The European market potential for strawberries

The European strawberry market is a high-value market with consumers that expect quality and freshness. Despite the dominance of local growers, the demand allows for additional import. Germany and the UK import the most strawberries, but non-European suppliers also have a small window to supply Spain, Belgium and a niche market in the Netherlands.

Contents of this page

1. Product description

The common strawberry is known as the garden strawberry, a hybrid species of the genus Fragaria (Scientific name: Fragaria × ananassa). The northern hemisphere also has a wild variety that grows naturally, known as wild or woodland strawberry (Fragaria vesca).

In Northern Europe, most varieties are short-day plants or Junebearers that hibernate in winter, such as the Elsanta, Sonata, Clery and Malling Centenary. The Everbearer and the Dayneutral varieties are more common in Southern Europe. In Spain, the largest producer and exporter of strawberries in Europe, the Camarosa, Fortuna, Sabrina and Candonga are among the popular varieties. See the study on Entering the European market for fresh strawberries for required characteristics.

For a more complete overview of strawberry varieties, see Frutas-hortalizas.com, strawberryplants.org and the list of strawberry cultivars on Wikipedia. You can also find commercial varieties via breeding companies and nurseries and different breeding initiatives, for example:

- Flevo Berry (Netherlands)

- BerryLAB (Italy)

- Fresas Nuevos Materiales (fnm) (Spain)

- Hansabred (Germany)

- Driscoll’s (USA / international)

Figure 1: Strawberries types and the Harmonized System (HS) code

Photo by ICI Business

2. What makes Europe an interesting market for strawberries?

Strawberries are a popular and high-value summer fruit. Despite a dominant local supply, there is always a period of low availability when strawberries can be imported. External influences such as the COVID-19 pandemic have a minor influence on the overall non-European supply.

Strawberries are a high-value and popular summer fruit

Strawberries are one of the most popular summer fruits in Europe. Strawberries are very well integrated in the European consumption of fresh produce with a wide production throughout Europe.

The consumption of strawberries in Europe is estimated to be around 1.2 million tonnes or more. The local production is about the same in volume. According to a consumer report by Roamler, 93% of Europeans consume strawberries. In the local season strawberries become a regular item in consumers’ shopping baskets.

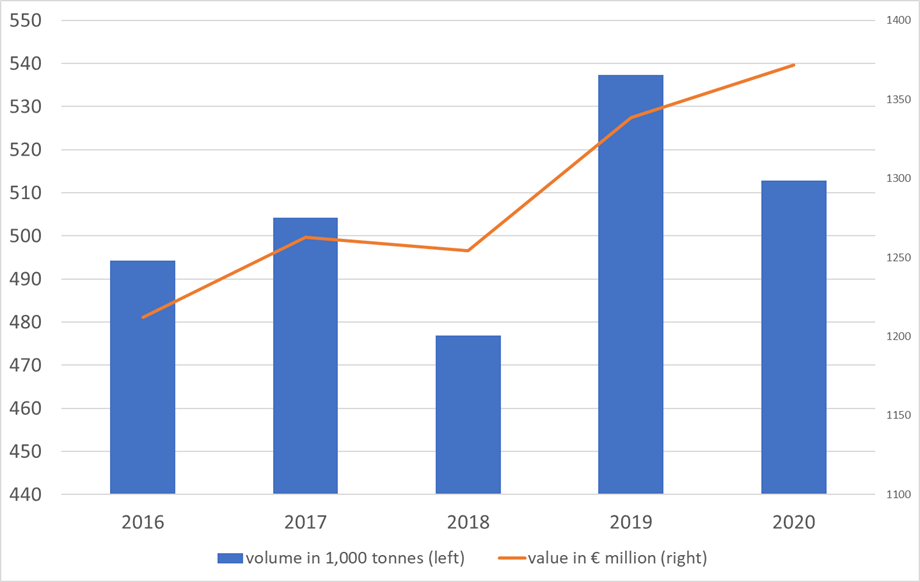

The total trade volume fluctuates around 500 million tonnes. The local climate influences the availability of strawberries, but the overall trade value shows an increasing trend. Like other soft fruit, strawberries are offer high value. A continuous focus on quality can secure gradual market growth in the years to come.

