Entering the European market for fresh strawberries

Entering the European strawberry market can be a big step. Competition from producers in and around Europe is strong and the quality expectation is high. Morocco and Egypt are the biggest non-European competitors that supply Europe in the off-season. It is crucial to invest in quality varieties, good cultivation practices and compliance to the EU standards. If you do so, an international grower organisation could be an interesting partner, in addition to a number of soft fruit importers.

Contents of this page

1. What requirements must strawberries comply with to be allowed on the European market?

Fresh strawberries must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant for an overview of export requirements for strawberries (code 081010).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Fresh strawberries containing more pesticides than allowed will be withdrawn from the market. The same goes if your product contains contaminants such as heavy metals.

Strawberries lead the list of the 2021 Environmental Working Group’s ‘dirty dozen’ of the most contaminated fruit. Furthermore, pesticide residues on strawberries are also a main concern for consumers. Strict regulations and product reputation require you to pay extra attention to reducing pesticide use.

Note that retailers in several EU Member States such Germany, the Netherlands and Austria, as well as the United Kingdom, use MRLs that are stricter than the MRLs laid down in European legislation.

Tips:

- Reduce the amount of pesticides by applying Integrated Pest Management (IPM) in production. IPM is an agricultural pest control strategy that involves an integrated approach to prevent harmful organisms and keep the use of pesticides within acceptable levels. Read about Integrated Pest Management (IPM) on the website of the European Commission.

- Find out the MRLs that are relevant for strawberries by consulting the EU MRL database in which all harmonised MRLs can be found. You can search on your product (“strawberry” or product code 0632010) or pesticide used. The database shows the list of the MRLs associated to your product or pesticide.

- Read more about MRLs on the website of the European Commission and check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that the levels of lead contamination in your strawberries remains below 0.20 mg/kg and cadmium below 0,050 mg/kg, in accordance with to the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

As from December 2019, new European regulation came into force for the trade in plants and plant products from non-EU countries. This regulation requires strawberries to have a phytosanitary certificate before being brought into the European Union, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072

Tip:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

Maintain high quality standards

The quality and marketing of your product must comply with the marketing standard for strawberries published by the Working Party on Agricultural Quality Standards of the United Nations Economic Commission for Europe (UNECE), or as defined in the EU Regulation 543/2011.

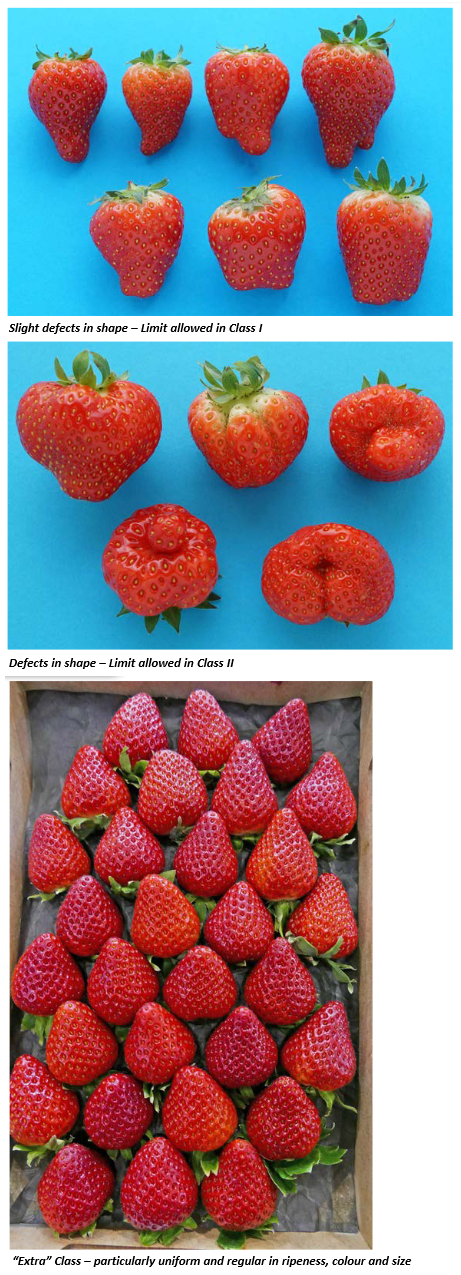

These marketing standards describe the minimum requirements for strawberries (see table 1). Europe almost exclusively requires class I strawberries as a minimum. Strawberries in this class must be of good quality and their characteristics should within the permissible tolerances (see table 2). Long-distance suppliers of air-freighted strawberries must strive for perfection. Class I is often expected by supermarket buyers, while in gastronomic or exclusive market segments it is better to exceed this quality and supply preferably ‘Extra’ class.

