most favoured for fresh consumption. A good quality plum has smooth skin, and likely a whitish bloom.

Tip:

- Make sure your buyer knows your product and variety. Buyers are often reluctant to purchase stone fruit varieties they are not familiar with. Send samples if necessary and discuss the product features before shipping.

Certification

Common certifications for fresh plums and other stone fruit are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommended.

Sustainability and social responsibility

For fruit collectors and exporters it is important to show that you are engaged in the well-being of your production sources, both socially and environmentally. The best way to do this is through adopting social and environmental standards, such as Sedex Members Ethical Trade Audit (SMETA) and GlobalG.A.P.

For plums waste can also be an issue to confront, because they have a short ripeness cycle and are easily damaged during production or post-harvest. As a supplier you will make a good impression when you can show an active waste policy or alternative destinations for the plums that are not suitable for fresh consumption, such as drying or other processing.

In the near future you can expect new environmental and social initiatives with standards that become more extensive with regular audits. For example, the Sustainable Trade Initiative for Fruit and Vegetables (SIFAV), a private covenant between European importers and retailers, has formulated new goals towards 2025 that include reducing the carbon footprint and increasing sustainable water use. With this in mind, it is sensible to measure your environmental impact and explore new standards such as SPRING, a GlobalG.A.P. add-on for sustainable irrigation and groundwater use, or the Corporate Carbon Footprint of TÜVRheinland.

Retail chains sometimes have their own standards, such as Tesco and the Tesco Nurture programme, an add-on module to GlobalG.A.P..

The Green Deal

In the coming years the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal, aiming to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address for example packaging and food waste. EU trade agreements with several countries, such as Moldova, already include rules on trade and sustainable development – other countries are expected to follow. For suppliers of fresh fruit and vegetables, it is important to look ahead of the increasing standards and try to be in the frontline of the developments.

Tips:

- Implement at least one environmental and one social standard. See the Basket of Standards of the Sustainability Initiative of Fruit and Vegetables (SIFAV).

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

What are the requirements for niche markets?

Organic can be a requirement in fresh and processed plums

Organic certification can be an interesting way to make your plums stand out and market them at a higher value. The demand for organic plums is still a niche, but you might find additional opportunities in the processing of organic plums. Dried plums or prunes, for example, are often part of the health food segment, which has a high share of organic sales. By preserving organic plums directly after harvest, it is also easier to maintain their quality.

Organic plums are often purchased and processed by specialised companies, such as Tradin Organic, which sources organic plums in Serbia for freezing, drying or making puree.

To market organic products in Europe, you must use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that in January 2022 the new legislation Regulation (EU) 2018/848 will come into force after a year’s delay due to COVID-19. Inspection of organic products will become stricter to prevent fraud and producers in third countries will have to comply with the same set of rules as those producing in the European Union.

Tips:

- Consider organic plums as a plus, not a must. Remember that implementing organic production and becoming certified can be expensive; you must be prepared to comply with the entire organic certification process.

- Learn about the processed fruit sector via CBI’s information on Exporting processed fruit and vegetables and edible nuts to Europe.

2. Through what channels can you get fresh plums and other stone fruit on the European market?

Well integrated exporters have the best chance to supply to large channels, such as supermarkets, whether or not via an importer or service provider. Class I plums are dominant.

