Entering the European market for table grapes

The European grape market is highly competitive and most of the supply is programmed by large retailers. New grape varieties can help you improve productivity and extend your season with high-quality grapes. Early or late varieties will help you efficiently fill in the gaps in the supply windows between producers from Peru, Chile, South Africa and India, which often flood the market in the European counter season.

Contents of this page

- What requirements and certifications must table grapes comply with to be allowed on the European market?

- Through what channels can you get table grapes on the European market?

- What competition do you face on the European table grape market?

- What are the prices for table grapes on the European market?

1. What requirements and certifications must table grapes comply with to be allowed on the European market?

Fresh table grapes must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use the My Trade Assistant of Access2Markets, which provides an overview of export requirements for fresh table grapes (HS code 08061010).

What are the mandatory requirements?

Pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. This is especially relevant for grapes as they are directly consumed.

To avoid health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

Note that buyers in several EU Member States, such as Germany, the Netherlands and Austria, use MRLs which are stricter than the MRLs provided for in European legislation.

Tips:

- Consult the EU Pesticides database to find the relevant MRLs for table grapes and all harmonised MRLs. You can search by product or pesticide used to find a list of associated MRLs.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Make sure that lead contamination in your grapes remains below 0.10 mg/kg and cadmium below 0.050 mg/kg, according to the Regulation (EC) 1881/2006 setting maximum levels for certain contaminants in foodstuffs.

Microbiological criteria

Food safety authorities can withdraw imported table grapes from the market or stop them from entering the European Union if salmonella, E. coli or other bacteria are present (Regulation No 2073/2005).

The European Food Safety Authority recommends using good agricultural, hygiene and manufacturing practices to reduce contamination in grapes.

Tip:

- Make sure to use clean water and equipment for the cultivation and packing of grapes. Also maintain good hygiene practices in case of manual packing of the fruit. Use the Codex Alimentarius - Code Of Hygienic Practice For Fresh Fruits And Vegetables as a guideline.

Phytosanitary regulation

The European Union requires table grapes to go through health inspections before being entering or moving within the European Union. The plant health inspection must take place in the country of origin and the shipment must be accompanied by a phytosanitary certificate, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072.

Tips:

- Learn more about the European phytosanitary rules in Council Directive 2000/29/EC and the new Implementing Directive 2019/523 on the protective measures against the introduction of harmful organisms in the European community.

- Check which (other) fruit and vegetables require a phytosanitary certificate in the lists of Annex XI and Annex XII of Regulation (EU) 2019/2072).

Quality standard

At the very least, fresh table grapes should comply with the general quality requirements (see Table 1). Europe almost exclusively requires Class I grapes as a minimum. Table grapes in this class must be of good quality and within the permissible tolerances. Grapes must be firm, firmly attached and, if possible, have their bloom intact.

In no case may the defects affect the fruit flesh, the general appearance of the produce, the quality, the keeping quality and presentation in the packaging.

For more information on quality, size, packaging and labelling requirements for table grapes, see the UNECE standards for TABLE GRAPES.

Table 1: Quality requirements and permissible tolerances for fresh table grapes

| General quality requirements (all classes) |

| 1. Sound – produce must be free from rotting or deterioration likely to make it unfit for consumption; |

| 2. Clean, practically free of any visible foreign matter; |

| 3. Practically free from pests; |

| 4. Practically free from damage caused by pests; |

| 5. Free of abnormal external moisture; |

| 6. Free of any foreign smell and taste; |

| 7. Able to withstand transport and handling. |

| 8. In addition, the grape berries must be intact, well-formed and normally developed. |

| Permissible tolerances for Class I table grapes |

| 1. A slight defect in shape; |

| 2. A slight defects in colouring (Pigmentation due to sun is not a defect); |

| 3. Very slight sun burn affecting the skin only; |

| 4. A tolerance of 10% is allowed for fruit that meets Class II standards; |

| 5. A maximum of 10% of grapes detached from the bunch. |

Figure 1: Example of different classes of table grapes

From left to right: ‘Extra’ Class (bloom intact), Class I (normal quality), Class II (variation in berry shape)

Source: OECD (2006), Table grapes, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Tips:

- Maintain strict compliance with quality, delivering it as agreed with you buyer. Being careless with product requirements or pushing quality limits will lead buyers raise issues with quality. Send images of your product before shipment to avoid miscommunication.

