The European market potential for fresh plums and other stone fruit

Plums are the most promising stone fruit to export to Europe. They are the most imported stone fruit from non-European suppliers and its supply has increased over the years – local production often Plums are the most promising stone fruit to export to Europe. They are the most imported stone fruit from non-European suppliers and its supply has increased over the years – local production often runs short and is limited to the summer. Germany and the United Kingdom will offer the most opportunities for exporters, however, you will need to find the right varieties and quality to please consumers.

Contents of this page

1. Product description

Plums (scientific name: Prunus) are a type of stone fruit, also known as drupes, which refers to a fleshy fruit with a hard inner layer, or stone, that surrounds the seed. Most countries have their own plum production and varieties.

Plum species that are significant for commercial trade include the hexaploid European plum (Prunus domestica) and the diploid Japanese plum (Prunus salicina). Within these species there are many varieties and hybrids varying from red, purple to yellow and green skin or flesh, many of which you can find for sale in Europe. In long-distance trade the American-Japanese varieties are most dominant because these are more suitable for transport.

Besides fresh consumption, plums are also consumed dried (dry prunes) or used in juice, dairy products or liquor.

| Harmonized System (HS) code | 080940 Plums and sloes 08094005 Plums |

| Examples of commercial varieties |

|

Other stone fruit

| 0809100000 Apricots 0809210000 Sour cherries (prunus cerasus) 0809290000 Other cherries 0809301000 Nectarines 0809309000 Peaches 0809409000 Sloes |

Sources: Eurostat; Wikipedia; Frutas-hortalizas.com

Figure 1: Plums

Source: Pixabay

2. What makes Europe an interesting market for plums and other stone fruit?

Within the stone fruit category plums are the most popular and the most imported stone fruit in Europe. Difficulties in local supply can further increase demand.

Plums offer most opportunities for exporters

Plums, sweet cherries and nectarines represent the highest volumes in external import. Fresh plums lead the import volume with the largest variety of supply countries. Therefore, plums offer most opportunities for non-European exporters.

Peaches, nectarines and plums are the most consumed stone fruits in Europe. Each of these fruits have a production value of over a million tonnes per year. Peaches are the most produced stone fruit in Europe with between 2.5 and 3 million tonnes and therefore require less imports from foreign producers.

The demand for imports from outside Europe is greatest for plums, sweet cherries and nectarines (see Figure 2). Sweet cherries represent the highest value due to the higher kilo price, but in volume plums lead the imports in the stone fruit sector. The non-European import for these fruits fluctuates according to the availability and the demand.

The supplying countries for plums are also more diverse than for cherries; the demand for cherries is largely met by Turkish exporters. In the EU, plums from outside Europe are mainly supplied by exporters from Moldova, South Africa, Serbia, Chile, Macedonia, Bosnia and Herzegovina and Turkey with volumes in 2020 varying from 22,000 tonnes (Moldova and South Africa) to 2,800 tonnes (Turkey). The United Kingdom (no longer part of the EU) imported 9,800 tonnes of plums from South Africa and 4,600 tonnes from Chile in 2020. In other words, export opportunities for plums can be created for different origins.

Tip:

- Read more about your competition on the fresh plum market in the CBI study Entering the European market for fresh plums and other stone fruit.

Climate adversity increases the need for imports

Plums and other stone fruit are typical summer fruit. This means consumption generally increases with attractive prices (high availability) and warm weather. As a supplier you need to be prepared for fluctuations in trade.

A successful plum season is subject to good climate conditions. In Europe many companies depend on this, especially in Spain and Italy, which supply most of the plums within Europe. The production in Spain has not been exceptionally strong in the past years and fluctuations in the European harvest of 300 tonnes from one year to the other are not unheard of. As an exporter you will regularly find short-term opportunities due to the varying availability of plums worldwide.

Frost and excessive rain drastically reduced the European supply of plums in 2018, and again in 2021. The off-season supply also regularly encounters problems due to drought or excessive rainfall, for example in South Africa and Chile, two of the main non-European plum suppliers.