Class II strawberries are less common. The ones that are available as fresh products are mainly from local or regional production. They can be purchased as a ‘cheap’ buy at street markets or are sometimes marketed as a distinct product by supermarkets, such as IMPERFECTLY tasty strawberries at Sainsbury’s or ‘Wonky’ strawberries at Aldi.

The development and condition of the strawberries must be such as to enable them to withstand transportation and handling and to arrive in satisfactory condition at the place of destination.

Table 1: General quality requirements and permissible tolerances for strawberries

| General quality requirements (all classes) |

|

|

|

|

|

|

|

|

|

Table 2: Permissible defects and tolerances

| class I ‘good quality’ | ‘Extra’ Class ‘superior quality’ | Class II |

Slight defects allowed*:

| bright in appearance

free from defects with the exception of very slight superficial defects* | Defects allowed:

|

| practically free from soil | free from soil | slight traces of soil |

| Minimum size 18 mm with 10% tolerance | Minimum size 25 mm with 10% tolerance | Minimum size 18 mm with 10% tolerance |

| Max. 10% Class II, of which max. 2% not meeting minimum requirements or affected by decay | Max. 5% Class I, of which Max. 0.5% Class II | Max. 10% not meeting minimum requirements, of which 2% affected by decay |

*provided these do not affect the general appearance of the produce, the quality, the keeping quality and presentation in the package.

Uniformity

The contents of each package must be uniform and contain only strawberries of the same origin, variety and quality. In the ‘Extra’ Class, strawberries must be particularly uniform and regular with respect to degree of ripeness, colour and size, with the exception of wild or wood strawberries. In Class I, strawberries may be less uniform in size. The visible part of the contents of the package must be representative of the entire contents.

Figure 1: Examples of different classes

Source: OECD (2021), Strawberries, International Standards for Fruit and Vegetables, OECD Publishing, Paris.

Sweetness

In addition to the marketing standards, the sugar content (Brix-level) is an important measurement for the taste quality of strawberries. However, the relation between quality and Brix level is not an exact science. Consumer preferences and experiences vary, but in general a higher Brix level increases sensory characteristics.

Acceptable Brix levels start at 7 °Brix, although buyers that purchase strawberries with a focus on taste quality, may not accept a Brix level lower than 8. On the other hand, a common practice of some supermarkets is extending the shelf life by buying strawberries that are picked at a minimum ripeness and thus lower Brix.

Strawberry varieties grown in Northern Europe are often less hardy, but sweeter than varieties that are cultivated in Spain or Northern Africa. New varieties such as Calinda, Sonata or Allegro reach a higher Brix level than traditional varieties such as Elsanta.

Table 3: Indication of taste quality and Brix levels

| Brix | Taste quality | Variety |

| 7-8 | Normal / acceptable to good | Elsanta |

| 8-9 | Sweet / good to excellent | Calinda, Sonata, Sonsation, Allegro |

| >9 | Very sweet / Excellent | magnum |

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to file claims on quality issues.

Maintain temperature during post-harvest and product handling

Pre-cooling is an essential process in maintaining the quality of strawberries. To conserve strawberries during storage and transport, the relative moisture must be 90-95% or even higher and the temperature must be around 0 ºC. The use of small packing improves conservation.

Offer different packaging options

When you supply strawberries to Europe, you must be able to offer different packaging options for both retail and wholesale channels. Packages must be new and of a good quality.

Strawberries are usually packaged in boxes or trays with a maximum net content of 5 kg, in units of direct sale or arranged in a single layer.

Retail buyers often require packages of up to 500g, such as clamshells, top-seal trays or flowpacks. Top-seal packaging is increasingly used to reduce the amount of plastic packaging. Carton or moulded paperboard pulp is also used as a sustainable alternative, especially for domestic and organic strawberries.

Food service buyers also buy strawberries in larger packages, such as 1 or 2kg single-layer boxes.

Tips:

- Always discuss the specific requirements for size and packaging with your buyer.

- Study the proper post-harvest practices and handling for fresh strawberries on Frutas-hortilizas.com or the vegetable produce facts of the postharvest centre of the University of California.

- Make sure your strawberries are kept at the right temperature and under the right conditions to ensure optimal freshness and taste. Supply chain logistics should not affect the product taste in any significant way.

- Use the CBI module on the requirements for fresh fruit and vegetables for information on the details of labelling your product.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh strawberries are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are also recommended.