Figure 2: Total European import and internal trade (all sources)

Source : ITC Trademap

Non-European supply remains stable despite of COVID-19

There is a year-round supply of fresh strawberries from European cultivation, but the off-season production is not sufficient to meet demand. There is still need to complement the local harvest in the winter and early in the season.

The import from non-European suppliers covers only a fraction of the total consumption in Europe, but with 43,000 tonnes in 2020 it is still an interesting volume. The main window for non-European supply runs from November to March, with a peak in December for the Christmas holidays. In May through July (2021) there is an additional import tariff of 12.8% on imported strawberries.

During the COVID-19 pandemic the demand was more erratic. Consumers opted for fruits with a longer shelf life and sales to the food service industry were minimal due to lockdowns. Countries also relied much more on their local supply. Despite this, the import volume from non-European countries remained stable in 2020 and even increased mainly due to increased imports in Romania (from 2,000 to 6,000 tonnes).

The average price level for foreign strawberries decreased in 2020. The lower value can be related to the higher market share for suppliers close to Europe and a decline in air freight. Countries near Europe such as Turkey and Serbia performed well. Morocco, Egypt and Jordan also maintained an acceptable volume in relation to previous years. However, import from distant countries became more difficult. Imports from the USA, Mexico and Ethiopia were less than the year before.

When the impact of COVID-19 is over, there will still be opportunities for foreign strawberries from multiple sources. But to maintain this foreign supply, the strawberries must be of premium quality and sustainably cultivated to compete with the greenhouse production in Europe.

Tips:

- Keep up-to-date with the latest updates in the European strawberry market through news items on Freshplaza and their regular overview of the global strawberry market, Eurofruit and FreshFruitPortal.

- Learn more about the developments on the European market and meet other strawberry companies at international congresses such as the Global berry congress in the Netherlands.

3. Which European countries offer most opportunities for strawberries?

Strawberries are consumed all over Europe. The largest importers are Germany, UK and France. Belgium and Spain also have a relatively high import from non-European countries, namely Egypt and Morocco. Furthermore, the Netherlands and the UK offer small opportunities for premium strawberries flown in from larger distances. The demand for organic strawberries is increasing as well, but these mainly come from local sources.

Table 1: Popular strawberry varieties for domestic production

| Region | Popular varieties for cultivation |

| Netherlands | ‘Sonata’, ‘Lambada’ |

| United Kingdom | ‘Malling Centenary’ |

| Central Europe | ‘Alba’, ‘Asia’, ‘Brilla’, ‘Joly’, ‘Romina’, ‘Sibililla’ (early and mid-season production) |

| Germany, (Poland) | ‘Cristina’, ‘Letitia’ (late season) ‘Malwina’ (very late season) |

| Central Europe & Germany | ‘Clery’ (Patented by Consorzio Italiano Vivaisti-CIV) |

| Northern & central Europe | ‘Sonata’, ‘Elsanta’ (old cultivar, no patent, gradually being replaced by various new cultivars) |

| Scandinavian countries | ‘Korona’ |

| France | ‘Gariguette’ (old cultivar), ‘Darselect’ |

| southern Europe (central areas of Italy, Spain, Greece) | ‘Clery’, ‘Joly’, ‘Alba’, ‘Asia’, ‘Garda’, ‘Eva’, ‘Romina’, ‘Sibilla’, ‘Cristina’, ‘Darselect’ |

| southern Europe (Southern Italy, Spain, Greece) | ‘Florida-Fortuna’, ‘Camarosa’, ‘Monterey’, ‘Portola’ (USA cultivars), ‘Sabrosa-Candonga’, ‘Sabrina’, ‘Rociera’, ‘Melissa’ (Spanish cultivars), ‘Calinda’, ‘Victory’, ‘Primavera’ (new cultivars) |

| Huelva (Spain) | ‘Florida-Fortuna’ (Florida University), ‘Primoris’, ‘Rociera’ and ‘Rabida’ (Fresas Nuevos Materiales-FNM) |