- Make sure your table grapes are well preserved to ensure optimal freshness and taste. Supply chain logistics should not affect product taste in any significant way.

Maturity

Table grapes must be sufficiently developed and display satisfactory maturity and ripeness. Therefore the grapes must have reached at least 16° Brix. Fruit with a lower index are accepted if the sugar-acid ratio is at least equal to:

- 20:1 if the Brix level is greater than or equal to 12.5° and smaller than 14° Brix.

- 18:1 if the Brix level is greater than or equal to 14° and smaller than 16° Brix.

Tip:

- Always double check maturity requirements with your buyer if you are not sure. The official standard is only an indication and maturity requirements can vary in different end markets or for certain grape varieties.

Size and packaging

Size is determined by the weight of the bunch. The minimum bunch weight is 75 g, but it does not apply to packages intended for single servings. There is a tolerance of 10% on bunches not meeting size requirements. In each sales package, one bunch weighing less than 75 g is allowed to adjust the weight.

The contents of each package must be uniform and contain only bunches of the same origin, variety, quality and degree of ripeness. However, a mixture of table grapes of distinctly different varieties may be packed together in a package, provided they are uniform in quality and, for each variety concerned, in origin.

Common packaging include:

- clamshells or punnets with heat-seal or flow pack, various sizes, for example, 10x500 g or 18x250 g in a box;

- bag-in-box between 4.5 kg and 9kg;

- carry bags with grape bunches between 4.5 kg and 9 kg.

Figure 2: Examples of table grape packaging

Source: OECD (2006), Table grapes, International Standards for Fruit and Vegetables, OECD Publishing, Paris

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Find the legal requirements for labelling in the buyer requirements for fresh fruit and vegetables on the CBI market information platform.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Pre-packaged Foods and Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

What additional requirements do buyers often have?

Variety

Europe’s table grape market is large and there are many varieties which you can export. The choice of variety depends on several criteria:

- The presence of seeds;

- shape and colour

- skin thickness

- maturity period

- resistance against diseases and pests

- transportability

- shelf life.

With early, mid-season and late varieties you will be able to cover a large season. The rest is a combination of finding the right, sweet taste and cost-competitive grape cultivar.

There can be regional differences in grape preference. In northern Europe, mature seedless white grapes with thin skin and sweet taste are most preferred. Seedless grape consumption was developed later in southern Europe and berry size is sometimes of more importance in countries such as Italy.

Tips:

- Learn more about different grape varieties, characteristics and their seasonality, by consulting the ripening calendar of grape innovator Sun World International, the harvest calendar of grape breeder SNFL group and the Table and Dried Grapes report published by the Food and Agriculture Organization of the United Nations.

- Select the grape varieties that best suit your client’s market, or find the right buyer for your variety. Visit your export market regularly to update your market knowledge.

Certification

Common certifications for blueberries include GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommended.

Sustainability and social compliance

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate is highly recommended. You will often need a Sedex Members Ethical Trade Audit (SMETA) to get your product up to retail standards.

Retailers can also impose their individual standards, such as Tesco Nurture. Especially larger retail chains in northern Europe are more prepared to buy your product if you comply with social and sustainability standards.

In the near future you can expect new environmental and social initiatives with standards that become more extensive with regular audits. For example, the Sustainable Trade Initiative for Fruit and Vegetables (SIFAV) has formulated new goals towards 2025 that include reducing the carbon footprint and increasing sustainable water use. SIFAV is a private covenant between European importers and retailers. With this in mind, it is sensible to measure your environmental impact and explore new standards such as SPRING, a Global G.A.P. add-on for sustainable irrigation and groundwater use, or the Corporate Carbon Footprint of TÜVRheinland.

Tips:

- Implement at least one environmental and one social standard. See the Basket of Standards of the Sustainability Initiative of Fruit and Vegetables (SIFAV).

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

What are the requirements for niche markets?

Organic certification can increase the value of your table grapes

Organic certification can be an interesting way of setting your table grapes apart and marketing them at higher prices. The demand for organic table grapes is growing, although it is mainly supplied from within Europe. Specialised buyers that import organic table grapes are, for example, OTC Organics and Eosta (the Netherlands) and the Ethical Food Company (UK).

