Entering the European market for pumpkins and squash

Pumpkins and squash are a relatively easy crop. They can grow fast without the use of pesticides, and are therefore often sold as organic-certified in the European market. There is a considerable local production in Europe, but in the first and second quarter of the year, there is a window for imports of pumpkins from outside Europe. Exporters should be aware of consumer preferences and pricing strategies and stand out through off-season supply, variety, taste or quality.

Contents of this page

- What requirements and certifications must pumpkins and squash meet to be allowed on the European market?

- Through which channels can you get pumpkins and squash on the European market?

- What competition do you face on the European pumpkins and squash market?

- What are the prices of pumpkin on the European market?

1. What requirements and certifications must pumpkins and squash meet to be allowed on the European market?

Pumpkins and squash should comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI website. You can also use the My Trade Assistant tool by Access2markets, which provides an overview of the requirements for pumpkins and squash per country.

What are mandatory requirements?

Mandatory requirements concern food safety and quality. They include legal rules, quality requirements and packaging and labelling requirements.

Control of pesticide residues

Regulation (EC) No 396/2005 sets maximum residue levels (MRLs) of pesticides in or on food and feed of plant origin. An MRL is the highest level of pesticide residue that is legally tolerated in or on food products when pesticides are used.

You can find the MRLs for the pesticide residues relevant to pumpkins and squash in the EU Pesticides database. To get all the MRL details, you should search for product code 0233020 (pumpkins) and 0232030 (courgettes). It is essential to familiarise yourself with the MRLs and to not exceed these levels. When pumpkins or courgettes contain more pesticide residues than allowed, they will be taken off the European market.

If your products do not comply with the European food legislation, they will be reported through the Rapid Alert System for Food and Feed (RASFF). This tool allows food safety authorities to quickly exchange information on health risks associated with the food and to take immediate action. For pumpkins, there have not been many reports related to pesticide residues in the past years. In one case, too high levels of heptachlor were found in butternut pumpkins.

For courgettes, the following overly high levels of pesticide residues were found:

- Flonicamid (MRL is 0.5 mg/kg)

- Heptachlor (MRL is 0.01 mg/kg)

- Iprodione (MRL is 0.01 mg/kg)

- Metalaxyl (MRL is 0.01 mg/kg)

- Omethoate (MRL is 0.01 mg/kg)

Tip:

- Visit the website of the European Commission to get more information about MRLs. Also check with your potential buyer what their specific MRL requirements are.

Control of contaminants

Pumpkins and squash may contain contaminants. These are substances that are not added to food on purpose, such as heavy metals (cadmium and lead) and perchlorate. These can end up in or on food due to environmental contamination or during production, packaging, transport and storage. As contamination has a negative impact on the quality of food and can cause a risk to human health, the EU has set maximum levels for certain contaminants in food.

The maximum levels of contaminants are laid down in Commission Regulation (EU) 2023/915:

- Perchlorate: 0.10 mg/kg

- Cadmium: 0.02 mg/kg (the maximum level applies after washing and separating the edible part).

- Lead: 0.05 mg/kg (pumpkin is a fruiting vegetable).

Tips:

- Make sure to keep up to date on the maximum levels of contaminants that are allowed for pumpkins and squash.

- Read more about contaminants on the website of the European Commission.

Plant health and phytosanitary regulation

Regulation (EU) 2019/2072 requires pumpkins and squash to have a phytosanitary certificate before entering the EU. The exporting country's national plant protection authority issues the phytosanitary certificates. This certificate guarantees that the pumpkin or squash is:

- Properly inspected.

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests.

- In line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072.

Tips:

- Contact the National Plant Protection Organisation (NPPO) in your country to arrange a phytosanitary certificate. Only these organisations are authorised to issue phytosanitary certificates.

- For an example of a phytosanitary certificate, look at Annex V of Regulation (EU) 2016/2031.

Product quality requirements

To export pumpkins and squash to Europe, your product must meet quality standards, which are outlined in EU legislation and product standards. As pumpkins are not covered by a specific product standard, you should comply with the general marketing standard (GMS, Annex I, Part A) of Regulation (EU) No 543/2011.

For courgettes, there is a specific standard: the UNECE standard for courgettes, which includes varieties grown from the Cucurbita pepo L. courgette group. If your product falls into this category, you can follow this standard. Courgettes are defined in three classes: Extra Class, Class I and Class II. European buyers mostly require Class I.

Packaging and labelling requirements

Pumpkins placed on the European market should meet the legislation on food labelling. Make sure to label in a correct way, as incorrect labelling can lead to fines and recalls. For all the packaging and labelling requirements, see our study on buyer requirements for fresh fruit and vegetables. Especially for the organic market, laser branding can be applied to mark the individual fruits.