Source: Status of strawberry breeding programs and cultivation systems in Europe and the rest of the world, Journal of Berry Research, vol. 8, no. 3, pp. 205-221, 2018, complemented with additional sources

Germany: Leading consumption with growing import

Germany is the largest market for strawberries in Europe. Fresh strawberries are very popular in spring and summer. Despite the large domestic production and preference for local strawberries, the import of foreign and non-European production continues to increase.

With 152,000 tonnes in 2020, Germany is the third-largest producer of strawberries in Europe, after Spain and Poland. A gradual shift from open field to protected cultivation will secure the local supply in the future and extend the local season. Breeding programmes by Flevo Berry and Hansabred, among others, reinforce the sector with varieties that fit future cultivation systems. This way German farmers continue to fulfil the growing demand for (local) strawberries. Local is considered more sustainable, as is organic cultivation. With 350 hectares, Germany has one of the larger production areas for organic strawberries in Europe.

In addition to the local production efforts, Germany is also the largest strawberry importer with an import value of over 300 million euros in 2020. More than 70% of the import comes from Spain. The Netherlands is the second-biggest supplier. Non-European import remains limited and will continue to fluctuate according to the availability of local and regional supply. In 2020 Germany imported €13.6 million from outside of Europe, mainly from Egypt and Morocco, which equals less than 4,000 tonnes.

The technical development of the German open-field strawberry production will take time. A great part of the consumption will depend on imported strawberries for many years to come. For non-European suppliers it is important to be relatively close to the German market and mainly during the European winter period.

United Kingdom: Possibly more non-EU import after Brexit

British people are among the biggest consumers of strawberries. Furthermore, the dependency on imported strawberries is still high despite of the ambitions in own cultivation.

British strawberry consumption increased together with production over several years. According to experts this growth has been made possible by the large amount of imported labour from other parts of Europe.

In 2019 the United Kingdom produced an all-time record of 124,500 tonnes of strawberries. Brexit (Britain leaving the EU) will motivate the country to scale up its domestic production and avoid dependence on other European countries. A large part of the production already takes place under protected cultivation – mainly with polytunnels – and investments have been made in strawberry varieties such as the Malling Centenary, a strong plant that provides quality fruit. However, rising costs of labour, storage, haulage, planting, and farm maintenance is leading to a decline in production, which is a huge concern for the British berry growers organisaton.

Currently, the UK is the second-largest importer of strawberries in Europe with a value of over € 200 million. Traditionally, the UK mainly supplements its own production through suppliers in Spain, the Netherlands and Belgium.

Since the UK has left the EU, shipping in additional supply from Europe takes longer due to the increased paperwork required. As a consequence, the difference between strawberries from the EU and other countries in the region such Morocco and Egypt is getting smaller. The United Kingdom has made trade agreements with Morocco, Egypt, Turkey and Israel, among others. Also the value or prices for imported strawberries are relatively high. This provides opportunities for less common supply countries such as Jordan.

France: High standard in sensory quality

France is one of the larger import markets for strawberries, but its consumers are more particular in their preferences than those in other European countries.

French consumers have a high standard for the taste of strawberries. Varieties such as ‘Darselect’ and the older ‘Gariguette’ do well in France because of their unique flavour. It is difficult to introduce new cultivars if their fruits do not reach the same sensory quality.