For non-European suppliers, it is important comply with European legislation. You must use sustainable and organic production methods and apply for an organic certificate from an accredited certifier.

Note that since January 2022 the new legislation Regulation (EU) 2018/848 has come into force. Inspection of organic products will become stricter to prevent fraud, while producers in third countries will have to comply with the same set of rules as those producing in the European Union.

Tips:

- Strive for residue-free grapes and certify your production as organic, if possible, to broaden your market opportunities. But, remember that implementing organic production and becoming certified can be expensive; you must be prepared to comply with the entire organic certification process.

- Download the current list of control bodies and authorities to see which certifiers are active in your region.

2. Through what channels can you get table grapes on the European market?

The main channel for table grapes in Europe is supplying to retail chains, which requires high volumes of almost exclusively Class I grapes or higher. You can best reach this sales channel with the help of grape importers and service providers that supply to those retailers. Your offer will be most interesting to them when you are able to extend your season with appealing grape varieties.

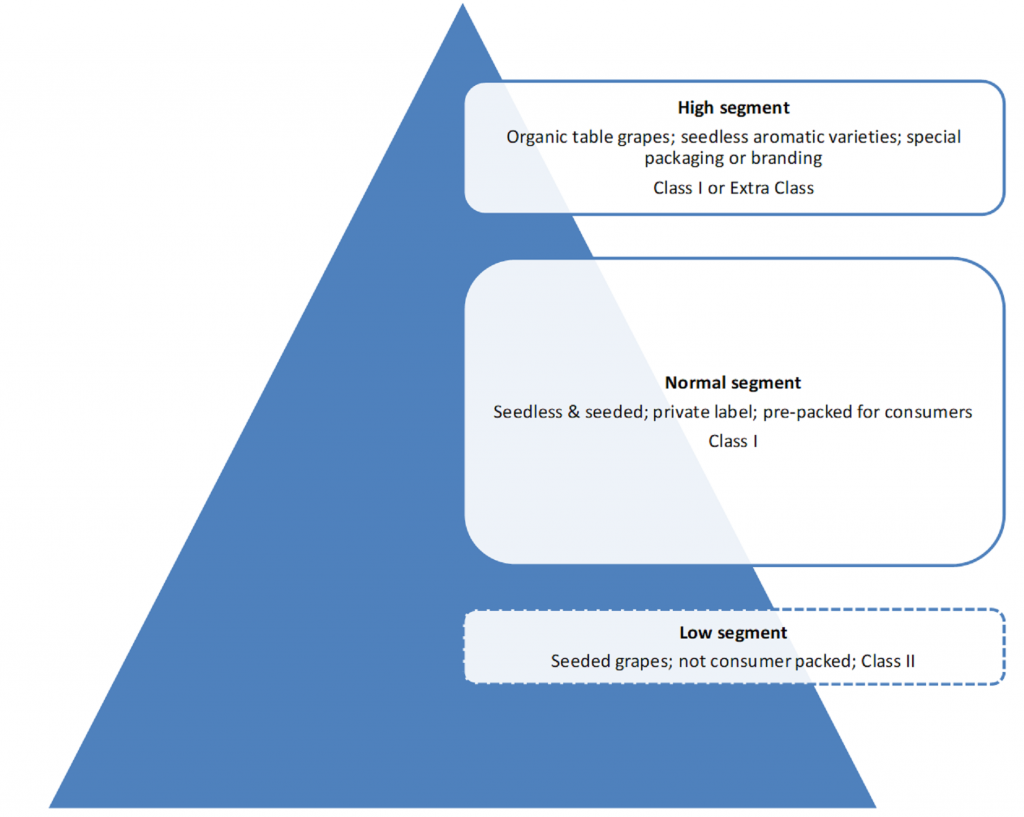

How is the end market segmented?

The most common market segment for table grapes are consumer packed, Class I grape bunches. Most of these grapes are seedless and sold under private label. There is no exact data available on varieties, but you can expect the majority of the grape consumption to be white or green grapes, followed by red grapes and in much smaller volumes blue or black grapes.

The grape sector is large enough to offer opportunities for differentiation. There are possibilities to supply certified organic grapes or special aromatic varieties, such as Sable Seedless and Cotton Candy grapes. You can also add value by branding a high-quality product, but this takes a lot of promotion in your target market.