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

In the coming years the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally-friendly. It will ensure a sustainable food production and address for example packaging and food waste. EU trade agreements with strawberry-supplying countries like Mexico, Peru and Ukraine already include rules on trade and sustainable development, and other countries are expected to follow. For suppliers of fresh fruit and vegetables, it is important to look ahead of the increasing standards and try to be in the frontline of the developments.

Retailers can also impose their individual standards, such as Tesco Nurture. Especially larger retail chains in Northern Europe are more prepared to buy your product if your compliance to social and sustainability standards is in order.

Sustainability can also be a reason for buyers not to purchase airfreighted strawberries, as these have a much larger carbon footprint. But the same goes for strawberries cultivated in heated greenhouses.

Tips:

- Implement at least one environmental and one social standard. See the Basket of standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

- For other additional requirements such as payment and delivery terms, see CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

There is demand for organic fruit, but strawberries are difficult to cultivate organically and the price can be an obstacle for the average consumer. Organic production in Europe is limited. France and Italy have the highest share in organic production: 7% of the strawberries in France are from organic cultivation and in Italy this is 6%. Other European countries only produce 0-2% organic.

Organic strawberries can be an interesting niche, especially for smaller companies that can dedicate more attention to labour-intensive growing. Organic certification can be an interesting way to set your strawberries apart and market them at a higher value. The demand for organic vegetables is growing, although it is mainly fulfilled by European growers.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that starting January 2021, new legislation will enter into force in the form of Regulation (EU) 2018/848. You must use sustainable and organic production methods and apply for an organic certificate with an accredited certifier.

When producing and exporting organic strawberries to the European market, focus on maintaining shelf life and a competitive cost price.

Tips:

- Strive for residue-free strawberries, and certify your production as organic only if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the most recent list of control bodies and authorities to see which certifiers are active in your region.

2. Through what channels can you get strawberries on the European market?

Being part of a large growers’ organisation will give you the best chance of getting your strawberries on the European market. Alternatively, you can also work together with soft fruit importers or importing wholesalers. To explore different channels and segments, product quality must be part of your focus.

How is the end-market segmented?

The supermarket channel is dominant for the sales of strawberries. Traditional markets such as street markets are declining, but for now they remain one of the preferred places for consumers to buy strawberries. Premium-quality, organic and perfectly ripened strawberries are often marketed in specific outlets and food service establishments.

Market outlets

On average, 84% of European consumers prefer buying their strawberries in supermarkets, including hypermarkets and discount supermarkets. Supermarkets are especially dominant in Northern Europe. The concentration in this channel makes these retailers powerful buyers. The larger supermarket chains include Lidl (Schwarz Group), Carrefour, Tesco, Rewe, among many others.

The market share of traditional markets is declining. However, street markets and farm stores remain popular places to buy strawberries. In Spain there is an exceptionally high percentage of 69% of the consumers who like to buy their strawberries at the farm. The advantage for consumers to buy at the farm is that freshness is guaranteed, and they avoid early-picked strawberries sometimes sold by supermarkets that prioritise shelf life over sweetness or ripeness. There is also a significant number of consumers (16%) that like to grow their own strawberries.

The food service market is not mentioned in figure 1, but must not be underestimated. Restaurants, pastry shops and caterers are also important users of strawberries, mostly in pastries and desserts.

Quality

The main market segment is made up of Class I strawberries, which can be found in all types of market outlets. When supply is high, product promotions in supermarkets help to move more products.

The highest priced strawberries are ‘perfect’ looking strawberries with a superior taste (‘Extra’ Class) and organic strawberries (different classes). For organic strawberries there are specialised organic grocery shops, but supermarkets also tend to sell them when available. ‘Extra’ Class strawberries are mainly sold in premium stores or used by professionals in the food service industry.

Lower-quality strawberries, such as Class II or oddly shaped strawberries, are used in the processing industry to be frozen and used in the production of juices, dairy products and more. Strawberries with minor defects can also be sold fresh at lower prices. Street merchants can drive a good bargain with strawberries like these, and some supermarkets offer them with a distinct presentation.

Tips:

- Adjust your focus according to the segment you are selling to. Price and shelf life are important buying criteria for supermarkets, while gastronomic channels require high-quality strawberries.

- Find an overview of supermarkets on Wikipedia’s list of supermarket chains in Europe or the Top 10 Food Retailers in Europe in the Retail-Index.