French consumers are difficult to please and their preference for local fruit has not been favourable for import. For several years the import of strawberries has been declining, with smaller volumes coming in from Spain as well as a dip in the incoming supply from Morocco and Egypt. The import from outside Europe was still over 5,000 tonnes in 2017, but has been around 2,000 tonnes lower in recent years (2018-2020). There seems to be little compensation with volumes from domestic production or from other sources. This leads to believe that French consumers are more likely to switch to other seasonal fruit such as stone fruit, or that they are very selective in the quality strawberries they choose. So less strawberry consumption in volume, but better in quality and organic. The French production is not large, but with around 7% it has one of the highest shares of organic production.

When doing business on the French market, you must focus on strawberries with superior flavour. Exporting from a country that maintains good trade relations with France, such as Morocco or Mauritania, is an advantage.

Belgium: Small country, big in strawberries

For a country as small as Belgium, the quantity of strawberries it produces, imports and exports is impressive. A year-round demand for strawberries benefits foreign suppliers.

With nearly 48,000 tonnes of domestic production for a population of less than 12 million, strawberries are well integrated into the Belgian food culture. There is demand for strawberries throughout the year. For most of the calendar year Belgium is a net exporter, thanks to greenhouse producers such as the cooperative Hoogstraten. But in the darkest winter months (December and January) import is needed to fulfil local demand.

Around 20,000 of the 34,000 tonnes of strawberries imported by Belgium in 2020 originate in the Netherlands, but at the same time the Netherlands is also the largest export destination for Belgian strawberries.

In the winter, Egypt is the main non-European supplier with more than 5,000 tonnes per year for the last 3 years (2018-2020). The import has increased to fill in a growing year-round demand, but with further development of lit greenhouses in Belgium, imports from Egypt could be reduced.

Netherlands: Technical cultivator with small opportunity for premium trade

Just like Belgium, the Netherlands has a year-round demand for strawberries with a large production and a net export value. However, the country requires less import from outside Europe. It does manage some minor long-distant imports for the premium trade, but it does not fulfil the same trade hub function as it does with exotic fruits.

The Netherlands is a leading country in strawberry breeding, production and trade. The production volume in 2020 was 77,600 tonnes and it has been increasing over the years. This production continues in smaller volumes outside the main season in highly technological greenhouses with artificial lighting. Therefore there is less need for import from Northern Africa.

There is a significant volume of exchange between the Netherlands and Belgium, but Germany is an equally important destination for Dutch strawberries. The import from outside Europe is not significant – Egypt being the largest with (only) 800 tonnes in 2020. Additionally, small volumes on pallets are flown in from countries further away, such as Jordan and Ethiopia. By using the different seasons of producing countries as optimally as possible, the Netherlands can tap into a niche market for premium out-of-season strawberries.

Spain: Major producer with mainly opportunities for Moroccan production

Spain is the largest producer and supplier of strawberries in Europe. Despite its local production, there are still specific windows when foreign farmers (mainly from Morocco) can supply Spain with strawberries.

Spain generally produces between 340,000 and 400,000 tonnes of strawberries. In 2020 the harvest was much lower at 272,600 tonnes due to adverse weather conditions, but still enough to be Europe’s leading producer. Due to the COVID-19 pandemic there was also less demand from buyers in France as well as in the food service industry.

Spain exports strawberries throughout the year, but the main season runs from February to May. High investments in cultivation combined with the current risks have offset some of the Spanish strawberry farmers. Other farmers are investing in early varieties so they can enter the market earlier in the season.

Moroccan suppliers in particular should follow the developments in Spain. More than 80% of Spain’s strawberry imports originate in Morocco – a volume of 15,000 tonnes. In Morocco, the season is slightly different and production costs are lower. Morocco supplies Spain mainly between November and March. A minor volume of 100 to 500 tonnes is flown in annually from Peru between October and December.

Tip:

- Focus on the European markets that are most likely to import from your country. Coming from Morocco you should mainly target Spanish companies; Egyptian companies have found a good market in Germany and Belgium; and long distant suppliers such as Jordan or Ethiopia can best try their luck with buyers in the UK and the Netherlands.