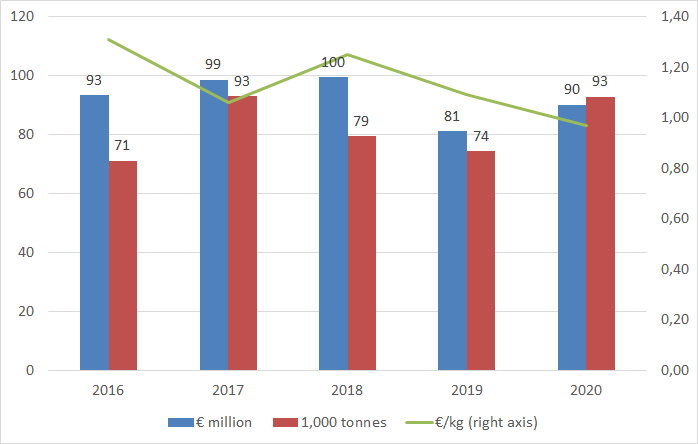

Weather issues are the main reason for the trade and imports of fresh plums to go down in volume. The trade prices move together with the availability of fruit (see Figure 3). Shortfalls result in higher prices. But plums also must remain affordable, otherwise consumers do not buy them. Lower availability and high prices increase the opportunities for alternative suppliers such as Moldova, Serbia and Macedonia.

Figure 3: Import and trade value of non-EU plums in the European Union (EU-27)

Source: Eurostat / Access2Markets

Tip:

- Stay up to date with the seasonal supply, production volumes and possible shortfalls in supply. Check the news and market overviews regularly on platforms such as Freshplaza, Eurofruit and FreshFruitPortal.

3. Which European countries offer most opportunities for fresh plums and other stone fruit?

Germany and the United Kingdom are the largest destination markets for fresh plums, but for imports from non-European suppliers the Netherlands is most relevant. Germany and the United Kingdom are also good markets for sweet cherries and nectarines. Austria plays a logistical role in the transhipment of Turkish cherries and Serbian plums to Germany.

Local production is usually preferred over imported stone fruit. This is partly due to the eating habits of specific varieties, but local fruit is also considered to be more sustainable and fresh.

Table 1: Importing countries with highest import value from non-European suppliers in 2020, in million euros

| Plums and sloes | Sweet cherries | Peaches and nectarines | Apricots | Sour cherries | |||||

| Netherlands | 32.1 | Germany | 97.7 | United Kingdom | 25.0 | Germany | 9.2 | Germany | 1.0 |

| Germany | 20.0 | Austria | 55.1 | Netherlands | 15.0 | Romania | 5.2 | Austria | 0.8 |

| United Kingdom | 19.8 | United Kingdom | 20.1 | Germany | 12.2 | Austria | 3.5 | Hungary | 0.5 |

| Poland | 5.7 | Norway | 9.3 | Romania | 6.6 | United Kingdom | 2.2 | Romania | 0.5 |

| Austria | 5.5 | Spain | 8.7 | France | 4.4 | Netherlands | 1.2 | France | 0.3 |

| Romania | 5.3 | Italy | 6.8 | Italy | 3.6 | Poland | 0.9 | Poland | 0.3 |

Source: ITC Trademap

Germany: the largest end market for fresh plums

Germany is the largest destination market for fresh imported plums, but just like other producing countries the external demand depends on the local production. German buyers prefer German plums, then European plums and lastly plums that are imported from outside Europe.

The import volume of plums in 2020 was 52,000 tonnes, half of which came from Spain and Italy. Moldova, Serbia and South Africa were the largest non-European suppliers with between 3,000 to 5,000 tonnes each. Part of the German supply from Serbia and Moldova is probably also registered as import in Austria, which functions as a logistical transit hub for plums.

German plum imports are not stable and vary according to the national production as well as the attractiveness of foreign supplies. In 2016 and 2017 the German production was lower than in previous years, so the import volume went up. In 2018, a record of 70,000 tonnes of German plums decreased the need for imports. In 2020, imports increased with a significant increase from Moldova.

Other stone fruit that has potential in Germany are sweet cherries and nectarines (see Table 1). Cherries are currently mainly supplied by German and Turkish suppliers. Nectarines have little local production, the largest amount is imported from Spain and Italy during summer and a smaller winter supply of around 3,500 tonnes from Chile and South Africa. For suppliers from other countries there can be opportunities when focusing on the months with low supply (see supply calendar in the market entry study for plums) or when you are able to compete with producers in Chile and South Africa.

United Kingdom: important importer of non-European plums and nectarines

Imports of plums in the United Kingdom have decreased in the past years, but it remains the second-largest destination market for non-European suppliers.

The United Kingdom has a minor production of plums, which accounted for 7,400 tonnes in 2020. This is not enough to supply the masses and large buyers turn to foreign suppliers to meet the demand. The total import of plums was 36,000 tonnes in 2020 (see Figure 4). Around 14,600 tonnes were imported from countries outside of Europe (see Figure 5). While British farmers focus on flavour and the quality of their local varieties, buyers may be more price sensitive and choose cheaper imports. However, with Brexit and the devaluation of the British pound in mind, you can expect prices and imports to face more pressure – which could explain the decreased import volume.

