The European market potential for pumpkins and squash

The European market for pumpkins and squash is dominated by supply from Spain. However, in the first and second quarter of the year, there is a window for imports of pumpkins from outside Europe. The European market for pumpkins offers opportunities, but competition is strong. Local produce – mainly from Spain – and imported products compete for consumer attention. As pumpkin is a healthy and environmentally sustainable vegetable, its consumption in Europe will remain strong.

Contents of this page

1. Product description

Pumpkins and squash belong to the family Cucurbitaceae (its scientific name), which also includes cucumbers, melons and gourds.

Pumpkins is a squash plant variety of the species Cucurbita pepo (commonly referred to as the field pumpkin). It is usually characterised by its thick rind on the outside and seeds and flesh on the inside. Pumpkins are typically round and orange, although their size, shape and colour can vary significantly between different varieties. They are commonly grown as food items. They can be roasted or made into soups and purees and are famously also baked in pies. They are also traditionally carved out to be used as lanterns during Halloween.

The most known vegetable within the group of pumpkins and squash is the courgette, also called ‘zucchini’. Courgettes are a summer squash type that can reach nearly a metre in length, but they are usually harvested immature, at 15 to 25 cm. Courgettes are also treated as a vegetable. They are usually cooked and served as a savoury dish or side.

Like pumpkins, courgettes are from the species Cucurbita pepo and are members of the squash family. They are long, with a smooth, thin and edible skin that varies in colour, typically from green to more yellow varieties. Some popular varieties of courgette include the Black Beauty, the Golden Zucchini and the round globe types, like Ronde de Nice.

Figure 1: Different varieties of pumpkin and courgette available in the European market

Source: Globally Cool

Both pumpkins and courgettes are not only versatile in their uses in dishes but also provide nutritional benefits, including vitamin A, potassium and fibre. They can be grown in a variety of climates. The different varieties offer a range of flavours, textures and uses in recipes, from sweet pumpkin desserts to savoury zucchini breads.

This study focuses only on the exports of fresh pumpkin and squash to the European market. The Harmonised System (HS) code for pumpkin is 070993, with the description “Fresh or chilled pumpkins, squash and gourds Cucurbita spp.”

2. What makes Europe an interesting market for pumpkins and squash?

The European market for pumpkins and squash is dominated by supply from Spain. As a result, the quality of the Spanish harvest has a big impact on the European market. Your best opportunities to export pumpkins and squash to the European market are from November to May.