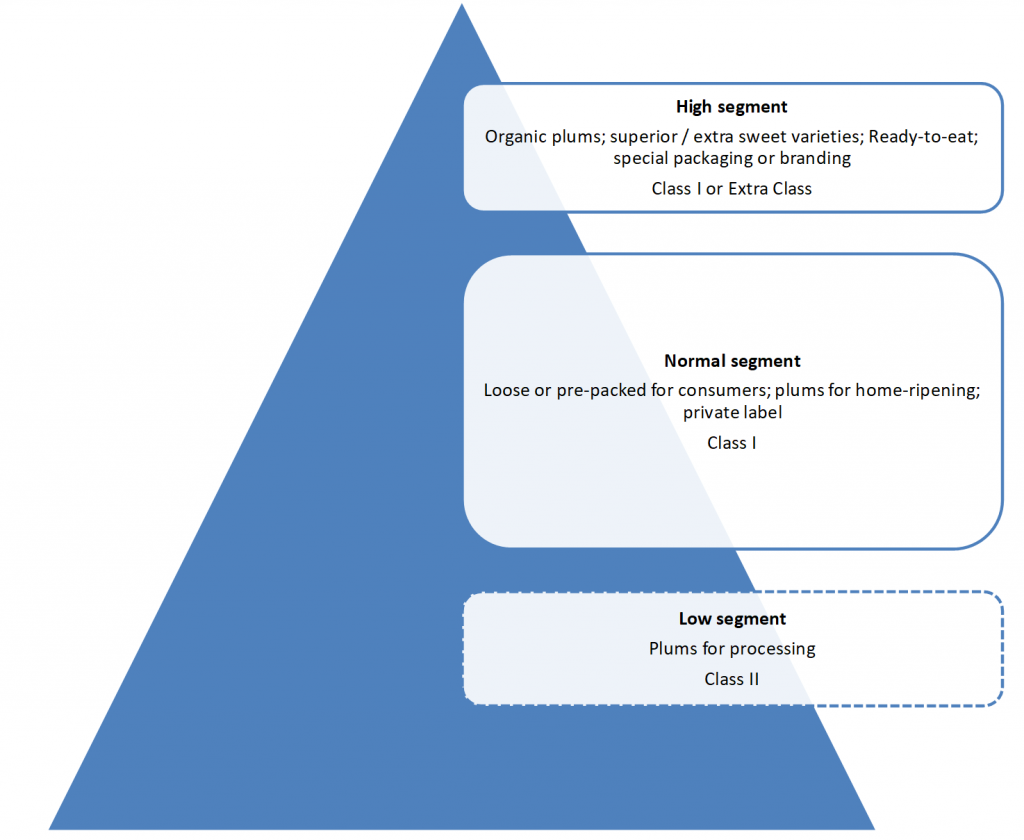

How is the end market segmented?

The principal segment for fresh plums are Class I plums, either loose or packaged (see quality and packing requirements above). Plums for home ripening are usually priced lower than perfectly ripe ones.

Plums are a traditional fruit in Europe and it is therefore difficult to give them exclusivity. Sometimes a local origin adds value for which consumers are willing to pay, such as Mirabelle plums from the Lorraine area (see Figure 3). Organic plums are also sold with a premium, but these are also often grown within Europe.

Figure 3: Mirabelle plums from the Lorraine region in France with Protected geographical indications (PGI)

Photo by org-carrefour per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported.

Retailers often use branding and special packaging to push plums into higher segments. Typical features they promote are ready-to-eat or ripe fruit and extra flavour or sweetness (see Figure 4). Future segmentation will likely include more varieties with superior characteristics.

Figure 4: Ready to eat, Class I plums sold by Ocado in the United Kingdom

Photo by alia per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

Class II plums are not preferred for fresh sales, but are rather used for processing. The same goes for odd sizes and surplus production volumes.

Figure 5: Market segments for fresh plums in Europe

Tips:

- Focus on fresh plums with export quality. Export quality means at least Class I and attractive sweet varieties. Lesser varieties and qualities are generally not imported from outside Europe, unless meant for processing.

- Be honest about the quality and defend your product. Document your cold chain and product appearance with photos before shipping, in case value and price are renegotiated.