Export packaging traditionally consists of wooden crates of 300 or 500kg, but nowadays, pallet boxes are also used.

Figure 1: Pumpkins from Kenya, ready for export to Europe

Source: Globally Cool (June 2024)

Tip:

- Make sure to discuss specific packaging requirements and preferences with your European buyers.

What additional requirements and certifications do buyers often have?

In addition to the legal requirements, European buyers often have other requirements. These include, for example, GLOBALG.A.P. certification and compliance with social and environmental standards. Last but not least, organic certification has become quite important in the European pumpkin and squash market (but it is less relevant for courgettes).

Certification

Food safety is essential in the European market. Therefore, several European buyers will require certain certifications. A common certification programme for good agricultural practices is GLOBALG.A.P. Buyers in Europe will often request this certificate, especially those that supply to supermarkets. For these buyers, it has become a minimum requirement.

Some retailers have their own additional standards. For example, the Dutch retailer Albert Heijn and the Belgian retailer Delhaize have developed a GLOBALG.A.P. add-on – called AH-DLL GROW – to meet growing consumer expectations concerning product quality and food safety. Producers that supply to these retailers should have this farm-level risk management system in place. It sets out rules for hygiene, residue monitoring and the prevention of foreign body contamination.

Sustainability compliance

Social and environmental compliance is increasingly demanded by European buyers. This often means that you will need to sign the buyer’s code of conduct or a third-party code of conduct. You can also choose to follow third-party certification schemes. Examples include:

- GLOBALG.A.P. Risk Assessment on Social Practice (GRASP): a GLOBALG.A.P. add-on for the evaluation of the well-being of workers at the farm level.

- Supplier Ethical Data Exchange (Sedex): a global initiative to make global supply chains more transparent. Sedex has also developed a social auditing scheme – SMETA – to help companies assess the working conditions and environmental performance in their business and supply chains.

In addition, some supermarket chains have their own schemes, such as Tesco’s Nurture (add-on module to GLOBALG.A.P.).

Tips:

- Implement at least one environmental and one social standard. See the SIFAV Basket of Standards developed by the Sustainability Initiative Fruit and Vegetables (SIFAV).

- For requirements related to payment and delivery terms, see the CBI’s study on organising your export of fresh fruit and vegetables to Europe.

Organic certification

Organic-certified pumpkins and squash have become quite normal in several European markets such as Germany, the Netherlands, the United Kingdom and Nordic countries.

If you want to market organic pumpkins and squash, you should comply with Regulation (EU) 2018/848. It lays down the rules on organic production and labelling for organic products.

Tip:

- Consider organic production carefully, as getting certified is expensive. For some markets and types of pumpkins, organic certification is important, while for other produce it is not a must.

2. Through which channels can you get pumpkins and squash on the European market?

In this chapter, the focus is on pumpkins and less on courgettes. For courgettes, the channels are more straightforward. Most courgettes are conventional, consumed at home and bought at supermarkets, specialised food and vegetable stores or street markets. Courgettes are not so frequently used in restaurants, therefore the volume sold through the food service channel is relatively small. Further, for courgettes, an extra‑high segment does not exist and the low-end segment for industrial processing is relatively small when compared to that for pumpkins.

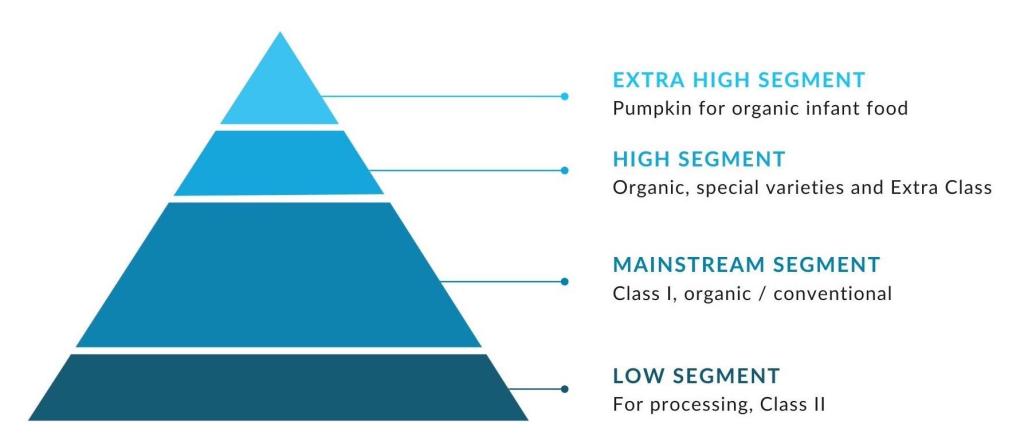

How is the end-market segmented?