Window of opportunity for developing countries

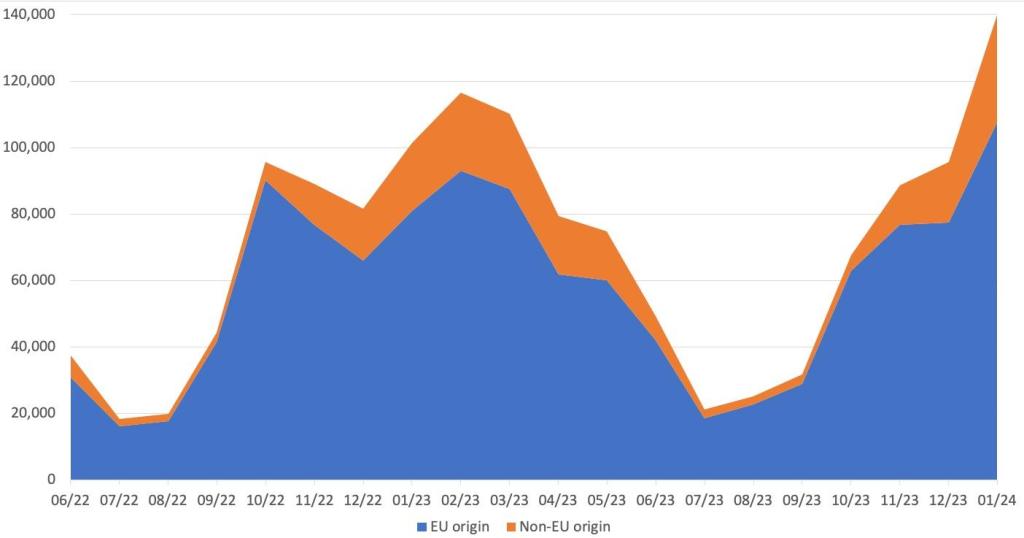

Spain is Europe’s leading producer of pumpkins, squash and gourds, and serves both the domestic and European markets. Throughout the year, European countries therefore rely heavily on supplies from Spain. However, there is still demand for imports from outside the European Union (EU). Figure 2 makes a distinction between imports from EU versus non-EU countries, showing the window of opportunity for developing countries.

The supply of pumpkins from outside Europe mostly occurs during the European low season, although Figure 2 is slightly misleading. The peak in supply from outside Europe seems to coincide with the peak in the Spanish supply too, but much of the Spanish supply of both pumpkins and courgettes is re-exported.

Most pumpkins and squash are imported from outside the EU from November until and including May (see the corresponding orange colour in Figure 2). Imports peak in January, February and March. These months therefore provide the best opportunities for exporters from developing countries.

Figure 2: European imports of pumpkins, squash and gourds by main origins (in € thousand) per month (June 2022–January 2024)

Source: Globally Cool, based on UN Comtrade statistics (May 2024)

Europe is a relatively stable market

The European import market for pumpkins, squash and gourds has stabilised in recent years, as average growth before 2019 was higher. About a fifth of the import volume comes directly from developing countries, making Europe an interesting market for you.

Source: UN Comtrade (May 2024)

*Developing countries following the OECD-DAC list of ODA recipients; “Rest of the world” refers to all other countries.

European imports of pumpkins, squash and gourds grew from 663,000 tonnes in 2019 to 740,000 tonnes in 2023. This translates to a compound annual growth rate (CAGR) of 2.8%. This was mainly due to relatively strong import growth in 2020, after which the imports seem to have stabilised at about 720-740,000 tonnes. Most of these imports were of courgettes.

The imports of pumpkins, squash and gourds from developing countries grew from 114,000 tonnes in 2019 to 144,000 tonnes in 2023, with a CAGR of 6.0%. As a result, their import market share grew from 17% to 19-20%. This shows that Europe could be an interesting market for you, as an exporter from a developing country.

Pumpkins, squash and gourds are also commonly grown in Europe, both commercially and privately. This domestic production is supplemented with imports. On average, the apparent annual consumption in Europe grew from 4.0 kg per person in 2019 to 5.1 kg in 2023.

This consumption is likely to keep on growing in the next few years, driven by trends that are in favour of healthy and sustainable vegetables like pumpkins and squash. This will result in increasing local production and a growth in off-season imports of pumpkins from outside Europe by at least 5% on average. This growth will be highest in the organic-certified segment (up to 7% per year).

Tips:

- Secure your market before expanding your production and make sure you have reliable sales contacts. Finding buyers can take time, especially when there is abundant supply from Spain.

- Read the CBI tips for finding buyers and the CBI tips for doing business with European buyers of fresh fruit and vegetables.

3. Which European countries offer the most opportunities for pumpkins and squash?

France is Europe’s leading importer of pumpkins, squash and gourds, with a market share of 22%. Germany follows with 15%, and then the United Kingdom and the Netherlands with 12% each. Together, these countries represent more than 60% of the total European imports.

Note that here we only discuss import volumes. We do not take consumption into account as an indicator for market selection, since import volumes are key for pumpkin exporters from developing countries to select priority markets.

Source: UN Comtrade (May 2024)

France: the largest European market for pumpkins, squash and gourds

France is Europe’s leading importer of pumpkins, squash and gourds. From 2019 to 2023, these imports were fairly stable, at about 165,000 tonnes. France imports about 18% of this produce directly from developing countries, except in 2020-2021, when their market share was relatively small – but still amongst the largest in Europe.