Plums are not as much of a traditional summer fruit as in larger producing countries, so the consumption is less bound to the summer period. South Africa and Chile remain relatively important suppliers of fresh plums, focusing on the European off-season. The plum import volumes from these countries in 2020 were 9,800 and 4,600 tonnes respectively. Spain (11,800 tonnes) and Italy (3,200 tonnes) focus more on the summer supply to the UK. The United Kingdom also leads the European import of nectarines, which amounted to 45,000 tonnes in 2020, of which 8,800 tonnes were imported from non-European countries such as South Africa and Chile.

Netherlands: typical trade hub for off-season stone fruit

The Netherlands is a trade hub for many off-season fruits. In stone fruit their presence is less obvious as it is a typical local summer fruit. Nevertheless, it is the largest importing country of plums from non-European origin (see Table 1).

Plums are mainly imported by the Netherlands from January to April, before the start of the Spanish season. This trade function makes the Netherlands an interesting country for non-European suppliers. In total the Netherlands imported 29,000 tonnes in 2020 (see Figure 4), with South Africa and Chile as main suppliers. A volume of 25,200 tonnes was (re-)exported, putting the Netherlands in the top three of plum-exporting countries in Europe. In 2020 it even exported more plums than the large producing country Italy.

Besides plums, the Netherlands also trade a significant number of nectarines. In 2020 nectarine imports were 28,100 tonnes, of which more than half was exported.

France: big in plum consumption

France is one of the main plum-consuming countries in Europe. However, imports are only a small part of the total consumption. Most consumption is made possible by locally produced plums.

France is one of the largest importers of plums. The total import is relatively stable at 14,200 tonnes in 2020 (see Figure 4). This is only an estimated 7% of the French consumption. Most of the imports are supplied by Spain (9,900 tonnes). The import from non-European countries was (only) 2,300 tonnes in 2020. The dominance of Spain as supplier is similar in the import of peaches and nectarines, which are also very popular stone fruits with French consumers.

The consumer in France is mostly focused on local and in-season plums, such as the Mirabelle, Greengage, Reine-Claude variety among many others. Plums are consumed fresh as well as used in a variety of food preparations such as dried prunes, marmalade or brandy. Further innovation in variety development, colour and taste must help the plum industry maintain its market.

Despite the focus on local plums, the plum tradition should be able to sustain a good percentage of imported plums. Also, when the harvest in France is below expectation this should be a hint for foreign producers that operate in a similar season. The forecast for 2021 is a 40% to 50% loss of the harvest in Tarn-et-Garonne, the French department where 80% of the French plums are produced.

Romania: leading in plum production

Romania has a plum culture and its growing import of plums offer opportunities for nearby supplying countries.

According to production statistics Romania is the largest plum producer in Europe with several local varieties (for example: Tuleu Gras, Grase Romanesti, Vinete Romanesti) and few commercial varieties for export such as Reine Victorias. Romania produces between 400,000 and 500,000 tonnes of plums under normal conditions. In 2018 and 2019 the country outperformed itself with 830,000 and 693,000 tonnes. On a global level, only China produces more. Despite the increased production volume, imports kept increasing. Plums are used for making brandy (Țuică) as well as different food preparations. Very few plums are exported.

Romania mainly offers opportunities for low-priced plums such as those from Moldova, its main supplier due to its cultural and geographical proximity. About 10,600 of the 14,900 tonnes of imported plums came from Moldova. Although Romania imports more and more plums, as a supplier you must be competitive and preferably at close distance to support the growing demand.

Poland: high consumption of affordable plums

Plums are a common fruit in Poland. When the local yields are low, extra plums are imported. Price is an important factor in supplying Poland.

Poland is one of the larger plum producers in Europe, with fruits harvested from both commercial orchards and household production. The official production is usually well above 90,000 tonnes. In case of a lower production, plum suppliers in the region can take advantage of the temporary shortages in Polish production. There is not a great off-season demand. Most consumption takes place throughout the local season and with local and regional supply. So, the additional demand is fulfilled with supply from Spain, Moldova and Serbia, the main trade partner for plums.

In 2020 imports were 19,500 tonnes, which could be considered a good market for foreign suppliers. About 7,200 tonnes were supplied by non-EU countries; 5,500 tonnes by nearby Moldova and Serbia and less than 1,500 tonnes by counter-seasonal suppliers from South Africa and Chile.

The prices of Polish plums are usually lower than German ones, according to industry sources about 20 percent lower during the season. As an external supplier you will also have to deal with the lower prices that Polish wholesalers are used to pay for plums.

Tips:

- Find potential trade partners at the Fruit Logistica in Germany or at the Fruit attraction trade fair in Spain.