Fresh pumpkins and squash end up on the market through different segments: the food retail segment, the food service segment and the processing industry. Below is a visual presentation of the different segments, after which each segment will be explained in more detail.

Figure 2: Market segments for fresh pumpkins in Europe

Source: Globally Cool (June 2024)

Fresh pumpkins sales are about equally divided over the food retail and food service channel within Europe. The extra-high segment includes pumpkins used as an ingredient for baby food production in Western and Northern Europe (especially Germany).

The high-end segment includes organic pumpkins, Extra Class and special varieties in relatively low volumes. High‑end supermarkets and food service distributors, organic supermarkets and specialised fresh fruit and vegetable shops sell these high-end pumpkins.

The mainstream segment is the largest. These pumpkins are typically Class I and can be both conventional and organic. The pumpkins on offer differ from food retailer to food retailer. While one retailer may only sell organic pumpkins, another retailer may offer a mix of conventional and organic pumpkins.

Variations per region

Note that the shares and the offer of pumpkins differ per European region. In eastern Europe, most of the pumpkins sold are conventional. This is also the same in southern Europe.

In western and northern Europe, the food retail channel offers a lot of organic-certified pumpkins. These pumpkins can be either loose or cut into pieces (or halves) and packed in transparent plastic bags of 300-500 grams. Class II pumpkins are used in the food processing industry for the industrial production of pumpkin soup or frozen pumpkin, for example. The extra high-end segment includes the most demanding food processing industry: the baby food industry. Pumpkin is a well-known ingredient for baby food. Butternut squash puree is also a popular baby favourite.

Western and northern Europe is also where most pumpkins are sold through the food service segment (around 60%). In the food service segment, the share of organic certified pumpkins is typically a little bit lower than in the food retail segment (but relatively high still compared to the overall fruit and vegetable sector, as the cost price difference is relatively low).

Tip:

- Be aware of the differences between European regions. While in eastern and southern Europe several buyers may accept Class II conventional pumpkins, for western and northern Europe your offer should focus on Class I pumpkins.

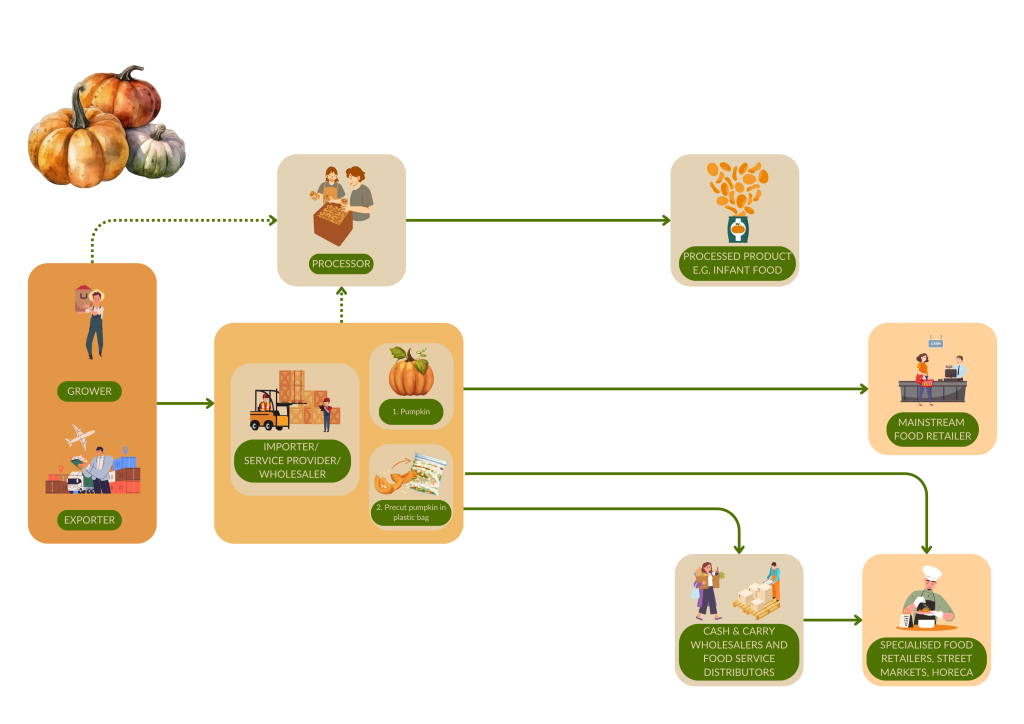

Through which channels do pumpkins and squash end up on the end-market?

Both the food retail and food service segment are important segments for pumpkins and squash. Figure 3 shows the different channels. After that, the channels are explained in more detail.