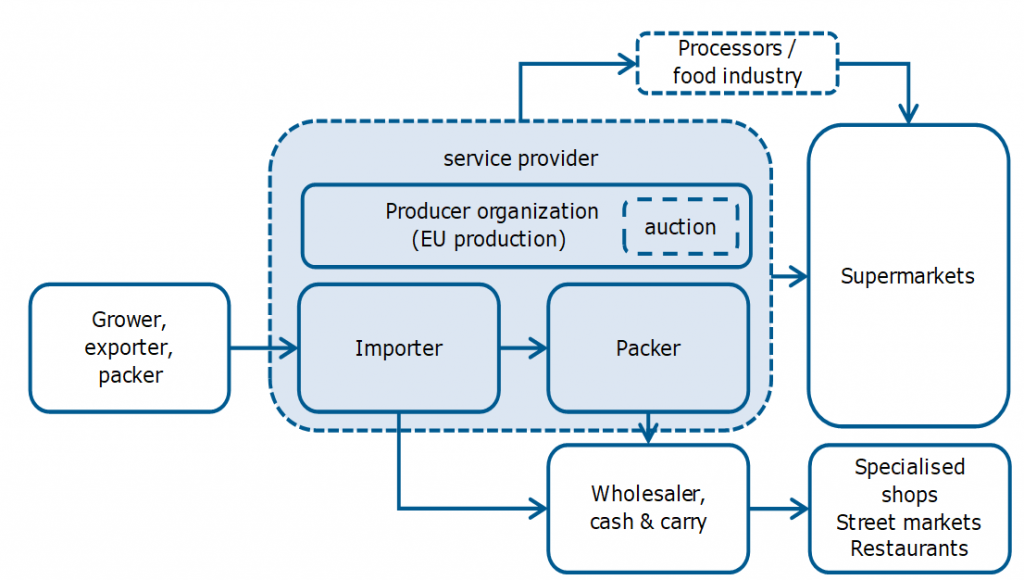

Through what channels does a product end up on the end-market?

Most strawberries go directly from farmers organisations to wholesalers and distribution centres owned by large retailers. Importers complement this supply with strawberries from other regions. Companies that combine production, packing and import can become full-service providers. The food service segment and street markets are supplied by wholesalers.

Figure 3: European market channels for fresh strawberries

Source: ICI Business.

Producer organisations supply a mayor share

Growers’ organisations play an important role in the supply of strawberries. As a result of the cooperation between strawberry breeders and growers, they become strong marketing companies and supply major clients. Examples of such organisations are:

- Berry Gardens (UK), a growers’ group that has a direct relationship with Driscoll’s breeding programme.

- BerryWorld Group (UK), formed after a successful joint venture breeding programme, expanding into the UK, the Netherlands, France, Spain, South Africa and Australia .

- Hoogstraten (Belgium), a cooperative auction house with its own grading system and branding.

- Angus Soft Fruits (UK), a soft fruit producer organisation with a global network of growers.

- Fresón de Palos (Spain), one of the largest strawberry growers’ cooperatives in Europe.

- CoopHuelva (Spain), a cooperative that is represented by the salesforce of Onubafruit.

- Coforta (Netherlands), a cooperative of over 500 growers and a market leader in soft fruit, sold via their sales organisation the Greenery.

Growers’ organisations and their marketing and sales offices need a year-round supply to meet their clients’ demand. So import and cooperation with growers in other countries is often part of their activities.

Tip:

- Activate your browser’s “Translation” function to make foreign websites available in your own language or change to an English version.

Importers focus on additional supply and niche varieties

Importing companies make sure that the local supply is complemented by sufficient volumes from foreign producers. Importers can manage supply chains from different origins and perform quality control for imported strawberries. They are familiar with all the different requirements that end clients may have and distribute to different European markets.

There are many importers of different sizes and each with their own focus. Most importers, such as Sofruce in France, are focused on the supply from other European countries, Egypt or Morocco, but there are a few companies that import from other origins. For example, Yex has imported strawberries from Ethiopia and BerryWorld has growers in Jordan and South Africa.

Companies such as Berries Pride (part of Nature’s Pride) has included exotic varieties such as ‘strasberries’ (a raspberry flavoured strawberry) and pineberries, cultivated in Belgium. And SpecialFruit commercialises Calinda strawberries as a separate strawberry category from regular strawberries.

Service providers provide access to supermarkets

Successful supermarket suppliers often position themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to (re-)packing and branding. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider requires.

Supermarkets are an important channel for strawberries. They usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency in their supply chain.

Most producer organisations or cooperatives (see above) have turned into service providers. They provide complete services to retailers. For example, The Greenery, Berry Gardens and Angus Soft Fruits supply supermarkets with pre-packed strawberries throughout the year.

Wholesalers (spot market)

Wholesalers often supply smaller quantities of fresh strawberries to secondary channels such as hospitality and food services, specialised fruit shops and street markets. The wholesale channel is important for strawberries, as they are a common product for local shops and street markets, but they are also used in restaurants and pastry shops.