Spain and Morocco are logical pumpkin, squash and gourd suppliers to France because of their connection to the Mediterranean area. Nearly three-quarters of France’s imports come from Spain. Morocco accounts for about 17% of French imports, while Senegal, South Africa and Costa Rica have been supplying a small volume each for a few years now.

Most (≥90%) of France’s imports of pumpkins, squash and gourds are courgettes. In 2018, courgettes were the 6th most popular vegetable in France, after potatoes, tomatoes, lettuce, green beans and carrots. They are a key ingredient in classic French dishes like ratatouille – a vegetable stew that also commonly includes tomatoes, onions and aubergines. France is one of Europe’s largest markets for some specific varieties of pumpkins and squash, such as white courgette.

France is one of the countries that produces the most pumpkins, squash and gourds in Europe, behind Spain. France also (re-)exports some of its pumpkins, squash and gourds, at an export-import ratio of about 20%. In volume terms, they reached 30-34,000 tonnes per year. France’s main destinations for these (re-)exports are neighbouring European countries.

The balance of imports and exports remains in the country, and these products find their way to consumers through different channels. The most important channel is food retail chains. The consumption of these products per person in France is relatively high, at about 8 kg per year.

Germany: increased imports from developing countries

Germany is Europe’s second largest import market for pumpkins, squash and gourds. Imports grew from 110,000 tonnes in 2019 to 113,000 tonnes in 2023, at a CAGR of 0.6%. This included a peak of about 130,000 tonnes in 2020-2021.

Imports from developing countries grew from 9,300 tonnes to 12,000 tonnes, at a CAGR of 7.3%. As a result, their direct import market share grew from about 8% to 11%. Although this share continues to be below the European average, this is encouraging.

Spain is Germany’s leading supplier, supplying about two-thirds of the imports in 2023, followed by the Netherlands at 14% and Morocco at 6.0%. Turkey provides a steady 2.5%. Other suppliers from developing countries include South Africa (1.0%), Argentina (0.3%) and Egypt (0.3%). These countries increased their market shares, except for Argentina.

Between 80 and 90% of Germany’s imports of pumpkins, squash and gourds were courgettes. However, imports of pumpkins, gourds and other types of squash grew at a relatively strong CAGR of 5.5%. Hokkaido pumpkins have especially become more popular in recent years. Germany is also one of the better markets for organic produce, since the country is the largest organic food market in Europe.

Nearly all of the imports are intended to supplement Germany’s domestic production for consumption. Germans annually consume about 3 kg of pumpkins, squash and gourds per person.

The largest market channel for pumpkins in Germany is food retail. German retailers are amongst the strictest buyers in terms of requirements. This applies to several aspects, the main one being the level of pesticide residues that is allowed, although this is not a very difficult requirement to meet for pumpkins.

The United Kingdom: large market for non-European suppliers

The United Kingdom’s imports of pumpkins, squash and gourds grew from 82,000 tonnes in 2019 to 86,000 tonnes in 2023, at a CAGR of 1.2%. This included a peak of 97,000 tonnes in 2020, after which imports stabilised. Virtually all of these imports are destined for domestic consumption.

Imports from developing countries performed particularly well. They grew from 17,000 tonnes to 24,000 tonnes, at a CAGR of 9.5%. This also means that their direct import market share grew from about 20% to 28%. This is considerably above the European average.

Brexit in 2020 has caused some important changes in the way that pumpkins and squash are supplied into the country. Most notably, the Netherlands and Germany lost their share in the British market (from 9% and 5% in 2023 respectively to almost zero in 2023).

Spain continues to be the leading supplier to the UK market, with an import market share that grew from 49% in 2019 to 58% in 2023. Portugal followed with 11%, and South Africa with 10%. Morocco has become the fourth largest supplier, as its direct import market share grew from 0.2% to 6.7%. Other suppliers from developing countries include Argentina (2.9%), Brazil (1.3%), Turkey (1.2%), Costa Rica (1.2%) and India (0.5%).