Figure 3: Market channels for fresh pumpkins to Europe

Source: Globally Cool (June 2024)

Figure 3 shows that the importer/service provider is the most potential type of buyer in Europe by far. Importers/service providers can be divided into several groups:

- Fresh fruit and vegetable importers. These companies are specialised in trading fruit and vegetables. Each importer is different in terms of their range of products, the origin countries of the produce, the destination markets and the market channels and segments they sell to. Many importers are located in the Netherlands due to the Netherlands’ position as a trade hub for fresh fruit and vegetables in Europe. Examples of importers in the Netherlands are Nature’s Pride (specialised in exotics), Bel Impex (exotic fruit and vegetables from niche origins), Exotimex Europe (exotic fruit and vegetables from China, Ecuador, Costa Rica, Brazil, Ghana and South Africa for the foreign food market), Bud Holland (unique niche fruit and vegetables, including rare pumpkin varieties from, for example, Peru), YEX (exotic fruit and vegetables), Exotic Roots (pumpkins from India and mini squash from South Africa). Some examples of importers from other countries are Yummy Fresh (Spain, imports contract-farmed pumpkins from Peru, Mexico and Senegal during the off-season), Tropifruit (United Kingdom, imports Afro-Caribbean fruit and vegetables for the foreign food market) and Wealmoor (United Kingdom, imports subtropical fresh fruit and vegetables).

- Importers with a strong focus. This group includes companies that have a very narrow focus on fruit and vegetable types and/or origins. Examples of companies in this group are Q-cape (Netherlands, imports pumpkin and sweet potatoes from South Africa), GlobalFair (Netherlands, imports pumpkins and a few other fruit and vegetable types), GreenLine Gate (Belgium, imports fresh fruit and vegetables from South America, including pumpkin from Chile).

- Producer organisations or cooperatives of vegetables growers. These organisations, like ZON and the Greenery (both in the Netherlands) and BelOrta (in Belgium) form a connection between producers and the food retail and food service industry. Cooperatives play a large role in the European trade of courgettes; however, they are less dominant in the trade of pumpkins. Interestingly, in the past few years, some cooperatives were formed to join producers in selling and marketing pumpkins. Examples of these initiatives are the Agrolulo Group/FENIXFOOD in Spain and Georgs Bio-Bauern in Germany.

Processors

Processors buy (mostly) class II pumpkins and squash and add value by turning them into, for example, fresh cut and packed pumpkin, frozen pumpkin and pumpkin puree. The trend for more convenience in the past decade has been an important growth driver for this market channel. Examples of companies in this segment are AGF Direct and De Terp Pompoenen, both from the Netherlands.

Food service

The food service sector includes restaurants, hotels and catering services and relies on two main types of suppliers: cash & carry stores (non-specialised wholesalers) and food service distributors.

Cash & carry wholesalers sell a wide range of products in their network of outlets. These outlets are open to businesses only. An example of a cash & carry store is Metro Makro (in the Netherlands). These wholesalers often only work with one or just a few suppliers. For example, Makro’s fresh pumpkins and squash are supplied by the importer Nature’s Pride.

Food service distributors have large storage facilities and a fleet of trucks to deliver all kinds of food on a daily basis. They either purchase products from manufacturers, from importers, or directly from foreign exporters. One of the largest food service distributors in Europe is Bidcorp, delivering food and non-food products to the food service sector in many European countries. European fresh fruit and vegetables importers/wholesalers, such as Van Gelder Groente en Fruit, supply Bidcorp’s food service operators with fresh fruits and vegetables.

Food retail

The share of fresh pumpkins sold through food retail chains is largest in the Northern and Western parts of Europe. Each European retail chain tends to have a different supply structure. Some work with annual supply contracts, while others have dedicated service providers. For example, the German food retailer Lidl works with OGL Foodtrade.

Within Europe, there are several growers that can directly supply retailers. One example is the Portuguese company VGT with annual capacity of 9,000 tonnes of butternut pumpkins, 3,000 tonnes of Muscat pumpkins, and 150 tonnes Hokkaido pumpkins. One other example is the company Van der Weerd Pompoenen (Netherlands).

What is the most interesting channel for you?

While the local European production of pumpkins and squash dominates the European supply, there is also a need for imports from outside Europe. Several of Europe’s exotic vegetable importers (also) buy pumpkins and squash from outside Europe. Especially when European supplies are limited. This mostly concerns the off-season supply of pumpkins, but courgettes are also imported from outside Europe from time to time. In addition, specific or niche varieties, such as mini courgettes or pumpkins, are sourced from outside Europe frequently.

Potential buyers can be found in most of the market channels. You should choose your potential buyers in relation to your products, country of origin and experience:

- If you are new to exporting to Europe, focus on relatively small importers that do not require large volumes and strict food retail requirements. These smaller importers can help you to develop and grow your ability to meet European buyer requirements.