Some wholesalers also import products themselves, but most of them mainly handle local produce and products supplied by importers. Without a retail programme they only cover the spot market, moving with the fluctuations of the trade. Typical wholesale markets are for example Rungis in Paris, Mercabarna in Barcelona and New Spitalfields market in London.

Tip:

- Use the major market channels of service providers and growers’ cooperatives when you are offering large volumes of strawberries. Their retail programmes and supply contracts may provide some stability. Remember that supermarkets maintain strict rules and do not allow you or your buyer to change supply conditions.

What is the most interesting channel for you?

The most interesting way for foreign strawberry producers to enter the market, is through cooperation with growers’ and marketing organisations. Using high-quality production as a strength makes it easier to integrate with these supply chains. This way you can not only share a larger sales network, but also knowledge and other resources.

Alternatively, you can try to find an importing company or trader. When you want to present yourself as a suitable exporter, your direct relation with farmers will be crucial. With a high-quality product you can fill potential gaps in the European market.

For large far-off suppliers the European strawberry market is a niche, which can best be combined with fulfilling your local and regional demand for strawberries. However, small airfreighted volumes of strawberries have the best chance of reaching specialised wholesalers with import activities.

Tips:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

- Work together with breeding companies and find partnerships with growers’ organisations to become part of a large group with a dedicated sales force.

3. What competition do you face on the European strawberry market?

Strawberries are a major fruit category with ample supply throughout the spring and summer and a large number of competitors. Off-season competition is also increasing, in particular from companies in nearby countries that have invested in quality varieties and integrated in larger groups.

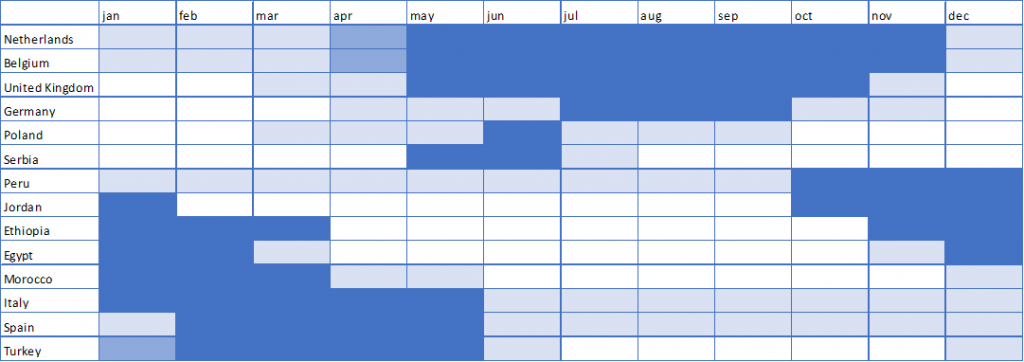

Figure 4: Indicative supply calendar

Source: ICI Business based on industry sources and supply data

Which countries are you competing with?

Your main competition will come from Europe itself. The demand mainly depends on how the local season develops. Outside of Europe, Morocco and Egypt are the strongest competitors. These countries are close to Europe, and are able to supply strawberries when production in Europe is low. Except for Morocco and Turkey, most exporting countries export their strawberries by airfreight.

Morocco: direct supply lines to Spain

With nearly €60 million in strawberry exports to Europe, Morocco is the main non-European supplier. While it also exports to the Netherlands, the UK and France, most of its exports (nearly 60% in 2020) are directed to Spain. Spanish companies are also among the main investors in strawberry production in Morocco. These include companies such as Fresh Royal. For them the country offers a good climate, and affordable land and labour. Moroccan strawberries can be transported by road (and ferry) to mainland Europe and their season starts slightly earlier than in Spain.

The Green Morocco programme (Maroc Vert) has made agricultural development a priority for the Moroccan government, encouraging private investment and exports. In 2020 a new agricultural strategy was launched: Generation Green 2020-2030, which aims to put more focus on the security of a rural, agricultural class, promoting social development and protecting against the threat of environmental challenges. These programmes will help to strengthen the competitive position of Morocco and secure the strawberry production for European(/Spanish) buyers.

Egypt: a preferred origin for off-season strawberries

Egypt offers an ideal alternative for additional supplies during the off-season period. The country can supply strawberries exactly when European production is at its lowest and greenhouse production has become very expensive due to the dark winter climate. In 2020, the Egyptian export was mainly divided between Belgium, Germany and the UK, but this can vary year to year.