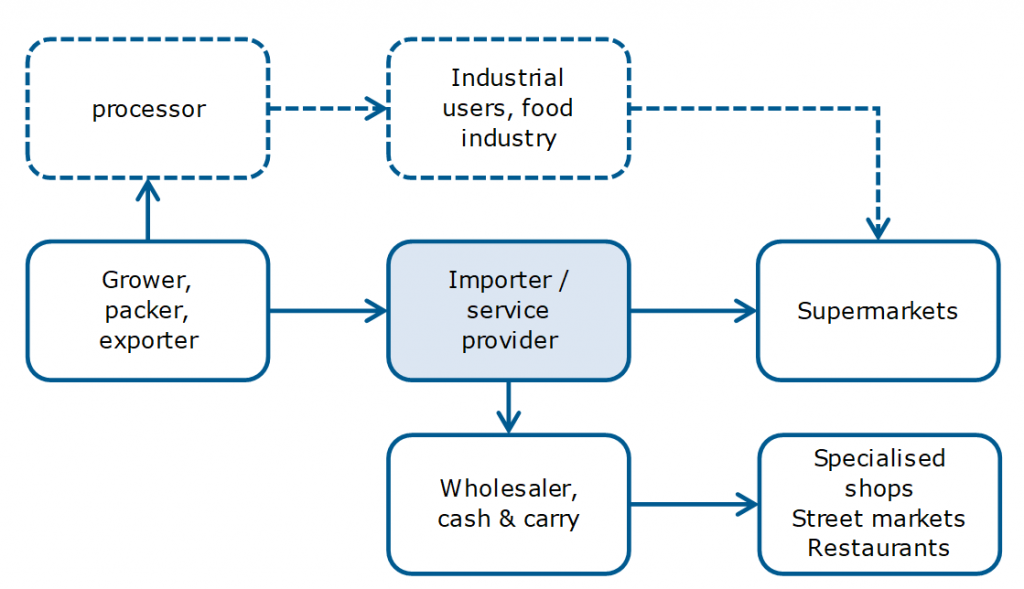

Through what channels do plums reach the end market?

Importers and service providers

Importers and service suppliers play a central role in the distribution of fresh plums. They are familiar with all the different requirements of end clients and are able to distribute to different market channels, such as wholesalers and supermarkets.

Importers that are specialised in stone fruit and well-integrated with producers become attractive for end-market buyers. By sourcing plums and stone fruit in different regions, they can guarantee year-round supplies. Some of these companies have their own packing stations, although pre-packed plums are also supplied by packers in origin countries.

When import companies provide different services, such as retail packing, ripening service and multiple origin sourcing, they can become service providers to large retailers. These include large integrated fresh suppliers, such as Total Produce Indigo, the French subsidiary of the Total Produce Group, Greenyard Germany and OGA/OGV Nordbaden, but also specialists in stone fruit such as Cancel Fruits and companies with ripening facilities such as Nature’s Pride.

Supermarket programmes

Supermarkets are a major channel for plums and other stone fruit. During the European season, plums are typically supplied by European producing countries, such as Spain. It is therefore easy for supermarkets to get closely involved in the sourcing of these products. Several supermarkets have their own purchasing centres in Spain, such as Carrefour (Socomo) and Rewe (Eurogroup España). But these purchase centres are also responsible for importing from several non-European countries.

Direct sourcing helps supermarkets to improve cost efficiency and control the supply chain with maximum transparency. However, only large producers will qualify to directly supply to a supermarket chain, and most likely they will still have a service provider to assist with import, logistics and quality control.

Large European supermarket chains, such as Germany’s Lidl and the Netherlands’ Albert Heijn, have selected external service providers to supply them with a programmed supply of stone fruit, including plums. They work with exclusive partnerships with OGL Food trade and Bakker Barendrecht. Others also work with temporary contracts.

Wholesalers (spot market)

As any other fruit, plums also need a spot market. For plums, the spot market is especially important to get locally produced plums that are not suitable for supermarkets on the market. The spot market also helps regulate supply shortages and oversupply, and it services small outlets.

Traditional fruit wholesalers that cover the spot market move according to trade fluctuations. They supply to specialised shops, street merchants, restaurants and hotel chains. Sometimes these companies combine import and wholesale activities, but a small wholesaler does not take many risks with importing long-distance plums or other stone fruit. Typical wholesale markets include Rungis in Paris and Mercabarna in Barcelona.

Large fruit wholesalers, such as Staay Food Group, maintain a large international network and offer their own cash & carry service points, where clients can purchase a wide variety of fruit and vegetables, including plums, cherries, nectarines, peaches and apricots.

Processors

Part of the fresh plum supply ends up in the processing industry. This usually happens right after harvesting close to the cultivation area. Greece and Spain produce most plums for the processing industry. But also in Romania, the processing industry is large and the majority of plums are processed into alcohol, or dried or used for jam. Peach and nectarines are also important for processing into juice, canned fruit and dairy products.

Figure 6: Market channels for fresh plums and other stone fruit

Source: ICI Business

Tips:

- Connect to importers by visiting trade fairs, such as Fruit Logistica in Berlin and Fruit Attraction in Madrid, or use their virtual market place and online catalogue.

- Read the tips for doing business with European buyers on the CBI market intelligence platform and learn more about contracts and general conditions in trading.

- When visiting plum producing countries (see competition below), try to visit the local wholesale market to get an idea of the varieties, presentation and prices of plums and other stone fruits.

What is the most interesting channel for you?