- If you are an exporter from a country that is established in and well-known for exporting pumpkins and squash, such as South Africa, focus on importers that import pumpkins, but not yet from your country.

- If you supply very niche varieties of pumpkins or squash, focus on specialised importers of niche exotic fruit and vegetable types and varieties. One example of a specialised importer is Bud Holland.

- If you want to supply organic-certified pumpkins or squash, make sure to look for importers that specialise in organic exotic fruit and vegetables, such as OTC Organics. Traceability and organic certification are essential for accessing the European organic market.

European buyers prefer to create long-term relationships to make sure they have a reliable, steady supply of ginger and can rely on you for buying quality products.

Tips:

- Choose the type of buyer that best fits your company and product. There are several channels to choose from, but each buyer will have their own specific requirements in terms of varieties, quality, volumes, windows, etc. Make sure to be aware of the different target groups and discuss the preferences and requirements for pumpkins with your buyer.

- Attend trade fairs to connect with potential buyers. Key events for fresh fruit and vegetables in Europe are Fruit Logistica (Berlin, Germany) and Fruit Attraction (Madrid, Spain).

- Consult the CBI's tips for finding European buyers on the European fresh fruit and vegetables market.

3. What competition do you face on the European pumpkins and squash market?

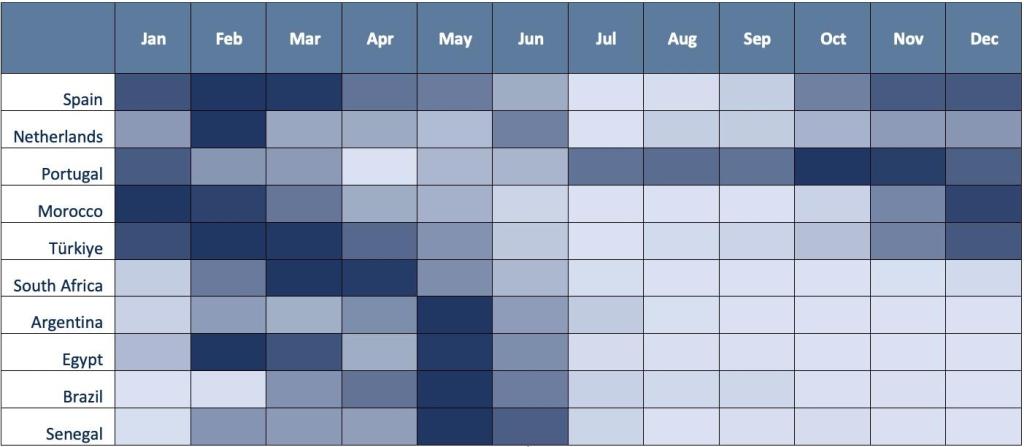

Spain dominates the European pumpkin and squash market, but significant volumes are also imported from outside Europe. The main opportunities for non‑European suppliers when there are gaps in supply from other supplying countries. For countries from the southern hemisphere, there is an opportunity in the European low season, which is from April until October.

Which countries are you competing with?

The off-season for pumpkins and squash is during the months of April, May, June, July, August, September and October. Supply in these months is limited compared to the other months of the year. This can be also seen from Figure 4, in which the light blue colour shows the months in which the exported values to Europe were the lowest. Figure 4 shows the leading supplying countries for pumpkins and squash. This table includes most of the countries that supply pumpkins and squash (except Brazil and Honduras for pumpkins).

Figure 4: Indicative supply calendar for pumpkins and squash to Europe for the main supplying countries

Source: Globally Cool, based on UN Comtrade monthly data for 2023

Over the period under review (2019-2023), Senegal, Egypt, Türkiye and South Africa have especially increased the volume of pumpkins and squash that they have exported to Europe considerably. Figure 5 shows more details on the volumes supplied to Europe.

Source: UN Comtrade (May 2024)

As an exporter in a country outside Europe (such as Egypt or Senegal) to the European market, most competition comes from Morocco, Türkiye and South Africa and from European supply itself, which is dominated by Spain. The Spanish supply to the European market should be taken seriously, as that volume is almost 9 times larger than the volume of pumpkins and squash exported to Europe from Morocco, which is the largest non-European export country.

Morocco: strong in courgette exports

Moroccan exports of pumpkins and squash to European countries amounted to 60,000 tonnes in 2022, representing an 8.1% share of total European pumpkin and squash imports. Moroccan exports of pumpkins and squash to Europe peak every year between November and March. The strengths of Morocco are its geographical distance to (especially southern) Europe, its good climate conditions and its slightly different season.

France and Spain are Morocco’s primary markets for pumpkins and squash. Despite the vegetable sector’s efforts to diversify exports away from Europe to the Middle East and Africa, Moroccan pumpkins and squash are only exported in substantial volumes to the United Arab Emirates and Qatar.