On the low end of the market you will find less popular and older grape varieties that are not in favour anymore with the large retailers. This lower-priced segment also includes seeded and unpacked grapes, often from local origin, and mostly sold in traditional grape countries, such as Italy and Spain, but also in eastern European countries.

Figure 3: Market segments for table grapes in Europe

Source: ICI Business

Tips:

- Focus on table grapes of export quality, meaning at least Class I and modern varieties. Lesser varieties and qualities are generally not imported by most European countries.

- Be honest about quality and back up your product. Document your cold chain and product appearance with photos before shipping to help you in case the buyer wants to renegotiate value and price.

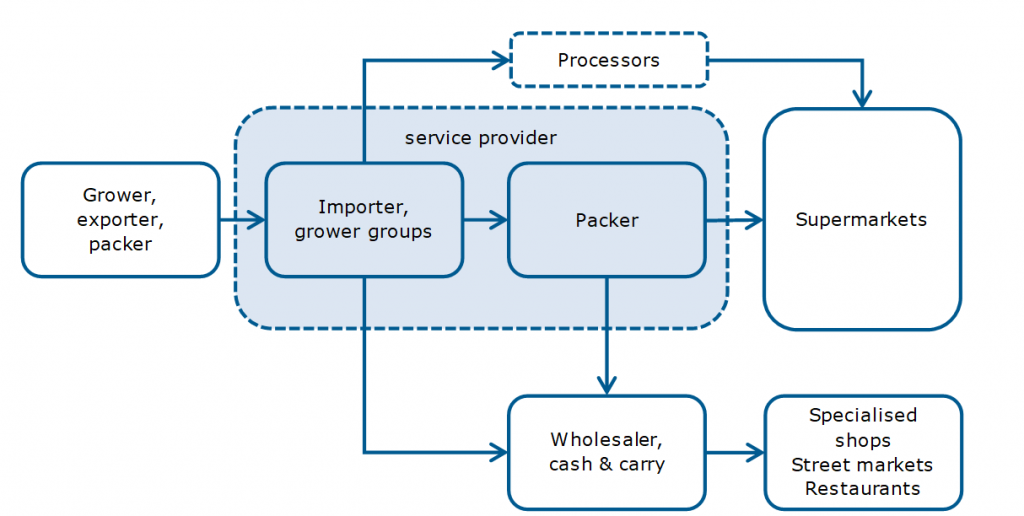

Through what channels do table grapes end up on the end market?

Importers and service providers

Importers have a central role in the distribution of table grapes. They are familiar with all the different requirements of end clients and are able to distribute to different markets.

Table grape specialist importers are well integrated with grape producers. By sourcing grapes from different regions they assure their clients of a year-round grape supply. Some of these companies have their own packing stations, although most of the packaging takes place at origin. When they do provide different services, such as retail packing and multiple origin sourcing, they can become service providers to large retailers.

Some of these companies include large integrated fresh suppliers, such as Greenyard, which have their own procurement offices in producing countries. But there are also companies more specialised in table grapes, such as Grapes Direct in the United Kingdom.

Fresh grapes for processing, for example, for salads and mixed fruit packers, can be supplied by importers as well. But this is a small segment compared to the direct fresh consumption.

Tips:

- Offer different packaging options to make your company attractive to a wider group of importers.

- Read the tips for doing business with European buyers on the CBI market intelligence platform and learn what buyers find important.

Supermarket programmes

Most table grapes are sold through supermarkets. Grapes are a typical product that is programmed under supply contracts and marketed as a private label product.

Many supermarkets select external service providers to supply them with table grapes for a contracted period or programme. Some work with annual contracts, while others select an exclusive service provider such as German discounter Lidl has done with OGL Food Trade.

In large volumes, fruit categories such as table grapes, retailers get much more involved in sourcing. By sourcing grapes directly, retailers improve cost efficiency and control the supply chain with maximum transparency. Only large producers will qualify to directly supply to a supermarket chain. Most likely, a service provider will be in between to assist with import and logistics.

Tip:

- Make use of independent service providers when dealing directly with retailers. There are many companies which can take on import formalities, warehousing, packing and distribution for you, for example Kloosterboer, LBP and Cool Control.

Wholesalers (spot market)

Although table grapes are largely traded on a contract basis, the grape trade needs a spot market to service wholesalers and small outlets, as well as to regulate supply shortages and oversupply.