Service providers and specialised importers are the most logical channels to market stone fruit. Importers and traders can represent your product in the European market. But without a guaranteed or fixed price, this can be tricky because you depend on the performance and network of your buyer. Being part of a retail supply programme gives you the best security and margins are often more profitable on average. However, the requirements are high and the room for negotiation is minimal.

The most likely route to become part of a retail programme is to cooperate with a service provider that has a local infrastructure and supply contracts with retailers. Large producing exporters have the best chances to find cooperation with supermarkets and their service providers (see examples of service providers above).

If your production is small, you can either look for cooperation with other producers and mutual benefits by extending production volume and supply season, or you can build commercial relations with traders and established importers.

Importers that work with stone fruit include, for example, Roveg (Netherlands), which has subsidiaries in important plum producing countries Spain and Chile, Kölla (Switzerland), which has multiple sales and purchase offices throughout Europe, and Global Fruit Point (Germany), which also has representatives in France and the Netherlands. Traders are used to working with multiple supply sources and can add your supply to other trade flows. The standards they maintain are the same as the wholesale or retail clients they work with.

Tips:

- Select your buyer relations wisely and be sure that your importing partner defends your interests. You must know what kind of network and experience they have; the most reliable partners often have supply contracts or programmes with important end clients.

- Read the CBI tips for finding buyers and the tips for doing business with European buyers of fresh fruit and vegetables.

- Focus on long-term commercial relationships and supply chain integration. This can also include taking part in several steps of the supply chain, such as setting up commercial platforms, contracting production or joint ventures. Read the example of a German-Bosnian partnership on Freshplaza.

3. What competition do you face on the European plum market?

The market for stone fruit is competitive. Different fresh fruits can potentially substitute each other, but in plums you will also be in competition with both European and non-European producers. Supply gaps and temporary shortages will be your biggest opportunities.

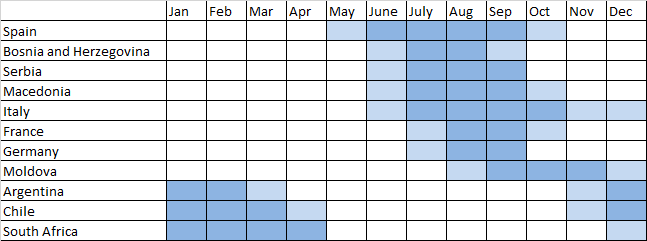

Which countries are you competing with?

Many European countries produce plums and supply their own markets when plums are in season. Spain, Italy and France compete in supplying European countries. South Africa is still the largest non-European supplier to EU countries, with Chile closing in with a similar production season. Producers in Serbia and Moldova are close to Europe and are also increasing their volumes, in particular to Germany and Eastern Europe.

Figure 8: Indicative supply calendar for fresh plums to Europe

South Africa

South African producers have lots of experience in producing and exporting many different fruits, among which stone fruit. The country has an ideal growing period to supply counter seasonal plums to Europe, and it therefore not competing with European growers.

Plums from South Africa are generally of good quality, which is part of their success. Some South African growers are integrated in European joint ventures, such as The Custom Plum Company, which is part of the Fresca Group in the United Kingdom. The United Kingdom is, together with the Netherlands, the main destination for South African plums.

Recent difficulties in production in South Africa have opened opportunities for suppliers from other countries such as Chile. In the past few years, weather proved to be a weakness for South African stone fruit cultivation. Drought has had a major effect on yields in 2018 and 2019, and 2020 was not a very productive year either. The supply to Europe decreased from 44,800 tonnes in 2017 to 31,800 in 2020. In 2021 due to logistical issues too many plums from South Africa entered the market simultaneously, resulting in a price drop.

The prices for South African plums are higher than their Chilean counterparts. But due to increasing costs and a lack of further price increments in the past years, farmers have become reluctant to invest in further development and expand their market.

Despite the recent decline, South Africa remains an important counter seasonal supplier of plums to Europe. South Africa is the main supplier of plums to the Dutch and British market, were their plums account for respectively 21,200 and 9,800 tonnes of imports. The Netherlands should be considered a transit country.

Chile

Chile is the largest plum exporter in the world. Chilean growers exported a total of 139,500 tonnes of plums and sloes, of which Europe only imported 13,200 tonnes. More than 70% of Chile’s plum export was directed to China, the United States and Brazil.