The vast majority of exported products are courgettes, with the peak months between November and February every year. The peak season for pumpkins is different, with the top months being the period from March to June. Exports to France and Spain remained rather stable in this period, amounting to 14-17% of French imports and 40-50% of Spanish imports.

Only 4-5% of the Moroccan products in this category exported to France are pumpkins; the rest are courgettes. For Spain, the share of pumpkins from Morocco is considerably higher (30%).

There are some other European countries that recently increased their imports of pumpkins from Morocco a lot:

- The United Kingdom: Exports grew from 150 tonnes in 2019 to 5,500 tonnes in 2023.

- Italy: Exports grew from 5 tonnes in 2019 to 750 tonnes in 2023.

- Switzerland: Exports grew from virtually nothing in 2021 to 460 and 570 tonnes in 2022 and 2023 respectively.

While tomatoes are Morocco’s leading export vegetable, followed by sweet peppers, courgettes and pumpkins are the third largest export vegetable category. In 2022 and 2023, Morocco produced approximately 300,000 tonnes of courgettes, which is a little lower than the 330,000 tonnes reported in FAOSTAT for 2021. The outlook for 2024 is positive, with a planting area increased by about 20%.

The primary production areas in Morocco include the regions of Souss-Massa, Tadla-Azilal and Doukkala-Abda, which benefit from fertile soils and favourable climatic conditions. The industry is largely driven by small to medium‑sized farms, many of which have adopted modern agricultural practices to grow their yield and ensure sustainability. The MOROCCO FOODEX, short for Food Export Control and Coordination organization, represents the interests of the fresh fruit and vegetables sector and a few other food industry sectors.

Türkiye: strong position in German-speaking markets

Turkish exports of pumpkins and squash have to Europe have risen decently, with a growth of 15% per year. The volume of 33,000 tonnes in 2023 was equal to 4.5% of total European imports. Türkiye is the favourite supplying country amongst German-speaking and eastern and south-eastern European buyers and has a strong window of opportunity, with its largest volumes exported to Europe between November and May each year.

About 65% of Turkish exports in this category are courgettes; the rest is pumpkins. This ratio is more balanced (approximately 50:50) for exports to Europe. Türkiye is the fifth largest supplying country to Germany and became the largest supplying country to Austria. The large Turkish-origin populations in both countries make it easy to connect and therefore focus the export of Turkish pumpkins and squash to these markets.

Türkiye has been the dominant supplying country to Romania, Bulgaria and Greece for years already. Türkiye benefits from the close proximity to these three countries. Other interesting strengths of Turkish exports to Europe include the following:

- Exports to the United Kingdom grew rapidly in 2020 and 2021, to reach about 1,000 tonnes per year in the period from 2021 to 2023.

- Exports to Poland grew sharply in the period from 2021 to 2023, to reach 1,130 tonnes in 2023.

- Exports to Austria grew from 1,300 tonnes in 2022 to 7,400 tonnes in 2023.

- Exports to Switzerland jumped from less than 8 tonnes per year to yearly volumes of more than 200 tonnes per year since 2022.

Other markets where Türkiye has gained a market share and a strong position are Sweden, Croatia and Norway.

Turkish pumpkins and squash are often priced competitively in the European market, due to the lower production and labour costs in Türkiye compared to European countries. Especially destination markets in south-east and central Europe benefit from relatively low transportation costs and time, ensuring fresh and timely delivery of the pumpkins and squash. Obviously, this advantage, combined with the competitive price, is most rewarding in eastern and central European markets but it is also gaining an advantage in north and north-western Europe.

Following data from FAOSTAT, Türkiye produced approximately 770,000 thousand tonnes of pumpkins and squash in 2021. This makes Türkiye one of the leading production countries worldwide. Although several years were marked by challenging weather conditions from 2020 onwards, the short-term outlook is slightly more positive. Relatively good weather conditions and a larger planting area are having a positive impact on the 2024 harvest.

With Russia as the largest export market, Israel in the third position and Ukraine fourth, Türkiye’s pumpkins and squash exports are clearly more diversified than these of Morocco. Obviously, Türkiye benefits from its large scale, along with its central location between south-eastern Europe and south-western Asia.

The Mediterranean Fresh Fruits and Vegetables Exporters' Association (MEA) represents the interests of over 1,000 fresh fruit and vegetable exporters from Türkiye. A few Turkish companies also offer baby pumpkins, for example the company Onkel.

South Africa: early window for pumpkins in Europe

South Africa’s pumpkin and squash exports to Europe peaked in 2021, at 29,500 tonnes. The average growth over the period from 2019 to 2023 is 11%, because its exports to Europe declined every year after 2021, with the largest decline in 2023 (16%, to 22,400 tonnes). This drop was primarily caused by the very high sea freight rates in 2022–2023, making South African produce too expensive in Europe. In 2024, the lower freight rates will likely boost South Africa’s exports of pumpkins again.