Traditional fruit wholesalers cover the spot market and move with the fluctuations of the trade. They supply to specialised shops, street merchants, restaurants and hotel chains. Sometimes import and wholesale activities are combined, but a traditional wholesaler does not take many risks with importing long-distance table grapes. Typical wholesale markets for table grapes and other fruit include Rungis in Paris and Mercabarna in Barcelona.

Non-specialised (cash & carry) wholesalers supply to the same food service end markets. Just like supermarkets, they are able to work with long-term contracts. Metro Cash & Carry, for example, has its own Valencia Trading Office (VTO) to source table grapes in Spain and from international producers.

Figure 4: Market channels for fresh table grapes

Source: ICI Business

What is the most interesting channel for you?

The most interesting channel to aim for depends largely on the size and structure of your company. The higher your production volume and the longer your supply season, the more interesting you become to large buyers that have programmed supply or direct sourcing deals with supermarkets. You will have to accept all the specific requirements of supermarkets to trade with them, without making concessions or negotiating the rules of the game. Either way, being closely connected with the primary production is key.

When your production is not as large, you had best find another strategy. For example, you could look for cooperation with other producers and look for mutual benefits in size and season. Or you can build commercial relations with traders and established importers. For example, Grapes Direct (United Kingdom) and Direct Source International (Netherlands) source grapes from many different origin countries. Full-service providers, like Kölla (Switzerland), have multiple sales and purchase offices throughout Europe. These companies will do the quality checks and make sure the table grapes find the right end market.

There are many importers and traders that can represent your product in the European market. This can be tricky because you depend on the performance and network of your buyer. Grapes in the spot market are often traded on commission. It is important to check if your importer has a wide network to market your product, or preferably has supply contracts with retailers in place.

Tips:

- Select your buyers wisely and be sure that your importing partner defends your interests. You must know what kind of network and experience they have — the most reliable partners often have supply contracts or programmes with important end clients.

- Focus on long-term commercial relationships and supply chain integration. This can also include taking part in several steps of the supply chain, such as setting up commercial platforms, contracting production or joint ventures.

- Connect with importers by visiting trade fairs, such as Fruit Logistica in Berlin and Fruit Attraction in Madrid, or by using their online catalogues.

3. What competition do you face on the European table grape market?

In table grapes you will encounter competition from both local producers in Europe as well as non-European suppliers, depending on the season. Developments in grape varieties can have great influence on competitive strength. They increase yields and close gaps in the grape calendar. Exporting more grapes to an established market, such as Europe, often puts extra pressure on prices. It helps to have other export markets outside Europe, including a domestic market.

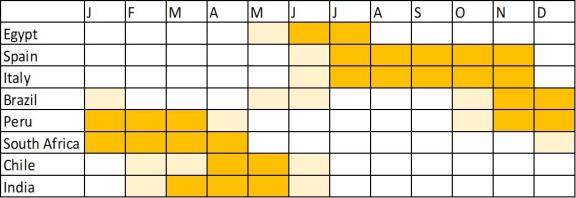

Which countries are you competing with?

Table grapes in Europe is a very competitive market. Italy and Spain are the main supplying countries of table grapes within the European season. Your main competitors outside Europe are counter-seasonal suppliers such as South Africa, Peru, Chile or India. On the edges of the European season you will find Egypt and Brazil.

Italy and Spain

Europe’s table grape production is estimated at 1.7 million tonnes. Italy, Spain and Greece account for most of it (see figure 5). In the European grape season, Italy and Spain are your main competitors. They have a local advantage and as long as their supply is abundant, it will be difficult to be in the market at the same time. Their peak supply is in August and September (see the indicative supply calendar in figure 7). On the other hand, European production of table grapes is becoming expensive and competition from nearby regions, such as Egypt and Morocco, is increasing.

Italy is the main supplier to the EU market with over a million tonnes of annual crop. But according to industry sources, Italy is also one of the last countries changing to the preferred seedless varieties in Europe. The “Italian Grapes report 2020” mentions that seedless grapes are mainly grown in the Puglia area. Here they account for only 30-35% of the total production. But in the past few years the seedless trend has been in full swing.

Spain’s production season of table grapes is gradually increasing and surpassed 0.3 million tonnes in 2021. Some of the main growers in Spain are advancing fast by upgrading their grape varieties, with high yielding and seedless club varieties early in the season.