Chile fills in the off-season supply gaps, for example, when South Africa has lower availability. Unlike South Africa, production volume is increasing and yields are improving. Europe is also a good market for Chile when prices in other markets, such as China, are decreasing due to Chilean oversupply.

Chile’s large export-focused plum production continuously works on varietal improvements. According to Fruits of Chile, three key varieties are Angeleno (purple skin), Larry Ann (intense red skin) and Black Amber (dark skin) and new varieties with unique colour and flavour are being introduced, such as Candy Stripe, Dapple Dandy and the Lemon Plum.

As a supplier you can learn from Chile’s experience with plum varieties, but if you meet them in the same harvesting period, Chilean growers will be strong competitors.

Serbia

Serbia is one of the largest plum producers in the world and growing as a competitor in the European plum market. Serbia could be much bigger in the export market if it were not for the local demand and processing of fresh plums. Plums are used in Serbia’s local industry for making prunes and the spirit slivovitz.

If prices and demand for plums are high, Serbian farmers can shift their produce to the fresh export market and become a stronger competitor in the supply to Europe.

The lack of a steady fresh supply to Europe has withheld Serbian producers from building up a more significant reputation in fresh plums with EU buyers. But in the past years, and especially during the COVID-19 pandemic in 2020, Serbia did very well. In 2020 Serbian exports to Europe increased significantly to 23,700 tonnes, a 50% increase on the year before.

The Serbian supply season is similar to the south of Europe and the country is perfectly located for supplying to the eastern European markets of Croatia, Poland and the Czech Republic, for example. But also in Germany and Austria they do good business. In Germany and Austria, Stanley is probably the most popular variety due to their quality and suitability for transport.

Trade with Serbia and other western Balkan countries is expected to further develop. The European Union has approved the extension of the trade measures for another five years until 2025 and exporters will be able to continue their duty-free plum export.

Moldova

Moldova’s plum exports to Europe showed an impressive growth, from 7,500 tonnes in 2016 to 22,400 tonnes in 2020. Improvements in quality and focus on the EU market have contributed to the growth.

In 2014, Moldova shifted its focus from Russia towards the European Union, after an import ban in Russia and trade negotiations with the EU. The Association Agreement between the European Union and the Republic of Moldova was signed in June 2014 and has been in full effect since July 2016. Today (2021), Moldovan suppliers benefit from a duty-free quota of 15,000 tonnes for fresh plums to the EU. The United Kingdom, no longer part of the EU, has an additional duty-free quota of 2,043 tonnes.

Moldova has a similar plum season as the central European region. The main advantage compared to Europe are the lower production costs and attractive fruit prices. Prices of Moldovan plums are generally favourable, while many growers are still inexperienced with the quality requirements of buyers from the EU. But this is changing fast with the assistance of development programmes such as the CBI export promotion project in the Moldovan agrofood sector and USAID projects.

Russia and Romania have been (and still are) the main export markets for Moldova. In the past few years other Eastern European countries as well as Germany and Austria have increased their import of fresh Moldovan plums.

Currently, Moldovan producers are able to export to Russia again and recently in 2019 Russia also removed the import taxes on Moldovan fresh fruit. It is uncertain how this will affect Moldova’s focus on the EU market in the future. Russia is for Moldovan producers are better known and easier market with less requirements. But at the same time, Moldova is trying to get more connected with the EU and it seems that it is holding on to this new market. If plum growers maintain their focus on the EU market, they may become stronger competitors.

North Macedonia and Bosnia Herzegovina

Close to Serbia, plum producers in North Macedonia and Bosnia Herzegovina have also positioned themselves in the top six of non-EU suppliers of plums. These countries are generally price competitive with EU producers, but export volumes are fluctuating. Most Balkan countries have a strong local demand for plums, including for processing.

With the growth of Serbia as a fresh plum exporter, European buyers may also become more interested in other Balkan countries. Both North Macedonia and Bosnia Herzegovina managed to export around 6,000 tonnes in 2020. North Macedonia can enter the market slightly earlier and supplies a wide selection of countries in the central and eastern part of Europe, while Bosnian plums have a closer relation with Germany.

In the next five years the Balkan countries could achieve further growth due to favourable trade conditions with the EU. The Balkan countries are participants in the ‘Stabilisation and Association process’ and therefore have unlimited duty-free access to the European Union market. Starting 2021 until the end of 2025 the REGULATION (EU) 2020/2172 declared that all products covered by Chapters 7 and 8 of the Combined Nomenclature, which includes all fresh fruit and vegetables, originating in the beneficiary countries, will be admitted for import into the European Union without restrictions and custom duties.