About half of the British imports are courgettes and half are pumpkins, gourds and other types of squash. This makes the United Kingdom the leading European import market for pumpkins, gourds and squash. Spain dominates the supplies of courgettes (at 81% in 2023), followed by Morocco (12%). The imports of other vegetables in this category are more evenly spread – while Spain (28%) is the leading supplier, South Africa and Portugal follow closely (20% each).

At the start of 2024, courgettes were the 41st most popular vegetable, liked by 57% of British adults. Pumpkins came 46th, being liked by 45%. They are particularly popular amongst Millennials (54%), which is promising. Butternut squash is a popular and widely available variety of winter squash. Nevertheless, out of the six focus countries, the United Kingdom has the lowest (apparent) consumption of pumpkins, squash and gourds per person: less than 2 kg per year.

The Netherlands: trade hub for re-export across Europe

Despite being a relatively small country, the Netherlands is Europe’s fourth largest importer of pumpkins, squash and gourds. This is due to its role as a key trade hub for the import of fruit and vegetables into the European market. This is also shown by its export-import ratio, which is about 50-60% per year. Fruit and vegetable importers in the Netherlands often not only serve the local market but also re-export to other European countries.

Dutch imports of pumpkins, squash and gourds grew from 73,000 tonnes in 2019 to 86,000 tonnes in 2023, at a CAGR of 4.4%. They showed a steady increase until peaking in 2022.

Imports from developing countries followed a similar pattern, peaking at 19,000 tonnes before returning to 11,000 tonnes. This translated into a CAGR of 3.4% between 2019 and 2023. The direct import market share of imports from developing countries grew from 13% in 2019 to 21% in 2021, before dropping back to 13% in 2023. This is considerably below the European average.

Spain (52% in 2023), Portugal (14%) and Germany (13%) are the leading suppliers to the Netherlands, followed by South Africa (8.3%). Other suppliers from developing countries include Argentina (1.9%), Brazil (1.4%), Turkey (0.5%) and Egypt (0.2%).

About 56% of the Netherlands’ imports of pumpkins, squash and gourds were courgettes. However, imports of pumpkins, gourds and other types of squash grew at a strong CAGR of 11%. Interestingly, Portugal (30% in 2023) and South Africa (19%) are the leading suppliers of this category, whereas Spain dominates the courgette supplies with a share of 79%.

In 2019, courgettes were the third most popular vegetable in the Netherlands and pumpkins came seventh. According to the study, pumpkins are becoming more available throughout the year, but they are most popular in October. This is very much related to their use as Halloween or general autumn decoration, which is actually the same in most other European countries. Per person, Dutch consumption grew from 3.6 kg in 2019 to 4.8 kg in 2023.

Italy: imports from many different developing countries

Italy’s imports of pumpkins, squash and gourds rose strongly in 2023 (+28%), strengthening the country’s position as the fifth largest European importer. Imports grew from 34,000 tonnes in 2019 to 45,000 tonnes in 2023, at a CAGR of 7.5%.

Imports from developing countries grew from 4,600 tonnes to 9,200 tonnes, at a strong CAGR of 19%. As a result, their direct import market share grew from a below-average 14% to more than 20%. This is promising.

Spain (46% in 2023) and France (21%) are Italy’s leading suppliers, followed by Egypt (6.2%). These countries are mainly followed by various developing countries, including South Africa (5.7%), Tunisia (4.5%), Morocco (1.7%) and Mexico (1.0%), which strongly increased their direct market shares. Peru (0.5%), Uruguay (0.4%), Senegal (0.4%) and Argentina (0.1%) let some of their shares slip.

About two-thirds of Italy’s imports of pumpkins, squash and gourds were courgettes. However, imports of pumpkins, gourds and other types of squash grew at a particularly strong CAGR of 11%. Egypt, South Africa and Tunisia are the leading suppliers of this category, accounting for more than half of the imports in 2023. Italy imports most of its courgettes from Spain, with a share of 61%.

In 2022, courgettes were the third most popular vegetable in Italy. For younger consumers, whether or not their fruits and vegetables are produced in Italy is less important than for older generations. This could offer opportunities.