In the export trade, Spanish grapes are 30% more expensive per kilo than Italian grapes. While Italian growers compete with low-priced grapes, Spanish producers focus on exporting seedless grapes, which should be your aim, too, as a foreign supplier. Italy’s strength, in addition to volume, is the large area of organic grape cultivation. According to the latest available FiBL Statistics, Italy had 2,177 hectares of organic table grapes in 2017; Spain had 320 hectares in 2018. Altogether, these fields can yield tens of thousands tonnes of organic table grapes.

Tip:

- Establish potential partnerships with important growers in Spain or Italy. As a counter seasonal supplier, you can greatly benefit from the network of a European partner. This way you combine forces to become a year-round supplier of table grapes.

Figure 7: Indicative supply calendar of table grapes in Europe

Source: ICI Business

South Africa

Europe is South Africa’s main export market, in particular the United Kingdom, where nearly a quarter of all South African exported grapes end up. Still, most of South Africa’s grape exports go to the Netherlands, and from there on to different European destinations.

The South African supply to Europe was 246,000 tonnes in 2021. This was 10% higher than the five-year average (see figure 6). South Africa is depending even more on the European market because of reduced imports from Russia and China due to the war in Ukraine and the COVID-19 aftermath.

South Africa is a preferred supplying country because of its producers’ long experience in grape production and their large volume of seedless white and red grapes. Older varieties such as Crimson Seedless, Prime, Thomson Seedless and Scarlotta Seedless are declining and new cultivars such as Sweet Celebration, Autumn Crisp, Sweet Globe and Starlight are increasing. South Africa’s grape production extends from mid-November to mid-April and is expanding. The forecast for 2021/22 crop is between 327,600 and 349,650 tonnes (see Table 2).

Newly planted high-yielding varieties will keep South African table grapes competitive in the European market. But the increasing production costs and competition from South America in the coming years are taken seriously by the South African growers.

Table 2: Table grape production in South Africa, in tonnes

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

| 279,000 | 275,000 | 298,000 | 337,000 | 327,600 – 349,650 |

Source: The South African Table Grape Industry’s (SATI) in various news sources

Tips:

- Evaluate varieties continuously. When selecting a new variety, yield and production costs are important factors for your competitive position, but a superior taste will help you to become a preferred supplier.

- Follow the South African harvest if you share a similar season. Excessive yields will push prices down. But climatic issues in South Africa, such as drought, can increase the need for importers to find alternative supply sources.

Peru

Peru is a relative newcomer in the international grape market, but quickly gained a strong position in the European market. Peru’s grape production increased rapidly and is forecasted to reach 700,000 tonnes in 2021/22.

Most of the production is exported. Peru has no other option than to export the table grapes because the local market opportunities are very limited. However, Peruvian grape volumes have grown so large that at peak supply, they affect the exporting potential and profitability of suppliers, not only in Peru, but also in Brazil, Chile and South Africa.

The main markets for Peru are the United States and Europe. European import of Peruvian table grapes increased from 56,000 tonnes in 2017 to 132,000 tonnes in 2022. According to the Peruvian table grape producer and exporter association (PROVID), Peru’s growth can be attributed to their extended seasons and continuous varietal renovation. In the 2021/22 season, exports of white seedless grapes increased by 37% and those of red seedless grapes by 14%.

The seeded Red Globe used to be dominant in Peruvian cultivation, but growers have been updating their vineyards with several popular seedless varieties. Large volumes and popular varieties have turned Peru into a strong counter seasonal supplier to Europe. According to FruiTrop the Red Globes represented a third of the exports in 2019/20 instead of 80% in 2012/13. New varieties such as Crimson and Sugraone are increasing their market share, together with a whole range of other seedless varieties such as Flame Seedless, Sweet Globe, Jack Salute, Autumn Royal, Sweet Sapphire, Sweet Celebration, Timpson, Cotton Candy and Arra 15.

A competitive advantage in Peru is the stable, desert-like climate. Thanks to two different growing regions, Peru has an extensive supply season. In Europe they are mainly on the market between November and March – with grapes from the main production region in Ica. The main concern for European buyers is the lack of sustainable water sources in Ica, which can be a reason for them to import from alternative sources.