The Egyptian cultivation of strawberries has been developing steadily. Growers have introduced new varieties of strawberries and technical improvements, increasing the yield and the quality of the produce. Strawberries from Egypt are hardy and known to have a good shelf life. The main strawberry varieties are Festival, Fortuna, Florida and the new variety Sweet Sensation.

Egyptian strawberry producers are competitive and close to Europe. Unlike Morocco, most of the strawberries are airfreighted to Europe, which increases the price.

Turkey: mainly supplying Romania

Turkey is a large producer of strawberries and production has further increased in the past years – from 376,000 tonnes in 2015 to 487,000 tonnes in 2019. Despite this volume, Turkey is barely a competitor on the European market. The export to Europe in 2020 was limited to 5,800 tonnes to Romania.

Turkey has enough potential on its local market and nearby Russia, and does not need to compete in Europe with producers from Morocco or Egypt. However, with such a large production and its proximity to the European market, Turkey could become a stronger competitor in the future. It can easily reach Eastern European markets by railway, but also air-freight strawberries to Western Europe.

Jordan: niche supplier of quality strawberries

Jordan grows its strawberries at 800 metres above sea level, which has a positive result on their quality and taste. Strawberries from Jordan are considered a niche and can only compete in Europe as a high-quality product in the winter. The supply window for Europe runs from November until January and was valued at €3 million euros in 2020. Most of these strawberries were flown into the United Kingdom or the Netherlands. Long-distance suppliers such as Jordan will remain under pressure because air-freight is not the preferred shipping method due to its high environmental impact, and more and more buyers are avoiding air-freighted fruit.

USA: declining export but still prominent in breeding

The United States are among the largest strawberry producers in the world. But volumes have been declining and so has the export. While the USA still produced almost 1.4 million tonnes in 2015 according to Faostat, in 2019 this was reduced to just over 1 million tonnes. The export to Europe also declined: while it was still valued at €5.8 million euros in 2018, in 2020 it had declined to just over €2 million.

The strength of the US growers lies in their influence on the breeding of strawberries. One of the leading strawberry breeding companies and brands, Driscoll’s, originates in the United States.

Serbia: small supplier with growth potential

Serbia is already a supplier of frozen soft fruit, and with its proximity to Europe it has potential to grow into a larger exporter of fresh strawberries as well. Companies such as All Berries have introduced new varieties from Italy to make Serbia a more attractive origin for fresh strawberries. The drawback of Serbia is that most cultivation takes place in open fields, which makes it more dependable on weather conditions and resulting in more unpredictable harvests.

Practical markets for Serbia in Europe include Croatia, Romania, Poland, Germany and Austria. Exports to Europe are growing but remain small with a very short window; approximately €1.7 million in 2020 and mainly in May and June. Russia buys most of Serbian’s fresh supply.

Europe: your main competitor

The average annual production in Europe (including the UK) is around 1.3 million tonnes. The total volume is gradually increasing due to the adoption of new cultivars and protected cultivation that improve productivity and extend the harvesting season.

The European strawberry season starts off around February with supply from Italy and Spain, followed by early Northern-European countries with greenhouse cultivation such as in the Netherlands, Belgium and the United Kingdom. Towards the summer all Northern-European countries are on the market, including Germany. The peak of Europe’s strawberry season takes place from April to July. Finally, there is a smaller supply from greenhouse cultivation in the winter.

Spain, the Netherlands, Belgium and Greece supply both their local markets but also have a strong focus on export. Other countries such as Germany, France and the United Kingdom use their local production mainly for domestic consumption. In Poland, strawberries are for a large part processed into frozen products.

As a foreign producer your opportunities principally depend on the European strawberry season. When the climate in Europe does not allow for sufficient production, strawberries are imported from other regions. In the months May through July, supplying Europe becomes less attractive due to the import tariff of 12.8%. The winter months between November and January offer the most potential for you to supply strawberries to Europe. There will still be competition from local greenhouse strawberries, but some buyers will prefer the more affordable and sturdier varieties from Egypt.

Tips:

- Focus on the winter months to supply Europe. This is the principal period when supply from European producers is lower and often more expensive due to greenhouse cultivation.

- Differentiate in varieties that are suitable for your climate, soil and cultivation method. A longer distance to the market requires a hardy strawberry with good shelf life, but find a good balance between shelf life, flavour and cost of production.

Which companies are you competing with?

Companies that you have to compete with are generally producers or integrated companies that find their strength in cooperation.

Pico: focus on sustainable cultivation and the right varieties

Pico started with strawberry production in Egypt in the 1980s. After making the cultivation more sustainable the company grew to become a fully-certified international supplier. Today, the company has several production sites and their own packing facilities.