The alternative name for courgettes, ‘zucchini’ originates from Italian, which shows the country’s strong ties to the vegetable. Per person, Italians consume 9-10 kg of pumpkins, squash and gourds per year. This is the highest consumption per person in Europe. Italy mainly serves its domestic market with an annual production of about 560-600,000 tonnes. This makes Italy Europe’s second largest production country of pumpkins, squash and gourds, after Spain.

Spain: mainly imports from developing countries

Spain is Europe’s seventh largest importer of pumpkins, squash and gourds, behind Belgium. Because Belgium barely imports any of these products from developing countries, the Spanish market is much more interesting to explore. From 2019 to 2023, Spain’s imports stayed roughly around 34,000 tonnes. 65-77% of these imports came directly from developing countries, making it one of the largest market shares in Europe by far. This is not that surprising, as Spain itself is the leading supplier to other European countries.

Morocco (50% in 2023) and Portugal (23%) are Spain’s leading suppliers, followed by South Africa (6.4%). Peru and Senegal supply a further 4.3% each. Other suppliers from developing countries include Argentina (3.3%), Costa Rica (0.8%) and Brazil (0.5%). The smaller suppliers strongly increased their direct market shares, except for Brazil.

About half of Spain’s imports are courgettes and half are pumpkins, gourds and other types of squash. The courgette imports mainly come from Morocco (63% in 2023), followed by some intra-European trade. Supplies of the other category are more diversified, with Morocco, Portugal, South Africa, Peru, Senegal and Argentina in the lead. Together, these countries accounted for 90% of the imports in 2023.

Spain is Europe’s leading producer of pumpkins, squash and gourds, with about 700-800,000 tonnes per year. This production serves both the domestic and European markets. Not only is Spain Europe’s leading supplier, but its domestic consumption is also amongst the highest in Europe – 7 to 8 kg per person, per year.

Tips:

- Find potential trade partners at the Fruit Logistica in Germany or at the Fruit Attraction trade fair in Spain.

- Monitor exchange rates to determine which markets offer the best purchasing power. Amongst the focus countries, the United Kingdom is a relatively large market that does not use the Euro as a national currency. This country will have more purchasing power when the British pound (GBP) is strong.

- Use Dutch traders if you have difficulties entering different European markets. Dutch importers often have wide experience in trading and are familiar with the different European preferences. Dutch fruit companies have a direct approach, so calling or visiting them often works better than emailing.

4. Which trends offer opportunities or pose threats in the European market for pumpkins and squash?

The main trends in the European market for pumpkins and squash include the growing interest in healthy lifestyles and sustainability. Diversification and convenience products also offer opportunities.

Healthy lifestyles stimulate interest in pumpkins and squash

European consumers are very aware about health. They are increasingly focusing on a healthier lifestyle, which includes improving their eating habits. According to Statista, about 60% of EU consumers try to actively eat healthily. They are trying to reduce their consumption of processed foods and artificial additives and preservatives. This can boost their interest in pumpkins and squash. Both of these vegetables offer nutritional benefits, as they are high in nutrients like vitamins, minerals and fibres. They can be used in a variety of dishes, from soups and stews to roasts and purees. This flexibility allows them to be used in diverse cuisines and diets.

In line with this trend, pumpkins and squash are commonly being used to replace carbohydrates. For example, courgette spaghetti (or ‘courgetti’) can be used instead of traditional wheat-based pasta. Consumers can buy ready-made fresh courgette spaghetti or make it at home using a spiraliser. Companies like Magioni incorporate vegetables in products like their American-style pumpkin cinnamon pancakes and courgette pizza base. These ‘vegetable-enriched’ products are a good way for both adults and children to eat more vegetables.