Table 3: Grape production in Peru, in tonnes

| 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

| 623,000 | 630,000 | 653,000 | 665,000 | 700,000 (forecast) |

Source: USDA Foreign Agricultural Service (October 2020 and November 2021)

Tip:

- Try to avoid the peak supply period from Peru, if you can. Peru will likely play a more dominant role in supplying to the European market and their growing volumes can easily cause oversupply.

India

India has become one of the top grape suppliers to Europe. Indian growers are known to be price-competitive. After several years of growth, European import stabilised at around 100,000 tonnes. European buyers mainly source white seedless grapes from India. The UK is India’s largest market.

Indian grapes are essential to fill the supply gap between South Africa and Egypt. The supply window is short and sometimes reduced due to early and late varieties in competing countries with overlapping harvest seasons. Importers in Europe also turn to India when Chile and South Africa do not meet the required volumes or price-quality combination.

India has the advantage of a large grape production in combination with significant domestic consumption. Indian growers can switch from opportunistic export to falling back on the internal market. This is a big plus that South Africa, Chile and Peru do not enjoy. Moreover, India can also compete quite well with low prices. However, none of this could prevent the reduction in exports due to COVID-19 in 2020. The next challenge is to find alternative markets for the supply to Russia. Russia is an important market for India and several supply routes have closed due to the war in Ukraine.

Tip:

- Diversify your export markets, especially if you cannot fall back on the domestic consumption in your country.

Egypt

Egypt is increasingly competing at the beginning of the European grape season. The country is price-competitive and has taken steps in improving quality and food safety by investing in post-harvest processes. The extended Egyptian season is mainly of concern to Spanish and Italian grape growers, forcing them to specialise and innovate to remain competitive.

With 79,000 tonnes of table grapes imported by Europe in 2021, mainly between May and July, Egypt closes an important window in the grape trade. They are capable of delaying some of the European supply. Fewer supply windows also means fewer opportunities for new suppliers, unless you have something unique to offer.

The proximity to the European market helped Egypt to continue exports during the COVID-19 pandemic in 2020. Unlike producing countries such as India, they were able to profit from the increased demand and continue their growth into 2021.

Chile

Chile is a traditional grape exporter and one of the largest in the world. For a long time they were the second largest supplier to Europe, but they gradually dropped back to fifth place. European importers purchased an estimated 71,000 tonnes from Chile in 2021.

Despite Chilean producers’ long experience, grape production volumes are declining, and so are exports. This is partly due to varietal transitions, but also because of water and labour shortages. Water and labour costs will be major issues for the future of the grape sector.

The main season for Chile runs from January to May. Most of Chile’s table grapes are shipped to Europe at the end of the Chilean season, because there are still large overlapping supplies available from Peru and South Africa in the first months of the year. Chile often also prioritises the United States and Chinese market, which are more significant for Chilean grape export.

Chile’s reputation in table grapes will keep competitors at a distance, but due to increasing production costs and declining production volume, new opportunities will arise for table grape growers from other countries.

Tip:

- Learn from Chilean table grape growers. See which grape varieties Chilean producers promote and their merchandising practices on the Fruits from Chile website.

Brazil

Brazil could become the game-changer in the next few years. Brazil has a great advantage in climate zones and diverse growing regions for table grapes. Brazil uses a significant portion of its grapes to meet local demand, but when local consumption is low, export becomes the focus. Companies such as the Spanish grape grower El Ciruelo have invested in the Brazilian production of seedless table grapes. They aim to increase Brazilian consumption as well as export to other markets. With these recent investments in seedless cultivars the focus on export may become more structural.

Although Brazil is able to produce year-round using different production zones, most Brazilian grapes arrive in Europe between October and January. A minor volume to Europe follows in May-June. The projection is that grape production will increase from 1.53 million tonnes in 2022 to 1.77 million tonnes in 2030.

In 2021 Europe imported 55,000 tonnes of table grapes from Brazil. This is significantly more than in the years before. If Brazil continues to upgrade the table grape sector with its current energy, plus maintain costs at an acceptable level, they can become a stronger competitor on the European market in the coming years.

Which companies are you competing with?

The grape market is highly competitive, so you must find or create your competitive advantage. This includes diversifying export markets, products or grape varieties. You can also work together with other grape cultivators to extend your season and supply volume. The following companies employ these and other practices.