4. Which trends offer opportunities or pose threats on the European strawberry market?

Freshness and taste are crucial for European consumers when they purchase strawberries, and they are increasingly preferring local production over imported strawberries. Technical improvements further extend the local seasons. As a result, suppliers from abroad will have to strive for perfect quality and timing with attractive strawberry varieties to remain interesting for European buyers.

Focus on sustainability and local freshness

Freshness, price and appearance are important factors for European consumers when they buy strawberries. But in reality taste and seasonality are the main reasons for purchasing them, whereas local production is becoming increasingly important.

According to a Roamler consumer report 31% of the European consumers say they only buy nationally produced strawberries. These strawberries offer the best guarantee for freshness, but they also have the best reputation in their own market. Taste and sweetness are a common argument for buying local strawberries. For professional buyers sustainability also plays a role.

Especially French and Italian consumers value local strawberries because of their flavour – but in Germany local supply is also gaining importance because it is considered to be more sustainable and safer. The United Kingdom and the Netherlands are the least worried about whether strawberries come from domestic cultivation, but even here national strawberries are clearly marked on the package and a distinction is clearly made. In January 2021, Carrefour in France suspended the sales of strawberries until mid-February. The taste quality of the strawberries on sale in January was insufficient and it is also an excellent way to raise customers' awareness of the importance of fruit and vegetable seasonality.

Strawberries are heavily promoted during the local season, but some consumers are prepared to pay a premium for high-quality, tasty strawberries during the off-season. When exporting strawberries to Europe, it is important to pay attention to quality and taste and understand how consumers experience your product. By supplying superior-tasting strawberries, you will motivate consumers to continue purchasing your product.

Smaller supply window due to technological improvements

Growers in Europe are adopting more and more technology in the cultivation of strawberries. A significant number already work with a form of protected horticulture, using substrates, plastic tunnels or glass greenhouses and artificial lighting. This technological improvement is accompanied by developments in improving strawberry cultivars, such as early-growing or late-season varieties.

As a result, strawberry farms in Europe do not only gain more control and efficiency in production, but also extend their production seasons. Consumer demand is encouraged by an almost year-round supply of quality strawberries. As such, while consumption is increasing, the window of opportunity for external suppliers is becoming narrower.

Breeding quality strawberries

European breeding programmes have become very common. Since the mid-90’s the Community Plant Variety Office (CPVO) has protected almost 550 new strawberry cultivars for the use in the EU territory. The main focus points of breeding are: extending seasons, ease of picking, taste, yields, shelf-life and adjustment to climate or production method. EU-funded projects, such as the GoodBerry project that ended in 2020, also contributed to new cultivation techniques and accelerate the development of desirable and high-quality strawberries.

As foreign producer you must keep up with the developments in the strawberry industry. Besides excellent cultivation techniques, it is crucial to have access to superior cultivars. Nurseries such as Strawberry Jordan Nursery provide these through a license agreement with Eurosemillas, reproducing Californian strawberry varieties such as the Camarosa, Ventana and Albion.

Using digitalisation to maintain efficiency

The Belgian company Octinion introduced a first commercial strawberry picking robot at Fruit Logistica in February 2019. The company claims the robot can pick one fruit every 5 seconds. These types of digitalisations will help European farmers to remain efficient and competitive in the future. It will keep strawberry prices affordable and avoid the switch to low-cost production countries.

Tips:

- Explore different strawberry varieties with breeding and licencing companies. A superior strawberry cultivar is one of the principal ways to differentiate your supply in a positive way.

- See what kind of digital technologies you can implement to make your business more efficient and competitive in the CBI study Going Digital in the fresh fruit and vegetable sector.

- Read more about which trends offer opportunities on the European fresh fruit and vegetable market on the CBI market intelligence platform.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research