- Always keep in mind the local production and preferences. When you find a potential partner in Europe (for example through trade fairs) you can discuss with which plum varieties and markets they have positive experience.

- See Gardenfocused.co.uk for plum varieties that are cultivated in the United Kingdom. You can use this to compare with the plums you export to the United Kingdom and define possible strengths of your product. For several typical European plums, see ‘most popular plums in Europe’ according to Taste Atlas and the most produced and exported varieties on Frutas-hortalizas.com.

4. What trends offer opportunities or pose a threat on the European market for fresh plums and other stone fruit?

There is more and more attention for local and seasonal plums and other stone fruit. This can hamper imports, but the ongoing development in new tastes and varieties will provide opportunities for growers that are able to differentiate with superior products.

Focus on taste increases opportunities for hybrids and new varieties

Taste and consumer experience have become important in the purchase of fresh plums. Plums need to be at their optimal ripeness when bought and consumers have a preference for sweet varieties. This has paved the road for new varieties that excel in sweetness, appearance or bite. As a supplier you can offer something unique to capture the consumers that go for taste and quality.

Hybrids such as the Pluot (75% plum - 25% apricot) and new ‘club’ varieties find their way into mainstream channels and growers in producing countries such as France, Germany, Spain, Chile and South Africa experiment with new varieties. The development of new varieties is far from being as advanced as with major fruit categories such as apples, but it is considered necessary to boost plum consumption in Europe. According to the Bavarian Centre of Pomology and Fruit Breeding (Bayoz) selling fruits with perfect taste is the only way to increase European plum consumption in the future.

Plum growers try to give plums, a traditional mass-produced fruit, a more exclusive character by improving appearance and taste. This is also a way for them to differentiate their product. Club varieties such as Franzi (sweet, early ripening variety) and Lovita (premium red-fleshed and late plum variety) are examples that strive to achieve this. Selecting the right varieties is an important part of positioning your company on the European market. New plum varieties should not only be superior in taste, but must also have a good shelf life, be tolerant to cracking and common diseases, and preferably freestone, meaning they separate easily from the flesh. The main difficulty for growers for investing in variety development is the low price of plums.

Growers and fruit marketers work together in getting new varieties to the consumer. For example, the fruit company Mack in the United Kingdom and South African stone fruit producer Fruits Unlimited have joined forces by founding The Custom Plum Company with the ambition to bring a series of exclusive Zaiger Interspecific plums to the British market.

Tips:

- Find the right varieties that are most favoured in your destination market. Check wholesale markets and retail shops to see which varieties are sold in which countries and their different channels.

- Inform yourself about new plum varieties and trends by following the works of plum breeders. Much of the plum breeding in Europe is done by universities and institutes such as the University Hohenheim in Germany, the University of Bologna in Italy and the Fruit Research Institute Čačak in Serbia, among others. See also the objectives of breeding centres in the chapter about plum breeding in the book ‘Prunus’.

- Participate in international events to learn from other professionals and experts such as the Symposiums on Plum and Prune Genetics, Breeding and Pomology.

Figure 6: Packaged British plums by Sainsbury’s supermarket

Photo by tacinte per Open Food Facts under the Creative Commons Attribution-Share Alike 3.0 Unported license

Attention for local seasons limits the imports to off-season

There is an increased attention to the specific season of fruits, which is often promoted by retailers that add extra value to locally produced fruit. When there is an abundant local supply, it will become more difficult to sell plums from abroad. Local plums and other stone fruit are also considered to be more sustainable because of the reduced need for transportation.

During the local season, plums are already cheaper and more promoted than the rest of the year. But several supermarkets give extra attention to fruit that is locally produced. This is seen for example with French or British plums (see Figure 6), for which the local origin and sometimes the national flag are clearly presented. It reflects respect to the local farmer, but consumers are also keen on the freshness and low carbon footprint of local produce.

While consumer awareness of local seasons increases, the opportunities for developing countries are often limited to the off-season and supplementing the European production. In full season you will have to find new ways to compete with locally grown fruit, for example by offering unique plum varieties. Either way, try to find the most efficient route to maintain freshness and reduce your carbon footprint.

Tips:

- Verify when it is most convenient for you to export to Europe. Look at the supply calendar in the Market entry study for plums and other stone fruit, and try to plan around the bulk supply from European producers. The European production is mostly limited to the summer period.

- Communicate to your buyer when your company has taken measures to reduce the carbon footprint or other actions that make your product more sustainable. Explore the possibility to communicate this on the packaging of your stone fruit as well.

- Read the CBI Trends in fresh fruit and vegetables to get more insights into fresh fruit trends.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research