Fruitsland (Italy)

Italy’s Fruitsland has a highly diversified offer of table grape varieties from July to December. This is an innovative company that has invested in marketing as well. A modern website promotes the technology and production methods they use.

Good presentation and an attractive product assortment are essential for any company in the European market. But it is the promotion of your unique selling points that makes you stand out. Fruitsland’s self-presentation as an innovative and diverse grape grower is definitely a strength which supports their expanded network throughout Europe.

Tip:

- Find your unique selling point as a company and promote it to stand out in the highly competitive table grape market. Check the website of Fruitsland for inspiration, but make sure you create your own corporate identity.

The Grape Company (South Africa)

One of the large grape exporters from South Africa is The Grape Company. It is actually a group of affiliated growers covering the entire South African growing season. The Grape Company is socially engaged and focuses on quality. Approximately 90% of their production consists of seedless grapes and all of their growers are certified with GlobalG.A.P., Sedex and Tesco Nurture, which make The Grape Company a very suitable partner for European importers.

Tip:

- Look for cooperation and even integration with trusted clients. Buyers are increasingly interested in getting more directly involved in production, which can provide you with a reliable sales channel.

Verfrut (Chile/Peru)

Verfrut is a Chilean fruit company. As producers in neighbouring Peru quickly ramped up grape cultivation, Verfrut decided to integrate an orchard in Peru. Cultivation in two countries extended their supply season by several months. The long availability and reliable supply of grapes makes the company attractive for supply programmes of large European retailers, such as Tesco.

Today, the Verfrut Group consists of five companies, including a distribution company in the Netherlands and a logistical service company. With more than 4,300 hectares of orchards in Chile and over 2,700 hectares in Peru, the company is the largest individual fruit grower in Chile and the largest grape grower in Peru.

Companies like Verfrut do not rely exclusively on a few export markets, which makes them more resilient to market fluctuations. According to Verfrut’s website, only 18% of their grapes are destined for Europe, while most of their production goes to the United States, Russia, China and several other markets.

Tips:

- Diversify your export markets. Europe is a big market for table grapes, but much more saturated than growing markets, like China. Europe should be one of your target markets, but it is better to spread your chances and risks over several export markets.

- Find out who your main competitors are in Peru, whose export volumes are growing fast. You can find current market shares at AgroDataPeru (in Spanish).

Which products are you competing with?

Grapes can best be compared with other fruits that are easy to snack on, such as berries or fresh cut tropical fruit. These are the fruits that are most likely to be used as an alternative for grapes. However, table grapes are a main category fruit. High availability and affordable prices will keep plenty of grapes on supermarket shelves. Something to look out for is inflation. Costs of production and logistics have increased and this may favour more affordable or locally grown fruits.

The most notable substitute for table grapes are actually other table grapes from improved and mostly seedless varieties. Interest in seedless and superior taste provides opportunities to diversify your table grape supply. Consumers in Europe are usually not aware of the specific cultivars – they mainly select on colour, seedlessness and appearance in general.

Tips:

- Offer different sized packaging, such as smaller 250 g punnets. That is one way to make your table grape portions more comparable to those of small soft fruit, such as blueberries and raspberries.

- Get insights in competing fruit categories, such as blueberries, by reading the information on exporting blueberries to Europe on the CBI market information platform.

4. What are the prices for table grapes on the European market?

Average prices for table grapes have been relatively stable over the past years in Europe; the main (short-term) fluctuations are caused by changes in product availability. Prices from importers to wholesalers vary normally from a little over €1/kg up to €3/kg. If you work with an importing company or trader, expect to pay them approximately 8% commission plus handling costs.

Retail prices are usually between €4/kg and €6/kg. Retail promotions can push prices below these averages, while premium and organic grapes can fetch significant higher prices. Be aware that retail prices have no relation with trade prices.

The increasing costs of production and logistics are pushing up prices. This will influence trade prices in the next few years. Do not count on full compensation for all your increasing costs. As a supplier you are expected to invest in efficient solutions. In the destination market retailers may adjust the number of promotions for consumers or ask their suppliers for smaller packaging to keep prices levelled.

Tip:

- Look at indicative market prices on Fresh Fruit Portal (importer’s selling prices) or in France at France Agrimer (trade, wholesale, retail prices), search term ‘raisin’ (grape in French).

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research