Another strength of the company is its focus on programmes with well-known strawberry breeders such as Driscoll’s, EMCO CAL, Red Eva and Angus Soft.

The company grows hardy strawberry cultivars such as the Florida Beauty, Winter Star, Sensation, Fortuna and Bonaire. These varieties have a relatively long shelf life and the harvest stretches out from November until March.

Freshkampo: strong through integration

FreshKampo is an enterprise that originated in Mexico, but expanded to Europe. Today it has its own production in Morocco. The FreshKampo-Euromeridian branch office in the Netherlands supplies the European market with strawberries from Morocco, Spain and the Netherlands. By integrating production with international subsidiary companies that are responsible for the marketing the fruit, the company can cover a large sales area but also target large retail buyers such as Aldi and Edeka.

Cuna de Platero: highly organised cooperative

When Spanish strawberries come onto the market, the European market practically closes for strawberries from outside Europe. Spanish cooperatives dominate the market early in the season, at least until the Northern-European harvest has started. Cuna de Platero is one such cooperative; a group of highly organised farms with strawberry as one of their principal products. Every farm has its own code and a traceability system monitors almost real time the location and the condition of the fruit supply. This way 46,000 tonnes are produced and transported annually.

Tip:

- Clearly define your strengths as a company and your competitive advantage before entering the European market. You can differentiate in different ways, such as specialising in breeding or integrate in larger supply chains. Either way, your own cultivation or a direct link with production is a must-have asset.

Which products are you competing with?

Strawberries mainly compete with other soft fruits, such as raspberries and blueberries. Strawberries are still the largest soft fruit category, but the popularity of blueberries and raspberries is also increasing rapidly. Especially blueberry is a strong competitor because of its shelf life and long-lasting quality.

Within the strawberry category you may experience increasing competition of new cultivars that are high in yield, have a longer shelf life or a superior taste. As a producer you can improve your competitiveness by differentiating in strawberry varieties. Take into account that many of the new varieties are licensed – this means you must invest first before improving your margin or market potential.

When selecting a new cultivar you can focus on the following 10 criteria:

- Productivity: Crop productivity or yield;

- Plant resistance: Tolerance to pathogens;

- Plant adaptability: Adapting to local cultivation conditions (soils and climates) and systems (open field, protected, soil-less);

- Plants with “easy picking” characteristics: Strawberries that grow away from centre of the foliage;

- Seasonality: Early, mid or late-season, or everbearing cultivars;

- Sensory quality: Taste, eating quality;

- Shape and size: Uniformity is more attractive to buyers and large fruit can reduce labour costs;

- Fruit hardiness: To reduce damage during picking and long travel shipment;

- Fruit colour: In general bright red is considered attractive;

- Micronutrient content: Nutritional benefits that favour human health;

Tip:

- Choose the cultivar that fits you best as a supplier. Do not just consider the market demand, but also your growth climate, production method and local circumstances. Compare the offer of different local and international strawberry breeders and keep innovating.

4. What are the prices for fresh strawberries?

Prices for strawberries depend on the quality, origin (transport costs, local/import), production method (open field/greenhouse) and availability (supply and demand). Prices for local and imported (air-freighted) strawberries have different price structures and high prices in the retail do not automatically translate in higher prices for the exporter.

Supply and demand

Strawberry prices fluctuate throughout the year. Prices are lowest when there is an abundant local supply, roughly as early as February until mid-summer in July or August. During the peak season, promotions in supermarkets – with deals like 2 for the price of 1 – push large amounts of strawberries into the market. Retail prices can go as low as €4/kg, which means that suppliers have to accept prices of between €1 and €2/kg, while at the same time quality strawberries can still be sold for €4/kg at wholesale level elsewhere.

The highest import prices are achieved in November and December, when local supply is at its lowest and additional import is needed to fulfil the demand in mainly luxury segments. Prices for greenhouse-grown strawberries from the Netherlands and Belgium can go up in wholesale(!) price to €10/kg in the winter months, which makes import an attractive alternative.

Local vs import

Transport makes imported strawberries relatively expensive, especially when they are air-freighted. The import value per kilo for non-European strawberries is around €3/kg, while the European supply is traded between €2 and €2.5/kg – these are average values. In 2020 the prices for European strawberries went up and the import price from outside Europe went down. This was likely influenced by a lower production in Spain and the effects of the COVID-19 pandemic, which caused consumers to favour local supply and made air-freighted strawberries too expensive.