Most of South Africa’s export volume consists of pumpkins because of its early export window, which runs from early May to the end of June. The main destinations that South Africa exported pumpkins to in 2023 were the United Kingdom (8,500 tonnes), the Netherlands (7,000 tonnes), Italy (2,500 tonnes), Spain (over 2,000 tonnes) and Germany (over 1,130 tonnes). Over the whole period from 2019 to 2023, the leading European destinations were the United Kingdom and the Netherlands by far, followed by Spain and Italy.

South Africa exports less than 10% of its production volume (close to 280,000 tonnes in 2022). In addition to about 2,500 tonnes exported to other southern African countries, South Africa depends on the European market for its pumpkin exports, as its exports to other continents are limited. The export window is from early May to the end of June. The range includes Hokkaido pumpkins, muscat pumpkins and butternut squash.

The South African Fresh Produce Exporters’ Forum (FPEF) raises funds for the export industry to ensure participation in major international trade fairs, such as Fruit Logistica Berlin. The forum also distributes the annual FPEF Export Directory to help raise awareness amongst potential buyers of South African fresh produce. South African exports of pumpkins to Europe will largely depend on the future development of shipping costs. As shipping costs are not expected to increase substantially in 2024, the outlook for 2024 is therefore positive.

Spain: highest market share between October and March

Spain is the leading supplier to the European pumpkins and squash market. The Spanish production output is huge. It peaked in 2021, with a record volume of 790,000 tonnes. In 2022, the production volume dropped by 6.0% to 745,000 tonnes due to a considerable drop in courgette production that year. This drop was part of a broader trend observed across various agricultural goods, influenced by factors like high input costs and unstable market demands that year across Europe.

Between 7-9% of the Spanish export volume consists of pumpkins, for which the Spanish export window is from October to April. For courgettes, the export window also starts in October, but export volumes already drop substantially in March. Spain’s leading export destinations for both courgettes and pumpkins are France, Germany, the United Kingdom and the Netherlands.

Most production takes place in the regions of Andalusia, Murcia, Valencia and Castile‑Leon. The industry is well-organised, with an integrated value chain that covers everything from the selection of seeds to distribution, which ensures high-quality produce at competitive prices.

For courgettes, the Spanish share in the European market reaches up to 70% in the period from October to March. This very high share gives the Spanish industry the power to act upon critical market conditions. For example, in October 2023, the Association of Fruits and Vegetables from Andalusia announced a temporary ban on the sale of Class II courgettes due to the very low market prices for courgettes at that time.

Tips:

- Find out which of your pumpkin or courgette varieties provide(s) the best timing for the European market.

- Build a reputation in the vegetable trade, especially if your country is not known for its vegetable production. Your production process must match the quality of the practices of growers in the listed competing countries and beyond.

- Invite buyers to your farm to convince them that you manage good agricultural practices very well.

Which companies are you competing with?

The main competing countries are Spain, Türkiye, Morocco and South Africa. Below are a few examples of successful exporters to the European market.

Al Gharb: courgettes as part of a wide range of fresh and frozen vegetables

Al Gharb is an agricultural company located in Morocco's fertile and well-watered Gharb region. The company specialises in producing and exporting a variety of fresh and frozen fruit and vegetables. With a focus on high-quality products, Al Gharb uses advanced agricultural practices and modern packing facilities to guarantee premium product standards. The company emphasises traceability and good quality monitoring and serves both domestic and international markets.

Al Gharb exports significant volumes to Europe, North America and the Middle East. The company offers a wide range of fresh and frozen vegetables and fruits, including courgettes.

Another Moroccan exporter of courgettes is SL Fresh. Although the Moroccan companies focus more on courgettes (zucchini) than on pumpkins, several companies offer pumpkins too. For example, one European importer that sources Hokkaido pumpkins from Morocco is Nature’s Pride.

Lucerne Fresh: focus on customer satisfaction and optimal grower returns

Lucerne Fresh is a leading South African company that specialises in producing and exporting fresh produce, including vegetables, stone fruit, pome fruit, table grapes, citrus fruit and subtropical fruit. It focuses on delivering high-quality fruit and vegetables, including pumpkins, to various markets globally. Its total annual output is 45,000 tonnes of fruit, produced at seven of its own farms and five partner farms.

The ‘Lucerne’ brand is a well-known brand in the South African retail and wholesale market, and for export markets they have added the brands ‘Simply Gold’ and ‘White Tiger’ to their portfolio in recent years. An important aspect of the company is its commitment to sustainable and environmentally-friendly farming practices, to make sure that their produce is not only fresh but also ethically sourced.