Europe: Spain and Italy

Europe’s total plum production is close to 1.3 million tonnes. Most of the production is consumed or processed in the countries where the plums are cultivated. Spain and Italy are the largest supplying countries to neighbouring markets, but their plum exports have been declining in recent years.

During the high-summer months (July–September) the supplies from Spain and Italy are at their peak. These European plums are protected by an Entry Price System, which puts an import tax on all plums that are imported from outside the EU for less than €70,10 per 100kg. Therefore your best chance to supply to Europe in the same season is when production in these countries faces serious downfalls, for example, due to weather.

Spain supplied other European countries with 75,000 tonnes of fresh plums in 2020, which is not bad considering the slow exports of the two years before. But Spanish growers are struggling with increased production costs, and production volumes in recent years have gone down due to excessive rain. Spain will remain Europe’s most important supplier of fresh plums, with its main target markets being Germany, United Kingdom and France. But the country is also showing gaps where other plum suppliers could step in.

Italy’s supply of fresh plums fluctuates. In a good season, Italy exports up to 45,000 tonnes to other European countries, mainly Germany and the United Kingdom. In 2020, Italy suffered under the COVID-19 pandemic outbreak and plums were affected by frost in springtime, so plum production declined by 27% and exports to the EU halved to only 17,700 tonnes.

Tips:

- Make sure you can match the volume and the quality of leading export countries, such as South Africa and Chile. For example, you can try to extend your supply season by working with different plum varieties or supply sources, and become more attractive to European buyers.

- Diversify your markets. Opportunities for plums in Europe vary from year to year, so it is best to do business with several key markets, including several European countries.

- Check the import duties for your plums and those of your competitors to compare your costs and competitiveness. Use the HS code for plums (08094005) in the search option in Access2markets.

Which companies are you competing with?

Strong competitors in fresh plums cover a long supply season with several varieties. Through integration with growers and building partnerships with representatives in Europe, these companies achieve strong market positions. Specialisation in specific varieties and organic plums can be a possibility to stand out from other suppliers.

Tany Nature

Tany Nature is one of the largest stone fruit and plum growers in Spain, with 2,800 hectares of planted land in Spain and Portugal and their own packaging facilities. It has the size and the means to do in-house research and development, adopting the best possible plant material and production practices.

The company has control over the entire supply chain from production until the marketing of plums. This control makes them a strong player and attractive to buyers. For large buyers in Europe, they are therefore a safe choice. In addition to supplying to the EU market, they also export to Brazil and South Africa.

Delecta Fruit

Citrus and stone fruit exporter Delecta Fruit is owned by South African leading plum producers. They supply a wide variety of plums from different regions, covering a long season from mid-December to April.

The long season and the engagement with growers makes Delecta Fruit an attractive supplier for leading European retailers and wholesalers. In addition, practically all aspects are well organised, from logistics with cold chain management to certification for food safety and sustainability. Among their large buyers is Total Produce Indigo in France.

OrganoGroup

OrganoGroup is a producer of stone fruit and apples in South Africa which has been certified organic for 15 years. They are one of the few non-EU suppliers of organic plums through their subsidiary Pro-Plum Orchards. They prove that you can find niche markets through specialisation.

The company works in close cooperation with specialist buyer OTC Organics, which operates in the Netherlands and in Canada. With their cooperation, organic fruit has found sales opportunities in Germany, Scandinavia and Switzerland, among other regions where organic consumption is relatively high.

Tips:

- Show that you are in control of your operation. Implement quality monitoring systems to guarantee perfect handling and cold chain.

- Develop both export skills and knowledge connected to stone fruit cultivation. Both are important to get into business with important buyers.

- Specialise in a specific product, a special variety or organic product, if you cannot compete on volume and price.

Which products are you competing with?

Fresh plums compete with other stone fruit, such as peaches and nectarines. Kilo prices tend to be slightly higher for plums, which sometimes influences consumer choice towards other stone fruit. New sweet plum varieties are a good way to justify the higher price.

Stone fruit in general are often marketed as affordable mass products when in season. As a result, plums and other stone fruit are economical alternatives for other, more expensive fruit, such as mangoes. The European production of stone fruit in 2020 was 6.2 million tonnes. Most of the production consisted of peaches (42%) and plums (21%).