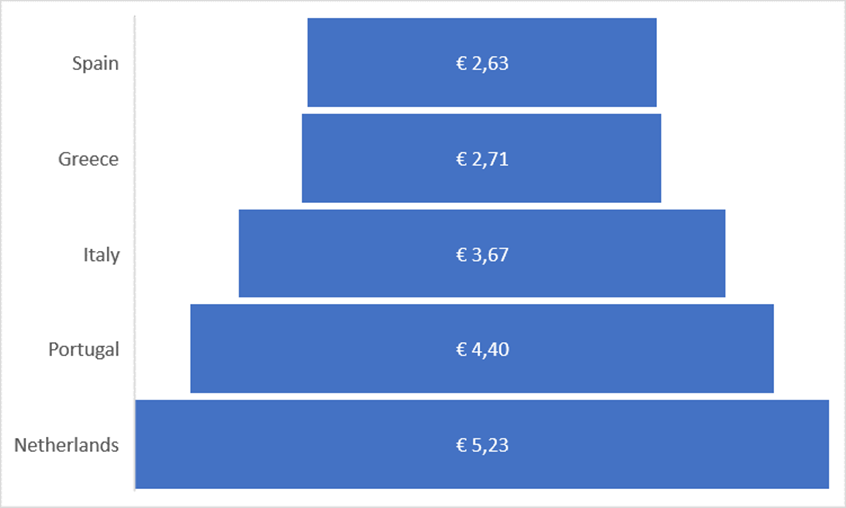

Price difference between origins and destinations

Quality plays an important role in price setting. For example, strawberries from the Netherlands were valued much higher than strawberries from Spain. For non-European exporters, quality is even more important because they lose the advantage of a locally cultivated strawberry, which often has the preference. Quality not only ensures that you’ll get an acceptable price for your product, but it is your entry card into the European market.

Furthermore, destination can also be an influence. For example, import prices in Spain and Romania are generally lower, partly due to the lower cost of terrestrial import from (respectively) Morocco and Turkey. Markets that are more difficult to reach or markets that require premium quality have higher import prices. These countries include for example Belgium, the United Kingdom, Germany and the Netherlands.

Figure 8: Prices at wholesale markets in Germany (2019), €/kilo from different origins

Source: Revista Mercados

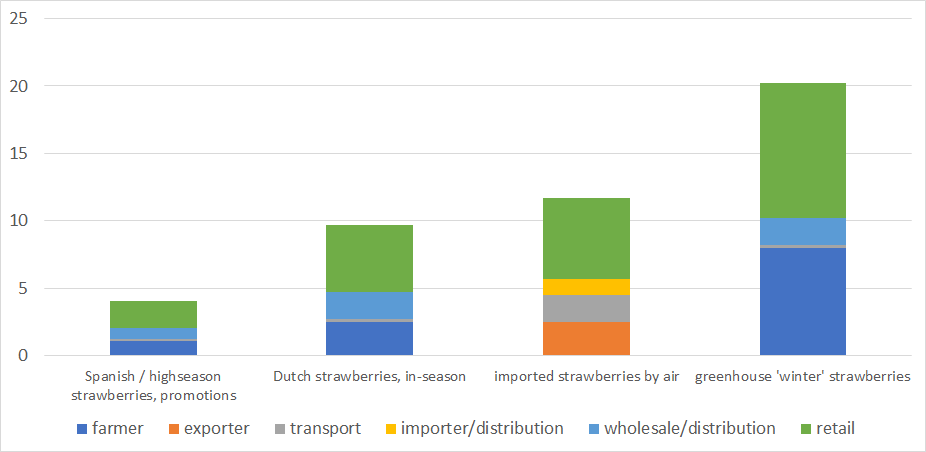

Price breakdown

The prices and price structure of strawberries vary a lot throughout the year. As such, it is not possible to define a reliable price breakdown scheme. The figure below is purely indicative and hypothetical.

The most important rule to remember, however, is that the market determines the trade price. Importers often calculate a net margin of 8% over their selling price and will also deduct handling and import-related costs. A perishable and fragile product like strawberries can easily lead to higher costs due to waste or quality issues.

The trade price of non-European strawberries must be attractively priced to compete with local strawberries. Local strawberries often have the preference, which means that imported strawberries have to either be superior in quality or lower in price.

Figure 9: Indicative price breakdown

Tips:

- Find a French price history on the Market News Network of FranceAgriMer from producers, importers, wholesalers (“gros”) and retail (“détail”).

- Get regular market and price updates from the fruit and vegetables webpage of the Federal Agency for Agriculture and Food (BLE) in Germany (in German). Scroll down to the “Markt- und Preisbericht” (market and price news). The information is available and most extensive in German, but you can use the “Translation” function of your browser.

- Check prices in Spain on Mercalicante or Junta de Andalucia.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research