Lucerne Fresh has a strategic focus on customer satisfaction and on flexibility in supply chain management, with strong quality control (e.g. the temperature is strictly maintained at 12-15 degrees Celsius, depending on the variety). This makes them a reliable supplier in the European fresh produce market.

FlorFruits: high-end competition within Europe

The Spanish company FlorFruits is located in the region of Valencia, where most of the Spanish pumpkin production takes place. The company also owns a subsidiary company in Peru called FlorFruits Peru, which allows them to provide products for almost the full season, as the Peru exports start from December when the Spanish season is over. In 2023, the company produces over 120 containers of different pumpkin varieties, such as the Muskat, Sweety Queen, Carruécano, Delica and Hokkaido varieties.

FlorFruits has experienced an ongoing strong demand from European buyers, which made it possible for them to increase their land surface for pumpkins by 35% in 2023. The company has contracts with clients and supermarkets all over Europe. German buyers in particular appreciate the Sweety Queen pumpkin, which is a variety owned by FlorFruits.

FlorFruits exports are good for 75% of total sales and range between 7 and 8 thousand tonnes per year. At this volume, the company makes up between 10-15% of the Spanish annual export volume.

Tips:

- Improve your export window and save on marketing costs by working together with other pumpkin growers from your country or – if feasible – from neighbouring countries.

- Find strategic partnerships and create an integrated supply chain with access to packing plants and logistics.

- Make your logistics as efficient as possible and maintain a temperature of 15 degrees Celsius.

- Learn from the practices of the companies described above and from other producers and exporters of pumpkins. For example, the company Star South from South Africa has a strong social media marketing strategy and also has its own YouTube channel. Another example from another supplying country is Gadex from Egypt.

Which products are you competing with?

Pumpkins and squash are a unique vegetable, so there is little competition from other vegetables. Products that compete with fresh pumpkins include other types of squash, such as butternut squash or Hokkaido pumpkin. These alternatives offer similar nutritional benefits and culinary uses.

Sweet potatoes are a competitor due to their similar texture and sweetness, making them a good substitute in recipes. Additionally, frozen pumpkin provides a convenient alternative for people who want to save time when cooking and baking. Frozen pumpkin therefore directly competes with fresh pumpkin, especially as an ingredient for making pies and desserts.

Competition in the market for fresh courgettes (zucchini) typically includes other types of summer squash, such as yellow squash, which has a similar texture and flavour. Aubergine can also serve as a substitute in many dishes due to its comparable texture when cooked.

Tip:

- Clearly communicate the benefits of your pumpkin varieties to prospective buyers.

4. What are the prices of pumpkin on the European market?

Prices for pumpkins and squash show some variation through the year. These prices depend on the origin (transport, quality, brand), the type (common or niche varieties) and the availability. The availability is defined by the balance between supply and demand.

For example, the price of a Hokkaido pumpkin (with an edible peel) can be almost double the price of a butternut pumpkin, but the seed price is also higher and the average yield is lower. Also, since the demand for pumpkins weighing between 1-2 kg is the highest, this is also typically the size category that gains the best prices. Another example is yellow courgettes, which can be sold at more than three times the price of normal green courgettes.

Certification may also play a role in the prices for pumpkins. In most supermarkets, organic-certified pumpkins are about 10% more expensive than conventional pumpkins. However, export prices of organic-certified pumpkins are not always higher than prices for conventional pumpkins. The price difference depends on the market situation for both types. For example, when conventional pumpkins have limited availability, their prices easily rise to 10-20% above the organic pumpkin market prices.

The large market for organic-certified pumpkins and courgettes in Germany can be explained by the relatively high import prices for German pumpkins and squash when compared to the other focus markets. At the same time, the German import prices are lower than in Austria, Switzerland, Norway, Sweden, Denmark and Finland.

Source: Globally Cool (June 2024)

The two main conclusions that can be drawn from Figure 6 are:

- The prices of German imports are higher than those of most other European countries. This is because in Germany, a large share of sales are organic-certified products, which (on average) receive higher prices than conventional pumpkins and squash. Additionally, Germany is a large producer of organic-certified baby food, with a substantial need for organic-certified pumpkins.

- Italian, Dutch and Spanish import prices are relatively low (but not the lowest prices in Europe; these are mostly in south-eastern Europe).

- European import prices for pumpkins and squash have gone up considerably since 2021. This is due to increasing costs of energy and transportation.

For 2024, the export prices will likely decrease a bit due to lower energy and shipment costs.

In terms of margins, the food retailer receives the largest share, with a margin of between 50 and 200% (in Figure 7, this is 72%). Figure 7 gives an indication for 1 kg of pumpkin, sold for approximately €3 in a Dutch supermarket.

Source: Globally Cool (June 2024)

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research