Price and retail promotions play an important role in consumer purchases.

Tip:

- Work on your presentation. With attractive packaging and nicely sorted plums, you will add value for your client and create an advantage over other fruit not as well presented.

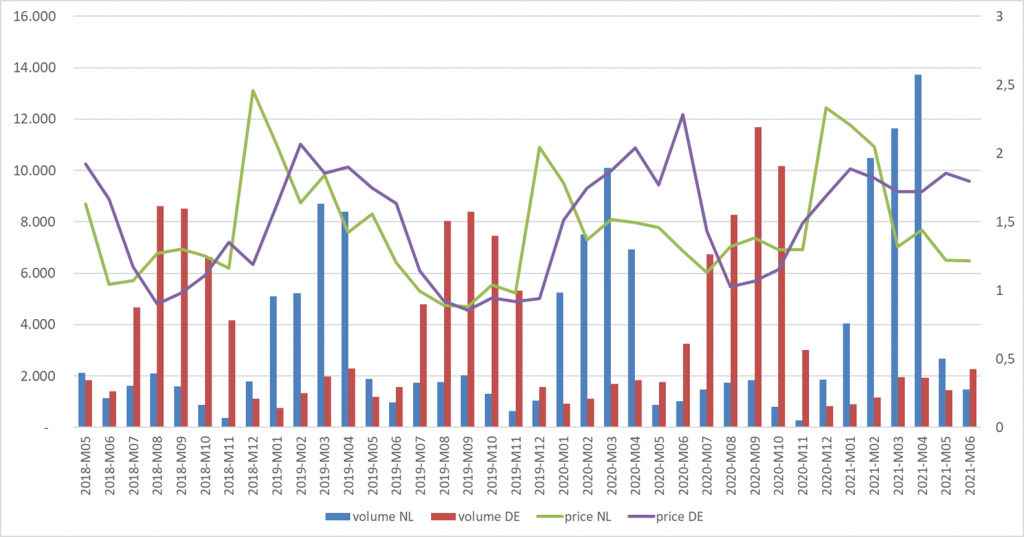

4. What are the prices for fresh plums and other stone fruit?

The prices for plums vary per season according to their availability. Most plums become available during the European season and that is when prices are low because of large local volumes and fewer shipping costs. Other factors that influence the price are varieties and sizes. For example, club varieties and triple-A size are higher in value.

The average trade price for plums is a little over €1/kg, which increases when plums are imported during the off season. There is a significant difference between plum import prices from the Balkan countries (approximately between €0.30 to €0.70) and the prices from off-season suppliers such as South Africa and Chile, which can be three to four times higher. The price difference should not only be explained by the longer shipping route, but also by the lower availability during the off-season and the high export quality of mainly fresh dessert plums (destined for fresh consumption).

Interesting fact:

Trade statistics show that in the years when prices from Chile and South Africa are low, the prices in the Balkan countries are higher. Also, the Netherlands has an opposite import season from its main export market Germany. The Netherlands has a much higher import in the winter and early spring from long-distant suppliers with a price peak in December for the Christmas holidays. Germany imports much more from the European and Balkan countries, including re-exports via the Netherlands (see Figure 10).

Figure 10: Monthly import volumes and prices of plums in Germany (DE) and the Netherlands (NL), in tonnes (left axis) and value/kg (right axis)

Source: ITC Trademap

Bulk wholesale prices or importer’s selling prices average roughly between €1.10/kg and €1.50/kg. While imported plums in the off-season go for asking prices of up to €2.5/kg, prices for local produce can drop easily below €1/kg for plums that are not selected for export. If you work with an importing company or trader, expect to pay at least 8% commission plus handling costs.

It is nearly impossible to provide price indications beforehand. This can best be checked by collecting data at the time of export from different sources, for example, wholesale markets and preferably directly with importers.

Retail prices have little relation with trade spot prices and tend to be more stable, although promotions during the season can lead to significant price drops. European supermarkets charge consumers between €2.50/kg and €6/kg for fresh plums. Special varieties, such as pluots, are sold in the higher range of €4.50 to €6.

Tip:

- Find different prices for plums on the French market via The Market News Network by FranceAgriMer - search for “prune” (French for plum). Use the browser translate function such as ‘Google translate’ to read the information in your own language.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research