Figure 5: Courgette pizza

Source: YouTube

Pumpkins and squash can also be used as an alternative to meat or as an ingredient in vegetarian burgers. This could offer opportunities, as the number of vegetarians and vegans in Europe is growing. In a 2021 survey across 10 European countries, 46% of respondents had already reduced their meat consumption and 40% planned to do so in the future. 7% followed a completely plant-based diet, and 30% identified as flexitarians (mostly vegetarian). 45% of flexitarians would like to see more plant-based options in supermarkets and restaurants. Taste and health are the main purchase drivers, followed by freshness, no additives and lower prices.

Tip:

- Study the EU legislation on nutrition and health claims to avoid making claims that are not allowed.

Sustainability has become mainstream

Sustainability has become mainstream in the fruit and vegetables sector. European buyers are increasingly interested in sustainable fruits and vegetables and want to have a transparent supply chain. Sustainability includes both social and environmental aspects. Pumpkins and squash can fit in well with this trend.

For example, butternut squash is resistant to droughts (lack of water) and can withstand different climate conditions. This makes it a resilient crop in the face of climate change. It can be grown in both small-scale and larger agricultural operations and can be produced organically relatively easily. The plants can produce a substantial yield from a relatively small planting area. Butternut squash has a hard skin and a long shelf life, which allows it to be stored for months without refrigeration.

Sustainable sourcing is an important trend in leading importing countries like Germany, the Netherlands and the United Kingdom. As a result, you will increasingly have to deal with sustainability requirements from European buyers.

For example, Dutch fresh produce importer Eosta has developed Nature & More; a ‘trace and tell’ consumer trademark and online transparency system. Their products carry a unique (QR) code that provides online access to the producer and gives full transparency about the ecological and social impact. Eosta assesses companies using the Sustainability Flower: a framework to monitor and manage sustainability impacts in terms of seven key aspects: society, economy, climate, water, soil, biodiversity and individual well-being and development. Using natural branding, they mark products using light to avoid plastic packaging.

Figure 6: Natural branding on pumpkins

Source: YouTube

Organic pumpkin and squash

The increased interest in sustainability and healthy lifestyles is also boosting the demand for organic produce. Organic retail sales value in the EU multiplied by over four times between 2004 and 2022, with particularly strong growth from about 2014 to 2020. They peaked at €4.6 billion in 2021, before dropping by 3.4% in 2022. This likely reflects a decline in consumer demand due to the cost of living crisis and rising food prices. Germany is the largest market, followed by France. Spending on organic products reached €104.30 per person – up to about €400 in Switzerland and Denmark.

Similarly, EU imports of organic vegetables dropped by 20.7% in 2022, from 138,000 tonnes to 109,000 tonnes. The Netherlands and Germany are the EU’s leading importers of organic agri-food products, accounting for a combined 53% of the imported volume. France follows in third place. As a key trade hub, the Netherlands re-exports a significant part of its imports to other EU countries. Germany’s organic imports declined in 2022 (‑13%), while Dutch imports increased (+4.6%).

Most leading supermarkets in the top six EU importing countries sell organic pumpkins and squash, including Carrefour (France), REWE (Germany), Tesco (the United Kingdom), Albert Heijn (the Netherlands), Conad (Italy) and Día (Spain).

In the Netherlands and surrounding countries, around 90% of pumpkins grown there are estimated to be organic. The two leading Dutch supermarkets, Albert Heijn and Jumbo, only sell organic pumpkins. According to GroentenFruit Huis, pumpkins belong to the top five best-selling organic fruits and vegetables in the Netherlands. This top five accounts for 55% of the total organic food sales in the country. An example of a company that produces and sells organic squash on the European market is De Terp Squashpackers.

For courgettes, the situation is different. Although organic courgettes are offered in supermarkets, most of the courgettes on sale are still non-organic. So, whether or not organic certification is beneficial depends on the type of produce you want to export as well as the European market you want to enter. For pumpkins and squash, organic certification might be necessary, while for courgettes it is not a must.

Tips:

- Reduce your use of pesticides through natural or integrated pest management (IPM). Read more about IPM via the Food and Agriculture Organization (FAO) and check for guidelines in your country.

- Ask your buyers about the possibilities of supplying organic pumpkins and squash. Buyers in this market often specialise in organic produce and follow strict guidelines. Read more about the principles of organic agriculture via IFOAM Organics International.

- For more information about organic certification, see our study about market entry for pumpkins and squash.

Diversification offers opportunities

The European market has seen a shift towards a broader variety of pumpkin and squash types. This trend is influenced by consumers exploring different foods and opening up to different food cultures from around the world. Consumers are interested in different flavours, textures and cooking properties, for both everyday cooking and special dishes. Smaller varieties weighing about 1-2 kg are becoming particularly popular. Exporters of special varieties can benefit from this.

Traditional pumpkins are joined by varieties such as the butternut squash, muscat pumpkin, Hokkaido pumpkin, Kabocha squash and spaghetti squash. In addition to common, dark green courgettes, European supermarkets now also sell yellow, light green and round varieties.

These different varieties offer opportunities. For example, thanks to its small size and edible peel, the Hokkaido pumpkin is becoming popular in Europe. Suppliers from developing countries can benefit from this, but you must be able to meet the high standards of the European market. You should also be aware that although the prices you may achieve for special varieties can be relatively high, so can the seed prices. Nevertheless, diversification is a good strategy as it reduces risk.

An example of a company that has used the opportunity of diversification is South Africa’s Yukon Group. This company produces a range of speciality vegetables and microgreens, including year-round baby vegetables. In addition to butternut squash, Yukon exports baby courgettes, gems and yellow and green patty pans. Most of the baby vegetables are grown on the company’s own Yukon Farm – planted mechanically and harvested by hand. Yukon uses an incentive-based payment system, which enables employees to potentially earn far more than the minimum agricultural wage.

Yukon’s vegetables are shipped daily from airport depots in Cape Town and Johannesburg. They arrive in Europe within 72 hours of being harvested, under strict quality control. A full quality report is made upon intake and sent to teams and growers throughout the supply chain. The airport teams also do mixed loads and just-in-time labelling. According to Yukon, “All our suppliers are certified to provide assurance that product is produced according to industry best practice, ethically sourced, environmentally sustainable and fully traceable.

Figure 7: Ratatouille with baby courgettes and patty pans

Source: YouTube

Tips:

- Use varieties that fit the expectations of specific users or consumers. You can best focus on the varieties that are sold most often. Supplying niche varieties is possible, but the market potential will be rather small.

- Provide preparation tips and recipes to help your importers educate and inspire consumers and increase consumption.

- For more sector-wide information, see our study on which trends offer opportunities in the European fresh fruit and vegetable market.

Pumpkins and squash make their way into convenience products

The European demand for convenience food products continues to rise, as consumers are looking for quicker and easier meal solutions to fit into their busy lifestyles. Products such as pre-cut pumpkin, canned puree and ready-to-eat pumpkin or courgette soups satisfy this need. The aforementioned examples of ready-made courgetti and vegetable-enriched pancakes and pizza bases also fit in with this trend.

Fresh pumpkins and squash can also easily be combined with other products in convenient recipe boxes and meal kits. These boxes provide consumers with the products they need to prepare a specific dish, in the required amounts. Such boxes are most popular in the Netherlands and Belgium, but they are available in a few other European markets as well.

Such meal kits typically include a combination of fresh produce and dried or preserved ingredients like spice mixes and sauces. Consumers may have to add ingredients like eggs and meat or seafood themselves. This allows them to keep the meal vegetarian or vegan. Recipes can range from ratatouille or curry with courgettes to pumpkin soup and risotto.

Tips:

- Be aware that convenience products are often packaged and/or processed in Europe. Nevertheless, you can study your options to add value by developing and packing a product at the production stage.

- Find out what other trends influence pumpkin exports by reading our study on trends for fresh fruit and vegetables in Europe.

- Consider organic certification for your pumpkins and squash. If you want to market organic pumpkins and squash to Europe, you should comply with Regulation (EU) 2018/848.

This study has been carried out on behalf of CBI by Globally Cool.

Please review our market information disclaimer.

Search

Enter search terms to find market research